Yves here. Although Keen’s use of the Godzilla metaphor is fun, the unvarnished facts he presents are plenty alarming. Bank of England Governor Mark Carney is actually gleeful at the prospect that England’s banking sector might grow to be as large relative to its economy as Iceland’s and Cyprus‘ on the eve of their busts. But even worse, Carney’s enthusiasm for a banking sector that continues with its cancerous (or as Keen would have it, monstrous) growth gives license to bank lobbyists in the US and Europe to press for high rates of growth in their finance sectors so as to defend their national champions.

By Steve Keen, a professional economist, long time critic of conventional economic thought, and author of Debunking Economics. Originally published at Business Spectator

Fans of Japanese schlock fiction will be pleased to know that that old mega-favourite Godzilla is returning in 2014, to stomp on simulated cities in a cinema near you. And of course, he’s bigger and better: the original Japanese movie had him at about 50-100 metres and weighing 20-60,000 tons; I’d guess he was about twice that size in the 1998 US remake; and by the looks of the trailer for the 2014 movie, he’s now a couple of kilometres tall and probably weighs in the millions.

That’s good: when you want thrills and spills in a virtual world, then as it is with sport (according to Australian comedic legends Roy and HG) too much lizard is barely enough. The bigger he gets, the more he can destroy, which makes for great visual effects (if not great cinema).

But in the real world? The biggest dinosaur known came in at about 40 metres long, weighed “only” about 80 tonnes, and had an estimated maximum speed of eight kilometres an hour. In the real world, size imposes restriction on movement, and big can be just too big. So a real-world Godzilla is an impossibility.

Cinema — especially CGI-enhanced cinema — can overcome the limits of evolution, and therein lie the thrills and spills of Godzilla: the bigger he is, the more terrifying. Godzilla is scary purely because of his scale: a 100 metre Godzilla is scary; the 1 metre iguana species from which he supposedly evolves is merely cute. In Godzilla, there is a positive relationship between size and destructive capacity.

Maybe Bank of England governor Mark Carney should attend the UK premiere, because he clearly needs to learn this lesson and apply it to his own bailiwick. If he can’t learn it from economics, then maybe he can learn it from the movies by analogy: finance is dangerous in part because, like Godzilla, it is too big.

Instead, as Howard Davies — himself an ex-deputy governor of the Bank of England — observed in a recent Project Syndicate column, Carney seems almost to celebrate the prospect that the UK’s financial sector — now with assets four times the size of its economy — might grow to nine times the size of GDP if current trends continue.

“Bank of England Governor Mark Carney surprised his audience at a conference late last year by speculating that banking assets in London could grow to more than nine times Britain’s GDP by 2050… the estimate was deeply unsettling to many. Hosting a huge financial center, with outsize domestic banks, can be costly to taxpayers. In Iceland and Ireland, banks outgrew their governments’ ability to support them when needed. The result was disastrous,” Davies said.

In a speech marking the 125th anniversary of The Financial Times, Carney noted that when the paper was founded, “the assets of UK banks amounted to around 40 per cent of GDP. By the end of last year, that ratio had risen tenfold.” He then noted that if the UK maintains its share of global finance, and “financial deepening in foreign economies increases in line with historical norms”, then “by 2050, UK banks’ assets could exceed nine times GDP, and that is to say nothing of the potentially rapid growth of foreign banking and shadow banking based in London.”

From 40 per cent to 400 per cent of GDP in 125 years, and then from 400 per cent to 900 per cent in another 35: even the Godzilla franchise would be impressed with that rate of growth. And Carney seems to relish the prospect. Though he notes that “some would react to this prospect with horror. They would prefer that the UK financial services industry be slimmed down if not shut down”, he next stated that “in the aftermath of the crisis, such sentiments have gone largely unchallenged”. And he proceeds to challenge them.

After stating that “if organised properly, a vibrant financial sector brings substantial benefits”, he denied any responsibility in determining how big the financial sector should be — either absolutely or relative to the economy:

“It is not for the Bank of England to decide how big the financial sector should be. Our job is to ensure that it is safe,” Carney said.

Oddly, as well as seeing no necessary relationship between size and safety, he also takes a lopsided position on this non-responsibility: while he is not responsible for determining the finance sector’s size, he nonetheless thinks that his role is to make it as big as it can be:

“The Bank of England’s task is to ensure that the UK can host a large and expanding financial sector in a way that promotes financial stability…” Carney said.

Herein lies the rub, and the non-sequitur: bigger cannot mean more stable, for the simple reason that the assets of the financial sector are, in large measure, the debts of the real economy to the banks. The bigger the assets of the financial sector, the higher the debts of the real economy have to be. Ultimately, even with near-zero interest rates, servicing this debt is likely to prove impossible to large segments of the economy, leading to a financial crisis.

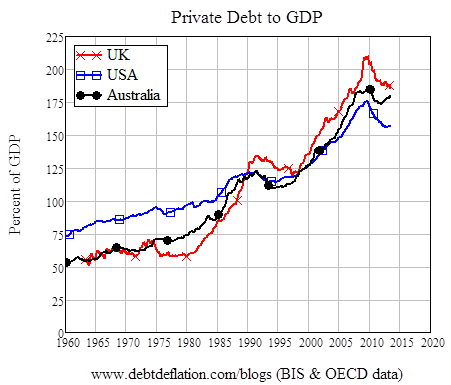

That logic is what led me to expect a financial crisis back in 2005: when I saw the data for Australia’s and America’s private debt to GDP ratios (figure 1), I was convinced that a crisis was in the offing. That rate of growth of debt compared to GDP could not continue. Figure 1 shows that I was right: the rate of growth of debt turned negative, ushering in the economic crisis that no central bank foresaw (except the Bank of International Settlements, thanks to its Minsky-aware research director Bill White). Debt to GDP levels fell as, for a while, the private sector deleveraged.

Growth is now returning — strongly in the US, meekly in the UK — largely because private debt is rising once more. But rather than seeing danger here, the UK’s central banker happily contemplates a world in which the UK financial sector is more than twice as big as it is now — which would require the liabilities of the non-bank side of the economy to grow to roughly four times GDP.

Figure 1: The UK’s Godzilla is bigger and faster growing than the US Godzilla

There is a line of thought that blames central banks for causing the crisis — with Scott Sumner being the first to outright blame the 2007 crisis on Ben Bernanke. I don’t blame them for causing the crisis, but rather for letting the force build up that would make one inevitable — by letting bank debt get much, much larger than GDP without batting an eyelid.

Now we’ve had the crisis, and if Carney’s speech is any guide, they’re once again letting private debt levels rip again, because even after the experience of 2008, they can’t see a problem. Given this complete failure of oversight, I expect that the sequel to the economic crisis of 2007 will appear before the next sequel for Godzilla.

Ben Bernanke just happened to give a speech today/yesterday to a packed auditorium of over 1000 people as part of the financial conference staged by National Bank of Abu Dhabi, the UAE’s largest bank. Bernanke was paid at least $250,000 to speak at this gathering which is reportedly more than he made for a full year as the Fed chairman.

The United States became “overconfident”, he said of the period before the September 2008 collapse of U.S. investment bank Lehman Brothers. That triggered a crash from which parts of the world, including the U.S. economy, have not fully recovered.

The United States became “overconfident”, he said of the period before the September 2008 collapse of U.S. investment bank Lehman Brothers. That triggered a crash from which parts of the world, including the U.S. economy, have not fully recovered.

“This is going to sound very obvious but the first thing we learned is that the U.S. is not invulnerable to financial crises,” Bernanke said.

“My natural inclinations, even if it weren’t for the legal mandate, would be to try to help the average person,” Bernanke said today in his first public remarks since leaving the Fed in January, referring to the central bank’s mandate from Congress to ensure full employment and stable prices. “The complexity though arises because in order to help the average person, you have to do things — very distasteful things — like try to prevent some large financial companies from collapsing.”

“The result was there are still many people after the crisis who still feel that it was unfair that some companies got helped and small banks and small business and average families didn’t get direct help,” Bernanke said. “It’s a hard perception to break.”

This comment is mostly a steal from ZH and their full posting is here: http://www.zerohedge.com/news/2014-03-04/bernanke-finally-reveals-one-word-why-financial-system-crashed

My perception, which is going to be very hard to break, is that Ben Bernanke is now reaping the “benefits” of his contribution to the rape of small banks, small business and average families in the US.

Yes, I am sure Ben Bernanke worries about the average person, since ZIRP has absolutely denuded anyone who accumulated any savings prior to 2008 and has chosen not to participate in the latest stock bubble. Of course, he could have protected small savers with special interest bearing accounts up to a reasonable maximum amount. Instead he has engineered further bank looting by permitting the giant banks to grab the country’s deposits and pay next to nothing (and I mean next to nothing) on them for the past five years. This speech of his is sheer chutzpah and I wonder if anyone will call him on it. The Fed has been a looting engine under his stewardship and I expect this to continue under his new female counterpart. We change the gender of these enablers; we may even change the race. But we are very careful never to change the character.

If banks wanted to hold more cash they wouldn’t be securitizing everything under the sun.

If we think of banking as, say, the aircraft construction business sector, and Britain was so good at making the machines we had 90% of world manufacturing we would be pretty happy. So why should we not seek world domination through banking? It’s just another business after all. Steve just wants to keep Britain poor so we can’t attract the best cricket and rugby league players and get back to trashing the Aussies at sports not involving sitting down. He’s got the plot of Godzilla wrong. The creature rises as the great protector, much as the kamikaze wind once dispersed the Korean fleet.

Sadly, the wrong choice of metaphor does not negate what Steve tells us about the Jabberwock banks. I doubt more than 10% of finance activity can be legitimate and necessary. In my book, finance can only be a combination of cost and economic rent, unless it is historical privilege, tribute, usury and other stealing backed by violent threat. We lack proper definition of what we have in practice.

Steve seems to be describing finance as holding and running the Ponzi book. At the point when no further funds can be attracted the Ponzi goes bust and countries with a big percentage of the book get stuffed along with investors. A lot of it seems like crooked betting too. A tenner on the Pakistani lad to bowl a no ball second up in the third over. What I’d like to see is a model of an alternative money system with genuine scientific transparency and explanations to us as a democratic polis as to why it is on our interests to remain in the current system.

What I can’t see is why (necessarily) having a big finance industry to GDP ratio means that a country will go pop when the financial bubble collapses. I can see the obvious. If you have a mega portion of the bad debt it’s bad news. But it is also possible to imagine one’s banksters sophisticated enough to be winning gamblers, better than the others around the world and with a key method secret to them. Britain as James Bond writ large!! No doubt he will take time out to see off Mitchell Johnson too, passing his century as a squadron of pigs fly over Lords. Nicolas Shaxson has a lot right on this financial curse, as no doubt has Steve Keen. What strikes me as missing is a component that explains how “money” makes provision for the crashes that should wipe it out.

Maybe it’s all very simple and we are still effectively a slave economy?

The real economy can service only a limited quantity of debt, while growth in the financial sector is dependent on accelerating debt levels. Once that comes to a halt the bubble bursts. The definition of a Ponzi scheme is that it requires continuous growth to function and falls apart when that growth ceases.

The statement that stands out for me is Carney’s claim that “in the aftermath of the crisis, such sentiments have gone largely unchallenged,” meaning sentiments that the banking system be slimmed or shut down. This would indicate being out of touch with one aspect of reality, since it seems fair to say that the banking industry has a vocal defenders, widely broadcast.

To those who know Keen’s work well: is he really expecting a crisis to come on sooner than later, before the next Godzilla sequel?

My pretty rough understanding of Keen’s work is that, following Minksy, we should see a period of deleveraging, followed by a gradual increase in debt, and then a final ponzi phase . . . is Keen suggesting that the cautious phase has already passed?

I’m a bit unclear on how seriously Keen takes Carney’s speculations.

Keen is arguing the goons at the top are attempting to jump directly from the speculative phase to the final “Ponzi” phase, because that’s when they generate the most profits for themselves. Minsky’s work only applies if a government actually takes the necessary steps to create financial stability, and this time around no one has done that.

Finance is about grabbing interest and fees for enabling speculative plays on assets. Assets move from one speculator to another at ever increasing prices, until an asset class stops moving because nobody will pay a higher price. At this point, the earning power of that asset class is tested, because banks have financed most of every exchange. Inasmuch as the earning power is largely fictional, the assets are thrown on the market and somebody is left with the bad loans. These days, that somebody is a public institution.

Everyone in finance understands this, and attempts to protect himself by making side bets on all the loans, with market participants who are every bit as insolvent as they are, and whose only hope of paying off on a losing bet is a bailout from the same public holding the bag on the bad loans on which the bets are placed.

Yes, I can see why a person would want to have as large a share of this global finance business as possible.

Oops. That last sentence should have read, “I can see why a country would want to have as large a share of this global finance business as possible.”

What I find fascinating is that this article doesn’t make any mention that Andrew Haldane might have pushed back against those statements of Carney’s. Given Haldane’s $100 billion dollar question and Banking on the state in which he makes very clear statements about how big is too big, and his role as director of financial stability, I would have expected some counterarguments.

Ah, from what I found, Carney is indeed actively anti-Haldane.

Yes, and Carney drove Haldane out of the Bank of England for precisely that reason.

Hu? According to everything I find, Haldane is still at the BoE…did the net miss smth?

Carney is the new Dr. Strangelove. Why not? Financial meltdowns are far more devastating than atomic ones. Steve Keen himself is the architect of a new model, but it is slow to be revealed. For a while he said it would be based on Minsky; then he said it would be based on Energy-oil; and a model of economic entropy, etc. I agree with allcoppedout above that we as yet still lack a proper definition of what we have in practice and we need a model based on evidence that is transparent and falsifiable. The only way to do that in a profit driven world is model Minsky bubbles (Larry Summers would think this was a great idea.) and write derivatives which paralyze finance in the end. So we already know that doesn’t work so well. It leaves us with a painful reality – banking is based not on debt but expectations of profit. Pure fantasy.

If the elite game-plan is, as Dimitry Orlov put it the other day, the destruction of nation-states, then this looks like a pretty sound tactic.

I have no problem with the end of nations. We obviously need a form of federal global democracy. I’m struck that weak national security has been exploited by slavers so routinely in history. I’m not at all sure finance can be defined without such real history and how it has translated into our still non-modern world. What prevents Susan’s (Popper’s) transparency and falsifiability?

Economics is essentially institutional, requiring in analysis, social constructionism and probably awareness of the role of approximation in mathematical modelling (this really is tough stuff – look up Gunther Ludwig – and doesn’t reduce to catchy terms like ‘paradigm’, rejected by Kuhn before social scientists took it up). None of the knowledge we have actually grounds on some ultimate justification. Even fossil records and memories may be founded in some present solipsism (Bishop Usher had the world beginning in 4004 BC complete with such). Daft as this sounds, and useless as it is, one can’t actually falsify the possibility.

Ponzis may simply use new money to pay old investments, drawing people in with promises of high returns like politicians do on policy. But the new money may also come from exploitation like slaving. In 1751, our Ponzi scheme might have outfitted half-a-dozen ships to take the Moscovite captives of the Tartars to their plighted destination, or set up the concentration camps of ‘Red Rubber’, the Indian opium fields producing China White or now the mining company based in the DRC we are taking to IPO. How could we do any sensible science on the institutional facts we might write in the prospectuses of such business?

Whatsapp was ‘worth’ $19 billion. This kind of valuation is also Ponzi. What I think we lack is opportunity costing on how this unholy mess works against what decency and a self-adjusting model of excess might bring us. The idea that this would be a Soviet economy is a valid warning, but surely no reason not to do the modelling and what we would need to make such a thought experiment work on our thinking and practice. I have in mind the database controlled production processes I used to work on in the 1980s. In these, there were often parts of complex processes that would go ‘exponential’ if not governed and redirected by signals’ processing. We could use similar in economic modelling. This is generally ruled out by ideological instruments of torture.

The lack of actual modelling, even if economics seems full of models, is amazing to me as a scientist. QE isn’t inflationary because the money is all in a hole in the ground. Please! I want to know what proportion of world wealth my salary represents (I’ll take an aggregate figure of ours) before and after. I already know there is inflation personal to me from not being able to put my fees up since 2007 and what my bills are. The people telling me the sky would have fallen are all doing rather nicely as the use of foodbanks grows. I can’t look at Cameron and Osbourne without vomiting. I think we can model all this.

Marx gave us the Theory of Surplus Value, which explains why technical progress never inures to the benefit of labor. Veblen gave us the right model of capitalism in The Theory of Business Enterprise (1904) and Absentee Ownership (1923). Everything Veblen said is still true, only more so. Mathematics can add nothing, because nobody can identify all the variables. This means you can understand the process, but never predict the outcome.

Most of the data economists collect is meaningless, and much of the collection is fraudulent, so economics has become an exercise in obscurantism and propaganda.

I agree in spades gibbs. Marx, Veblen, Soddy, perhaps some of the modern social epidemiologists actually have the feel of people actually trying to explain and look for better ways of doing our stuff, rather than treading treacle in a biological-libidinal fix.

I sort of disagree on the ‘maths’. Economics does sums fixated in arbitrary common language-games, nearly all arithmetic-based. We have obviously established that money accumulates with the 1%, so what stops us there? One can easily think of an overflow pipe directed back in as negative feedback. Why do we let people get rich at the cost of corrupt politics with its positive feedback into cronyism? We could do a lot more modelling with real maths, including modelling in how people who can’t do maths fit.

Economic activity is perverted by the extraction of surplus value and by the recapitalization of assets changing hands using the leverage of loan credit. Day by day, these two forces multiply financial capital in the hands of those controlling what Marx called Means of Production, and those having access to Loan Credit. Asset values trend ever upward, but are subject to periodic shakeouts, which makes playing the investment (speculation) game risky for those using their own money. Much of the financial capital is ‘managed’ by financial gymnasts playing heads they win tails the putative beneficiaries lose. Workers are inevitably squeezed because technology undermines the exchange value of labor, although workers in rich countries do comparatively well even if they don’t do well enough to satisfy all the wants endlessly created by advertising. In some cases they don’t do well enough to satisfy essential needs, because taxes and rent gouge huge portions of the wages they receive during an endless race to the bottom conducted by business.

Things have gotten even worse in the past five years, because those who succeeded in overleveraging and looting major financial institutions have been rewarded and kept in place and allowed to continue the same activities that crashed the system. Personal debts that cannot be paid and in many cases cannot be serviced remain in place because they were made non-dischargeable in bankruptcy. Accounting has entered the realm of fantasy and banks pretend to solvency as the Fed allows bad loans to be hidden on its books. It is impossible for anyone to know what any asset is worth, and the value is subject to dramatic change at any time for any reason or no reason at all.

What could math do to amplify anyone’s understanding of this? What values can be quantified? If you want to make things better for people, you must stop taxing labor and begin taxing financial capital and land at its unimproved value. You must also make government an engine of real progress through infrastructure investments benefiting workers. Free education and medical care would be a good beginning, guaranteed interest payments on reasonable personal savings, low interest business loans would also help. But even if you did all this, you would still have the problem of corporate toll booths, business competition, etc.

I think the best we could hope for is to give industrious people a better chance of personal success and diminish the consequences of personal failure. This would require a serious commitment which simply does not resonate with any existing political constituency or any candidate for office I have noticed in fifty years of observation. At best they want to create a few more shitty jobs. At worst they want to engineer the political choices of people half a world away, as if that could possibly do anything to benefit 99% of the people living here.

Gibbs,

Couldn’t agree more. Though perspective seems the bigger problem. Start with the incorrect assumption that governments operate like households and everything else gets conflated. Obviously they don’t have to, maybe they should , but don’t , or we couldn’t afford the wars and bailouts, yet we pretend they do, or maybe the plutocrats lie and pretend they’re ignorant of the operational realities of domestic and global monetary systems ,since this is easiest for the lay ,distracted, misinformed voter to comprehend, less they loose all faith in dollars and the governments response causes anarchy or hyperinflation. Do math models predict this? Sure they do. But can math suggest how we should proceed, since the variables might approach infinity? Economics is a justification for political intentions, a support system for power. Did it make economic sense to kill sixty million bison and replace them with a hundred million cattle? Depends on your motivations, power structure, societal designs, ethical considerations, ect. Would scientific knowledge have made a difference? Math might have helped determine the most economic solution, but the variables inputted would have represented subjective quanta, that undoubtedly skewed results. Quantifying economics is good , but first you have to discus and define parameters. Math is to economics what latin was to Christianity, a purposeful obfuscation. The more i contemplate this, the more insane i get. Capitalism has its pluses, socialism does as well, and than science can clarify vagueness. Elephants and whales have a right to thrive unmolested, but humans want land for their crops and cheap accessible oil for their energy needs. Our growth concentric economies need increased populations to take on more and more debt. I have no idea how how we economically address these concerns if money continues to be the absolute measure of things. Perception! At the end of the day, all these variables need to be honestly and openly discussed. Aint going to happen in time to save the real irreplaceable treasures of this planet. I have no use for mathematical economics, it assumes that which is easiest to create is the scarcest. Maybe we’re just too smart for our own good. Nah, that doesnt make sense, we just need a revolution in thought. I have no idea how, but the 80% whom havent been helped by the finance capitalism our system morphed into, need to simply stop sending payments to the F.I.R.E sectors. That will hopefully grab their legislators attentions. Hell the middle east used our social media technologies to instill change, we’re too interested in vane banal pursuits. Maybe it is time to wake up. I hope.