As we indicated, we were doubtful that a deal with Greece on its bailout could get done, since if nothing else the two sides had irreconcilable positions on structural reforms. That was one of the biggest reasons for Greece rejecting the idea of extending the current bailout, that they did not want the strings attached, such as continued privatizations and further “progress” on labor-crushing market reform. The only way an agreement could have been reached would have been for Greece to capitulate on these issues, which seemed unlikely given how Syriza had risen to 80% approval ratings in the polls based on its Troika-defying stance.

So it is not surprising to learn that the bailout talks are over, with no agreement reached. From Bloomberg:

Talks between Greece and its official creditors in Brussels broke up on Monday after the country’s new government said it could not accept euro-area proposals for it to stick to the terms of its bailout.

The Greek government labeled the eurogroup’s demands a “absurd” and “unacceptable,” in an e-mailed statement shortly before the meeting ended.

The Financial Times has more detail:

A crucial meeting of eurozone finance ministers over the future of Greece’s bailout broke down in acrimony after Athens angrily objected to the bloc’s insistence that it extend its current €172bn rescue, calling it “absurd” and “unacceptable”….

Some eurozone officials have suggested that without an extension, Greece could instead begin talks on an entirely new bailout, but such talks are likely to take months, meaning Greece could be without financing well into the spring.

Athens has insisted that it has enough funding to keep the government running for several months, but some eurozone officials believe it could run short of cash next month.

The pink paper also notes that it might be possible to still get the necessary governmental approvals if an agreement could be reached this week (a climbdown from the earlier “absolutely gotta have a deal today at the very latest” stance), the talks were described as collapsing in “acrimony” which is no foundation for getting things back on track. Ethakimerini has confirmed that on Twitter:

#Eurogroup chief Dijsselbloem: "Given timelines, we have this week but that's about it. Maybe new #Eurogroup on Friday" #Greece

— Kathimerini English (@ekathimerini) February 16, 2015

Athens had stressed in a document released in Greece that it regarded the technical discussions of the last few days as a forum for mapping out differences only and not for resolving them. That also did not go over well with the Eurogroup ministers. The draft language was harsher than that of the memo leaked from last week’s meeting, indicating that the Eurogroup ministers had become more hostile to Greece’s position. Again from the Financial Times:

Monday’s talks collapsed when Yanis Varoufakis, Greek finance minister, strongly objected to a draft statement according to which Athens would drop its fierce opposition to prolonging its bailout.

The draft statement, obtained by the Financial Times, said that Greece would agree to a six-month “technical extension”.

“This would bridge the time for Greece authorites and the Eurogroup to work on a follow-up arrangement,” reads the statement.

“The Greek authorities gave their firm commitment to refrain from unilateral action and will work in close agreement with its European and international partners, especially in the field of tax policy, privatisation, labour market reforms, financial sector and pensions,” it added….

German finance minister Wolfgang Schäuble accused Athens of “behaving rather irresponsibly” over its talks with its eurozone creditors.

According to Greek officials, the eurogroup meeting itself got off to a rough start. A Greek government official said a text presented for discussion at the meeting violated an agreement between Alexis Tsipras, Greece’s new prime minister, and Jeroen Dijsselbloem, the eurogroup chairman, made last week to resume talks on a way forward for Greece’s rescue programme.

The Greek official said the text required them to continue with the current bailout and called the insistence “absurd” and “unacceptable”. The official added that those who persisted in pushing for a continuation of the current programme were “wasting their time”, and predicted no deal was reachable if discussions continued down that path.

Without an extension of the current programme, focus appears to be turning to allowing the current bailout to expire and to quickly turn to negotiating a new rescue more amenable to the new Greek government.

“The second alternative would be the negotiation of a new programme but . . . time begins to run out,” said Mr Noonan.

Jean-Claude Juncker, the European Commission president, suggested to his fellow EU leaders at last week’s EU summit that a special gathering of eurozone heads of government might be needed this week, but officials said this is increasingly unlikely. One official suggested it could be held at the end of the month, but “only if the eurogroup meetings before had failed”.

It is also key to recognize that this is not some crafty plan by Varoufakis to precipitate a Grexit, a course of action he has consistently rejected and sees as a terrible outcome for Greece and the EU. From his op-ed today in the New York Times, No Time for Games in Europe (hat tip Santiago). Key sections:

….my game-theory background convinced me that it would be pure folly to think of the current deliberations between Greece and our partners as a bargaining game to be won or lost via bluffs and tactical subterfuge.

The trouble with game theory, as I used to tell my students, is that it takes for granted the players’ motives. In poker or blackjack this assumption is unproblematic. But in the current deliberations between our European partners and Greece’s new government, the whole point is to forge new motives. To fashion a fresh mind-set that transcends national divides, dissolves the creditor-debtor distinction in favor of a pan-European perspective, and places the common European good above petty politics, dogma that proves toxic if universalized, and an us-versus-them mind-set.

As finance minister of a small, fiscally stressed nation lacking its own central bank and seen by many of our partners as a problem debtor, I am convinced that we have one option only: to shun any temptation to treat this pivotal moment as an experiment in strategizing and, instead, to present honestly the facts concerning Greece’s social economy, table our proposals for regrowing Greece, explain why these are in Europe’s interest, and reveal the red lines beyond which logic and duty prevent us from going…..

I am often asked: What if the only way you can secure funding is to cross your red lines and accept measures that you consider to be part of the problem, rather than of its solution? Faithful to the principle that I have no right to bluff, my answer is: The lines that we have presented as red will not be crossed. Otherwise, they would not be truly red, but merely a bluff.

But what if this brings your people much pain? I am asked. Surely you must be bluffing.

The problem with this line of argument is that it presumes, along with game theory, that we live in a tyranny of consequences. That there are no circumstances when we must do what is right not as a strategy but simply because it is … right.

Against such cynicism the new Greek government will innovate. We shall desist, whatever the consequences, from deals that are wrong for Greece and wrong for Europe. The “extend and pretend” game that began after Greece’s public debt became unserviceable in 2010 will end. No more loans — not until we have a credible plan for growing the economy in order to repay those loans, help the middle class get back on its feet and address the hideous humanitarian crisis. No more “reform” programs that target poor pensioners and family-owned pharmacies while leaving large-scale corruption untouched.

Our government is not asking our partners for a way out of repaying our debts. We are asking for a few months of financial stability that will allow us to embark upon the task of reforms that the broad Greek population can own and support, so we can bring back growth and end our inability to pay our dues.

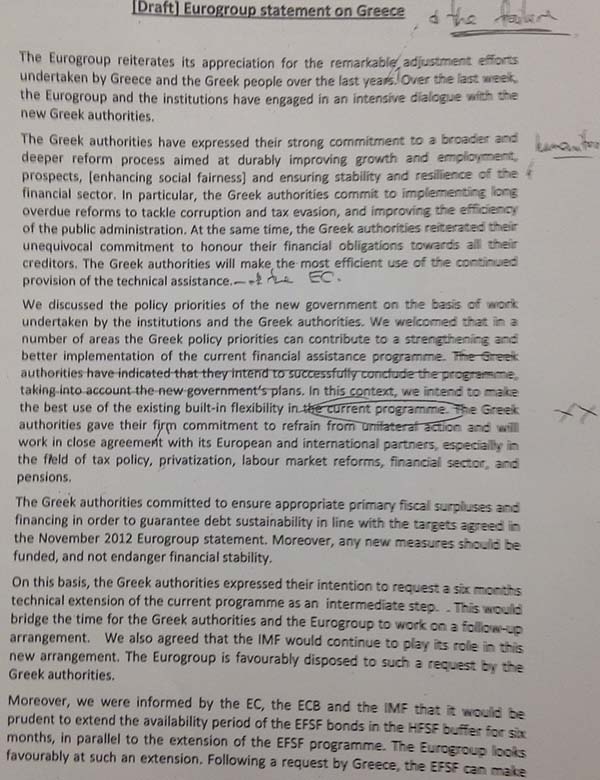

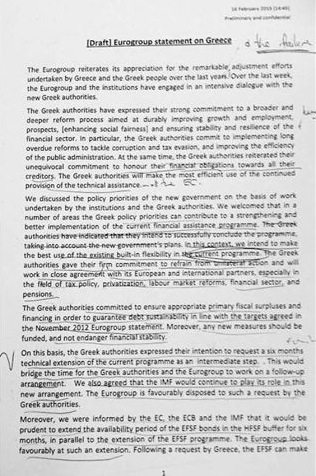

Edward Conway has tweeted the draft communique that Greece rejected, with penmarks by Varoufakis:

Here is the full leaked draft eurogroup communique. Greeks have just rejected it as “totally unacceptable” pic.twitter.com/0wXcJaamE3

— Ed Conway (@EdConwaySky) February 16, 2015

[Inserted later for legibility] The Financial Times has added the memo image to its article:

As has happened before, there seem to be more than one leaked version of the draft floating about. See this, more marked up version on Facebook (hat tip Lambert):

Either way, both appear to have assumed a Greek capitulation. Now we get to see what the Troika’s Plan B is now that Greece has demonstrated its resolve.

Update. The notion of a special EU meeting of the heads of Eurozone governments, mentioned in the Financial Times, has apparently been nixed. Hat tip Lambert:

Dijsselbloem: I spoke to President Tusk, he has no intention to call an EU summit on #Greece | #Eurogroup

— Yannis Koutsomitis (@YanniKouts) February 16, 2015

And this provides more confirmation of how testy the discussions were:

I've been told #Eurogroup broke up even before finance ministers got a chance to discuss draft #Greece statement

— Peter Spiegel (@SpiegelPeter) February 16, 2015

Last week someone posted about an upcoming election this week in Hamburg. Until, then it’s CYA time for Merkel. Then the negotiations start…

You are seriously overestimating the importance of the Greek question in a German state election. It’s probably about zero.

I think the issue is that, according to polls, the CDU looks to take a serious beating in that local election. Fr. Dr. Merkel will therefore be more concerned about internal German political tactics and how to avert a complete rout than about the Greek question.

In the face of Varoufakis’ expert denial, I still think it’s ultimately a game of Chicken. That is, definitionally, a game both sides can lose – very badly.

And it looks more and more like going smash.

I’ve read for years that the Euro was structurally unsound, that false neoliberal economics were built into its foundations. That’s why Varoufakis is saying that the whole thing has to be rethought “for Europe”. But smash may be the only way to really do that.

On general principles, I suspect there are frantic rethinkings and negotiations going on behind the scenes, hiding behind all this hardass behavior. The Eurozone faces political rejection over the next few months – both Podemos and the National Front in France explicitly reject it. If the ECB functionaries want to keep their jobs, they better be thinking fast.

They let all the crooks get away already. It’s apparent the Greek economy can’t anywhere nearly pay off the full debt amount. Who knows if Greece fixed up the tax system and the odd way guv finances just seemed to flow strange places – but still add to GDP.

Then the ECB and IMF paid off all the crooks on the finance side already and hold much of the Greek debt. They have their rules that sternly say they don’t take haircuts on their lending.

So the only way for this meeting to succeed with both sides happy is to find a third party not present in the meeting and agree to screw the third party.

They say they may re-convene.

“Last week someone posted about an upcoming election this week in Hamburg. Until, then it’s CYA time for Merkel. Then the negotiations start…”

Happened Saturday. CDU (Merkel) down 6% to worst ever showing there by far. AfD took that percentage as its gain. Other parties stable.

so Merkel’s on her way out anyway. Remember,. she did quite poorly in the last general election, depends on a coalition with the Social Democrats. Which tells you jus thow right-wing they’ve become.

when is the next general election in Germany? When the SD wants it? All they have to do is leave the coalition.

The problem is that, in Germany as in the rest of Europe, the neoliberals have pervaded the two main parties (Grosse coalition), which makes it very difficult to displace them: it took two three cycles of Greek parliaments to displace them: one PASOK, one ND, one Grand Coalition); in France one Sarkozy, one Hollande/Valls…; in Italy one Berlusconi, one PD…; and unless we work hard in Spain we will see the same: one PSOE, one PP, one Grand Coalition…

We might be lucky in Spain, and it looks like we are, but it is going to be a tight fight. And in Germany their regime decomposition will go towards right wing parties.

The eurogroup understands the issues, and they understand Syriza’s approach.

All they had to do was give a “thumbs up” or “thumbs down”. That’s all.

Instead, they punt, and do nothing.

Why?

Is it because Varoufakis has turned public opinion against austerity.

Is it because a good part of the financial establishment no longer backs their extremist economic theories? (FT’s Wolfgang Münchau says Varoufakis shood stand his ground)

The eurogroup has shown that they’re all wussies unable to make the tough choices when they have to.

Instead, they choose the one option that no one expected: Run out the clock.

How do you respect people like that??

There is no plan B. The technocrats don’t want to tell the Greek bondholders they have nothing, and a “grexit” is frightening.

Just for fun, Greek leaves and gets a loan from Russia and China. Their merchant marines become stateless or take drachmas. Free of the Eurozone, Greece begins seizure of non-Russian foreign assets. There are at least two houses in my extended family in Greece. Greece demands new lease terms for NATO or leases to Chi/Russo/BRIC affiliates. Spanish voters follow suit seeing a post-Euro world is possible.

The debt holders are still waiting on payment. Who holds the Greek bonds? Mr. Onassis or the French teacher union. If you screw the teachers union, people will be in the streets. If you screw Mr. Onassis, who knows what he might do or reveal?

Because official propaganda b as been to paint Greece as a rotten child, anyone holding their debt won’t receive sympathy from voters. There won’t be a bailout like 2008. Washington can’t even gin up support for a war and an air campaign.

Believe me, the EU and Eurogroup are not people worthy of respect; the first are the worst example of petty bureaucrats on mega tax free salaries; the second are NATO intimidated or NATO promoted quislings. Neither lifeform is capable of creative thinking and certainly not risk; principles are unheard of.

Best assessment I’ve seen on today’s events:

https://mobile.twitter.com/OpenEurope/status/567403004085944320?p=p

Well this is rich!

“An SPD politician from Merkels’ social-democrat coalition suggested s that Prime Minister Alexis Tsipras should replaces Finance Minister Yanis Varoufakis as he apparently creates lots of confusion, German politicians cannot understand.

SPD executive board member, Joachim Poß, wrote in an e-mail for his party colleagues:

“Greek Finance Minister Varoufakis has best demonstrated with his performance until now, that he is not up to the demands of such an office. In the interest of the Greek people and in view of the difficult situation, Prime Minister Tsipras should consider to replace Mr Varoufakis with a political experienced, realistic-efficient person.” (Handelsblatt)

Gee, a few EU Wimps got some hurt fee-fee’s or something?

Neither side can afford to give in. Yet the future of both Greece and Europe is at stake. Which makes this a revolutionary situation. The Greek leadership must recognize this. If they don’t, they will be deposed and truly revolutionary leaders (from either the left OR the right) will emerge. Same with Europe generally. If not now then in the near future, the Euro-economy will collapse and a completely new (and revolutionary) approach will be necessary. The resources are there, natural, manufactured, human. The money will no longer be there. Better this than the opposite, so things could be worse.

Did you miss that Syriza has 80% approval ratings, double what they got when they came into office? You can’t depose a government that has overwhelming popular support.

An EU embargo against Greece would do the job. Get some starving multitudes, feed them through hard Right groups for a few months, voila, a parallel government. It doesn’t have to be a plurality even to seize power. Is anybody keeping an eye on the Generals? That’s where I’d expect your garden variety oligarch to gravitate to.

The genius of the Syriza position is that they have the makings of a Popular Front. That’s why any reactionary movement will have to prepare very carefully. I hope it doesn’t end up like in 1946, with America and Britain “assisting” the so called anti-Communist forces.

I do get the 80% figure, but that can be finessed. Just look at America.

Oh no, an embargo would make Syriza more popular. Everyone in Washington and the Democratic Party including the newly elected and wildly popular Barack Obama piled on Charlie Rangel a few years back. Voters gave the national party a huge FU. Take Super Hitler Putin. Russians don’t care about whatever filth Hillary Clinton is spewing. All they see is the U.S. going after everyone on the neoconservative hit list.

An embargo would underscore every negative argument about the EU, and two, the political leadership isn’t popular in the EU. Anything short of new terms and a photo-op will be seen as a negative.

South Africa was a radically different situation. The majority were actively engaged against the ruling elite.

An EU embargo would be utterly against EU rules. That would be tantamount to saying the EU Is an complete sham.

When I consider that the EU elites face the possible dissolution of their grand dream due to Greek ‘intransigence,’ the bending, if not outright breaking of a few rules might seem like a small price to pay. What’s really fascinating here is that it is getting difficult to figure out who is the more desperate party, the Greeks or the Eurocrats.

It looks like we will find out what’s up when the reauthorization of the Greek banks access to the ELA comes due.

The military voted Syriza. Even the senior members of ND are backing the government ie Dora Bakogiannis, Michelakis etc. Not spite-filled, extreme right wing Samaras but t’were ever thus!

Thanks for that information! Since militaries have also historically backed popular movements, this bodes well for the nation.

Now I guess that people are beginning to understand why Tsipras selected ANEL as a government partner, instead of engaging in complex negotiations with neoliberal parties and get dragged into joining the goodfella party. He knew that he would need a deep and wide suport for what was coming, and that only an anti-austerity “national” popular front would do.

Defaulting and keeping a long cold head fight against austerity is going to prove hard. If you notice that most if not all of the EG and ECB’s people is related with Lehman Brothers, Goldman Sachs, etc or has a history of corruption like Wolfgang Schaüble (yes, he who calls corrupts the Greeks, though irresponsible looks more of a mafia term) you see that the battles being fight now are a continuation of the ones that should have been won after the 2008 financial collapse. This and I guess Ukraine are the next battles of this fight. I hope we are able to stop war in Ukraine and austerity in Europe, but it is proving a difficult task. :)

That’s a great link on Schaüble. Here are some excerpts:

Wowsers. The CDU is one big happy, isn’t it?

Not that I’m foily… But this seamy episode makes me wonder if the brutality of the German state is overdetermined; for example, if the privatizations being imposed on Greece involve the distribution of any other “envelopes,” and that might be an additional (that is, besides neoliberal ideology) reason to force “structural reforms” (translation: kaching!) through. If the CD, and Schaeuble, run true to form, that would be the case.

We in Canada are familiar with KH Schreiber: as a lobbyist and influence peddler, he gave our former PM Mulroney about $300,000 under the table. The PM sued the Canadian government (taxpayers) for $2,1 million for defaming his character.

See: http://thetyee.ca/Views/2007/12/03/ChargeBrian/

I wonder where KH is now.

Mulroney claimed to have a good character!? Whatever will they think of next?

(It sounds suspiciously like one of those ‘Tall Tale’ contests they have out in the wilds from time to time.)

What I meant, Yves, is that they will lose their popular support if they fail to take a revolutionary stance. If they back down and accept the troika’s terms, they will quickly lose their support. And if the troika backs down then several other European states will be demanding similar compromises, which the ruling oligarchs are unwilling to accept. So as it seems to me, the Syriza leadership will have no choice but to embrace some extreme form of socialism — which in the present context would be a revolutionary act. It’s easy to keep repeating that the present system is a mistake and can’t continue. It’s not so easy to envision how extreme the alternative will need to be.

Only 35% of the electorate voted for anti-EU parties. 30% didn’t vote, and maybe a good portion of the rest wanted to see negotiating in good faith. There are mandates, and there are Mandates. Syriza ca me in with a mandate, and they have taken action recognizing a “grexit” was not explicitly endorsed by 65% of the voters and local majorities everywhere but Athens and a few islands.

Maybe not quite germane but Obama came into power with a “mandate” and promptly enacted the opposite of what had been endorsed by the voters. He’s still there, by the way.

There is a (in)famous conservative theory that one needs only a small percentage of the “right people” to rule a State.

The kicker is that it might be the Germans who set things up so that a Grexit happens anyway. No one I’ve read knows how much pain such an event will cause the German banks. Given the choice of enduring events, or shaping them, good, bad, or indifferent, a rational actor will chose as much control as possible so as to shape events to their own benefit. The better question is; How much pain can Germany endure?

But Obama is a pig, and he also promised bipartisanship nonsense too.

Obama was a proud supporter of Joe Lieberman, and without the constant refrains of racism directed towards any criticism of Dear Leader, more voters would have seen what a clown he is. All the Team Blue types made promises about he would be super liberal when he was reelected. After his reelection, he pivoted towards attacking SS, and he has been irrelevant ever since.

Obama might be a pig, but you should see him with lipstick on!

I wonder what the quid pro quo is for his throwing in with Lieberman?

It probably has something to do with all the money he expects to get paid after he leaves office.

That was then, how about now?

There must surely be some conditions under which a majority would prefer an exit.

Three weeks ago?I believe, stressing BELIEVE, Greece’s population is close to that point, but I think a good portion of the population wants to see the niceties observed. Greece tried the Troika’s way. The growth didn’t come, and now they have made a counter offer. I say let the EU be the bad guys because they will find more allies in future Euro governments by being evicted then if they left.

The UK election is in the Spring. Spain is in December. Hollande is despised. Merkel has a grand coalition, and she brought a temporary surge of female voters to her party. Her standing might not be so great. Poland is interested in grabbing western Ukraine and full of people like my father’s mother, and the rest is too fragmented and small to be of concern. The governments behind the Troika will be gone or too unpopular to rally around.

Syriza is now polling at 80%. Massive domestic support for their course of action. Up 10% in the last week.

That assumes Greece’s enemies are rational and wouldn’t be willing to try something so obviously doomed to fail.

The US govt deposes popular govts all the time. It’s a cottage industry to the CIA and it’s tool, USAID. The IMF also serves the neoliberal political interests of the DC plutocrats as needed. Being democratically elected or emensely popular won’t stop a US-driven coup.

That’s what I’m afraid of too. Just look at Chile in 1973.

I don’t want a revolution anyway. You remember what Danton said: “In a revolution, the biggest scoundrels come to the top.” And he ought to have known.

The Berlin based Jacques Delors Institut has just issued a paper on the possibilities for a Grexit, where one can read this:

So the ECB, despite the threats it likes to issue, has in effect its hands tied in what concerns a cutoff of ELA to Greek banks.

This means the Greek government has many options left. It could proceed “as if” ECB threats don´t matter – for instance, by selling newly issued bonds to Greece´s commercial banks and then transfer the new deposits abroad, in order to pay the old debt held on the ECB´s books. Once freed from its foreign debt burden (the Bank of Greece´s TARGET2 debt balances would increase every time a payment abroad is made, but this would not matter much, since TARGET2 debts, being a type of perpetuity, only pay interest, currently at near zero rates) Greece would be in a much stronger position to negotiate an orderly exit from the euro, free from a high foreign debt burden in a currency (the euro) destined to appreciate vis a vis the new Drachma.

Greek comercial banks issue “money” – in the form of euro deposits. Let the Greek government take advantage of this power and use it to free the country from a crushing, euro-denominated foreign debt burden.

Varoufakis: Ahead of Eurogroup, Moscovici presented me a draft statement that I was perfectly happy to sign.

Yea! These Euro ministers/bureaucrats are used to finance minister who complain about austerity policies but understand they do not have any choice in the matter. Just shut up and do what you are told.!

Now they are faced with a smart finance minister who knows that there are alternatives to austerity that could actually bring a better economy for Greece and Eurozone and has the courage to change this spiral of depression in Greece. If Germans and ECB leaders really think that letting Greece exit the Euro would not create economy problems for them or Eurozone, they are just being pig-headed idiots.

So it is not surprising to learn that the bailout talks are over, with no agreement reached. But what is suprising, and not encouraging, is that if anything the Eurogroup hardened its stance against Greece and expected it to capitulate

Call me not surprised at the Eurogroup’s head in the sand reaction to the guy who was elected on a platform of specifically not rolling over. Then when they pop their head out of the sand, look around, see Greece standing firm, they start getting pissy and band together to give Greece the sweevil eye. Wow. Like that’s going change Greece’s stance – Eurogroup staring at Greece like the coffee clutch on Thursday afternoon. Let’s face it: The Eurogroup KNOWS the EU hinges on this as Spain is set to exit next if Grexit goes. Then after Spain, there’s Italy and a whole bunch of others. Back to printing the drachma, the lira, etc. Those fancy EU coins will be meaningless. Its not Greece that needs to bow down. Its the Eurogroup if they want to save their ‘power’. And that’s what its all about right?

BBC now carrying a story there may be more talks.

EU deadlines are rarely as firm as they are presented as being.

At least the BBC is presenting the same story on both the UK and World sites.

One noticeable thing about these stories is the willingness of Greece to present the logic of its positions, and the complete unwillingness of the EU/Dijsselbloem/Schauble to offer any evidence to support how the current bailout terms are sustainable. If all they can ever say is that the existing bailout agreement must be followed, without presenting (to the public) arguments about why it is the right course to take, how can they expect to get any of the critically thinking public on their side?

This outcome isn’t really that surprising. If neoliberalism is built upon few ideological pillars, the big three being, limited government, privatization/power of property, and the absolute authority of the central bank, Greece is challenging at least two out of the three, if not all three. No Western nation can openly tolerate this since it is deeply heretical. No nation in the past has been tolerated for following the same path. If Greece weren’t so close to “the countries that count” in Europe there would already be a coup and/or a war.

A coup against a government with 80% support? That would be Venezuela in 2002. Very hard to do that without a very violent and authoritarian government. I can’t imagine how the Troika, with its irrational and destructive policies, wouldn’t be blamed for what followed and wouldn’t play a huge price if that were to happen. We shouldn’t forget that just before the crash in 2008, the IMF was all but dead. It had Turkey and that was it. The crash, caused by policies the IMF has long backed, ironically saved the IMF but if its policies don’t radically change it will once again be in a similar position.

I, personally, think the left in Europe should use this as a “great awakening” moment, a moment in which the true anti-democratic nature of the system is laid bare. The countries in the EU have to see their economies grow at a rate at least equal to the interest rate on their public debt. If they can’t indefinitely, which they can’t, then they will eventually be in a similar position.

I hear the argument and do respect the premise. My objection is that the idea proposed about the 80% figures importance presupposes “rational” actors in charge of all parties. By very definition, authoritarian movements are crypto rational. The infamous “we create our own reality” quote by Rove is the best exemplar of that phenomenon.

I get you but if the ECB, the EC and the IMF’s policies not only lead to an ongoing depression but a coup and a violent and authoritarian government, they will pay a price. I don’t think it would intimidate others as much as it would enrage people. There would be a huge backlash. They are already playing with fire.

I agree about the “playing with fire” meme. My fear is that certain groups think they can control the turmoil. Very much like the Junkers and Financiers who thought they could ‘control’ Hitler in the 1920s and 1930s.

Too, as others have pointed out, the potential for backlash exists in most European countries, not just in Greece.

As the Chinese say, “We live in interesting times.”

Nationalize Greek banks confiscating deposited euros and replace with 1s and 0s of new Drachmas for the middle class on down.) Add 50% to jump start the economy?) Screw the wealthy. Let them keep their damn euros. Turn the nationalized banks into public banks run as utilities.

This can be done overnight with software and nothing more.

Monday morning Greeks awake with x number Drachma in their account rather than euros. Greek government can credit Drachmas AS NECESSARY to encourage the economy to move out of austerity while using the (confiscated euros to enable foreign trade.)

I get the feeling that Greece has put all its cards on the table. And that maybe the problem lies in Germany and they are hiding something. Desperation can fake it both ways. To make your opponent look offended, or make you look offended. Since Greece makes no bones about being bankrupt and seeking a solution, I think it is Germany that cannot face up to certain realities which, if known, would make Germany look considerably weaker. But what? Maybe they know their industrial powerhouse is crumbling and they are virtually in the same boat with Greece. But more frightened. (And Finland? Why even worry about Finland? It has an economy that wouldn’t even have been significant in 1950, nor has it been caught between superpower techtonic plates with 50 years of extortion and bribery… and etc.). I think something much, much bigger is being finessed here.

I presume that one big hidden issue is represented by the precarious situation of German banks. Let us remember that a whole bunch of them just about passed the infamous BCE stress tests, after much effort propping them up beforehand. We also know that those stress tests were all smoke and mirrors: the recent case of the to-be-nationalized Italian Monte dei Paschi di Siena is an illustration — the stress tests indicated it needed €2.1bn additional capital, and the most recent figures demonstrate it needs anything from €3bn to €5.3bn. While institutions like Deutsche Bank remain gigantic refuse bins for complex financial products, the banking systems in some other countries in the “German camp” (notably Austria) are slowly crumbling.

The second one I can think of is the future of the Turkish Stream pipeline and its possible continuation — to Greece…

Yep if anything were to happen to Deutsche Bank especially its derivatives book, the Germans are toast and would be exposed as the emperor with no clothes. Someone make it so, stat!!

Amazing how self-destructive national economies become when they focus more and more on finance/debt. What is good for finance is for society to go into debt to finance. If finance is bailed the debt owed to it is bailed out. So, use public money to make sure the public’s debt to finance is kept on the books. Risk is usually used to justify profits in finance, right? Finance is justified in making a profit because the money invested could result in losses and the profits are a reward for the risk taken on. Well, government’s now are removing that risk as much as possible with public money. So, socialize the risk then make sure all the gains are private and keep the structure of wealth exactly as it is. It’s insane.

If Greece is able to pull the temple down upon the Eurostines, hopefully the Eurostines will end up even more destroyed than Greece itself will be.

As I’ve mentioned before, now is the time for the creation of a Greek workers state, the Democratic Peoples’ Republic of Greece, if you will. Its time for the confiscation of private property and the public trial of the capitalist filth that engineered this situation. With 80% popular support, there is no other sensible direction for the party of the left to take except for the seizure of power. It is then that Greece will teach the Eurozone bullies a certain measure of respect.

To me, the Eurogroup is a vendor selling a payment service to a nation-state member of the European Union. They are shopkeepers that want to be paid. They can not understand why politicians don’t understand that a deal is a deal and that they want all of their money, not some of their money. The politicians don’t really want to talk to a vendor, the Eurozone, they want to talk to politicians about the social order and getting a New Deal because the old deal is no longer acceptable. If you have to have people living on less money than it takes to live, you are vendor that does not comprehend the meaning the of the question: What makes the social order possible? How is change in the social order possible?

The shopkeepers do not understand that change is coming and they are not going to get their money because their deal smashes the social order which is the basis for earning enough money to live and pay the proper level of Eurozone debt service. The debt service demand is destroying the capacity of Greece to make any money at all to live, much less pay back all of the money to the shopkeeper. Hence, a New Deal is necessary and different people, politicians, have to handle the situation because capitalists, in particular bankers do not understand that money does not make the world go round, but in this instance, money is grinding the social order to a screeching halt. The bourgeosie should never be allowed to have dominant political power because they will turn the state into a money making operation. And we know that the state does not need to make money since it issues it, but not in the case of the Eurozone. The Eurogroup has to be controlled by a larger political entity in order that it won’t act like a vendor with ultimate political power. That is not how the social order is made possible. That is how revolutions are made.

Below is a sample demand of the Greek Worker United Front Group- PAME

Notice how little the monthly wages are!

——————————————————————————————————————————–

Recuperation of all losses-We will not live on breadcrumbs!

We move forward for wage raises everywhere!

– SIGNING of National General Collective Agreement with re-establishment to 751 euros for those who are paid the minimum wage as a minimum for increases in all minimum wages.

– No worker to be paid under 751 euros.

– Abolition of the disgrace of 586 and 511 euro wages, the wages of hunger.

– Re-establishment of the lower sectoral wages at levels before 2009.

– No employee without a Collective Agreement. Put an end to the modern guillotine individual contracts.

– Abolish immediately all the anti-labour laws that destroy the collective agreements. Complete and obligatory enforcement of the collective agreements. Implementation of the after effect of the Collective Agreements until the signing of new Collective Agreement without any time limit. Elimination of the right of individual employers to sign contracts with wages below the sectoral collective agreements.

http://mrzine.monthlyreview.org/2015/pame110215.html

Right.

The Greek government could also get direct loans from the country’s commercial banks and then use the newly created euro deposits to either pay bills internally or pay debt held abroad.

Of course, the ECB could react by cutting off the Bank of Greece from the TARGET2 system and then euro deposits wouldn’t be transferable abroad. But again, that would be an expulsion of Greece from the eurozone – an illegal and unconstitutional measure that the unelected ECB governors would likely refrain from adopting.

If Greece keeps its nerve it may will win this battle. And it’s a good sign to observe outstanding U.S. liberals like Krugman coming out in support of Greece’s refusal to raise its primary surplus target.