By Marshall Auerback, a hedge fund manager and portfolio strategist. Cross posted from New Economic Perspectives.

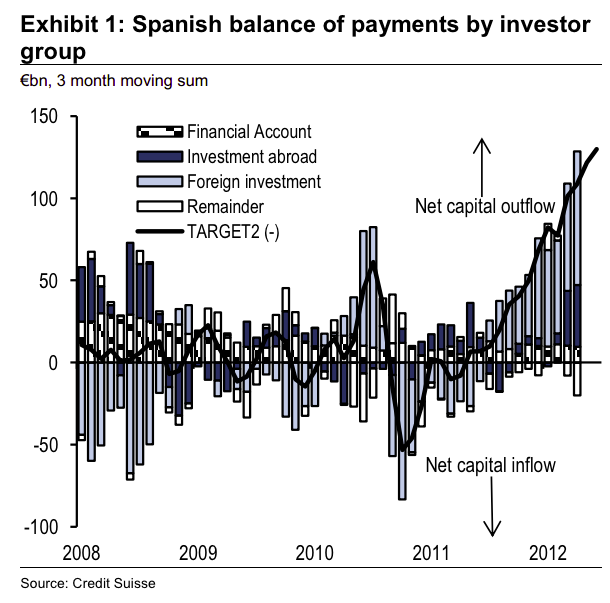

Just when you think that things can get no worse in Spain, they do. Take a look at this chart, courtesy of Credit Suisse via FT’s Alphaville

Yiagos Alexopoulos at Credit Suisse estimates that Spanish capital outflows are currently running at an annualised rate of 50 per cent of GDP. No question, the bank run is clearly accelerating, and one can easily understand why. The country is turning into a Little House of Economic Horrors. The alleged “rescue” of Madrid’s banks is a non-starter. 100 billion euros won’t begin to cover the scale of the problem on any honest accounting or “stress test” (and that’s before we get to the next phase of announced austerity measures).

Chuck Davidson of Wexford Capital has completed a report where he looked at the Spanish banks, extrapolating to all of them from a close look at the big five.. He haircutted their assets by 25%, which hardly seems excessive. Moving from the big 5 to the entire banking system, he came up with 990 billion euros as the capital needed to get Spain’s banks to Basel 3 risk weighted capital standards. Madrid, we have a problem!

That’s of course after these very same banks have ripped off thousands of depositors, who were strongly encouraged to buy preferred equity shares and subordinated debt, which were touted to them as higher yielding, low risk fixed income replacements instead of lower yielding deposits

As Ed Harrison of CreditWritedowns.com has noted in a recent post:

When the banks tried to get private funding, universally they were unable to get institutional and or foreign investors onboard. Bankia, for example, wrestled with whether to pull its IPO altogether after receiving a tepid response from institutional investors. Instead, Bankia went ahead with the IPO, getting the money from Spain’s retail investor base. Other banks raised money by unethically and potentially illegally pressuring bank depositors into preferred equity and subordinated debt instruments they did not fully understand. Reuters says, for example, that 62% of sub debt holders in Spain are also depositors at the same institutions.

To help fund these bailouts, Spanish PM Mariano Rajoy is continuing to propel the country toward national economic suicide via more ruinous fiscal austerity measures. He has just increased the sales tax from 18% to 21%. This in a country with 25% unemployment, 50% youth unemployment and collapsing retail sales.

That will raise a ton of revenue, NOT!

Who needs to get the Troika to force fiscal austerity on you, when you’ve got Spanish quislings perfectly happy to do the job themselves?

As market participants are coming to recognize the extent and gravity of the bank run (of which Spain is surely the weakest and most dangerous link) and its dire implications for the ECB, Europe’s capital outflow is likely to intensify further, especially given the paltry response from last week’s umpteenth summit to “save the euro” and the mounting legal challenges in Germany to any form of euro-wide deposit insurance. In regard to the latter, it is entirely plausible that Germany’s Constitutional Court rules that the ESM itself (now under legal challenge) is ruled unconstitutional by German law which would put paid to any Eurozone wide solution to the bank run.

If so, the euro should fall precipitously despite today’s unprecedented spec short position. The recent adverse price action in the euro suggests the capital outflow from Europe may be intensifying because market participants are coming to realise that the odds of a euro exit by one or more countries are increasing and political obstacles will probably prevent an effective policy response like deposit insurance to arrest Europe’s bank run and capital outflow.

Given the prospect for policy paralysis ahead, we should expect a continued capital outflow of the kind now manifesting itself in Spain. That outflow should strain the recent efforts of the ECB to retard depreciation of the euro and alert even more participants to the euro’s truly rickety foundations.

“Who needs to get the Troika to force fiscal austerity on you, when you’ve got Spanish quislings perfectly happy to do the job themselves?”

Actually that is part of the deal negotiated within EU: Spain gets the loans to bail out the banks with some conditions, including raising VAT (they were very insistent on this). While it’s Rajoy who implements it, the tax raise is part of the conditions imposed by EU in fact. Notice that it’s sales tax, not rent tax nor business tax, so it’s more burden for the poor but all good for the rich.

Otherwise it’s mostly rats abandoning the sinking ship.

My main concern is if and how will this collapse evolve into a war. Because some other state like, say, Portugal will probably do without one but Spain is so multiethnic and never-consolidated that will no doubt implode sooner than later.

“Notice that it’s sales tax, not rent tax nor business tax, so it’s more burden for the poor but all good for the rich.”

It’s not related to that. It’s just that the State needs cash NOW, its coffers are looking bad, and VAT is the easiest and quickest way to get more cash. The background of this decision is that VAT State income has been falling over 10% during this year due to falling retail sales. The State needs to compensate for that NOW, it’s urgent. Increasing the taxes on the rich may be implemented but will give the State more cash next year (if at all).

Nonsense. If they need money now they can just do a 1-off tax on all assets over €1m or whatever. Raising VAT is useless unless you expect wage increases; it just leads to less volume sold (and therefore more companies going bankrupt) in societies where wages have stagnated and people have little to no (net) savings left. It is also the preferred way of the EU since the Maastricht treaty of raising taxes.

“If they need money now they can just do a 1-off tax on all assets over €1m or whatever”, yeeah, it looks crazy but let’s give it a shot. How would you frame that tax in terms of the law? A new tax would require a parliamentary procedure and even after it passes the parliament it might be subject to constitutional examination. A new tax will take months, if not over a year, to be effective. Or are you thinking that this “1-off tax” could be forced-fed as the variation of some existing tax?

“How would you frame that tax in terms of the law? A new tax would require a parliamentary procedure and even after it passes the parliament it might be subject to constitutional examination”. I have to remind you that raising VAT, slashing one salary from public workers, ending and lowering unemployment benefits (latest round of “fiscal consolidation”) was also done through a parliamentary procedure (where PP has ample majority) and might also be subject to constitutional examination.

Mind you they could have cut all the lard from having duplicated authorities in each Region, ending support for failed government-owned local televisions, consolidating the thousands of municipalities (some 80 or less population-strong…), ending fiscal privileges to some regions, letting go of “mancomunidades” (another layer os useless bureaucracy). Why don’t they? Because that’s where all of the politicians’ friends, family, and fools are “working”.

Spain deserves this catastrophe if they cannot get rid of the politicians that are currently un-ruling.

To Yan:

I agree with you, the point is that the VAT works as an quick fix like no other tax to help relieve the CURRENT drop in State income.

Note too that some reductions in the size of the administration are part of the new package, certainly imposed from Brussels.

I don’t think it is the case at all. The central state is not so needy (not at all) and redistribution to autonomous communities (regions) and municipal governments is only done on yearly basis, if at all.

Also it’s the same medicine used in Greece and other places: it’s old good IMF “business-friendly” model: suck the poor dry and leave the rich untouched. It does not work, we all know it, but it will be done once and again becuase it does work for one purpose: class war as usual, class war against the workers by the high bourgeoisie and their lackey allies of the so-called “middle class” (petit bourgeoisie).

On the less dramatic side, Spain had the lowest VAT levels in EU and now it just does it not anymore.

But essentially is a top vs. down class war item, a classic case of “Sheriff of Nottingham” syndrome.

Although the major moves in the European re-alignment are class-war oriented (internal devaluation by wage shrinking in troubled countries) not all that is being done is motivated by that. There are more mundane things that make your Leaders take action, even things that go against the major drive, such as increase the Spanish VAT because that income has been falling and the Spanish State needs cash now, the VAT is a major source and a quick fix, and the Leaders of the subjects of other countries have been pointing out that Spain had a comparatively low VAT.

Why is anyone surprised by capital flows out of Spain? Who but an i*iot would leave money there? Since more than 95% of the population doesn’t have any money, what difference does it make? Spain’s problem is private debt which sooner or later must be liquidated if the economy is to function at all. I don’t understand what Auerback is talking about and I wonder if he does.

I agree. Short of a permanent fiscal transfer from Germany, Spain will leave the Eurozone.

So, if you have excess Euros, you’ve got to decide, do I believe…

(i) German voters will vote to send 10% of their GDP to the perirphery, on a permanent basis, which means that the EZ will remain.

(ii) German voters will not send 10% of their GDP to the periphery, which means that the EZ will dissolve.

or

(iii) Brussels will appoint a Viceroy in Berlin, a Viceory who will decide that the best thing for the German voter is to send 10% of his GDP to the South, which means that the EZ will remain.

So what is it, (i), (ii), or (iii)?

Germany out, back to the DM, then devalue the euro rather abruptly.

‘Spain is so multiethnic and never-consolidated that it will no doubt implode sooner than later.’

Whoa, that’s a pretty dark outlook. But it’s true that economic stress amplifies tendencies toward internecine warfare and regional secession.

Thank goodness that could never happen in the United States! /sarc

Yugoslavia, Czechoslovakia and the URSS collapsed under similar circumstances and it is very clear that Western Europe (notably Spain) has been potsponing that fate for centuries thanks to their, now long gone, geopolical dominance over the World. It’s long overdue. I just would prefer the Czechkoslovakian to the Yugoslavian model of split, but while that may happen in Britain (i.e. Northern Ireland or Scotland have been acknowledged the right to self-determination, in Spain it’s most unlikely: IMO there will be war eventually).

From the viewpoint of the Basque Country at least, Spain is an imposed burden and more so now that it is needy and in crisis. 2/3 of the same for Catalonia. If an opportunity window opens we will break apart, you can be certain about that. We have a strong economy (http://forwhatwearetheywillbe.blogspot.com.es/2012/04/socio-economical-situation-of-southern.html) and Spain is a burden for us in all aspects (the economy being actually the less important maybe).

An independent Euskadi would be a good place to live and a respected country. Only thing, so crazy about Euskera. A University professor has to be fluent in Euskera, how’s that for a sure way to reduce the pool of talent?

University has been the education area where more laxitude there has been about Basque language recovery but, gee, I guess that if you want to teach in Portugal you must do it in Portuguese (or hire a translator but that’s impractical except for very short courses or workshops) and if you want to teach in the Netherlands you must need Dutch, right?

Anyhow, there is huge demand of education in Basque language (because after all this is what students themselves demand) and hence it’s logical that knowing Basque is, if not a requirement, at least a great plus. Same for all public office and in general. You may find the same “problem” if you’re a welder looking for job at Fagor, mind you (if the working language is Basque, what is relatively rare, sadly enough, you have to know it).

Hah! When I was in the Basque in June, I took note of the fact that it was the only place no one commented on unemployment.

Hope you enjoyed your visit, Yves.

I must say that there is middle to high unemployment except for Gipuzkoa province but there’s also some welfare state, so it’s less obvious: unemployed people survive with some dignity and are not thrown to the streets or to beg from their relatives and friends. What happens is that unemployment is made less visible and painful by means of paliative care.

“He [Spain’s top State boss] has just increased the sales tax from 18% to 21%. This in a country with 25% unemployment, 50% youth unemployment and collapsing retail sales.”

It should be noted though that Spain has a tranche VAT system, a basic tranche, a general tranche, and a sumptuary tranche. The poster is only quoting the increase in the sumptuary tranche, from 18% to 21%. This tranche includes items such as cars, electronics, used houses, electricity, telephone, clothing, The general tranche will increase from 8% to 10%. An average of 60% of a familiy’s regular consumption goes to items in this tranche, which include most food items, dairy, beef, fish, transport and cinema/theater/shows tickets, many products affecting tourism, the main industry now in Spain, and sanitary services. Finally the basic tranche will not be changed remaining at 4%; this is fruits, milk, eggs, bread, vegetables, medicines, books, newspapers, and social protection houses.

Spain has a large underground economy.

The VAT is one way to tax that economy [members of the underground economy pay the VAT every time they spend the money they earned or obtained in the underground economy.]

Good point. This might also be the reason why Greece has a high VAT.

18% is the regular VAT, Rubén. I pay 18% at supermarket, 18% with the electricity bill and 18% for everything that matters. And if you live under Spanish jurisdiction you do too.

The other two are the reduced and super-reduced VAT levels, which affect less important stuff, mostly water and some foodstuffs.

But now that you mention I have not heard anything either about the luxury VAT, how strange? Does it even exist?

Dear Maju, when you go to your ‘Eroski’ you pay the State a mixture of VATs. If you want to change the names, all right. Call it regular at 18%, now 21%. Few supermarket products fall in this category, as I mentioned above, electronics and clothing. For elaborated food stuff you payed 8% and now you’ll pay 10%. For your ‘txapata’, milk, fruits, etc, you pay 4% and will continue doing so. The weighted average including all consuption of goods and services got to be in the range of 12 to 15% I guess.

Maybe: foodstuff is weirdly taxed. But normal stuff like electricty of the internet are at 18% (21% since next month). And that means like a littl bunch of euros right away for the state… well, in my case the provincial chartered government (which pays the feudal tribute only yearly and, often, under coercion).

Whatever the case I am certain that I pay more for electricity and phone/internet than for all the food I can eat in a month. Food is not the problem (you can always start a crisis diet of rice and lentils): bills, home costs are the problem.

And I don’t live under Spanish jurisdiction. I moved to a safe haven months ago.

It seems immoral to me. The government should make sure that Andorra “residents” pay A LOT each time they make any sort of transaction or even breath outside their fake residence principality.

I think it’s worse than many of you believe.

***************

http://www.guardian.co.uk/business/2012/jul/13/eurozone-crisis-italy-downgraded-moodys

Bad news for Spanish consumers, emerging after the day’s cabinet meeting. Giles Tremlett in Madrid reports:

Just when they thought it could not get worse, Spaniards have discovered that the VAT hike of three points announced by prime minister Mariano Rajoy on Wednesday as part of a new 65bn euro austerity package will actually see 13 percent added to the costs of some goods and services.

Theatre tickets, cinema tickets, hairdressers, funeral parlours and numerous other services will all see their VAT rate jump from 8 percent to 21 percent, according to budget minister Cristóbal Montoro, who declined to go into more detail.

***************

60% of family expenditure does not go to food. It goes to rent and bills, all of which have the 18% VAT (except water).

Quick correction: purchasers of used homes do not pay the VAT tax, they pay a property transfer tax (Impuesto sobre Transmisiones Patrimoniales) which is between 6 – 8%. Purchasers of new homes pay a reduced VAT tax (8% at the moment)

Until December 31, new houses pay the supereduced VAT 4%.

I live in Spain. The top rate (21) applies to most of my expenditures – rent, light, gas, water, clothes, shoes, glasses + contact lenses, telephone. Basically I don’t spend money on anything else but for food because I haven’t got anything more to spend. In fact I basically don’t eat out, have not purchased any clothes or shoes in at least 12 months, haven’t gotten new glasses in 5+ years, etc…

The single most important expenditure is rent.

Ironically without Germany in the EMU the other countries would probably find it easier to move to more sensible sensible fiscal and monetary consolidation of powers just like those of a sovereign currency country. Ironically this is also what Germany wants but purely on German terms. In plain language Germany is not a team player.

Totally in agreement… assuming that the other states would have statesmen in power and not these selfish bank lackeys. The level of statesmanship in European politics is almost zero these days.

And that is the true problem: no statesmen (or stateswomen), no meaningful nor coherent policies that can lead us anywhay.

So totally in agreement re. Germany but still very disappointed about the political class in the other states, specially in Latin Europe.

you mean without Germany AND Netherlands, Finland, Austria, Belgium and in the end France and Italy too.

It’s nonsense to single out Germany. The eurozone outliers are the ones that did bankrupt their economies by greedy bankers and corrupt politicians: Ireland, Spain and Greece.

And the eurozone can survive fine without these countries.

That’s not true Eric: the self-designed outlier is Germany. I have no idea why you excluded Italy from your previous list anyhow: Italy has debt three times that of Spain (Germany and France are still, or rather were before the Bankia scam, above the Spanish debt levels as well).

I really hate to defend Spain (I’m Basque: they are our enemies) but it has been a model state in EU. Only the following issues are bad: (1) the housing bubble (more like USA or Britain thatn your usual EU member), (2) cronyism (largely by the conservative ruling party, which has damaged the savings banks), (3) chronic very high unemployment (only French overseas departments used to be worse within EU).

Nobody but those affected seems to care about the third or seriously want it solved and the other two are not that outstanding – unless you politically decide to make them a public problem, transferring bankers’ “loses” to the citizens by all means possible.

Spain has kept a very good debt behavior, while other states (Germany, France, Italy, Greece…) abused the tolerance of the Eurozone failed mechanisms to keep them in line.

Germany has not been any model but has a higher tier industrial and financial sector which helps them to stay afloat… by the moment.

France, Netherlands, etc. are just like Spain or Italy although a bit less obvious and they are collapsing as we speak. Now we discuss Spain and Italy but next year we will be discussing France and Germany. Remember this.

How about Netherlands and Finland? They are even more stringent than Germany. Finland even wants collateral from Greece and Spain for more loans.

Germany is at least pressing for political union, as a step towards fiscal union, most of the other Northern countries don’t want this. Germany is not the outlier.

I mentioned Italy because Italy has at least something of a functioning economy. Yes, they have high public debt. But low private debt, lots of private savings and a low budget deficit. Italy could survive if they somehow can get interest rates down.

Spain, Ireland and Greece are a different story. They did blow up their economies with housing bubbles and/or a bloated corrupt public sector. Much more difficult for them to get things going again, espcially since the markets have little confidence in Greek and Spanish Governments. And not without reason: how the PP has handled the Bankia scandal sofar is outrageous.

They are small countries, the big game in the Eurozone is between Germany, France, Italy and Spain (in this order) and, outside the Eurozone, Britain and (to some extent only) Poland. In terms of votes even Romania weights more than the Netherlands.

Anyhow, while Finland (and some other Eastern countries) are doing alright (or at least recovering from extremely deep depressions, case of Lithuania), the Netherlands is more like next in line for contagion: they have got a horrible year (last four known quarters) economically with a marked recession of -2% GDP change.

I see your point re. Italy. However before the Bankia-plus bailout, Spain was relatively clean in terms of debt, with figures still under those of Germany. IF Spain would have let the banks fall (except for small account guarantee and management), then it’d be relatively alright.

Italy has an economy (in the North) but Spain has one too. Although it’s heavily concentrated in the separatist areas, there’s also a decent amount of industry, quality agriculture and services in Spain proper. If Spain took the Icelandic path of not keeping the country hostage of the banks, it could land on its feet.

The real problems are, IMO, two:

1. The EU does not want any banks to fall: it’s against the rules of the game which are: “banks always win, no matter what”, letting banks fail or creating a state-managed economy is not allowed. This really makes EU inviable as it is but it may take a decade for the engender to collapse.

2. In Spain the fox has been put to ward the chickens. The main criminals of Bankia are all PP members, as are all those mafioso speculators of “the brick” (“el ladrillo”, they say for the building industry and speculation), who were propped since the Aznar era. And there is no alternative after the PSOE suicided itself by holding right-wing policies and electing Rubalcaba (a right winger) as new leader, while the United Left (in theory similar to Syriza but in practice much more social-democratic and uncharismatic) is too feeble and weak to rally the masses, lacking a half-decent leadership.

But as of now Spain still has a public debt that is a fraction of that of Italy. IMO Spain is Ireland at the Nth power, but Italy is Greece on steroids. And the Greek case is much worse than the Irish one for the general economy because it just won’t make a landing soft or otherwise: it’s an endless black hole.

As a Finn I can say that our rainbow coalition government (it includes both labour parties as well as the most right-wing party) is an absolute disgrace. The reason why they’re demanding collateral is because the social democrats campaigned by criticising neoliberalism. This collateral stuff is a smokescreen designed to convince voters that they’re “responsible”. Both left-wing parties have performed one of the most radical U-turns in our political history. Before the elections they criticised the bailouts and neoliberalism, now they see no problem with the Troika’s agenda. A member of the Left Alliance (to the left from the social democrats) even applauded the Rajoy government for “being more committed to budjet cuts” than the Greeks.

Yes, quite right. Marshall has some articles on this. Apart from the only real fixes, a US of Europe – i.e. central fiscal spending for full employment, or a return to national currencies, a short term breather or fix would be for Germany, the major surplus nation to leave the Euro. Everything else – corruption, bubbles, profligacy (hah!) is just twaddle – they aren’t so bad, historically speaking or so damaging anywhere in Europe. The problem is the Euro, the stupidest monetary system of all time.

The Euro is like AIDS. It destroyed the immune systems of the Eurozone nations, their capacity to deal with problems which will always come up. And which in a normal country, would be dealt with, without much muss or fuss. Of course there would be some stealing, some who win or lose unfairly, but every problem wouldn’t metastasize the way they do now. But the invisible hand of the Euro allows everyone to criticize the failing State of the moment for it flaws, which are inevitable, who is without them? – but not the mechanism which makes these flaws life-threatening.

Worrying about this other stuff is like worrying about the sniffles when you have AIDS. The only opportunistic infection which is bad enough to be dealt with separately is the German trade surplus sucking Euros from the periphery. German refusal to allow the periphery Euros for the Germans to suck out of them is just comical.

It’s a tragedy. People think the pain of austerity is somehow noble and the sacrifice will pay dividends in the long term, but it’s been a real failure so far. Spain may be better off biting bullet and trying to go it outside Euro. At least that will prevent future Euro induced crisis. http://www.economicshelp.org/blog/5525/economics/spanish-economic-crisis-summary/

On a longer term note (can’t help myself half mex have spanish so some national pride), imagine given that spain has a well educated population, a magnificent rail and transit system thus low rate of auto ownership, good social cohesion (low crime rate, tight extended families), good health measures over 50% of energy is renewable and good climate. Imagine when the U.S. gets to this state what would it be like given, poor infrastructure, reliance of fossil fuesl, fat sick people, poor mass transit, high rates of crime and family disintegration. Things bad but am still long the motherland…As the u.s. approaches its own abyss it will be much, much worse than what is happening in spain. Additionally, spaniards given history are a better equiped to deal with adversity than folks across pond….

We muddled through the 1930s ok …

America is not the place it was in the 1930’s.

An example of what it was like then: My mother lived on a homestead out on the prarie in Wyoming during the depression. No neighbors nearby but right next to the railroad tracks. Every day hobos jumped off the trains and came over to their farm to beg or work for food. In the entire depression they only ever had 1 chicken stolen from them.

Can you imagine what would happen today?

Today all the chickens would be stolen, house burnt down and the residents of the home would be beaten up and the assailants would record with their phones and put it on you tube.

You are confusing hoboes with the Seventh Cavalry. ;)

I don’t think so. I think the same thing that happened in 1930 would happen today. Just because people are out of work, doesn’t turn them into criminals. Ordinary people still have dignity today just as much as they did 80 years ago. They will go out of their way to make sure that you know that even though their clothes are not what they once where, the person inside is still worthy. You really have to grow up in an environment of hopelessness and low self esteem to think yourself so worthless as to throw common decency to the wind like that.

Happy to see good sense. It is a major part of kleptocratic propaganda, a long-running, intensifying propaganda campaign, to convince everyone that this is how people, the homeless, the down on their luck, the ordinary people, the 99%, would and do behave – the same deplorable way that the kleptocrats do. Not so.

I think we’re actually going to have to rescind immigration restrictions altogether and open the borders wide to all comers. From where I sit down here in NM, migrant Mexicans are the only ones with the cajones and the work ethic to rebuild this fucking place after white upper class America blows it all up.

Is the run caused by a fear that the banks will close and the money will be gone, as if it were just another investment, or are they afraid the Euro will be devalued? Is money leaving Spain and going to Germany or the US?

Why can’t bank runs become deposit insurance funds? Nevermind.

I imagine they fear that Spain will leave the Euro. All Euros in Spanish bank accounts will be converted to pasetas overnight. Then over the next 5 days the paseta devalues by 2/3 because nobody wants them, not at home and certainly not abroad. This solves the debt problem and ultimately will likely fix unemployment. However it is no good if you have money in the bank.

People in their unenlightened self interest would rather trash the national economy and run the banks than take an immediate loss themselves. They want the other guy to take the loss.

meanwhile a marie antionette moment

from jesse

Spain’s oligarchy appears to be a bit backward and thuggish. Rather than clumsily rigging lotteries and construction projects, they would be better off forming a banking cartel, rigging market prices, and stealing a little from everyone, every day, on every transaction. Then you can be a Very Important Person, dress well, have Congressman publicly kiss your ring, and still gorge yourself at the trough of public corruption.

“It should come as no surprise to anyone that major commercial banks manipulate Libor submissions for their own benefit. The OTC derivatives markets was designed by the big banks, for the big banks, to ensure that as they set up their own private securities exchanges – away from regulatory scrutiny – they could control the interest rate settings. Money center commercial banks did not want the “truth” of market prices to determine their loan rates. Rather, they wanted an oligopolistically controlled subjective survey rate to be the basis for their lending businesses.”

David Zervos

Jefferies & Co

That is sophisticated financial corruption. That is progress.

From a friend in Europe:

Yesterday, after PM Rajoy announced that the government was going to cut the benefits the unemployed receive, a PP congresswoman, Andrea Fabra, daughter of Carlos Fabra, was caught on camera applauding and shouting “Que se jodan” – which translates roughly to “screw them all.”

Miss Fabra was appointed Parliamentary Advisor at the age of 24, straight out of university. Her father has “won” the lottery at least 7 times, and is under multiple investigations for corruption.

“Qu’ils mangent de la brioche.” France, late 18th century

“Que se jodan!” Spain, early 21st century

At least, back then, they had better manners.

Well there is something to be said for honesty. If members of congress, administration and banking industry were less schooled in the ways of doublespeak and spin their true motives and feelings would certainly emerge–which would be also “screw em”. Their actions do betray the same sentiment as the parliamentarian in Spain. Damn backward spaniards they need to sharpen up on PR. Do a hope and change or some sort of shared sacrifice for the good of all mantra or do like the us. and say we actually have a recovery if you look deep enough, or there is opportunity in every crisis……We latin’s just don;t get it….

Can someone explain to me why do these politico types keep on trying to push a cart with the credit rope, even though it should be bloody obvious at this point that it’s not going to work? Is it just corruption and wanting their best hubbies in the 1% to rescue their assets before letting the system collapse? It’s quite obvious by now that the only destiny the eurozone has is dissolution, the only question left is whether it’s done messily (“orderly”) or insanely messily (“disorderly”). Why do they even bother keeping up the facade of this idiotic union having a chance to survive? Why don’t they look up from their own feet at the horizon and draw the conlusion that the experiment failed that there’s no meaning in throwing good resources after the bad. Cut everybodys losses and dissolve the union.

Same reason as 99% of everything else in life: habit.

We Care More Than They Do

Well I took the opportunity this afternoon to do more in-depth, high-level macroeconomic research on the Spanish debt situation.

That’s right. I took a lunch break in the garden of the Spanish cultural institute next to my office and button-holed two hapless Spaniards affiliated with the Institute, eating their lunch at a cast iron round picnic table next to my chair under the trees, and peppered them with questions about Spanish social stability.

“Do you guys think the place will explode with rage and descend into violent anarchy?” I asked. This is my baseline scenario, based on what I read and see on Youtube.

They looked at me kind of funny and then looked at each other. One was a man with short cropped hair and a very hooked nose, like something out of an El Greco background. The woman was a teacher and another earthy anarchist type.

“No”, they said and laughed. The woman rambled on for 5 minutes. The guy basically nodded his head, and interjected a comment every now and then. The Spanish people, they said, will go out and socialize, not rebel. Wine is 1 euro. They’ll bitch about politics for a while, but then they have their fill and shift the conversation to what’s really important to them — hanging out with friends and family. They will endure, no matter what.

“So they’re won’t be something like the Civil War?” I asked. (I have no tact at all and will ask anything I want to anyone I want).

“No” They said. But this made them serious. The people still remember the civil war. They were forced to fight, region against region, forced by circumstances they hated, fightin even against family. They remember. And they never want to go back to that.

No matter what I said or how I phrased it, it didn’t matter. When it came to social collapse and anarchy, “No” was the answer. Instead, the people will eat and drink and socialize and bitch and moan and maybe protest here and there, and then spend time with family and care for each other and endure and find society and friendship over a 1 euro glass of wine.

“OK” I said. What else could I say? Except for “thanks” Then we all said good-bye and I left and as I walked away I heard them talking in Spanish, happily, and laughing.

It makes you wonder what money is and what wealth is. This of course is a cliche. They have for free what many others try to buy, but never can, with any money. Something that might be called “peace of mind”, I suppose, or “love of life”. Nothing is ever perfect, but I suppose the nature of the imperfections that violate the pristine ideas of things are not so clear cut or measureable as to allow for easy analysis or clear cause and effect. If it were easy, what would be the point.

Well said and certainly rings true with my admittedly limited experiences in Spain. That said, when neither they nor their friends, nor their family have any more more money for vino, or food, or rent… something tells me their stories might change a bit. Unwinding an all-encompassing gluttonous kleptocracy from the bottom up is certainly going to affect someone negatively.

Those two nice people… how representative they are?, how will they think and feel two years from now, when they may have lost their jobs or seen their friends’ gang dissolve as each one tries to wade the tide on his/her own rather miserable means, maybe hiding at home ashamed of not having a job anymore or maybe jumping off a bridge or maybe emigrating by force to Germany only to be forced back because Germany has also gone into deep crisis mode?

“Wine is one euro”, you say, as if that would be cheap. It used to be maybe five or ten cents (the lowest quality, maybe 15-20 the regular one) when I was young. Spaniards, like Greeks, are paying Germany prices… without German salaries nor German welfare. It is only when you put those prices back in pesetas when you realize how expensive has everything become, very specially those little pleasures such as wine, coffee, cigarettes…

I sincerely think that Spain and Italy are and will be forced to descend by the Greek road to nowhere, to desperation. We’ll see a lot of strife, certainly in Spain. Those people still are with the mentality of the boom but the boom is long gone and people is desperate. Truly so.

This doesn’t ring true to me. While I’m not Spanish, I’ve lived and worked in Spain a while, and the rest of my family is Spanish – in my workplace the reaction to last week’s cuts was rage – and there will be fairly immediate consequences by way of strikes and work actions – not all of them organized by the usual suspects – although whether they will have much effect is doubtful.

What is changing is that old people and the comfortable middle class are getting angry because the life situations they once counted on have suddenly disappeared.

I should say, I’m a public employee – a university lecturer on a temporary contract extendable for a total of 5 years – summing up all the cuts this year (various “complements” have been reduced or eliminated, with little fanfare, and the community also reduced our pay) of different sorts my (pretax) pay this year has been reduced by more than 3000 euros out of 24000 – on top of that the income tax on my bracket, and now the VAT, have increased – my wife is also a public employee, with a slightly better salary – and for our family of 5 the cuts and tax increases this year suppose a reduction by more than 20% of our post-tax income relative to last year. By EU standards our salaries (for the sort of work we do) were already low, and now are lower. For us leaving is a possibility, and we have begun to think about it seriously. That’s a bad sign I think.

These are huge reductions in salary – and there are hundreds of thousands of those who thought themselves in the comfortable middle class who are finding that they can’t pay the rent (the situation of someone unemployed for two years is obviously worse). Folks have passed from being indifferent to being angry – even those who voted for the current government believing its clearly insincere promises (on all of which it has almost immediately reneged – e.g. Rajoy swore he would not raise the VAT). The general perception is that the political class is obliging ordinary people to pay for its sins, that debts are socialized while profits are privatized, etc.

Folks get angry that Aznar and Zapatero and the rest get pensions for life while the rest of us get pay cuts, but they do have trouble seeing much beyond that. The idea that the euro could collapse is still widely dismissed as doomsaying, although a lot of folks probably think it might be a good thing, since all the euro has brought ordinary folks is higher prices and a real estate bubble.

Again it is important to understand the dynamics of kleptocracy. Elites identify their good as the general good, or more precisely that their good is a necessary precondition to the good of everyone else being met. This is the rationale that allows them to screw over Spain’s 99% while turning a blind eye to the huge capital flows of the 1% out of the country.

Most looters don’t look upon what they do as looting. They look on it as being smarter than the other guy. At the same time, they see their needs as critically important (God’s work) to society and so most always come first. They see the real problem as the 99%. The 1% and the elites who support them don’t make mistakes. So any mistakes that are made must be the fault of the 99% and it just goes to show what an ignorant pack of freeloaders the 99% are that they don’t man up, accept responsibility for their mistakes, and bite the bullet to pay for them.

One of the hardest ideas to get across is that the 1% and the elites who abet them may look normal but they do not belong to the normal world. So it is important for us to stop acting as if they are. We need to stop thinking they are incompetent or giving them the benefit of the doubt, that is that they are stupid or mistaken but still acting in good faith. As I have pointed out before, believing your own lies does not equal good faith. The critical lesson here is that we need to stop looking at the 1% and our elites as if they were normal, act perhaps wrongly but in good faith, and are a lot like us. They are not not. They are criminals, no matter how they dress it up. They exploit our assumption of normalcy and good faith to unleash class war against us and continue their looting of us.

This is what we need to keep uppermost in our mind every time we hear or read something about Geithner, Obama, Romney, Merkel, Hollande, or Rajoy (or Gates, Buffett, and Soros). These people are not on our side. They are criminals and true enemies to us, and all our hopes and dreams for fair and decent lives.

“They exploit our assumption of normalcy and good faith”

Yes.

Gosh, I hope this sort of broad sweeping generalization doesn’t become dogma. I’m in the 1% now. I got there by being at the right place at the right time through dumb luck. I’d hate to think I’d be up against the wall with the kleptocrats because the company I work for gave me stock options and then proceeded to execute the most astounding corporate turnaround in history.

It was all going so well until the bonnet rouges appeared at the front door.

Your wealth is based on theft from the poor and the middle class. So you can be wealthy, the vast majority of the country is saddled with debt, high unemployment, loss of housing, lost pensions, poor and overpriced healthcare, bad schools, and decaying infrastructure. The country’s wealth inequality is simply too unequal.

http://dearkitty1.wordpress.com/2012/07/11/spanish-conservatives-impose-austerity-violently/

The true face of austerity Europe

Wednesday 11 July 2012

Austerity Europe reared its ugly head today when a volley of rubber bullets fired by police injured scores of protesters and members of the media during Spain’s “Jarrow March.”

Coalminers and trade union activists angry over government subsidy cuts had massed by the gates of the Ministry of Industry in Madrid and were making their voices heard.

Riot police guarding the building charged using their batons, leaving about a dozen wounded.

Witnesses said some supporters who had joined the demo at the last minute then began to throw stones and firecrackers at police – who replied with rubber bullets.

Reports said that “several” demonstrators, members of the media as well as some policemen had been injured.

One witness said: “At least one photographer had severe bleeding from the head, and a television camera operator was lying on the floor and looked unconscious.”

Police were reported to have arrested five people and at least 23 people were said to have been tended by emergency services for injuries after the charge.

Around 25,000 miners had converged on Madrid and linked up with union activists to protest against a 63 per cent cut in government subsidies to mining companies.

We will all be much happier when we can safely conclude that the pain in spain is mostly in the brain.