If you look from 50,000 feet, there are two sides to the debate over mortgage modifications. On the one hand, a surprisingly large group, which includes beleaguered homeowners, mortgage investors and town and municipal governments, all favor mortgage modifications, particularly principal modifications. Their argument is simple. If you are dealing with a big enough loan, it’s always better for a bank to take half a loaf rather than none when a borrower gets in trouble. That’s why, historically, banks would quietly cut a deal with a stressed homeowner who still had a viable level of income and was committed to keeping his house.

Against them have been arrayed a peculiar band of moralists who argue that people who can’t pay their obligations should suffer, no matter how high the cost of this cut your nose to spite your face attitude is in terms of damage to home prices in the community and lost tax revenues. And in keeping with that, the press has taken up the “strategic default” meme, which perversely tries to depict lenders as victims of calculating borrowers.

The interested group that seldom makes its wishes known in public, of course, is the one that benefits most from this perverse status quo of “fewer mods than there ought to be” which is mortgage servicers. They aren’t set up to do mortgage modifications while they have set up streamlined processes for foreclosure. And they also get paid additional fees when borrowers are delinquent and enter foreclosure (many aren’t legitimate; as we heard from whistleblowers at Bank of America, foreclosure abuses and fee padding were endemic).

The foregoing means that modifications are always preferable and servicers need to be pressed harder to do more, right?

Not necessarily. Never underestimate the ability of banks to game a system.

On the one hand, if a borrower can get a mortgage modification that enables him to keep his home, everybody wins except the servicer, who doesn’t get his late fee/foreclosure pound of flesh (note various incentive fees to servicers under programs like HAMP and HAMP 2.0 alleviate but don’t necessarily solve this wee problem).

However, the part the modification proponents often underplay is borrower redefaults. The moralists love to inveigh that redefaults are just proof that the borrowers were deadbeats and should never have been cut a break. But the reality is that the redefaulting borrower also comes out a loser. If they had not gotten the modification, they would have lost the home sooner, which means they would have saved the additional payments under the modification. That’s more money to establish themselves in a rental, since moving and putting down a deposit require outlays. And for some people, those savings may mean the difference between living in a car or on the street.

And who wins in a redefault? The servicers. They get to collect even more late fees and other padded fees than they would have otherwise. For instance, the Bank of America whistleblowers (and others) have found evidence that banks inflate attorney fees during the foreclosure process. In many states, there are limits on how much is permissible, and on top of that, Fannie and Freddie have their own caps. If a mortgage is modified, all the past due charges, such as attorney fees, are often rolled into the principal balance. File reviewers reported numerous instances of impermissibly high attorney fees ($5,000 to $10,000 was common, and one case featured a simply implausible $85,000 total). Similarly, whistleblowers at another servicer, PNC, report that a crisis erupted during their OCC mandated foreclosure reviews when the guidelines were modified to require that they find and check the documentation of third party fees such as attorney fees. They stated that it was clear the attorney fees charged through the widely used Lender Processing Servicing platform could not be substantiated. So the evidence points to widespread abuse.

One example comes via a sad tale in the Puget Sound Business Journal (hat tip kimberly k). A young man bought a condo in Maine in 2006 at peak of bubble prices with a fixed rate loan and 10% down. He could afford the loan. However, when the crisis hit, a number of people in the condo defaulted, leading to increases in HOA fees. In addition, he met his fiance and they both struggled post the crisis in the crappy Maine economy (Maine is not exactly robust even in the best of times, and suffered not only a fall in tourism but other important sources of income (such as decommissioning of a major airbase, low lobster prices, etc). They put the condo on the market in 2011, six months before their move to the Seattle area.

To shorten a long and painful story, after they failed to attract a tenant and kept lowering the asking price, Bank of America refused to entertain a short sale offer. They insisted the couple default. They then refused to accept a post default second short sale (the persistent buyer kept trying to work with BofA for nearly a year). The latest chapters:

After that second short sale was rejected, we began what is called a “deed in lieu” process, which basically means you skip the foreclosure process and hand over your deed to the bank….

Then, as things looked like they were finally going to be over, we got a letter back-dated by two weeks that said Bank of America was selling our loan to another company….

The company that now owns our loan? The lawyers we’ve talked to call it the worst mortgage company in the country….

The new company, Green Tree Servicing, has nothing. No documents. No idea who we are when we call. No idea that we’ve been through two short sales and a deed in lieu process. They just offered us a loan modification.

You can bet that Green Tree will locate and/or make up every sort of charge they can since this couple defaulted and capitalize it. They don’t care if the mod works. In fact, their incentive is to have the mod fail since they’ll get all the charges they bundle into the mod first if the condo is foreclosed upon (the servicer reimburses itself first out of sale proceeds for principal and interest it has advanced to the investors and foreclosure and various other fees, like late fees and its servicing fee).

So modifications can serve as a way not to save borrowers, but to extract more blood from them.

And the worst is the officialdom has no idea of how often this sort of abuse occurs. Oh, they do collect overall statistics on modification redefaults. But they have no idea what a good level of redefaults is, in part because numbers alone don’t tell the story. People can redefault because Shit Happened (job loss, death, disability, medical emergency, divorce) or because they were going to hit the wall regardless or because the modification was too small and the servicer knew or should have known that. The first category can’t be foreseen but the latter two can be, and the authorities should be just as keen to avoid those outcomes as they should be to get big enough mods to borrowers who can be salvaged.

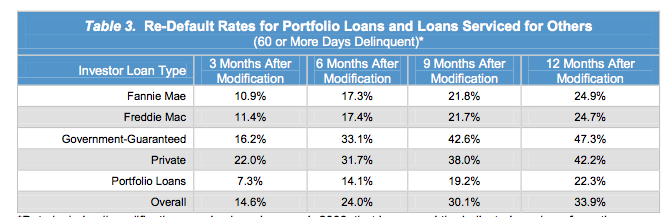

And there is some evidence predatory mods are taking place now. See this table from the OCC’s latest mortgage metrics report (hat tip MS):

Notice the 47% redefault rate after 12 months for “government guaranteed” loans. The narrative attributes the disparity to “differences in the loans and modification programs as well as the servicers’ flexibility when modifying mortgages they owned” but the OCC and other regulators lack the underlying data to know what is really afoot. And a near 50% redefault rate looks a lot more like borrower abuse than misguided servicer charity.

So be careful what you wish for, even for long-suffering borrowers. The Puget Sound article depicts clearly that being allowed to keep a home can be a curse rather than a blessing.

Not only a 47% rate for government guaranteed loans but the lowest rate, 22%, was for portfolio loans. How utterly predictable! This tells us that the 12-month re-default rate on a well-underwritten mod should be 22%.

Both the government and private investors need to insist that their servicing contracts get rewritten once they expire to disincentivize this kind of gaming of mortgage mods. That is, assuming the private investors can get the trustees to go along. OTOH, why are private folks investing with these thieves in the first place?

Imagine how many jobs would be created if the government actually set about solving this whole mortgage mess — putting in place a proper system of account, analyzing on a case-by-case basis all the distressed homeowners, etc.

Not only would there be the direct economic benefit of relieved homeowners, but you’d be training new graduates in the skill of financial regulation, and employing those from FIRE who are unemployed and have experience to manage the whole thing.

It might create just as many jobs to outlaw the securitization of primary residences. Could decentralization of this one banking function be turned into a viable political issue?

It doesn’t sound like these mods are being securitized just a continuing amazing lack of oversight and regulation and lack of prosecution for wantonly fraudulent activities.

I would suspect that some of these mods as well as the refinancings are actually ‘desecuritizations’ as they try and clean up their title mess at the expense of homeowners. It seems clear that in the governments set of priorities homeowners come last. HAMP is another example of a limp program and soft treatment of the abusive banking system..

Well I only re-defaulted because wells fargo told me to!! I was current on a modification that was higher then my original mortgage but then BP oil spill hit. My worked dried up as well as my husbands over time. but we were paying essentials with our credit card and paying the mortgag eon time. when i called wells fargo hamp loan they told us we had to be in emminent default to get help (which we now know is a lie) but i was in emminent default. how long can you go on using credit cards. it didnt matter if i qualified for a hamp loan. they wanted the default/the foreclosure. so the moved my completed file that was in review out of review, next the lost every fax that was sent, then they lost a fed ex mailer. that had a tracking number and a signee. when they “found” all my documents werent there. then i receive a denial because of failure to submit documents on time. That was the day i started looking for a lawyer. How can our governemnt continue this facade. so i have a lawyer foreclosure papers served. judge court orders discovery it has been a year wells fargo has produced nithing to prove ownership of my fnm loan aquired 1 week afetr closing with mo recorded assignments??????????????????????????????????????????????????????????????

I like that idea no securitization on primary residences. who aloud that anyway. playing the stock market on our homes and then everything crashed. the banks do not own the mortgages, the GSE’s do not own these mortgages. they were all blederized and sold off as stocks. no one knows who owns them yet you have judges that refuse to give a primary residence back to the homeowner. he rather rule for the bank that diesnt own it either

Exact same situation…oil spill, default, modification paperwork lost 8 times, Assignment of mortgage filed. But here is the deal – we reinstated and suddenly they deny the assignment. It shows they never really assign the mortgage. It is just a paper they file to have standing to foreclose. If people reinstate they will not send you a notification required as per 15 USC 1641 (g). Like the assignment never happened. We took them to court and they said in court they don’t have our mortgage and note.

It’s hard to believe this slow-motion train wreck has been allowed to continue for so damn long.

Nearly three years ago we bypassed a lot of personal trauma by handing over the keys to our home. It was our third home, so we lost a lot of equity. But when you lose two-thirds of your income, what can you do?

We are still digging out. The good news: we are in a starter home and starting to rebuild equity/credit/stability for the kids.

Three years ago, before we negotiated the DIL with our servicer, they offered us a one-year “mod” that would have reduced payments but rolled over the difference and added lots of fees to our balance. I imagine if we had complied we could have gotten extensions every year. But where would we be now? How deep the hole?

Our economy is still on life-support because so many people accepted the poisoned chalice Yves writes about here. You can’t do anything but shuffle along if you accept these mods. It’s debt slavery, nothing less. Today my husband is negotiating to buy a company from its original owner in another state. If we were in our old house, massively in debt, he would have no choice but to keep his wretched job and count the years until retirement. Now he can take a chance. Maybe it won’t work out, but in this hunkerdown economy there is no point for waiting for the sun to come out. You have to light it up yourself.

“being allowed to keep a home can be a curse rather than a blessing.”

Exactly so. Which is why the strategic default “meme” isn’t always a meme. Plenty of underwater borrowers, especially those who want to relocate, have figured this out.

BAC assigned Green Tree – Limited Power of Attorney in 2009.

Official Records of Maricopa County Recorded Helen Purcell 2009-0892088 09/25/09 02:31 PM

This means Green Tree has been acting as the “Master Servicer” and the Coordinator of everyone’s misery all along. What is equally important is that Green Tree was acquired by the entity below in August 2011 to cash in on all the booty captured by Green Trees deceiptive collection practices. *Search these words: Green Tree collection complaints.

If the NC trolls don’t block my posting, readers can confirm for themselves by reading details of Green Tree’s purchase as well as the acquisition of GMAC servicing rights by:

Walter Investment Management Corp.

Form S-3 REGISTRATION STATEMENT – As filed with the Securities and Exchange Commission on February 13, 2013

Registration Statement No. 333-

I’ve been kept in “Foreclosure Limbo” by Fannie’s appointed “Foreclosure Mill” since 2011 for loans originated by a local Non-Lender that arranged several loans (seven)for me from 1997-2006. All were fed into the GMAC, Countywide blackhole. All are now being controlled by Green Tree. Who, by the way is the entity funding the foreclosure attorneys who are protecting the same lender who orchastrated these loans.

I’m not fighting foreclosure. I’d welcome it, but they won’t do it. I keep getting their letters (for years now)just like everyone else has, but it’s just BS. They won’t foreclose. It’s likely that they are setting me up as a “Stategic Defaulter”, which is absolutely not true.

This was all planned. Some would fall for the Loan mods. some would bail out of their homes, some would kill themselves and some would send in all their personal info. month after month, while they kept everyone in limbo until statutes of limitations ran out. The only ones winning, (besides wallstreet) are the attorneys picking the bones of all those captured by this pre-planned land grab.

I’ll let you all know when they hall me off to jail for doing this “On Purpose”.

Do check out the Green Tree assignement thing. I was not able to link it for some reason, but it should be accessible to those willing to dig a little.

Lucy Lu if you’re out there. You’ll know how to do it and make it available to readers.

Thank you NC for making this site available.

Checking my credit, I just discovered Green Tree sent a second that was wiped out six years ago to a collection agency. I also carefully paid them all the deficiency judgement they were owed (more than they would’ve gotten in foreclosure.)

Ocwen is still reporting me late on a wiped out second they bought from Wells five years ago (bought post-BK, when it was already worthless.) It never ends. Six years of this shit. According to my attorney – in the old days, when there was some rule of law in this country, one letter to a bank about a violation of a legal stipulation or law would solve cause the bank to stop the illegal activity. Now, in our new fascist system, nothing will, not even your own death.

There is clearly evidence that servicers (and banks in general for that matter) are taking full advantage, worse the evidence has been around a while now. I want to know how we fix it. The longer this drags on the more decent people that are harmed and these predatory companies just get wealthier. There has to be a way to strike back and enact some real change. Ideas?

@down2long – Search for and read this filing. You’ll find on around page 9 of 83 that Walter Investment Management Corp. had a partnership agreement with Ocwen to acquire either the debts or the servicing rights.

If you or anyone else received any Deed-in-lieu or “short sale” letters from REDC you’ll be interested in knowing that 1. FHFA was formed on July 30, 2008, for the purpose of taking over Fannie Mae (and others) but the announced takeover didn’t occure until weeks later which gave Fannie loyalists like Jason Allnutt time to select The Foreclosure Mills a week or so before Jason left Fannie to head up none other than REDC Default Solutions. Coincidental? Before Fannie, Jason was a well connected player at GMAC. Coincidence? Where is Jason Allnutt now? He is CEO of Auction.com which is the outfit that lists all these worthless titled assets you and I are responsible for, so they can be acquired by other institutional investors for pennies on the dollar, while you, me and millions of others like us remain on the hook for the rest of our lives.

Coincidence? NOT

Oh, yeah check this out and tell me Fannie’s peeps didn’t have a hand in all this.

http://www.dsnews.com/articles/fannie-mae-awards-4-star-designation-for-first-time-2013-04-09

It was all planned.

Thanks for the link to DS News.

“Since its launch, DS News magazine has positioned itself at the forefront of an evolving industry. Always current with the most up-to-date default servicing news, DSNews.com keeps you informed …”

http://www.dsnews.com/

The “DS” stands for Default Solutions. Their business model supports the industry that is screwing everyone.

My posting of the link was to highlight Fannie’s connection and support of Green Tree. NOT to promote DSNEWS as something worthwhile.

Isn’t a forgiven loan considered taxable income?

You get out of the loan but get nailed by the IRS?

I also thought if an investor takes a loss on a security – taking a tax write off – a tax event – that the loss is not recoverable by anyone anymore. Should that not translate to the underlying debt (mortgage note) IE: the homeowner would owe less because the debt had been written off in a taxable event?

Boy, I am confusing myself.

Yes, unless you can demonstrate insolvency or financial hardship to the IRS. That’s why the de facto forgiveness of debt in a foreclosure ins’t treated as taxable income.

Ahh the Power of their DECEPTION…

You should NEVER try to CONTRACT again because there was NEVER any loan by your first SUBPRIME LENDER that went belly up aka DEFUNCT mean YOUR CONTRACT was CANCELLED and UNENFORCEABLE as they BREACHED their DUTIES not YOU.

Therfore IT’s a TERMINATION of an agreement…

That means YOUR CONTRACT is NO Good and “NO ONE can have JURISDICTION over you…”

BEWARE of this MATRIX to trick YOU into another contract, and under the FDCPA they HAVE to prove that they own the DEBT.

UCC law states that a MUTUAL CONTRACT involves BOTH SIGNATURES or its INVALID…

So the next time that you sign a contract, YOU better make sure that YOU have two SIGNATURES YOUR name and the bank CEO on that same CONTRACT or its FRAUD…

It is great to see the level of understanding apparent in these posts. My own situation defies explanation. After thousands of hours of research I can state; 1. there are no trusts 2 almost all subprime loans are GSE false defaults wher only collection rights survived after ins payouts. 3. there are no banks, lenders. mortgagee on securitized loans. Only a holder at best. Absent the forged backdated fabricAted document trail, there is nothing, let alone a holder-in-due course. It is all fraud on the court cArried out by attorneys for the servicers. You can take that to the bank

I too was told not to pay my mortgage in order to get HAMP……that was a big mistake!! Filed BK13 in Oct 2010 to keep house. This Jan, right before our mortgage payment was due, we got notice that GMAC sold our mortgage to….you guessed it …Green Tree!!! I was really angry and scared, ready to do battle with these a-holes. Of course all the numbers were a mess nothing made sense but what could we do? My Bk lawyers are no help. Then we got a packet in the mail with a proposal to modify. It reduced our mortgage payment by about 1/3, and reduced our interest rate to 3% or so. (currently at 5.5%). We were pre-qualified and did not have to submit any paperwork, just start paying the new amount for the usual 3 months. The people in BK at Green Tree were actually very nice and helpful. They told me that they were offering all of the mortgage holders they got from GMAC modifications. Fannie owns my mortgage and they also told me this mod would be coming from Fannie. They will roll all our arrears into the new mortgage, I’m sure it will be like a 40 year mortgage or something but we want to keep our place. We are waiting for the final offer…….I feel like I’m waiting for some bad news any day or a request for paperwork… something that shows they are up to their usual tricks. It does seem to be to good to be true. I do not trust them, but my lawyers looked at the inital offer. They know I have lawyers and am in BK so what tricks can they pull? We shall see. I will be on the lookout for crazy fees and whatnot and will go over the final mod. carefully. I feel like I am playing a very dangerous game with these folks. Thanks for letting me vent.

Search: “Green Tree collection complaints”.

It’s the only way to find out what other’s have already experienced.

“And a near 50% redefault rate looks a lot more like borrower abuse than misguided servicer charity.”

This could be read a couple of different ways. I presume you mean abuse of borrower rather than by borrower.

I think we would have been out of this hole if they would have foreclosed on homes like the 90’s and let over their head borrowers just default and rent..

Greed and debt to not work well together. The people whining about their homes, refinancing and no ability to make the payment shouldn’t have been in a home to begin with. I’m sorry but many people didn’t buy too much, borrow against some BS equity or use the money for other purposes. I was an underwriter in the 90’s and the whine and chees from the people whom can’t do their homework before purchasing the biggest item in their life doesn’t motivate me to give them an easier ride.

Being humbled is the best thing for you especially when it comes to money and greed.

Prudent people are being thrown out the window for a bunch of whiners, pick up and get on with life..

Unimpresssed by your credentials and even less with you’re inability to recognize that “we whiners” cannot pickup and move on.

But, we do have a message for uninformed trolls like you.

http://www.youtube.com/watch?v=OXRBELZpKak

“Our ‘neoconservatives’ are neither new nor conservative, but old as Babylon and evil as Hel!.” Edward Abbey

Dear CD,

You are an idiot. Just thought you should know.

Did you read anything on any of the pages of this entire site? Did you (as an alleged “underwriter”) realize you were part and parcel co-conspirator of this very crime?

If you can find someone who knows a little math, compute the Cost-Benefit ratio of either A: the current situation or B: the “government” taking all the bailout funds and just paying off every mortgage on every primary residence of every borrower. “Free Homes”? HARDLY!!! Have you ever written a mortgage amortization program for a computer, or studied the historical laws prohibiting USURY? You pay three times for one house. Did you ever buy a house, or did your mommy and daddy do that for you too?

On that note, how many military “programs” could pay off every mortgage of every borrower’s primary home, if that “program” funding were “redistributed” in a Just way? Any one of MANY!! So the Navy will do without one ship or the Air Force will have to use live pilots, or we don’t have some other useless waste, and all that money (plus whatever we’re able to scratch together in today’s “economy”) gets injected directly back into the Real World!!

I’m just trying to show how easy it is to find solutions for this problem, if people like “CD” can be kept in their place.

The lies the banks tell you are easy to spot: “We need all that (Usury/Amortization) for the RISK!” — guess what, that “risk” is paid with the first third, the profit is paid with the second third, and if your career gets cut off at the knees before you “get to” pay them the final third, they think they’re entitled to take your family’s home as well. Apparently the less intelligent among you (CD) think that’s okey-dokey. Show your proof. (That would be easy if you actually HAD any!)

SOME of us (most, I’d wager) prudently, responsibly arranged loans to buy our families’ homes when “times were good” and had no culpability at all in the bursting bubbles of the last few decades. Now we’re “too old to hire” and there’s no one there to hire us anyway. You’ll say “just move where the jobs are”, but that isn’t where our homes are, which was the point of all this in the first place — owning homes.

Thanks for pissing me off again, because that’s the only way We the People will ever get these criminals to jail (or a big bonfire!!) is if we can all stay pissed off until the last of YOU (CD) are put down.

Meanwhile, what’s being done in 2013? The foreclosure mill that’s attacking me (with no regard for propriety or even the Rule of Law or the orders of our state Supreme Court) leaves me feeling like I’m being beaten to death by a team of black-belt karate experts, and I’m not even a fighter. All the lawyers I meet seem to be heavily invested in MBS, so all they can offer is “help” filling out HAMP forms. With no taxable income for a decade (and not one cent missed nor a minute late on 1.5 DECADES of mortgage payments — at 7.125%!!), my “papers are not in order”; so why would I expect it to help by merely recreating a lost Note? That’s a lot like going to a rapist and saying “oh, I forgot how much it hurt the last time, would you mind raping me again?” In case metaphor is too deep for you (CD), it is exactly like throwing away the one broomstraw I can hold up to defend myself — right now the lack of a Note is the only thing stopping them. If I Make a new Note through “HAMP”, they can steal my home “legally”.

No honor at all among you theives.

http://www.irishexaminer.com/business/loans-ruling-could-affect-billions-233298.html

There were also several hundred thousand people who could pay their mortgages, but brcause they were late a couple of times, (for various reasons) got sucked into the loan mod scam and eventually went to foreclosure. They were told to stop making their payments so the loan could be modified. They were told to submit more and more documents. This went on and on and when they got suspicious and tried to start making their payments the banks would not accept them and put them into foreclosure. I know, I’m one, but don’t just take my word, look it up online!!!