Mr. Market is having a major sad today largely as a result of disappointing retail sales figures for December, a 0.9% fall, well below the median forecast of analysts suveyed by Bloomberg of a fall of 0.1% and lower than the most bearish forecast of 0.5%. Maybe I should just pay attention to NC reader and shopping maven Li, who told me repeatedly that the retail environment was in poor shape based on the fact that major retail stores were putting through December markdowns vastly ahead of their usual schedule.

We’ve ben skeptical of the theory that lower oil prices would be a boon for the economy. The argument has been that consumers would spend their savings elsewhere. As Ilargi has pointed out, all that does in shift consumption from one category to another. It does not lead to a net increase in spending.

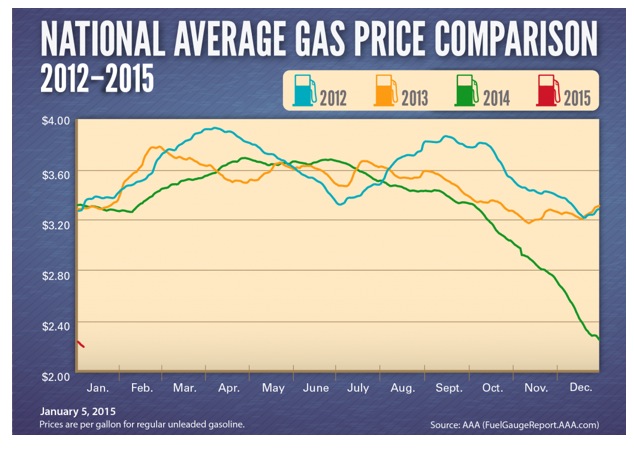

Now admittedly, one month does not make for a trend, so we’ll have to see more data to determine if this pattern holds. However, gas prices were already appreciably lower in December and consumers were not spending those savings at the pump. From Bloomberg:

The figures used to calculate gross domestic product, which exclude categories such as food services, auto dealers, home-improvement stores and service stations, decreased 0.4 percent, the worst performance since snow covered much of the country in January 2014, after rising 0.6 percent in November.

Sales of electronics declined 1.6 percent last month, while purchases of apparel decreased 0.3 percent, today’s report showed. Receipts fell 0.9 percent at general merchandise stores and 1.9 percent at building materials outlets.

Purchases at service stations, which have declined seven straight months, plunged 6.5 percent in December. Gas station receipts accounted for about 10 percent of total retail sales last year.

The Wall Street Journal seems puzzled:

Sales at retailers and restaurants decreased a seasonally adjusted 0.9% in December from a month earlier, the Commerce Department said Wednesday. That was the largest monthly decline since January 2014. Excluding gasoline sales, purchases fell 0.4%, while spending declined 1% when removing the volatile autos category.

The numbers are at odds with what most retailers say was a relatively strong holiday season and underscore the volatility of consumers, who may have more money in their pockets thanks to lower energy prices but aren’t necessarily spending it.

The results “were weak even after accounting for the huge plunge in gasoline prices,” PNC Financial Services Chief Economist Stuart Hoffman said. Excluding gasoline, the consumer-spending trend is “increasing, but growth does not look as strong as it did in November.”

This AAA chart shows the magnitude of the price decline over the late year and the magnitude of the fall in December:

Now even if consumers do start spending more on other categories as they become acclimated to the new normal of cheaper gas prices, not only is it unlikely that we will see net gains on the retail sales side of the economy, but the losses on the wage side appear to be underestimated. It isn’t simply that the states that showed big job creation gains were all the energy producing states. It’s also that the jobs in the energy industry are moderate to high skill, highly paid work. And the knock-on of increased construction work is also well paid. The likely slowing/stoppage of hiring net in the energy sector as a result of the oil price plunge, combined with the addition of mainly McJobs elsewhere, may be the big culprit in the mystery of the last jobs report: increased hiring but lower average wages.

Moreover, there’s a bigger backdrop that no one seems to be factoring in: that the press is full of stories of pensions being slashed. If citizens have to be able to carry themselves through retirement with less in the way of employer and government support, then they need to be saving much more, now. Part of the “new normal” is working age people adjusting themselves to the fully rational expectation that investment returns will continue to be weak and that social safety nets will only become more tattered. So the idea that near record low household debt service costs bodes well for economic growth (ie, they have more room to spend and even lever up more) ignores how much the economy has changed, in terms of job stability and quality and retirement prospects. That means much greater pressures to save.

Yves, by chance are you aware of any study that shows the empirical economic results of the Jan 2013 “Fiscal Cliff”?

IIRC sane, numerate, earnest, non-propagandistic, Keynesian-ish economists like Dr. Dean Baker/the MMTers/etc were declaring that since Government was the only of the 4 GDP components that could at the time have the potential to be strong, since Consumption, ~70% of GDP was weak, facing tremendous Uncertainty with high unemployment & declining median income, Investment was weak because private companies will not spend when facing weak Consumer demand, & of course Net Exports have a been a decades-long drain on US GDP. IIRC These economists mentioned that the Fiscal Cliff’s reduction in (Federal) Government spending would reduce the overall GDP & the Consumption component, from what these metrics would otherwise be absent the Fiscal Cliff.

Did the Fiscal Cliff reduce GDP & Consumption from what it would have been? Perhaps this poor Dec 2014 retail sales report is related in part to the economy-worsening effects of the Fiscal Cliff?

Thanks again for your excellent reporting/analysis.

spot on point about shifting the money saved by lower gas prices. not changing our spending habits at all. putting the extra into savings account. most people i know adjusted their gas consumption habits during the recession and are not going to change them again, no matter the price. (only if it got really high, like >$4/gal, would most people i know consider getting a more efficient car).

i dont see how this oil price drop can be good for our economy in the short term, as much of this oil is produced domestically. so now there is less money going to american companies. even if i spend all that money, those goods i purchase are probably not american made.

Sorry, why even make this post. Real Consumer spending is already rising the fastest in years from the price drop.

One thing we can be sure of – with the stock market adjusting to a new normal, the 0.01% will have to think of other ways to supplement their vanishing wealth.

We will only know retroactively in some investigative reports.

In the meantime, they will be working hard. Can’t be lazy.

There is no new normal. Nor is there anything for stocks to adjust to sans energy stocks, which made up a far smaller amount of liquid than you think. Thanks to a decline of Brent Crude from its 4 year run at 100-110 dollar a barrel, the economy is recovering from some bad inflation.

Maybe new abnormal.

Yeah, deflation is great you guys. Pay no attention to the collapse of copper prices behind the curtain. Everything is fine.

All right Jim. We know it’s you behind the curtain. Don’t worry about the ankle biter, he’s got an appointment with the vet back in Kansas; where none of us are at the moment.

As for “no new normal,” well, I suspect that the game plan, insomuch as there can be considered a plan at work, is to restore the “Olde Normale.” In other words, Neo-Feudalism.

There had been a lot of cars and pickups purchased in 2014. I don’t know where they got the money.

http://fortune.com/2015/01/13/subprime-auto-loans/

Nearly 39% of open auto loans worth $337 billion were for customers with below-prime credit in the third quarter of 2014, CRL said in a report released Tuesday. That’s an increase from $304 billion in 2013 and just $255 billion in 2012. Those in the automotive market cheer these increases — after all, more people getting credit means more people buying cars, which means more money for everyone from lenders to dealers to manufacturers. The CRL, though, has concerns that the default and delinquency rates are increasing, and argues that the auto lending market could be in a bubble

No such thing as financial bubbles.

Could be in a bubble!!?? When cars and trucks now sell at prices one could buy a cheap house for? (I’m not pulling your leg. If you are willing to do some rehab work, you can buy a single family rental in a halfway decent neigbhourhood for around Fifty or Sixty Thousand here Down South. We did, and in what has turned out to be a very good place to live.)

No aspersions to you optimader. I recognize irony when I see it.

Phyllis remarked a few weeks ago when this very subject came up while we were stuck in traffic, (even one horse college towns have rush hour,) that these people had better have some sort of living space paid for to go out on a limb for an overpriced iron horse. “When the bust comes,” she said, “they won’t even have the cars to sleep in at the parking lot. The cars will all have been repossessed.”

Ambrit

I’m pleased to hear you found new digs! College towns have there advantages relative to recreation. Plus, you can hang your shingle and do some partime gentlemen plumbing for mechanically hopeless faculty and rental property owners.

It’s a case of not so much finding new digs as becoming more realistic about where we have been living for the last several years. Once one clears the cobwebs out and views things with much less baggage, things become better and better. Sometimes, the fault lies in having unrealistic expectations. This particular one horse town does have a restored 1920s theatre and collegiate music and theatre offerings and a reasonably civilized ambiance. We know several of our neigbhours well enough to sit on the porch with them and talk. Kids still ride bikes down the street, even though we suspect some of those velocipedes are ‘hot,’ and people jog along the street and alley, young mothers roll the babies along in their perambulators, two or three in a chattering group. We will always keep our eyes and ears open for that magic dream cottage, but that’s just what it really is, a dream.

Thanks, and we hope your art projects do well and satisfy you. It’s hard work, but worth the effort.

Ambrit

You both own your time now, your in a college town, the world is your oyster. Buy a couple betterthan average bikes used, helmet, gloves pack lunchs and go have fun. They might offer a deal on classes, if not free, (if its a state school) for senoirs. A friends mom in MA in taking random classes at MIT gratis as a senior retiree

Greenbacker, do you have a link? source?

* * * crickets * * *

Completely agree with Greenbacker. While there are plenty of headwinds buffeting consumers, its waaayyyy too early to suggest that a consumption binge isn’t going to follow the large reduction in consumer in monthly household overhead that is occuring. It may take several months before people really feel it. WAY too early.

Problem with that idea is that most people I talk to “on the street” are underwater in one way or another. Their first ideas when considering the uses this mini windfall can be put to use for will be to pay down personal debt. Don’t assume that just because someone is poor or lower class they are stupid.

Hmm. You’d think if people were going to binge, they’d binge in the Christmas season, especially with the discounting, especially given that gas drop money’s in their pockets immediately.

Sorry, but this was in bulk gas prices and disinflation in prices. Strip that out and it was pretty good.

Not according to the WSJ:

November and October once you strip out everything, were up largely as seen through real personal consumption figures. From December’s view, that level of spending was maintained.

Then we have revisions. Put it this way, if retail gas rises in February again and oil bottoms, what will happen to retail sales? they will rise, potentially largely.

I don’t even know what you’re trying to say here. If gas prices rise as oil bottoms out? What? If you “strip everything out” from November and December, what are you measuring?

Greenbacker, you can’t say that until we get the December CPI on Friday…if prices for goods less energy are down more than 0.4%, then come back and make your claim…

Strip out prices and prices were pretty good. Gotcha.

No one is spending money because no one gets enough to buy things once they’ve paid the monthly slice of their debt. Brilliant wall street minds will be very confused as stocks fall due to continually declining revenues when all the peasants run out of money to buy imported abs plastic trash from China. Maybe the president will go on tv and tell people how important it is to buy buy buy.

That we know how to solve these problems and are given nothing but fuck yous and cold shoulders is so angering. We can fix these problems. The elite would rather be lords over peasants.

I just saw this article on Sciencedaily:

http://www.sciencedaily.com/releases/2015/01/150114140448.htm

Not that I’m in opposition to your sentiments at all, but the plain fact of the matter is that you can’t square a rising world population with declining resources and come out with a result showing anything other than overall industrial-society living standards must decline. The fact that the elites are apportioning themselves more and more resources at the (extra) expense of everyone else is simply the normal course of events in failing civilizations. It’s a dire mistake to think that some set of policies, if implemented, will reverse the trend of industrial decline. That’s like tilting at windmills when you could be doing something useful with your time instead.

Mulling this, thanks for the link.

•Big Retail Sales Miss for December Dents Theory that Consumers Will Spend Gas Savings

How much money has the consumer actually accrued as a result of gas savings in December/how immediate (lag time) should be expected for any reallocation of spending? This may result in lowering revolving credit//CCard debt rather than a bump in consuming more stuff?

In our household the “savings” from gas account for about $20 a week. However, that $20 is dented by increases in food and health care. I figure we might pocket $50 a month when all is said and done. As Yves has said though, we figure we’d be better served to save it since you can’t be sure anymore that ANYONE will be held to their promises they made for your retirement.

A coffee can buried in the back yard sounds pretty good… No bail-ins, no monthly charges.

/Post Edited for Political Correctness … I am going to the meetup and don’t want EVERYBODY annoyed with me./

With a bunch of the pearl-clutchers angsting over the fact that something like half the population lives paycheck to payckeck, the other half prays for them spend the couple of bucks they save on gas a week on Christmas presents. A good friend of ours is paying down personal debt to zero. Wonder how that shows up in the Econocrats’ numbers? One wonders if a few of the sheeple are wising up. It’s likely bad for “business.”

I don’t understand how it is good for the economy to encourage over-spending among the many people who don’t have it. Yes it might pump up retail sales in the short term but so what? Hard to avoid the conclusion that anyone encouraging such over-spending is really not on your side.

Companies like it when people overspend for two reasons. First, it obviously increases sales. Second, it results in workers who are on a perpetual treadmill of debt, keeping them desperate and compliant. Workers won’t dare quit work or the rock boat at work if they know that they’re only a week away from homelessness. They’ll accept poor treatment, long hours and dreadful working environment just to avoid homelessness.

Once you step away from the cycle of debt, you have the power and can stop being a debt slave to your employer. Unfortunately, America makes it difficult to step away from that cycle of debt with the preponderance of low wage jobs, staggering student debt, dysfunctional health care system, widening inequality and woefully insufficient mass transit systems.

Don’t forget to include student debt and how our esteemed legislatures have made escape from unbearable debt nearly impossible.

Meanwhile, Germany just made college free.

http://www.stopfake.org/en/su-25-mh17-and-the-problems-with-keeping-a-story-straight/

Thanks for this post. Your last para nails it.

We stopped spending in 2008. They’re just now noticing?

We haven’t owned a car since 2003. Can’t afford anything about it – not the payments, insurance, tires, gas, none of it. So the lower price of gas is not more money in our pockets. All pockets still empty.

We are early 60’s. All of our parents are in failing health and largely destitute. When they all finally do going into long term care on Medicaid, the system is going to seize what little they have left. All hard working tax paying Americans their entire lives, who will be completely asset stripped in their last days.

Some of our Millennial kids have student loans. All of our kids have not been able to find decent long term employment, ever. Two of them live in a trailer park, one of them still lives with us. None of them have health insurance. Out of all of our kids only one of them owns a car. We had to buy her a set of new tires last year, $500 she didn’t have.

I lost my last part time job two years ago. Over 60 no one will hire me, I will never work again. We are broke, as are our parents and our kids.

Fifteen years ago, all of us were doing all right, humming along, same as it ever was. Now we are three generations with practically nothing left.

Pretty sure this is the real America I’m talking about. Two dollars off on gas is not going to suddenly improve the reality in which we now live.

Sorry if it’s in bad taste, but I can’t resist this linkage.

“Going In Style” 1979:

http://en.wikipedia.org/wiki/Going_in_Style

“Work hard and play by the rules.” And here we are.

One very truthful comment. The word ‘consumer’ says it all. Reminds me of when Bush told us all to go shopping. The new normal is hating being called a consumer. Really hating it.

We are citizens, and we have been shortsheeted by our government, which increasingly tries to distract us from this elephant in the room.

Even the government calls us customers now. I don’t understand why being a customer in the eyes of a transit agency or a court clerk is suppose to be an upgrade from being a citizen. After all, a citizen has rights, and governments owe duties to their citizens, but what rights does a customer in a box store have? It is a major downgrade. One of the really gross marketing concepts to be shoved into the lexicon. Right up there with the “ownership society”

Even lottery sales are dropping :) http://www.zerohedge.com/news/2015-01-14/us-economy-so-bad-even-lottery-sales-are-collapsing

LOL. Someone better give out free hopiums.

Serious question: does anyone have any recommendation on a safe company to join for the next 5 years? I am about to graduate from a CS Masters Degree program and I think I am kinda sick of working on computers.

My thought is tangibles. Plumbing, electric, bricklaying, HVAC. Readers?

Do commercial SCUBA. Pays well and you retire after ten years.

Great suggestion. Takes a real checklist mentality, though, IIRC.

Yes, it’s a line of work where you can’t afford mistakes. But I’ve known some guys I’d considered a bit less than detail oriented who came out of the training program with their heads screwed on straight. Nothing like a healthy fear to focus the mind!

I worked alongside a retired hard hat diver once. He said he quit the day he watched one of his diving buddies die because someone on the deck crew turned the wrong valve on at the wrong time. (This was offshore oil pipeline maintenance work.) SCUBA is more individually oriented, but still a high risk occupation. Still, it is well paid and not too chancy.

I’d move to China while they’re still letting Americans in. Even if you have to teach English, it’d be worth it.

I could cry, right here on the internet. Not for me, but for our parents and our children. We simply cannot save that many needy family members of multiple generations.

Our grandparents were Great Depression people and we remember them and their stories well. They had a certain freedom of self-resource that the nanny state now prohibits, and is even illegal. I truly have no idea how all of our now indebted, indentured, landless, elderly and under-jobbed family members will survive into the future.

For what it’s worth, we have plans to expatriate in the next 12 months. But what about the rest of them? Very hard to just walk away.

My ss benifits will increase 23 dollars a month this year. I’m sure that will make up for the 18.000 dollar price increase of a medium priced home last year.

Good post and comments. I thought there were too many sales during the holiday season, which is not a good sign for retail. Maybe everyone did their holiday buying in October and November, but I doubt it. The only person I know who is doing serious buying is a friend who is getting her house fixed up before she retires, knowing she will not have the money for big purchases (such as a dishwasher) after. I remember — from many years back — people splurging at Christmas time. The way the economy is now, I’d buy a sweater with reindeer on it at a consignment shop and leave it at that.

Yves last paragraph is the key. I also recommend this:

On the Causes of Investment Decline in the US Economy, by Jack Rasmus, July 28, 2014

http://www.counterpunch.org/2014/07/28/on-the-causes-of-investment-decline-in-the-us-economy/

” If one believes lack of income is the primary cause of declining real investment today in the USA, then the solution is simply to raise wages and income of households that typically spend by whatever means—tax cuts, subsidies, etc. The problem is simply an insufficient level of income.

“But what if, alternatively, it is not income that determines real investment, but rather the addiction of investors to financial asset speculation and investing that is the main determinant of slowing real asset investment? If the latter is primary, then simply raising wages and incomes alone will not necessarily ensure real investment returning to historical levels in the US economy.”

I don’t think it’s either insufficient income, or speculation that is the problem – it’s both. They go together. In order to pay for the looting (“profits”) of the speculators, the populations’ wages and earnings are held down and destroyed.

This is not a new problem. Grab a Bible and look up “usury” in the concordance.

Gasoline is certainly lower, but groceries, propane and firewood certainly are not. Looks like a warm spell is ahead, maybe that will help. Crapification of everything keeps me from purchasing extra clothing or other retail items or services. When I do buy something I am much more likely to look for quality made items on the used market even though it takes a lot of time. More and more people are dressing in drab colors…. in the last great depression brown was a big color. I seem to recall mention that drinking and eating out and were up last month… in the last great depression that and movies were about the only areas where spending remained strong.

The US Energy Information Administration estimates savings of about $550 per household over the course of 2015. In the end, this is really not that much money, just over $10 per household per week. There are plenty of other increased expenses to absorb that in a hurry.

My sister works for American Airlines. She like other AA employees are all getting huge raises. Lower gas does benefit some. Her raise is >$7/hr.