While it is refreshing to see the authorities man up a bit in dealing with a miscreant bank, it’s also critical to recognize that the US show of spine with BNP is all about the US tightening control over international payments. In other words, the harsh settlement is all about the US projecting its power overseas via financial services. It is not a precedent for how the authorities will deal with other types of bank abuses.

Key elements of the deal, as told by the Wall Street Journal:

BNP Paribas SA BNP.FR -1.92% and U.S. prosecutors have agreed to broad terms of a deal in which the bank would pay $8 billion to $9 billion and accept other punishment based on what investigators say is evidence the bank intentionally hid $30 billion of financial transactions that violated U.S. sanctions, according to people close to the probe.

The two sides in recent days reached a general outline of a deal that also would include a guilty plea to a criminal charge of conspiring to violate the International Emergency Economic Powers Act and a temporary ban—likely lasting a period of months—on the company’s ability to transact in U.S. dollars, according to several people familiar with the discussions.

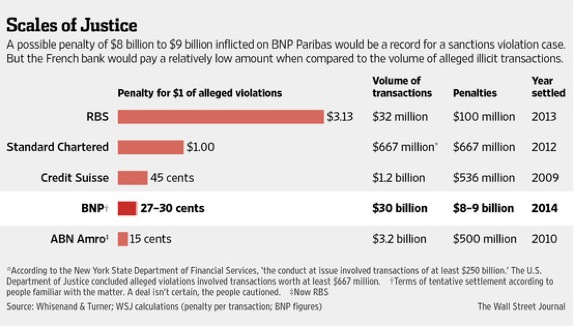

This chart illustrates that these settlements don’t appear to have much logic:

Now one might contend that the Standard Chartered fine was proportionately worse because (as we wrote at the time) the bank was a defiant, recidivist breaker of anti-money-laundering rules, where records were doctored to fool regulators and in-house counsel blew off “cut it out” advice of outside counsel. One might also argue that the dollar amount of the fine doesn’t tell the whole story, since losing access to dollar clearing services will be very costly to BNP. It won’t just be the additional expense of having to conduct transactions through correspondent banks; BNP is also at risk of having clients that engage in a lot of dollar-related business picked off by competitors.

But notice how these are all foreign banks? Why don’t we contrast those fines with the slap on the wrist that Wachovia received in 2011? As we wrote then in Wachovia Paid Trivial Fine for Nearly $400 Billion of Drug Related Money Laundering:

If this news story does not prove that banks are effectively above the law, I don’t know what does. The Guardian, in an account yet to be picked up anywhere in the US media (per Google News as of this posting, hat tip readers May S and Swedish Lex) reports that Wachovia was at the heart of one of the world’s biggest money laundering operations, moving $378.4 billion into dollar-based accounts from Mexican casas de cambio, which are currency exchange firms. While these transfers took place over a period of years, the article notes that it equals 1/3 of Mexican GDP. And the resolution?

Criminal proceedings were brought against Wachovia, though not against any individual, but the case never came to court. In March 2010, Wachovia settled the biggest action brought under the US bank secrecy act, through the US district court in Miami. Now that the year’s “deferred prosecution” has expired, the bank is in effect in the clear. It paid federal authorities $110m in forfeiture, for allowing transactions later proved to be connected to drug smuggling, and incurred a $50m fine for failing to monitor cash used to ship 22 tons of cocaine.

The operation may have started sooner, but the Wachovia admitted in the settlement that as of 2004 it had reason to address the procedures used for these transfers and chose not to.

Back to the current post. That itty-bitty fine, even if you throw in the forfeiture and call it $160 million, is 0.42%, or cents, using the denomination of the Wall Street Journal chart. It wouldn’t register on the scale they used. So foreign critics are correct when they contend that they are treated more harshly than domestic players.

But the overseas firms do benefit in one respect from the US tendency to go easy on banks. No individuals were charged:

As part of the deal, officials plan to announce the departures of more than 30 bank employees, acceding to demands by the New York Department of Financial Services that individuals also be punished, according to people close to the talks. The majority of those people have already left the bank, they said.

Can’t break the well established pattern of at most foot soldiers being put under the hot lights, now can we? Clearly, former prosecutor, now New York Superintendent of Financial Services Benjamin Lawsky wanted more, but having people forced out was apparently all the the other regulators involved in the settlement were willing to extract.

The Journal points out that this settlement came despite vociferous objections from the French, including Prime Minister François Hollande. It looks like that had no impact. But lobbying dollars in DC, or the prospect of cushy revolving door post-regulatory employment? That clearly is much more valuable negotiating currency.

I may have fallen prey to the law of diminished expectations, but I’m actually getting more excited about these prosecutions and about Preet Bharara, the U.S. Attorney for Manhattan. I didn’t think much of him when he first started but each prosecution he’s handled he’s upped the penalties. While I agree that prosecutors are being much harsher on foreign banks than U.S. ones, the penalties are getting harsher and harsher. Recall that HSBC only paid $1.9 billion over allegations that it failed to monitor money transfers of $670 billion from its Mexican branch (albeit its unclear how much of that was drug money laundering vs. legit transfers).

A few years ago we were all complaining about how the prosecutors were settling for piddly amounts out of court without an admission of guilt. Then we were complaining about how the admission of guilt was only for civil infractions and no criminal charges were being sought. Then we were complaining about how no individuals were being held accountable. We now have fines, criminal charges (that stick), dismissal of individuals responsible, and the potential death blow of lack of access to dollar clearing services.

While I agree there is still a lot further to go (I’m still waiting for perp walks), I think we should realize that we’ve come a long way. It takes a long time to turn around a regulatory environment that for decades has been all about coddling and protecting banks. And within the limits set by current (and craven) Justice Dept. thinking (no TBTF bank should fail due to regulatory actions), I think the prosecutors have to slowly ramp up their actions while showing that it won’t cause a bank failure. For example, I suspect the reason for only a temporary revoking of dollar clearing services is to see how much it affects the bank. If the bank doesn’t fail (for whatever definition of failure the SEC defines for TBTF banks), then I’m expecting longer and harsher penalties for future prosecutions.

I wouldn’t have said this a couple of years ago, but I think we may finally have a few guys like Lawsky and Bharara who deserve our support for just how far they’ve pushed SEC and justice dept bigwigs (I’m looking at you Schapiro and Holder). Here’s hoping they continue to push further until, you know, someone actually finally wears an orange jumpsuit. Orange is the new black, after all :-)

Almost forgot: and they managed this much despite personal lobbying from the French PM?? I think you unfairly discount how difficult it is for civil servants to stand up against that kind of pressure.

No, this is all a function of it being a Congressional election year when the Dems are in trouble. The JPM settlement which everyone got excited about was mainly a FHFA settlement which the DoJ cleverly rolled into a bunch of other settlements to get the #s looking bigger. Jamie Dimon got off extremely well in that one. Ditto BofA. That bank would have been bankrupted a couple of times over with any proper settlement. They paid cents on the dollar and are still engaging in horrifically bad servicing, even going out of their way to pointedly defy new requirements like single point of contact (which we thought was misguided, there were better ways to solve that problem, but the rules are the rules).

The only meaningful precedent in this settlement (and this is significant) is that a bank is being cut off of dollar clearing. But the issue is defying the US on its use of economic sanctions. The US is getting really tough ONLY when security state issues are involved, not other banking abuses.

Exactly.

“That bank would have been bankrupted a couple of times over with any proper settlement.”

When have you ever known a board of directors to agree to a settlement that would take the firm into bankruptcy? The impulse at that point is generally to make the opponent prove it.

Um, that means the officials should have demanded much tougher sanctions, including:

1. Removal of current board and much of senior management

2. Much much tougher behavioral changes

3. Debt resturcturing

Or in lieu of 1-3

4. Resolution.

4 is the threat to get 1-3.

The point is that with the massive liability involved, you do not settle. You dictate. Hank Paulson, for all his faults, understood that well. He put both Fannie and Freddie in resolution. He made it clear it was not negotiable and he would do it the hard way if they fought.

Exactly right, Yves.

The government takes its cut of the criminal enterprise. BNP will probably get a stern reprimand, laugh, and then adjourn for lunch at Morton’s.

Being a corporate “people,” I wonder if these folks could be drawn and quartered.

Another way to look at these fines they are not just targeting any foreigners, but specifically European interests. Europe has a track record of in turn fining American high tech companies. A few of our high exalted, self-absorbed Commission heads, like Redding take narcissist glee when rulings are handed down on the likes of Google. However, Americans seem to have the upper hand on bigger cash disgorgements. I suppose the perennial “bigger is better” juxtaposition is a way to demonstrate ones superior manhood.

Like Washington, Brussels is trying to project global power and does what it can to upstage the Americans. For example, the €200 and €500 notes did not come up by accident. They were designed to compete against the $100 note and to compete for the

lucrativedark money that floats around the world. Yes, to compete for the global tax evasion, money and drug laundering business.Sadly, these euro notes are used extensively to undermine tax collection in depressed countries like Spain. You have a big job? You don’t pay by wire transfer but with €200 and €500 notes. Everyone knows the drill. We call the €500 note OBLs, because they are never seen and are used for dark work.

Tit-for-tat economic and political gamesmanship between Brussels and Washington is standard fare.

So, is the U.S. justice system xenophobic, or not? :)

Or BNP could have lobbied for a presidential pardon, March Rich style?

Interestingly, Bank of France governor Christian Noyer had already warned that these sanctions on dollar clearing by a non-American bank might lead to a shift away from the dollar in international transactions.

He appealed for companies all over the world to start doing transactions in euro, renmibi and other currencies in other to overcome this kind of political risk.

So it does look as if this fine, coming shortly after the recent U.S. court decision on Argentina’s debt (widely seen as unfairly favoring American hedge funds likely at the expense of the good name of New York as a center for sovereign debt emissions) may ultimately contribute to the undermining of the U.S. position as the world’s financial hegemon.

Quite right. When even so-called allies can find themselves severely sanctioned for violation of an extraterritorially-projected U.S. law, then they have an urgent incentive to diversify out of an inherently risky politicized currency. Thus, the dollar’s shrinking share of global reserves.

This process is particularly tricky for Europe since much of it is still occupied by the U.S. military 69 years after hostilities ended. Polish Foreign Minister Radoslaw Sikorski, who was quoted on a wiretap describing his country’s security relationship with the United States as “worth nothing,” gets it. But the rest of Europe is still fulsomely admiring the naked emperor’s fine clothes.

That’s going to start shifting if things go on like this I think. It was one thing under Bush, but we sort of expected that with a new administration the US would get more balanced, and frankly, sane, but it hasn’t really happened, and with the noises Clinton is making there’s not much confidence things will improve much if she gets in. Plus the likelihood things will get worse if the other lot win. Very few people in Europe wanted the Ukrainian sh*t storm to kick off like it did. Syria too.

The Polish have been amongst the very strongest adherants of a pro-US policy, and if they’re getting sick of it, then the Germans and French will be seething.

I can’t help thinking of the Peloponnesian war, when Athens and her allies took on Sparta and hers, and had the best of the early rounds. However, the democratic, trading empire Athenians ended up alienating her allies to such an extent they began to abandon her, and in the end military overreach defeated her.

This is a spectacularly dumb-sounding question but I know of nowhere else to ask it! What will this mean for Americans abroad who bank at BNP? I’m renegotiating my mortgage at BNP Rives de Paris and I keep waiting for them to tell me, oh, sorry, we can’t work with you after all, nor accept all those foreign wires (ie, money from my American clients) because they’re in dollars. Sorry I know this conversation is much more macro than all that but I wonder if it will have on the ground retail consequences for the wee folk like me, in ways other than the typical, “pass the fines onto the customers…” I don’t even want to bring this up with my potential future banker.

They will do business as normal but use correspondent banks, which will cost them more.

Geez, so why don’t these non-USA banks just hire JPM CEO Jamie Dimon for USD$100M/year? He could save them so much money!! (never mind the whaling fees).

How much of BNP activity involved washing US citizens’ tax-evading funds?

That is the only arena that deserves sanctions and fines.

The rest is pure super-mercantilism on an unprecedent scale. I’m surprised that the commenters on this site don’t see that. This move has nothing whatsoever to do with cleaning up the banking system.

Does the US government ‘own’ the US dollar, a global currency? No.

Frankly, the French, if Hollande et. al. weren’t so gutless, should be pulling out of the trans-atlantic free trade (sic) negotiations. Europe in general should pull the plug. It should have done so already over the NSA sping disclosures.

Does PNB really need to pay a correspondent bank?

Is there anything to stop BNP from setting up a wholly-owned subsidiary to act as middleman for those dollar transactions, and just transfer a few staff – on paper – to handle the chore? Would our regulators catch on? Or care?

Oops. Maybe nobody will notice the dyslexic acronym above. Like I didn’t.