Yves here. Given how many QE-induced distortions we have in the economy, I’m not certain the spike in inventories (in isolation) is as telling a symptom as it was last time around. But most analysts took note of how much of last quarter’s GDP figures reflected both a big increase in inventories and a negative GDP deflator, and they expect the next quarter or two to be less robust.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

“We do have more work to do in the US,” admitted John Bryant, CEO of Kellogg’s which makes Pringles, Pop Tarts, Kashi Cereal, and a million other things that consumers are increasingly reluctant or unable to buy. He was trying to explain the crummy quarterly results and the big-fat operating loss of $422 million, along with a lousy outlook that sent its stock careening down 4.5% during the rest of the day.

Then in the evening, ConAgra, with brands like Healthy Choice for consumers and something yummy they call “commercial food” for restaurants, cut its fiscal 2015 earnings guidance, citing a laundry list of problems, including the “strengthening dollar” and “a higher-than-planned mark-to-market loss from certain commodity index hedges.” But it blamed two operating issues “for the majority of the EPS cut: “a highly competitive bidding environment” and “execution shortfalls.”

After which confession time still wasn’t over: it would be “evaluating the need” for additional write-offs. What had gone well? Cost cutting – “strong SG&A efficiencies,” the statement called it. But the pandemic cost-cutting by corporate America represents wages and other companies’ sales.

It’s tough out there for companies that have to deal with the over-indebted, under-employed, strung-out American consumers with fickle loyalties and finicky tastes, who have been subjected to this corporate cost-cutting for years.

And so retail sales, according to the Commerce Department, dropped a seasonally adjusted 0.8% in January. That’s on top of a 0.9% decline in December. The hitherto inconceivable is happening: folks are saving money on gas, but not everyone is immediately spending all that money! It’s so inconceivable that I warned about it and other effects of the oil price crash two months ago: “Wall Street promises a big boost to US GDP,” I wrote. “What have these folks been smoking?”

But even excluding gasoline sales, retail sales were flat last month after edging down 0.2% in December. And sure, some of the savings from gasoline will be spent eventually, but there are plenty of Americans with enough money left over every month to where their spending patterns aren’t influenced by the price of gas.

But this report, an advance estimate that is subject to potentially large revisions, covers only spending at retailers and restaurants, a portion of total consumer spending, which includes healthcare and anything else that consumers pay out of their noses for. And year-over-year, retail sales actually rose 3.3%, with food services sales up 11.3%, auto sales up 10.7% thanks to prodigious subprime financing, while sales at gas stations sagged 23.5%.

So from just the retail sales report, the consumer situation remains murky.

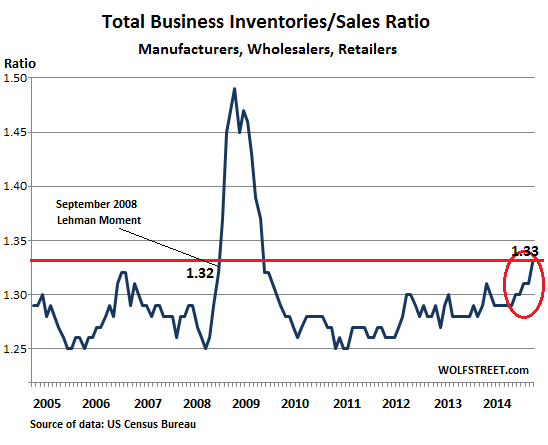

But there is another gauge that is moving deeper and deeper into the red. It has been deteriorating consistently since last summer. A couple of days ago, I reported that wholesale inventories were ballooning in relationship to sales, a red flag in our era when just-in-time delivery and lean inventories have been honed into an art to minimize how much working capital and physical space gets tied up. The crucial inventories-to-sales ratio for wholesalers had reached the highest level since the financial crisis.

Now the Commerce Department released total business sales and inventories for December, which include sales and inventories at retailers, wholesalers, and manufactures – the entire channel. And it’s even worse.

Combined sales by retailers, wholesalers, and manufacturers, adjusted seasonally but not for price changes, dropped 0.9% from November, and was up only 0.9% from December 2013 – not even beating inflation.

Retailers were able to keep their inventories stable in relationship to sales, which inched up 2.6% year-over-year. So the inventories-to-sales ratio remained at 1.43.

Further up the channel, wholesalers saw sales rise only 1.43%, but their inventories stacked up, and the inventories-to-sales ratio hit 1.22, up from 1.16 a year earlier.

And manufactures? That great “manufacturing renaissance” in the US? Year over year, sales declined 0.9%, but inventories rose 2.7%, and their inventories-to-sales ratio jumped to 1.34 from 1.29 a year earlier.

For all three combined, the inventories-to-sales ratio rose to 1.33 in December, after climbing methodically since summer. The last time it was rising to this level was in September 2008 – the Lehman Moment – when sales up the entire channel were beginning to grind to a near halt, a terrible condition that morphed into the Great Recession. That propitious September, the inventories-to-sales reached 1.32, still a smidgen below where it is today:

Optimistic merchants and manufacturers expect sales to rise. They plan for it and order accordingly. If sales boom and draw down inventories, the inventories-to-sales ratio remains lean. That’s the rosy scenario. But that hasn’t been happening recently.

In our less rosy reality, sales are not keeping up with expectations, and inventories are piling up. The increase in inventories adds to GDP, and so from that point of view, they beautify the numbers. But from the business point of view, growing inventories caused by lagging sales can turn into a nightmare. And unless sales can somehow be cranked up for all businesses across the entire country to bring down these inventories, orders to suppliers will be trimmed – and that ricochets nastily around the economy with all kinds of unpleasant secondary fireworks.

“Here in Houston a number of projects have been canceled, engineers are put on ‘hold,’ and everyone is waiting for the other shoe to drop,” an engineer in the energy sector wrote. “Not pushing the panic button by any means” is how the Texas banking regulator phrased it. But it’s looming in front of everyone. Read… Oil Bust Hits Office Construction Boom, Banks, Suppliers – But Hey, “So Far” No Apocalypse

When the oil bust hit Denver in the 1980’s there was a very high number of “see-thru” office buildings that had been completed, but had no tenants.

In order to avoid collapsing the banks that had financed this construction, Denver had four or more years of very creative office leasing. The building managers could not reduce the cost per square foot to it’s market value of about $10.00/sq.ft. Instead, they rented it at the $40.00/sq.ft. needed to keep the bank auditors from having a hissy-fit and then gave rebates that reduced the real rent to $10.00.

Everyone, including the bank examiners knew that all of these numbers were bogus, but as long at the fake numbers were technically OK, the buildings could be rented for a cheap price and the banks did not have to close their doors.

Part of the reason this worked was that the worst effects of the bust were limited to Denver, and everyone knew that after four or five years, the worst would be over.

You are incorrect. Buildings are appraised on basis of effective lease rates. $40/SF for 4 years with 3 years free is not an effective rate of $40/SF.

Of course it wasn’t an effective rate of $40/sf but one way or another they managed to cook the books and pretend that the leases justified the collateral value of the buildings.

As I pointed out, the bank “regulators” managed to kick dirt over the entire mess. The alternative would have been to throw all of the building loans into default and trash the balance sheets of most of the banks in Denver.

lol to this post. Sales are exceeding expectations and it shows in the excess stocking. This means GDP is being undercounted as well and will have to be revised up. Matter of fact, the amount of wholesale inventories are rising with real pce spending.

Huh? Any respectable financial forecaster will tell you that inventory build means lower product sales in future quarters as inventories are reduced to normal levels. Did you miss that holiday sales weren’t all that swell?

i dont know what he’s thinking but he’s on the right track…all the “respectable financial forecasters” i’ve read are missing the impact of falling prices…the inventory to sales ratio for petroleum and petroleum products, which is about 10% of wholesale sales but just 3% of wholesale inventories, rose from 0.31 to 0.34…there was a monstrous build of petroleum inventories which has distorted the ratios in this report…

https://rjsigmund.files.wordpress.com/2015/02/february112015crudeoilstocks.jpg

most forecasters are calling for a 0.5% hit to GDP from lower inventory growth…i havent crunched the numbers yet, but it looks close to a wash to me…

First, 0.5% when you are only at 2.6% and then by use of a negative GDP deflator, is not trivial. And you are conceding the point, contrary to what greenbacker asserted, that inventory build is a negative for growth.

And your point about falling prices makes no sense in the inventory context. If inventories are building as prices are falling, that implies the prices you built them at from an accounting standpoint, will be less than the price at which you sell them. In other words, your inventories carry hidden losses, which at a -0.1% GDP deflator would appear to be trivial, but in the oil build you highlighted, could be material. Krugman kept arguing, during the oil bubble of 2008, that the lack of an increase in inventories meant that the price spike was the result of real economy factors, which meant the price was not artificially high and hence would persist. He ignored that oil can be inventoried by keeping it in the ground.

However, this time most producers are continuing to pump because for various reasons most of them still need the revenues (or in the case of the Saudis, they are trying to force the supply adjustment on everyone else). Opinion varies widely as to how much and how quickly prices will recover. They’ve bounced back rapidly from the low of $43, but there have been a lot of efforts to talk the market up. Large inventories mean that the price is higher than it would be at normal inventory levels. The president of BP thinks low (as in $60ish at best) prices could persist for a long time. If China continues to slow and Europe continues on its deflationary path, we are looking at continued weak fundamental demand for energy supplies.

I think what he is saying is that there is momentum building and inventories are increasing because the producers are seeing increasing sales in the pipeline… maybe inventories won’t be high enough for what is coming. Time will tell I guess.

The reality is that for the last 40 years, thanks to the US dollar as a reserve currency, most of the wealthy in other countries are either bankers, exporters or dictators… they want and need a strong US dollar. This structure is weaker than in the 70s and 80s but it is still there.

My guess was that the US would devalue its dollar for a few years while licking its wounds and then would drastically increase the value of its dollar for a second round of easy money thanks to its global reserve status.

Then the US gets a nice bout of growth and inflation to devalue the debt that was printed at less than 2%…

It isn’t 1960 any more. Just-in-time inventory management is now ubiquitous;d you run out of toasters and you order only what you need to statisfy immediate sales expectations. Stocking up is a thing of two decades ago.

I believe just-in-time inventory management is peaking with TBTF. A few more years of it. The culmination of a 40 year cycle. At one point decentralization will reduce the efficiency of JITI… production will need to get redistributed over time.

But right now we are in the final innings of TBTF spreading to many more sectors than banks… free money, low rates, cheap oil and cheap real estate, why not load up right now?

maybe i wasnt being clear…remember that inventory building contributed .82% to the 4th quarter GDP increase of 2.6%; analysts are saying that will be less; i’ll paste what i just wrote on wholesale inventories here (without the half dozen links to avoid moderation:

both sales and inventories from this report were included in 4th quarter GDP, but inventories were only estimated when the GDP report was released two weeks ago, when the BEA assumed that wholesale and retail inventories had increased and that nondurable manufacturing inventories had decreased in December…in reporting on this report, analysts assumed that this report indicated that the BEA overestimated inventories and hence marked down their estimates of GDP…economists polled by Reuters estimated that GDP could be lowered by at least 0.5%; Wells Fargo economists concurred; Macroadvisers estimated a total hit of 0.6% to GDP from a combination of December reports….however, it’s likely that very few of these estimates have adjusted inventories for inflation, a necessary prerequisite to determine their impact on GDP..

starting with wholesale inventories, which we have already noted were up just 0.1%, largely due to a 6.2% drop in petroleum inventories…most of the inventories covered by this report would be deflated by the BEA using the producer price index for December, which showed a 1.2% drop in prices for finished goods, along with a 1.7% drop in prices for intermediate goods and a 5.0% drop in prices for raw goods…however, most of that was as the result of lower energy prices, which fell 6.6% at the finished energy goods level…that alone would indicate a real increase in energy goods inventories, which was borne out anecdotally by news articles in December indicating seasonally record stocks….looking at foods, we see wholesale prices were down 0.4% for finished foods, 0.8% for intermediate foods, and 6.9% for raw foodstuffs….the wholesale inventories report indicates that inventories of wholesale groceries rose by 1.1%, while inventories of farm products rose by 0.8%; once adjusted for prices, BEA would find that real inventories of wholesale groceries rose by 1.5%, while inventories of farm products may have risen by as much as 5.8%, and it’s those real inventories that would be applied to GDP…meanwhile, wholesale prices less food and energy were up 0.2% for finished goods, down 0.6% for intermediate goods, and down 0.5% for raw goods…to determine real inventories for each of those goods, the BEA would use the corresponding itemized tables in the producer price report…prices for finished wholesale goods, for instance, are listed in table 4 under “Final demand goods less foods and energy”….by way of example, wholesale inventories of computer equipment were up 2.6% in December, while their prices were down 0.7%; that would suggest that an increase of 3.3% in real inventories of wholesale computers for December would be applied to 4th quarter GDP..

on retail inventories, again sans links:

similarly, inventories of goods at retail would be deflated with the various components of the consumer price index for December, which showed a drop of 0.4%…again, energy prices were a major factor, but even excluding food and energy, prices for goods less food and energy were down 0.3%…but we dont have to pick through the CPI report to get the deflator for December, because the BEA has already computed it in their income and outlays report for December, which we looked at last week…the PCE price index was down 0.2%, already implying an increase to GDP…but to adjust retail inventories, we’d have to use the PCE price index for goods, which we find was down 1.0% in December when checking Table 9 of the pdf version of that report…applying that to retail inventories, which are not broken down by category, we’d estimate that real retail inventories rose 1.1% in December, in keeping with or even more than the BEA estimate..

remember, these same price indexes must be applied to sales; that’s why there was such a large jump in real PCE in the 4th quarter, despite weak retail sales in current dolllars…

the rest of the story:

we would find the details on factory inventories in the the Census Bureau’s Full Report on Manufacturers’ Shipments, Inventories, & Orders for Decmeber (pdf), but again they would be deflated with the appropriate price index for the types of inventories the various manufactures are accumulating…most of these price indexes would again be found in the producer prices report…inventories of non-durables, which were estimated in the advance GDP report, were down 1.5% in December, but again much of that was due to an 8.8% drop in refinery inventories, which make up 15% of non-durable factory inventories..other factory inventories which fell included textiles, rubber products, pesticides and industrial chemicals, which use petroleum as an input…indeed, checking the producer price index, we find prices for industrial chemicals were down 4.4% in December, indicating the 0.6% drop in inventories of chemicals wasn’t a real drop at all, but actually a real increase of around 3.8%..other components of factory inventories are less clear; to figure inventories of capital goods, for instance, we might have to estimate using the GDP deflator for equipment, which showed an annualized price increase of 1.1% in the 4th quarter..that would be about 0.1% per month, a subtraction but not significant…

all in all, it appears that the BEA estimates for 4th quarter GDP inventories were pretty close to on the mark, and that the estimates of economic forecasters that reduced inventories will cause a major writedown of 4th quarter GDP will prove to be unfounded…

or maybe the west coast port issues were on peoples minds and instead of sticking to JIT they moved to JIC (just in case)…

http://www.autonews.com/article/20150213/OEM01/150219901/honda-cuts-production-toyota-airlifts-parts-amid-west-coast-port

i’m only talking about the impact of falling prices on GDP, not on the lower values of inventories held by companies, which is admittedly a negative…a lower price, ie a negative deflator, results in an increase in GDP (because the same dollar value indicates more goods produced)

the deflators used on the various components of 4th quarter GDP are in the last column of table 4 here:

http://www.bea.gov/newsreleases/national/gdp/2015/pdf/gdp4q14_adv.pdf

look at the large negative deflators for the various categories of goods; i’ve never seen anything like that.,.

here’s my point:

if the economy consumes 10 apples at a dollar a piece in November, and 11 apples at 90 cents each in December, sales have gone down by 1% but GDP is up 10%…if there are 10 apples on the shelf in both months, reported inventories will go down 10% but the inventory contribution to GDP will stay the same…

I think what they are saying is that the companies will sell at a loss but make up for it with volume…

Excess inventory means sales aren’t meeting expectations.

most of the drop in business sales was associated with lower oil prices; even “manufacturer’s sales” were more than 10% refinery sales, down from more than 12% in November..

You’re talking about spending. That isn’t the same thing as accumulation of prodict units.

the way to determine “excess” inventory is to compare it to sales…if sales are down because of falling prices, and you havent marked down your inventory accordingly, your ratio (which wolf cites) will be distorted…

Sales/inventory ratio isn’t the only way, it’s the easiest way and doesn’t acknowledge the two variables can move independently. Like any econometric method its usefulness is specific and limited.

agreed.

which is why i flipped out on wolf’s chart this morning…of “business sales”, more than 10% of wholesale sales is petroleum based, 8.8% of retail is gas stations, and even manufacturer’s sales were more than 10% refinery sales, down from 12% in November…so of course sales, denominated in dollars, are going to be down; less so inventories, as oil is a smaller piece of that pie..

Thanks rjs. Excellent information.

Your blog is also very informative. https://rjsigmund.wordpress.com/

It appears to me that U.S. growth is inevitably slowing as global growth slows.

Or preparation for coming demand. But with all the free money right now and cheap oil and storage, why not load up if markets will reward you for taking on more debt? So not sure if it’s coming demand or the effect of free money.

The QE party is only beginning in Europe

Money for free

Companies and consumers must change everything: machines, cars, etc.

Example: Renault stock at 55 in October, now just under 80. New buy recommendations at 100

Casino just opening

All because Germany did not want a proper EU stimulus and in the end was outvoted on QE

To do other wise would be an admission of being ideologically refuted… that might encourage the little people to start knocking of the noses of a few idols…. in the temple.

Skippy… which could lead to more horrible acts… down right lack of respect or total lack of fear…

It would be a no-brainer for investors, only Greece is pooping the party, to everyones consternation.

It might be interesting to plot margin vs stock prices, I’d guess the % stocks bought on margin starts increasing the minute QE was announced and will increase until the day they say stop, barring Euro meltdown of course.

With euro 20% lower to USD, investors holding USD can buy in euros without too much currency risk. Funds now flowing in from overseas to euro markets

The ‘subprime car loans’ effect is all too evident on the streets around here. Most older people we talk to, when this subject comes up, and it does, regularly, wonder how the younger cohort is going to cope when the party stops. We older people remember busts from days past, and have trimmed our consumption habits accordingly. Phyllis laughs when she recalls how her parents generation would push delayed gratification, citing their memories of the Depression as motive. With the destruction of the broad based middle/working class proceeding apace, what else did the “captains of industry” expect? Given the relationship suggested by the chart, all we need now is a “Black Swan” event, like the ‘Lehman Moment’ back in ’08. Which comes first, the powder or the spark?

Perhaps it’s time for the periodic reminder of this classic: “In The Vaults Where The Dry Powder Is Stored”

Oh my! Lambert! Thanks for that link. Or maybe not… It’s going to be stuck in my head like a ice pick all day. I had completely forgotton the whole “keeping our powder dry until we win the WH” thing.

Those subterranean storage rooms must be packed solid by now.

It’s going to take hours of weeding and farm chores to work through that reality-again.

As to the Richter piece? Uh-yup. Rotten indeed. Sitting on a shelf with all the other moldy half loafs we’re expected to buy.

I fear Hunter Biden reached the dry powder first.

I’m with you NTG!

What with the oligarchs scrambling to get another blank DOD check to doom another generation of US soldiers to the hot hells of Syraqistan (when they are not home committing suicide at the rate of 25 a day) following on the backs of failed Ukranian & Libya (etc) coups with war-king Bibi with his nukes under his skirt hiding with the Saudi’s like a lurcher over the DC capitol, NO ONE is connecting the dots here in terms of the “cheney” dynamic in play right before our eyes.

Another decade of endless war should take care of those pesky inventory over-runs! Where to send the DOD auction bids for contracts? Oh, no need to look far, new dude sworn in last week, the arms-contractor-in-chief!

Comparing to KMT before China civil war bodes badly, since we all know what Mao’s response was: widespread famine and starvation plus occupation of Tibet.

>> banality of bankrupt empire?

Many of those younger people had no other choice. Public transit is often a disaster, and the used car market has never recovered from cash for clunkers and longer lasting cars. You can’t buy a used Toyota.

How else can they afford a vehicle?

So they’ve analysed what went wrong?

The plan was good – that we know as it was the glorious (job-creating?) leader who came up with the plan and he is infallible. That leads to the only possible explanation: the plan was poorly executed by the peons…

“But it blamed two operating issues “for the majority of the EPS cut: “a highly competitive bidding environment” and “execution shortfalls.””

I have no idea how much the seasonal weather affects build up of inventories, but here in New England we’ve had a least 6 days since January where you simply can’t go anywhere and have to stay home. That has to affect shopping and inventory build ups to some extent.

The inventory build was last quarter….

Everything going as expected… debt-to-GDP too high. Government doing whatever it can to get GDP number up… more sales, inflation and misrepresenting inflation.

I remember reading somewhere that 5-7% the average American’s income goes to food vs. 9-11% for Canadians and more than 15% for Europeans. This low number probably reflects the low quality in the choice of food in the US but it probably also reflects the impact of subsidies (i.e. corn) on food prices.

Anyway, the trillion dollar question is whether this 5% will be going to 15% over time. If one believes resources will become increasingly precious in a globalized world that has gone from 3,5B to 7B since this debt cycle began, then it is logical to think in terms of purchasing power and not inflation/deflation terms.

Critical reading skills are must when reading about the Richest Country In The World.

The average family income is about $50k. 7% is $3500/yr. $291/month. You don’t really believe a family of 4 eats for $291 a month in the land of Exceptional Farming and Fast Food Lunches at work for the two income $50,000 family??? We are easily at 15% now.

The average household in US is max 2.5 people.

You can split hairs… but you are taking the argument away from my point which was that maybe over time, Americans are destined to lose purchasing power as US food prices even out to what foreigners are paying for their food.

This year the war on crapification in my house continues in earnest. For the most part my purchases will be replacing things which are two years old or less, now heading for the junk yard… all of which should have lasted at least ten years. Fans, window unit AC, wheelbarrows, reusable rubbermaid type food containers which did not last through two uses, etc. Like Obamney, not care, I am doomed to spend much time shopping for things I should not have to think about for more than a few minutes. Measure that cost/loss! Will my war be futile, is there any semi-quality left? Am I crazy, or should a three speed oscillating fan last more than two years in this day and age.

Want to measure potential demand… figure out a way to measure the pile up of the lowest quality plastics and electronics at the dump. Then figure out the refusal of all manufacturers to make one decent model of a particular item. This is where/how most Americans will be forced to spend their time re-consuming.

As for food companies mentioned in the post I have yet to see so much as a price drop of nickel on boxes of cereal and such… while we all know their energy/oil costs have dropped dramatically. They are not passing the savings along at all.

I am convinced that the Corporations had to move off-shore because American workers would not build crap…because these same workers wouldn’t buy crap as long as there was an alternative. It was one of those hidden labor costs that doesn’t get talked about.

The Asian slave classes aren’t buying anything, let alone the crap they ship here, so there’s no existential conflict amongst the labor force.

Until the cycle breaks down. As it is breaking down now. Pretty soon, American manufacturing start-ups will occur, just as the anti-agribusiness farms did a decade ago. And the mindset will shift. And then, perhaps, American People can reclaim their economy from the New World Order.

Couldn’t agree more about quality of goods. I am buying less because of it. After a 32 inch flat screen TV I bought tanked in 2-1/2 years, it seems unwise to spend on anything like a smart TV or TV upgrade. After a neighbor’s new fridge blew its electronics in a simple power outage situation, I’m sticking with my old, old-fashion fridge. And don’t let’s get started about processed food! It is so expensive for virtually no food value. It is too salty, too sugary, too fattening and low in real food value. And it is not so painful to cook a meal. It takes about 30 minutes most nights to make a dinner from scratch.

Bought my 30″ RCA TV at Salvation Army, its at least 20 yrs old and still going strong. Paid $30 for it and it took 3 guys to get it in the house. Ya know, back in the day, Americans used to make TV’s and they were well paid to do so. It was a product worth having and you didn’t complan about the price much.

Note that your smart TV very likely listens to your conversations and records the data. And you sign a contract allowing them to do so. http://www.ibtimes.co.uk/samsung-smart-tvs-listen-your-private-conversations-share-details-advertisers-1487153 The “stupid” TV’s should be named, “Constitutionally Compliant TVs”. They are also the cheapest. Unfortunately, their life span is likely short, but at least they should still be good by the time you get them home from the store, if you don;t stop to pick up milk or something, (and maybe even by the time they arrive from your favorite Web site).

I buy all goods except underwear at Goodwill, ebay, or craigs list and find them high quality-superior to the crapification.

constitution tv is goingg obsolete now, as local tv stations are drawing down their signal broadcasts….it will be back to ham radio (or Pacifica for those of us who know better)

No need to blame Asians: it was the greed of Americans for the “cheap” over value that rewarded corporate usa for moving offshore (except for a few handfuls quaker-ish communities who have kept a culture of buying local over the decades)

First of all, they dare tell us there is no inflation when obsolescence is right there in front of our eyes forcing us to waste time an money and costing us much more in the long run. Then, they dare apply hedonics to these lower quality products, their reasoning being that there are more buttons or IOW more functionality!

LOL!

The good news I gleaned from this is that ConAgra and Kellogg, who are huge supporters of Monsanto, are losing money. I stopped buying products from companies like them (a couple years ago) that support and use Monsanto products and refuse to label them as GMO laden. They spend huge bucks defending and supporting Monsteranto against the wishes of the American people and now they’re losing money and market share. YAY

Just wondering what the connections are to the tbtf banks which have been practicing stockpiling for several years, first in tankers filled with Saudi oil parked in some remote island harbor waiting for the price to go up but the price only went up briefly so what did that accomplish – then the Fed forbidding the banksters to stockpile other commodities in warehouses and pretend business is brisk but really they are just transporting the stuff from one warehouse to another – doesn’t all this misbehavior really make a farce out of just-in-time inventories around the country? – apparently somebody has to stockpile stuff so they can supply the JIT inventories… And GDP is being balanced similarly. If people are buying fewer valuable products, then just make crap and sell lots of it. Groaf and cat food. Clearly there is a lot of method to this madness. It is the suppression of manufacturing and consumption but don’t let it get out of control. Maybe.

It seems like all the conversations are playing in the silt of small impacts on the economy pulling in different directions. Unless you can do a computer simulation of all the forces in play to calculate the net tiny result of the balance of myriad tiny forces, then all talk about qualitative effects is just word play. This is not a binary system of off and on, it is a play of forces that have parts per million to account for.