By Philip Pilkington, a writer and research assistant at Kingston University in London. You can follow him on Twitter @pilkingtonphil. Originally published at Fixing the Economists

A recent post by Lord Keynes inspired me to write up some very general thoughts on the state of mainstream economics. Today, I believe, mainstream economics is completely incoherent. What do I mean by that? Well, basically if you are in the mainstream you can pretty much believe in whatever you want these days.

Mainstream economics today can be made to say anything. But in being able to do this it says nothing. All the new gimmicks that have been introduced into the mainstream — from asymmetric information to rational expectations — have rendered it a total free-for-all. So, some of the mainstream will tell you that fiscal stimulus will have zero effect on the economy (Ricardian equivalence) while others will tell you that it is the key to future prosperity. Many will fall somewhere in the middle, unable to articulate their actual beliefs in any concrete manner.

In my experience the mainstream has become so incoherent that most of the time these economists will formulate their policy stance completely arbitrarily. Their opinions on the real economy are formed very much so the way the man in the street formulates his: either by assimilation of whatever is in vogue or by engaging in largely arbitrary construction (usually in line with the political predilections of the person in question).

How did this occur? I would argue that there were two key moments in the history of mainstream economics that led to this Great Unwinding. The first was the Cambridge Capital Controversies (CCCs). The results of the CCCs led to a fracture within the more pragmatic side of the mainstream. The object of attack in the CCCs was the standard marginalist production function. The production function sought to show two things. These were as follows.

(1) That the distribution of income in a market economy would be dictated by relative productivities of labour and capital. In more straight-forward terms that means that labour and capital get what they contribute.

(2) That market economies are inherently self-stabilising in the long-run. While planned savings and investment might diverge in the short-run causing unemployment or inflation they would equalise in the long-run. This avoided what came to be known as ‘Harrod’s knife-edge’. Harrod maintained that capitalist economies were inherently unstable in that planned savings and investment would only equalise by a fluke. This implied that continuous and vigorous policy intervention was required to stabilise a capitalist economy. (For more details on Harrod’s knife edge see here and here).

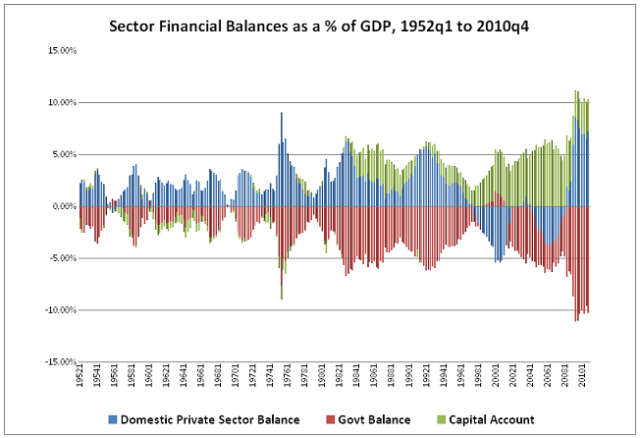

I think that Harrod was right. If you look at really existing capitalist economies government deficits are required to keep them ticking over most of the time. Take a look at the sectoral balances of the US below if you don’t believe me. Government deficits are clearly used almost constantly to offset private sector savings.

Government intervention to stabilise the economy when savings and investment diverge is the rule, not the exception. There is no ‘long-run’ process of adjustment. Otherwise we would see a balanced government budget in the long-run. We don’t. Not even in the 1950s and 1960s when there was no substantial current account imbalance (i.e. in what effectively amounts to a ‘closed economy’).

What the CCCs showed was that the marginalists could not even prove that a market economy was self-stabilising in the long-run in theory. This led the marginalists to retreat into ever more abstract and out-of-this world constructions. While the production function and the Solow growth model that grew out of it were at least somewhat realistic — that is, you could at least imagine applying them to the real-world — the general equilibrium models and later the microfounded models that came after them were blast-into-space unrealistic.

Solow himself noted this in his Nobel Prize lecture (he won the prize for his flawed work showing that the economy was self-stabilising in the long-run… which shows what passes for Nobel Prize-winning ‘science’ in mainstream economics). I will provide a long quote here because it is important to show how Solow felt about the tendencies generated in economics in response to the CCCs.

The end result [of the new highly abstract constructions] is a construction in which the whole economy is assumed to be solving a Ramsey optimal-growth problem through time, disturbed only by stationary stochastic shocks to tastes and technology. To these the economy adapts optimally. Inseparable from this habit of thought is the automatic presumption that observed paths are equilibrium paths. So we are asked to regard the construction I have just described as a model of the actual capitalist world. What we used to call business cycles – or at least booms and recessions are now to be interpreted as optimal blips in optimal paths in response to random fluctuations in productivity and the desire for leisure. I find none of this convincing…

But now I have to report something disconcerting. I can refer you to an able, civilized and completely serious example of this approach and suggest that you will find it very hard to refute. You can find non-trivial objections to important steps in the argument, but that would be true of any powerful macroeconomic model.

There is a dilemma here. When I say that Prescott’s [i.e. a proponent of rational expectations] story is hard to refute, it does not follow that his case can be proved. Quite the contrary: there are other models, inconsistent with his, that are just as hard to refute, maybe harder. The conclusion must be that historical time series do not provide a critical experiment. This is where a chemist would move into the laboratory, to design and conduct just such an experiment. That option is not available to economists. My tentative resolution of the dilemma is that we have no choice but to take seriously our own direct observations of the way economic institutions work. There will, of course, be arguments about the modus operandi of different institutions, but there is no reason why they should not be intelligible, orderly, fact-bound arguments. This sort of methodological opportunism can be uncomfortable and unsettling; but at least it should be able to protect us from foolishness. (My Emphasis)

Here you see the Great Unwinding in full force. Solow knew that on their own logical terms the new models were impossible to refute. In order to dismiss them he had to basically say that in his opinion they were unrealistic and also point out that there were a whole multitude of models that were logically consistent but arrived at different conclusions. This is where the debate remains today and it is this that accounts for what I have referred to above as the free-for-all within the discipline. But of course the data shows Solow’s own work not be realistic with respect to the real world. So, the invocation of realism — something that I would generally applaud — inevitably comes back to bite Solow firmly on the buttocks.

This confusion was amplified when the neo-Keynesian policy consensus began to unwind in the 1970s due to the inflation. Into this vacuum stepped Milton Friedman and his monetarism. It was noted many times that there were altogether mystical elements in Friedman’s argument and that it ran contrary to the facts but the profession swallowed it. This was because it gave them a common cause to rally to away from the confusion within the discipline.

The second point at which the Great Unwinding took place was when the monetarist policies failed. I have written about this before in extensive detail and if the reader is interested they can consult that writing for an account of the failure. After monetarism had failed the profession once again slipped into incoherence. Rather ironically, this gave rise to the profession asserting that they had reached a ‘New Consensus’. But they had done no such thing.

Whereas in the 1970s and 1980s everyone was talking about monetary control to stop the inflation, in the 1990s there was confusion all around. Economists became rather obsessed with the NAIRU — that is, the idea of a natural rate of unemployment which if the economy fell below it there would be inflation — but this quickly fell apart when unemployment in the US fell below the NAIRU level and no inflation resulted.

After the crisis of 2008 the incoherence became amplified. Today the lack of consensus and the confusion is shocking. While policy-making economists in central banks and the like have a fairly good idea of what is going on the profession is in complete turmoil. This, I think, accounts for why the chief economist at the Bank of England Andy Haldane and Benoît Cœuré at the ECB are calling for substantial curriculum reform. When I speak to people like Haldane they seem to agree with me that the discipline is in turmoil and has no clear-cut answers to the questions of today. The opinions of the leading lights seem formed arbitrarily according to their political or ideological temperament. (The more progressive elements like Summers and Krugman are scrambling to make sense of the world but in refusing to dump the theoretical baggage they have accumulated over the years their attempts appear weak and unconvincing).

What I have always found refreshing about Post-Keynesian economics is that there is and has always been a strong consensus on real-world issues. I may vehemently disagree with the politics of, say, a Marxist-Kaleckian but it is very likely that we will hold basically identical opinions on practical matters. This consensus exists not only across space but also through time. What I mean by that is that Post-Keynesians rarely change their stances on real-world issues after the fact. This is because they usually get it right first time so there is simply no need.

Because of this you also see a smooth evolution of Post-Keynesian theory over the years. You do not see it wracked by ‘crises’ thrown up by the real-world as you do the mainstream. Rather you see it build upon itself in different directions. While the mainstream have a seeming crisis of faith every five to ten years that calls for a complete shake-up of the discipline, the Post-Keynesians roll calmly from one development in the theory to another.

This is why I strongly support the pluralist movement among students. I believe that if all the options are put on the table the students will likely gravitate toward Post-Keynesian economics for the simple reason that it is the most comprehensive and coherent body of theory available. I am perfectly willing to let students make this decision on their own. It seems that it is the mainstream who insist that only their approach is taught. Their insistence on monopoly is, I believe, a sign of enormous insecurity.

Update: The following paper by Kevin Hoover provides a fantastic overview of the Harrod versus Solow issue as to whether capitalist economies are inherently stable or unstable. Hoover, whose work I have discussed here before, strikes me as very Post-Keynesian in this paper.

Economists are not as good as they think they are. They utter a few things they have a vague idea about and and it is taken as Gospil. Develop a consensus? Forget it.

So, what is fair-market capitalism vs crony-capitalism?

One that puts the wealth of the Nation and populist above all else.

Think pre 1970s when limits were enforced on capitalism.

Primary flaw in economics;

The planet is infinite (supply)

and

Growth is infinite (demand)

equals

We are so screwoomed!

The problem is a Metastasizing Crime Wave. Any analysis of Economics that ignores that is irrelevant. The article mentions neither crime nor corruption.

Restore the Rule Of Law.

There’s a lot more than that going on. Most of my professors in college were not criminals and didn’t have any use for them. That had nothing to do with why they believed and taught the old mainstream BS. It was much deeper and more psychological than that.

“Most of my professors in college were not criminals….”

Faint denial indeed. What college would that be? One of the many that is run with Government money or endowments/trust funds from the Banksters and other Corporadoes? Professors do not need to be criminals themselves; silence is enough.

Myself, I’ll take the ongoing and relentless diminishment of the Rule Of Law as the Number One Problem in the US. See NSA activity as one glaring example. Activity of which any dissident Professor would be acutely aware.

“This is why I strongly support the pluralist movement among students. I believe that if all the options are put on the table the students will likely gravitate toward Post-Keynesian economics for the simple reason that it is the most comprehensive and coherent body of theory available.”

This is like saying that you are in favor of student being taught creationism alongside evolution, because it’s “fair”. Although that might be an unfair comparison, since you did admit in your post that economics is not a science. So I suppose this would be more like teaching creationism alongside astrology. “Economics”, as much as it exists at all, is really only the navel-gazing contemplation of how political factors cause resources in a society to be distributed, which in turn is almost completely dependent on the particular cultural quirks of that society.

Mixing that stuff with math and elaborate monetary theories that purport to explain economics everywhere is really just an exercise in mental masturbation. At best you’re going to get a clunky model, with way too few factors considered (for example, how does resource depletion and/or pollution/corrupt central planning/war/etc affect the model?) of how economies operate, given that they are exactly like our current economy at exactly this point in time–and this model will have no predictive power or usefulness to anyone whatsoever. It’s no wonder the elites have co-opted economics to serve their agenda. You can make it say anything you want it to day, and has the veneer of academic credibility. Even if there were an “honest” economics there would be no way to differentiate it from all the fraudulent kind.

“way too few factors considered (for example, how does resource depletion and/or pollution/corrupt central planning/war/etc affect the model?)”

That is an understatement, to put it mildly. The value of considering financial flows and economic balance is meaningless–or worse than meaningless, as it contributes to deception–if it does not consider the things you mention.

* What good is it if economic “performance” goes up if this means we have no clean water or air?

* What good is it if the tech sector is booming, resulting in consumers addicted to mind-stultifying content and activities, or absorbing EMF frequencies that interfere with healthy cell activity and reproduction, or reducing the number of crucial species to the point where humans can no longer be adequately supported?

* What good is it if economic terms such as “private” do not indicate its distribution, whether that means 10 people, 5 multinationals, or the billions of people in the 99.99%?

“Investment”, “production” and “consumption” are not inherently good or bad–it depends on what is being invested in, produced, or consumed, and what the environmental, health and social impact are, considering the whole life cycle of products / technology / impact on users.

What economists are developing and talking about methods to analyze and compare economic activities, real or modelled, to include factors such as these?

The neoclasssical response to crisis is not only incoherent but shows evey indication of being made up on the fly, which is ironic given their claims of “rigour” in theory and analysis. One confidently informed me that Ricardian-Barro Equvalence does not tell us government cannot stimulate, but rather it cannot stimulate over the long-term. When I inquired as to how long-term is defined in this case I was told that equivalence manifested as nominal spending declined; in other words that stimulus stopped working when the stimulus ended and this was the proof that government cannot stimulate.

We even had a commenter here at NC opining to us that the failure of monetary policy to stimulate investment these past six years proved that monetary policy is effective, because it can only affect such spending “at the margins” and therefore wouldn’t be detectable.

What nobody likes is that there is a fundamental difference between discussing and describing animate and inanimate objects. It’s tough enough to understand how carbon and hydrogen interact (as anyone who has taken Organic Chemistry will attest). Throw people into your mix and good luck. It would be as if every hydrogen atom had a different attractive or repulsive force and a mind of its own. What would happen to Chemistry under such circumstances? Right, it would start to look a lot more like Economics!

It’s great to see Pilkington citing Kevin Hoover, who wrote one of the best textbooks available on Macroeconomics.

As Perry Mehrling has pointed out, Hoover’s text develops theory from facts on the ground, not microeconomics principles in our heads. It connects theory to the real world as documented by macroeconomic data. A pity that it is not more widely used in colleges around the world.

As many have pointed out here on this blog the problem with economics is that it has tended to believe it is a separate discipline from political science thus I prefer the term political-economy rather than “economy.” For example, when the author refers to “market economies” what does he mean? A true market economy would allow me to stand outside my house and sell what people really want–marijuana!

Economies are a function of political arrangements–Walmart thrives, in part, because of laws restricting markets. In my view, most markets are fixed and regulated to provide guaranteed profits for oligarchs. The move is always towards corporations using their power to fix markets in their favor. Thankfully, in areas where profits are low and markets are marginal there is room for people like me to carve out a little niche. But I am competing with the mass marketing of the corporations that know how to get dogs to salivate when they ring the bell–thus my interest in breaking conditioning.

Bet I could pay my monthly rent with dope and BJs…FREEDOM!!!

Can you have markets without private property? + Can you have private property without the state (force-based guarantor of property)?

Ergo:

Can you have markets without the state? –> Can there ever be such a thing as a ‘free’ market?

As you imply, we cannot study the ‘market’ as a distinct phenomenon. It is a component of the state, an outgrowth, an arena/mechanism for trading private property, a process that serves the elites rather than the hoi polloi, and thus helps preserve the state’s pyramidal structure of top-down rule. What all this might have to do with ‘fixed’ and ‘rigged’ is far less important than recognising the logical (and to my mind now as good as inseparable) bond between state, private property and markets/money. As I have some to see it, market and state are social phenomena that are manifestations of civilisation, in that they organise / make more efficient the ongoing exploitation of nature, or rather the transformation (taming) of ‘untamed’ nature into commodities in pursuit of ‘profit’. This tends to perpetual growth for a whole variety of reasons, and looks like it one of the reasons why civilisations outgrow their environment and collapse. In other words, they don’t know how to stop growing. Perpetual growth is what they are about, fundamentally.

Perpetual growth is a requirement with this political-economy and has to be more than the growth in population by several percentage points because, since almost every enterprise is sustained on borrowed money, the interest must be paid. Currently we are not growing fast enough to meet the interest which is why long-term growth without debt forgiveness is not possible.

An economic model should incorporate every single variable in our universe. Something we can not do. Until then, the best we can do is we create models that focus on a few variables and pound on them until they are so distorted that we need to look for other variables to pound on for another few decades.

Since the war, all economic recoveries have been focused on housing… Build them, fill them up and put cars in the driveway. Debt-to-income went from 0 to 165%. Suddenly, we end up with a generation bulge with too much debt and real estate at retirement looking to flip to over-indebted young ones.

What Banger said: political-economy. There’s no science in either, as far as I can tell.

Main Street had seen little relevence with Wall Street until recently. “Political economy” seems to effectively describe the Federal nature of intervention in the markets without which local banks would still be beholden to their depositors and loans and interest rates would reflect local reality/politics where, of course, one size does not fit all!

When nearly everyone is mad, then madness becomes the norm. And the few sane are branded as crazy. We have gone through the Looking Glass is my humble opinion.

I have tried to understand economics. I have taken a class, I have read many books, including Paul Krugman’s 940-page textbook, and it just does not make sense to me. Max Tegmark is from Denmark, and like many of us he made a stab at picking a career when he graduated from high school. Here is what he wrote (emphasis added):

Tegmark decided to become a physicist and is author or coauthor of more than two hundred technical papers, twelve of which have been cited more than five hundred times. He holds a Ph.D. from the University of California, Berkeley, and is a physics professor at MIT. I applaud Tegmark’s wish to make “our planet a better place,” and I agree with his description of economics as being “a form of intellectual prostitution.” I wish I had thought of it.

Another scientist, more famous than Tegmark, was Albert Einstein. He shared Tegmark’s wish to make the world a better place, and he believed that the economic scourge of capitalism produced more evil than good. He was inclined toward socialism which is a dirty word in America today, but based on my reading of his views, I think he was more inclined toward any system that obeyed the will of the people. In any case he wondered if the field of economics would be useful in designing a government of the future. In 1949 he wrote:

So, for anyone out there who thinks economics is a science, I will be happy to debate it with you. However, your quarrel is not with me—you really should take it up with Max Tegmark or Albert Einstein.

If economics is a science then it is at the stage of searching for its Galileo.

I see economics as a subset of politics but mainly as a form of literature. For me, much depends on how it is written. My favorite economist to read is John Kenneth Galbraith because he wrote charming prose and presented economics to us in a sensible and relatively jargon-free way.

Fiction or non-fiction?

How long will it take to unwind ourselves? Nice to have the internet so everybody can become contrite simultaneously. And why is it we cannot conceive of our existence without profit? The best solution would be to print up so much money that nobody needs it, flushing all societies with money sufficient for anyone to buy anything and keep flushing it in even when inflation takes off, as it surely will for a while. But more money can douse inflation. Easy. And just keep up this insane sounding economic therapy until everyone forgets the last 2000 years of war.

Currently I’m ploughing through the paperback condensed version of Robert Skidelsky’s biography of John Maynard Keynes and much of what Philip Pilkington is saying in this article Robert Skidelsky has attempted to say in the book chapter entitled “Firing at the Moon” where he attempts to weigh up the importance of Keynes break with Classical economics with his publication of “The General Theory…” In reading Skidelsky’s perceptive comments I couldn’t help but think that Keynes break with the Classical economists was a the outcome of a gradual movement away from seeing money simplistically as a commodity and seeing it as a relationship or rather a set of interwined relationships. Post-Keynesianism and particularly the work of the MMT theorists seems to me to be a coherent addition to understanding those inter-relationships in our use of money. When you are hell bent on being a Gangster Capitalist you really don’t want to hear such explanations of money’s inter-relationships because the adverse effects of your behavior on society by ignoring such relationships make you feel like a clumsy oaf when you want the reputation of a Lord of the Universe. How much better to pay some not so perceptive and scrupulous economists to justify your unthinking money as a commodity based rampage through the world!

+100

Economics is inherently hopeless. All theories are nonsense.

To reconstruct a credible economics from scratch you should:

1) Look at the natural world. It contains minerals, plants, and animals interacting in complex and largely (though not universally) self-sustaining ways, with cycles on vastly different time-scales. This is the primary economy.

2) Look at how humans tap into this–sustainably or not–to divert materials and energy for their own life and use. This is the secondary economy. The secondary economy is itself part of the primary economy: Its effects feed back into the natural world for good or ill. In the West we call these feedbacks externalities and refuse to think about them. All peoples who are successful over long time-spans give externalities at least as much weight as “useful” life activities.

3) Look at how symbols and markers (money, contracts, credit, derivatives–including all of what is called finance) are created to manipulate the economy of human activity. This is the tertiary economy. In the West we have created a tertiary economy that is inherently unstable, as if this were a virtue. But that is not the main problem.

The main problem is that our Economics believes the tertiary economy creates the secondary and primary economies, in that order. Reality is the exact opposite. The tertiary economy can effect the secondary economy but controls nothing. And it is the primary economy–not the tertiary economy–that makes human life possible.

–Gaianne

Great comment.

I agree, wonderful commentary. I vote you as one of many in the hopefully near future that could structure our new model of economy.

The basic laws of Keynesian Economics:

1. Supply and Demand (this includes demographics)

2. If a person starves to death even though there is plenty of food available, because they can’t afford to pay themselves enough to pick up the food, they are insane (generalize to societies).

3. If it is physically impossible for something to occur, it won’t (changing the relative rate of taxation on capital gains be damned).

The basic laws of Neoliberal Economics:

1. Everything is always guaranteed to get better and better, even if it is obviously getting worse, Because Markets! (Can I have my check now?)

More on the insecurity of the ‘mainstream’ neoliberal economists here:

http://globuspallidusxi.blogspot.com/2014/05/economics-is-to-economy-as-alchemy-is.html

“The opinions of the leading lights seem formed arbitrarily according to their political or ideological temperament”

You don’t say.

What is economics about? Or, what is economics supposed to be about?

It’s supposed to be about well-being for a society. The study of it, at any rate.

That seems a bit vague. It could mean economics was about public health, or education, or the proper religion, or any of a variety of things. I have been trying to figure out what economics is specifically about in the sense that biology is about living organisms, or certain aspects of living organisms, anyway. If we knew what economics was about in this sense, we could determine whether anything anyone was doing was accumulating knowledge, or solving problems, or whatever we think it ought to be able to do. So what are we working with, or on, when we’re doing economics?

Just my approach, but the study of economy should strictly be concerned with the efficient use of resources (i.e. it should be strictly materialist). Under that definition we are doing a horrendous job. Other disciplines can concern themselves with social relations, identity, politics etc. This approach is the only way I see our species surviving in the long term.

An Alternative to Capitalism (since we cannot legislate morality)

Several decades ago, Margaret Thatcher claimed: “There is no alternative”.

She was referring to capitalism. Today, this negative attitude still persists.

I would like to offer an alternative to capitalism for the American people to consider.

Please click on the following link. It will take you to my essay titled: “Home of the Brave?”

which was published in the OPEDNEWS:

http://www.opednews.com/articles/An-Alternative-to-Capitali-by-John-Steinsvold-130326-864.html

John Steinsvold

“We have met the enemy and he is us.”

Pogo quotation by Walt Kelly.

Marx had most of economics as we currently practice it figured out quite some time ago, and it hasn’t really changed except for jargon (in place of “methods” or “mechanisms”) and technology (neither have done much to alter the ideology of Capital). I know people cringe when they hear that but I have yet to come across anyone who has clarified our economic system better (no Piketty does not count, he is part of the problem). If he had included a thorough critique of economy as it relates to ecology he would have had a complete overview of our economic model and its effects on environment and society. Every accepted and empowered economist since Marx has been both influenced by his revelations (more like stating what everyone already knew) and a reactionary agent against those revelations. Keynes gave Capitalism a human face to little avail and at the expense of the environment, while Mises was just ignorant (he is about as intellectually compelling as Ayn Rand). Inject all other economists in the Capitalist paradigm and its the same story. They will discuss everything within the system but never step outside of it and critique it in its entirety. Marx told it straight and he did it as meticulously as possible. Most important, he recognized the economy as a political-social system not a scientific one. It is no wonder that his analysis is the closest to a scientific one as could possibly be done since it recognizes the system for what it is. The same can be said for all subsequent “Marxists” after him. They just “get it” in a way our modern so-called pragmatic economists don’t.

I like this website. I cannot, however, catch up to the more advanced discussions. Suffice it to say, though, that I am more educated in the basics of economics than many average people. Therefore, I guess you could say that I am making an argument based on public understanding, rather than the more complicated models of famous thinkers.

From a purely peasant perspective, I find much of the public economic debate and analysis to be largely amorphous, at least in the sense that they spend far too much time philosophizing about economics and don’t like to get down to specifics very often. Many Youtube videos offer up Economics 101 as a way to explain the virtues of capitalism, but capitalism is far more than just market choices. It is money-as-debt, compound growth, and the stock market.

Missing from the debate is how, for instance, money is a driver of our very activities as a society, so if money is debt, society must always be in a fevered frenzy of activity and this debt is making us all sick. Correct me if I’m wrong though, I would love to have someone prove that my statement makes no real sense, whatsoever. Sure, Mises proved that money ‘should’ only come into existence as debt, as a way to measure it correctly, but sometimes I feel that it creates more problems than it solves. Bankers say it’s just good accountancy, but it also gives them a good excuse to continue to be a burdensome middle man for our monetary transactions. I would almost rather see banks meld more closely with businesses, like, become integrated in the very heart of them, in order to limit the cost of the industry. Could be dangerous, could be interesting, I could also be crazy for the idea, but again, it would be interesting to have any of you offer some kind of response to this.

I also hear not that many people talking about the problem with corporations in the first place. In the Wikipedia entry, “The Modern Corporation and Private Property,” which was written a long time ago, it threw out the idea that the corporation is inherently immoral, since it offers up to people fruits, in terms of money, which they have not labored for. I agree. If the only thing that you have to offer a corporation is money you have already earned, you really do not bring much of value at all. And also in my opinion, the stock market is truly only useful in an era of limited capital. We don’t live in such an era. In the context of all of this, what can you call capitalism and the stock market then, other than a primitive way of controlling inflation? There are caveats to the virtues of this type of investment, but the idea is basically true, in my limited view. Proudhon, an anarchist, stated that unearned income, (interest), should be illegal, and Buffet also asked innocently, “Can’t we have a system that isn’t based on interest?” These are systemic questions. Most economists don’t offer arguments based on the very fundamentals, and that troubles me.

Also, there is not much effort to explain to people what the difference between socialism and capitalism is.

Many people may have different views, but the idea to me is that socialism largely encompasses non-performing assets, (which do not generate much if any money), and capitalism is something that should be relegated to production activities. Problems arise in a lack of this kind of understanding, and also in trying to throw capitalism into all aspects of society, under the banner of the philosophy of the tragedy of the commons. Neo-liberalism has eviscerated the idea of much of American community life under that idea alone.

So you see here that people would already be better-served if they saw economics in terms of naked accountant terminology, rather than a philosophy of market choices. Non-productive assets, to me, are assets that Karl Marx thought could be created by communal wealth-building activities, without the need for money even, but the point, at least, is to create that exact distinction in people’s minds, so they can more coherently make logical choices for themselves.

But maybe the economic juggernauts understand all of this and way more than I will ever understand, but they don’t find the time to talk about it all. And we are all left worse off because of it. I could spend more time throwing out my thoughts, but I wanted to keep it shorter. Maybe if I don’t come across as crazy and uneducated to you all, I will make the effort to say more, but I think that in the interests of the political aspect of political-economy, all views from everyone affected should be valid.

Some really excellent comments have been written here. I like to contribute to the discussion from another angle.

Any system that organizes society carries the seed of its own destruction in itself; this for the following reasons:

1. Those that benefit from the system excessively will ensure with the gained power to fester it and as a result increase their own power further until a totalitarian status is reached or until the population rebels.

2. Policies that seem to benefit a certain group of the population will over time become unsustainable due to the reflexivity of the subjects’ behavior.

From my point of view, we should embrace instability and decentralization of power simply due to the fact that stability and power concentration enhance the above developments.

Marx’s answer to the question, “who controls the means of production?” was, “the workers”, or maybe it was Engles. Anyway, as Gaianne points out so clearly, it’s the Earth – and I add, the Sun. They were here before us humans, and they will endure our “… hyper-magical, ultra-omnipotince … ” (E.E. Cummings) and continue to create and produce long, long after we have bit off our own face. Humans have, at times, here and there, had the sense to live in accord with the Earth Sun and Moon. Our modern regard for our abilities to control everthing seems quite … reasonable … as it seems to have worked out pretty well, untill it didn’t. Of course it is still working out better than ever for a few physcos who mistake luck for merit. They are confirmed faithful believers in control, they are surrounded by believers and acolytes, and if they can’t control it, they aren’t interested, though time will eventually take “their luck” away. Economics is just another way for humans to try to control their world, though who can even control themselves?