Yves here. We’ve flagged in earlier posts how the Spanish banking crisis has the potential to become destabilizing politically, as if Spain wasn’t already at considerable risk of upheaval. Spanish depositors were pushed to convert their deposits into preference shares, which they were told were just as safe. This was a simple desperation move by the banks to save their own skins, customers be damned, by raising equity from the most unsophisticated source to which they had access. And now that that gambit failed, these shareholders are due to have those investments wiped out unless the Spanish authorities can cut a deal to spare them. Don’t hold your breath.

By Delusional Economics, who is horrified at the state of economic commentary in Australia and is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness

I mentioned back in early July that Spain had a serious political problem brewing because the draft Memorandum of Understanding for the Spanish banking system clearly stated that:

Banks and their shareholders will take losses before State aid measures are granted and ensure loss absorption of equity and hybrid capital instruments to the full extent possible.

From a market perspective this is absolutely the correct thing to do. Equity is a risky business. You take a punt, the banks falls over, your money it gone, fair enough. But in Spain it’s not that simple because of something I commented on in April:

The key in a banking crisis is to keep the confidence of depositors. But while many countries relied on capital injections and government guarantees, Spanish banks have added a unique twist of effectively turning some depositors into equity holders. That puts customers on the front line.

Some banks started by persuading depositors to switch from low, interest-bearing accounts into preference shares, which paid a fixed, higher interest rate. The benefit for the banks was that these securities counted as core capital under banking rules. UBS says Spanish banks issued €32 billion ($42.7 billion) of such instruments from 2007 to 2010.

But as the crisis deepened, these instruments became illiquid, trading at deep discounts. At the same time, they ceased to count as core capital under new rules known as Basel III. So banks have encouraged investors to convert preference shares into either common stock or mandatory convertible notes, which pay a high initial yield before later converting into stock.

And so now, under the watchful eye of the Spanish regulators, depositors in Spanish banks had been converted into equity holders and these same people were about to see their savings eaten up by the first stages of a banking bailout.

Although there are other factors involved, I think this is one of the primary reasons Mariano Rajoy has been so hesitant to move forward with any bailout, and it comes as no surprise that he is now attempting to negotiate a way out for these people:

The Spanish government is in talks with Brussels to allow tens of thousands of retail clients who bought risky savings products from now nationalized lenders to avoid losing their investments as part of Spain’s bank bailout.

In place of inflicting large losses on small savers who purchased savings products linked to preference shares in in the lenders known as cajas, the Spanish government is negotiating a compromise where they will suffer an instant haircut, and then be repaid in full over time by their banks, people familiar with the talks said.

The decision to inflict losses on holders of high interest preference shares and subordinated debt in rescued savings banks has been highly controversial in Spain, with the terms of the country’s bank rescue not distinguishing between professional and retail investors.

Apart from the obvious question of whether they will actually get a deal, the other question is will the banks be in any position to make those payments in the future. As WSJ reports, the banking system looks increasingly flakey as deposits continue to leave the country and the hole is filled by ECB:

Spanish banks borrowed a record amount from the European Central Bank in July, as other sources of funding evaporated further in the weeks following the announcement of a €100 billion ($123 billion) bailout for the country’s financial industry.

Bank of Spain data indicated that net ECB borrowing rose to €375.55 billion from €337.21 billion in June. It was the 10th straight month of increases, highlighting how the country’s lenders are having more and more difficulty financing themselves through private investors.

Spain’s traditional funding sources have been dwindling as the economy sinks deeper into a downturn. During the Spanish construction boom of the past decade, German and other European banks were more than willing to fund the rapid expansion of the Spanish banking system, inflating the country’s credit bubble.

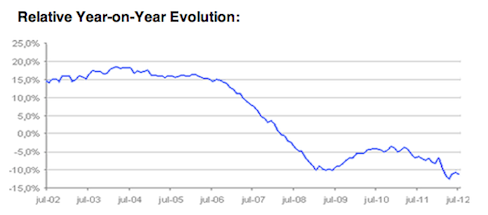

And the latest report from Tinsa makes it very clear that the bubble’s deflation is far from over:

The IMIE General index registered a year-on-year decline of 11.2% in July, pushing the index down to 1577 points. The cumulative decline in house prices since the market peaked in December 2007 is 31%.

…

In terms of the cumulative decline in house prices by region since peak prices, there was a 37.2% fall in July for the “Mediterranean Coast”; followed by 33.5% for “Capitals and Major Cities”, 32.1% for “Metropolitan Areas”, 29.2% for the “Balearic and Canary Islands” and 25.9% for “Other Municipalities”, which comprises the remainder.

Mariano Rajoy is expected to meet Herman Van Rompuy, Angela Merkel, Mario Monti and Finland’s President, Sauli Niinistoe, over the next few weeks in order to discuss his country’s future. It is, however, increasingly obvious that he will have little choice to accept whatever he is given, and I have to question again exactly how long he has left in politics.

young phill pilkington could surely find a way to “post-keyneese” out of this mess.

Lay off young Phil with out substantial argument or its head shots a dawn, proto – troll.

skippy… BTW ask daddy if you can buy some gum, that should keep your gob occupied for a bit.

Agree. “And is the name “Phil” so difficult to remember how to spell?)

As I recall the Keynes theory relies on saving during the boom phase, so it doesn’t even apply to our current situation.

We need a theory which involves reckless spending on non-performing assets during the boom, and then insider looting of all remaining wealth during the bust. Oh that’s right we already have that theory.. it’s called a reset with possible mass conflagration.

+ 1

ditto…no nod to Rush

Reckless spending? Where? If you had said spend on worthless crap like the military, then you might be on the track to something meaningful, but the deficit itself has not been that great or even harmful.

The deficit is just getting worse and worse. The biggest fraud of all is how it got created. Privately owned central banks such as the Fed creating money out of nothing, lending it to the government who then has to pay it back with interest. The more the government spends the more they get into debt and the more they have to raise taxes to pay for it.

Many retirees and pensioners were deceived by cajas to buy those preference shares. The first caja to ussue those shares was, not surprisingly Caja de Ahorros del Mediterraneo (CAM), strongly exposed to real estate investment in the mediterranean cost. I remember well those “analysts” and “experts” that cheered up CAM saying that issuing those shares was a corageous move.

Hehe, using civilians as shields: a good old war tactic. If you aim to shoot us, you will be shooting widows and orphans – say the bankers. Too big to fail is so last season. Now it seems to be too sensitive to fail.

Seems more like terrorist hostage-taking to me.

What we need is snipers with good aim.

AKA regulators?

Is there any data on how many customers got these convertible instruments and how much they amount to? I had the feeling it wasn’t many but who knows how much rip off has been going on.

I’m spanish. I know people (including my parents) who put savings in “safe, guaranteed investments” that turned sour and they lost all interest when withdrawing after the crisis, that’s the best case the worst one being getting some garbage equity or losing principal. I just don’t know how much that happened.

Question:

What are these Pref shares trading at today?. The article says they were at steep discounts a year ago. I’m assuming they are worse off today.

I wonder what an account statement says about these holdings for individuals. Are the reports based on par? Or market?

This is like the Fannie and Freddie story. They had big pref shares out to the public. It was sold to retail with the whisper, “the money is quaranteed by Uncle Sam”.

The 25$ pref is now trading at about $2……….

And like the ARS (auction rate securities) sold to Ma and Pa as “safe as cash” by Citi/JPM etc.

And soon to be compared to Munis, and “high quality dividend paying stocks”.

Just the same thing Charles Keating tried with Lincoln Savings and Loan. Once again financial services types acting like used care salespersons.

They have no more fiduciary duty than the used car sales person. The banks spent lots of money to fight legislation which would have made them fiduciaries.

How many people know their broker has NO requirement to look after their best interests.

“…the Spanish government is negotiating a compromise where they will suffer an instant haircut, and then be repaid in full over time…”

BWA-HA-HA-HA-HA-HA-HA!!!

Well, what they say is that shares would be exchanged by bonds with a haircut of about 50% but with high interest rates, after 10 years you would recover an amount of principal plus interests roughly equivalent to the initial investment.

As you wrote: BWA-HA-HA-HA-HA-HA-HA!!!

The power of these banks is totally illusory. The sad thing is that politicians outside China and Russia live in a world of illusion, where capitalists are wise, sagacious and always toiling for the benefit of humanity.

I predict some form of fascism in Spain. It’s the only way to maintain the current hegemony of finance capitalism. Greece is already on its way.

“I predict some form of fascism in Spain.”

I predict some form of fascism in the US. It appears to my dumb Southern eyes that various forms of State Capitalism is the wave of the future. How this differs from fascism is above my pay grade – perhaps they are the same only the term fascism was retired after WWII.

Perhaps the founding father John Jay said it best:

“those who own the country ought to govern it”

Mitt and Paul would agree.

Jim

In the US?

“Predict”?

No: “Observe”.

Again we need to distinguish between Europe’s 99%s and its kleptocratic elites. Rajoy is only incidentally Spanish. Otherwise, and more importantly, he is a servant of kleptocracy. So it isn’t Rajoy against Germany and the North. It is German, Spanish (Rajoy), Greek, Italian, etc. elites against all the 99%s.

If ordinary Spaniards want real answers and solutions, the first step is to overthrow their current political class. This class does not represent them. It only represents itself and its interests. The sooner this is understood, the sooner things get better.

Spanish depositors were pushed to convert their deposits into preference shares, which they were told were just as safe. Yves Smith

Ironically, if banks only issued their own common stock as money, bank runs would be impossible. Why? Because common stock is not normally redeemable. It make no false promises as the banks do (“Your deposit is available on demand even though the reserves backing it are pledged multiple times.”)

Instead, rather than “sharing” wealth, we have a money system that steals and concentrates it.

Our money system is based on:

1) theft

2) lies

3) usury

4) oppression of the poor since they are considered less “credit worthy”

5) Extraordinary government privileges such as deposit insurance and a legal tender lender of last resort.

Note that bank regulation does nothing to fix the above.

“Spanish depositors were pushed to convert their deposits into preference shares, which they were told were just as safe. This was a simple desperation move by the banks to save their own skins, customers be damned, by raising equity from the most unsophisticated source to which they had access.”

Profoundly sad. Completely immoral.

There seems to be no difference between Spanish Banks and US Brokerage Firms. Spanish depositors were pushed (bamboozled) into turning their sure cash into unsecured betting chips for the banks; Sentinel used segregated customer funds as collateral for speculative capital (in the process pulverizing the “segregated” customer funds).

There is no difference. These are all instances of Kleptocratic maneuvers to grab working people’s cash — across the international world of finance.

More examples of the fact that we now live in the age of Kleptocracy vs. The Rest of Us. Any of the latter who don’t see it are either too afraid (and/or in denial), or too dumb (at a Very low level of dumbness).

People should be afraid. In Europe and the US the police state is securely in place. In the US the Executive can simply have dissenters held without trial if they become too troublesome. The banks own the system and the only ‘crimes’ the bought judiciary will now prosecute are the ones that upset Wall St (whistle blowing; protest and real journalism)

The trappings of democracy are looking more and more like a meaningless facade, and for the first time since 1789 the ‘rule of law’ is a revolutionary demand.

yes we already have fascism, crony capitalism is another word for it.

One minor correction, “Finland’s President, Sauli Niinistoe” his last name is “Niinistö”, the “oe”=”ö” replacement doesn’t really work with finnish.