By Eric Tymoigne, Ph.D., Assistant Professor of Economics at Lewis and Clark College and Research Associate at The Levy Economics Institute. His research expertise is in: central banking, monetary economics, and macroeconomics.

The public debt is the outstanding U.S. Treasury securities (USTS). It includes both marketable (T-bills, T-notes, T-bonds, TIPSs, and a few others) and non-marketable securities (United States notes, Gold certificates, U.S. savings bonds, Treasury demand deposits issued to States and Local Gov., all sorts of government account series securities held by Deposit Funds). What are the means to reduce the public debt?

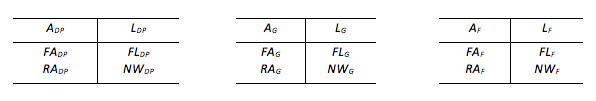

To answer this question it is best to start with the flow of funds accounts. Flow of Funds data are divided in three broad sectors: Domestic Private, Government, and Foreign. They each have a balance sheet:

FA: Financial Assets, FL: Financial Liabilities, RA: Real Assets, NW: Net Worth

It is trivial that every lender there is a borrower so:

(FADP – FLDP) + (FAG – FLG) + (FAF – FLF) ≡ 0

Simplify by assuming a closed economy with no debt in private sector and only the Treasury in the government sector:

Simplify by assuming a closed economy with no debt in private sector and only the Treasury in the government sector:

FADP ≡ FLGT

The financial liabilities of the Treasury (Public Debt) is the financial asset of the domestic private sector. Remember this board in NY city:

Well you could change it to this: (Suddenly I feel $119,027 richer!)

Now let’s assumed that the Treasury wants to eliminate all its financial liabilities: no more public debt! (FLGT = 0). What are the means to do so?

- Let securities mature and do not repay securities holders: 100% tax => FADP = 0 (the U.S. domestic private sector lost a bunch of financial assets!)

- Switch to a Treasury financial instrument not considered a liability (Coins are treated as equity by the Federal Accounting Standards Advisory Board): FADP ≡ FLGT => FADP ≡ NWGT

- (If one adds the monetary authorities, aka Federal Reserve in the government sector) Switch to another liability of the government: repay with Federal Reserve liabilities (Credit the bank accounts of treasuries holders and inject reserves in banks, or pay with FRNs): FADP ≡ FLGT => FADP ≡ FLGFR (Main way today)

What if the Treasury does not want to reduce it public debt but want to bypass a debt ceiling?

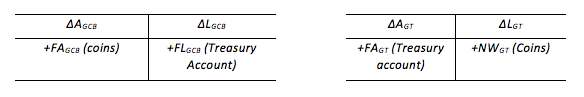

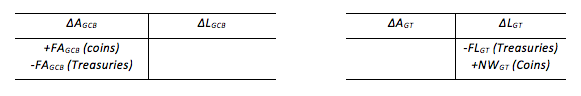

1-First, coin issuance to Fed (∆ refers to change in assets or liabilities):

2-Second: buys back treasuries from Fed with coins: debt-equity conversion (now the Treasury can issue more treasuries)

3-Third: issues a treasury liability not subject to the debt limit. Examples are United States notes, which look exactly like federal reserve note except for the color.

So, if I understand correctly:

Issue platinum coin(s) (‘coin issuance to Fed’), and then create a modern version of Lincoln’s Greenback (real platinum backed, sovereign-government issued money – the “Dollarinum”) on the back of it. Use that money to buy back debt (treasuries) from the Fed (which legally they must accept; thus endowing the Fed requisite equity) and, concomitantly, open the fed’s own fiat currency (presently in circulation) to currency competition?

Hmmmm! If you allow the American people (and foreign governments) to make their own choice as to which currency they have most faith in, it’s issued as a floating currency and created interest free too, I’ll buy it!

While it seems to me that the Fed would have to accept the platinum coin, as according to law, any currency/coin issued by the US Treasury is legal tender, apparently the Fed and Treasury (Timmy) has interpreted the law otherwise. As Ezra Klein wrote yesterdat:

“The Treasury Department will not mint a trillion-dollar platinum coin to get around the debt ceiling. If they did, the Federal Reserve would not accept it.

That’s the bottom line of the statement that Anthony Coley, a spokesman for the Treasury Department, gave me today. “Neither the Treasury Department nor the Federal Reserve believes that the law can or should be used to facilitate the production of platinum coins for the purpose of avoiding an increase in the debt limit,” he said.”

We can speculate about different alternatives to skirt the debt ceiling issue but a final decision has been made by the administration. Obama says he’s willing to risk default, if necessary, in order to maintain his principled belief that responsibility must remain with Congress. IOW, Obama’s hands will be tied, he’ll have to sacrifice some virgins to appease the vain and tyrannical Congressional deities.

The administration’s position is that raising the debt limit is Congress’s responsibility until the day that Congress votes to make it the White House’s responsibility, which is a resolution the Obama administration would happily accept. Until then, White House officials say, they will not negotiate over the debt ceiling, and if congressional Republicans attempt to use it as leverage, then the consequences will be theirs to bear. As White HOuse Press Secretary Jay Carney put it, “there are only two options to deal with the debt limit: Congress can pay its bills or they can fail to act and put the nation into default,.”

http://www.washingtonpost.com/blogs/wonkblog/wp/2013/01/12/treasury-we-wont-mint-a-platinum-coin-to-sidestep-the-debt-ceiling/

Hmmm! This is not a ‘Platinum Coin’ solution, I think. As I interpret Dr. Tymoign’s methodology, he’s not suggesting avoiding the debt limit per se (i.e. increasing the amount of money by one trillion and continue to pay debt once it is breached), simply the creation of an “alternative “currency that allows the government to buy back treasuries from the Fed – thus reducing outstanding liabilities, thus not actually hitting the debt limit. As such, I believe Ezra Klein’s reporting is neither pertinent nor germane to the line of Dr. Tymoign’s thinking.

It’s an interesting notion – this alternative, “proper”, government issued money might even prove to be more valuable and in demand than the Feds own issued currency. And, its issue would be entirely legal; the Fed has no choice but to accept it (and any other number/type of currencies issued by the government). The additional benefits of a proper Government backed; floating currency, issued with no interest competing in a ‘free-market’ would be fascinating to say the least. Still, I’m inclined to believe that Obama doing a Lincoln is highly remote, alas!

“Neither the Treasury Department nor the Federal Reserve believes that the law can or should be used to facilitate the production of platinum coins for the purpose of avoiding an increase in the debt limit,”

I don’t want to read that to say that the law cannot and should not be used for the purpose of avoiding an increase in the debt limit.

That might be just the purpose of the law to repeal the debt limit – long overdue.

One of the bloggers I read pointed out that the Fed has not said it would not accept the coin. The spokesman for the Treasury said neither Treasury nor Fed believed it was ‘appropriate.” I hate it when Obama has his minions go out ant publicly announce he will not use some tool that is available to him. Anyway, there is a technical word, “seigneurage,” which describes the profit to the crown from minting coins. In this case we could use an ounce or two of platinum, print on the face of the coin that it represented $1 Trillion, and voila! We have a seigneurage profit of $1 Trillion minus the market value of an ounce (or so) of platinum. Probably want to mint a dozen or so, but only deposit them at the Fed one a a time. On the other hand, as other posters point out, the reason Obama is doing this is so he can claim he was forced to cut earned benefits to get the Republicans to give him a two month extension on the debt limit.

Please advise the source of the comment that the Fed did NOT say it would not aaccept the coin.

Because THAT to me raises the Constitutional question.

“Mr. Chairman I have here a $Trillion deposit for my account, as authorized by Statute and the Constitution’s power for Congress to coin money and regulate its value.”

It’s not the Chairman’s job to determine the legality of the deposit being made.

Once authorized and minted according to law, it becomes currency.

Period.

Obama is extremely fond of breaking the law and ignoring the Constitution, as we found out with warrantless wiretapping, Bradley Manning, and the “assassination lists”.

So of course Obama and Geithner would rather violate the 14th Amendment by allowing the US to default on its debt, than take the entirely legal option of minting coins.

At that point someone can sue in federal court to FORCE the Treasury Secretary to mint the coins. I suggest getting the legal paperwork ready.

Nat- don’t worry, O won’t let that happen, he will, “reluctantly” make a deal with the Reps, part of which will be whacking “entitlements”, in order to save us from the terrible fate of “defaulting” –

To buy back the treasuries, Treasury could always issue 1 trillion $1 coins… Good luck stocking all that metal.

In addition, to juice up the deal the treasury could buy back treasuries from the Fed at a premium. Why would the fed refuse such great deal?

Private companies use all sorts of tricks to reduce their leverage. Gov can do the same.

Of course the better option is just to get rid of the debt ceiling…

No. I believe he is offering three different alternatives for avoiding the debt ceiling, here. Deposit coins in Treasury’s account at the Fed; or use coins to redeem Treasury Securities from the Fed; or simply issue a “greenback” type currency.

Correct. The bypassing of the debt ceiling involves three options. It should read first option, second option, third option.

Am I the only one who believes a competing currency would confuse the American public and undermine confidence in our economy? The economy is still in the shitter partially because, despite flush with cash, corporations are not spending because they’re not confident in the recovery. Do you think resorting to gimmicks like swapping fed notes for us notes will really increase confidence? If the ultimate goal of bypassing the debt ceiling is to improve the economy my government spending, then this won’t work if it undermines confidence.

Confusion? No – least of our problems. Since, actually, both The United States Note (a still legal national currency note)and Federal Reserve Notes (Federal Reserve System note) have been legal tender and have been used in circulation as money in the same way since the gold recall of 1933.

However, the United States Note’s circulation was contracted through the period leading up to 1878 – when it was capped at $347,000,000 or so – and none have been issued since January 1971.

The principal difference between a United States Note and a Federal Reserve Note is that a United States Note represented a “bill of credit” and was put into circulation free of interest. Federal Reserve Notes are backed by debt purchased by the Federal Reserve, and thus generate interest, for the Federal Reserve System.

So, I guess if your average union soldier could work with two currencies (or more) in circulation and figure out which one best served his interests, I’d have faith that our savvy, street smart, 21st century American could do the same, no?

All we need to do is get Dr. Tymoigne, et al to persuade the Treasury to remove the circulation cap on the still legal United States Note, and let it compete with the Federal Reserve Note. If not for the public’s general use, then at least for the government to pay its armed forces, healthcare and government administration costs?

The circulation cap on the US Notes was unfortunately put in place by Congress. Hence the need for the platinum coin.

“Federal Reserve Notes are backed by debt purchased by the Federal Reserve, and thus generate interest, for the Federal Reserve System.”–TP

That’s the give-away that the whole monetary system is designed very differently than most people think it is. Government securities are valuable because they are backed with a promise to re-pay in currency. The currency, in turn, is backed by ( or maybe “denominated in”?) Government securities (well, Gov’t securities and RMBS). Tight little logical loop, that…

On a technical note, I’m pretty sure the interest from Treasuries held by the Fed is returned to Treasury in full.

“On a technical note, I’m pretty sure the interest from Treasuries held by the Fed is returned to Treasury in full.”

No, it’s not. This is very important.

Look up the details on this. It’s retained by the Federal Reserve Banks.

This is in fact the *essence* of the corrupt deal which was made to establish the Federal Reserve; the government got control over the money supply, *but private bankers got the profits from the seignorage*.

The Fed returned $90 billion in profits to the Treasury this year.

[Just to put this to bed once and for all.]

@ Nathanael

You’re wrong about this. You need to look it up: http://www.federalreserve.gov/publications/annual-report/2010-federal-reserve-banks.htm#8

What makes up that difference?

It has been the law since 1947 that Fed profits be returned to the Treasury. Eustace Mullins, Gary Kah, and Thomas Schauf have misled the American people on this; they didn’t do their homework.

_________________________

From: Money and the Federal Reserve System: Myth and Reality

by G. Thomas Woodward, Specialist in Macroeconomics, Economics Division, July 31, 1996, Congressional Research Service Library of Congress , CRS Report for Congress, No. 96-672 E

A note on Federal Reserve Capital Earnings

Thanks for making this key point:

“The principal difference between a United States Note and a Federal Reserve Note is that a United States Note represented a “bill of credit” and was put into circulation free of interest. Federal Reserve Notes are backed by debt purchased by the Federal Reserve, and thus generate interest, for the Federal Reserve System.”

The Federal Reserve System, which is owned by private banks. Federal Reserve Notes exist to funnel interest to private banks. US Notes are the same *except* that they aren’t giving away free money to bank executives.

Note the subtle distinction: the Federal Reserve System is *owned* by private banks (they get the profits), but *controlled* by the government (it appoints a controlling share of the boards).

Nathanael says: ‘Federal Reserve Notes exist to funnel interest to private banks’.

The Fed transferred $79.3 billion in 2010; in 2011, transfer $76.9 billion in profits to the Treasury – as the Fed is required by law to turn over its profits to the Treasury each year – 97 per cent of which was generated by interest payments.

Though, somewhat, like a charity or church the Fed is a tax-exempt, “non-profit” organisation; rather than paying for funding, it simply creates the money that it needs at, effectively, no cost. In addition to the money sent to the Treasury, the Fed spent, approximately, $5 billion on its own operations (Salaries, OOE, etc.); though, there has never been a full audit of the Fed to determine whether its stated income and operating expense reconcile.

@Titus Pullo

Again, another myth about Federal Reserve audits that needs to be cleared up, especially on a finance blog. (It would be helpful if MSM anchors and pundits spent less time in the makeup room and out to dinner, and more time hitting the books, as well.)

From: Money and the Federal Reserve System: Myth and Reality

by G. Thomas Woodward, Specialist in Macroeconomics, Economics Division, July 31, 1996, Congressional Research Service Library of Congress , CRS Report for Congress, No. 96-672 E

I believe it’s implicit that I am referring to a financial audit rather than an operational audit of the Fed.

Still,(and, contradictory to your opening clause) is Dr Woodward’s own clear distinction of internal and external audits of operations (efficiency, risk policy etc.) and a government (public) financial audit (monetary policy and financial assets, liabilities, and items held in custody, etc.). With respect to the latter (monetary policy and financial assets, liabilities, and items held in custody….), the Fed has never been publicly audited – least of all by the GAO.

From the Feds own web page http://www.newyorkfed.org/aboutthefed/fedpoint/fed35.html. :

..’Operations at each Federal Reserve Bank also are subject to review by the Government Accountability Office (GAO), the audit arm of the U.S. Congress.

(My parsing of the paragraph)

..’However, GAO auditors are restricted by law from reviewing monetary policy operations and transactions carried out by the Federal Reserve on behalf of foreign central banks’..[and domestic banks] …. (for completeness).

And, your emphasis of Dr Woodward’s book extract seems to support the Feds own public statement (link above).

I agree.

and there is no reason to do so.

Getting rid of Federal Reserve Notes and replacing them all with US Notes would certainly increase confidence. The “End the Fed” types from both right and left would be happy, for one thing!

Totally agree.

I totally support ending the FRbanknotes(so to speak).

In the process of “End the Private Fed”.

But the proposal here was for competing currencies.

That’s ludicrous.

You can have alternative currencies now.

But they have no standing as ‘currency’.

What is needed is a complete change to the electronic Greenback-type currency.

This is the essence of monetarily sovereign accounting that resolves the national debt issue.

IF there is a national debt issue.

For the Money SYstem Common

Confusion would not be a problem, since the notes (and the electrons zipping around inside computers) would look and act in exactly the same way.

And Corporate confidence is not what we need to be concerned about. The Corporations are doing just fine, sitting on their mountains of cash, as you point out. It’s those on the bottom of the pyramid who merit concern, and making sure that they possess enough effective demand (i.e. money) to provide for themselves and, who knows, maybe even have a few “unnecessary” things.

The corps will start investing as soon as they see an opportunity to profit, but those opportunities will remain slim if not-enough people have not-enough money to buy the stuff that’s already laying around, waiting for buyers. How is driving our country further into recession by not doing anything to increase purchasing power going to help restore the confidence of our beloved corporations?

Longer-term[?] we need to look at why the economy keeps funneling money away from “the bottom” and into the hands of corporations/investors who don’t do anything with it. There’s a fundamental design flaw there. It’s like a leaky engine that you have to keep adding oil to or it’ll seize up. We can keep adding oil (federal deficit spending) or we can fix the design flaw so that the money goes back to people who need it.

Great minds think alike…I’ve been trying to use the “engine” metaphor in talking with folks about macroeconomics for awhile. Money is the oil in the engine, and if there isn’t enough of it due to leaks (trade deficit), or if it is pooling up in one particular area (finance) and not getting to others (workers), then the engine seizes up and all hell breaks loose.

The problem right now is that, while we need to have a continual flow of new oil into our engine to make up for trade leakages, the new oil is being mainly poured into the finance industry which is where a whole lot of oil is pooling up already.

I think this could be worked into an understandable, basically correct metaphor for getting MMT across to non-econ types. Lets keep fleshing it out…

Or server where one component has a “memory leak” that causes periodic thrashing and crashing.

Also, adding oil through fiscal stimulus (financed through debt issuance, most of which is re-purchased by the Fed…) is preferable to QE, which never even has a chance to get to the real economy, where it might actually do some good.

The main problem with the so-called debt, is that it’s creation (which is really just a way of adding more oil to our leaky engine) currently entails the use of middle men (Primary Dealers), which is totally unnecessary and unfair. Apart from that, if the Government doesn’t spend more than it taxes, our leaky engine is just going to grind to a halt faster.

Corporations are not spending their cash hoard because they are not “confident” in the “future” of the “economy”?

What if they are not spending their cash hoard because they want to keep it for buying up distressed people and assets for a penny-on-the-benjamin when the opportunity arises? What if they are saving it to spend on buying up all the National Forests, National Parks, National Wildlife Refuges,

all the BLM land they want to buy, all the TVA/BPA/CVA/etc. dams, all the books in the Library of Congress, etc. etc. etc. if/when Obama and the Catfood Democrats are able to push the US FedGov into liquidation and IMF supervision and sell off all these public commonwealth assets under the Yeltsin Plan which they are working to bring to fruition?

You hit a partial strike on the head of the nail driven home so well by Atlanta Fed Credit Officer Robert Hemphill back in 1933 in support of the Chicago Plan for Monetary Reform.

The negative-velocity of hoarding can never be made up for by the Fed’s QE programs, as the Fed only does loan transactions that prodice excess reserves, and money never gets into the real economy.

Only the government can spend new money into the economy, and only after it is authorized, in a manner similar to either the Platinum seigniorage or that proposed in Dennis Kucinich’s proposed monetary reforms.

Said Hemphill:

“If all the bank loans were paid, no one could have a bank deposit, and there would not be a dollar of coin or currency in circulation. This is a staggering thought. We are completely dependent on the commercial Banks. Someone has to borrow every dollar we have in circulation, cash or credit. If the Banks create ample synthetic money we are prosperous; if not, we starve. We are absolutely without a permanent money system. When one gets a complete grasp of the picture, the tragic absurdity of our hopeless position is almost incredible, but there it is. It is the most important subject intelligent persons can investigate and reflect upon.”

Said Kucinich:

http://www.monetary.org/wp-content/uploads/2011/11/HR-2990.pdf

For the Money System Common

The insanity starts here:

“It is trivial that every lender there is a borrower so:”

This is not trivial at all and it’s an excellent case in point of why economics is an ideology rather than being in any way science-like. Ignoring the interest component of debt, not to mention the pervasive fraud and cronyism rampant in the financial sector and Washington is just the sort of thing that an ivory tower economist who is completely out of touch with reality would do.

I will not even go into the insane and unworkable “simplifications” going into that that make this model completely bogus for the real world. Instead I will rant.

Economics is a religion with math thrown in to fool the gullible. And the funny thing is that it’s not even especially good math, since the actual mathematics discipline has advanced considerable since when the economics ideologies that use math to prop up their specious social ideas split off from it way back around the first Great Depression(Referenced from Steve Keen’s Debunking Economics).

But hell, I say we just let the delusional economists have their way. Let them try out their gobbledygook math and phony models on reality. Personally I’m looking forward to the economic collapse and the subsequent frugal, low-consumption lifestyle we’ll have afterwards, and losing access to 2/3 our energy when we lose world reserve currency status will be a great start on that. It’s coming regardless, but this monetary insanity will do quite a bit to speed that up.

JGordon,

Your points are well taken. My experience is that ideology powers an economist’s analytic framework, whether its a Mises who begins with a maximum private sector/minimum public sector, or the Krugmans of the world who never met a public sector initiative they did not like.

An interesting example of this with the MMT adherents is this Harvard Review interview with Bill Mitchell which may identify realistic cause and effect insights while revealing an ideology promoting a role for government in promoting full employment, a popular policy outlook of questionable Constitutional legitimacy. It seems safe to say that all proponents of MMT support government programs for full employment, which supports your argument.

http://hir.harvard.edu/debt-deficits-and-modern-monetary-theory

JGordon says: : “I will not even go into the insane and unworkable “simplifications” going into that that make this model completely bogus for the real world. Instead I will rant.”

It’s important to distinguish between pure math and an economic thesis. For the purposes of illustration and the general reader the math used by Dr Tymoigne’s is perfectly sound. You may not like his underlying thesis or assumptions – but that doesn’t make his math “gobbledygook”.

I encourage you not to “rant”, but to expound on the perceived “insane and unworkable “simplifications” you see in his methodology – even just a little, if your insight is profoundly complex. As you might postulate something original, we’ll all be the better enlightened for it (truly, a noble endeavor in itself.

Frederick Soddy tried to invent or develop a science-based

economics. The Dry Land economists such as Charles Walters,

Erhard Pfingsten, Red Paulson, Carl Wilken, etc. developed a parallel and successor reality-based economics which they often called Raw Materials Economics. Charles Walters himself referred to the inspiration and insight he recieved from Frederick Soddy’s book Wealth, Virtual Wealth, and Debt: The Solution Of The Economic Paradox.

Here is a website maintained by a very cone-of-silenced/ wet-blanketed group of economists who call themselves Raw Materials Economists. They might also be called the Lost Future Economists or the Dry Land Economists.

http://www.normeconomics.com/materials.html

Thanks for the rant! I am with you for most of it.

There is no math here, this is just standard boring accounting without any economic theory.

The simplification was made to get to the point as quickly as possible(you would not like the accounting identity with all sectors in it…)

Now it is trivial because when someone borrows that means one person owes and another has a claim on the borrower; there are always two parties in a financial transaction. If you combine them (sum their debt and claim) financial assets and liabilities cancel out.

Yes that involves interest payments but balance sheets do not record this financial operation (If you want interest payment in the story, they would be an income to the domestic private sector)

Hope that helps!

Just for general reference. The pertinent section of the 14th Amendment:

“Section 4. The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.”

That is if the government decided it would pay off its debt in sea shells, then it would have a Constitutionally prescribed right to do so.

And 31 USC 5112(k):

“(k) The Secretary may mint and issue platinum bullion coins and proof platinum coins in accordance with such specifications, designs, varieties, quantities, denominations, and inscriptions as the Secretary, in the Secretary’s discretion, may prescribe from time to time.”

Also so from Article I, Section 8 of the Constitution:

“[The Congress shall have Power] … To coin Money, regulate the Value thereof … ”

which is what 31 USC 5112(k) does.

The government has the tools to overturn or work around the debt limit. But it is hard to see it doing so seeing as it invented the fiscal cliff and its suites precisely to justify cuts to spending which benefits the 99%.

Here, Hear!

(my version)

Why visitors still use to read news papers when in this technological world all is presented on web?|