By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Testosterone Pit.

A friend of mine is suffering from excruciating anticipatory pain. He’s heading to New York to attend his daughter’s graduation, which should be a glorious moment in life. But her commencement speaker is Fed Chair Janet Yellen. “Gotta find some thorazine to take before the ceremony,” he muttered. He paid for his daughter’s education. Not many students are that lucky.

Student loan balances soared 362% to $1.1 trillion since 2003, during a period when mortgage debt – including the effects of the current Housing Bubble 2 – rose “only” 65% to $8.2 trillion and credit card debt actually declined by 4.2% to $660 billion (chart). The burden of servicing that increasing pile of student loans is eating into other forms of borrowing and spending, such as the American classic, reckless consumption on credit cards, or the purchase of a home. And so the proportion of first-time buyers – the single most important sign of a healthy housing market – has been shrinking for years.

Recent graduates are facing a job situation that remains tough. The employment-population ratio for 25-34 year olds (chart) is on a similarly terrible trajectory as the EP ratio for the overall working-age population: It declined sharply from the employment peak in 2001 when 81.5% of the people in that age group were working. The ratio dipped below 78% in 2003, recovered a little, only to plunge in 2008, finally dropping below 74% in 2010. Since 2012, it has been recovering in fits and starts to a recent high of 76% earlier this year, only to drop again more recently. Like other Americans, this age group is having trouble finding jobs.

Over 70% of the students who are sitting through a commencement speech this spring have student loans. They will start their career, if any, with an average student loan balance of $33,000. Even when adjusted for inflation, it’s about twice as much as 20 years ago. Back then, only 43% of students graduated with student loans. After decades of red-hot tuition and fee increases, working your way through college in four years, the way I and many others did back in the day, has become a pipedream.

Every year, it gets worse. The Class of 2012 was the most indebted ever. Then the Class of 2013 took over that dubious honor, only to be trumped by the Class of 2014. Next year, the honor will go to the Class of 2015. Among the reasons for this fiasco: the way colleges are paid liberates them from both free-market and governmental constraints. They can charge whatever they want and get away with it because students can just go ahead and borrow it. Even noisy student protests with mass arrests trip up administrators only briefly. And through the student loan programs, designed with whatever intentions, the government is simply aiding and abetting colleges in extracting ever more money from the future lives of their students.

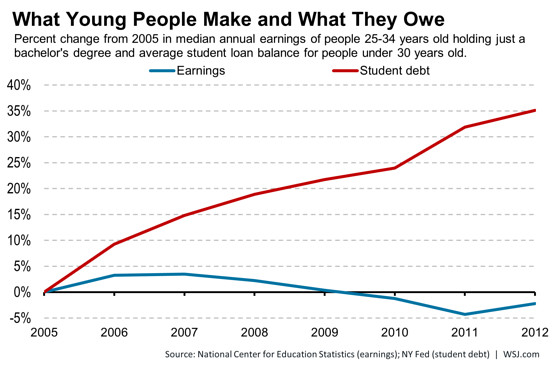

The equation might not have gone so horribly awry if each class of graduates had seen their incomes skyrocket in line with their student debt. But that’s a crummy joke. Between 2005 and 2012 – the last year for which this data set is available – the inflation-adjusted average student loan balance of graduates under 30 years old has soared 35% while the median annual income adjusted for inflation for college graduates between 25 and 34 years old has declined by 2.2%. And this is what this torturous condition looks like:

Something has to give. Sure, whittling down real incomes via inflation – among the goals of the inflation mongers at the Fed, the IMF, and elsewhere – reduces the labor costs of employers and makes the US more competitive with Bangladesh. Not raising the minimum wage in line with inflation is based on the same principle. And surely, providing workers only minimum food, some rags to wear, and basic shelter, instead of paying them actual wages, would do an even better job at it.

But this strategy has a drawback. These graduates will soon enter the generation of potential first-time home buyers. Today’s first-time buyers graduated a few years ago. For them, dealing with their student-loan burden isn’t nearly as much of a drag on their spending power. And they’re already staying away from the housing market.

The Class of 2014, including some of those who dozed through Yellen’s commencement speech, will be suffocating under their record-setting student loans that they have to pay for with their skimpy wages – the lucky one who find jobs that pay enough to make any payments at all. This is the future generation of first-time home buyers. And on top of their mountain of student loans, they’re facing higher interest rates and the inflated prices of Housing Bubble 2, if it can be kept inflated long enough, which appears unlikely, given the deteriorating condition of the crux of the housing market, these suffocating first-time buyers.

If only the masters of universe would take off their blinders and see that they are wiping out the future for many. Short term gains at the expense of tomorrow will cost the country royally. Debt forgiveness should be considered at the expense of the Koch Bros.

If only the many would take off their blinders and wipe out the future for the Masters of the Universe. They’ll have to, if they want to have any future of their own. The Masters don’t care and wouldn’t care even if you could show them with algebra how their debt schemes are destroying the long run for the vast majority. They still come out on top in the long term by maximizing their short term interest and ruining everyone else. Even if you convinced them larger profits could be made with a more generalized prosperity, they would not care to change. Even if you convinced them that their dominance would lead to the decline of the US they would not care. They have no loyalty to anything and can move to another country very comfortably when conditions in this one get too unsightly and squalid for them.

Agree. The MOTU don’t owe allegiance to any nation, anybody, anything, except themselves. Frankly, the bulk of the 1% have so much money that it doesn’t matter where they live, plus their corporations can be incorporated wherever it makes the most tax sense. They don’t give a sh*t about the USA in any way, shape or form, and they see no need to pay their fair share to support the infrastructure that they use. Let the rabble pay for that, if they can. If the infrastructure gets too crummy for the MOTU here, then they’ll go elsewhere where the rabble has been forced – like the Egyptian Pharoahs of yore had their rabble/slaves build those giant pyramids – to keep the infrastructure up to par.

Even if one could somehow prove to those in the 1% that they would somehow be better off, themselves, if they paid more in taxes and worked to improve US/EU/Australian (etc) society/nations, they simply don’t have the interest anymore in doing that. I think they’ve drunk their own Kool Aid, and the notion of having to share with anyone has become a huge anathema, while their addiction to making more & more money and acquiring more & more things has risen concomitantly.

Appealing to the mega-rich with “reason” is not the answer. These are not reasonable human beings.

As a student in that age group with student loans to be paid off, expropriating money from individuals or corporations you do not like to pay off my debts makes little sense in the long run. While it would be like winning a lottery, it suggests that a whole generation does not need to honor a commitment we made when taking the loan. This creates little incentive to work and yes, labor in jobs we otherwise do not like and improve our career and professional prospects. Peace.

There is no peace.

people are not talking about taking money from the top .1% to pay your college loans.

People are talking about making the top .1% pay a fair share of the society they consume.They are not “job creators”, they are” labor exploiters”, resource mis-allocators”,and “potential squelchers”,etc.

What people are talking about is to stop the top .1% from exploiting the long running systems that have engendered the academic industrial complex, as well as the rest of their industrial complex megaliths like the :military industrial complex,or food/agribusiness industrial complex or the health insurance /medical/pharmaceutical industrial complex ,energy industrial complex,or the prison industrial complex,etc….all tools of the financialization industrial complex, that uses their paid minions to fill out the rolls of the three branches of gov’t and the fourth estate.

What people are saying is the world as it stands sucks because it was rigged by people who were blind with greed and stupid from being spoiled from the get go.Competence didn’t do this to us.lies do.

No small amout of taxable income is going to change the system.and the system sucks…..

there are answers, as to what to do… but people need to be clear on just what it is they are trying to do.

They don’t have blinders on. They just don’t give a shit about the proles or their future.

(i) “makes the US more competitive with Bangladesh”: has the US some sort of right not to have to compete with Bangladesh? What sort of right might that be?

(ii) And yet I suspect that the people complaining most loudly about the bad effects of sloshing student loans around are the very people who were keenest on sloshing student loans around not too long ago.

Well, it was a sound theory at the time.

*Export all our low-end jobs that don’t require much skill to other countries that are full of people without much skill and could use the work to build up an economy.

*Send all our kids to college (because we’re all exceptional) and they will qualify for nice desk jobs making middle class wages in air conditioned offices with benefits.

The problem with the theory is that a) sending someone of below average skill and IQ to college just results in a below average skill worker with a mountain of student loan debt and b) technology came along and decimated the need for a whole lot of those desk jobs with middle class wages.

So, now we have a huge number of college educated people with massive educational debts that aren’t qualified for the jobs that are left out in the market. The jobs that do still pay decent wages have the pick of better candidates and we’re mostly creating service level jobs that will never allow those workers to pay off that student loan debt.

A debt jubilee won’t help because even without that debt load there are still not enough jobs for the workforce we have and housing costs continue to rise. Technology and corporate mergers/downsizing continue to eliminate jobs at an astonishing pace. Labor is a dirty word amongst the corporate elite who drive policy, every large company out there is trying to figure out how to reduce their labor expenses in the name of the mighty Shareholder Value.

Your guess as to when the whole enchilada blows up because there aren’t enough people left with middle class wages to support our consumption based economy.

But what if it was never a sound theory and the elites knew it? What if they knew all along what outsourcing would do to wages and employment here, and they went ahead with it anyway? I’m pretty sure they must have. Remember the push for trade agreements NEVER originated from the masses. It was top down the whole way.

Sending someone with below average skill to college may result in a better educated human being. However that doesn’t necessarily have anything whatsoever to do with the job market.

JRS,

You may want check the 1994 interview with Sir James Goldsmith. He laid it out in very clear terms. What clarity and both the interviewer Charlie Rose and the other guest the Asst trade secretary were comparatively clueless and parroting talking points. Now 20 years latter it is chilling how clear and prophetic he was.

http://www.youtube.com/watch?v=4PQrz8F0dBI

Separately, I think the disequilibrium is so stretched that the worlds economies are now on a wing and a prayer and will remain so until either a new paradigm is birthed or a new energy source is found.

http://www.youtube.com/watch?v=4PQrz8F0dBI

has the US some sort of right not to have to compete with Bangladesh? What sort of right might that be?

That right is whatever society chooses it to be. The notion we need to compete with another country for sufficient demand to provide full employment at a strong wage is conservative clap-trap.

The treacherous double speak of the esoterica minded…. is something to behold.

“That right is whatever society chooses it to be.” What on earth does that mean?

“The notion we need to compete with another country …”: is this some sort of “money does grow on trees” argument?

What money are we competing for? Do we need to compete with Bangladesh for East African Francs? Australian Dollars? Turkish Lira? I know I can’t buy groceries without getting enough Mongolian Tugriks; silly me, I forget that I pay for those in U.S. Dollars and we have the only USD factory in the universe.

In fact, everything in the U.S. is paid for in USD which can only come from us. Therefore we have no need to compete for our own currency.

And before you or anyone else try to move the goalposts, my comment and the comment I am responding to are solely about money. If you want talk about real resources, fine, but you weren’t thinking about that and it is a different subject from insufficient financial assets.

The global race-to-the-bottom has left us with massive inequality and environmental devastation, not to mention industrial ghost-towns near-slavery working conditions. Is it your position that there is no alternative?–that no one has a “right” to not engage in this process, that all must compete with all…for the benefit of whom, exactly?

We have the right, which we refuse to exercise, to set living wages for our people and set tariffs to keep out goods made at slave wages in sovereign slums like Bangladesh. Want to get all American Liberal on my ass about those poor Bangladeshis, and how can you say that about their country, and they have a different culture which we must respect, well, fine. I am, at this stage of my life, immune to such indignation. America is a disgrace, but still run better and more fairly than most places. And some cultures stink.

Or, to put it a different way, what right do Bangladeshis have to sell in out market? If I want to sell my goods in a marketplace, I have to play by the rules of that market (or I should–and yes, I know how America unfairly pushes its weight around to smash its way into other peoples’ markets and make them play by our rules, and I know and assert that that is wrong).

We can either defend what we have and set the rules here to fairly compensate the people who do the actual labor, or to maintain a decent standard of living people will clamor, as they have always clamored, for us to go to another community and take those means from them. Plunder of one kind or another has been a constant part of civilization from the Sumerians to the American Wild West and beyond. I don’t like it or think it just. Keeping out goods made in Bangladesh is a lot less awful and destructive than the historical alternative.

That was an entirely offensive – and ignorant – comment.

diptherio;

I think he’s arguing for a return to old fashioned Nationalism. To H— with the Global Corporations. Some ideas in that vein:

1) Hold a “Bastille Day” celebration at Guantanamo. (I’ll bet Tio Fidel would love to help, even if only clandestinely.)

2) A new “Constitutional Convention.”

3) A “Welcome to the Terror” presentation for as many of the .01% as we could rope in. (Large parts of the National Guards can be reasonably expected to pitch in. They are straddling the Professional Military Civilian Homefront divide and see a lot more than anyone suspects.)

4) An Industrial Mentoring Framework (IMF for short) to kickstart new industrial programs. (I forsee the new Madame La Guillotine Corporation being one of the first. Demand should be great.)

5) Post Office banks and State Banks. (Why not Beard the banksters in their dens, eh?)

6) A Green Infrastructure construction program. (Kills lots of birds with one stone. Poor birds. At least we’re going to eat these avians.)

7) Extend the free public education concept to include secondary education. Since many of our Community Colleges are secondary Vocational Schools, why not append them to the local School Systems?

The list could go on forever, but it’s time for lunch. Bon appetite!

5) Post Office banks and State Banks. (Why not Beard the banksters in their dens, eh?) ambrit (Hattie’s gulch)

Yes, we should have a Postal Savings System but it should make no loans and pay no interest.

As for State Banks they are bound to violate Equal Protection under the Law if they lend and probably if they pay interest too since both favor the rich. Banks should be 100% private with 100% voluntary depositors.

One does not beard the bankers by playing their game. If the poor need money for homes and cars then one-time grants at 18 or 21 is the way to go plus land reform so no one hasn’t a piece of land to live on and grow food, well separated from neighbors and free from neighborhood association nazis.

If the profits of cheaper foreign labor were roughly equally shared in the developed countries then:

1) They would be little desire to close the borders to foreign goods and workers.

2) Per Maslow’s Hierarchy of Needs, the population of developed countries would INSIST on paying more for foreign goods so long as the foreign workers were decently paid.

Learn to share* people or was kindergarten wasted on you?

^Common stock is an ideal endogenous money form that requires no usury nor government privileges as the current money system does.

It’s hard for me to see how the recent Fed could be seen as “inflation mongers”. They have consistently failed to achieve their official 2% inflation target, and that target is itself seen as too low for the times by many critics. Of course, the idea that the Fed can successfully engineer any particular target inflation rate is probably flawed.

The reason student debt is so high isn’t because the Fed has built a student debt bubble. College loan interest rates are no lower than they used to be back in the good old days of affordable higher education. The debt level is high because college costs way more than it used to cost and government is subsidizing it way less than it used to. At the same time, due to growing inequality and economic insecurity, the earnings and status gap between those with a college education and those without it is tremendous, so aspiring students and parents are willing to pay the price. We need to go back to a more comprehensive socialization of education costs with a commitment to educational excellence by state-run institutions exerting downward cost-pressure.

Are you serious? Prices in our society would be much lower if the Fed regulated the FIRE sector and sold asset holdings like ABS and Treasury Securities.

One can argue about the costs and benefits of such an approach to public policy, but that’s what people are talking about when they call the Fed ‘inflation mongers’. Whittling down real income has been the primary mechanism of the looting for many years now.

That’s hard to believe. The modern Fed, like other central banks, has moved to an aggressively low inflation stance since the 80’s. If anything, you should be concerned about central banks’ steady commitment to protecting creditors by preserving the real values of nominal assets through low inflation.

I guess I’m confused about what there is to believe. If one “believes” the Fed’s own numbers, they have bought half a trillion dollars’ worth of treasury securities and another half a trillion dollars’ worth of mortgage backed securities just in the past 12 months.

I thought the debate was about whether this is good or bad, not whether this is happening.

http://www.federalreserve.gov/releases/h41/current/

‘We need to go back to a more comprehensive socialization of education costs’ … which will push them higher still.

Dear Jim;

The football coach of my local State College made around $900,000, base salary and bonus, per year! Adjunct professors scrimp by at $64,480. Post docs get $35,000 and Grad Students get $19,000. Even if Socialization of Education increases the costs, most of us would put up with it if it could be shown that gross inequality of outcomes was decreased.

Ambrit, at least in my state (WA), the football and basketball coaching salaries come out of revenues for licensing logo items, ticket sales, media contracts, and donations from alumni supporters. So the sports coaches are not competing in the same salary pool with the profs – they are competing with salaries among other league members and the pros. (I’m not defending the salaries, simply pointing out they don’t come out of taxpayer funds.)

On the contrary. The availability of cheap, state-funded, high quality, not-for profit higher education options help keep costs down across the industry. Same is true of health care.

Oh, my. You used key words that upset the True Believers in Laissez-Faire. Your brief mention of the way things worked (very well) c. 35 years ago did not faze them in the slightest. It couldn’t. You’d committed intellectual apostasy by advocating “socialization of education”, and all evidence must fall before the need to fight you on that account.

When I took out student loans in the early 1980s, the interest rates were >3% below the average for loans with similar risk profiles in the private market. There was a 9 month, post-graduation grace period, along with the deferment options that still exist today for graduate students. Young people could find entry level and summer work that paid enough to cover sizable percentages of their total education costs; loan growth was hemmed in by the existence of other payment options.

The dangerous, bubble-riffic increase in student loan debt is a direct reflection of the decision to gut higher education funding at the state level. US academia is bloated, poorly run and fraught with structural inefficiencies. Howeveh………. it is no worse in on these scores than it was 10-20 years ago. The student debt burden has soared over that time period, because that is when tuition and ancillary fees went through the roof.

It’s amusing to read the Righteous excoriating moral turpitude in today’s borrowers — using the same tired cant that they employed ~20 years ago in re welfare deadbeats. Back then, no one but the wooliest of socialists believed that their assaults on the characters of poor women might ever be used against hardworking middle class people.

And yet, here we are. Same language, different class of targets.

They ARE inflation mongers precisely because they are so afraid of causing it. That is why they have been comparatively complacent for decades with higher levels of unemployment that used to be considered acceptable. Volcker was explicit that he wanted to use unemployment to break the bargaining power of labor. The Fed is most decidedly in the “keep labor down” business even if Wolf didn’t make that point as well as he might have.

And the Fed focuses only on core inflation. They ignore increases in food and fuel costs. Those are much bigger % of lower income budgets, so increases in those items hit particularly hard.

Yves:

Why is it only you and I understand the true intent of Volcker’s smashing of the economy? Labor employment is not a direction which the Fed will take as its unemployment is a lever against wage driven inflation and used as an excuse to drive interest rates up in Capital driven inflation.

Volker got a good personal reputation, but many saw through his lowering inflation blitzkrieg. He always was a fool of the rich.

The catalyst for the end to the Vietnam War was kids and the draft. The war ended not because of the military or the politicians but because the kids were out on the street and on campus protesting the war because of the risks involved in the draft once you turned 1-A status.

Massive debt and unemployment for educated people in this age group can be the same catalyst for change when there is no way out

I hope they blow the place up – the system needs the spark to set the fire so other demographics pile on.

I think they have to blow the place up. They already are to a certain degree. They’re not buying houses, they’re renting in urban environments, they’re not buying cars, they’re not getting cable TV, they’re abandoning religion as religion gets more authoritarian and intolerant. In short, they are adopting a significantly different lifestyle from that of their parents.

They have to.

They live in a world where there are limited job opportunities, especially if they don’t have any exceptional skills that the business marketplace is willing to pay well for. “Good enough” doesn’t cut it anymore. They are generation who cannot build a middle class lifestyle because the bar for that wage base has been raised dramatically.

The conservatives will says that wages are dropping to the right levels but they don’t grasp what the ripple through the economy that is going to entail. It lowers housing values outside of urban areas and top school districts, it impacts every facet of our consumption chain. Which means fewer dollars to flow upwards, it means fewer self-made millionaires, it means fewer chances for a small business to become a big business. Which is ok if you’re in the 1% bracket that’s already made it to the top and crushed your competition via legislation and buy-out. Sucks for everyone else, though.

Also, why the hell are the apostrophes and quote marks being dropped out of posts?

This is evident in even in 3rd rate cities.

In Reno, NV the midtown area is expanding with new, small-scale and attractive construction. The far-flung, outlying suburbs are…….. tired looking. The irrigated vegetation is dying. In small commercial strips and subdivisions, dusty pink stucco cladding is starting to spall away from the chickenwire. The very newest examples of this kind of development still look good in a sterile, gated sort of way. However, the 80s and 90s era exurbs are shabby, and their supermarket-anchored mini-malls are half-empty.

The Masters should look to the experience of rentiers in the Dutch Republic, and ask themselves who will defend my claims on billions of dollars after the US collapses?

The property rights the financiers claim to so dearly adore are defended by someone: the American superpower. Once the US collapses into third world poverty, aint gonna be a superpower! Why should the Indians or Chinese care about the “rights” of Wall Street criminals?

Everyone defaulted on their Amsterdam loans in the late 1700’s and the British swooped in and scooped up all of the ships and colonies the Dutch East India Company ‘managed”. Wealth based on paper and “managing global supply chains” is super easy to steal.

Buy why should anyone miss a chance to declare the End of History, to declare that the World Is Flat and to cynically pronounce that the MOU’s have escaped the gravity of nations states?

Dan Kervick said: The reason student debt is so high isn’t because the Fed has built a student debt bubble. College loan interest rates are no lower than they used to be back in the good old days of affordable higher education.

Um, no. Student loan interest rates are stupidly high right now compared to the days of yore. Heck, you could have seen this during my own student college career (loans taken out in 2003-2007). The first two years had unsubsidized loan rates of 3.1 percent. The last two years had rates of 6.7-6.8 percent. And that increase was just in a 4-year span.

I can only imagine what unsubsidized loan rates are now.

Right. I said they were not lower. So the idea that there is a college loan bubble being created by some Fed policy of “easy money” makes no sense at all. Students are borrowing more for college these days despite higher rates.

Right which is one reason you should learn that one cannot necessarily control price inflation with increasing the PRICE of credit but by limiting the AMOUNT of it.

Unlimited credit creation can create price inflation EVEN at high interest rates so the solution is to limit lending, as much as possible, to actual fiat, you know, eliminate all privileges for the banks, the means by which they can leverage so much, what I’ve been saying for years now.

So my (personal) interest rates from the way-back machine (roughly 25 years ago)

State Guaranteed Loan: 7.5% (but with some very sweet deferment possibilities)

Federal Guaranteed Loan: 9.xx% (also some good deferment possibilities)

Private Loan: 14% (no deferment at all – interest started accruing 0.1 seconds after I received the loan proceeds).

Rates were MUCH higher in nominal terms, but not in inflation adjusted terms. And the T&C’s were incredibly generous: the state guaranteed loan paid the interest while I was in school, for 6 months after graduation, and allowed unemployment deferment up to 24 months in total (available in 3 month increments — followed by a 6 month grace period each time where the state picked up the interest). The Feds picked up the interest while enrolled. Oh, and no Visa/MC available to run up bills.

Economics has a tendency to complicate the simple and such is the case w/r/t student loans:

1) Students and parents have been brainwashed to believe that YOU ARE A LOSER if you don’t attend college

2) There are a limited number of employment opportunities available for non-college graduates and NO “professional opportunities (from an employment perspective, BA 2014 = HS 1954)

3) While trades are a meaningful alternative to a college education, I suspect that the “smarts” and “ability to learn” to be a (for example) plumber’s apprentice are equal to or greater than many BA programs AND you need to have mechanical aptitude (so “learn a trade” is an alternative, but not an easy one)

4) Lower end entry-level jobs are typically reserved for those of dubious immigration status. Again, from 25 years ago, I worked in various restaurants. Virtually the entire wait staff were in college or recent grads (it was decent bridge employment). Those opportunities are gone, so no “working through” college. Can’t even earn beer money today.

5) Building on (4) – ongoing competition from imported workers (H1B are practically indentured servants) and exported work.

6) College education is a rent seeking quasi-monopoly with mythic status. Can’t afford it, and can’t live without it.

7) And for what you can’t afford, there’s a friendly financial institution ready to lend you the money.

Yves

That Average is very misleading. While the Average debt is $35K, for the class of 2015,

it’s a very funny distribution. Some of the Class of 2015 have debts of over $150K

and others have debts of zero. I’d say 20% have a ton of debt, and 40% have a car payment

and the rest have zero.

The Car Payment crowd with some care and luck will get that paid off, but be driving shit cars for 20 years. It’s the ones with the Mortgage payment who are in trouble.

One can reasonably assume that the 20% with the Mortgage payment will either never buy a house or never marry or marry someone and never buy a house.

That means a generation of kids will be effectively stunted. some 20-30% will be apartment

dwellers, living with their parents, sharing a house, grinding under the load in some poverty wage public sector job….

These are supposed to be the Echo Boomers, and instead they will be more like the missing generation. 1925 – 1940

The student loan situation may be getting worse and the unemployment and underemployment situation is bad. But housing has been unaffordable for a long time, Generation X many of them couldn’t buy houses (that’s what 1/2 million dollar or more shacks in the ghetto will do to the next generation) and the morons at the Fed reinflated the housing bubble, to make sure housing was forever kept unaffordable for young people (boomers loved it because there housing was kept expensive, even if it meant there own kids could never buy, of course the big beneficiaries were banksters).

pat:

It would be better discussion if you cited something. I am no fan of Jason Delisle, the Republican plant on the New America Foundation a supposed centrist org. He does a nice job of breaking the debt down. One comment:

“So how much of the $1 trillion in outstanding student loans financed graduate and professional degrees versus bachelor’s or associate degrees? If the breakdown resembles recent disbursements, it is about 40 percent.”

Which implies 60% of the $1+ trillion are with Bachelor’s Degree grads. Jason seems to feel that we should cut off those who pursue Masters and Phds from any type of financial assistance. I guess we could do so and confine ourselves to a bunch of BA/BSs; but then, we would not have those in place for research and science or financial engineering (well maybe we do not need financial engineers).

Undergrad owing money at the 50th percentile is ~$23,000. http://newamerica.net/sites/newamerica.net/files/policydocs/GradStudentDebtReview-Delisle-Final.pdf

One effect of student debt, students become serfs *if they can ever find a job and repay* is that it produces worried, anxious, striving young ppl, who will never contribute to ‘innovation’, start-ups, new Science, those famed US values.

A small -successful- portion just hunkers down and pays and pays and bows down to the masters.

Apparently student loans still return enough? Who knows? Who measures this? What are the numbers?

Of course the Colleges and Unis are making out like bandits. They just cash in..they are ‘competitive’…

A society that rips off and enslaves it’s own young, as now in the US, does it under the assumed or touted banner of perpetual growth. Which no longer exists.

The young can’t buy homes and support another section of the economy? Pardon me how is that surprising? They won’t buy boats, jewels, fancy equipment, cars, or eat out blowing a lot of cash, and if they buy homes they pay the banks first of all, huge mark up (mortgages) and second, the State apparatus.

They owe and can’t consume or invest. (In a large part because they can’t find jobs.) So all this is just a fight between different sectors that are tryin’ desperately to squeeze out the last pennies.

Bland pseudo-economic analysis under fake professional veneer is really dismaying. It implies that the status quo has to be accepted and no remedies are available or ever proposed.

Yellen’s speech was as bad as Wolf feared. MarketWatch picked up this quote:

My predecessor at the Fed, Chairman Ben Bernanke, demonstrated such courage, especially in his response to the threat of the financial crisis. To stabilize the financial system and restore economic growth, he took courageous actions that were unprecedented in ambition and scope. He faced relentless criticism, personal threats, and the certainty that history would judge him harshly if he was wrong. But he stood up for what he believed was right and necessary.

Ben Bernanke’s intelligence and knowledge served him well as Chairman. But his grit and willingness to take a stand were just as important. I hope you never are confronted by challenges this great, but you too will face moments in life when standing up for what you believe can make all the difference.

http://blogs.marketwatch.com/capitolreport/2014/05/21/yellen-tells-graduates-show-grit-like-bernanke/

————

Short translation: When out of money, PRINT for all you’re worth. That is, as long as you’ve got a government badge. Otherwise you’re goin’ to jail, punk. In that case, hit the lecture circuit after you’re released.

The printing has not proven to be the problem. The hyperinflation that I’ve heard over and over was just a month away has been a month away for six years. What proved the problem is who wound up with the money and who got screwed. The richer you were, the richer you are today. If you were poor or lower middle class and in trouble in 2007-9, you are still in trouble or ruined. That’s the crime, and that’s what Yellen is either too blind, stupid, or malicious to see.

As a recent graduate with student loans, I was stunned when I received an email from Fed Loan Servicing stating “Over 70% of our borrowers on Income-Driven Repayment (IDR) plans qualify for a monthly payment of $0.00.” So over 2/3rds of their borrowers are not servicing their debt? This does not sound good…

Housing and student debt does have consequences but other factors are also impacting first time home buyers:

1. The lack of new home construction particularly near metro employment centers. Here is a FED chart showing new construction since the early 60’s: What new buyers are facing is purchasing existing family homes in established areas which always has been more expensive then new homes built further away from the metro employment areas. Generally home buyers making purchases of existing homes have had assistance from relatives or earned the down payment after selling there first time newer home and are now moving up.

http://research.stlouisfed.org/fred2/series/HOUSTNSA

2. 2nd issue is the American Dream home: 3/2 1/4 acre lot within employment metro area. We have had 50 years of over built single family homes in and around the major employment centers without adequate public transportation and restrictive zoning keeping out multi-family construction. The result is we now have blanketed metro employment areas with single family housing have no more land to build and have a patch work of zoning restrictions on building multi-family units combined with the slow down of tract home building outside the metro areas this has caused existing single family housing prices to rise, pricing out most new home buyers.

3. if students did not have large debt loads they still would be competing for expensive single family homes in metro neighborhoods as demand for these American Dream home far exceeds availability. What will be required in the future is revise zoning laws and an accent on multi family construction within established neighborhoods, all very unamerican!

What will be required in the future is revise zoning laws and an accent on multi family construction within established neighborhoods

IOW — a decline in the standard of living.

Then: A 3/2 single family home and a car in the driveway

Now: A 2/1 apartment and a bus pass in the wallet.

Yes well that IS necessary anyway given global resource constaints. A society entirely ruled by the 1% with overt poverty (hunger and homelessness etc.) is not necessary however.

Precisely. How long can 6% of the global population consume 4x or 5x or 20x or 50x or 100x that of anyone from all the nations of the other 94% of the global population peacefully?

“Decline of the living standard” , even if college grads were debt free there ability to have 20% down payment for homes is a stretch and to expect the urban landscape to continue to roll on with the American Dream home no matter how far someone has to commute seems unrealistic. The American Dream home is very expensive by world living standards not only to build but maintain so an apartment and bus pass may in the end be a better lifestyle as people get away from the ball and chain of maintaining there American Dream home and become more interested in the cultural and community life around them.

Kids: Today, Yesterday and Tomorrow

The problem with kids today is not that they are coddled or raised in poverty. Those are symptoms of civil marriage. The answer to spoiled children with an intact umbilical cord to their mother, who is fed by a government umbilical cord, is not to exploit disconnected children in the field or in the factory, or vice versa. Both exist, are symbiotic, in the same circuit, with the connection hidden by the misdirection of the ivory tower economists, reflecting their own assumptions in the magic of free trade agreements, that opportunity cost cannot be measured, therefore is to be ignored, until it can’t.

Civil marriage systematically denies children an equity position in the economy, replacing the natural feedback loop with an artificial one. An economy that creates debt in their name before they can fathom debt, as slaves of slaves, is far more cruel than direct physical slavery, because it is their own habits that intern them, which is why you see so must self-destructive behavior. Physical bruises heal faster than psychological bruises.

If you look, you will see that all empire participants, including the hedge fund managers, are economic slaves to the debt they are trading between themselves. If that debt as income should stop growing, they would all be immediately impoverished. They are all dependent upon making their own children slaves to a demographic ponzi. And they do it to themselves, seeking something for nothing. That someone like Warren Buffet is efficiently organizing the market is a derivative.

They race around in circles, collecting each other’s byproducts, competing to see who can get the greatest return on the least effort, which is lionized in the media surrounding them. Without your health, you quickly have nothing, most are granted health at birth, which simply needs to be maintained with nutrition and exercise, yet the AMA doctors organizing the breeding result are the landed class with the highest income, producing more destruction every year. They are morons, but who are the morons feeding them?

So, your first order of business as a young person is to maintain sufficient privacy, distance, to ignore the empire morons. Your next order of business is to maintain your own health. And your next order of business is to develop your skills, to compliment the talents you were granted at birth. If you think about it, you are far better off working for a low wage and collecting no debt, in return for the opportunity to develop skill, than you are efficiently collecting debt in a corporation.

That’s what the old-timer, with the assets you need to begin and no one to give them to, because old-timers with assets are always surrounded by parasite salesmen, is looking for. Be the needle. Goldman Sachs and all the others are built on greed, social depravity, family members stealing from family. But, if you are not part of a couple, capable of producing productive children, your outcome is going to be the same as the morons, despite your best intensions.

Nothing has changed about empires. You don’t have to reinvent the wheel. As you can see, the empire ponzi works, until it doesn’t, when the middle class created for the purpose is crushed, from the bottom up. The only improvement made by dc technology is the ability to liquidate individuals in aggregate, to hide the result from other individuals until they are ready to be liquidated.

There is no lack of opportunity, globally. It’s everywhere, in the form of misappropriated assets, as is the kindling you need to start the fire. The problem solution for the majority is that they have embedded fear in their habits, so they cannot see the opportunity. All they see is threats to be mitigated by insurance, debt as income, which is imploding. Placing the derivative before the integral has the same result every time.

Pitching the empire hoard your second derivative is far more effective than defending your integral. Despite all the pieces of the fusion/fission reactor I have placed in over 500 articles, the hoard cannot see it because the participants cannot think for themselves. They can only comply with their peer pressure group, as they were bred to do. I really don’t care what you do with the reactor, and neither do the other old-timers, so long as you do something, anything, productive.

Learn to think with a spouse, chosen for the purpose. Finding a needle in a haystack is simple if you are a needle, but impossible if you hay. Every process has priorities, a budget and a feedback loop. And you have the entire universe at your disposal. Even the most ignorant bear can recognize a human capable of completing the circuit. Ignorance is the enemy, not any of its derivatives. Knowledge is a derivative.

A male telling his daughter over and over again that she not need learn to work because a man is going to provide for her, and then seeking a female to provide for him is not the solution. Neither is a female telling her son that he must provide for her because she has no male. Unless you want to grow empire gravity, issuing debt in the name of the unborn is certainly not the solution, which is why Putin is kicking Obama’s A, the empire kettle calling the empire pot black.

Don’t join the resistance. Leave the morons behind. An autocratic central government does not create effective communities, as all of Asia has proven, repeatedly, for over 5000 years. Only you can build a community, upon which the bank is completely dependent. All a bank can do without community is issue debt as an asset, which is what you awe looking at. Adjust privacy accordingly.

Don’t deny your children equity in work, and expect not to grow the empire, to kill its own. The nation/state is a derivative of public education, not the other way around. Communities do not raise productive children. You do. The cornerstone of community, and everything else in the human economy, is marriage, not a contract for divorce to feed the lawyers and doctors. Empire History is nothing to fear.

Wha…? This is, either intentionally or unintentionally, a prime example of a Gish Gallop.

tried

It is strange that there is no mention in this article of the debt forgiveness programs. The cost that will ultimately instead be paid for by the government, will be enormous: http://online.wsj.com/news/articles/SB10001424052702303887804579503894256072308

There are also limits to what percentage of your income needs to go to paying down your debt:

“The fastest-growing plan, revamped by President Barack Obama in 2011, requires borrowers to pay 10% a year of their discretionary income—annual income above 150% of the poverty level—in monthly installments. Under the plan, the unpaid balances for those working in the public sector or for nonprofits are then forgiven after 10 years.

Private-sector workers also see their debts wiped clean—after a longer period of 20 years—reflecting a government aim to have no one, wherever they work, paying down student debt their entire working life.

An independent study estimates the future cost of the 2011 program, known as Pay As You Earn, could hit $14 billion a year.”

The upshot is that many students will be paying ten percent of their discretionary income for ten years (if they get a government or nonprofit job) or twenty years (if they get a regular job). Then the government will pay off the balance. All sorts of interesting uses are being made of these programs:

“The popularity of the programs comes as top law schools are now advertising their own plans that offer to cover a graduate’s federal loan repayments until outstanding debt is forgiven. The school aid opens the way for free or greatly subsidized degrees at taxpayer expense.”

Ten percent of one’s income is not enough to ruin a person’s prospects; not at all, as long as there are jobs!!!! However, this arrangement does require that the person be in close contact with the government at all times, in order to not “fall out” of the forgiveness program; to not screw up in some way this government assistance. This makes young people utterly dependent on the government to prevent their debt load from becoming impossible.

I was one of those people with student loans. I still don’t own a car.

Well, I didn’t own a car until I was 33 and my husband was 37 (I’m now 50). We realized that we could save a lot of money that way. And it wasn’t because public transportation where we were was so wonderful; it wasn’t. It was a drag sometimes, but we did save money. At least for your generation (I’m guessing you’re younger), it’s not so strange.

To my fellow young Americans with massive student loan debt:

Leave the United States, and never, ever return. Start with teaching English in China, or somewhere in Central/Eastern Europe. With a few years of job experience you can get a teaching job basically anywhere. Find a nice place. Settle down. Learn the language. Be happy. There is no future for us in the United States. Leave while you’re still allowed to.

Sincerely,

Young Ex-Pat

I think the sequences of Google Street-View pictures from Detroit should give us all pause. I forget if that post was linked here or not but it links back to “Why Don’t We Own This?” and the summary of $1/2B in back property-taxes “owed” to the city, mostly by the Banksters, it turns out.

Detroit is the ultimate success of Laissez-Faire Neo-Liberal Economics. It was gutted by politicians and their cronies. The promises made to citizens and employees were routinely broken (failure to invest, the spending of monies that were supposed to fund pensions and other future expenses). The industrial base played the “too big to fail” game even before the Banksters and paved the way with some earlier bail-outs. It has been habitually looted and, ultimately, abandoned by the (its) elites.

I haven’t been back to Endicott, Owego, Poughkeepsie, or Kingston, NY, but all have been the victims of abandonment by their formerly paternalist Industrial Giant (IBM) and left for dead. The carcass has been picked pretty clean. What’s left in Poughkeepsie and elsewhere is funding the “services” scam while the rest of the cash can be milked from a captive customer base. It is the same story as the Automotive Industry and Detroit. I only mention this one because it bit me an mine.

I don’t feel like getting a translator and finding the Indian or Chinese who thay claim has my old job. The truth is, they walked away from all of the work we did back then are in “maintenance” (extraction) mode. And the robots that took over the plant floor are lousy conversationalists and probably drink something even more objectionable than Miller Lite.