By L. Randall Wray, Professor of Economics at the University of Missouri-Kansas City, Research Director with the Center for Full Employment and Price Stability and Senior Research Scholar at The Levy Economics Institute. Originally published at New Economic Perspectives

Our Mission Oriented Finance conference explores how to direct funding toward what Hyman Minsky called “the capital development of the economy”, broadly defined to include private investment, public infrastructure, and human development. (See more here.)

But to understand how, we need to understand what money is and why it matters. After all, finance is the process of getting money into the hands of those who will spend it.

The dominant narrative is that money “greases” the wheels of commerce. Sure, you could run the commercial machine without money, but it runs better with lubricant.

In that story, money was created as a medium of exchange: instead of trading your banana for her fish, you agree to use cowry shells to intermediate trade. Over time, money’s evolution increased efficiency by selecting in succession unworked precious metals, stamped precious metal coins, precious metal-backed paper money, and, finally, fiat money comprised of base metal coins, paper notes, and electronic entries.

However, that never changed the nature of money, which facilitates trade in goods and services. As Milton Friedman famously proclaimed, in spite of the complexity of our modern economy, all of the important economic processes are revealed in the simple Robinson Crusoe barter-based economy.

Money is a “veil” that obscures the simple reality; in the conventional lexicon, money can be ignored as “neutral”. (For those well-versed in economics, we need only refer to the Modigliani-Miller theorem and the efficient markets hypothesis that proved finance doesn’t matter.)

We only worry about money when there’s too much of it: Friedman’s other famous claim is that “inflation is always and everywhere a monetary phenomenon”—too much money causes prices to rise. Hence, all the worry about the Fed’s Quantitative Easing, which has quadrupled the “Fed money” (reserves) and by all rights should be causing massive inflation.

This post will provide a different narrative, drawing on Joseph Schumpeter’s notion that the banker is the ephor of capitalism.

Looking at money from the perspective of exchange is highly misleading for understanding capitalism.

In the Robinson Crusoe story, I’ve got a banana and you’ve got a fish. But how did we get them? In the real world, bananas and fish have to be produced—production that has to be financed.

Production begins with money to purchase inputs, which creates monetary income used to buy outputs.

As mom insisted, “money doesn’t grow on trees”. How did producers get money in the first place? Maybe by selling output? Logically, that is an infinite regress argument—a chicken and egg problem. The first dollar spent (by producer or consumer) had to come from somewhere.

There’s another problem. Even if we could imagine that humanity inherited “manna from heaven” to get the monetary economy going—say, an initial endowment of a million dollars—how do we explain profits, interest, and growth?

There’s another problem. Even if we could imagine that humanity inherited “manna from heaven” to get the monetary economy going—say, an initial endowment of a million dollars—how do we explain profits, interest, and growth?

If I’m a producer who inherited $1000 of manna, spending it on inputs, I’m not going to be happy if sales are only $1000. I want a return—maybe 20%, so I need $1200. If I’m a money lender, I lend $1000 but want $1200, too. And all of us want a growing pie. How can that initial million manna do double and triple duty?

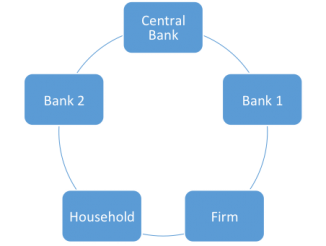

Here’s where Schumpeter’s “ephor” comes in. An ephor is “one who oversees”, and Schumpeter applied this term to the banker. We do not need to imagine money as manna, but rather as the creation of purchasing power controlled by the banker.

A producer wanting to hire resources submits a prospectus to the banker. While the banker looks at past performance as well as wealth pledged as collateral, most important is the likelihood that the producer’s prospects are good–called “underwriting”. If so, the ephor advances a loan.

More technically, the banker accepts the IOU of the producer and makes payments to resource suppliers (including labor) by crediting their deposit accounts. The producer’s IOU is the banker’s asset; the bank’s deposits are its liabilities but are the assets of the deposit holders (resource suppliers).

This is how “money” really gets into the economy—not via manna from heaven nor Friedman’s “helicopter drops” by central bankers.

When depositors spend (perhaps on consumption goods, perhaps to purchase inputs for their own production processes), their accounts are debited, and the accounts of recipients are credited.

Today, most “money” consists of keystroked electronic entries on bank balance sheets.

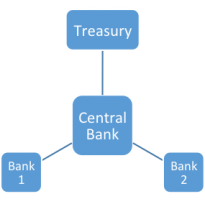

Because we live in a many bank environment, payments often involve at least two banks. Banks clear accounts by debiting claims against one another; or by using deposits in correspondent banks. However, net clearing among banks is usually done on the central bank’s balance sheet.

Like any banker, the Fed or the Bank of England “keystrokes” money into existence. Central bank money takes the form of reserves or notes, created to make payments for customers (banks or the national treasury) or to make purchases for its own account (treasury securities or mortgage backed securities).

Bank and central bank money creation is limited by rules of thumb, underwriting standards, capital ratios and other imposed constraints. After abandoning the gold standard, there are no physical limits to money creation. We cannot run out of keystroke entries on bank balance sheets

This recognition is fundamental to issues surrounding finance. It is also scary.

The good thing about Schumpeter’s ephor is that sufficient finance can always be supplied to fully utilize all available resources to support the capital development of the economy. We can keystroke our way to full employment.

The bad thing about Schumpeter’s ephor is that we can create more funding than we can reasonably use. Further, our ephors might make bad choices about which activities ought to get keystroked finance.

It is difficult to find examples of excessive money creation to finance productive uses. Rather, the main problem is that much or even most finance created to fuel asset price bubbles. And that includes finance created both by our private banking ephors and our central banking ephors.

The biggest challenge facing us today is not the lack of finance, but rather how to push finance to promote both the private and the public interest—through the capital development of our country.

That is the main topic of our Mission Oriented Finance conference.

“In the real world, bananas and fish have to be produced—production that has to be financed.”

In the world of finance, that’s clearly true. What’s ignored here is that in the “real world” you get a banana by climbing a tree. The other guy gets a fish by lying quietly next to the stream with his arm in the water waiting for a fish to swim over his fingers.

If you climb back down the tree with more than one banana, and if the fisherman hangs around the stream long enough to get more fish than he immediately wants to eat, you each have a basic inventory of goods for a barter economy.

The other way you get your basic inventory for trading is to go down the road to a distant village and lurk quietly until you see a horse is not carefully guarded.

None of this needs a banker to make anything happen. If you are hungry, you climb the tree. If you are not hungry, you hang around the home tipi and help the kids guard your own horses.

You could carry this silly analogy in a lot of different directions, such as where someone makes you a deal where he winds up “owning” the banana tree and where he winds up “owning” the creek with the most fish.

Back in the old days, it never occurred to anyone to invent a Collateralized Debt Obligation backed up by fish that had not yet been caught – but that is probably because the people of those times were too primitive to have invented finance.

But with just a little imagination, the guy who went down the road looking for horses could have had a much easier life as a banker.

And there is still another way of everyone getting both bananas and fish — it is called sharing. It is simple b/c it involves no keeping track at all. My, admittedly not scientific, hunch is that ‘barter’ was only between strangers; friends and family, fellow villagers, tribesmen, neighbours, whatever, simply shared.

Well, my unscientific belief is a) there never was a barter economy, at any time, at any place, so these fables are tales for children, and b) barter exists between friends and family, not strangers. F&F know the cost and worth of exchanged items, strangers don’t, so they would want an independent means of evaluating on item.

“In the real world, bananas and fish have to be produced—production that has to be financed.” In the world of finance, that’s clearly true. What’s ignored here is that in the “real world” you get a banana by climbing a tree. The other guy gets a fish by lying quietly next to the stream with his arm in the water waiting for a fish to swim over his fingers.

Production doesn’t have to be labor intensive. And I think you have things a bit backwards. In the real world someone is paid to climb the banana tree. Grabbing one and trading it for a fish is relegated to academic texts, it is not and has not been a typical feature in human societies.

If you climb back down the tree with more than one banana, and if the fisherman hangs around the stream long enough to get more fish than he immediately wants to eat, you each have a basic inventory of goods for a barter economy.

Barter economies are theoretical. Not one as yet has been identified by historians or anthropologists.

Barter economies… e,g, Adam and Eve… apple [monies]… caveat emptor… squared~

Would God be the ephor here, or the Serpent? One actually produces the “product,” the other facilitates the “trade.”

Bank of Amsterdam, was possibly the first central bank was set up to eliminate barter.

“To remedy this situation, the Bank of Amsterdam was originated in 1609. The Bank was to facilitate trade, suppress usury, and have a monopoly on all trading of specie. But the bank’s chief function was the withdrawal of abused and counterfeit coin from circulation. Coins were taken in as deposits, with credits, known as bank money, issued against these deposits, based not on the face value of the coins, but on the metal weight or intrinsic value of the coins. Thus, a perfectly uniform currency was created. This feature of the new money, along with its convenience, security and the city of Amsterdam’s guarantee, caused the bank money to trade at an agio, or premium over coins.( The premium varied (4 to 6 and 1/4 percent), but generally represented the depreciation rate of coin below its nominal or face value.[3]”

http://wiki.mises.org/wiki/Bank_of_Amsterdam

The Bank of Amsterdam like all private banks depend on the taxpayer (government), because they fail, which makes our present system of paying to use our own currency ignorant.

“The Bank of Amsterdam (Dutch: Amsterdamsche Wisselbank or literally Amsterdam Exchange Bank) was an early bank, vouched for by the city of Amsterdam, established in 1609, the precursor to, if not the first modern central bank.[1]

Along with the last decade of the Republic of the United Provinces. In 1790, the premium on the Bank’s money disappeared, and by the end of the year it had declared itself insolvent. The City of Amsterdam took over the control in 1791. After the creation of the Kingdom of the Netherlands in 1815, the bank was then finally closed in 1819.”

http://en.wikipedia.org/wiki/Bank_of_Amsterdam

I agree with Ben Johannson, you can’t argue that something that has ever been known to exist provides the theoretical basis for your arguments. That’s just nonsense. Ronald Reagan said that an economist is someone who sees something in real life and then sets out to prove that it is theoretically impossible. It appears that the opposite is also true. Money is anything, with emphasis on anything, that one is willing to accept in exchange for his or her goods or services. It is simply an IOU and can be created by anyone. The only issue is that anyone must be someone who can make the seller of goods and/or services accept it in order to make the exchange. Bitcoins come to mind. When the State of California is unable to pay its bills because of the budget mess there, employees are paid with state IOUs that are accepted by many, including some banks. I could go on. Any other definition merely reinforces the punch line in an old joke about economists regarding how to cross a river with a dangerous current: Assume a bridge.

‘Grabbing [a banana] and trading it for a fish is relegated to academic texts, it is not and has not been a typical feature in human societies.’

Ben’s vividly invented history reminds me of another mythical tale that seemed entirely plausible to a pimply 18-year-old:

Well you know in the old days

When a young man was a strong man

All the peo-PLE — they stepped BACK

When a young man wa-alked by …

Yeah, I remember them days! All the middle-agers and greyhairs, respectfully scraping and bowing whilst clearing the way for my youthful personage. With a slight nod of the head, I’d acknowledge their accolades, rapping my diamond-studded walking stick on the pavement for emphasis as I passed.

And so it is with Wrandy Wray’s alternative creation story, of money birthed fully-formed, immaculate, by bankers. The reality, of course, was that gold miners created money with the sweat of their brow, enabling derivative professions such as banking and prostitution. Fiat currency is merely a fetish object for the secular religion whose sacrament is licking bankster bollocks.

I was thinking along the lines of some Divine Monetary Intervention creation myth as well. A long time ago, the first time when 2 hominids had a large harvest on the same day they looked at each other and said “Hey, I could never catch that many fish.” “I could never climb high enough to get that much fruit. If we both had some of each others’ bounty, our own meal would be so much better. How’s that sound?” At that moment, the Bankster Deity of Free-Marketry appeared in a flash of light and commanded “Halt! Thou shalt not exchange goods without first determining the value of each item relative to a completely irrelevant object.” They realized their folly and no one traded any goods/services until a well established monetary and banking system was in place, saving themselves from total annihilation.

Money began with governments, as you’ve been told a million times. But feel free to outright lie; it has become a feature of your prose-vomiting onto the internets.

“Money began with governments”

Ooops, A sliver of naked truth.

Needs some dressing…….. like….

for 2500 years, all that Guv-money had zero debt attached to its issuance.

Thus ‘money’ is obviously not ‘debt’, but strictly a legal, social construct.

And you hold Mitchell-Innes in high regard…….why?

Is it because the bankers introduced double-counting….. and the world has not been the same since?

Jim Haygood: The reality, of course, was that gold miners created money with the sweat of their brow, enabling derivative professions such as banking and prostitution.

Credit, money and banking are far older, millennia older, than any monetary use of gold, any use of gold at all. Wray’s story is the one held by anthropologists, archaeologists, historians, numismatists and sociologists, all disciplines with standards higher than economics today. Commodity money, gold as money is a fairy tale of bad economists. If you think different, tell me what millennium BC evidence for gold miners creating money is from. The deeper problem is the category mistake of thinking that money is a thing, a commodity, rather than a social relation of credit=debt.

Money, as a universal means of exchange is a socital relationship, that of credit and debt, of a commercial nature.

The nature of money has nothing to do with credit and debt until it is accumulated as capital (privately owned exchange media) for lending purposes, and later bastardized by the gold-merchants into fractional lending……..where debits and credits are ledger-entried to the books of the lenders and borrowers.

Been that way ever since.

Can never figure why MMT thinks this is a good idea..

Or why you think it will fund the JG.

“Fiat currency is merely a fetish object for the secular religion whose sacrament is licking bankster bollocks.”

Here’s an interesting exchange you might have read about in Luke 20:21-25:

21They questioned Him, saying, “Teacher, we know that You speak and teach correctly, and You are not partial to any, but teach the way of God in truth.22″Is it lawful for us to pay taxes to Caesar, or not?” 23But He detected their trickery and said to them, 24″Show Me a denarius. Whose likeness and inscription does it have?” They said, “Caesar’s.” 25And He said to them, “Then render to Caesar the things that are Caesar’s, and to God the things that are God’s.”

What were the consequences of not rendering to Caesar? Even JC himself recognized what creates demand for Fiat currency. All the sophistry that you can muster isn’t gonna change it.

“Barter economies are theoretical. Not one as yet has been identified by historians or anthropologists.”

Correct, beyond the absurdity of setting relative value barter does not scale in either the time or distance domains. How many honduran green bananas is a dry bulk container ship of australian bauxite worth? How about if the bananas are going brown?

What should the minimum wage in green bananas be for the serf loading the banana boat? It there a minimum wage scalar from green bananas are gone and just the one w/ brown spots are available to complete the barter exchange

Thanks for making that point. The enormous difficulty of determining equivalence of value with no standard metric makes barter exceedingly difficult to manage.

Not so fast.

Yes barter economies don’t exist in history – but how do you know?

We know that the earliest forms of civilization just some form of monetary system. But we know this because they kept records detailing the transactions or even setting out the laws that governed those transactions.

But bartering is absurdly simple, trading one thing for another. No records or third person is involved. Two cave men trading a fish for a banana would not leave any evidence for us to observed, either in the archeological record or even today.

But you can’t say barter doesn’t exist, and you certainly can’t say that barter can’t exist. The best you can say is that a complex economy has never been built using a barter system.

But barter dose exist, the most famous example being the “purchase” of Manhattan for about 60 gilders worth of goods (Worth $24 to $1050 US, depending on how you calculate inflation).

This is typical fiscal centrism at work. If money isn’t involved – we dismiss it out of hand. Barter by definition – doesn’t involve money, there for it is dismissed as theoretical.

This becomes more relevant when you ask what preceded the use of capital. Surly money didn’t always exist. The most likely precursor would be the collective, where every one produced for the tribe and was provided for by the tribe. Native Americans when contacted by Europeans had no concept of ownership and thus the concept of money in its totality was an alien concept. Yet tribal life existed without money. How can this be? It’s also widely believed that this mode of economics dominated much of human development, especially during hunter/gathering and early agriculture. Small tribes today can even be seen sharing resources and labor tasks.

How does modern economics deal with this?

Well I can’t speak for every one, but I have seen some dismiss this as impossible, or arguing that some other form of non-capital/capital was used. There is a Librarian comic book floating around that uses “fish” as a form of capital, and later used precise metals. In fact, Librarians insist that this is a superior mode of economics and want to return to the gold standard. This is simply Librarians attempting to impose their definition of “money” onto every one else.

Even Randy Wray is guilty of fiscal centrism. He starts out with:

“But to understand how, we need to understand what money is and why it matters. After all, finance is the process of getting money into the hands of those who will spend it. The dominant narrative is that money “greases” the wheels of commerce. Sure, you could run the commercial machine without money, but it runs better with lubricant.”

What runs better with “money” as a “lubricant”? Here Wray is basically “selling” the role of capital to improve commerce. He then defines commerce for though the banana & fish analogy, arguing that production has to be financed.

Gerard Pierce correctly called this out by pointing out that you “produce” a banana by climbing a tree and you “produce” a fish by fishing in the stream. Why would Wray assume that production had to first be financed before a barter exchange could be made? He then argues (from the Robison Crusoe analogy) that the precursor to modern money was the cowry shell.

Money doesn’t grow on trees, but here it seems money washes up on shore. Thus money always existed. That being the case – how dose Wray connect the evolution of cowry shells to MMT’s argument that money is produced by the state? The logic doesn’t follow.

It doesn’t follow even for Wray as his next example is to jump to the ephor – an agent of the state to spend/create money, and then the roll of the banking system – all without managing to answer his own question – what money is and why it’s important.

It’s a worthy question. But I just have to faint dead away when I see economies like Wray attempt to tackle this question from a fiscally centric point of view.

Of couse barter existed. If I trade my Skittles for your potato chips we’ve bartered. But an econony is all transactions together. In millenia of recorded history not one culture can be identified which fits the mainstream economic description of a barter economy because debt has been ubiquitous; I don’t see a reason to assume it was invented simultaneously with writing. If new evidence emerges I may revise my opinion but new evidence at this point doesn’t seem likely.

It doesn’t appear to me that you addressed “Code Name D” example of American Indians. If theirs was not a “barter” economy, what kind was it?

Is this a semantic debate? Is there a term for sharing/trading that would better fit the “economy” of native Americans?

I use the term Aquarian, but this use doesn’t appear in any of the literature, so that is probably not correct.

Wampum are traditional shell beads of the Eastern Woodlands tribes of the indigenous people of North America. Wampum include the white shell beads fashioned from the North Atlantic channeled whelk shell; and the white and purple beads made from the quahog, or Western North Atlantic hard-shelled clam.

Wampum were used as money[1] by the Native Americans, and were kept on strings like Chinese cash. …etc

https://duckduckgo.com/?q=Wampum

Going to need a bit more than a Google search for this.

It was a debt-based economy just as ours is now. First Peoples around the globe traditionally regulate transactions by a complex web of social obligations; we’re no different, we just use a form of obligation we call dollars, yen etc.

Social obligation is not the same thing as debt. The draft is a form of social obligation, serving on a jury is a form of social obligation. These do not involve debts in any way.

Native Americans did not have the concept of property. Outside that context the notion of “debt” is equally meaningless.

“In millenia of recorded history not one culture can be identified which fits the mainstream economic description of a barter economy.”

I agree, and I already said as much.

But barter is not the only alternative.

It’s my observation that a barter economy preceded a modern one is largely a Libertarian invention because they can not conceive of a world without currency. They seem to argue that money/debt always existed – ubiquitous to use your words. They can only see a world made up of transactions. As you said, “But an economy is all transactions together.”

But we do have evidence that of small tribes simply shared resources and labor tasks – also without the need for debt or capital. In place of the profit motive is the need for simple survival.

Money is important because it helps to facilitate trade which allows for a more complex economic structure, include specialization of tasks and sophisticated management of resources. Wray argues that money is important because banks need it. This in my opinion doesn’t answer the question he himself posed – what is money. And it certainly doesn’t address the barter argument made by librarians.

Answer – money isn’t any thing. It’s literally worthless on its own. Its only value is as a medium of exchange. And the point of the exchange is the necessity of resources for consumption.

Money is a medium of exchange. Wray’s conclusion is right – I am simply saying that how he got there needs to be challenged.

It’s my observation that a barter economy preceded a modern one is largely a Libertarian invention because they can not conceive of a world without currency. They seem to argue that money/debt always existed – ubiquitous to use your words.

There’s a little more to it. The mainstream tells this narrative, that barter came first, then credit and then currency to provide support for the “neutrality” of money; if things happened in this order then it demonstrates the commodity itself is always what is desired and money solely a means to acquire additional commodities, hence Say’s Law:

A product is no sooner created, than it, from that instant, affords a market for other products to the full extent of its own value.

This allows for deployment of multiple fantasies: first, that all capital will always be invested productively (because the goal is always more commodity production) unless government interferes with the process. Investing all capital leads to full employment which means that all else being equal unemployment is impossible. If the country is below full employment this indicates that investors lack “confidence” or that government is skewing the labor market with unemployment benefits and minimum wage laws.

As each of us can only purchase the productions of others with his own productions – as the value we can buy is equal to the value we can produce, the more men can produce, the more they will purchase.

Second, that whatever goes on in the financial industry is irrelevant (because all capital is productively invested and banks exist solely to serve industrial and household needs). This is why all those lovely models economists tinker with had no variables for money, debt or financial institutions.

Third, saving, liquidity preference or animal spirits depending on what you want to call it, can be assumed away. Because everyone is rational (so we’re told) they will behave rationally and invest by loaning their savings to an entrepreneur. So once again markets return to a natural equilibrium as demand for production cannot remain below supply for an extended period of time (no mass unemployment).

Markets are inherently stable, prices instantly adjust and barter is still the dominant form of exchange (with money just a veil over the process); I don’t think it can be emphasized enough how seriously rejection of the mainstream narrative on the origins of money, barter and debt undermines neoclassical theory.

“Money is a medium of exchange.”

Money is what society accepts as form of payment. But the above discussion about money neglects one important issue.

Current Currencies have been created by governments and were originally backed by gold which represents a tangible asset. Therefore, there existed a clear difference between money and credit. Since abandoning the Gold-standard, a kind of a phase transition took place in that the difference from what the average person conceived as money and what was considered to be credit got confused. Now suddenly everything is considered money, whether it is a bond of Greece (that will never be paid back) or actual cash currency.

Now, we have to consider the reason for this development to arrive at a reasonable conclusion. It was an unobserved and well camouflaged power grab by governments to use “money” for supporting their welfare programs in the form of confiscating part of the savings via currency devaluation and as a result extending the life cycle of financial irresponsibility.

Money must contain the service of “store of value”, because otherwise people turn away from it and start to save in other forms (property etc.). I am certain that when the population has the right to vote on the type of money they would like to adopt, the result would be a resounding choice for money that maintains its purchasing power.

But of course, those profiting from the present system are numerous, presently in charge and cannot imagine a world, where they may be redundant as there simply is nothing to manipulate.

You need to unpack the agency behind case by case observations to the loose term “Government”.

skippy… bad habit of some to use that as a bit of a eb’val strawman imo.

“You need to unpack the agency behind case by case observations to the loose term “Government”.”

Well, that will be the day when I am going to analyze the behavior of organisms that have the inherent quality to grow on their increasingly infantilized host like a cancer by bureaucratic means of regulation, control, monitoring etc. so that the host (population) is conditioned to believe that there is no life without the parasite.

Thank – you – for prime example – conformation of the self inflicted ignorance your stripe is so renown fore….

Linus

Over-stating your case a bit there.

Actually, by a lot at the end.

But here:

“”Current Currencies have been created by governments and were originally backed by gold which represents a tangible asset. Therefore, there existed a clear difference between money and credit.””

Credit, as in bank-issued account balances, a.k.a. bank-credit……in those government-created , gold-backed, currencies was never different from money.

Those bank-credit account balances were what served as the nation’s money.

It was always the M-1 money supply……that of bank-credit balances……that was backed by the government’s gold holdings…..creating an exchange value with the commodity.

See Rothbard’s ….. The Mystery of Banking

What is the basis for your statement of a clear difference between money and credit when we were on a gold-exchange standard?

And, IMHO, ‘store-of-value’ is down on the food chain of monetary functions, except insofar as its purchasing power is concerned, which is more of an means-of-exchange function.

Thanks.

The difference lays in the fact that an anchor-less currency can be manipulated at will, while a currency backed by e.g. gold does not allow that as otherwise the gold starts to be withdrawn (that was the reason for abandoning the gold standard!). Well, it was different as theoretically the government (FED) was restricted in its monetary policy if they adhered to the gold standard. But as usual, the urge to acquire and maintain power governments rather attempt to offer unsustainable programs (e.g. build up debt and promises) that do depend on (or at least supported by) a monetary policy of currency debauchment which finally led to lifting the gold standard. That this entails the institutionalization of “moral hazard” is considered a side effect that we seem to have to accept as any alternative might show serious negative consequences.

Inflation is a cumulative process of increasing prices, wages and output fueled by artificially generated positive expectations. Inflation is a pernicious spiral. It decreases the burden of debt and creates an incentive to advance consumption and investment. Inflation is especially dangerous because once the process becomes entrenched, it becomes very difficult to stop.

You (elbridge & skippy) demonstrate with your comments that you are well indoctrinated by the present economic models and theories. Everything is connected, even the touted militarized policing or the increasing transparency of the citizens and in-transparency of governments cannot be analyzed without a conceptual understanding of the context. It all boils down to increased power in less and less hands, a problem that has to be resolved by decentralization at some point in the future (even I doubt it but I still hope that it will be achieved without much violence). As Frederic Bastiat said: There is only one difference between a bad economist and a good one: the bad economist confines himself to the visible effect; the good economist takes into account both the effect that can be seen and those effects that must be foreseen.

To close this comment read the words of Albert Einstein: “You Can’t Solve Current Problems With Current Thinking – Current Problems Are The Result of Current Thinking”.

“..you can’t say barter doesn’t exist, and you certainly can’t say that barter can’t exist.”

doesn’t equal

“.. Not one as yet has been identified by historians or anthropologists…”

saying “yet to be identified” is not equivalent to saying (doesn’t/can’t) exist

Therefore Argument from a false premise on this point.

Thee classic example of capitalistic overproduction

Wine production and consumption in Europe.

http://www.nytimes.com/2013/11/27/dining/in-wine-drinking-europe-and-america-trade-places.html?_r=0

Of course the New York times will not say this but we now all know how the world really works,

“Partly, this is because everybody’s world has become so much bigger. About 50 to 75 years ago, most Europeans outside of big cities drank only the local wine. It was all that was available. You bought a barrel for the year, or refilled your demijohn at the local cooperative.

Even 10 years ago on a trip to Campania, I met wine consultants who knew nothing of Barolo. Why should they? They were from Campania! Such narrowness would be unthinkable today”

To further juice the decline you get health fascists enforcing laws so that even more can be exported for imported products that are unaffordable to most……….but they do have a choice.

A good bottle of wine once a month when their father had a vin ordinaire once or twice a day……………

God help us all from Americans who truely believe in religion.

Today its the religion of capitalism at all costs.

Where is another way to think about it;

We are nodes and and the environment, society, the economy, etc. are the network. We have discovered that if we can standardize the medium of exchange between nodes, we can create ever larger social and economic interactions. Meanwhile those managing this system have discovered that the more society can be atomized and have natural connections broken apart, the more it needs this standardized medium and the more value those managing it can siphon off the rest of the network of social and economic connections.

We are now to the point of breakdown, where all organic social and economic growth is being shredded in order to support the metastasizing growth of this medium of exchange. The parasite is killing the host.

After it breaks down, we will need to go back to a more localized network of interactions and understand the limits of a standardized medium. It has its uses, but once it takes over, it does more harm than good.

Meanwhile those managing this system have discovered that the more society can be atomized and have natural connections broken apart, the more it needs this standardized medium and the more value those managing it can siphon off the rest of the network of social and economic connections.

I don’t think that’s correct. Money is a social relationship as is the transaction conducted with it. By starving most of the populace for money they are also being deprived of the social interactions which characterize a currency, forcing individuals and families to engage in more socially dysfunctional activities just to get by. So less use of the standardized medium is associated with atomization rather than more use.

Ben,

“By starving most of the populace for money they are also being deprived of the social interactions which characterize a currency, forcing individuals and families to engage in more socially dysfunctional activities just to get by.”

Necessarily we are in a very late stage of this process, where those doing the draining have lost all sight of the larger dynamic and are simply competing with each other, as to who can collect the most. Remember this process has evolved over the course of millennia and those most successful at each stage are those most focused on the immediate, not those with the broader view.

Money is a social relationship. It is cooperation between and among people. But it doesn’t take into account the selfless cooperation of a once-abundant planet. Which no longer exists. The problem with capitalism is that it has not changed its assumptions. Capitalism is certainly capable of cleaning up the planet and financing basic and applied science – but it does so still for short term gains. These accomplishments, a clean environment basically, have requirements that are so intrinsic and also so vast that short term gains are antithetical to any progress capitalism might attempt to make. We need long term thinking. Very long term. We need to redefine profit as something that can be maintained throughout the centuries. And we need to do this no matter how much “money” it takes to get the momentum rolling into the future. Into the real profit.

Susan,

Yes, money is a social relationship, indeed, and in today’s modern economies, systematically legalized through collective social action, through government.

Money itself, then is a social construct, and that construct…. the ‘system’ of money ….. is always nation-based, thus governmental in nature, (see : U.S. Constitution)

Capital is indeed a tool utilized by its owners, for goals that are met through always shorter-term planning horizons, horizons shortened through ‘bought’ innovation and competition……. the Larry Summers school.

So, you provide these two identities.

One social, cooperative and ultimately, governmental. (money)

One profit-seeking, competitive and ultimately private.(capital)

In trying to keep this car(U.S. economy) on the road, should ‘money’ need capital (debt), or should capital need money?

You opine so correctly that we need ‘long term thinking’ to solve the day’s woes, a change that is only really achievable through cooperative social vehicles and tools.

Why then do you support this private, profit-oriented, capitalistic debt-money system, rather than that of a governmental, socially-oriented, and public-equity based money system….. that amenable to longer term thinking.?

Do you secretly cling to the hope that capitalism will somehow get us there?

Thanks.

I wasn’t really trying to be all that serious, but we did have one historical example of a barter economy – it was called the United States of America and one specific time was 1786.

That was when the banksters of the time insisted on payment in gold for debts incurred during and after the American Revolution. If you check out the history, no one had any hard money – many debts were paid when the harvest came in, and those debts were paid by barter.

One of the political battles of the time was the political effort of small landowners to get the state to create paper money.

The Boston merchants, bankers and lawyers had discovered that if they demanded payment in gold, they could foreclose, obtain the land that had been put up as collateral and divide up the loot among themselves. And they did.

The result was Shays’ Rebellion which has been described as the American Revolution’s Final Battle – the one that we the people lost.

But that isn’t barter, in which there is no medium of exchange. A debt is an IOU issued by the lender and acts as the medium; it is money. In barter debt does not exist, it’s a straight swap of bananas for fish or whatever the commodities happen to be. Once you extend credit you’re beyond such a system, which is why social scientists have had no success in identifying actual barter economy.

They way I think I of it (whether correct or not) is that barter is an exchange where each product’s value is determined to be equivalent at the time of the transaction, where as in a monetary exchange an intermediary is used to time-shift the determination of equivalence.

I am sure there is a better way to express this.

I think that’s a useful way to look at credit/debt, where an otherwise instantaneous transaction becomes an inter-temporal exchange (some now for the rest later). Currencies can do the same thing but also allow instant pricing by acting as a metric.

I would say that is wrong, and this is at least implicit in the writings of the most careful MMT thinkers – Mitchell-Innes, Wray and Geoffrey Gardiner & Geoffrey Ingham. As Mitchell-Innes said, and Gardiner highlights, “There is no medium of exchange”.

Barter is not simpler, but more complicated than creditary transactions. Intertemporal transactions are fundamental and possible, not impossible simultaneous ones. Barter is two creditary transactions. A giving B a banana creates a credit for A, a debit for B. B giving A a fish creates the opposite. It is these credit/debts which are cancelled against each other, and which are the values of the products which are determined equal by agreement.

I don’t think anyone is reducing money to a medium of exchange, only looking past it to the situational context.

What could be more simple than each party bringing its exchange value directly to the transaction? My turnips = your squash. Those are economic resources ……. wealth…..transacted ultimately……no “owesies” needed.

It appears your claim is that inter-temporal, contract-based (debt/equity) transactions are somehow simpler. Sorry, Cal.

No wonder Mitchell-Innes got it all wrong.

“” A debt is an IOU issued by the lender and acts as the medium; it is money.””

WARNING MMT Blind-spot in evidence.

The confusion of money with debt runs deep and long in MMT mythology.

Here, presented in reverse from its traditional Mitchell-Innis “Money is Debt”….. we have Ben J’s offering that “Debt is Money”.

For clarification.

Money is not debt. And. Debt is not money.

‘Money’ is never expressed in ‘debt’ terms; debt is always expressed in ‘money’ terms.

Ben has expressed here a partial definition of debt.

Here, debt is an IOU issued by the lender…..

Did Ben mean to say, a U-O Me issued by the lender?

And, please do not confuse the ‘issuing’ bank’s account balance liability, part of the bank’s internal financial management operation, with the ‘debt’ associated with bank ‘lending’. Their similarity ends with the like-amount.

Or, did Ben confuse another mal-definition of MMT-money, an IOU of the issuer…… which, of course, it is not? Greenbacks were money issued by the government and there was neither debt nor liability created on the issuer’s accounts.

I will be glad to address the claim of ‘money’ being an IOU (obligation) of the issuing government to receive the Guv-money in taxes, if necessary.

Ben’s description of “debt …. acts as the medium, it is money” does not define what a debt is , nor how it acts.

A debt is a contract AGREED between borrower and lender, it is not ‘issued’ by anybody, and has other essential qualities like the amount of the transaction, always expressed in the money-denomination of the realm, and the repayment terms for settling the transaction, and remedies for default on those terms.

Again, ask any financial auditor what a IOU-‘debt’ is.

But the real flaw is to claim that such a debt, itself, IS ‘money’.

The ‘debt’ cannot ever be money.

The debt-contract amount becomes an asset of the lender and liability of the borrower, while the ‘credit’ so ‘de-novo’ created (that which serves as money in a debt-based system of money) becomes the liability of the lender and the asset of the borrower.. The debt itself never either ‘acts as the medium’ or, ‘is money’.

Can we clinch our modern money understanding?.

How does the borrower repay the debt?

WITH ‘that which serves as money in a debt-based system of money’, a.k.a. more bank credit.

It should be painfully obvious that if the medium used to pay off the debt is the same ‘money’ as that which the debt created, that debt itself cannot be ‘money’…… rather it is money-owed.

Money is money, created (as a money unit) and made ‘medium’ by sovereign money statutes.

Sorry, but we really do need to know what both money and debt are in order to have any money-system based advancement.

“”Looking at money from the perspective of exchange is highly misleading for understanding capitalism.””

Were we attempting to understand ‘capitalism’, something neither identified or defined? It seemed that what ‘matters’ and needs understanding, is the system of money.

“”Like any banker, the Fed or the Bank of England “keystrokes” money into existence.””

Actually, no money is keystroked into existence by the the Fed……. Only interbank settlement media that has zero effect on ” money, which facilitates trade in goods and services.” ”

So, IOW, if it doesn’t facilitate trade, commerce and DP, then it isn’t ‘money’.

“Central bank money takes the form of reserves or notes, created to make payments for customers (banks or the national treasury) or to make purchases for its own account (treasury securities or mortgage backed securities).””

Actually, reserves are not money by any definition of money, and banknotes are not keystroked into existence by the central bank…….rather printed by Treasury at the request of the the private bankers and issued into circulation by those private bankers to meet public demand.

Again, at the money-policy level, trading reserves for securities between banks and the CB does nothing for the real economy where we need “money, which facilitates trade in goods and services”.

“Trade” in goods and services……i.e. affecting our national GDP.

That’s where “money matters”.

If you’re talking about non-circulating interbank media, then you’re not talking what really matters about money. Not sure about ‘capitalism’, though.

GDP is highly questionable as a economic baseline [social cohesion], then you compound the issue by using the word “real money” [cough commodities e.g private ownership]. People that look at money as a commodity have a mental predisposition, nothing and I mean nothing can change that, its a anchor point to their personal mental reality, and of themselves, intrinsically. To detach from this position would be akin to reevaluating everything they ever beloved, including themselves.

Sorry, I don’t know of any monetary economic models, theories or systems that operate on a ‘social cohesion’ basis. And since these all use GDP, or typo-ed as DP, is there any ‘real’ problem with what was said? I agree it is a flawed metric, but we need agreement on its replacement.

As for “real money”, not sure where I used that, but okay, FYI, real money is not what the Austro-capitalists believe in at all. They believe in non-real, metal-based currencies, and I believe in the State Money that Knapp advanced, that of state issuance by governmental fiat.

And definitely not the non-State, private banker money issuance supported by MMT.

Sorry to waste all those keystrokes on Austro-think, skippy.

Any medium of exchange which facilitates a transaction is money, therefore reserves are money. Your definition is far too narrow.

Far too narrow? Not just ‘too narrow’? Not just ‘narrow’?

Since when did Benny J get to decide whose definition of money is valid, and whose is ‘far too narrow’..

What you need is a working definition of money, and not a baseless claim of what it is that you think satisfies your definition.

Medium of exchange?

Reserves are a medium of exchange?

Exchange of what?

Of goods and services produced and consumed in the national economy?

Nope. (non-cash) Reserves don’t do that, nor are they involved in any GDP transaction.

They are banker-play settlement media WITHIN the national payments system.

Stop pretending that anything Benny and friends write about ‘money’ has any currency in the legal-economic world where we all live and work. Ain’t happening.

If ‘media’ are not identified in national money-statutes as money, then it is not national money. Anywhere.

National money is that which serves as the ‘universal means of exchange’ in the nation where it is denominated by law.

But, whenever Benny J manages to change the international legal aspect of what IS money, I’ll be sure to give a call.

Of goods and services produced and consumed in the national economy?

Clearing payments between banks is a service.

If ‘media’ are not identified in national money-statutes as money, then it is not national money.

Nowhere in your original comment to which I responded did you use the phrase “national money”; you wrote “money” and money exists all over the place without a statute giving it official status. Governments don’t have monopolies on social obligations.

True, governments only have a monopoly right, through sovereignty, to say what serves as ‘money’ in the national economy, where its unit-of-account denomination is used in expressing money-financial conditions throughout commerce…. that which you take to and from a legal bank..

So, let’s be clear that when it comes to ‘legal money’, it is governmental in nature.

I have never seen any legal-money qualities in anything not monied through sovereignty… the national legal money system.

That which ‘serves’ as money can be any commodity or form of wealth that two parties agree upon, this being the “transaction” facilitated by what you called a medium of exchange above. e.g., as municipal scrip, localized exchange media, and others.

That’s why using something besides money that facilitates exchange does not make it “money”……..It is not a money transaction any more than the Monopoly money transactions are so.

Bitcoins are a commodity that settle many transactions today, agreeable between parties. Bitcoins are not money. They are a commodity that is identified solely through its counter-identification with real monies.

Failure to understand the relationship between sovereignty and money leads to flawed vision of the any monetary system. It is a public power, and as Lincoln described it “the supreme prerogative of government”.

It has a legal aspect and function that no other commodity has.

Including reserves.

If reserves really had money-quality, then it would not be possible to operate a national money system without them.

I have said before, reserves take the essential form of settlement media ONLY BECAUSE the ‘credit’ that serves as money in a debt-contract is fully destroyed (non-existent) at the end of the debt contract.

Were real money issued in its stead, then that “money” would be permanent, would this be present to settle the debits and credits of every associated transaction, always without destruction, and people would be asking, “what the hell are reserves anyway?”.

It would not be the payments-system settlement that makes it money, but the (sovereign) law that established its issuance.

Neither reserves nor Treasuries are ‘money’, and neither can be used to pay taxes.

Bank credit legally ‘serves’ as money and is used universally to pay taxes.

money is a legal concept and has a legal definition. only if courts accept it can it be money.

That just isn’t true. Monies like gold, silver, paper and digital currencies are used all the time today for creating and settling debt obligations among private parties. Statues aren’t necessary for a currency to exist, they serve to give governments sole control of “a” money and to force everybody to use it. The difference between public and private money is the breadth of acceptance.

Ben the re-“definer’ at his best.

I thought we agreed that ‘debts’ could be anything.

I just repaired my friends boat without payment because her late husband got me out of a diesel-engine riddle half a dozen years ago.

She insisted on paying me with a bottler of wine, a jar of her local honey and $20 for materials. I found them in my pickup when I got home.

The $20 was ‘money’.

I consider her balance as a wine and honey credit.

But WHY do we discuss such ‘non-money’, ‘near-money’ and like-money qualities when we are discussing monetary economics as a tool for social betterment?

Is it to shed light?

Or, to confuse?

Here’s a doozy from Ben.

“” Statues aren’t necessary for a currency to exist,….””

Some readers might believe that, cause Ben obviously knows a lot of stuff.

Currencies, if we care, are that which the Chicago Exchange markets, I believe over a hundred in all.

Can Ben tell us which ones were not established by law?

No, he can’t.

Because they are not legal to exchange without the imprimatur of the sovereign.

But, again, why do we talk about this money-crap, when what we want to know is how to use the money system to solve our problems?

Understanding reserve accounting will not solve our problems.

Don’t waste your time there unless your job is in liability-management at a commercial bank.

Understand sovereignty.

Understand the national money system.

Understand modern political economics.

Tell us, then, what MMT offers for a solution.

And I don’t mean the post-Keynsian stuff.

IF public debt matters to the public, then how do we fund the JG?

Because public debt matters to the public.

And, do you really think, Ben, that private money is going to fund the JG?

Another category error, except at more tedious length than usual. I don’t understand why people demand political “solutions” from MMT, instead of taking the insights MMT has to offer and advocating solutions themselves; one doesn’t demand that a plumber be an architect, after all. In a functioning democracy, one would expect this to happen. Perhaps Elbridge could lead the way!

Obviously, I could. Thanks.

And I again advance the readers’ thinking with a link to Dr. Joseph Huber’s latest sovereign money publication.

http://www.sovereignmoney.eu/sovereign-money-in-critical-context

I ask a contrast with Dr. Wray’s Primer, Lambert, at your convenience.

We need architects and plumbers.

If modern monetary theory really sees itself as plumbing system theory,….. all bathtubs and pipes that start with faucets (flows), rather than a water source……. then it ought to say so.

We all pay attention here because it is ‘money’ that possesses ALL of the purchasing power available in in a modern monetary economy, ALL of our national wealth-accumulating power, a power that is needed to advance both GDP and the people’s overall well-being.

Chiefly among the mis-postulated that MMT has to offer is Dr. Wray’s observation on reading Mitchell-Innis that the nature of money is ‘debt’.

Despite 2500 years of debt-free government money issuance, MMT sidles up with the 1913 banker-think, and advances ‘accounting’ and ‘computer technology’ as monetary science advancement.

One wonders where Dr. Wray’s learning path would have gone without taking the M-Innis debt-end fork.

Sorry, one cannot ‘take the insights that MMT has to offer’ and build anything, when those insights are in error.

We have built our debt-based national money systems based on that banker-error, and they have gotten us where we are. Unpayable debt saturation.

More of the same plumbing will not fix anything.

Whenever you’re ready, see Dr. Huber’s science.

Then, let’s talk.

All moneies are debt-based, which has been explained to you ad nauseam

Overly-worded “nuh-uhs” notwithstanding.

“”All monies are debt-based””

Well, yeah, sort of.

And that’s a L O N G way from saying what is in discussion here, that money is debt.

It’s not that all ‘monies’ are debt-based .

It’s that all money systems are debt-based,

but that’s by design of money statutes.

Ben, money systems being debt-based is the problem today ……… the inability to advance aggregate demand due to chronic debt-saturation.

Did you even read that Adair Turner stuff?

How do you think a central banker becomes a monetary reformer?

Advancing the ‘more-debt’ agenda will not happen because it is wrong. It is wrong because it can’t work, (Again, see Turner) and that defines the jitters in the financial economy.

More debt: We MUST but we CAN’T.

And if per chance you were to realize the alternative ‘more-money’ agenda (partly joined by Firestone, etc.), we will be glad to agree that that’s what you’ve been saying all along.

What about when someone picks one or many bananas and shares them with others?

I’d call that

“too primitive”an advanced economy.Nothing says you can’t, it’s just that no one can find an example.

I was walking home the other day, and I traded a dollar (I didn’t have a banana on me, but I would have used it if I had) to a homeless guy for letting me pet his dog.

Maybe you need to get yourself some more generous friends….

Dan, cat said economy. That means all of us together, ok?

What is the legal remedy when poisoned by the free banana.. and perhaps go into anaphylactic shock? Will I need a cart of bananas at the emergency room to trade?

You hear that about hunter/gatherer societies — that social prestige is measured not by how much you possess, but how much you give away. I guess the closest modern equivalent would be throwing really good parties…

BYOB

“Our Mission Oriented Finance conference explores how to direct funding toward what Hyman Minsky called “the capital development of the economy”, broadly defined to include private investment, public infrastructure, and human development. (See more here.)”

I like this trio of goals which I think can all be considered part of the ‘public interest’ and good goals for our policy. He goes on to expand on this in the reference with a ‘KEYNES-SCHUMPETER-MINSKY SYNTHESIS’.

He takes demand theory from Keynes, good sovereign and private bank underwriting from Schumpeter and Minsky’s worry about financialization building too muh on itself.

“the process “begins with money to end up with more money”—as both Marx and Keynes said”

“Unlike Schumpeter, Minsky did not see the banker merely as the ephor of capitalism, but as its key source of instability. This comes from his understanding of finance as having a dynamic of its own (M-C-M’)—beyond a medium of exchange, an insight which of course Marx had as well.”

I think this trio gets us back on the track of socially useful capital development.

Yves, I want to comment by going in a slightly extended direction. I have two thoughts about the above definition and it’s application to today’s economy. One is the velocity of money, and the other is wealth inequality/concentration. I believe both are related.

What I see happening in our current economy is large concentrations of wealth in a few persons hands. So imagine mr. Crusoe trades bananas for fish. Eventually mr. Crusoe may not need as many fish as he is getting in trade. So his accumulation of fish builds up. But he is not the only person that needs fish. Like is said in the post, fish do not fall from heaven, they are created by electronic keystrokes. But if there are too many fish, they lose value. So mr. Crusoe is encouraged to invest his fish at a market which then redistributes those fish to ppl who can put those to work. Again, if There is no constraint on the keystrokes, then mr. Crusoe will not put those funds to work at the market, because the market doesn’t need his funds. Sorry for the detail here, but my point is that as mr. Crusoe takes more fish out of the market and keeps to himself, the less there is for other ppl that need fish. This is where the velocity of money piece comes in. Now working with fewer an fewer fish, other ppl need that money to go out, in the form of purchases, and come back in the form of a paycheck sooner and sooner. It becomes a situation of being perpetually behind financially, all the time. All the while, mr. Crusoe is piling up his wealth every week because he gets a slice of each pie no matter what. Which leaves the pie smaller for the next time it gets divided up. So the funds need to move through the economy even faster (move thru the economy = producer makes something of value, pays workers & sells the product, producer and worker take funds and spend those on production results, producer pays workers with profits, etc.).

So I see this happening now that our economy no longer makes anything. Without the producer taking things without value and creating things with value, and with wealth being taken out of the pie by inequality, ordinary ppl need what’s left to get to them faster so they can stay one step ahead.

Kind of a side issue, but I’ve never seen MMT (or any other branch of economics) discuss the fact that many business transactions are not financed by banks but by other businesses.

It is common practice for a business to sell to other businesses on credit. I.e., “net 30,” where the buyer has 30 days to pay the cash price, and after that he is charged interest. Some businesses make as much or more off the interest charges than they make on selling their product.

This is commonly done for routine business-to-business transactions, while bank loans would more likely be required for the occasional large capital purchases.

I have no idea how the size of business-to-business financing compares to the size of bank-to-buisiness financing, but I suspect it is not trivial ?

No, it isn’t trivial at all. I argue such transactions should be included in what is labeled shadow banking, where non-chartered entities make unregulated loans. It was a problem in the run-up to the GFC and it’s only grown since.

Will we ever be rid of the seventeeth and eighteenth century Western barter mythology that persists despite Graeber’s straight-forward debunking of it? Daniel Defoe’s Robinson Crusoe indeed!

We needed money when a priest-king legitimized it and demanded it for tithes, tributes, or taxes. Most non-money exchanges even in our current highly monetized society takes the form of time-delayed gifting of “favors”, solicited (loan) or unsolicited (gift) with a flexible requirement for repayment.

Money was socially required to enforce centralized control over harvest surpluses, non-agricultural production, and establishment of military and priestly castes. And those military and priestly castes enforced the extraction and the use of money.

It seems to appear under agriculture (including fishing) when harvests become plentiful enough for there to be political arguments over the distribution of surpluses, the evolution of social stratification, and the institutionalization of specialized symbolic and rule-of-force roles–all of which evolve the society into greater inequality, intermediation, and rigid division of labor (qualifications, certifications, rites of passage, guilds).

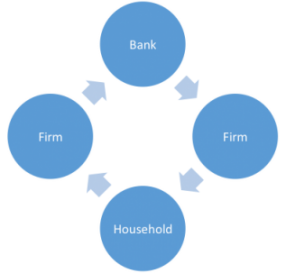

The circular diagram of Bank -> Firm -> Household -> Firm -> Bank -> Firm -> … reminds me of M.C. Escher’s infinitely ascending and descending staircase. For examples of the image, see:

Escher Staircase Illusion

Ohhhhhh – I may have to steal … er I mean share that from you.

Maybe you could give me a banana or a fish in exchange for the link to the images!

If you can’t define what you mean by wealth – what it is and how much of it any one person or generation is entitled to – you have no way of determining how much money is needed. Money is debt, not wealth – and debt can be created easily enough. Real wealth, on the other hand, can not. The emotional responses to MMT are based upon a deeply instilled belief that no “economic unit”, be it a person or a nation, is entitled to something for nothing, whether this is the result of simple theft, a government / banker partnership in the creation of ex nihilo money or the reputed efficiency of Western finance in which the creation of too much money is hidden by various forms of financial engineering that trace their lineage back to fractional reserve banking.

That said, there are some simple truths here that no one, including MMT theorists like Wray seems to be willing to acknowledge. Perhaps the most important from the perspective of the survival of our species is the fact that the United States is increasingly attempting to pay its way in the world with dollars – with “debts that can’t be repaid (and) won’t be” as Wray’s colleague Dr. Michael Hudson is fond of saying – rather than real wealth creation. Having hollowed out its economy by off-shoring its ability to pay its way in the world with real wealth creation, increasingly its only recourse is to threaten the world with guns and bombs – and if they don’t work with nuclear annihilation.

Another simple truth is that for those with more money than they will ever need the only remaining use for it is acquiring more money. In practice if money is in practice debt – a claim on real wealth created by someone; “legal tender for all debts public and private” – this means the accumulation of ever more debt. The workings of the exponential function – in finance-speak, compound interest – insure this can’t go on forever. Again, as Dr. Hudson explains, “big fish eat little fish” until there are no more little fish left.

There are more truths – like the increasing levels of what Thorstein Veblen called economic “sabotage” required to sustain the West’s “full employment for money” program. Buts that’s probably enough truth for today.

In fairness to Dr. Wray, he does say: “The biggest challenge facing us today is not the lack of finance, but rather how to push finance to promote both the private and the public interest—through the capital development of our country.” The problem some of us have with MMT is that it doesn’t attack this “challenge” head-on. It is really just a variation of Keynes’ “euthanasia of the rentier”. Even if we had the time to give that “euthanasia” another try, leaving the life-threatening system of military Keynesianism in place to grow ever larger and more malignant certainly threatens the lives of people beyond the country’s borders if not those of its own citizens.

We’ve had almost a century of “euthanasia of the rentier” now. As they say “how’s that working out for you now?”

+7billion

Steven:

In practice if money is in practice debt. Money is debt in theory, not merely in practice, and debt is not a claim on existing real wealth, but best taken here as a primitive term, as a social relation integral to the production of “real wealth” – in the future. Debt is the basic concept. Money is defined in terms of it, not vice versa.

like the increasing levels of what Thorstein Veblen called economic “sabotage” required to sustain the West’s “full employment for money” program. This gets things completely backwards. Unemployment is Veblen’s economic sabotage, and economic sabotage creates unemployment through artificial scarcity, not employment. Full employment (towards socially desired ends) for money (what else?) is the only reasonable state and goal, and is very easy to attain. What is hard is deprogramming almost everyone – whose “heads have been fuddled with nonsense for years and years.” Wray sometimes calls MMT the Keynes-Veblen theory of monetary production economies or something like that, incorporating Veblen’s theory of sabotage, by capitalist “undertakers”.

The problem some of us have with MMT is that it doesn’t attack this “challenge” head-on. It attacks it head on in the most direct way possible., Full employment. The JG.

We’ve had almost a century of “euthanasia of the rentier” now. As they say “how’s that working out for you now?”

No, we had a few decades of euthanasia of the rentier – you can take 1933 to 1973 as the period, especially in the USA – and it worked very well for the ordinary person. The last 40 years, we have had “exaltation of the rentier” (Wray has some papers about this, using this or similar terminology), and this has been a catastrophe for everyone else and humanity at large, But though they have tried, the exalted rentiers haven’t hollowed out the US economy anywhere near as you say.

Finally MMT is the opposite of magical thinking, of thinking that anyone can get something for nothing. But for societies, just as for individuals, once they discard childish things, wishful thinking, magical thinking – most of today’s “economics” – and just seize what they already have and are – they are always surprised at what they can achieve – how amazingly magical non-magical thinking is!

Money is debt in theory, not merely in practice, and debt is not a claim on existing real wealth, but best taken here as a primitive term, as a social relation integral to the production of “real wealth” – in the future.

Cigarettes used as a medium of exchange: money, not debt. Salt used as a medium of exchange: money, not debt. Potatoes used as a medium of exchange: money, not debt. These commodities have fallback utility value rather than a government’s fiat or anyone’s promise. Easy to measure and store, they serve primitive economies or those under duress as media of exchange, store of value, and unit of account.

No surprise that Dr. Wray invokes bananas as a means of illustrating the futility of commodities as money. Strawberries on the truck from Tijuana also serve nicely, if straw is the coin of one’s realm.

Cigarettes used as a medium of exchange: money, not debt

there in an old joke/parable about a can of tuna being use as a currency. .That can of tuna became progressively more valuable since it was originally traded for a mere banana ’til the final owner who exchanged it for a case of oranges.

The new owner opened the can to have a tuna salad he long craved and to his horror when opened, it was well over the hill and needed to be thrown away. He complained bitterly that it was a worthless can of tuna to the new owner of the case of oranges.

To which the man responded, you opened it??? That can of tuna was the trading kind not the eating kind!

At best, you are confusing particular money-things with the money itself, which is always a debt, always a relationship. Nothing, including money has every been used as a medium of exchange, particularly in “primitive” economies, where people are too sensible to confuse themselves with crazy self-contradictory complications and just use the natural intuitive theory = MMT. You can use dollar bills in the toilet if you are rich and momentarily deprived of TP – dollar bills have fallback utility value. But that doesn’t make money = toilet paper. As I said above replying to pebird, barter exchange is not simpler, but more complicated than creditary transactions. Barter is 2 credit transactions misleadingly collapsed together. As many have said above, there are no examples of barter economies, of cigarettes or potatoes or anything else being used as media of exchange, but all human societies use credit.

Your mistake above is like confusing a wedding ring or a marriage certificate for a marriage. Money is a relationship between two people (One might be named Uncle Sam or Seventeenth National Bank). The human mind can understand relationships, like marriage, like the parent-child relationship, like money, like debt.

You have good ideas elsewhere – and you seem to understand the right theory and think it is possible. So it is beyond me why you adhere to a crazy, complicated, accounting-violating (and therefore inapplicable to actual practice) impossible theory of money. (Positive money, AMI whatever) E.g. thinking there is a mystical difference between government bonds, FR notes, reserves, coins and US notes. They’re all the same thing, state money. I hope you agree & think that the MMT view is at least possible in theory, even though you think it is wrong. My point is that your views are not possible, even in theory.

If you want to make pointless hit-yourself-on-the-head-with-a-stick distinctions between them, you have to do it carefully and consistently and do the accounting correctly. MMT does; other theories always do something like make the distinctions in one place, but not another, to make the desired entity (the central bank, the sooperevilpowerful private banks) have magical powers. See my comments to elbridge in the Hudson thread.

You can use dollar bills in the toilet if you are rich and momentarily deprived of TP – dollar bills have fallback utility value. But that doesn’t make money = toilet paper.

And so here you’ve gone out of your way, as Randy did, to deny the possibility of commodity money by selecting a commodity that lack the common attributes of moneyness, such as scarcity, durability, compactness.

Money is a relationship between two people (One might be named Uncle Sam or Seventeenth National Bank).

The relationship you’re describing is called debt. Accounts payable and receivable. Money is that wherewith such debt is discharged, if so contracted. It may be someone else’s good promise, assigned to the payee. Another debt. Or it may be some desirable item that already exists. There are immense advantages to the prior form, but it’s not a necessary attribute of money.

thinking there is a mystical difference between government bonds, FR notes, reserves, coins and US notes. They’re all the same thing, state money.

There is a difference founded in law and evidence. The US assigned its sovereign rights to a corporate entity that now has the power to clear or deny payments, and protect its interests and those of its shareholders in a thousand other ways.

Just imagine if the law said that it is the US Government that is responsible for all contracts, debts and engagements of Federal Reserve Banks. Our MMT friends would be shouting it from the rooftops.

Instead, we have Warren Mosler coming on to this board to proclaim that “what are called shareholders are merely depositors.” And Yves actually contradicting Mosler, clinging instead to the exquisite difference between common and preferred shareholder.

So bonds and FR Notes are the same. Why then must the US Gov indebt itself twice for each dollar of Fed-funded deficit spending, via one dollar of T-Bills and another dollar of Reserves? As long those reserves are a US liability anyway, let’s credit ourselves with funds to repair our infrastructure. “[G]overnment usually does not recognize it operates a monopoly money,” says Wray. Either a small army of public officials are unaware of the laws to which they are bound, or Wray is.

I’ve shown you all some of the fine print. What does MMT offer to support its claims? Bathtub drawings. Butterfly drawings. Ruml said something. Mitchell-Innes said something. The Indiana Legislature was wrong about something. The epistemology of the bereft.

I trade in evidence, Calgacus, and eagerly await yours. Those who shun complexity and prefer to be persuaded by evidence-free oleaginous rhetoric, deserve it.

Econ,

Please to not confuse the discussion with evidence, facts, etc.

If you have any anecdotes, hyperbole, or economic fables you care to advance, then fine, joust away.

Otherwise, we bring out the heavy lumber.

“” At best, you are confusing particular money-things with the money itself, which is always a debt, always a relationship.””

A tenet stated.

No explanation necessary.

Any five year old knows that.

Money itself is always debt.

Always?

A debt?

Which is a contract relationship of amounts owed and conditions for payment in the currency of legal issue.

That’s what a debt is.

Ask any financial auditor what a debt is.

Money is not debt.

Money is what is used to settle debt contracts.

When you have publicly issued money, it stays in existence (circulation) forever.

Or when the government decides to destroy them for some reason.

Like the Greenbacks.

No debt.

Just money.

Circulated for well over a hundred years.

Always a debt ?

Ask any financial auditor what a debt is.

Concept of debt long-preceeded finance. You’d be better off addressing your question to an anthropologist or historian.

Concept of Debt ?

Greenbacks circulated for a hundred years. More, actually.

No debt was involved.

Concept never entered the discussion…… until now.

My comment was directly responsive to a claim that

“”……. with the money itself, which is always a debt, always a relationship. “”

We were not discussing the anthropology of debt ‘concepts’.

But whether money “itself” was always a debt.

I proffered elsewhere that for 2500 years sovereign fiat money was issued without debt.

Thus, my question stands.

Always a debt?

(“In practice if money is in practice debt.” – You discovered what I meant to say in spite of the way I said it. Well done!)

“…debt is not a claim on existing real wealth, but best taken here as a primitive term, as a social relation integral to the production of “real wealth” – in the future.”