So when does a related entity rise to the level of being an affiliate? That issue, sports fans, will likely determine whether the SEC will hit the private equity kingpin KKR with fines relative to its relationship with the consulting firm KKR Capstone, which works exclusively for KKR’s portfolio companies.

A Wall Street Journal story digs into the economic and legal relationship between KKR and KKR Capstone. The article makes a persuasive case that their dealings are dubious from a fund investor perspective.

It is key to understand how important this story is. Although the SEC has been saber-rattling with surprising vigor about the extensive abuses it has unearthed in the private equity industry, it’s quite another matter to have a major media outlet describe what looks like misconduct at an iconic player. KKR was the first large-scale, institutional private equity firm and set many of the standards for the industry. A big factor its rise to leadership was its success in fundraising. That in no small measure depended on it being the first to systematically cultivate public pension funds as investors. Those investors now account for roughly 30% of total private equity fund commitments.

So what has the Journal revealed? Its charge is that KKR may be violating its agreement with investors by failing to share the fees of its captive consulting firm, KKR Capstone, with limited partners. The Journal managed to obtain the critical terms from a 2006 KKR limited partnership agreement. Those contracts, as we’ve discussed in previous posts, are treated as as state secrets by the private equity industry.

Over the years, one of the few ways that the limited partners in private equity investments have pushed back against the numerous fees that private equity firms charge over and above their management fee and carried interest (the prototypical “2 and 20”) is by winning the concession that a certain percentage of those extra fees, typically 80%, be credited against management fees. The Journal tells us that sort of arrangement was in place for the 2006 fund in question:

Big investors now routinely demand a share of fees private-equity firms charge their portfolio companies—often 80% to 100%—arguing that the charges drain companies bought with their money. Investors generally don’t collect fees directly, but use them to offset a portion of annual management fees they would otherwise owe private-equity firms.

When raising $17.6 billion for its 2006 fund, KKR agreed to share 80% of a range of fees collected by its management company or any “KKR affiliate.”

Now if KKR Capstone is an affiliate, all those fees should be included in the rebates against the management fee. But KKR has not been making those credits, even thought there is considerable evidence that KKR Capstone walks, talks, and quacks enough like an affiliate to be deemed to be an affiliate.

Capstone, later KKR Capstone, was created by KKR in the late 1990s as a McKinsey-style in-house consultant to KKR. Its status as a captive firm (KKR Capstone works only on KKR investments) alone is enough to raise eyebrows.

This is the home page of the KKR Capstone website, which happens to be located within KKR’s website (the URL is http://www.kkr.com/businesses/private-markets/kkr-capstone). Note all first three pages of links on a Google search of “KKR Capstone” go to the www.kkr.com site (click to enlarge):

Take particular note of the first sentence from the text:

…KKR CAPSTONE, a team of operating executives across North America, Europe, and Asia, available exclusively to KKR and KKR’s private equity portfolio companies as well as KKR’s infrastructure and special situations investments.

“Available exclusively” means, in case you had any doubt, KKR Capstone is 100% captive to KKR. It strong suggests that that arrangement is formal, as in contractual. When one firm supplies all of the revenues of another party by virtue of being its sole meal ticket, they are in a position to exert managerial control, whether forcibly or through winks and nudges. And control, either direct or indirect, is key to what “Affiliate” is generally considered to mean. A representative definition:

Affiliate means, with respect to a specified Person, (a) any Person that directly or indirectly, through one or more intermediaries, controls, is controlled by or is under common control with the specified Person or (b) any member of the Immediate Family of such specified Person. For all purposes under the Agreement, each Principal and each general partner, member, executive officer or director of any successor to the General Partner will be deemed to be an Affiliate of the Partnership and the General Partner (or its successor, as appropriate) for so long as such Principal or such general partner, member, executive officer or director of any such successor, as appropriate, remains in such capacity.

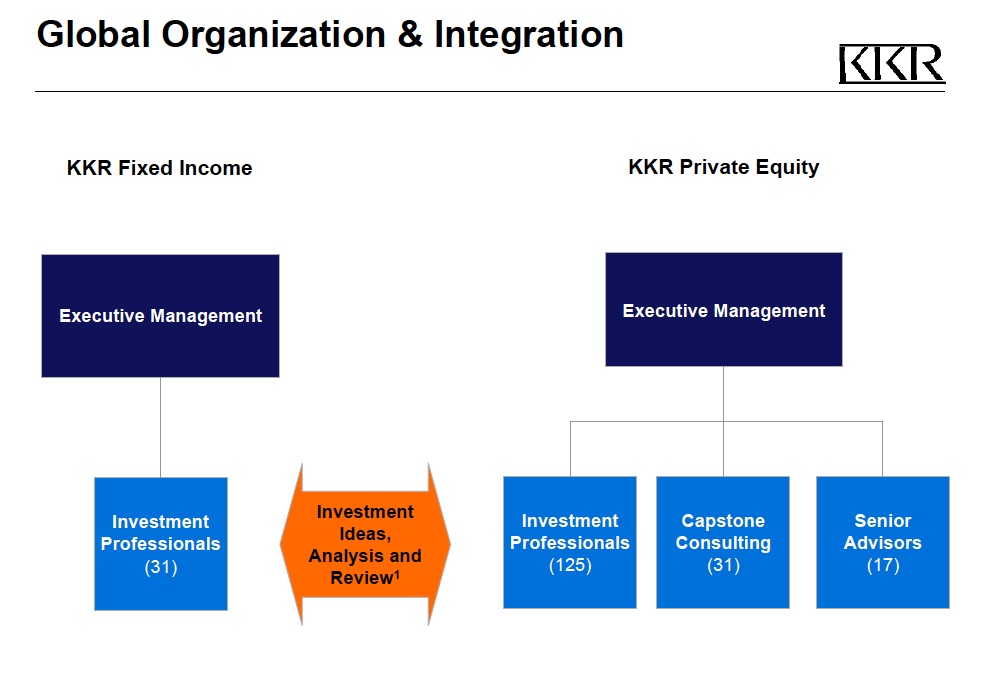

KKR has not been shy about showing that it exercises operating control over KKR Capstone. See this slide (p. 53 of the document, p. 23 of the slideshow) from an investor presentation when KKR was going public in 2008:

Now 2008 is admittedly a while back. What evidence does the Journal have of an overly-cozy relationship between KKR and KKR Capstone? From the story:

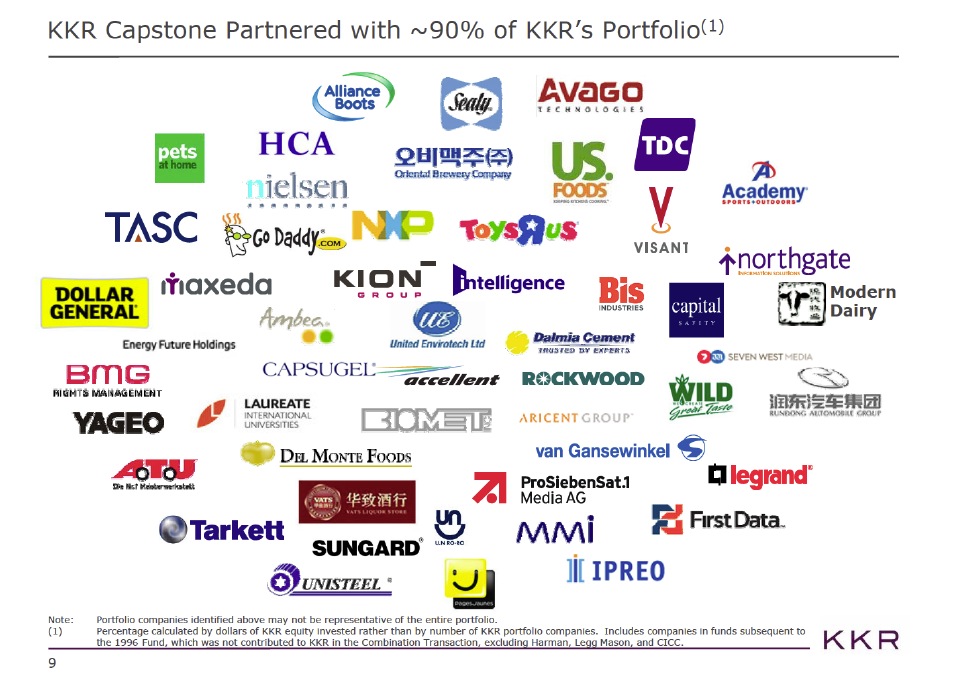

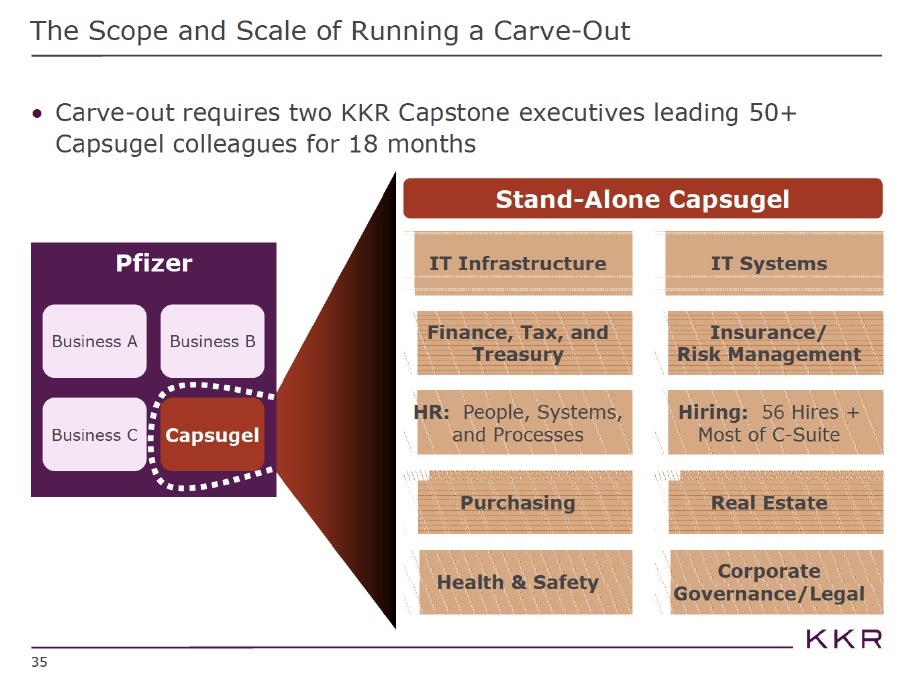

Capstone Consulting LLC—which licenses the name KKR Capstone from the private-equity firm—was founded in 2000 to help KKR improve operations at the companies it was buying. Filings show it has grown to employ more than 50 operating consultants; its leader sits on KKR’s key portfolio-management committee, and its top executives participate in KKR’s share of its deal-making profits.

“I can’t think of any other group that is probably as important to the success of each of our businesses,” Mr. Kravis said in a 2012 investor meeting.

In 2011, KKR began including Capstone’s results in its own financial statements, under accounting rules mandating such consolidation if one company has a “controlling financial interest” in another.

The same year, KKR listed Capstone as a subsidiary in its 2011 annual report, a signal that Capstone had become an affiliate. Under securities laws, a subsidiary is defined as a controlled affiliate. KKR says now the listing was a mistake and that Capstone isn’t a subsidiary but a “variable interest entity.” It never corrected the filing, the KKR official said, because the error was “immaterial.”

Did you get that? The KKR Capstone top brass participate in the “carry pool” at KKR. Lordie.

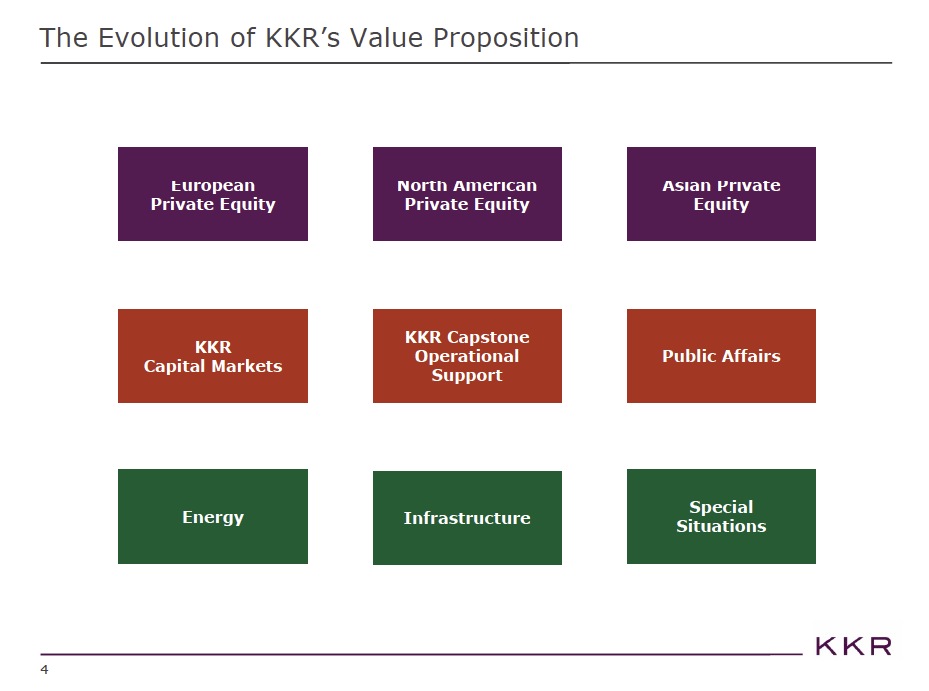

But it gets even better. In March 2012, KKR made an presentation to investors, and by “investors” we mean the investors in KKR’s shares, and not the investors in its funds. KKR considered KKR Capstone to be so important to its success that it made KKR Capstone the focus of this session. Pray tell, how can you depict an operation that you do not exercise control over as a asset or operation worthy of public shareholder interest?

KKR depicted KKR Capstone as an essential part of its business:

Notice the use of “partner” which suggests tighter management and financial integration than typical consulting firm engagements, which are arm’s length, with fees set via time-based charges:

Mind you, this arrangement looks an awful lot like conduct the SEC has put in its crosshairs. As we wrote earlier this month, an SEC official, Drew Bowden, gave a remarkably detailed description of the nature and range of abuses the agency was finding in its examinations of private equity firms. One of the problems he flagged:

Some of the most common deficiencies we see in private equity in the area of fees and expenses occur in firm’s use of consultants, also known as “Operating Partners,” whom advisers promote as providing their portfolio companies with consulting services or other assistance that the portfolio companies could not independently afford.

If anything, Bowden’s boss Mary Jo White had been more pointed in the section of her Congressional testimony at the end of April:

Some of the common deficiencies from the examinations of these advisers that the staff has identified included: misallocating fees and expenses; charging improper fees to portfolio companies or the funds they manage; disclosing fee monitoring inadequately; and using bogus service providers to charge false fees in order to kick back part of the fee to the adviser.

We explained what this meant in practice:

PE firms raise funds by showing prospective investors a strong team of professionals who are going to find attractive companies to buy and manage them. The limited partnership agreement, which is the contract between the private equity firm and the investors, typically says that the private equity firm has to pay for the wages of people working on the fund’s behalf. However, unbeknownst to the investors because it was never disclosed, part of the PE firm “team”, usually the members that work with portfolio companies, are actually being paid as independent contractors. The private equity firm then bills most or all of these sham independent consultants to the portfolio companies with whom they interact.

In other words, the private equity general partners are trying to have it both ways: the operating team members are an integral part of the private equity firm “team” for marketing purposes, but when it comes to who pays their bills, they are mere independent contractors referred to the portfolio company by the private equity firm (as if the portfolio company is in any position to reject these “referrals”).

From an economic perspective, every dollar that comes out of a portfolio company this way is effectively stolen from the limited partner investors.

The KKR investor presentation describes in detail how KKR Capstone executives and staff work with the portfolio companies in a manner that troublingly echoes the general picture we discussed previously. For instance:

And as we anticipated, KKR’s limited partners are surprised that KKR Capstone is treated for billing purposes as an independent party, and hence charged to portfolio companies, rather than largely against of KKR’s management fees. From the Journal story:

All this is news to some KKR investors. “I always thought Capstone was part of the firm,” said Christopher Wagner, a private-equity officer with the Los Angeles County Employees Retirement Association*, which is an investor in KKR’s 2006 fund.

Generally, says Mr. Wagner, “Any fee that’s generated because of the investment ought to be shared.”

So what is KKR’s defense?

KKR says it makes sense to exclude Capstone from fee sharing, because the group’s consulting services are used in lieu of hiring outside firms like Boston Consulting Group or McKinsey & Co.

That is utterly lame. The portfolio companies have no choice in whether to use KKR Capstone or not. One of the arguments in favor of using a captive firm would be that it is highly specialized and focused and hence can do the job far more cheaply than a big brand name consulting firm, where a significant part of the price premium is for legitimacy with the CEO and board. Notice that KKR does not try making the defense that KKR Capstone is cheaper than other consultants. The data points that the Journal unearthed are consistent with a rich billing rate:

Capstone earns consulting fees, which constitute the bulk of the roughly $170 million in such fees KKR reported as revenue over the past three years….One such company, First Data Corp., an Atlanta-based provider of credit-card-processing services, paid Capstone $35.4 million from 2011 through 2013, according to its regulatory filings.

The Journal states that Capstone has roughly 50 employees. If you take $170 million and generously haircut it to $150 million and divide that by three years and 50 staffers, you get $1 million in billings per consultant per year. That is not the sort of rate normally charged by roll-up-your-sleeves operating consultants.

Here is another revealing argument from KKR:

KKR said it sought a legal opinion from an outside law firm, concerned that the accounting consolidation of Capstone could have triggered a requirement to share the firm’s fees. The March 31, 2011, opinion by Linklaters LLP concluded Capstone wasn’t an affiliate.

The opinion, which was reviewed by the Journal, was based largely on legal-control factors, such as that KKR didn’t own any Capstone stock, and that it had no voting power and no power to designate Capstone directors or executives.

Linklaters? Do attentive readers remember who Linklaters is? It’s the law firm that blessed Lehman’s Repo 105 scheme. This smacks of opinion-shopping. KKR has ready access to many of the toniest white shoe firms in the US. The fact that it had to go to a UK firm to get the view it wanted is not pretty.

And US legal experts thought the KKR position was quite a stretch:

Robert Bartlett, a securities-law professor at the University of California, Berkeley, said Linklaters used a “very formalistic analysis” that didn’t address important functional-control tests or relevant SEC guidance about the consequences of Capstone’s accounting consolidation.

“They have a weak case it’s not an affiliate,” he said.

KKR piously says that in later deals they’ve tightened up their documents to make clear that KKR Capstone isn’t an affiliate. But it appears that the Los Angeles County Employees Retirement Association and potentially other investors missed that.

It might be time for private equity limited partners to wise up to the warning from the SEC’s Drew Bowden: “[A] private equity adviser is faced with temptations and conflicts with which most other advisers do not contend.” And this Journal story confirms that private equity firms are not inclined to resist these temptations.

____

* We had pointed out that LACERA, like many public pension funds, is a terribly trusting investor. Perhaps this episode will serve as a wake-up call. LACERA, as an existing KKR investor, would almost certainly have been solicited for later funds.

Yves, nice post. By the way, when did we stop calling them leveraged buyout firms and start referring to them as “private equity?”

Thanks!

That was a 1990s rebranding. In the 1980s, leveraged buyouts were distinct from venture capital; they are now both considered to be “private equity.” Roughly 85% of the funds go to the strategy now politely described as “buyouts.”

Small PEU Investors Are the Final Mark?

Dean LeBaron on private equity:

Finally you get very concerned about bubbles. In the United States private equity, which has been so popular for fifteen years, has now been made available for small investors. Woe the tide, beware small investors. You are about to go in to be fleeced.

I can hear PT Barnum or Carlyle co-founder David Rubenstein calling out to the crowd: “Small Investors! Step this way for the Great PEU Co-founder Egress.”

http://peureport.blogspot.com/2014/05/small-peu-investors-are-final-mark.html

WSJ also reporting that banks are thumbing their noses at regulators’ warnings that private-equity takeovers are being overleveraged:

http://online.wsj.com/news/articles/SB10001424052702304422704579574184101045614?mg=reno64-wsj&url=http%3A%2F%2Fonline.wsj.com%2Farticle%2FSB10001424052702304422704579574184101045614.html

Limited partners could always sue KKR. But then they’d be blackballed from buying into future partnerships. What to do, what to do?

In the case of public pension funds, maybe have the state attorney sue on their behalf, while piously claiming that the AG’s office is not a controlled affiliate.

‘We tried to stop him, Henry, but he just wouldn’t listen!’

Not if enough of them got together, but that would take organizing quietly, something I doubt they are accustomed to or good at doing.

I love the smell of elite cannibalism in the morning.

Isn’t it grand how highly paid elites, like the LACERA Private Equity Officer (officer curruptke?) unashamedly claim ignorance of the very things on which they claim expertise. Geithner did not know he was a regulator, Jim Wagner did not know what his charge was paying for.

Affiliate/VIE/partner/whatever you call it KKR has squared that circle going forward.

The concluding sentence in the WSJ piece is rich. .

” In investor agreements for its newer funds, according to KKR, the firm has inserted “clarification” language specifying that Capstone isn’t a KKR affiliate for fee-sharing purposes.”

BTW Matt Levine refers to your piece

http://www.bloombergview.com/articles/2014-05-22/kkr-didn-t-want-to-share-fees-with-investors

Well, naturally :-)

Hot diggity!

It’s only your pensions, guys, if you have them. Certainly if you’re a retired teacher in California, and I would be very interested, as a child of academics, to hear about TIAA-CREFF.