Commentators and analysts have been starting to estimate what the costs to banks for their Libor manipulation might be. We’ve pointed to an estimate by the Economist that says the damages for municipal/transit authority swaps due to Libor suppression (during the crisis and afterwards) could be as high as $40 billion. Cut that down by 75% and you still have a pretty hefty number. Other observers (CFO Magazine) have argued that the losers were mainly other banks, and since banks are pretty much certain not to sue each other, the implication is the consternation is overdone. But these markets were so huge ($564 trillion was the 2011 trading volume in one contract, the CME Eurodollar contract, which uses dollar Libor as its reference rate) that even a little leakage to end customers still adds up to a lot of exposure.

FT Alphaville has posted a new effort to pencil out the cost to the banks, prepared by Morgan Stanley. It focuses only on Libor suppression, that is, the lowballing of Libor during the crisis and afterwards. As the analysis points out, while the Barclays settlement discussed manipulation only from 2005 to 2009, a suit by Charles Schwab alleges the suppression continued through 2011. The assumption is that that is where the bigger damages lie; the banks were apparently all leaning in the same direction while in the earlier periods, the belief, based on the Barclays-related revelations, is that the banks would sometimes try to push rates up as well as down, and the impact at any one time may also have been less in total (we need to stress that that is an assumption, and given that industry participants also say the Libor manipulation goes back much further than 2005, it is probably more accurate to say that the forensics on the earlier period are more difficult, and we just don’t know yet how big the impact was over that time frame).

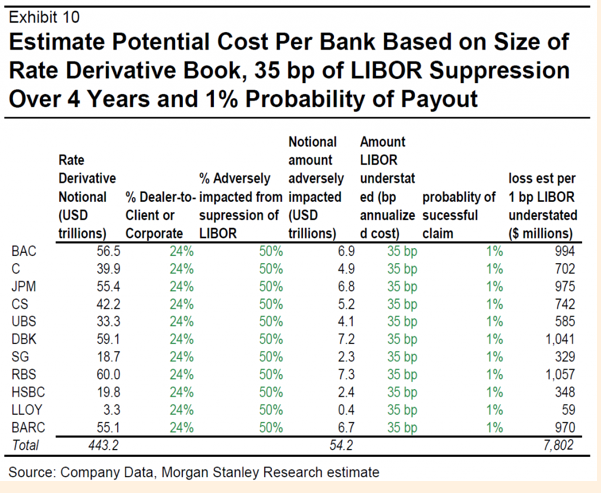

The Morgan Stanley estimate, which dors an admirable job of trying to dimension what the damage might be (this is admittedly a pretty fraught exercise) looks at different categories of exposure. First is regulatory fines, which it ballparks at $850 million for Bank of America, Citi and JP Morgan, and a mere $550 millionish for Lloyds. Next is litigation risk, which it sees averaging $440 million per bank, with the hit for each ranging from $60 million to $1.1 billion. It finally flags, but does not cost out, the fact that banks will be forced to change how they do business going forward. If the Libor revelations lead to more transparency, not just in Libor but other areas, that could have a significant impact. Banks enjoy a tremendous advantage over customers in markets where pricing is opaque.

But what about the bonuses that all the staff got as a result of this nefarious activity? The inability to recoup those payouts is a big reason to be skeptical that anything will change, ex much more aggressive supervision and disclosure, or maybe (gasp) prosecutions. And so far, despite the enormous costs of the crisis, the banks have done a good job in limiting reforms (I don’t take their caviling that their lower profits are due to regulation seriously. Damage your customers on a massive basis by blowing up the global economy, and lose your cheap float profits due to central bank ZIRP policies to prop up your balance sheets, and what do you expect?).

Morgan Stanley provides an estimate of the impact of Libor suppression, 35 basis points for each year, 2007 to 2011 (see exhibit 10, third column from the right). That level is consistent with NC reader complaints during the criss (go NC readers!). I’m surprised that it would have continued at that level post, say, early 2009, but we’ll assume four years.

They start with the $350 trillion notional amount outstanding linked to Libor (this from the British Bankers Association, per the text of the full report, which FT Alphaville posted at its Long Room; notice we’re not including ideas like the possible front running of futures contract). Note not all Libor tenors were affected equally; the biggest suppression was in the shortest maturities. Per the BIS, about 25% was with outside parties. So we’ll ignore distribution (as in some banks potentially profiting at the expense of other banks). We’ll also assume (following MS) that 2/3 of the time, the banks won against customers, 1/3 they lost (remember, we are looking at the profit impact to the banks). So we have net 1/3 of the time, banks winning v. customers from Libor manipulation.

Now 35 bps is the total manipulation assumed, but how much turned into actual revenue? This is a critical assumption. Let’s assume a mere one basis point.

So far, we have:

$350 trillion net notional x 25% customer trades x 33% net loss incidence from manipulation x 1 basis point revenue capture

That gives you $2.9 billion across all 16 banks, or $180 million per bank. Times four years, you have $720 million. Compensation as a percent of investment bank revenues is typically 40% to 50%. So we have, on pretty conservative assumptions, roughly $290 to $360 million in extra comp on average per bank for Libor manipulation. This would presumably have gone to comparatively few people (recall Bob Diamond trying to say only 14 traders were involved, although the FSA said “at least 14”). Assume 20 per desk. plus everyone in the reporting line above would have benefitted, as well as the C level execs. So how many people is that? Maybe 50 tops? OK, let’s be really charitable and assume only 50% directly benefitted those people, the rest helped improve bank-wide comp (all those back office types, etc). Even assuming that, you have an average of $2.9 to $3.6 million in extra bonuses per person over the four year period.

The point here is pretty simple. Even if you go to some lengths to cut the numbers way down, you come to the conclusion that if this manipulation had any meaningful impact on the profits of the swaps and derivatives desks, a comparatively small number of people who’d be very cognizant of the manipulation by virtue of seeing the contrast between posted Libor versus actual market prices, likely profited very handsomely. And the people up the line would have benefitted as well.

I hope informed readers will make suggestions as to how to come up with better approximations as to how much of the Libor manipulation led to higher bonus payments which will never be recouped.

But Yves!

They’re jerb creators!

~

so thet jerbs? we know they dont create jobs, so thats what they do. why do we need jerbs again I forget?

Friends;

It’s times like this when I wish I believed in Divine Retribution, Heaven and Hell, and all that. It would make the helpless feeling easier to bear.

It’s times like this that I wish I weren’t opposed to the death penalty.

It’s times like these when I wish the phrase “self-regulation” was a ‘just’ and ‘legal’ cause to beat the crap out of anyone uttering it.

Oh, that “we the people” were “self-regulated” in doling out the punishment…

It is a good thing that watchdogs like NPR’s/NYTimes’ Adam Davidson is doing such a great job of keeping the chattering classes informed.

Meanwhile, here’s a tiny bit of potential good news.

This guy’s favourite to become the UK’s next prime minister…

http://www.newstatesman.com/blogs/politics/2012/07/quote-day-ed-miliband-news-international

What we have is a system set up in a simpler time the when the people involved we more honest and the size and tempo of financials was far less.

The system we can probably fix if it were not for the lack of honest people.

The people will have to realize how dishonest they are and come to have a will to change.

Probably never happen, the concept of honesty seems to have been lost.

that was the old days, but that only really lasted a few deacades because before that it was as bad or worse, the numbers were just smaller

Too bad we don’t have young Giuliani available to frog march the bankers out their towers. We’ll have to make do with Schneidermuppet.

Pathetic.

If “quality of life” gave a f*#k he could have obstructed many of these Bush-era frauds ..

Thank you for taking the time to take an overview of the situation. A bit daring and difficult challenge.

As far as honesty, I think that the average person in the society is honest. The problem is that the sort of person who gets the opportunity to handle a hedge fund might not be familiar with the concept of honesty. Rolling Stone’s recent article on Frat Boy hazing at Dartmouth makes quite a swipe at the college culture. So then readers wrote in to reply, several mentioned “No wonder we have the lying and cheating high rollers in Wall St Financial Firms if this is what their academic lives were like. If to get into a Wall St firm, the job applicant has to be a former pledgie who spent half their academic life chugging booze, vomit and human waste, and then throwing up those contents.”

So maybe reforming these people shouldn’t be so hard They were brought up on booze and vomit – now all we have to do is put together a prison where that is all they will get to have from here on in. They are already used to it, so no need to feel bad for them, right?

Maybe I’ve contracted a bad case of “trillionitis” during the Great Recession, but these estimates sound like chump change to me. Surely somebody was making a lot more than this from rigging LIBOR.

I view this differently. I made VERY conservative assumptions, and the numbers you get dropping to individual’s bottom lines is still pretty big.

And this was only assuming banks v. customers. You had some banks that profited at the expense of others, so at certain banks, you can add the “distributional” profits to the customer fleecing profits.

I think I’ve just gotten jaded over the last couple of years.

I also wonder if I wasn’t paying rather too much attention to the revenue obtained rather than the total amount of manipulation. It seems to me that the latter figure better summarizes the deleterious effects on the rest of the economy.

Since your logic may have some reality to it, they need to do this,

http://www.nakedcapitalism.com/2012/07/so-how-much-did-the-banksters-make-on-libor-related-ill-gotten-gains.html#comment-757768

Otherwise, in their own words “head above parapet”.

Yves says:

“That gives you $2.9 billion across all 16 banks, or $180 million per bank. [per year] Times four years, you have $720 million.” [per bank on avg]

It also means that 2.9 billion a year for 4 years is equal to 9.6 billion that was added to the bonus pool for those 4 years at those 16 banks. At 40- 50% distribution rates 4- 5. Billion ended up in the pockets of those fortunate few.

MS may be wrong with their 35 BP estimate and Yves may be lowballing her estimate at a conservative 1 bp.

The actual looting lies somewhere in between, but Yves conservative estimate is revolting enough.

In the late 1800s US legislatures shifted penalties for white collar crimes from jail to fines. The argument was that juries would be less likely to convict if jail terms were the punishment. Given the high esteem (sarcasm intended) of banks in our society, why not experiment with a reversion to 19th century practice: jail terms….and in the general population, not white collar prisons…for any banker when the crime involves large sums of money and hurts the average person.

Robert, why not let the fuckers make all the money they want? But then tax them at a commensurate rate. The more you deviate from a base rate the higher percentage you pay. Really whats so difficult about that for people to understand? Thats the only cure that will ever work to get the pigs disinterested in the trough. I mean, how can they think of anything but money when there’s no problem just starting another scam, and if they get found out, oh well, pay a small percentage of the take and on to the next scam. The only answer is to limit their take.

@ Jack M: You are right. The trouble is, the fuckers are running everything, or working directly for those who do, so it ain’t gonna happen.

Heh, has ANY of these big bonus earners EVER been audited by the IRS ??

Assuredly there is people in this country who DO know these things.

Collateral damage to a larger number of non-fraudulent highly productive people that’s why.

Prison is an excellent deterent to those who think of themselves as been above the common man let alone thugs from the hood.

been => being

I thought the notional value of Libor related paper was considerably higher than $350 trillion.

What is the typical rate of profit per basis point movement?

As it is, for rough estimation purposes, it looks like revenue capture was one/one hundred thousandth of notional value. I would have thought it would be a little higher, a sort of percent of a percent kind of thing. So I am trying to figure out how it gets cut another tenth.

The BBA number (I think) is OTC trades, as in interest rate swaps, which would have the real profit opportunity for the banks. The really huge number was for a single CME contract, $564 trillion in the Eurodollar future, which reflects Libor. But that’s exchange traded, so the banks wouldn’t be acting as intermediaries on that.

I have no idea how much revenue capture there might be, this is just a stab to see if anyone comments.

And if the bankers didn’t make much more than I guesstimated, this shows their looting is inefficient (as in they do a lot of damage relative to what they extract).

“And if the bankers didn’t make much more than I guesstimated, this shows their looting is inefficient ”

And could also indicate they work for VERY specific people.

Actually, I think we may have a stock v. flow problem.

The FSA talked about the value of Eurodollar futures contracts traded in 2011 as $564 trillion.

But that contract has a three month maturity plus one contact can easily be traded multiple times over its short life. So the total outstanding on average of that contract is much less (1/10?) of the total traded over a year.

This article (h/t Simon Johnson) mentions “A 2010 study cited in the suit — conducted by professors at the University of California, Los Angeles and the University of Minnesota — indicated that Libor was significantly lower than it should have been throughout 2008 and was particularly skewed around the bankruptcy of Lehman Brothers.” Might that prove at all useful?

Seems fitting that an opaque finanical instrument(swaps) benefited from an opaque release of pricing libor. Banks have done everything possible to make sure the swaps market is opaque and not transparent. Just think all those contracts betting on libor and the very index is a process borne of collusion and fraud.

Opaque serves one purpose, to lull investors into believing their interests are included in the inclusion process of making-a-buck-identity.

Isn’t that an underlying theme here on NC, the identities ?

Heh.

I cannot make a useful estimate of the bonus payments due to LIBOR manipulation, but the best data on the manipulation that I have seen is embedded in more than 20 graphs and charts in the amended complaint filed this Spring in Schwab Short Term Bond Market Fund vs Bank of America Corp as Document 131 in the Multi District Litigation in the Southern District of New York. The data obviously developed by Schwab’s experts, is current through 2011 with some data going into 2012. You can obtain the Amended Complaint as a PDF with a simple search or read it on outside counsel’s (Lief, Crabaser) website. Fund managers like Schwab have a duty to recover the full measure of damages or more even though there is litigation risk. The banks have serious exposure to RICO, Clayton Act, and Sherman Act fines. Translation: The Morgan Stanley estimates are low. Once specific officers and employees are identified along with the actual bonuses paid in the different banks, valid estimates of the spoils could be accurately deterimned. The DOJ’s (Criminal Division) settlement with Barclays specifically reserves the right of criminal prosecution of said officers and/or employees. It would not be difficult to engineer a plea deal to get to the real story on “bonuses”.

Jesus, you have captured the story !!

“It would not be difficult to engineer a plea deal to get to the real story on “bonuses”. ”

[it’s doubtless ‘already been done’]

Liebor: Half a trillion dollar heist on mortgage holders in the US according to this article http://market-ticker.org/akcs-www?post=208502

Banks’ Libor costs may hit $22bn according to FT but then there will be the lawsuits

LIBOR scandal set to rock U.S. as experts warn it could be ‘the biggest consumer fraud in history’

http://www.dailymail.co.uk/news/article-2172377/LIBOR-scandal-rocks-US-experts-warn-biggest-consumer-fraud-history.html

Libor Scandal Could Turn ‘Ugly’ As U.S. Cities Begin To Sue

http://www.huffingtonpost.com/2012/07/11/libor-scandal-lawsuits_n_1665708.html

Libor is peanuts compared to the financial frauds associated with the housing bubble. Libor at most will probably be in the tens of billions while the housing bubble was in the trillions. The difference is that there will be more of a hew and cry this time because banks and other financial players, and not ordinary people, were the principal losers.

Fiddling Libor up from 2004 to 2009 was a good legalized form of extortion; fiddling it back down from 2007 to 2011 was a desperate attempt to stay afloat after the extortion killed the goose. Who are these idiots?

“Libor is peanuts compared to the financial frauds associated with the housing bubble. ”

And because of its size is well suited to make a beginning for anything other than a prosecutionally-‘challenged’ Justice Dept.

Don’t worry, though; we’re safe from 61 year old women who “steal” $13,000 worth of rent subsidies and food stamps:

http://strikelawyer.wordpress.com/2012/07/13/prosecutorial-discretion/

Yves,

I’d suggest complementing your ‘bottom-up’ analysis with a very ‘top-down’ one, the idea that the two efforts might bracket the true looting by the banksters.

Toward this end, I’d start with John Bogle’s argument, laid out in his book c. 2005/6, that Wall Street had doubled its share/percentage of corporate profits in the US from the the historical average 1930-1980 (approx 8%) to 16+% by 2003-4. (And IIRC, it hit 40+% post Lehman in 2009.) The question then is, how much of this increased profitability was due to superior technology (“rocket scientist” algorithms running on fast computers, etc), regulatory laxity allowing predatory practices, and outright fraud (from front-running to LIBOR rigging).

I don’t have the numbers in front of me to do this sort of breakdown but I’d be very interested if you took a shot at a back-of-the-envelope estimate of the quantities involved. I’m convinced we’re looking at hundreds of billions of dollars per year, especially when the sums are taken wrt the global economy.

Now we know how the 1% became the 1%.

p

According to Tom Paine, at foundation of every new government lies a great crime.

Yves, you say:

“Now 35 bps is the total manipulation assumed, but how much turned into actual revenue? This is a critical assumption. Let’s assume a mere one basis point.”

But why only charge the LIBOR manipulators for the instances when they made money? In every instance their intent was to help themselves to unearned profits at the expense of everyone else in the market. So it only worked in their favor for 1 out of 35 bps. The crime extends to the whole 35 bps. Therefore their penalty should be based upon the total amount of their manipulation: $350 trillion X 35 bps = $1.2 trillion. That’s $77 billion for each of the 16 banks.

I say let them pay it back over 20 years @ 6% interest. Payments made to the treasuries of each country affected.

Please re-read post headline.

The purpose of this post is NOT to figure out how much people were hurt, how much the banks should be fined, etc. It is to take a stab in how much the perps made personally that will never never be clawed back.

So the profits are what matter, the traders and execs are paid from profits.

“notice we’re not including ideas like the possible front running of futures contract”

“a comparatively small number of people who’d be very cognizant of the manipulation by virtue of seeing the contrast between posted Libor versus actual market prices, likely profited very handsomely. ”

This is where they need to break out the forensics and demonstrate to people that trusting in the investing world is not a farce.

Unless these traders have a new technology for communicating w/their clients, or perhaps the financial world’s al-Qaida-like courier messengers have defeated the Spy Alliance, again, ..

They’ve yet to develop the will of adults, or such seeming self-deprecation is chic at the Justice Dept. ?

[chintzy jokes]

“Libor manipulation led to higher bonus payments which will never be recouped.”

And pray tell why it is so? Theft is theft in any country and these gains can be recouped…providing there is political will to do it.

No, you really can’t claw back compensation unless you have holdbacks. There really is a pretty strong legal foundation in the US that you can’t rescind pay.

These guys might be fined, but that isn’t a clawback (the company would do the clawback, the government might fine). But the record here sucks. Gary Crittenden, the Citi CFO, paid a remarkably pathetic fine for lying about $40 billion of CDO exposures (as in not reporting them).

Love you Yves;”..you really can’t claw back compensation unless…” puts Whiley Coyete going over the cliff holding the billboard “National Security”.