Reuters has a new article, Insight: A new wave of U.S. mortgage trouble threatens, which is simultaneously informative and frustrating. It is informative in that it provides some good detail but it is frustrating in that it depicts a long-standing problem aided and abetted by regulators as new.

When the mortgage mess was a hotter topic than it has been of late, we would write from time to time about the second mortgage time bomb sitting at the major banks, particularly Bank of America. Unlike first mortgages, which were in the overwhelming majority of cases securitized and sold to investors, banks in the overwhelming majority of cases kept second liens (which in pretty much all cases were home equity lines of credit, or HELOCs) on their books).

This arrangement led to tons, and I mean tons, of abuses, which regulators chose to ignore or worse, actively promoted. Second liens, as the name implies, have second priority to first liens. In a bankruptcy or resturcturing, they are to be wiped out entirely before the first lien is touched (“impaired” as they say).

But the banks that had HELOCs on their books were often the servicer of the related first liens. And even though they had a contractual obligation to service those first liens in the interest of the investors, they’d predictably watch out for their own bottom line instead. For instance, if a borrower was deeply underwater, it would make sense to at least partially write down the second. If the borrower was delinquent, the servicer should write off the second and restructure (aka modify) the first mortgage. But instead you’d see banks use their blocking position as second lien holder to obstruct mortgage modifications. Worse, Bill Frey of Greenwich Financial documented that Bank of America had modified subprime mortgages securitized by Countrywide (as in reduced their value) without touching the seconds, a clear abuse (notice that this issue was raised in the BofA mortgage settlement, and bank crony judge Barbara Kapnik looks almost certain to sweep it under the rug).

Regulators played a direct hand in this chicanery. If the regulators had forced the banks to write down HELOCs, banks would have much less incentive to try to wring blood out of the turnip of underwater borrowers (particularly if the regulators had made clear they took a dim view of that sort of thing). But the authorities were far more concerned about preserving the appearance of solvency of the TBTF players.

Another dubious practice that regulators enabled was extend and pretend on HELOCs. Unlike first mortgages, where fixed payments are stipulated, HELOCs didn’t require borrowers to engage in principal amortization until typically ten years after the loan was first made (a minority of loans set the limit at five years). This is not unlike credit cards in the pre-crisis era, where banks were permitted to set the minimum payment so low as to pay interest only (banks are now required to set minimum payments high enough to that the balance would be paid off in 60 months).

If that isn’t bad enough, the banks went one step further. Banks were engaging in negative amortization, as in not even requiring borrowers to pay all the interest charges, which meant they were adding unpaid interest to principal in order to keep the mortgages looking current so as to avoid writing them down. As we wrote in 2011:

The bone of contention is that mortgage servicers, which also happen to units within the biggest US banks, have not been playing nicely at all with stressed borrowers out of an interest in preserving the value of their parent banks’ second liens. And the reason for that is that writing down second liens to anything within hailing distance of reality, given how badly underwater a lot of borrowers in the US are, would blow a very big hole in the equity of major banks and force a revival of the TARP…

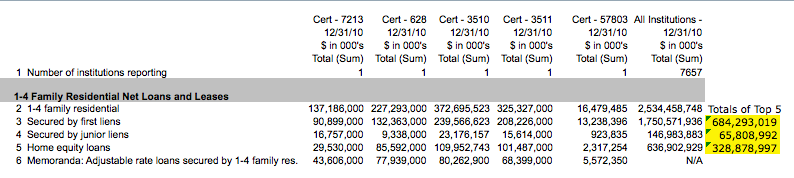

Anecdotally, it appears that banks use a very aggressive carrot and stick to keep seconds current. They threaten borrowers with aggressive debt collection on seconds. And on home equity lines, which are the overwhelming majority of second liens (see this spreadsheet courtesy Josh Rosner for details of the results from the five biggest servicers, click to enlarge), negative amortization is kosher.

For data junkies, 1 is Citi, 2 is JPM, 3 is BofA, 4 is Wells and 5 is GMAC

So what does a bank do? On day 89, before the HELOC is about to go delinquent, it tells the borrower to pay anything on it. A trivial payment is treated as keeping the HELOC current. So this explains Eisenger’s question: it’s easy for the Wells of this world to pretend that these second loans are doing fine if you will go through all sorts of hoops to make them look current, including if needed by lending them the money to make part of their interest payment. So even though a lot of commentators argue that it’s hard to argue that banks should write down their seconds if borrowers are current, what “current” really means deserves a lot more scrutiny than it has gotten.

And as Matt Stoller wrote in early 2012:

Over the past three years, the big four servicers have been keeping hundreds of billions of dollars of second mortgages on their books (mostly in the form of Home Equity Lines of Credit, or HELOCs). Many of these mortgages would seem effectively worthless, because a home equity line of credit or second mortgage on top of an already deeply underwater first mortgage has no value. You can’t use it to foreclose, because you’d get nothing out of the foreclosure – all of that would go to the first mortgage holder (usually some investor in a pension fund somewhere). It has only “hostage value”, or the ability to stop a modification or write-down from happening. The best way to clean up this situation is to have the regulators (FDIC, OCC, Federal Reserve) simply tell the banks that they must write down their second mortgages on collateral that has been impaired. That way, the incentive problem goes away. By forcing the bank to recognize the loss now, the bank will no longer stop a modification on a first mortgage. And in fact, the regulators pretty much agreed that this is what their examiners should do, when they issued new rules earlier this year on accounting for second liens.

Only, the regulators haven’t done it, because the banks claim their seconds are performing. Bank of America says that these loans are worth 93 cents on the dollar. Several of the other banks don’t break out their loss reserves for seconds, so it’s hard to tell, but I think it’s clear they aren’t reserving enough. We can tell that because the Federal Reserve itself is dramatically overvaluing these seconds. In a stress test, the Fed said in its worst case scenario that the banks would lose only “$56 billion”. These are low numbers. According to their most recent investor report, Wells Fargo alone has $35 billion of second liens behind first mortgages that are underwater.

So now, after years of denial by banks and enabling by regulators, the second lien chickens are finally coming home to roost. Homeowner advocate Lisa Epstein gives an idea of how bad this looks from the borrower side:

People who’ve owned their homes for decades, never paid a bill late in their life, and got one of these HELOCs in the early to mid 2000s are starting to get seismic shocks in their monthly statements. Monthly bills going from $200 to $1,200 is met with incredulity and confidence that a mortgage servicer mistake has been made until it is clear that they’ve received a rude reminder of something most families have forgotten or never fully realized. Some have been paying interest only for 10 years and a $25,000 balloon is coming due. For most, the only option is to sell if not underwater or to default and try to negotiate a reduction and deal with the IRS 1099 issue if the Mortgage Forgiveness Act expires without extension in a few weeks, risking foreclosure. And, then there’s the question about what to do with the first mortgage if there is one.

But the Reuters piece, while doing a good job of trying to get a handle on the magnitude of this problem, peculiarly plays down they way regulators have given the banks a wink and an nod all these years:

U.S. borrowers are increasingly missing payments on home equity lines of credit they took out during the housing bubble, a trend that could deal another blow to the country’s biggest banks….

More than $221 billion of these loans at the largest banks will hit this mark over the next four years, about 40 percent of the home equity lines of credit now outstanding….The number of borrowers missing payments around the 10-year point can double in their eleventh year, data from consumer credit agency Equifax shows. When the loans go bad, banks can lose an eye-popping 90 cents on the dollar, because a home equity line of credit is usually the second mortgage a borrower has…

The number of borrowers missing payments around the 10-year point can double in their eleventh year, data from consumer credit agency Equifax shows. When the loans go bad, banks can lose an eye-popping 90 cents on the dollar, because a home equity line of credit is usually the second mortgage a borrower has…

For home equity lines of credit made in 2003, missed payments have already started jumping.

Borrowers are delinquent on about 5.6 percent of loans made in 2003 that have hit their 10-year mark, Equifax data show, a figure that the agency estimates could rise to around 6 percent this year. That’s a big jump from 2012, when delinquencies for loans from 2003 were closer to 3 percent.

This scenario will be increasingly common in the coming years: in 2014, borrowers on $29 billion of these loans at the biggest banks will see their monthly payment jump, followed by $53 billion in 2015, $66 billion in 2016, and $73 billion in 2017.

The Reuters story also says that the Office of the Comptroller of the Currency was “warning” about HELOCs in early 2012. Ahem, they were recognized as a big undeplayed risk in the infamous bank stress tests of 2009. And if the OCC was so concerned, why did it then (as now) natter about the need for more data? Why didn’t it just demand it?

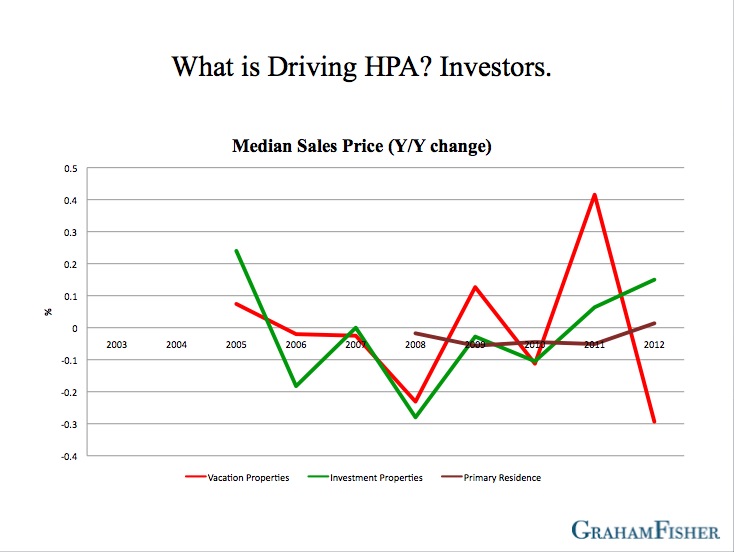

Regulators were clearly hoping that the housing market would recover enough to reduce the size of this looming time bomb. But the much-touted housing recovery has been almost entirely due to price appreciation in foreclosed properties. Josh Rosner ascertained that the year-to year median sales price increase in owner-occupied homes was a mere 1%.

Investor appetite for homes has been cooling, in part due to concerns about QE taper, in part due to one of the hoped-for exit strategies, that of turning a portfolio into a REIT and taking it public, looks to be pretty much dead. And reports of bad maintenance and tenant abuses by the kingpin investor in rentals, Blackstone, could also put a pall over the category, even for more responsible operators. So even a bit more uptick in supply due to HELOC-shock sales, short sales, and foreclosures, could put another dent in the faltering housing recovery.

The math of payment shock means the Reuters story is the harbinger of more accounts. I only hope some of them focus on how banks and regulators made matters vastly worse for borrowers through their efforts to save their own hides.

It might come as a surprise to NC devotees, but we primitives in Texas are not experiencing this problem to a significant degree. The main reasons are threefold:

–We didn’t have the absurd bubble in housing prices

–The economy has been better (or “less worse”) in general here

–And, perhaps most importantly, HELOC regulations in Texas state that the total value of first and second liens is not supposed to be greater than 80 percent of the fair market value of the home.

While the regulation undoubtedly could be abused via inflated appraisals, it served as a significant deterrent to using one’s primary residence as an ATM.

Just sayin’ ………

Valid points for sure, but this certainly doesn’t mean Texas will be immune from the distortions in the housing market. We’re already seeing overheating markets here in Houston. If the shale ‘miracle’ stalls, then it would be reasonable to assume our real estate market will soften too. I’m currently looking at new home builders and their cancellation rates. The diminishing effects of QE are already playing out here….

http://aaronlayman.com/2013/12/toll-brothers-q4-19-jump-in-cancellations-as-profit-increases/

Your observations are cogent, Aaron. I was merely addressing the issue of second lien write-downs. Home prices are up 12% or so here in Dallas in the last year, but the rate of increase is indeed slowing.

What used to drive me crazy about krugman was he was advocating fannie and freddie write down mortgages and attacking the administrator who didn’t want that. Now I am all for mortgage write downs, but he would leave out that second lein mortages should be written down first. so he was really advocating another big bank subsidy while saying he is for the common good. Why do people continue to beleive and follow that man I have no idea

Not to defend Kruggy too much, but he shouldn’t have had to specify that seconds should be written down first, should he? My understanding is that that is the current applicable law, so when advocating for mortgage write-downs, he was (or should have been) implicitly arguing for seconds to be wiped-out, no?

Not necessarily. It is the order of priority in bankruptcy court, but if the writedowns Krugman proposed were conducted outside of a bankruptcy, then it doesn’t necessarily follow tha the 2nds would be wiped before impairing the first mortgages.

Correct, in fact the Federal/state mortgage settlement astonishingly allows seconds to be written merely pari passu with firsts, as opposed to being required to be wiped out (the formula is more complicated, but the economic effect is pretty close to pari passu).

Thanks for the clarification.

This has been discussed for years on this blog and others, but it will “Shock” many public official with its “Unexpected” severity. Sigh. The crisis will have to be addressed quickly ( No time to read the bill) and the solution will benefit ….

They will be shocked, but the real shock will come from the pushback. In 2008, there was a young, seemingly anti war President who promised universal healthcare and higher taxes on the wealthy coming into office. The outcome was never in doubt. Perhaps Franken’s seat was in doubt, but that is about it.

This time people are poorer than they were, and there has been no accountability or sufficient sacrificial lambs to restore trust. Craziness will break out. The history of major protests and revolutions come after a series of smaller issues were assuaged by promises. Those promises were made and broken. There was no accountability from 2008 to now. Accountability will have to come first, and remember there is no honor among thieves.

Exactly.

This is and always has been a painful enactment of trivial gains in the hands of people who are simply cogs in a faltering machine.

It is at this point fascinating; and pathetic to watch ‘the financial community’ slosh around in its tanks of s**t poured straight from its eloquently designed pipeline.

Stories from the media would be wiser to simply start telling the truth. But they wont get it. They are still delusional, believing that the water and electricity services to Manhattan can somehow keep on infinitely…

Everything is paid for in false dollar,

From false transactions,

by false brokers,

making illegitimate trades,

based on grossly exaggerated numbers,

calculated by a computer network specializing in theoretical applications.

Ooops.

Well at least the BRICS nations will have plenty to offer the planet,

while the liars in North Carolina and everywhere else get to reap exactly what they have sowed.

The misfortune of a nation.

Knock knock.

The time is coming.

TRUTH

A HELOC with a ten-year interest only payment schedule, followed by balloon payments and tripling monthly payments, is an obviously abusive credit product. It’s got “Designed to Fail” written all over it.

A few questions we might ask: why would anyone take out a loan on their house, knowing that they’ll have to come up with a $25,000 payment ten years down the road, or risk losing their home? Assuming that the person is not especially stupid or delusionally optimistic, we might guess that either 1) they are unaware of the predatory loan conditions, or 2) they have been convinced that they won’t be a problem.

My educated guess is that some people were sold these loans without being made aware of the dreadful provisions and that others were told, “oh, don’t worry, you’ll be able to re-finance long before the payment resets and the balloon payment comes due.” As the Reuters article states:

I can just imagine the sales pitch now. Prices are rising and will forever! You’ll always be able to refi and your house is constantly gaining value, as if by magic. What could possibly go wrong?

The other question is why would a bank offer these types of products in the first place? Again, two possible answers: 1) they believed their own BS about infinitely-rising home prices, or 2) certain individuals within the banks stood to make lots of money, personally, by inflating loan volumes, regardless of quality; i.e. running the bank along the classic “bankruptcy for profit” model.

And why did the regulators let all this go on? Stupid or corrupt or both?…you be the judge.

why would a bank offer these types of products

You answered your own question: IBG-YBG

Back in the heady days of 2005-2008, lots of people took out HELOCs for their down payment.

Assured that housing prices would only go up, they would get a conventional loan for 80%, and then a HELOC for the remaining 20%. How else could they afford the home? (snark)

I know of at least 3 couples that did this… and I think it was kinda standard practice since they we’re all first time homeowners. What’s even more surprising… I believe it worked out for all three. They focused on paying the HELOC down first since it had a significantly higher interest rate and kept them from refinancing. Since housing prices have recovered, they should even have some equity now.

For those that have had to question the reality of their loan, a different picture emerges. One asks the servicer who owns the loan and there is no reply. One asks a legal question under various federal laws and one gets no reply. One submits discovery to get legal answers in court. There are no answers forthcoming. There is no legal proof that the lien still exists, except the claim in county records. This claim is the sole indicator, but no longer commemorates the original lender or the latest in a series of alleged owners.

When there are no answers to legal questions, there is no one willing to claim ownership. The only thing alleged is a servicer alleging it has a claim. Agency is not valid when there is no lien, secure claim or chain of title to support what is left in county records. So the documents have to be created to support today’s claim, and crime must be committed, and there are any number of participants willing to join the crime knowing there will be no prosecution for their actions. Imagine not having to ever say you are sorry.

Yep…here comes round 2…

this has the potential to be a major, major issue. Yves correctly noted that Bank of America had a significant exposure to the mortgage market, particularly second leins. It’s been some time since I looked at the numbers (though I doubt they’ve changed materially) but at one point BAC had more in second leins alone than they had in equity on their balance sheet. Now, not all of these seconds are worthless, but carrying them at 93 cents on the dollar when they should be much, much lower means that forcing a writedown is going to wipe out the equity of some of these companies (not that that’s necessarily a bad thing).

In the meantime, we still have shills for the banks writing scatology like this….

http://www.marketwatch.com/story/americans-fall-in-love-with-big-banks-again-2013-12-10

Why haven’t we already seen the time-bomb go off just from ARM primary mortgages recasting?

Remember this? http://www.snl.com/interactivex/article.aspx?CDID=A-10770380-12086

ZIRP and QE solved that. Interest rates were so low that the recasts weren’t terribly painful

I have to figure that the banks will find a way to extend and pretend or somehow get these loans refinanced and passed onto the GSE’s. If I recall, HAMP allowed banks to do this with the 1st loans they owned. Just too much money (and bonus $$) riding on it.

A serious, albeit dumb question:

What stops the banks from simply making a new 10 year HELOC? Regulators don’t seem to care and I’m sure the banks can come up with a “model” to show that the new loans are good.

Seriously — what stops them from kicking the can another 10 years down the road?

Nothing is going to happen here. 80 Billion a month is QE has solved this, and now the government owns it and they will cook the books to make it look like someone else owns it or never actually acknowledge it. It’s brilliant.

With all due respect, your comment is totally off base.

The amount of second liens is likely to come home to roost gradually enough now for the banks to be able to deal with it.

But this has nothing to do with QE. QE gooses MBS, as in bond prices. These are on balance sheet loans, a completely different category.

And these losses are CREDIT losses. No amount of cheap interest rates will make a default go away.