By Joe Firestone, Ph.D., Managing Director, CEO of the Knowledge Management Consortium International (KMCI), and Director of KMCI’s CKIM Certificate program. He taught political science as the graduate and undergraduate level and blogs regularly at Corrente, Firedoglake and Daily Kos as letsgetitdone. Cross posted from New Economic Perspectives

If the President’s budget were enacted by Congress, and OMB’s projections over the next decade hold, it would almost certainly mean economic stagnation punctuated by recession over the next decade. Would it also mean austerity, however? Let’s see.

The Sector Financial Balances (SFB) model is an accounting identity, and these are always true by definition alone. The SFB model says:

Domestic Private Balance + Domestic Government Balance + Foreign Balance = 0.

The terms refer to balances of flows of financial assets among the three sectors of the economy in any specified period of time. So, for example, when the annual domestic private sector balance is positive, more financial assets are flowing to that sector, taken as a whole, than it is sending to the other two sectors. Similarly, when the annual foreign sector balance is positive, more financial assets are being sent to that sector than it is sending to the other two sectors. When the private sector balance is negative, the private sector is sending more to the other two sectors than it is getting from them, and so on.

Now let’s think about austerity. From the perspective of the SFB model, government macroeconomic austerity is medium to long-term fiscal policy characterized by a focus on reducing budget deficits, or increasing budget surpluses, and mostly on the former in today’s environment where many nations have trade deficits. In addition, it involves destroying private sector net financial assets by cutting government spending and/or raising taxes in such a way that Government additions of net financial assets to the non-government portions of the economy (government deficits) fall to a level low enough (even becoming government surpluses) that they are less than the size of the trade balance, whether in deficit or in surplus.

For example, if a nation has an annual trade deficit of 1.5% of GDP and the Government runs a deficit of 1%, then that is a step toward macroeconomic austerity, because the private sector balance is then -0.5% of GDP over that period. On the other hand, if another nation’s annual trade balance is in surplus by 2% and the Government surplus is 5% of GDP, then this too is a move toward macroeconomic austerity, since the private sector will have a deficit of 3% of GDP for that year. If those negative private sector balances last for a few years then we can say that moderate macroeconomic austerity is in play, and if such conditions last for several years then we have severe macroeconomic austerity.

What if a nation runs a Government deficit of 4% of GDP and has a trade deficit of 2.5% of GDP over a year? Then the private sector will, in the aggregate, have savings of 1.5%, and there is no beginning of macroeconomic austerity. The same holds if there is a trade surplus of 2.5% of GDP and a Government surplus of 1%. Again, the private sector savings will be 1.5% of GDP and macroeconomic austerity has not yet started.

What about microeconomic austerity? Microeconomic austerity embodies the same idea as macroeconomic austerity, except that it applies to sub-sectors of the foreign and private sectors, rather than to each sector taken as a whole. So, we can have macroeconomic austerity with or without microeconomic austerity, depending on the sub-sector of the foreign and private sector we are talking about. However, if there is macroeconomic austerity, then there must be at least some sub-sectors within the private or foreign sector experiencing microeconomic austerity.

Issues of distribution of financial flows cut deeply here. If a nation’s economy is structured so that some parts of the foreign sector and some parts of the private sector have sufficient economic and political power to direct financial flows from outside and inside the sector disproportionately into their coffers, then macroeconomic austerity may translate into microeconomic prosperity for those sub-sectors, and into even greater microeconomic than macroeconomic austerity for the sub-sectors with lesser economic and political power.

Right now, in the US, the foreign balance is positive: we are sending more financial assets to the foreign sector than they are sending to us (the trade deficit). In FY 1999, the foreign balance has varied from 2.5% of GDP to over 6% annually. Most recently, it has been running at about 2.5%. If present trends continue, and the Government sector adds less than 2.5% of annual GDP to the domestic private sector through deficit spending, then it will be losing wealth year after year and we will have both aggregate macroeconomic austerity in that sector, and micro-economic austerity in some of its sub-sectors.

Which ones? We know from various studies of inequality (see here and here), that over the past 35-40 years, the American economy has delivered its financial growth disproportionately to large corporations, especially in the FIRE, energy, information technology, defense, and health care sub-sectors of the economy, and also to households either already wealthy, or deriving their income from large companies in these sub-sectors. The vast majority of households have been either barely holding their own or are losing ground economically. These trends have accelerated since the crash of 2008, since most of the gains from the “recovery” have gone to the already wealthy, the bailed out FIRE sub-sector, and the other sub-sectors and households listed above. Here it’s important to realize that since 2009 the private sector aggregate balance has averaged +7.5 % of GDP, with very little “trickle down” to the 99%. The trend over the past year is declining, however, and has dropped to around +5 %, still a substantial level of macroeconomic private savings not seen since the early 1980s.

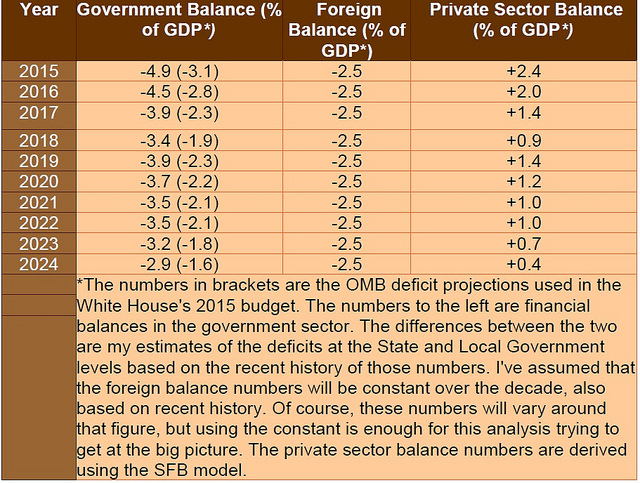

Here are the projections based on the OMB 2015 budget recently published by the White House, and on quarterly time series data kindly provided in Spreadsheet format by Professors Scott Fullwiler and Stephanie Kelton.

Table One: Sector Financial Balance Projections 2015 – 2024

Compare that figure to the mean of approximately 7.2% of GDP for the 6 year post-crash period of fiscal 2009 -2014. Consider also that Government injections resulting in an annual average private sector surplus of 7.2% of GDP over that period haven’t created enough aggregate demand to produce a strong economy with rapid job creation, full employment and widespread prosperity. Instead, these surpluses have only been enough to end the recession and produce a slowly growing stagnant economy, whose rewards are vast for the already wealthy and for large corporations, but are miniscule or non-existent for everyone else. And then ask yourself the question of what the result of the projected small Government deficits over the next decade in the 2015 budget, resulting in mean private sector savings of 1.2% of GDP is likely to do?

My answer is that the President’s budget plan, if enacted and followed, would first produce microeconomic austerity for the 99% with flat or shrinking aggregate demand, and then continued and exacerbated economic stagnation compared to what we’re seeing today. We will also see rapidly increasing economic inequality, resulting eventually in renewed recession whose time frame would be determined by the willingness of the private sector to extend credit to increasingly hard-pressed consumers and small businesspersons.

The bottom line is that microeconomic austerity in the United States won’t end if the President’s budget or others like it or even more tight-fisted are enacted. But, on the contrary, such budgets will mark the beginning of severe microeconomic austerity in the United States leading to even more severe suffering than we’ve experienced so far and to social turmoil and political unrest.

And well it should, since none of the deficit and debt terrorism and miserly fiscal policy reflected in the President’s budget is necessary, because there is no shortage of Federal fiscal capacity in the United States, and no justification for the fiscal policies the US Government has followed since the Recovery Act. There is nothing but the political intention and will lacking to make our economy work for everyone. To create that intention and will we must replace every elected official in the United States if that’s what we need to do. And we should not stop replacing them until we find representatives who will enable us to create that just and fair economy that is our right!

My only quarrel with this essay is that GDP is a false measure of economic health. Today’s economy is based upon rent extraction and looting. It would certainly help if government spent money wisely to rebuild US infrastructure and hired lots of people at fair wages to do it. I don’t expect this to happen, regardless of budget messages and other Presidential public relations stunts.

The post isn’t about GDP, it’s about financial flows which are measured as a percentage of total output. Nor does Joe suggest anywhere that GDP is a good measurement of economic performance; to the contrary he explicitly states that distributional problems are preventing a stronger recovery despite several years of historically high surpluses in the private domestic economy.

The chatter about financial flows and national income accounts and sector balances is all hogwash. Regardless of what happens in these various sectors, the game keeps going on the basis of expanding private debt. That debt is tied to residential real estate, student loans, credit card loans, stock speculation, corporate acquisitions, etc. The debt doesn’t have to be paid off; it only has to be serviced, or if it cannot be serviced, readjusted in bankruptcy proceedings. Jiggling all these sector numbers is simply a waste of time.

Private BUSINESS debt is fine when it is made to fund new investment or otherwise support expansion of a business (it might fund hiring new people or a marketing campaign rather than buying assets). In fact, it was the norm for the business sector prior to the crisis to be a net borrower (except in recessions).

But now we have businesses acting as net savers and worse, the biggest companies are buying to fund stock buybacks to goose share prices and their bonuses.

And what is total output? I suppose that includes the value of clean air and parks and leisure time and vacation with the family and seeing the grandparents over the holidays and not being in prison and enjoying one’s recreation drug of choice…

and not being in prison and enjoying one’s recreation drug of choice… washunate

The rich like to imagine that their thievery is for the common good so obviously the poor do not need any escape from their misery. The Bible says otherwise:

Give strong drink to him who is perishing,

And wine to him whose life is bitter.

Let him drink and forget his poverty

And remember his trouble no more.

Open your mouth for the mute,

For the rights of all the unfortunate.

Open your mouth, judge righteously,

And defend the rights of the afflicted and needy. Proverbs 31:6-9

If the rich don’t like drug usage by the poor then why don’t they eliminate the injustice that causes it?

Where were you with this one when they pushed through Prohibition?

Not born yet.

And besides, there seems to be a conspiracy to ignore the Old Testament – probably because it speaks against usury and profit taking from one’s own fellow countrymen.

LOL!!

Nice exchange, gibbs and Beard.

It’s old Moses you know. More about Justice than turning the other cheek!

Ah, but turning to the left cheek and giving someone your undergarments along with your coat and so forth are neither complicity with the assailants nor forgetfulness of them. Rather, they are active, nonviolent rebellion against injustice and abuse of power. They are claiming a right to strength and dignity and respect unassailable by any level of class or power or wealth.

The point is to show the absurdity, the immorality, of the attacker, not to comply with the attacker’s wishes. A modern day version might go something like this:

When the TSA tells you it will take half an hour for someone to stick their hand down your pants in the hope that such inconvenience will make you shut up and do what you’re told, instead offer to just take off all your clothes right there in the security line.

I’ve often asked myself that very question. :) :) :)

Not as we currently measure GDP. But, let’s get ourselves a new measure. We could call it RGDP for “Realistic GDP measuring outputs that people actually value.”

Interestingly, that adds another layer of problems, from a mathematical/accounting perspective. Values are subjective, varying from person to person. That makes identities trickier, not easier.

Plus, we’re still left with the fundamental issue, that the Sector Financial Balances approach is irrelevant when the primary problem is allocation of resources within the sectors.

And I have an easy proof of that. Would you support the federal government giving me $1 trillion dollars? That would be stimulus, after all, increasing the public sector deficit so the private sector could save more!

Thank you for your concise summary of broad macroeconomic effects we can expect from the proposed federal budget, Joe Firestone. Its prospective effects on social policy initiatives and the desire for austerity are clear.

Not just clear, but blatant. To think that a small faction of Congress can push the Obama administration to write up a budget that can be seen to have a clear motive, and Obama does it like there is no alternative, is about as blatant as it gets. There is no coherent discussion on the subject because to discuss it would introduce concepts that are anathema to “free” marketeerism. Concepts like good government provides the best service at the lowest price to all its citizens. Oh God No! Our taxes will never be allowed to provide us with good modern government because that money has to go to bail out the banksters, et. al. And they pretend that it is sacrosanct because it is capitalism. They can’t even define capitalism. Yes, Joe Firestsone is right. We should get rid of everyone in congress and the administration and start over because they are also taking money from the banksters – they are beneficiaries.

If there is an end goal to this nonsense it is probably a plan whereby all these rents and fees and premiums could establish a fake alternative to socialism. So that the private “market” (excuse me while I vomit) is the sole provider of social services, utilities and necessities – and for a profit which will be reinvested into a totally-out-of-balance economic system which is sometimes called “financialism.” Thus making it necessary to impose austerity in perpetuity.

The era of austerity doesn’t exist. We have net deficit spent ten trillions dollars +/- over the past decade.

And what’s even worse, that money has been squandered on authoritarian misadventures from the national security state to the two-tiered justice system.

Raising taxes on the wealthy (i.e., ‘austerity’) would be a Great Idea.

Notice that in the Post, I point out that we haven’t had macroeconmic austerity during Obama’s tenure, just microeconomic austerity, government deficits notwithstanding.

“And what’s even worse, that money has been squandered on authoritarian misadventures from the national security state to the two-tiered justice system.”

That money has been used to very bad effect in the way you describe above. But “squandered” implies using up a scarce resource. However, one of the central points in my writing and in the above post is that reserves and appropriations for deficit spending are artificially and unnecessarily constrained by our political authorities. The Government has the authority to appropriate and to issue all of the money it has used for ill-purposes over the past years for spending on projects that will benefit most Americans. But it refuses to do that. And that is why we must replace them all, or at least as many of them as we can manage to defeat.

“The Government has the authority…”

I heartily agree. I’m a huge fan of fiat currency. I despise all attempts to link the ‘savings value’ of money to the ‘exchange value’ of money, the most common of which of course is a gold standard. But that also includes MMT’s effort to to link employment to the currency (JG as buffer stock price anchor) and its critique of our current system of using unemployment as that buffer stock. I think our history is quite clear that no such price anchor works when it is actually needed. Just look around at the cost of decent housing, healthcare, higher education, and healthy food.

Here’s the key: I am arguing that it does not follow from that authority that there are no negative consequences to the government spending dollars on bad projects. Quite the opposite, there are very real consequences. These consequences are why the money is squandered.

NOT because the government has a limited supply of currency units (it doesn’t), but rather, due to what happens when these currency units are put into circulation, such as when children grow up without fathers because some authoritarian psychopath puts their dad in prison.

I’m curious, does the part of the economy that is not reflected in figures ever factored in? Like cash dealings, illegal markets, skimming, offshore accounts and the whole illegal economy–how do these things get measured? Or do they have no effect. I’ve seen quite a lot of the illegal economy.

I know you believe such transactions amount to perhaps 20% of GNP. I’d say that the interesting thing about these activities is how the favor those on top and those at the bottom. The traditional middling sorts who are dependent on a paycheck coming from an established economic entity (for me, that was a university) have much less access to using and abusing the informal economy (and hiding or obscuring their income). Overall, however, since the big money is offshoring much more money than the poor are trading amongst themselves, I’d say such activities are a net drain on the economy (investment in R&D, plant, equipment, infrastructure, and inventories, plus purchasing power, which to me are the economy).

Yes, they represent demand leakages, making more room for government deficit spending.

The way to shut the mouths of austerity hawks is to reduce* fiat to legal tender for government debts ONLY. Then ONLY government and its payees need necessarily suffer from price inflation if the monetary sovereign overspends relative to taxation and real economic growth because the rest of the economy could use private currencies for private debts only.

We could save ourselves a LOT of trouble if we agreed that money should be created ethically instead of fighting over the management of a government-enforced monopoly money supply for ALL debts.

*After a universal, Steve Keen like, bailout with full legal tender fiat (US Notes) to force the banks to accept them.

Haven’t we been down the road of private currencies before and got but booms and busts. Stop being so anti-government; take it back instead so that it belongs to us.

Economics might become something we use to make freedom, decent ways to live and the rest possible. Instead, we live in the cream-off casino. Given what you can make very quickly from a 0.5% management fee on poker pots, the black economy must give inordinate advantages if it is running at 20%. I suspect more, as we limit one-armed-bandit rip-off at 25%.

If you swim in the sea north of the Welsh island of Anglesey, visibility in the water is very poor. In waters to the south it’s as clear as a bell. It’s to do with the presence and absence of ‘Liverpool’ effluent. Hard to know if there is any clear water free of financial effluent these days. The pumping system Joe’s flow-figures relate to somehow don’t describe the content of the flow. The money of the 1% emerges without smell in secure offshore laundries. This processing is somehow essential to we plebs. We get the other 99% content of the pipes and should be grateful. We once tried to measure pollution counting dog whelk ‘teeth’. I’m afraid the theory didn’t hold. We are counting similar ‘teeth’ here, with little understanding of how the ‘calcified deposits’ are caused.

I have a question on the Sector Financial Balances (SFB) model.

While I can see that it is true by definition for govt issued money and bonds I am not seeing how this relates to the economy as a whole where there are many asset that may be denominated in the same units as these govt-issue assets but are partially or totally independent of them.

For example banks issue credit money that is at least partially independent of govt money.

Private firms produce private assets that are totally independent of govt-issued assets (corporate bonds, company equity etc).

If the govt runs a surplus and the private sector runs a trading loss with the rest of the world then this means there will a drain of govt-issued assets. It says nothing however about what is happening to private wealth or private wealth creation.

Am I missing something ?

I just tread he link to the Wray article in the post which explains that all private financial assets have a credit and a debit side so will net to zero.

So I see now how SFB explains total financial wealth not just govt-issued financial wealth.

However financial wealth is one thing , real wealth is another. It is quite possible that total private financial wealth is falling ( govt surplus plus trade deficit) while real wealth (physical stuff generating streams of goods and services) is increasing.

Yes, it is. Real wealth can be increasing. So all of the above post relates to nominal transactions valued in the nominal terms of the unit of account. Google L. Randall Wray, and/or Stephanie Kelton on the hierarchy of money.

Nothing at all. If the world unified into one govermint and then everybody voted to abolish it and live a libertarian fantasy, how could the economy avoid total collapse? Mathematically the economy would go to zero. Unless there was exports to other planets. Economics is a mental disorder. It doesn’t matter who’s doing the economicizing. They could be a perfectly normal upstanding person who would be enjoyable company at dinner parties and baseball outings and quite sane in nearly all areas of their life, but the moment they start economicizing it, the mental disorder kicks in. It’s like what happens after 5 beers but it happens sober. You can click around the internet and see all sorts of persons caught up in the disorder. Then, for an antidote, go to Youtube and chill with some Led Zepplin or Bing Crosby. Either way it will take 5 or 10 minutes to get your brain back to a comfortable equilibrium.

Seriously Yves there’s only one way to settle this — once and for all — so we don’t have to waste anymore Youtube time arguing about it. I know I’m right but my credibility isn’t very high.

It’s up to you. Go get Mr. Dittmer and bring him back for one last shot at glory. I know he’s moved on, but this could be big. This could be a game changer for all of us. If we can just figure it out, once and for all, imagine the transcendence we could all experience. It would be like an airplane breaking above the clouds and you can look out the window and see the universe in its clear, celestially illuminated infinity.

I’ll trust him. Even if he says I’m full of sh*t, I’ll probably agree with him. But at least I’ll no longer be ignorant. Of course, there’s a chance I’m right and that would crack me up completely. If I am, Mr. Dittmer can take full credit. I really don’t care.

Bangor – I suppose a lot of this kind of analysis concerns what we ‘black box’. If we pump in one one side and can measure something we want coming out the other side who cares about the internal processes going on in the box sort of stuff. A bit like behaviourism as opposed to phenomenology.

The only black economy figures I ever seen appear guesstimate in nature. The British treasury used to record the opium and white trade ‘with’ China in detail. I don’t even understand the drug trade in economic tautology or conservation law terms (the pumping systems). We can track heroin from Afghanistan to a swap deal in Argentina and the cocaine from there through islands off Equatorial Guinea to the hands of someone I might have nicked via a test purchase operation. I can unit cost the arrest and conviction at about £100K and show black money retained in various points of the drug’s travel (rising from 5% retained near production to 80% in country of use). This is only the start. I usually found a huge number of dependants in the chummy’s circle, costing a fortune in health, remedial education, shop-lifting. housing, legal aid … and that all before misery inflicted on users, neighbours … to me not being happier on voluntary service overseas.

I’m always struck that we need to understand such as this and offshoring generally in simple opportunity costing. If we didn’t have to put up with the crime (it’s all crime to me), what else could we be doing? One has to be brief here, but I suspect the black economy is more massive than even we suspect. Joe (quite properly) is working on a sum we can do and evidence fairly easily. Better arguments may lie in consideration of just what ‘black’ is.

O/T at Joe… what would be your answer to this common question put to MMT:

All the oil that we import to power our modern economy is denominated in US Dollars.

Tell me what happens to our economy when the RBA starts printing and AUD/USD tanks?

So far no MMT advocate has been able to come up with a satisfactory answer to this.

Cheers