My, my, SEC head of enforcement Robert Khuzami has revealed himself to be both remarkably thin skinned and not very good at making a case for himself.

Former IMF chief economist and MIT professor Simon Johnson took a comparatively mild swipe at Khuzami last week in a post at the New York Times’ Economix blog. Johnson was arguing that the SEC needed a tough head of enforcement and put former SIGTARP chief Neil Barofsky up for the job. Johnson ‘fessed up that that was a bit of a downgrade, since he had earlier pumped for having Barofsky head the agency.

Here is Johnson’s discussion of Khuzami:

The departing director of the division of enforcement at the S.E.C. is Robert Khuzami, a former general counsel for the Americas at Deutsche Bank, a job he held from 2004 through early 2009. Although Mr. Khuzami was once a distinguished prosecutor, his appointment to the S.E.C. turned out to be a mistake because Deutsche Bank was so deeply involved in the securitization morass that led to the financial crisis of 2008.

(For more details, I recommend this Web page, with information collated by UniteHere, a trade union. You should also read this assessment by Yves Smith on her nakedcapitalism blog.)

Mr. Khuzami has vigorously defended his record and insisted it would have been “unwise” to press Wall Street firms and their executives for admissions of guilt. Whether the S.E.C. failed to prosecute the executives who made the key decisions because it had no case or because of Mr. Khuzami’s views, we may never know.

In addition, concerns continue to grow regarding the extent of mismanagement and illegal activity at Deutsche Bank during Mr. Khuzami’s time there; Mr. Khuzami has recused himself from the latest S.E.C. investigations.

According to Jordan Thomas, a lawyer representing one of the whistleblowers from Deutsche Bank, as quoted in the Financial Times,

During the financial crisis, many financial institutions faced an existential threat and the evidence suggests that Deutsche Bank crossed the line by substantially inflating the value of its credit derivatives portfolio – the largest risk area in its trading book.

This is precisely the kind of complex case that requires a skilled prosecutor with detailed knowledge of how the industry works. At the same time, it cannot be someone who has worked for a major financial institution either directly or as its outside counsel. The potential for a perceived conflict of interest is too great.

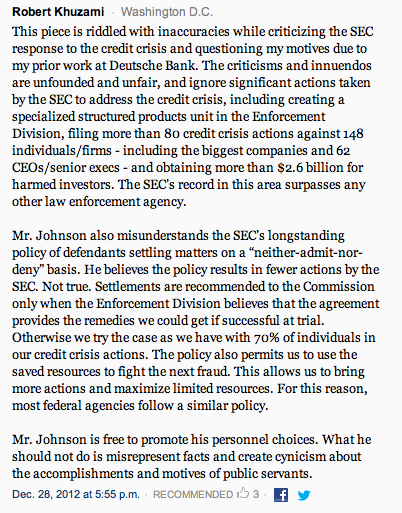

Khuzami responded in the comments section (I’m assuming it is indeed Khuzami; the post has been up for days and several readers pinged me about it. The SEC would surely be aware of it and would presumably have asked for it to be removed if it was a fabrication):

Readers may not be attuned to political and media protocol, but the fact that Khuzami responded to tame and well mannered criticism is simply stunning. This breaks with established form in two ways: first, he deigned to acknowledge the piece, and then that he took issue in a blog comments section.

This sort of loss of dignity is why people like Khuzami have staff. Someone at his level is supposed to be sufficiently well housebroken ignore public criticism unless it is from someone who can damage you or your organization. And if it gets to them, then the fallback is to draft a reply, sleep on it, and decide not to send it, or next best, run a sanity check with someone else at the agency, who would lead to him being told firmly that it would be a seriously bad idea to say anything. And even if someone senior were foolishly to go ahead, the comments section is the wrong place. If he thinks the article is inaccurate (which is Khuzami’s contention) he should take it up with the editors and demand a correction. Or if he thinks it’s unfair, a letter to the editor is a much more fitting venue for airing grievances.

Given that the Times run articles that verged on dictation from Khuzami , this whiney and weak rebuttal is stunning. He’s about to get his payoff; he can easily land a high six-possible low seven figure job at a major law firm. Getting exercised about this article in public is bad judgment, period.

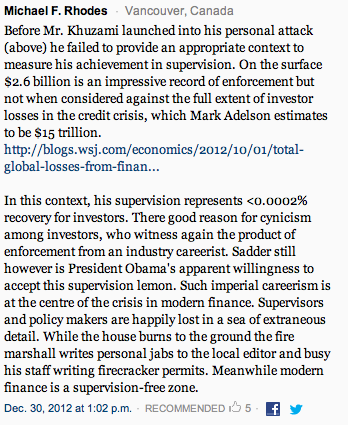

As for the substance of Khuzami’s remarks, it amounts to saying that the fact that the SEC handed out a lot of parking tickets is a worth accomplishment. Huh? We just went through the biggest loss of both financial wealth and economic output ever, with the US the epicenter of the crisis, and Khuzami is proud of $2.6 billion in fines? An order of magnitude more wouldn’t even begin to scratch the surface. The Times readers were having none of it:

Actually, Adelson’s estimate is light. Andrew Haldane of the Bank of England has penciled out the cost of the crisis in terms of output losses (lowered economic growth) and the low end of his range is one time global GDP, which in 2007 was $47 trillion.

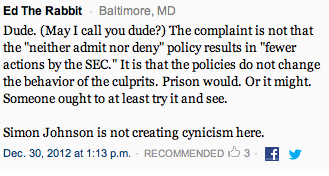

Since the Times’ readers did a good job of debunking, we’ll let them handle the other argument (such as it was) from Khuzami:

It shows a lack of engagement with reality that Khuzami thinks his record holds up to scrutiny. As we wrote:

Let’s look at the SEC’s record of enforcement fiascoes under Khuzami. The only thing he can claims is getting some bigger fry than usual on the insider trading front: Raj Rajaratnam, Rajat Gupta, and closing in on the SEC’s big target, Steve Cohen. Well, I suppose it’s nice that the SEC is becoming a better one-trick pony. But the wake of the biggest financial crisis in three generations was the time for the agency to up its game, and the SEC has failed miserably.

We’ll go through some examples of glaring Khuzami failures. Mind you, I’ve had to restrain myself; I could easily have written a post three times as long.

Khuzami’s overarching failure is the SEC’s embarrassing record in pursing fraud that was instrumental in causing the financial crisis. Khuzami has repeatedly claimed that it’s hard to go after these cases. Yes, if you aren’t competent, anything looks hard……

Third is Khuzami’s was complicit in some of the worst behavior during the crisis. He should have resigned when it became clear that CDOs were central to the crisis and the SEC would not be able to avoid dealing with them. The SEC appears to have taken a policy of suing on one CDO per major firm and settling. This is heinous, since each and every one of these firms sold more than one CDO and the bad practices were pervasive. From a December 2011 post:

So why has the SEC not pursued this area more vigorously? …

Look no further for an answer than the SEC chief of enforcement, Robert Khuzami… He was General Counsel for the Americas for Deutsche Bank from 2004 to 2009. That means he had oversight responsibility for the arguable patient zero of the CDO business, one Greg Lippmann, a senior trader at Deutsche, who played a major role in the growth of the CDOs, and in particular, synthetic or hybrid CDOs, which required enlisting short sellers and packaging the credit default swaps they liked, typically on the BBB tranches of the very worst subprime bonds, into CDOs that were then sold to unsuspecting longs. (Readers of Michael Lewis’ The Big Short will remember Lippmann featured prominently. That is not an accident of Lewis’ device of selecting particular actors on which to hang his narrative, but reflects Lippmann’s considerable role in developing that product).

Any serious investigation of CDO bad practices would implicate Deutsche Bank, and presumably, Khuzami. Why was a Goldman Abacus trade probed, and not deals from Deutsche Bank’s similar CDO program, Start? Khuzami simply can’t afford to dig too deeply in this toxic terrain; questions would correctly be raised as to why Deutsche was not being scrutinized similarly. And recusing himself would be insufficient. Do you really think staffers are sufficiently inattentive of the politics so as to pursue investigations aggressively that might damage the head of their unit?

Mind you, this is a short section of a detailed piece; I strongly encourage you to read it in full.

The pathetic part is that Khuzami seems unable to recognize how terribly he performed at the SEC, that is, if you think the job of the SEC is to protect the public rather than big financial services firms. The fact that his ego has been bruised is apparently more important than how his enforcement failures are helping to set us up for the next crisis. Johnson was even more correct than he imagined in taking Khuzami’s performance to task and insisting we get someone skilled, toughminded, and independent like Neil Barofksy in his place.

Holy crap!! You are 100% correct. I’m sure that the Times has a good idea who left that comment because they can check via IP address. Just goes to show that the S.E.C. and what ever firms he works for are Mickey Mouse operations because he acts in this manner. Which is supremely inappropriate for a person in his position.

Khuzami’s self justifying twaddle is the same craven bullshit the SEC has been peddling for forty years as an excuse to leave its hands off the major league Wall Street scammers, while making the world impossible for small companies hoping to raise public money for legitimate business.

The Agency has always been about public relations and nothing else, all this bushwa about one or two allegedly iron fisted prosecutors (whose names now escape me and have been consigned to history’s dustbin in any event) inducing heart attacks among faint hearted perps notwithstanding.

Anybody who has ever worked at the SEC knows all this. Just ask anyone who no longer enjoys a profitable gig based upon keeping it a secret.

So you get the schnadenfreude-meanwhile, has anything really changed to get us back to the rule of law? Between Breuer and Khuzami, you couldn’t have asked for the ultimate TweeleDee and TweeleDum for their ill-advised handling of prosecution. Perhaps that’s why gun and ammo sales continue to escalate as Joe Sixpack has finally come to inescapable conclusion that the US Government prosecutors couldn’t indict a ham sandwich (See US vs. Roger Clemens), let alone OFAC/SDI/DSN violations and SEC charges on the fear that the whole system would collapse.

Perhaps what we need is a good old fashioned bank run that targets the biggest miscreants. Then Dodd-Frank gets invoked and TPTB get the shock of their lives that they have less than 24 hours and total silence on the deliberations that has to occur in that window to attempt to resolve a failing institution. The government’s lack of resolve following Enron and Arthur Anderson (How many SOX prosecutions have their been? Anyone? Bueler?) seems to have caused a major shift in just going after small fish and not even attempt to prosecute felonies against multinationals (Big Pharma is also guilty of violating DPA’s as well, yet they manage to continue to operate rather than being broken up as they should be for their behaviour.)

And this last election shows that not much has really changed, nor will it change. So all we can do now if hope that someone doesn’t get the bright idea of firing up a false flag operation that drags the US into another ill-advised military action (none dare call it a war) and totally screw the pooch.

Maybe we can jail Tommy Chong again.

Come on, let’s be fair. Are you sure Khuzami had staff? Schneiderman didn’t even have a telephone!

I heard they make him work from home…

Lambert, Looking for the book you mentioned you are reading about stages of historic economic development beginning with Florence (or Venetians),then Dutch, then English, then American. The authors(French)premise was that each succesive regime further embraced costs previously externalised. He optimistically envisions the next iteration to include environmental and social costs not previously in the equation…maybe more anticipation of the financialization at the end of each of the regimes detailed. Searched in vain for earlier reference. Thank You

Using the Bank of England’s estimate for losses doesn’t include the rents gained by the individuals who perpetuated the financial crisis.

To be fair, you need to use the measure that also takes into the account the gains taken and distributed by the “victors”…

I think $15 trillion is a more fair base if you’re going to tout recovery of assets compared to losses.

Not all losses were crisis/fraud-driven. Everyone in management knows that when a crisis is out there you have to include it in any blame for anything going wrong.

Recoveries should be in relationship to damage done, which is economic losses. People losing their jobs is tangible harm, and it’s directly attributable to the crisis. When people measure the cost of a disaster like Deepwater Horizon, it’s the economic harm, not the damage to the platform only.

As to the gains, the banks were extremely inefficient looters. And did you miss that they pretty much all nearly went bust in 2008? So how did they benefit from the crisis? Tons of quant hedge funds closed. The only clear winners I can think of were the subprime shorts. Banks are structurally long, even Goldman was not net short.

And 1x global GDP was Haldane’s low estimate.

I agree on including the economic losses in any asssessment of “damage” attributable to banker misbehavior.

However, I would stop short of assigning blame for every lost job, missed earnings projection, and paper cut in corporate America/the global economy to the crisis.

We still had plenty of houses, infrastructure, toys built on the backs of easy-money top-down policies. These tangible assets, as well as offshoots of growth caused by the victors in these crises (and you’re 100% right, the looting by bankers was inefficient, but it did not occur in a vacuum, there were beneficiaries of the looters’ rents as well). For this reason I’m merely cautioning not to assign TOO much blame, but to keep it capped within rational analysis of the NET losses so that we can make direct linkages instead of generalizing every bad economic result as crisis-caused.

The primary crimes were committed by bank executives, who stole from customers (from mortgagees to investors, you know, people like us) and looted the banks.

The robbed evrybody

Am I the only one who is actually viewing Khuzami’s direct response to criticism through a blog post comment as refreshing?

Those of us who are ingrained in the blogosphere often complain about being ignored and this new medium being cast aside by the VSP’s…but here we have an example of them actually giving us legitimacy and responding on OUR TURF.

I welcome this rejection of the status quo by Khuzami, and hope that more public officials will follow suit and address criticism up close and personal without the filter of the PR industry washing away any true substance.

I agree with you 100%.

Rarely does Yves lay a turd, but that was one. And it really stinks.

Whatever the merits of his argument, or lack thereof, Mr. Khuzami should be commended for his willingness to responding directly in the comments section. It is a refreshing, inspiring, truly democratic gesture that shows respect for the public and for the concept of engaged debate.

And all that nonsense about “political and media protocol”, “established form”, “loss of dignity”, needs to be flushed down a toilet. This isn’t the Court of Louis the 28th King of France, this is America dammit — of the people, by the people, for the people. You man-up and you do it your way and you don’t let yourself genuflect to morons.

If Mr. Khuzami shows he’s one of the people — even if he’s only pretending, or even better, if his passion got the better of him because he really cares — that still makes me smile.

I also like the fact that the SEC head is participating in a blog. But Yves is thoroughly correct that it violates standard rules of the game our govt plays. We taxpayers pay the salaries of govt PR people to respond (if at all) to our criticisms of the govt and its offialdom. That way always get the well thought out bureaucratic response containing important repetition and therefor consistency over time. I can imagine Khazumi’s COS hearing from someone “you are not gonna believe what K did this time…” The COS is probably still screaming.

Your tone of praise for the status quo is, pardon my candor, a bit amusing to me.

A result of the PR industry influence in government communiation is that we miss out entirely on getting candid unfiltered TRUE responses from public officials.

Getting some direct feedback personally from the officials is an extremely positive development, in my opinion. And it isn’t meant to replace the official communications, but to be an addendum that fills out the holes left in the PR machine.

If you’re honestly satisfied with the SEC’s selective responses to criticisms, and don’t want to hear and read more off-the-cuff responses to frank blogosphere criticisms, then maybe you should read NC more for some insight into how unresponsive the SEC is to harsh criticism!

My post provided a description of standard gov practice – its all just lipstick on a pig.

@ craazyman

What kind of a turd does a peacock lay? Answer: Tiny enough not to stink.

I’m not a bird expert, but I admit I was shocked to see that peacocks can fly. It’s on Youtube. I thought they just walked around.

Otherwise, I agree with the rest of the post. I believe everything Yves writes, nearly all the time, like she’s my Momma. I lay a turd here in the peanut gallery at least 4 times a week. Sometimes more.

No, you don’t get this.

This is kicking down, on EVERY LEVEL.

This is a basic rule of engagement, you never never kick down.

Khuzami was kicking down on multiple levels:

1. Engaging with Johnson at all

2. Engaging via the blog comments section, which was Johnson’s turf.

Trust me, the DC people I’ve spoken to about this rolled over with laughter. I’m not exaggerating in saying that they went on about how hysterical this was at length. The fact of the rebuttal (compounded by its lameness) makes Khuzami look pathetic, thin-skinned and ridiculous.

Remember, protocol is extremely important in DC. People there have a very well internalized sense once they’ve been there any time as to the power hierarchy and what the norms are. Khuzami’s response was about as out of line as wearing madras pants to a black tie event. It falls way way in the “this is not how things are done” category.

If he felt it important to have some sort of response to Johnson in the comments section, the way to do THAT would be to have a SEC minion, ideally the communications person, do it. Doing it personally was a sign he couldn’t contain himself over the holiday period. He could not wait to get someone on it and lacked sufficient emotional control to restrain himself. So the real story is that the criticism is getting to Khuzami. That is entertaining.

And as much as you might like seeing blogs dignified, your enthusiasm for NC has led you to have a mistaken view of where blogs sit in the power structure. Blogs are not influential, except in that they are read by junior people who do real work and manage senior people. And extracts from them might be included in news clippings that are circulated daily in various agencies as a register of public sentiment.

I couldn’t give a damn about protocol and who should say what on a blog or elsewhere. I AM concerned about the loss of the rule of law, which seems to have begun at the very top of the society. We went from the Watergate era, where we very publicly told the world that no one is above the law, through the Reagan era, with 1000’s of prosecutions of financial fraudsters (and marginal and surreptitious law-cheating by Ollie North), through to Bush II’s famous nose-thumbing: The Iraq War. He and everyone else knew that was illegal but he told the world “I’m doing it anyway”. Fast forward to today, where we have Black Bush, institutionalizing law breaking and law-ignoring, and his supine Justice Department writhing around in their justifications for the non-pursuit of the highest and mightiest criminals the world has ever seen. It’s only a matter of time before Main Street takes the hint and decides laws don’t apply to them either, and no level of Orwellian police state repression will be able to keep them down. Peak civilization was right around year 2000 IMO.

hehehe…I’m imagining Mr. Khuzami sitting by the fire in his robe and slippers, becoming increasingly irate as he reads Simon Johnson’s latest article on his i-Pad. That sonuva…he thinks to himself.

He starts to write his rebuttal comment, hesitates for a moment, then thinks, aww…f*#k it, reaches for another Tom and Jerry and continues to type, a warm glow of self-righteous pride washing over him as he clicks the “submit” button

Five minutes later he refreshes the page to see if anyone has responded…Oh sh*t, he thinks, what have I done?

In the future we should be sure to bait bureaucrats at these opportune times, when their staff handlers are away and they’re likely to be boozed up and bored. This could become a whole new sport!

what if a dude has a matching madras bowtie, looks like Brad Pitt and has a Winchester 1894 lever action rifle? You wouldn’t go?

protocols and rules are for losers.

why do these people impress you so much? a man who’s afraid of being laughed at deserves to be.

type on Mr. K! at least that’s a sign you’re not a complete psychopath. Maybe Yves Smith will invite you to write a guest post, of course, you’d have to contend with the peanut gallery, but that would be a step up from Washington, DC,

I buy the argument that it is “unrefined” of him to do that. I think you’ve made the case that it is out of the norm and indicative of weakness, instability, whatever…

But I have to say I find it refreshing (if that was actually he) that he would just come out defending himself in the comments like that. The only thing I regret is that Khuzami didn’t have his own blog so they could have a classic back-and-forth blog war!

On a purely personal level I really do like to see these non-scripted, non-PR-scrubbed statements. It’s almost like getting an insider view without being on the inside.

This is amazing being in the 21st century and being able to see public officials make real-time emotional responses to digital criticism…

Excuse me?

“Refreshing” would have been if this asshate would have made some of these fuckers PAY.

Not that the SEC are be read NC, but that NC covers how unresponsive and inefficient the SEC has been, so anyone reading NC would know how poor of a job the SEC is doing in responding to the demands of even the mainstream to do something about banks.

As much as I like NC, I’m under no delusion that senior guys read you :)

craazyman,

Ahem, you still don’t get it.

Khuzami does not impress me but he does have power. That is the part that is grating.

And you don’t get to have power unless you have been well housebroken, been in big institutions, have worked with a lot of people who can attest you look the part and know how to operate. He broke training in his response. That is the part that you folks don’t seem to get and peculiarly don’t want to get. He humiliated himself in the way he chose to deal with the Johnson piece.

And his response wasn’t helpful or illuminating, except in further revealing his emotional state. He accused Johnson of misrepresenting facts (the politically acceptable way of calling him a liar) without substantiating his charge. So that was just name calling. The second bit was accusing Johnson of charging him with having bad motives. Johnson didn’t do that (I have, but he just linked to my piece rather than quoting it), so that was a straw man. The third bit was defense of SEC performance that was almost an aside and not convincing.

So you folks here are giving him credit he most decidedly does not deserve in saying positive things about his rebuttal, if you can even call it that.

I also believe that Yves Smith errs in ridiculing Khuzami for replying in the blog comment section. He is simply trying to give his perspective to the criticism.

“Am I the only one who is actually viewing Khuzami’s direct response to criticism through a blog post comment as refreshing?”

I wouldn’t have any particular problem with it except that he’s doing that instead of doing his job. When someone in that kind of position A) doesn’t do his job, then B) gets all bent out of shape about someone offering only he mildest sort of criticism about his not doing his job, and finally, inevitably, is (will be) rewarded for this performance with a lucrative post-not-doing-his-job position no doubt with someone who benefited from his not doing his job, I don’t find it terribly refreshing.

Because frankly, nowadays these kind of “you hurt my fee-fees” whines from people in his position are far too common and therefore far too stale to be refreshing no matter where and when they appear.

We are still up against a pathogenic culture in financial regulation.

It’s a field that has rejected academics and instead embraced people “with proper experience” inside financial institutions (aka “suspects”).

I’ve seen first-hand how very qualified outsiders are rejected for regulatory positions because they’re not seen as “experienced enough” to deal with financial industry fraud, because they simply haven’t worked in the industry!

It’s really laughable that you have to first sell your soul to investment banks to gain credibility to reform the system because any outside conscientiuous objectors are rejected as inexperienced and not knowledgeable on the topic. Even though academics usually have a better understanding of the I-banking model than most of the glorified salesmen who call themselves analysts/bankers.

I noticed there were only 4 responses in reply to Khuzami’s post at the NYTs – seems strange considering the SEC head actually piped up on a blog. Can someone tell Khuzami to reply here at NC?

Khuzami said: ” Settlements are recommended to the Commission only when the Enforcement Division believes that the agreement provides the remedies we could get if successful at trial. Otherwise we try the case as we have with 70% of individuals in our credit crisis actions.”

So I wonder who the patsy is at the enforcement division that writes twisted CYA memos saying that “yeah there are $80,000,000,000 in damages on dis here claim. But our very bist day in court would only git us this ver ver small sittelment amount. Cause that invisible hand thing and paniky dimwits causes these losses not banks. So y’all better take this ver fine offer mightily quick befur this bank here furces us to take this here claim to trial in frunt of that uppety judge at the fedup courte house (and lordy what a slog that would! An enfercment axn! I ain’ the one tryin it!)”

And thank you Mr Khuzami sir for the SEC talk point “we take 70% of indiv cases to trial.” How many indiv cases I wonder. And who are these individuals – financial grunts working in the bowels of Goldman? Still waiting for the SEC talker on % of banks or CEOs/CFOs who had to walk the plank.

As for the four published responses to Khuzami’s reply that appear on the Times’ site, Khuzami’s comment came 36 hours after Johnson’s piece was first posted, meaning many readers of the article never saw what Bob had to say. But probably more significant is the fact that the Times moderates the comments, so who knows how many responses came in but did not make it online. My own submission to the Times, which they determined was unfit to print, went something like this:

Way to go Simon! You’ve managed to flush Bob out into the open. We are getting somewhere.

Hey Bob: you are not at all persuasive here. But it is beyond interesting that you chose to respond; thank you for that.

Khuzami’s parents were ballroom dancers, for Christ’s sake. His sister is some kind of muralist and his brother is some kind of musician. He took several years off after high school and then went to college at a 3rd rate sh*thole like the University of Rochester or some damn place.

Does he even own a Ferrari? If so, let me guess, it’s probably some piece of crap like the $250,000 Modena Stradale, definitely not the $2 million Ferrari 599XX.

Could he even afford the $2.4 million Bugatti Veyron Supersport capable of reaching 0-60 mph in 2.5 seconds? I don’t think so.

When I invited Bob to lunch at Masa’s, the dress code says jackets are required for men, but Bob arrived in casual business attire.

I went to the men’s room and when I got back 15 minutes later, Bob still hadn’t managed to get us a f**king menu.

Finally when the wait staff saw me, the food started coming, and the courses were executed with perfect timing. All the wait staff including the restaurant manager were extremely friendly and fun and made sure we had a great time there, no thanks to Bob.

For the food, there were two options to choose from, a Four course degustation menu for $189 + $149 wine pairing and a Seven Course menu for $229 + $189 wine pairing. We both opted for the four course menu with wine pairing.

I don’t remember the details of all the wine pairings, but I remember Bob was drunk and acting really stupid by the end of it.

Our amuse bouché was a really good bite of smoked salmon with oranges, pickled ginger, caviar and black truffles. Bob didn’t touch his salmon, but it sure was a nice explosion of flavors in the mouth and that tiny bite set me up well for the courses to follow.

For the first course I opted for the Foie gras , which is an additional $25, but Bob declined even though foie gras is always worth the extra price. It was called the “Peach Melba” – Sautéed Artisan Foie Gras with white lady peach tartelette, pickled raspberries and vanilla essence.

I could go on, but why are we talking about Bob Khuzami in the first place? Sure, he works for us (or used to), and he did an okay job, I guess, but these people are a dime a dozen, clearly he will never be one of us.

We are the Peter Pinguid Society, we are the 0.01 percent.

Mon Cher Peter,

Il n’y a pas un accent aigu dans le mot “bouche.” Vous ne parlez certainement que Francais du restaurant.

My Romanian housekeeper told me there was an accent aigu with the expression “amuse bouche”.

On the one hand, she is old and ugly and and her teeth in particular are very rotten, but on the other hand I was led to believe she spoke excellent French. Also I have complete confidence in her, even if I’ve stopped giving her housework to do, because I can’t stand another human being looking at my personal objects.

The other day it was pretty funny, because there I was wiping my own floor, doing my own housework, in my $40 million mansion, but that’s how it is, the idea that another human being, however insignificant, could contemplate the details of my existence, and its emptiness, has become unbearable to me.

But if the old hag got “amuse bouche” wrong and put an accent aigu when there shouldn’t be one, it looks like I’ll have to let her go.

Ah, vous avez le Francais d’une Roman apprendree……

C’est tres droll ……….et declassee !

Uh, the old woman said that “Roman apprendree” doesn’t look right to her, and with the accents the other part should be: “trés droll et déclassé”

If she’s wrong again, I’m putting her on the first plane to Bucharest!

C’est vrai, mais mon clavier n’a gue la poncuation Anglaise,malheureusement.

“…n’a que la ponctuation” above, not “gue”

Great data points here! I’m grateful that Khuzami is such a small human being, he handed us some interesting insights into his character and culture here.

He isn’t really a big time crook unless you must let him alone to prevent the loss of public confidence.

“The only thing he can claims is getting some bigger fry than usual on the insider trading front: Raj Rajaratnam, Rajat Gupta…”

NOT EVEN THAT

First, of all these cases were just for show. They included witnesses like Crookest in Chief “David Blankfein” of Goldman Sachs and were prosecuted mainly to distract public’s attention from real financial crooks like Blankfein.

Second, though illegal, insider trading acts in these cases were sort of victimless when you look at the worldwide financial suffering inflicted by the U.S. bankers. Basically, win or lose, these guys, prosecuted for insider trading, were trading with their (their firm’s) own money. They were not scamming people by selling them some crap.

Robert Khuzami’s Comments were discussed in NC on December 27 (most of us figured that he’d be celebrating the holiday’s for the next weeks (cdertainly not enforing anything).

His Lead Position was: “The criticisms and innuendos are unfounded and unfair, and ignore significant actions taken by the SEC to address the credit crisis, including creating a specialized structured products unit in the Enforcement Division”

soooo….

he set up a unit…

and Obama set up (or is it, resetup?) a task force.

So now we’re all set.

Back in December I was outraged that he’d pull that ‘set up a task force’ bullshit on us and claim a great victory, but in the ensuing days I have have the opportunity (because I AM working) to reflect on the timing of his Unit. It was some time AFTER the Structured Finance books, that were thrown away by the apartment dwellers in my building, began accumulating in the basement. A sure sign that they all moved on, game over.

Put torturers on the bench of the DC Circuit; put a thief like Khuzami at the head of the SEC. That’s how to get the criminals off the streets!

Khuzami is not the problem. How many other supposed law enforcers (I think here of the banking regulators and DOJ) have done nothing of substance to the wrongdoers here? I mean, like breaking them up, criminal prosecutions, holding them up to public grilling and disgrace in hearings designed to peel away their unending BS and venality? Going after these instututions relentlessly for something else until they could be seriously nailed if the CDO stuff was too hard (sort of like getting Capone on income taxes)? These comments about Khuzami’s blog comment seem at once too narrow and overly vitriolic at a time when we just watched UBS get off so lightly in manipulating LIBOR for fear that doing more to it would have threatened the stability of banking. Really? As to the CDO problem and Khzami’s former role at Deutsche Bank, it should have been apparent to the SEC’s Chairman that this fact would affect all CDO enforcement investigations and decisions about other CDO players even if Khuzami took himself out of the picture in the case of Deutche Bank issues — and that it would be impossible to satisfactorily insulate that process from Khuzami’s inluence and thinking so long as he remained in his job as Director of the Division of Enforcement. She should have acted accordingly and replaced him. (No help from her General Counsel here, it seems.) That did not happen. Whether there were actual improprieties in carrying out that work or not (and there may well not have been), the appearence of impropriety was glaring, unacceptable at an agency that once commanded the respect of everyone in Washington. He, too, should have realized this and stepped down. But I guess that’s no longer the way the game is played. That is, with honor.

Classic comment by Khuzami that he’s saving up so he can prosecute “the next fraud.” Doesn’t want to waste his money on this batch. Even tho’ they got away with at least 15 trillion? Time to scrap the entire SEC. In it’s place set up a federal law enforcement agency and give it all the money it needs.

It is fair to suggest this, at least as to market fraud and manipulation from both a regulatory and enforcement point of view. Perhaps the CFTC, at least these days, an agency that is picking up rather than losing muscle, is a good candidate though it, too, has deep flaws in its past, pre-Dodd-Frank — different from those affecting the SEC now, but very real. So put the SEC/CFTC merger deal back on the table. Why not do this? The usual reason: Congressional oversight committee jurisdiction turf claims,with their respective political contributions mechanisms. Then there’s the reality of two very different and inconsistent statutory and regulatory schemes adminstered by these two agencies for what used to be very different industries — a truly knotty set of issues to work out even with the public’s best interests in mind (if it’s even imaginable that anyone would undertake the job with the idea of doing what’s right for the public instead what’s acceptable to the regulatees). As to a competely new agency, how is that Consumer Fraud Bureau thing working out? Point is that no one in Washington is interested in real boat-rocking law enforcement at these levels anymore. After all, that’s where the money comes from.

No offense to the “mgt” of this blogsite, but how about you guys find sponsors who aren’t promoting p&d issuers, like USGT?

I speak of http://www.doubling-stocks.net

Bitching about Khuzami while you yourselves aid/abet securities fraud is a bit hypocritcal, boys.

On Khuzami, 10 times better than that hoity toity (fill in the blank) Stephen Cutler.

Haven’t learned to ignore ads yet, huh?

I can’t say for certain, but I imagine Yves probably doesn’t have a lot of say over whose ads go on her sight. Generally, somebody like Google just picks what they think are relevant ads and sticks them on your site. When you sign up to put ads on your site, they generally don’t let you pick and choose which ones.

Thus, I have seen pro-Keystone Pipeline ads on Alternet, and advertisements for Citi credit cards next to stories about how Citi is a real crooked POS company.

It’s the paradox of the web, bro. Enjoy it.

I have no control over the ads that run here. I wish I could live without them, but they support the site, and IMHO are less intrusive than the ones you find on most MSM sites, so I trust readers will put up with them.

And the reason to object to ads (aside from the annoyance factor when they are lame, which is normal) is that the publisher might actually curry favor with the advertiser to get more of that type of ad. By contrast, I think it’s hysterical that I get ad revenues from advertisers whose practices (in general or by name) I’m attacking. It’s sort of like having the Catholic Church funding abortion clinics. Too funny.

And i’ve never ever seen the ad you are talking about. Google selects ads based on sites YOU visit. So if you see obnoxious stock touting ads, that’s because you’ve been visiting sites that tout stocks.

Yves, your analogy is great. As to p&d penny stock scams, not interested in those. I do know how the sponsored ad game works. Read a few SEC litigation releases, get pop up ads for penny stock p&d’s or O&G scams.

If you didn’t like Khuzami, you would have detested Cutler. Possibly the worst enforcement director the SEC ever had. He’s GC at JP Morgan now.

Sheriff Khuzami : http://www.flickr.com/photos/expd/8248119631/