Yves here. While this post by Rajiv Sethi contains some important observations about valuation, I’d like to quibble with the notion that there is such a thing as a correct price for as vague a promise as a stock (by contrast, for derivatives, it is possible to determine a theoretical price in relationship to an actively traded underlying instrument, so even though the underlying may be misvalued, the derivative’s proper value given the current price and other parameters can be ascertained).

Sethi suggests that stocks have “cash flow anchors”. I have trouble with that notion. A bond is a very specific obligation: to pay interest in specified amounts on specified dates, and to repay principal as of a date certain. They have other restrictions to protect investors in an indenture, which might include (for riskier companies) a minimum net worth requirement, a restriction on incurring more senior debt, required minimum interest coverage ratios, a sinking fund, and so on.

By contrast, a stock is a very unsuitable instrument to be traded on an arm’s length, anonymous basis. A stock is a promise to pay dividends if the company makes enough money and the board is in the mood to do so. Yes, you have a vote, but your vote can be diluted at any time. There aren’t firm expectations of future cash flows; it’s all guess work and heuristics.

By Rajiv Sethi, Professor of Economics, Barnard College, Columbia University & External Professor, Santa Fe Institute. Cross posted from Rajiv Sethi

At 7:30pm yesterday the Drudge Report breathlessly broadcast the following:

ROMNEY NARROWS VP CHOICES; CONDI EMERGES AS FRONTRUNNER

Thu Jul 12 2012 19:30:01 ET**Exclusive**

Late Thursday evening, Mitt Romney’s presidential campaign launched a new fundraising drive, ‘Meet The VP’ — just as Romney himself has narrowed the field of candidates to a handful, sources reveal.

And a surprise name is now near the top of the list: Former Secretary of State Condoleezza Rice!

The timing of the announcement is now set for ‘coming weeks’.

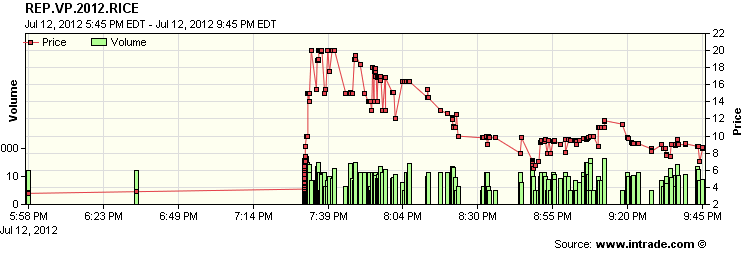

The reaction on Intrade was immediate. The price of a contract that pays $10 if Rice is selected as Romney’s running mate (and nothing otherwise) shot up from about 35 cents to $2, with about 2500 contracts changing hands within twenty minutes of the Drudge announcement. By the sleepy standards of the prediction market this constitutes very heavy volume. Nate Silver responded at 7:49 as follows:

The Condi Rice for VP contract at Intrade possibly the most obvious short since Pets.com

Good advice, as it turned out. By 9:45 pm the price had dropped to 90 cents a contract with about 5000 contracts traded in total since the initial announcement. Here’s the price and volume chart:

One of the most interesting aspects of markets such as Intrade is that they offer sets of contracts on a list of exhaustive and mutually exclusive events. For instance, the Republican VP Nominee market contains not just the contract for Rice, but also for 56 other potential candidates, as well as a residual contract that pays off if none of the named contracts do. The sum of the bids for all these contracts cannot exceed $10, otherwise someone could sell the entire set of contracts and make an arbitrage profit. In practice, no individual is going to take the trouble to spot and exploit such opportunities, but it’s a trivial matter to write a computer program that can do so as soon as they arise.

In fact, such algorithms are in widespread use on Intrade, and easy to spot. The sharp rise in the Rice contract caused the arbitrage condition to be momentarily violated and simultaneous sales of the entire set of contracts began to occur. While the price of one contract rose, the prices of the others (Portman, Pawlenty, and Ryan especially) were knocked back as existing bids started to be filled by algorithmic instruction. But as new bidders appeared for these other contracts the Rice contract itself was pushed back in price, resulting in the reversal seen in the above chart. All this in a matter of two or three hours.

Does any of this have relevance for the far more economically significant markets for equity and debt? There’s a fair amount of direct evidence that these markets are also characterized by overreaction to news, and such overreaction is consistent with the excess volatility of stock prices relative to dividend flows. But overreactions in stock and bond markets can take months or years to reverse. Benjamin Graham famously claimed that “the interval required for a substantial undervaluation to correct itself averages approximately 1½ to 2½ years,” and DeBondt and Thaler found that “loser” portfolios (composed of stocks that had previously experienced sharp capital losses) continued to outperform “winner” portfolios (composed of those with significant prior capital gains) for up to five years after construction.

One reason why overreaction to news in stock markets takes so long to correct is that there is no arbitrage constraint that forces a decline in other assets when one asset rises sharply in price. In prediction markets, such constraints cause immediate reactions in related contracts as soon as one contract makes a major move. Similar effects arise in derivatives markets more generally: options prices respond instantly to changes in the price of the underlying, futures prices move in lock step with spot prices, and exchange-traded funds trade at prices that closely track those of their component securities. Most of this activity is generated by algorithms designed to sniff out and snap up opportunities for riskless profit. But the primitive assets in our economy, stocks and bonds, are constrained only by beliefs about their future values, and can therefore wander far and wide for long periods before being dragged back by their cash flow anchors.

If you think stock prices are a function of future cash flows you are not paying attention. Financial markets are governed simply by the weight of decisions (bets, really) made largely by those managing leveraged pools of superfluous capital. The decision makers believe they are acting rationally, but the reasons are largely invented and predicated on fictions. Nobody knows what a stock is worth, which is why the prices are constantly changing. Trends are observable only in retrospect. Successful investors are merely survivors, while losers disappear along with their theories. Randomness rules while annointing a few stars like Buffett, who then get to spout nonsense about the phony deficit crisis on CNBC while a cast of network stooges kisses their behinds. Add a disgraced politician or two and you get yesterday’s performance, which needed George Carlin to do it justice.

The idea that derivatives can be valued is utter fantasy. Option traders with their Black Sholes calculators are no different than horse players following tout sheets. Because the investment game inevitably creates winners it appears to work in the eyes of those who believe in the magic of results. After thirty years in the game I can tell you that stock values are more like the weather in England than anything else. If you don’t like today’s price, wait a few days for another one.

I don’t expect any MBA to be persuaded by this. The dumbest investor client I ever had was a professor at Harvard Business School, who allowed himself to be fleeced by the oldest of Wall Street scams.

Nobody knows what a stock is worth, which is why the prices are constantly changing. jake chase

I’d say that is more a function of the underlying money system than the stock itself. How rapidly do people’s tastes in goods and services change? Not very fast, I’d bet.

FB, you’ve got to get out more. I spent a lot of time on that comment and you keep giving us the same old rant about counterfeiting cartels. Haven’t you anything else in the quiver?

There was no mention of counterfeiting there – just an observation that stock price volatility is often greater than the underlying fundamentals (excluding the money system) would indicate.

The point is important because a common objection to common stock as private money is that it is too volatile.

There haven’t been any underlying fundamentals since accounting stopped being objective. That was about 1970. Since then the accountants and the managements simply conspire to run the stocks up and down. It’s not about growth but about looting through stock option give aways.

Since then the accountants and the managements simply conspire to run the stocks up Jake Chase

With bank credit?

and down. Jake Chase

With naked short selling?

Both of the above are forms of counterfeiting. :)

and, thanks, too, for this:

( jake chase says:

July 13, 2012 at 8:35 am )

“FB, you’ve got to get out more. I spent a lot of time on that comment and you keep giving us the same old rant about counterfeiting cartels.”

Thank you for that post. It ought to be prominently displayed permanently somewhere –it is just about all there is to say intelligently about market investing.

People pay fortunes at elite business schools and the lucky, smart ones, get the views you just detailed. Others don’t get it.

If I can add something useful to your post, maybe it’s this–

I listen on and off to the leading business-news media in the french market; it’s a combined radio-television-internet conglomerate called “B-FM” (you can see the site here: http://www.bfmbusiness.com/ )

anyway, I listen only to the FM radio broadcast version–often an audio of the television’s broadcast programs.

the point in mentioning them is that viewers, listeners, get a daily does of our contemporary real-world modern sacred rituals. What market analysts are actually doing is the equivalent of what primitive tribal shamans have always done; they answer the human need for sense and meaning when confronted with randomly produced phenomena which is strange and often frightening and dangerous in some of its manifestations.

You can see and hear the same things (in the pages of the Wall Street Journal, or at its site, http://www.marketwatch.com ) being done on MS-NBC’s market programs where, everyday, highly-paid pundits offer their views on the meanings of the latest market activity–explaining, making excuses, offering rationales–this is exactly what tribal shamans must do and their arts, just like those of modern financial market analysis, are the stuff of ritual and serve, above all, to satisfy the psychological needs that ritual satisfies.

So, yes, I listen to “B-FM,” because I find it interesting to observe how our contemporary ritualistic uses of myth and sacred hocus-pocus are both practices and widely-believed even by (or should I say “especially by”?) extremely intelligent, highly-educated people.

So, maybe the thing to add to your concise presentation (which might be titled, “Everything You Ever Needed to Know About the Financial Markets and Investing”) is just the suggestion that, for real insight into what is happening in financial markets and in the ritualistic analyses to which they are subject , we should try reading The Mystic Experience and Primitive Symbolism, (1938) by Lucien Lévy-Brühl (April 10, 1857 – March 13, 1939).

A stock is a promise to pay dividends if the company makes enough money and the board is in the mood to do so. Yves Smith

Why would a dividend be necessary if the common stock itself could be used as money? Why take capital out of one’s common stock company? Isn’t the purpose of a common stock company to consolidate capital for economies of scale?

Also, if common stock itself was used as money then its true value would be measured by the demand for the issuing company’s goods and services and not be subject to fluctuations in the value of other monies. Why should, for example, a maker of discretionary goods have to suffer because his usual customers have less conventional money?

Also, with common stock as private money, stock splits could be used as a form of “dividend” to existing shareholders without removing capital from the company.

FB, with this comment you have confirmed my long-standing hypothesis that your “use common stock as money” plan is rather less than half-baked. If you take a company that is valued at $10mm and has 1 million shares outstanding, and I have 10 shares, each share is worth $10 and I have $100 worth of them. If the company issues a dividend of (or splits) 1 share for every 5 outstanding, it will have 1.2 million shares out, each of which will be worth $8.333, and my now 12 shares will be worth $100, and the net effect is nil. So why do I care if I get such a dividend? If your answer is that I care because, as demonstrated in the real world, stock prices go up on splits (evidently because people don’t understand the above math), well isn’t that there exactly the theft of purchasing power you are attempting to address in the first place?

Further, say my business consists of selling tacos on the beach. People come to this beach from all over, and since this is FBeardenland, they come bringing wallets full of common stock of, say, 50 or 100 different companies. I spend all of my time making tacos, so when these common stocks are presented to me as payment for my tacos, I don’t know how much change to give them because I have not read the update from my equity research department advising me of the latest valuations for each of the issuers of these 50 or 100 different companies. Oh, wait, I don’t have an equity research department, because I sell tacos on the beach. This is a problem, is it not?

Lastly, you are intent that “[common stock’s] true value would be measured by the demand for the issuing company’s goods and services.” My beach taco operation also happens to have issued common stock (ticker BTO). So I go to the farmer with my BTO common and offer some in exchange for produce and meat. The farmer consults his own equity research department, which advises him that BTO is seasonal and subject to weather risk (because they sell tacos on the beach), and because of La Nina they are expecting a wet stormy summer, so farmer had better take an awful lot of BTO in exchange for his produce and meat. I argue, since I still need some of my BTO to get paper napkins and taco shells, and claim that the experts in my meteorological risk team are predicting hot dry summers for the next six years. How stable is the value of BTO in this case?

Also, what does this mean: “Why should, for example, a maker of discretionary goods have to suffer because his usual customers have less conventional money?” ???

If your answer is that I care because, as demonstrated in the real world, stock prices go up on splits (evidently because people don’t understand the above math), well isn’t that there exactly the theft of purchasing power you are attempting to address in the first place? James Cole

Where is the theft? The point of the split is not to cheat anyone but to keep the price per share constant; remember, the common stock is to be used as money. It can’t be allowed to appreciate too much per share or like Berkshire-Hathaway it would be beyond the reach of ordinary consumers.

But yes, the split is an illusion of sorts but it would normally be done only after the stock has appreciated in value such that if the value of the stock went up 20% then you would have 20% more shares at the old price.

As for your beach taco example, people could still use fiat for all debts, not just private ones. Private monies would be an option, not a requirement for private debts.

Make that “not just government ones”

Why should, for example, a maker of discretionary goods have to suffer because his usual customers have less conventional money?” ??? James Cole

Example: People in Greece are using local currencies because Euros are in short supply.

there’s that old “equlibrium” theory (ET) again, wearing a false mustache and sunglasses just to fool us. :)

ET is a variation of the “natural rate” hypothesis. Like the natural rate of unemployment. There was no unemployment among the Navaho or Cherokees or Sioux tribes. Unemployment is not natural. It is unnatural. It is a form of social pathology, a disease. And there’s no such thing as equilibrium, except in Newtonian physics of orbiting planets. And then, if you think of time long enough, there’s no equilibrium there either.

My best 10-bagger is now a 1/2 bagger. It sells at 4 times earnings. I hope this is an over-reaction, but now I’ll settle for a 3 bagger (a 6 bagger from here). Who knows what will happen? This company may be a 10-bagger yet, but when it is, I don’t think we can say it was foreordained.

Just curious: why is that I don’t even get offered an adjustment when I write that the US is imposing austerity from above? I just get scrubbed.

Would you like an adjustment?