Yves here. While most investors and analysts were busy fixating on the Fed’s taper and the unemployment report and the Abenomics roller coaster, some important housing market news slipped under the radar. A Bloomberg report pointed to a panic among prospective home buyers (the ordinary person kind, as opposed to the investor/flipper/private equity landlord type) about being shut out of the market by rising rates. The Oregon Supreme Court whacked MERS (hat tip April Charney).

In addition, a bankruptcy court in Texas in In Re Saldivar accepted the logic of what we’ve called the New York trust theory in assessing standing in a foreclosure. Some defendants whose mortgages wound up in trusts governed by New York law (and the overwhelming majority elected New York law) have tried arguing that the trust did not have standing to foreclose since the borrower note had to get to the trust by a stipulated cut-off date, and that didn’t occur (and New York law is very unforgiving in terms of requiring that a trust act only as precisely stipulated; any acts not consistent with the governing instrument is a void act). While the decision is helpful, one otherwise good write up of the case speculated that it might be “REMIC Armageddon” and forecast all sorts of tax law issues arising. Sorry, sports fans, but tax law is a different beast than trust law. The REMIC issue was raised with the IRS first in 2010 and a few times since then, an the answer is crystal clear: the IRS doesn’t see any problem. So while this decision is a win for borrowers, it won’t nuke the mortgage industrial complex.

Another update comes from NC regular rjs.

By rjs, who is unencumbered by education and affiliations. Cross posted from MarketWatch666

While everyone was focused on the unemployment report, most missed another important report released this past week, the Mortgage Monitor for April (pdf) from Lender Processing Services (LPS). We’ve been following it as a proxy for the ongoing mortgage crisis.

While everyone was focused on the unemployment report, most missed another important report released this past week, the Mortgage Monitor for April (pdf) from Lender Processing Services (LPS). We’ve been following it as a proxy for the ongoing mortgage crisis.

LPS reported that 3,111,000, or 6.21% of home mortgages, were more than 30 days delinquent but not foreclosure in April, down from a delinquency rate of 6.59% in March. Of those, 1,717,000 homes were more than 30 and less than 90 days past due, and 1,394,000 mortgages were more than 90 days delinquent. In addition, LPS counts 1,588,000 homes, or 3.17% of all mortgages, in the foreclosure process. That gives us a total of 4,699,000, or 9.76% of home loans delinquent or in foreclosure as of April 30th, which marks the first time since 2008 that the total percentage of mortgages in arrears has fallen below 10%

Part of this reduction in delinquencies is seasonal. As we’ve seen, significant numbers of homeowners forego mortgage payments before Christmas, and typically catch up by March or April.

LPS also noted the highest rate of completed foreclosures in judicial states since 2010, which reduced the foreclosure inventory by 5.83%; nonetheless, homes in foreclosure are remaining delinquent in those states that require judicial review an average of nearly three years before the "foreclosure sale" is completed (you’ll recall foreclosure sales is a mortgage industry euphemism for home seizures, after which the home usually becomes part of the banks REO, or real estate owned – the glossary of terms used is on page 23 of the pdf)

Foreclosure sales as a percentage of the then current foreclosure inventory, which is the number of home mortgages stranded in the foreclosure process, is shown in the chart to the right; each line tracks the percentage of homes in foreclosure that are seized in any given month; the blue line tracks that metric for judicial states, or those where a court review is necessary for a home to be seized, which was at 3.01% of all judicial mortgages in April, 16.87% above the home seizure rate for judicial states in March; the red line tracks the percentage of foreclosed homes seized in non-judicial states, where foreclosures need not be handled through the courts; in April, that rate was 6.88%, a 10.95% month over month increase.

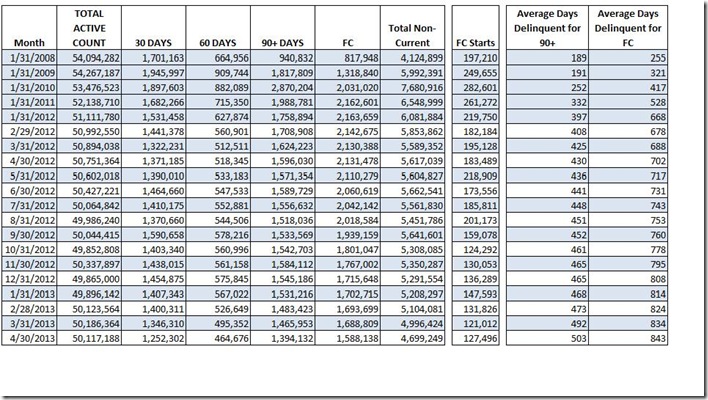

Data from the table below, taken from page 20 of the LPS pdf, best illustrates where we’ve been and how far we have yet to go. Each line first shows the month and the total active count, or the total number of active mortgages nationwide in that month; subsequent columns show the actual number of delinquent mortgages that are 30, 60, more than 90 days delinquent, or in foreclosure (FC), with a sum of the non current in the next column (. The big jump in short term delinquencies in September last year was due to the release of the iphone5)…then there’s also a separate column for foreclosure starts in each month. But it’s the last two columns that tell the story, as they give the accumulating days that an average home mortgage has remained either delinquent or in foreclosure without proceeding to the next step.

You can see that as of April, the average seriously delinquent homeowner has not paid on their mortgage for 503 days, and that the typical home in foreclosure has been delinquent for 843 days; in general, those who are seriously delinquent (more than 90 days past due) are not being foreclosed on, and those who are in the foreclosure process are not having their homes seized. Since this metric seems to be increasing an average of ten days a month, and new foreclosure starts are being added each month which should be bringing the average days down, we can only conclude that the foreclosure process is damn near frozen…and as we’ll see in the next graphic, this isn’t just because the courts are clogged…

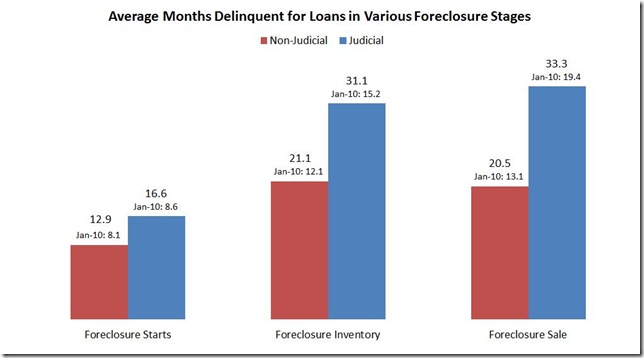

Below to the left we have a set of bar graphs from page 13 of the LPS pdf; as the heading reads,. They show the average months delinquent for various stages of foreclosure. Again, blue represents the times for judicial states, and red for non-judicial states. The top number over each bar represents the number of months a loan has been delinquent in that stage as of April; in the small print below that are the months delinquent for each stage and type as of January 2010, the peak of the crisis.

We can clearly see that at that time, foreclosures were being started after 8 months of delinquency in both judicial and non-judicial states, but now even starting the proceedings is delayed an average of 12.9 months for non-judicial states. and 16.6 months for judicial states, or nearly twice as long. Also note the length of time homeowners spend in the foreclosure process (aka foreclosure inventory) in non-judicial states, where court delays cant be blamed; early in the crisis it was 12.1 months, as of April, it’s stretched out to 21.1 months…

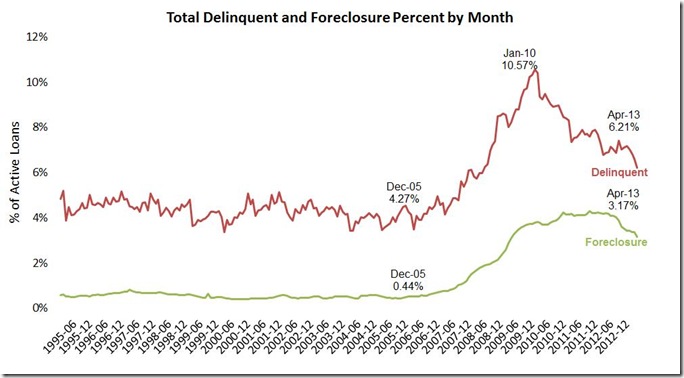

Lastly, the graph on the right above summarizes the delinquency and foreclosure history of US mortgages going back to 1995, showing both as a percentage of the active loan counts; there’s a callout for December 2005. .44% in foreclosure and 4.27% delinquent would represent a normal level of mortgages in trouble.

You see delinquencies, tracked in red, peaked at 10.57% in January 2010, and have now fallen to 6.27%; the seasonal pattern for delinquencies is also evident…and the foreclosure inventory in green is now down to 3.17%. Most of the Mortgage Monitor is graphics like these above with little detail; the data summary for the past 12 months is on page 18 of the pdf: if you are so inclined, you can also watch LPS Applied Analytics Senior Vice President Herb Blecher explain some of the graphics in a video presentation…

(Reuters) – Title insurer Fidelity National Financial Inc (FNF.N) said it will buy Lender Processing Services Inc (LPS.N) for about $2.9 billion in cash and stock to grow its mortgage servicing business.

FNF said the offer, which works out to $33.25 per LPS share, represents a premium of 19 percent to the average 30-day closing price of LPS shares. LPS shares were up about 3 percent at $33.90 in early trade.

LPS shares have risen just over 13 percent since the Wall Street Journal reported on Wednesday that a deal was in the works.

The insurer said it would pay half the deal value in cash and the rest in FNF stock, subject to some final adjustments.

LPS was spun off in 2008 from Fidelity National Information Services Inc (FIS.N), which was formed in 2006 in a merger between an FNF unit and Certegy Inc.

Bank of America Merrill Lynch and J.P. Morgan acted as financial advisers to FNF, while Credit Suisse Securities and Goldman Sachs advised LPS.

The deal, which is expected to close in the fourth quarter, includes a “go-shop” period through July 7 and includes a break-up fee of about 1.25 percent of the total value if LPS terminates the deal for a superior offer.

FNF, which has a market value of about $5.7 billion, posted a higher first-quarter profit earlier this month, as it earned more premiums from its direct title insurance business.

FNF shares were up 3 percent at $27 on Tuesday morning on the New York Stock Exchange.

LPS Officers & Directors

Hugh R. Harris President, Chief Executive Officer,

Thomas L Schilling Chief Financial Officer,

Daniel T. Scheuble Chief Operating Officer,

Joseph M Nackashi Executive Vice President,

Todd C Johnson Ex Vice President, General Counsel

Christopher P. Breakiron Senior Vice President

Alvin R. Carpenter Lead Independent Director

Dan R. Carmichael Director

**John W. Snow Ph.D.** Director

Philip G. Heasley MBA Independent Director

It makes sense. FNF writes title insurance. Perfect match. No wonder this merger was advised by all the TBTFs. As soon as they have this up and running they will have created a vertical supply chain, a true monopoly, on fraud and fraudulent securities, and of course on mitigating the remote possibility that there might be a missing note and some misplaced allonges. That can be taken care of with just a paragraph indemnifying the future interest holder. And might make the Fed and the GSEs happy enough to keep buying MBS, or to have the courage to resell them. The Fed doesn’t think it is very funny to have to pretend the paperwork is all in order when the entire goddamn country knows it is not. The Fed just can’t take a joke.

Multiple Law Firms Investigating the Acquisition of Lender Processing Services, Inc. (LPS) by Fidelity National Financial, Inc.

Lender Processing Services, Inc. : SHAREHOLDER ALERT: Law Office of Brodsky & Smith, LLC Announces Investigation of Lender Processing Services, Inc.

06/10/2013| 05:10pm US/Eastern

Recommend:

0

Law office of Brodsky & Smith, LLC announces that it is investigating potential claims against the Board of Directors of Lender Processing Services, Inc. (“Lender Processing” or the “Company”) (NYSE: LPS) relating to the proposed acquisition by Fidelity National Financial Inc.

Click here to learn more about the investigation http://brodsky-smith.com/593-lps-lender-processing-services-inc.html, or call 877-534-2590. There is no cost or obligation to you.

Under the terms of the transaction, Lender Processing shareholders will receive cash and stock valued at only $33.25 in cash for each share of Lender Processing stock they own. The investigation concerns possible breaches of fiduciary duty and other violations of state law by the Board of Directors of Lender Processing for not acting in the Company’s shareholders’ best interests in connection with the sale process. The transaction may undervalue the Company as an analyst has set a $36.00 per share price target on Lender Processing stock.

If you own shares of Lender Processing common stock and wish to discuss the legal ramifications of the proposed transaction, or have any questions, you may e-mail or call the law office of Brodsky & Smith, LLC who will, without obligation or cost to you, attempt to answer your questions. You may contact Jason L. Brodsky, Esquire or Evan J. Smith, Esquire at Brodsky & Smith, LLC, Two Bala Plaza, Suite 602, Bala Cynwyd, PA 19004, by e-mail at investorrelations@brodsky-smith.com, by visiting http://brodsky-smith.com/593-lps-lender-processing-services-inc.html, or calling toll free 877-LEGAL-90.

Brodsky & Smith, LLC is a litigation law firm with extensive expertise representing shareholders throughout the nation in securities and case action lawsuits. The attorneys at Brodsky & Smith have been appointed by numerous courts throughout the country to serve as lead counsel in class actions and successfully recovered millions of dollars for our clients and shareholders. Attorney advertising. Prior results do not guarantee a similar outcome.

Brodsky & Smith, LLC

Jason L. Brodsky, Esquire

Evan J. Smith, Esquire

877-LEGAL-90

investorrelations@brodsky-smith.com

http://brodsky-smith.com/593-lps-lender-processing-services-inc.html

Investors who purchased shares of Lender Processing Services, Inc. ( LPS ) prior to May 28, 2013 and currently hold any of those LPS shares, have certain options and should contact the Shareholders Foundation, Inc. at mail@shareholdersfoundation.com or call +1 (858) 779 – 1554.

On May 28, 2013, Fidelity National Financial, Inc. and Lender Processing Services, Inc. announced the signing of an agreement under which Fidelity National Financial will acquire all of the outstanding common stock of Lender Processing Services for $33.25 per common share. Under the terms of the agreement, Fidelity National Financial will pay 50% of the consideration for the Lender Processing Services shares of common stock in cash and 50% in shares of Fidelity National Financial common stock, subject to adjustment.

However, the plaintiff alleges that the defendants breached their fiduciary duties owed to LPS stockholders by agreeing to sell the company too cheaply via an unfair process.

The plaintiff claims that the $33.25-offer is too low and undervalues the company. Indeed, following the takeover news LPS shares reached $24.06 on May 28, 2013. In addition, at least one analyst has set the high target price for LPS shares at $36.00 per share. Furthermore, Lender Processing Services’ performance improved lately. For instance, it reported that its annual Total Revenue rose from over $1.98 billion in 2011 to over $1.99 billion in 2012. In addition, shares of Lender Processing Services, Inc. ( LPS ) grew from $13.69 per share in Sept. 2011 to $29.64 per share in October 2012.

Those who currently are investors in Lender Processing Services, Inc. ( LPS ) shares and purchased LPS shares before the announcement have certain options and should contact the Shareholders Foundation.

The Shareholders Foundation, Inc. is a professional portfolio legal monitoring and settlement claim filing service, which does research related to shareholder issues and informs investors of securities class actions, settlements, judgments, and other legal related news to the stock/financial market. The Shareholders Foundation, Inc. is not a law firm. The information is provided as a public service. It is not intended as legal advice and should not be relied upon.

CONTACT: Shareholders Foundation, Inc.Trevor Allen

+1 (858) 779-1554

mail@shareholdersfoundation.com

3111 Camino Del Rio North

Suite 423

San Diego, CA 92108

Read more: http://www.nasdaq.com/article/lender-processing-services-inc-lps-investor-lawsuit-against-takeover-for-3325-announced-by-shareholders-foundation-20130610-00522#ixzz2VrVfYSvb

It seems that the big banks needed a conference table and a secretary where they could meet and collude. MERS, FNS, LPS and, of course, they needed their legal advisors present to insure no jail time. They of course highered the best – DOJ, SEC, OCC, Congress and the rest.

I am puzzled about the lost hope of Remic Armageddon. I’m puzzled about the position the IRS took that missing notes are not a problem. But that is probably another insurance issue. As soon as they fudge all the FC title insurance, who cares? There will be a sub-paragraph also indemnifying trusts and trustees for the unlikely chance that the securitization timing was a little off.

The IRS got Charlie Engle. Then there was the story of the IRS agent who sought to enrich himself by working, ahem, with a bank. Why the puzzlement?

Is this the same kind of market manipulation that oil traders do when they slow down tankers? Except here it’s houses that are in the supply chain, not oil?

it seems the banks just dont want to take possession of any more properties; they may see it in their interest to allow families to occupy and upkeep houses, even though they’re generating no revenue, rather than have them empty and vandalized…referencing CoreLogic and RealtyTrac, AOL’s realestate blog found that 90% of repossessed homes were being held off the market last year…prices have risen since, but NAR figures dont show much of an increase in the inventory of homes for sale…they claim it’s that shortage of homes for sale that’s driving prices up…

It will be 1,686 days when the current bubble bursts.

Maybe if they re-lower the standards again. Get autobody painters, the ne’ver do wells back to hustle, start originating en masse, working with realtors and have the FBI off monitoring moslems or something.

Contract law now is pretty much as good as holding a gun to someone’s head anywho, so the previous foreclosees voluntarily sign their way back into the insanely overpriced broken down ol’rancher, cut a check to empty their bank accounts for the minimum down payment, make as many payments as possible, then hang out ’till the poop hits the fan again. Wash, rinse, repeat in various locations for the rest of the century! Air strikes without the drones.

And down in Florida, Governor Scott signed into law a bill that makes their infamous “rocket docket” foreclosure process legal.

http://www.housingwire.com/news/2013/06/07/florida-governor-signs-bill-speed-states-foreclosure-process?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+housingwire%2FuOVI+%28HousingWire%29

oh the irony

LPS Home Office

601 Riverside Avenue

JACKSONVILLE, FL 32204

United States – Map

+1-904-8545100 (Phone)

+1-302-6555049 (Fax)