It turns out Lambert’s mother-in-law research is pretty good. A February 27 report from Orono, Maine:

Long conversation between the driver of the municipal shuttle bus, a chatty type, and a passenger. She’s going to back to school to become a nurse (“those will be the last jobs to go”) he’s an older engineering student also working grocery bagging and doing internships.

They both think:

The economy is never going to get better

The next crash will be student loans

Not excited or angered about, just the way it is. And they’re both going into debt over student loans anyhow (she $40K worth but “a job for the rest of my life”).

Neither of them from the country, as it were. Both pretty cosmopolitan.

Word from the hinterlands…

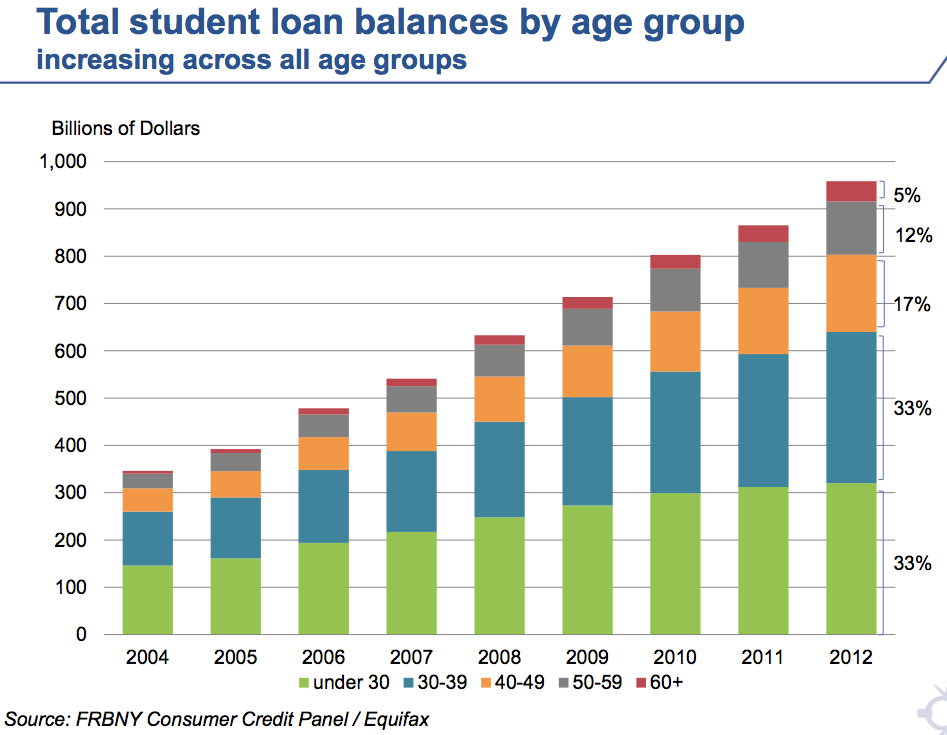

On February 28, the New York Fed released a study on student loans. Much blogosphere chatter, of the “it’s a bird, it’s a plane, it’s a bubble” based on charts like this…

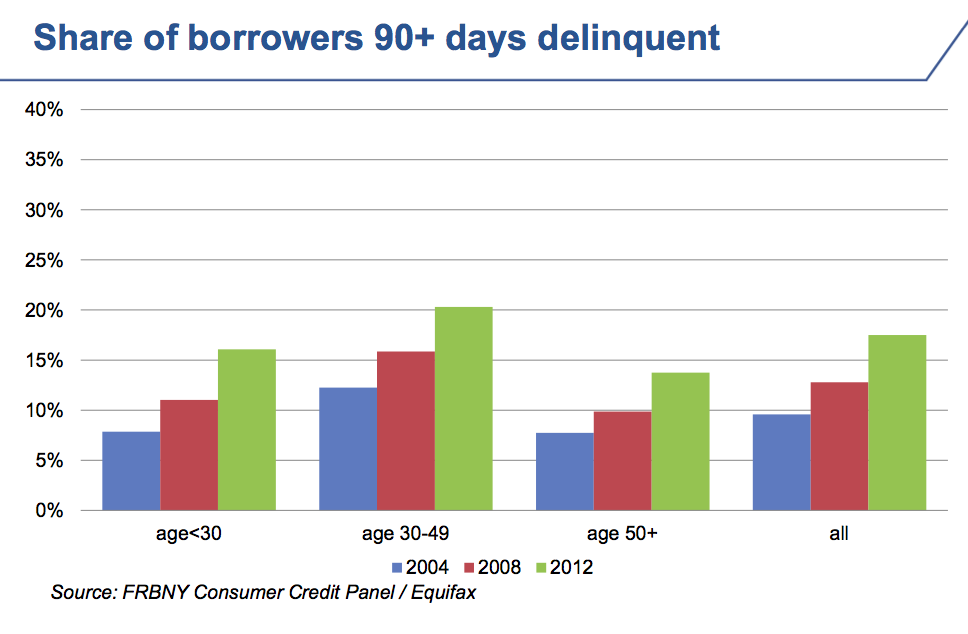

….pointing out that student debt outstanding is nearly three times as large as the total as of 2004, and more scary charts like this:

This is even uglier than you might think, since 30-49 are peak earning years. Oh wait, that was the old normal.

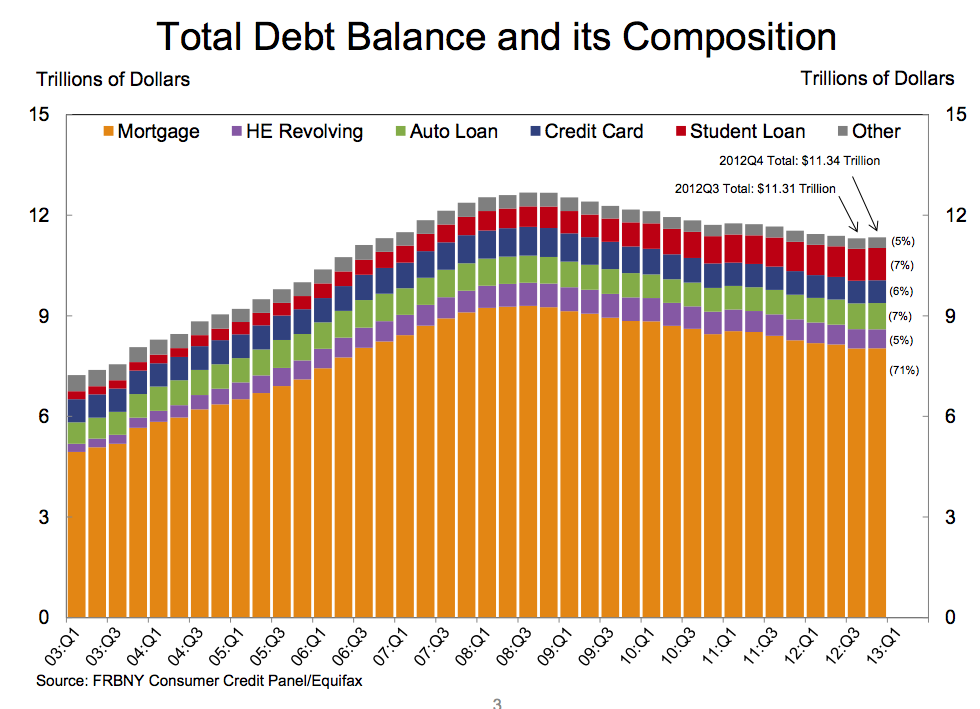

And when you integrate this with the just-released New York Fed quarterly household credit survey, you reach some not pretty conclusions. Student debt is now a bigger source of consumer borrowing than credit cards (we are speaking in terms of macroecomoic impact):

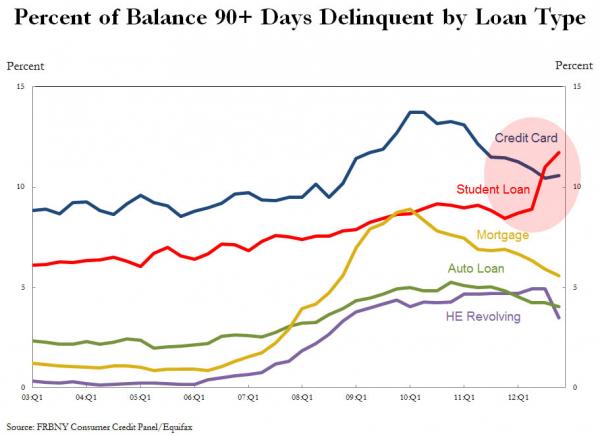

And it’s now the loan category where borrowers are in most distress (hat tip Russell H):

This level is particularly ugly given that student loans cannot be discharged in bankruptcy. It’s more rational to get in arrears on anything else, since you have some hope of negotiating for a restructuring.

As Warren Mosler said via e-mail:

Student loans have been making a meaningful contribution to aggregate demand.

If origination slows it’s another negative for growth and output to add to the tax hikes and spending cuts.

This is not to say I favor the student loan channel for education. Quite the contrary, in fact.

But just like the savings and loan credit expansion leg propelled the Reagan years, the .com and y2k credit expansion the Clinton years, and the sub prime credit expansion the Bush years, to a much lesser extent the student loan credit expansion has supported the current modest recovery.

And when they end the support ends.

So Lambert’s bus sources were spot on: student loans are not only looking bubbly, but the level of borrower stress is saying something has got to give. One sign is that law school enrollment has fallen 15% since 2010. Students are correctly worried about borrowing heavily in a weak job market. But so far, enough people believe in the value of education as a workplace credential that the student loans outstanding are still rising. It’s hard to discern how this plays out, but the endgame might not be that far off.

Yves,

In Firefox and Chrome, the height of the first chart (“Total student loan balances by age group”) is squashed. It looks fine, though, once I click on it and it expands.

Fixed, I resized it incorrectly.

I think JP Morgan has pulled back some from student lending last year. That’s probably the writing on the wall. But ….

I bet the market will rally to greater and greater heights because there will be a bailout :).

I can’t imagine any private lender being in the market, just like MBS is nearly extinct, too. In 2009(2010?) the Feds got rid of private loan insurance, and started originating the majority of student loans. IIRC, they also bought a large amt. of private issued around the same time. If this does pop, the Feds are already in a Maiden Ln position owning the majority of debt, and we can expect Exec. actions to respond to vast defaults – don’t know if that means bailouts or jail ups, but TPTB are ready.

Meanwhile they’re pimping $100k minimum “platinum” business accounts in LA County/SoCal and putting 3-4 retail cash “vacuums” in every town.

“This is even uglier than you might think, since 30-49 are peak earning years.”

Well, come on. How many degrees did the “slacker” generation(s) have to get just to land jobs outside the temp agency? Not that “temping” is all that different from the generational norm of “temporary careers.”

On a lighter note, still more academic stars driving up loan levels at NYU–and interest payments to “preferred lender” Citibank:

“During Dr. Sexton’s tenure, N.Y.U. has earned a reputation for lavishly rewarding its star faculty members. It bought a $6.5 million Upper East Side apartment for the head of its medical center, and it paid more than $4 million to help a former Columbia law professor stay in her turreted Upper West Side home when she joined the N.Y.U. law faculty. It gave the dean of N.Y.U.’s law school a $5.7 million loan to buy an apartment.

Those rewards, and salaries to match, have at times been a point of conflict among members of the N.Y.U. community. “Most faculty find these numbers to be obscene, especially at an institution where adjunct teachers qualify for food stamps,” said Andrew Ross, a professor of social and cultural analysis who is an outspoken critic of Dr. Sexton’s. “To students with a crushing debt burden, they are unfathomable.”

http://www.nytimes.com/2013/03/04/nyregion/nyu-gives-lavish-parting-gifts-to-some-star-officials.html?_r=1&

But apparently the NYT is still mystified about Jacob Lew’s payout.

To put those numbers in perspective, NYU only paid out $1.39 million in its student loan kickback settlement with Cuomo.

http://www.nytimes.com/2007/04/02/nyregion/02cnd-loan.html

The only way this can be justified is if NYU still owns the real estate. If so, it’s not a bad investment/strategy to preserve long term capitol.

No, Lew owns it, Martens tracked down that he refied the loan.

I don’t get it. How is this a “bubble”? Whatever it is, it’s not going to “pop” unless, somehow, Congress suddenly wakes up tomorrow, holds hands, and essentially relives all student debt, by allowing the loans to be forgiven in bankruptcy. Then, of course, you will see an immediate bubble in bankruptcy law practices, but, don’t hold your breath, at least with this Congress.

Did you forget about Fannie and Freddie? They had to be rescued, remember? Otherwise they would have failed.

I never said it would pop. You did. Please do not put words in my mouth.

This is a much smaller market but smaller bubbles end too. Subprime in the 1990s is an example.

@Yves

Yes, but, you used the term “bubble”, as many do, and, by definition, or, the historical use of that word, “pop” almost always follows. Most bubbles I can think of in history have, eventually, in a fairly dramatic downturn. I can’t see that happening here unless some laws are changed or most of these loans are forgiven. When that happens, I’ll be in the market for a zebra marked unicorn.

google ‘shorting student loans’ an notice ben forcing a prick

ex: http://www.businessinsider.com/how-to-short-the-student-loan-bubble-2013-3

“there have been until now zero opportunities for a the proverbial highly convex “ABX” short in the student debt space. This of course is the trade that was put on by those who sensed the subprime bubble is about to pop in early/mid 2007 and made billions as the yield chasers were summarily punished one by one as first New Century blew up, and then everyone else.

This may be about to change. As WSJ reports, SecondMarket Holdings, the private-market securities trading firm best known for allowing numerous overzealous fans to buy FaceBook at moronic valuations, ****on Monday**** “will roll out a platform allowing lenders to issue securities backed by student loans directly to investors.”

“”Student loans are souring at a growing rate—and investors can’t seem to get enough.

SLM Corp., the largest U.S. student lender, last week sold $1.1 billion of securities backed by private student loans. Demand for the riskiest bunch—those that will lose money first if the loans go bad—was 15 times greater than the supply, people familiar with the deal said…

“The catalyst for this new suite of services is investor demand,” said Barry Silbert, founder and chief executive of SecondMarket…

Investors’ hunger for risky loans shows the lengths they are willing to go to generate returns in a period when interest rates are hovering near record lows.

“It’s a reach for yield,” said Jeffrey Klingelhofer, a portfolio manager at Thornburg Investment Management, which didn’t participate in the SLM offering.””

http://online.wsj.com/article/SB10001424127887323293704578334542910674174.html

Even if it’s not a tulip, it sure smells like something.

As long as the government backs a great number of these loans, and the laws prevent any kind of discharge, then these don’t smell like tulips at all.

Issuers will be able to sell securities backed by private student loans, which ***aren’t guaranteed by the federal government***, as well as older federally backed student loans known as Federal Family Education Loan Program (FFELP) loans. They also will be able to distribute servicing reports through the new platform, said Mr. Silbert.

jump on in Ptup, the waters warm

If you read the WSJ article, it refers to private loans backed by parents, not federal loans backed/subsidized by the government.

I do agree that if the government is going to bail out the bad behavior of banks and other large institutions no matter what they do, then it is plausible to say that “there are no bubbles” because any prospective pop/fizzle can always be reflated.

Happy now? But it still smells like something.

“Happy now? But it still smells like something.”

That’s what I may be getting at. This is something different, and yet, smells and seems the same. But, as long as these loans are essentially backed by law, either initially by creating an agency to back them, or, on the back end, by preventing real default, then the bubble will never pop. It may deflate somewhat, but will live a very long time. And, if this securitization is successful, you can count on the status quo continuing, because now you have the most powerful of the elites with their fingers in the pie, and they will never allow this market to clear to sane levels.

Well, if your theory that the government will never let these students out of their loans by forgiving them or allowing them to declare bankruptcy–even if the government also has to bail some leaky bank garbage barges along the way–then it smells like wealth transfer from the student-laborer (we’ll call them) to investors.

All enforced by the power of the state, and using the schools as the mechanism of transfer. As this is 180 degrees from what people think the schools are for, this will amount to a very significant cultural betrayal in minds of those people, who you call “middle class.”

“it smells like wealth transfer from the student-laborer (we’ll call them) to investors.”

Not just investors – also to the massive post high school education industry in this country, and the wonderful upper middle class life that rewards most of it’s employees.

Some of its employees. Who sport the usual concentration of sociopaths.

The “pop” in this case will be a general economic downturn when households in aggregate reach the limit of their ability to service additional debt and quit borrowing. The average borrowed per year is about $150 billion, roughly a percentage point of GDP. Add in the spending multiplier and you’ve got a recession on your hands.

The bigger “pop” will be when prospective students catch on and stop enrolling in overpriced programs and taking out these massive loans. Crappy third and fourth tier schools cost almost as much as the ivy league. It’s starting to happen already, but it hasn’t reached the pandemic stage yet.

That is going to be a large impact focused on a highly opinionated group of people – Big Ed employees. They probably aren’t well-connected enough to get a true government bailout, but they will cause some significant discomfort.

At the same time, you will have a bunch of discontented young people whose time is not otherwise occupied and who have very little to lose.

I think it will qualify as a “pop.”

Remember, the group of people who are being made unhappy by student loans includes a lot of *highly educated* people who have actually learned about the French Revolution and stuff like that.

It’s not like making a group of illiterate drunkards unhappy. It’s far, far more dangerous for the elite.

I think if you have a high enough % of borrowers default, then you are looking at a “pop” scenario. True its different than other bubbles because of the state involvement and the lack of BK discharge, but if 25%, then 35%, then 45% of loans stop paying… if it walks like a duck, . . .

But, they can’t technically default. they will be on the hook until their final day. California and many other homeowners can just walk away from their homes and mortgages, but, the poor kids are stuck. Sure, a few years of these loans will pass without payments, but the banks will just add on a few fees and penalties and, of course, still factor in interest. the poor debtors certainly will not be able to live a comfortable life – odds are they won’t even be able to get a job. It’s not as though this is new – I was reading about these poor souls in debt peonage years ago, as soon as that damn bill also disallowing bankruptcy clearing of credit card bills was passed. As we have seen from housing, these loans will never leave the books of the banks, or be valued as they should be.

No,you can default, ie not pay, but not discharge. Default means nasty consequences, eg garnishment etc.

Which, in effect, is almost as bad as prison. Well, one will have freedom of movement in the outside world, but, will forever be obligated to the loan, and will be penalized in so many ways until the end.

Lots of discussion about student loans being almost “bulletproof” (exageration) to non conforming in any particular time term.

IMO, no loan is bulletproof to default….

You just walk away…

and,

Pay the consequences…….whatever those may be.

Many of those who might default in the future will just move to rural areas and live a “different” lifestyle; maybe a better Quality of Life.

No loan is bulletproof.

Or emigrate. Maybe Canada’ll get a wave of loan-dodgers this time.

Realistically it will just force graduates into the black economy, working off the books. This means either crime, probably mostly producing or selling illicit drugs or joining the swelling ranks of undocumented workers competing with illegal immigrants for low paying jobs with no worker protections–just the type of thing thing the .01% loves to see.

Can someone explain to me why primary and secondary education are universal and non-fee based being viewed as a net societal benefit–and indeed are essentially compulsory–while when it comes to post-secondary education, the rules are completely changed and that education is strongly disincentivized?

Because primary and secondary ‘education’ are essential indoctrination tools. The system would not continue without this proper ‘education’ of nearly all citizens.

By post-secondary education, the essential patterns of thought have been thoroughly imprinted, so it isn’t necessary that lower class citizens participate. Smarter and higher class folks need a more nuanced indoctrination, otherwise they may eventually be able to see through the simplistic lies of their mandatory ‘education’. They pay for the privilege of perpetuating the system that their world view has come to depend on.

“Realistically”, few will default as the gov’t plays extend and pretend with student loans. At the end of the 20-25 yr term after which IBR loans end, the massive tax liability of a $200K gift will land debtors in jail. Just kick that can on down the road . . .

@Sierra7:

Believe me, those who try to hide-out from the loan servicer’s attorneys in some rural community will NOT be living any kind of “better quality of life”, not by any common standards.

The former students who are forced to default on their slavery-loans, but who can’t get rid of them in bankruptcy, are the class of people who will make the revolution happen.

It is *astoundingly stupid* on the part of the elites to create a class of highly-educated debt-slaves and then give them a poor standard of living. It really is a recipe for revolution.

Kurt: right about the “off-the-books” economy. Wrong about what it will mean.

A whole lot of otherwise-legit work will go “off-the-books” simply in order to avoid the debt collectors. This will, as a side effect, reduce tax collection rates. So the college graduates will be working as accountants (off the books), marketers (off the books), salespeople (off the books), programmers (off the books), etc….

“Can someone explain to me why primary and secondary education are universal and non-fee based being viewed as a net societal benefit–and indeed are essentially compulsory–while when it comes to post-secondary education, the rules are completely changed and that education is strongly disincentivized?”

Because when the systemn was created, all we wanted was kids who could read & write, and be ready to work in a factory. It was form of social safety net and baseline for prosperous and civic society, promising to take everyone that far.

College was a luxury, and allegedly *theoretically* an investment in college tuition by individuals would pay for itself in future renumeration.

Actually, they should borrow the student loan money, use it to go to culinary school, become private chefs for the ultrarich and eat like kings and queens. While of course they will eat in the kitchens, most of the kitchens will be larger than middle class apartments.

When they tire of that life they can move to Italy, experience la dolce vita and do cameo appearances on the food channels. I don’t think they have to worry about garnishment over there, but I am not certain of that.

In any case, it makes far more sense than law school, and perhaps it always did.

The student loans are causing a tuition bubble as “affordable” becomes “able to pay not, regardless of the long-term cost later,” just like with housing. As Yves mentioned, law school enrollment is already affected as students have learned their degrees are oftentimes not worth the cost in this job market.

Many schools have an unaffordable cost structure and will fail, especially if — besides the high debt burdens — there becomes a public perception that skills and experience, rather than degrees, are what employers actually require. Further, low-cost “fine quality,” schools — especially community colleges — will rise in credibility and acceptance, starving the all but the very best colleges and University’s.

Finally, also as Yves points out, the macroeconomic problem from this non-dischargeable junk debt can be a long-term disaster as the student loan monster soaks up capital that should flow to more productive corners of the economy.

Well, fine, then I guess we can say that we have a higher education industry bubble, not a credit bubble associated with it. But, even then, I fail to see how there will be a sudden downturn of enrollment in these colleges soon, because the middle class is trapped in the belief, rightfully so, that the right schools are the best springboard. Such is our class system at the moment. It’s not as though millions are going to decide that it’s best their kids become auto mechanics. We need a real depression for that to happen.

I think of it as a competition bubble. The middle class idea of education is a lever to a leg up in a competition driven labor market. The idea only works so long as the labor market is expanding opportunities for so called educated young people (most of whom have no truly useful skills; rather they have an ability to articulate buzz words that provide comfort to employers, but not so much intellectual power as to actually question the game in which they jump in eagerly with both feet).

The whole system is just musical chairs, the byproducts are stress and an accumulation of overpriced drek, steroidal recreation activities, chronic dissatisfaction, ruptured relationships, alienated and depressed children, but ninety percent of those commenting see the solution as reducing the “cost” of the education (indoctrination, mostly) that keeps the whole idiotic game going.

The truth is that the parasitic looters at the top would be well advised to make the education free, to preserve the illusion that the students have a chance to “get somewhere”, which the overwhelming majority of them do not. For most, so called higher education is and will always be largely a waste of time, and time is something to be prized, because nobody knows how much they will have.

I would encourage any young person to avoid the education trap and begin acquiring truly useful skills and as many as possible as early as possible. Anyone who can actually do productive things has no need of our corrupt corporate ‘labor market’. He or she can always drop in a community college for whatever needed in identifying books truly worth reading.

I think it will be a slow death, rather than a quick one. And if it becomes too much of a disaster, I can see political change arising to support higher education. Our nation did not start out with universal right to a K-12 education, but ended up with one. The public may demand universal bachelors education and get it. Nothing will happen soon, and there will be no big bubble pop.

That would require taking on the massive higher education industry. Good luck with that one. Besides, we had almost free college education in this country in the 60s. I and my fellow hippie Boomers benefited from it. So, one has to ask, how did that train come off the tracks?

How did the train derail?

Look at the profligate boomers professors, the profligate boomer administrators, profligate boomer investors, profligate boomer lifestyles, up to their eyes in credit card, mortgage and car debt. This is entirely a boomer created problem.

Bring on the Obamacare death panels. I’ll be the first to pull the plug on the boomers who created and destroyed generation ‘debt’. In fact I’m looking forward to it.

Well, you may have a point there, son. But, please remember, when you walk up to my plug, I never got anyone into debt, and didn’t raise your tuition, OK? But, wait, if I’ve been in a coma for more than a week, please, pull that plug. Don’t want to enrich the medical industry more than it has been by profiting from sick, old people.

I’m a mid-to-late boomer (1956). The train came off the tracks when I was in high school/college (oil price shocks putting an end to the postwar economic boom). The coup de grace was the election of Reagan and subsequent conservatives, which was partly the fault of boomers, although I think a lot of it was the older generation punishing the hippies.

Simple: The boomers need the rents paid by thier children to play Golf in retirement. The boomers eat thier young. Most selfish generation.

This is a reply to student loan debtor’s train derail comment.

Just wondering if you are referring to the prolifigate boomers who chose to invest in their children’s education rather than in their own retirement? The boomers who thought that Ashley and Jack’s pre-school, gammar school, highschool and college educations came first along with the newest toys, games, computers, and Disney trips? The boomers who chose not to repeat the generational ideology of their parents,”my parents kicked me out and I made it on my own.” Flash forward to the boomers who had worked low-paying jobs and took out loans to put themselves through college and said, “I’m going to give my kids the best opportunities and help pay for their education,” by indebting themselves with parent plus loans and refinancing the house. Those selfish boomer parents who Now are indebted with a refinanced mortgage they’ll pay over the next 20 years into their late 70’s –so their kids could go to college. The same boomers who have nil to zero retirement savings.

By the way a large percentage of those selfish boomers have been fired, laid-off, or jobs eliminated over the past 8 years. And if they’re lucky to find a job, are now living on a quarter to a third of their previous income. And guess who their bosses are? You guessed it; the kids who educations –for the most part were paid by mom and dad Boomer. The same spoiled whiny adults who tell the 50+ boomer generation to get out of the job market and make room for the younger generation.

@ RPS, HAT TIP

Right On, @RPS! Put myself through college, made my own career and saved up my own Down Payment for a house the bank tried to steal when I never missed a paymnt. Then I take on 60,000 debt for my kids college plus cleaned out every bit of my retirement $ for pretigious private schools…youngest is a bartender and oldest son about to graduate from law school (for which he is paying via massive debt – but with help from me for living expenses). Was shocked when his car (that we bought) died (didn’t change the oil!) that I wouldn’t get him a new one (mine is 12 years old, husband’s is 20 years old). If I had it to do over I would have kicked them out at age 18. Have 2 younger ones coming up have already told them they get X amount per month for 2 years then I’m out.

It derailed when Reagan was elected and “soak the poor, giveaways to the rich, greed is good” became the policy of the decade.

If people can’t pay then they can’t pay. They may not be able to go bankrupt, but that doesn’t mean they can’t default. Then what?

Then they get off-the-books work in order to avoid having their wages garnished.

This will incentivize employers to OFFER off-the-books work.

Result: tax collections collapse.

This is the SHORT TERM result. It only gets more disruptive from there!

I think it should be “higher education bubble”, since that’s the asset, not the loan per say.

The 40,000 students at the German University where I teach pay no tuition. They pay a about €150 to register each semester and the fee includes a mass transit ticket. No football teams, no football coaches.

In case you missed it, courtesy of an NC commenter from a previous day:

https://www.youtube.com/watch?v=FuPeGPwGKe8

Changed your life, huh?? ;-)

The look on his face when the fighter jets blast over. Priceless.

Football teams almost always pay for themselves, and, along with basketball, pay for all the other sports. And they tend to drive alumni donations.

Without football, USC would be a rich man’s junior college…

Absolutely untrue, almost all Division One football programs lose money.

I call BS. As an alum, I can say that your statement might have had merit in year 1973, but not in year 2013. USC can match up with any Ivy and is currently ranked 24 by US News…so quit the hating…lol

What is remaining for demand – less than zero?

What are the components that reduce demand – – Mortgage debt (interest payments with no equity build) — credit card debt (interest payments with no equity build) — Student loans (interest payments with no equity build) — All loans

(interest payments with no equity build) — Working

(servicing interest with no equity build and declining wages)

Everybody (except a few) is settling on the griddle like pancake batter, flipped into poverty, turn up the heat – sooner or latter….that pancake has got to come off the griddle or it will burn.

“If you graduate with a university degree in Greece, Spain, Italy, or Ireland the first thing you do is emigrate.”

Since accumulating debt in order to acquire an education in the USA results in a lifetime sentence of debt servitude you have the same single choice as your fellow PIGGs. Emigrate to Chile, Colombia or Mexico. I doubt if you will be accepted by Canada or New Zealand—-.

And try to compete with those educated without the debt load.

I’m new to this forum but I wanted to state a few things about my situation:

I’m in my 30’s. I graduated with a professional degree about 8-9 years ago. I graduated with over $180,000 in student loans (little financial assistance from college/parents/gov) so I had to use loans, both private and federal.

I’ve gone out of my way to repay more than half of my loans, and my partner has paid all her $40,000 in student loans. It’s been a struggle. It require living austere. I know this site is anti-austerity but it sure as hell works for a household budget! Tiny apartments, making all meals at home, buying only cheap clearance clothes, no buying of x-mas, birthday, other gifts, etc. Starbucks coffee? Hahahaa I drink black tea at .05 cents a bag from Walgreens. Every bonus, tax refund, cash windfall, no matter what it was, for 9 years went to pay student loans.

I’m one of the few people I know with student loans – in their 30’s – who has made any sort of effort to pay them off. Most people I know, even 8 years after graduation – are still on some sort of IBR or graduated payment plan.

I finally bought a house last year. It was over $100,000 less than what I otherwise could have afforded but for my $500 a month student loan payment. And the $500 a month is low compared to the $1,100 I used to pay when I graduated school with higher interest rates and larger principal balances!!! Sorry boomers, I couldn’t buy your large house, I had to buy a smaller, austere house!

Car? I take public trans for work and my car is a 10 year old junker with well over 100,000 miles. I look at car ads in the newspaper, or online, and there’s just no way I can afford to make a $300 a month payment for 72 months plus insurance. So the car industry is just going to have to wait quite a while longer before I buy a new car!

Credit cards? are you kidding me? I’m carrying a small balance on my cards due to start up costs for my business (laid off from an above median paying job last year!) but for 10 years I haven’t carried a balance. I plan on paying off this business balance in full in the next few months.

Consumer spending? Hello IKEA!! New home means new furnishings and IKEA was the answer for everything. Sure it’s mostly junk, but it’s cheap and if I take care of it, it will probably last a while. But the other retails stores are wallowing in their sales misery as they fail to capture my spending dollars.

Travel? Are you kidding me? If I can’t drive there from my midwest locale, then I’m not going. I’ve flow once in the last 7 years. Sorry airlines, no extra dough to buy plane tickets!

Babies? I’ve got a second one on the way and I’m freaked out how to afford this baby. We waited a long time to have the first baby – why? No money for daycare paying $1,100 plus $300 for my partner’s and my student loans!

and you know what? I’m one of the lucky ones! Crazy, huh?

student loan debtor says:

I don’t think too many of the regulars around here make the mistake of equating a household budget to that of a nation that has monetary sovereignty.

The argument you are making is alluring in the same way the argument that the sun rotates around the earth is alluring. It is our everyday experience, after all, to see the sun rise in the east and set in the west. It’s difficult to place oneself at that Archimedean point somewhere further out in the universe so we can gaze down and see what’s really going on.

The Roman Empire spent like crazy on military and social services (bread and circuses!) and all it got was crushing inflation, which eventually lead to all the wealth concentrating into the 200 families that owned the entire empire. Sound familiar?

Then when these 200 families tried to avoid taxes by shuffling around their workers between properties, Diocletian decided that all workers must stay on the land. This was the beginnings of serfdom!

[Ad hominem. –ls]

I think most of the readers here make a difference between useful services and imperial largesse. Notice how America, like the Romans before it, have a military budget FAR LARGER than they could possibly afford.

Further, most of Romes expenditures were not aimed at improving the economy, but rather distracting the populace or invading other countries for profit. Which is sort of similar to what we do now. If Rome had done something to lift its masses out of perpetual poverty, perhaps their fate would have been less dire.

By the time of Diocletian the Romans had stopped invading 200 years prior and were instead defending and maintaining (and in many cases shrinking the empire). It’s a fact there was so much inflation due to rampant printing that there were two economies: the economy of gold and silver for the larger transactions of the rich; and the bartering and common currency for everyone else.

Did you ever think why you can pick up old roman coinage for cheap these days? It’s plentiful because they printed so much of it!!!!

Read up on roman inflation due to money printing…it’s what we’re doing today….

This is not rocket science.

http://www.ebay.com/sch/i.html?_trksid=p2050601.m570.l1313&_nkw=roman+coins&_sacat=0&_from=R40

Pages and pages of roman coins for sale on ebay. They printed so much! They too had a sovereign currency and overprinting caused crushing inflation that eventually sowed the seeds of feudalism.

The collapse of the Roman economic system was NOT, repeat NOT related to coining money. Coining lots of money and giving it to the poor was actually the solution to the problem, and the Romans never did it.

The collapse of the Roman system was related to excessive debt and excessive concentration of wealth. People in debt were converted from debt slaves into indentured servants, and eventually ended up with a feudal relationship with their employer/creditor.

Brad DeLong has some discussions of this on his website, with original sources.

“student loan debtor”, you actually hit at a key point here:

“there were two economies: the economy of gold and silver for the larger transactions of the rich; and the bartering and common currency for everyone else.”

This had NOTHING to do with money-printing. Printing money and giving it to the poor would actually have PREVENTED this. Think about it. The “two economies” problem had EVERYTHING to do with concentration of wealth in the hands of a few — so that the 99% didn’t have access to enough money to use it for anything.

BAHAHAAHAHAHAHAAAAAAA Mexico IS one among handfuls of meritorious scholars gracing this blog…my apologies yves but belly laffs are momentarily necessary

I must say, I guffawed too. I found [ad hominem] impressively perspicacious.

@student loan debtor: You are, indeed, one of the lucky ones. Your story speaks well of you, and I wish you and your family continued good luck.

I won’t repeat “from Mexico’s” remarks, but simply suggest that you continue to read Naked Capitalism faithfully so that in addition to being lucky, you will also come to understand how our money system works (and doesn’t). And then you will be able to teach your children something they are very unlikely to learn in any school.

I’m sure that Jamie Dimon and Lloyd Blankfein appreciate the “shared” sacrifice and for keeping the”magic” in the “magic of compound interest”.

You were conned dude. Cheap gubermint guaranteed credit jacks up demand with college places remaining relatively fixed. Price of tutition ratchets up. Said universities can now afford to pay administrators seven figure salaries and football coaches vastly more. New admin buildings, dorms, stadiums. Party central, never leave college without at least one nasty bout of VD and early stage liver scarring. You have been made to pay vastly more than you otherwise would minus government interferance for the sake of ‘fair and equitable’ outcomes so that people who have no business going to college can garner an education they would have gotten at high school a couple of generations ago. And you know what your peers will do? The ones who haven’t paid a cent of their loans back whilst you’ve been slaving away? They’ll wait for Obama to bring in some kind of forgiveness program funded with printed money while they laugh their a?ses of at the saps who’ve made an effort to pay it back. And you know what? They’re right.

Someone once told me I’d be digging ditches or flipping burgers if I didn’t’ get a college degree, and they’re probably right. The fact that I paid too much is true, but it’s independent of the fact that without a degree I wouldn’t have the ability to sit in my office at this professional job.

[ad hominem –ls]

I work for myself and I have mandatory breaks,

[ad hominem. –ls]

not necessarily true, all it did is increase the chances you’d sit in a professional job, it doesn’t guarantee it AND not getting a degree doesn’t guarantee you won’t get a professional jobs (though clearly you need certain education to be in some highly regulated professions like a doctor say).

Ikea?

Try Craigslist. We furnished our entire house with high quality things people were giving away for free, to and including TVS, upright pianos etc. Don’t buy Chinese sawdust when you can get high quality stuff for free.

Craigslist is in there too! Awesome 1960’s formica table for $30!

Not bad for used vehicles too, if you tract the VIN reports on Carfax.

The informal economy is the only economy for many of us.

Planting food also helps.

But don’t you recognize the absurdity of having to live that way? Starting out with nothing is one thing, but having to start off with that kind of debt load is insane. We’d be better off if government just paid for college/trade school as an investment in the future. The return would come in higher productivity and better lives.

Not judging,but I find it interesting that you are that committed to paying off debt but yet not married to your partner though you have two children. And I wonder why you think it is okay that you were charged a King’s ransom for what must be a low level job otherwise you would not have taken this long to pay off the debt. You were screwed yet seem to take pride in it that becaue you don’t have to work outside. Reminds me of the “no free house” mantra, so many similiary screwed by their mortgage, expouse.

In Roman Empire a slave could buy himself out of slavery. But is it a good argument to condone slavery?

I don’t think you’re just lucky. It’s very likely that you work in either law or medicine. You chased a job with high renumeration in either of those fields, by obtaining professional credentials, entered your chosen field, and received steady increases in pay and now you are trying create an impression that “it’s not so great for us winners, either”. I see no reason why you would have to live as frugally as you claim if you chose not to live in an upper middle class neighborhood, where the prices of many things is indexed to income. Affluence is relative For example, a rich man in a rich neighborhood is not rich. He is average because his purchasing power is average since there are other rich people around him bidding the prices up on assets.

Even though you may feel average in your neck of the woods, you’re married and you are able to provide for one child. If you were close to struggling to pay your student loans off, you would not have a wife , one child with another on the way, or reside in an upper middle class neighborhood. Your debt burden, unless you were charged a base rate north of fifteen percent interest rate on your private loans, is practically a non-issue. You have nothing to be upset about. Nothing.

I’m all for choosing to live austerely, but government is not like a household, so this narrative has nothing whatever to do with “austerity” as a matter of public policy.

So I guess I feel: Congratulations on your success — you’ve worked a brutal and vicious system. Some of us question why it has to be as brutal and vicious as it is.

One thing you don’t mention is health insurance. Did you have it throughout the 9 years of payback?

I don’t get the point here. It seems to my simple mind that you’ve spent the last 9yrs at a complete economic stand-still while you pay off massive debt to some unseen investor. And that’s only got you halfway. Assuming you intend to spend the next 9yrs doing the same, that is 20yrs of economic nothingness (no equity growth for you…you did not mention any type of ongoing savings/investment to benefit yourself or your family; a house does not count). So I see an very “educated” 40+ year old, who has nothing to show other than having spent 20yrs busting his a** to pay off a stranger. You mention being worried about your 2nd child (and the delay in having the first due to your financial situation triggered by your intense loan repayment schedule). So now you’re deciding family planning based on making sure that that unseen investor gets paid FIRST.

Absolutely right. “student loan debtor” is pretty close to being a serf in the feudal system already, but hasn’t noticed.

Yep, interest serving consumers have a long way to go to contribute to demand. Interest service is eating up dollars that are fewer and fewer available because of low employment and declining wages. Are corporations loaded with cash sitting on the side lines? yes. Why? because their is not enough demand to spur investment in the real consumption and production economy – or at least, the return does not match what can be had by looting – or investment devoid of a real economy link, just building the interest income stream up by increasing the debt load upon everyone and everything.

Why go back only to 2003? How did we survive the 90s when default rates were double what they are today? What “had to give” then?

http://www2.ed.gov/offices/OSFAP/defaultmanagement/defaultrates.html

You also need to look at insitution type. Most of the growth in default rates comes from for-profit schools, which can be addressed fairly easily. College students can also be squeezed a lot more than they currently are. Why are student loans paid back over 10 years when they’re used for 40+? It’s not like they have much of a choice since a college degree became a lottery ticket to middle class life.

The system is sustainable. It’s just not equitable.

Of course, any civilized society recognizes that there’s a public benefit to higher education and supports it accordingly. But then those societies have universal health care, too. Here, the message is clear: work until you die, pay your bills, don’t get sick, and be happy you have a cell phone and cable TV.

You are looking at the wrong stats.

http://online.wsj.com/article/SB10001424127887323701904578273711404133732.html

Moreover, there is a stat (I can’t find it now) that says that something like 40% of all student loans are in forbearance or deferment. Fewer and fewer students can repay these loans.

You’ve got to be out of your mind to think that the system is ‘sustainable’.

You’re looking at the wrong stats. WSJ is talking about “subprime” student loans (without defining what that means. From the TransUnion report:

“The 90+ day delinquency rate for federal loans was 12.31% as of March 2012, compared to 5.33% for private loans.”

Deferrments aren’t delinquencies.

http://newsroom.transunion.com/press-releases/transunion-study-finds-more-than-half-of-student-l-979763#.UTS5gFeyLtI

Deferments are not paying, often in perpetuity!

I’m sure you’ve seen The Wire – they call it ‘juking the stats’

Deferments in perpetuity are called defaults.

Less than half of all borrowers are repaying their student loans. Just think about that for a second.

It’s certainly not sustainable.

One way of killing the student loan bubble — a good way — is to print a lot of money and give it to the 99%.

Another way it could fall apart — a bad way — is the way such things fell apart during the Roman Empire. People with debt they couldn’t pay off were instead sworn to lifetime service with a single employer as a substitute for the debt. Soon, this became feudalism!

(I am oversimplifying the rise of feudalism, but this phenomenon was a significant part of it. Other methods of converting debtors into people sworn to the service of a lord were even more significant.)

I heard some essay that there’s now a conservative “conversation” about bringing back debtor’s prisons.

The whole of Europe was a debtors prison from around 500 to 1900, so maybe all this democracy stuff was really just a brief aberration. Free Markets are just natures way of erasing that little rounding error.

Uh, link please? That sounds pretty ridiculous. Or maybe you’re just ridiculous!

http://www.cbsnews.com/8301-505144_162-57417654/jailed-for-$280-the-return-of-debtors-prisons/

http://www.huffingtonpost.com/2011/11/22/debtors-prison-legal-in-more-than-one-third-of-us-states_n_1107524.html

http://blogs.wsj.com/totalreturn/2012/08/28/are-debtors-prisons-coming-back/

Google is your friend.

Please Note:

1) Folks get a bit cranky when one resorts to name-calling.

2) Folks get a bit cranky when one can take 32.7 seconds of a google-search to find the links that caused the name-calling, because the name-caller is too lazy to bother finding the links themselves, and finds name-calling quicker and easier.

3) What From Mexico said. Plenty of us here live on household austerity budgets. It is not the same as Obama’s much-touted and quite ignorant comment about government being run like a household.

4) You wrote below: “an my nuclear family has sunk into poverty, whereas I have moved into the upper middle class. It’s about a 1 in 4 chance I say. Good luck, better make sure you’re one of the one in four!” Is this one of those “I’ve got mine, good luck to the rest of you” memes?

5) Does your initial comment here and your assessment of your previous financial history match up to one who would describe themselves as “upper middle class”? I guess the definition of “upper middle class” has changed. Or something…

It’s not debtors prisons. it’s for contempt of court, not for failing to pay a debt. That’s a common mistake people make. This is not debtors prisons.

My household income is upper middle class, and so is my home value and my bank account size. But it took years of austerity to pay off the student loans despite the upper middle class income.

So yes, the two statements do jive.

And as far as ‘getting mine’ yes, I did get mine. So is the luck of the cosmic draw.

Your $500/month student loan payments required an austere lifestyle with an “upper middle class” income? I do not think it means what you think it means. And how are you managing to pay down 180k with monthly payments that low? Something doesn’t add up.

Hmmm. Its for contempt they are put in jail. Contempt if for not following a court order and that order is to pay the debt. Its debtors prison whether you is for contempt or if you call it “green eggs and ham”. If it were not for the debt there would be no contempt. Yeesh, the typical american mind is a thing to behold in action….

The payments were $1,100 a month for the first few years which was primarily interest. All tax refunds, bonuses, savings paid down about $10,000 towards principal (plus $10,000 a year interest) a year for 9 years.

In addition, my income has steadily risen during this time period, making it easier to make the payments, hence the home purchase.

And my wife paid off $40,000 of her own student loans plus $10-$15k interest. All together in the last 9 years we’ve paid close to $200,000 in student loans (with interest).

I said upper middle class – i.e. above $100k household income in my metro area. that’s nothing in NY or LA I understand but in the midwest $100k a year buys a nice if not lower end of the upper middle class lifestyle.

Take $20k a year for 8-9 years towards student loans (plus the taxes paid on the income to earn the student loans because the $2,500 paltry student loan deduction phases out) and you can see how despite an upper middle class income for the metro, a frugal lifestyle is necessary.

And my wife’s payments were around $300 a month (Which she jacked up to $500 a month, and then eventually just piad off the last $12,000 in a lump sum from savings). So $1,110 plus $300 PLUS principal payments adds up pretty quickly taking a $100,000 a year household income way back down to earth.

“student loan debtor”, what you’re describing is very similar to the way 19th century industrial companies could offer a very large wage rate — and it seemed great, until the employees discovered that they had to spend that money paying back “debts” to the company and buying products at the company store, so the employees could never get ahead.

It’s also similar to the way free laborers were reduced to serfdom during the late period of the Roman Empire.

All prisons are essentially debtor’s prisons. The criminal justice system is part of a system that carefully screens out the wealthy prior to entering that system.

Bingo.

Agreed. And *that* should settle it!

En este lugar maldito

donde reina la tristeza,

no se castiga el delito

se castiga la pobreza

Anonynmous Mexican poem

which translates to something like this:

Here in this godforsaken place

where sadness reins

they don’t punish crime

they punish poverty

EXACTLY. And in some states a PRIVATE COMPANY can arrest and detain you for relatively small debts, all while charging fees and interest to make it impossible to ever pay.

http://libertystreeteconomics.newyorkfed.org/2012/03/grading-student-loans.html

in 2011 studies have found that up to 47% of all student loans were in deferment or forbearance. It’s sustainable because half the loans are current but not being repaid. Throw in another 9.1% of defaults and over half of all student loans are not being repaid!

i agree with the ‘heard from bus’ scenario. as a current student who is well-beyond-proper-age and borrowing, here’s the perceptions i gather from on the ground:

1. there are no jobs. you can get burger flipper with no degree (and multiple years of experience), but if you want to move into assistant management at Macy’s, they’ll ask for at least an Associates or above. so, nearly unemployable without a degree, or base level employable with one. one girl said at a job interview that when they asked her about degrees, the interviewer said “i just have to check the box off” with the implication that no check in the box would result in no second interview at all.

2. any ‘desirable’ job that used to only require a bachelor’s now requires a master’s. most people i’ve talked to both at school and in industries in which i would have liked to participate have this to say: we don’t care what your bachelor’s is in. you need a master’s for this job anyway. philosophy majors welcome! and, they usually say this: diversity in knowledge is a good thing.

3. i am attending college 20 years too late. i have been reading many comment sections from articles on education which suggest that “most don’t NEED college anyway–they aren’t college material” and “college has been dumbed down” and “unless you’re getting an engineering degree of some kind, it’s wasted money.” i have no idea if any of these things are true or of they’re the result of the think-tank paid comment ballot-box-stuffing contingent. my take is that i have *just* kept pace with information creep that has occurred during my adulthood. i don’t feel any smarter than before (actually, i feel that i’ve learned a lot of factoids which are easily subject to being blown away by the next BIG study, but that’s the social sciences for you), and the only classes i both enjoyed and felt that i was learning anything in about the much-touted “Critical Thinking” aptitude that colleges are spewing comprises their main mission now came directly from my Philosophy classes (nearly ALWAYS derided in those same online discussions as a worthless topic). what i’m saying is this: one can’t be a functioning citizen anymore without college. it is as necessary to a post-industrial culture as high school trade shop was to an industrial one.

also, i don’t even think about paying my loans off. i’ll be lucky to be employed at Target. there isn’t much hope of me borrowing for that master’s. by the time i complete that, a person will probably need to be a student until they’re 28 to deal with the society we live in. oh, and i’ve heard that SSI is already garnishing the retirement ‘income’ of those who still owe on their loans. so, there isn’t any retirement either. work and pay, and do both until you’re dead. and crappy jobs to boot.

having come from a very poor background, i think the former future middle-class is waking up to the reality that those of us from the ghetto knew long before. and they wondered why there was no focus on “planning for the future” there, and an overall sense of fate/destiny being predetermined, probably from birth.

“having come from a very poor background, i think the former future middle-class is waking up to the reality that those of us from the ghetto knew long before. and they wondered why there was no focus on “planning for the future” there, and an overall sense of fate/destiny being predetermined, probably from birth.”

The middle class is disappearing. You either go up or down. There is still a chance to go up. most of all income and wealth gains in past 20 years has gone to the top – and the number of people at the top is growing. The number of higher income earning households is growing every day – just not as fast as the number of lower income earning households! I come from a lower middle class background – an my nuclear family has sunk into poverty, whereas I have moved into the upper middle class. It’s about a 1 in 4 chance I say. Good luck, better make sure you’re one of the one in four!

It sounds like neo-feudalism to me. As William Manchester put it in A World Lit Only By Fire, it

Here’s how Hannah Arendt describes the reappearance of the worst that feudal morality had to offer in Modern society:

Si Mexico! One wonders why homeland security is now ordering 2700 domestic use armored vehicles. Yes 2700. Wonder that they are expecting. The planners must assume that things will get sufficiently austere as to pry americans out of their professional cubicles or from their couches to the streets. Nah–I think HA was right–there is too much shame for people to do that plus the fear if things get better (or in u.s.a when they fix things when we elect the right people) an arrest record will upend their employment viability…

and this:

The Department of Homeland Security is seeking to acquire 7,000 5.56x45mm NATO “personal defense weapons” (PDW) — also known as “assault weapons” when owned by civilians. The solicitation, originally posted on June 7, 2012, comes to light as the Obama administration is calling for a ban on semi-automatic rifles and high capacity magazines.

Citing a General Service Administration (GSA) request for proposal (RFP), Steve McGough of RadioViceOnline.com reports that DHS is asking for the 7,000 “select-fire” firearms because they are “suitable for personal defense use in close quarters.” The term select-fire means the weapon can be both semi-automatic and automatic. Civilians are prohibited from obtaining these kinds of weapons.

and

DHS has ordered 1.6 billion rounds of hollow point ammunition. That’s prohibited by the Geneva Convention. Therefore it’s for internal use.

and

millions of Americans are jumping on the bandwagon and are clamoring for the prohibition of assault rifles, semi-automatic rifles and the new boogeyman, “sniper rifles”. So government is arming itself and we are supposed to disarm ourself?

No thanks, I’m taking a hunter safety course and am going to invest in something that has real value, firearms, the knowledge how to use them and the repudiation and rejection of the financial control complex that is more of an enemy than Al Queda ever will be. Constitutional rights, use them or lose them.

The elite are stupid if they think that the whole military will be on their side come the revolution.

The military would be on their side if, as in Burma / Myanmar, the military were treated as an elite caste and given better treatment than everyone else.

Instead, the military grunts are treated like crap. Why would they support the thuggish CEO bosses? Some will due to simple authoritarian brainwashing — but many won’t, due to personal experience.

Gotta quit making me cry at work!

” The number of higher income earning households is growing” Do you have any evidence for that statement?

“and the number of people at the top is growing.”

No, it’s not. It’s shrinking. You haven’t been following the numbers. The top 20% is losing its wealth to the top 1%, and the top 1% is losing its wealth to the top 1/3 of 1% — a group of households which is not growing.

I think this is one of the more important pieces I have read on this subject recently:

http://www.thedailybeast.com/articles/2013/02/21/america-s-new-mandarins.html

“Even many quite left-wing folks do not fundamentally question the idea that the world should be run by highly verbal people who test well and turn their work in on time.”

After due consideration, I couldn’t agree more. :)

Sounds like brahamanism to me.

Try running the world without food to eat or anyone to empty your garbage (and septic) and see how far you get.

The class prejudice against labor is stunning.

And their children, who by a funny coincidence, described in Chris Hayes’ Twilight if the Elites, seem to inherit their superiority, even though they claim not to believe in heredity superiority. But they won’t admit it’s privilege.

“Even many quite left-wing folks do not fundamentally question the idea that the world should be run by highly verbal people who test well and turn their work in on time.”

If the world were actually run by such people, that would be one thing. Instead the world is run by mentally defective psychopaths, who can barely put together an English sentence, who do their work incompetently and late, but who are really good at conning people and stealing money. We call them “corporate CEOs”.

There are two scenarios being presented here – the one of the person who found a job in which he can pay off his debt over his lifetime while struggling to survive, and the one in which there is no possibility to find work that will over his lifetime repay the debt.

Into which category will most debtors fall? Increasingly, given the mindset of government? It’s a no-brainer.

The third alternative is the example given for German schools where education IS AFFORDABLE. Where the welltrained or welleducated individual is not so burdened that as a worker he is able to support the salaries of other workers by buying their products. Can even, heaven forbid, have children.

Of course, debtor prisons would supply further employment, but who is buying that product? Gosh, gee, seems like we finally will be dipping into the pockets of the 1%. Nobody else is going to be able to pay. Of course, they will be so wealthy they won’t even notice, and who cared about old Bob Marley in any case?

Are there no prisons? Are there no workhouses?

Everything is affordable its just a matter of who is doing the affording.

More future earnings to be commited to debt service, less for goods and services.

The “market” continues to love student loans.

http://online.wsj.com/article/SB10001424127887323293704578334542910674174.html

The National Science Foundation’s report, “Doctorate Recipients From U.S. Universities,” says that only 64% of the Ph.D. engineering graduates found a pay check.

There you go. This is the sort of thing which sets the seeds for revolution.

It’s one thing to have an uneducated underclass. Europe in the Middle Ages was in some ways quite stable with an uneducated, illiterate underclass, brainwashed by the Catholic Church into submission.

It’s another thing to create a highly-educated underclass. That’s *insane*, yet that’s what the elite have been doing.

How I’ll know the end is near: when the banksters start offering student loan-based derivatives.

They already securitize – no reason that derivatives are not already in play OTC

agree Tom…i did a quick search an found this paper (haven’t read it yet)

After analyzing the causes, this Article draws on enterprise liability theory to propose a derivatives-based approach to stemming the run-away educational costs and improving the value proposition for American students.

http://www.lawschool.cornell.edu/research/JLPP/upload/CJP102-Macchiarola-Abraham-2.pdf

Easy money => overpricing of assets => bubble => bust

This is great for the finance industry, and employers,

because who doesn’t love having a pool of employees

who have already self-installed a non-dischargable

debt leash (choke chain), and a need to borrow money

for the slightest of emergencies?

Wonder if any generation of students will eventually

figure out they are being played against each other,

and opt to not play, en mass?

Student load default is also a back-door raid on social security.

Notice that paying one’s student debt load successfully does NOT contribute to one’s credit rating points in any way.

More ‘heads we win, tails you lose’ economics from our self-styled “leaders”.

The main culprits in the student debt crisis are the managements at the top prestige schools, Harvard, Yale, Princeton and Stanford. They set the prices for all the other schools: other Ivies and MIT are 1% lower, fancy private schools are 5-10% lower, and so on, down to the public universities, which 22-30%.

The top prestige schools kept raising their prices beyond the inflation rate for many, many years, simply because they could, and because it actually increased their prestige: demand was constant and price-resistant, and all could easily afford to give free-rides to any students they wanted but who couldn’t pay. Stanford, for instance, has so much money they don’t know what to do with it. They tear down perfectly good buildings and replace them with brand-new ones, and give free tuition to any students whose parents make $100k or less. They fly the Ultimate Frisbee team across the country for tournaments.

The simple solution in the future is to somehow compel Harvard to lower its tuition by 25% or more. Everyone else would follow suit in lowering prices.

Alternatively, the government could say that it won’t provides student loans to certain expensive schools, or beyond a certain level, or tie federal research grants to tuition levels or overhead amounts (say, 25% instead of 50-60%).

That would help a lot. But of course it will never happen.

There’s a Simple solution to the Ivy League problem of setting the “price”; revoke their Non-Profit status.

The Harvard Crimson. Excerpt Harvard’s Role as a Nonprofit (2009). Should Harvard act any different as a nonprofit than as a business? The answer is yes—Harvard gains huge financial benefits as a nonprofit, and with these benefits come additional responsibilities toward the community that businesses do not always have.

As a nonprofit, Harvard receives tax exemptions, deductions, and privileges that for-profit institutions must forgo. For example, besides innovative investing techniques, Harvard was able to build its endowment from $4.7 billion in 1990 to $37 billion in 2008 because it did not pay taxes on those gains. Relative to businesses, the federal government is subsidizing Harvard’s investment fund.

In addition, Harvard does not pay real-estate taxes. Instead, it makes voluntary payments in lieu of taxes. Last year, for all of Harvard’s property, it paid $1.9 million in lieu of taxes to the City of Boston. Boston officials estimate these payments would be 10 times as large if Harvard paid real-estate taxes. Partly due to these reduced expenses, Harvard currently owns over 923,000 square feet of property in Allston that are neither developed for Harvard’s purposes nor leased to Allston businesses. Harvard would be less likely to hold these land lots for long-term construction projects if it had to pay real-estate taxes on them.

As a nonprofit, Harvard also benefits from tax-deductible donations and a significant amount of federal grant money. Last year, Harvard received $651 million in donations. If donations to Harvard were not tax-deductible, this number would be a small fraction of this total. According to Harvard’s Office of Government, Community, and Public Affairs, Harvard received $535 million in federal grants in fiscal year 2008 that accounted for 82 percent of Harvard’s research revenue. Under the federal stimulus package, federal grants to Harvard are expected to increase considerably. Non-federally funded research is made possible through tax deductions on donations made by corporations and foundations….”

The culprits are those who lend money into existence thereby driving students and everyone else into debt.

And where do you think these culprits matriculated? The culprits built these exclusive Ivy League institutions of privilege. We the taxpayers financially subsidize the 1% class in their education and financialization endeavors. Seriously, it makes me feel warm and cozy knowing we the 99ers help build the fire that roasts us upon the revolving Ivy League ideologue spit of chain-ganged debt-indentured servitude economics.

Yes, there are Ivy league exceptions of allowing a few 99ers in (a feature and not a bug). They do need their pied pipers and guardians at the gate spokespersons playing the “You can too,” “Don’t stop thinking about tomorrow” and “Hope and change you can believe in.” Simply, Ben Franklin says it well, “ He who lives upon Hope will die fasting.” Indeed.

With the PPACA, about 70% of American families will get subsidies for purchasing health insurance.

At least with subsidies, we don’t have to worry about a loan not getting repaid!

Don Levit

In some ways, the debt-laden citizens of today may be returning to the kind of world we had just before the war when a lot of children finished school at grade 8 and went to work. They worked by mostly servicing the needs of their employers–housekeeping, farming, and other labour-intensive jobs. When they raised their large families, they told their children that education was the only way to get out of the working class and into a better job. Those children took their parents seriously and for the most part graduated from high school (during the 50s and 60s). Many went on to university and received degrees that gave them admission into professional jobs as teachers, lawyers and doctors.

Along comes the debt crisis (brought to us by the greedy bankers who found out how to game the system). With debt comes regression and the students who are indebted today will no doubt tell their children to not get into debt no matter what. Will those children grow up to be labourers for the 1%? Maybe.

There is a kind of circuitous link bought to the fore by all the debt that has accumulated. Too much debt often leads to the kind of poverty that existed before the war. In the 50s, we were told not to ever go into debt except for a house or a car and then only if they could be afforded by wages earned. Houses and apartments were smaller and cost less in those days.

Just a thought to share.

> Will those children grow up to be labourers

> for the 1%? Maybe.

It’s very difficult to take away privileges (in comparison

to never having had it to begin with, i.e. first world lifestyle). I can think of several possible outcomes, but

a compliant return to servitude isn’t one of them.

Yves posted the study about Americans being Weird.

What part of “punish unfairness, even at personal

expense” did the elite not understand?

I hope you are right, KnotRP.

The elite (corporate CEOs, mostly) are psychopaths. Either congenitally or situationally.

Their psychopathy prevents them from having “anticipatory fear” — being afraid of bad events in the future. So even if you explain to them that their current actions will lead to their heads and the heads of their children being put on pikes, and even if they believe you, they won’t stop their thieving behavior.

So many problems….

Why not address them at the cause? INTEREST…..%%%%%

National the banks.

Create state controlled banks

Eliminate the FED.

Audit the IRS and the FED.

Print our own money.

Why do we have the FED print money and pay them interest?

Come on everyone!

Read “Webb of Debt” by Ellen Brown.

Let me know what you think….

Oops…Skips letters and space bar function…Nationalize the banks. Old computer. Can’t afford a new one. Banks took all my money, and home of 32 years.

Whadda ya expect? We’re constantly bombarded with propaganda saying that if you fall behind and end up a section 8 Wal mart checker on food stamps its your own damn fault for not “investing” in an education.

That’s the plan, Yves. Work us until we die. No more retirement (“social security won’t be there” they say). IT’s all about leverage now. If you can keep your leverage going, you can consume as much as you want.

And notice how credit cards went down the same amount as student loans went up. It’s quite common to use the student loan money to live on.

Yves, what happened to all that talk about how all these parents were going to invest in these savings plans to pay for their kids’ college? Or all these “pre-pay” plans?

Just like Lambert’s bus sourses, there is a general consensus among everyone I know that the economy will only get worse from now on, that things are headed down the crapper pretty much permanently.

Therefore buying gold and solar panels and ammo and learning how to grow trees is an extremely rational and proactive thing to be doing.

It’s getting comical, now. Gotta have more fodder for those SLABS, I guess.

I say extend public school from K-12 to K-16 — esp considering the more than tacit understanding that without at least a four year degree, a person’s career prospects will be limited to either garbage collection or larceny. It seems a reasonable provision, and a small one, all things considered.

That said, I feel increasingly that a lot of degrees are more like discretionary goods, and that the theory-level is too often over-emphasized over hands-on application. If you’re really into a subject, you’re gonna inhale that shit regardless of whether you have a deckle-edged, foil-stamped bit of parchment hanging over your desk. (For that matter, a notorized collage of all your library receipts for four years should count for something, too.) We’re all, each of us, big fucking nerds when it comes to at least one subject, often to where a degree in said subject is really just a perfunctory measure.

”

I say extend public school from K-12 to K-16 — esp considering the more than tacit understanding that without at least a four year degree, a person’s career prospects will be limited to either garbage collection or larceny. ”

I’m going to call bullshit on this one. First off, the number of jobs which require a four year degree to perform, and these job are professional jobs that require licenses and admittance into selective prgrams are created at a slower rate at jobs that require little beyond a high school degree. This blog covered this trend a year or two ago.

It seems that many college educated have been indoctrinated to believe in the college educational system as a form of salvation, think it is essential requirement for employment…or SHOULD BE. They think everyone needs to go to college because THEY did. This is a belief that they act on. They started by suggesting that college degrees be required for everything. They have given lectures, donated funds, and lobbied to make sure other paths are suppressed. The first thing they did was get rid of the shop classes and looked the other way while manufacturing was offshored in the 1970s. They collectively created the the dyfunctional service economy that we are now wallowing in and they still think the solution is to send more people to college when we know only a small fragment of the population will make it to the few well-paying careers. Some of them are aware about what they are involved in, and are honest about their intentions , let’s call these the University of Phoenix crowd. Others think they are really uplifting everyone else and that the degree and education are transformative when in reality it isn’t.

There are people doing well out there without a bachelor’s degree. You see, they actually have a useful skill that they can market to people from all walks of life. Many of the high-paying careers that require much schooling are limited in growth due to the simple fact that most people and employers cannot to pay thse professionals the salaries they demand.

The more expensive and or ‘productive’ labor becomes, in the private sectors the less it is used.

Even if money wasn’t an issue and it was cognitively possible for everyone to complete educatio to enter in a field in the professional class, they would not be able to perchase each other’s services.

We want to thank Joe Lieberman and Evan Bayh, among others for their role in the Bankruptcy Law ‘reform’ [was it 2006?] that, in time, will be seen as the coup de grace to the middle class in the US.

What about for-profit universities? They are smack in the middle of this mess.

I recal some attention paid a while back to the scams perpetrated by online universities. One thing came out that they were basically milking the student loan program, by signing up young kids and adults with lies about graduation and placement rates, and then sticking the program with the bad debts.

I cannot find any data about what portion of the student loan bubble is with for-profit schools. But I am willing to guess that a high portion of the parabola is due to them.

But I did find this article about the proportionally higher delinquency rates. http://www.huffingtonpost.com/2012/12/27/for-profit-colleges-student-loan-default_n_2371688.html

And this: http://jacksonville.com/opinion/blog/406107/wayne-ezell/2012-08-01/how-profit-colleges-are-ripping-students-and-taxpayers

This has an interesting chart: http://blogs.courant.com/rick_green/2009/07/college-debt-borrowing-tuition-loans-grants-public-university.html

This one pretty much validates my point; look where all the loan growth is: http://www.educationsector.org/publications/drowning-debt-emerging-student-loan-crisis

The problem with for-profits is well-documented. “More asses in the classes”

I think the wider problem is :

overpriced school that provide a poor level of instruction and dump underprepared graduates into the market with a lot of debt.

I’m positive that the schools that fit this discription include more accrediated non-profit schools then you would like to admit. The kind of non-profits that are guilty of this stress that the purpose of a college education shouldn’t be to find a job immediately afterwords.

My point was we’re that in a conversation about a debt bubble, and if you dig into the data, there you find another massive for profit scam, one that is fueled by a government guaranteed loan system – a scam that in fact owes its entire existence to government backing, endorsement, and forebearance.

Without the loose loans and loose regulation of the for profit schools, there would be no bubble. I suspect all the other factors on the nonprofit side would add up to only a modest uptick in loans and default, it takes a unscrupulous for profit firm to supersize it into a bubble.

My point, if not obvious, this is the storyline of subprime mortgages. They started at FNMA, but went parabolic in the private sector.

What do you mean I don’t pay my bills?

Why do you think I’m broke? Huh?

I heard a story recently on Colorado Public Radio about how new nurses can’t find jobs. It looks like this is a national problem. All those people taking out student loans to go to nursing school may be left in debt with no job.

http://money.cnn.com/2013/01/14/news/economy/nursing-jobs-new-grads/index.html

This is all getting really messy. I am still paying back my loans and will be for quite some time. At least we’re getting some education, right :D