Yves here. Unlike many other comments on the state of Greece’s finances, this post takes a stab at Greece’s ongoing budget needs as well as its various debt due dates. Note that one uncertainty flagged here has been resolved in Greece’s favor. The Greek government will receive €550 million this month from the Hellenic Financial Stability Facility.

By Silvia Merler, recently an Economic Analyst in the DG Economic and Financial Affairs of the European Commission (ECFIN) and now an Affiliate Fellow at Bruegel in August 2013. Originally published at Bruegel

Discussions between Greece and its creditors are due to restart tomorrow. In the meantime, the pressure on Greece is increasing. Here we take a look at the relevant deadlines ahead for the Greek State coffers.

Redemptions to Official Creditors

As previously discussed, the path of redemptions to public creditors in 2015 is dominated by repayments to the IMF, T-Bills rollover and, in July and August, repayment of bonds held by the ECB. In March, Greece has 1.2 billion euros left to repay to the IMF, in three tranches: 335 million will be due on the 13th of March, 558 million on the 16th of March and 335 million on the 20th. On top of this, Greece will need to roll over 1.3 billion of T-Bills expiring on March 13th and 1.6 billion on March 20th. Once the March deadlines have passed, April and May will be relatively quiet, before funding challenges resume in June, and most importantly in the summer with the big tranches due to the ECB (see here for detailed dates on all payments).

Ordinary State Expenditures

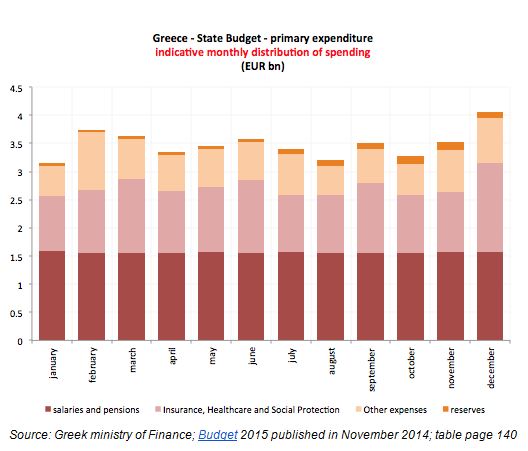

Beyond repayments to official creditors, the Greek government also needs to meet its ordinary primary expenditures during the year, so it is useful to have an idea of what these are and how much they account for. According to the 2015 budget published in November 2014 (unfortunately available in Greek only) the ordinary primary expenditure at the State level is expected to be about 42 billion for the entire year. Total expenditures are expected to be 56 billion at the State level (see figures in the most recent the budget execution bulletin).

About 78% of the State ordinary primary expenditure is accounted for by payments of wages, salaries and pensions as well as of insurance, health care and social protections. An indicative monthly distribution of expenditures provided in the 2015 budget suggests that in March the government will need to pay about 1.5 billion in salaries and pensions and 1.3 billion in insurance, healthcare and social protection (with similar payments foreseen over the following months, see also Macropolis here). These are expenditure items that are not easy to avoid or reduce in the case of liquidity shortage, at least not without having a significant social and economic impact.

ECB president Draghi reportedly told Greek Finance Minister Varoufakis yesterday that the Greek government’s books needed to be examined to determine its financing shortfall, and Commission, IMF and ECB staff are due to start the work in Athens on Wednesday. In the meantime, given the absence of real time data, it is very difficult to have an accurate impression of the exact state of the Greek State coffers.

According to a recent interview, finance minister Varoufakis suggested that the situation is not as rosy as previously thought: “I can only say that we have money to pay salaries and pensions of public employees. […] For the rest we will see”. Kathimerini reported yesterday that the General Accounting Office has blocked any state expenditure not related to salaries and pensions. The same article reports a government official as saying that the budget has 4,772 expenditure categories – not salary-related – and that a review has allegedly saved about 180 million.

Recent analyses by Macropolis suggest that the government can rely on a number of sources in the very short term. Following two recent ministerial decisions, it could utilize cash reserves of 250 million euros from OPEKEPE, e organisation responsible for managing Common Agricultural Policy aid, and 114 million from the Hellenic Telecommunications and Post Commission (EETT). On top of that, the Bank of Greece’s financial accounts show that the profits for 2014 amount to 641 million euro which, according to Macropolis, were also transferred to the government at the end of February. Possibly, 500 million more could come from a fund in the Hellenic Financial Stability Facility which, according to recent news, could be drawn upon subject to a law amendment.

Altogether, this adds up to 1 billion, which could be precious to Greece in the course of this month, but it does not seem to be a game changer if an agreement is not struck.

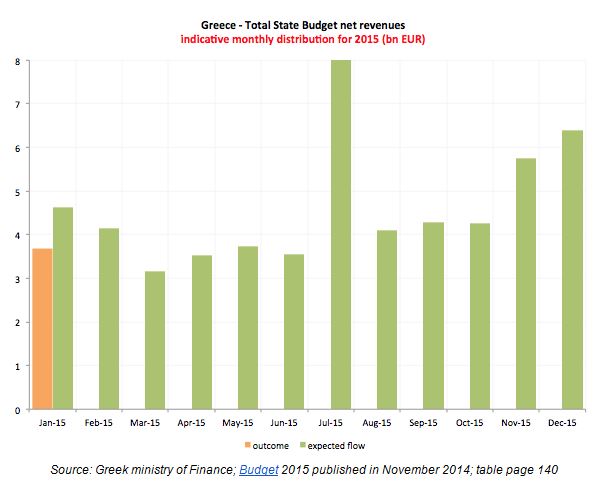

As previously shown, the Greek budget execution data for January showed a significant underperformance of revenues compared to the targets set. According to the Ministry of Finance, this was mainly due to the extension of a VAT payment deadline until the end of February 2015 (Figure 2). The data presented here suggest yet another reason why this is worrying. The budget execution data released in February will be key to watch.

Their annual budget is €56 billion and they took on how much to save the banks?!?

Is there a clear breakdown of their debt composition in terms of original liability incurred?

We need to start calling the inevitable an “EU default”. I find it difficult to call a Greek inability to pay a sovereign debt default.

The way the €550 million transaction from the Hellenic Financial Stability Facility worked out, seemed very strange to me. It looks like the ECB is worried that Greece is close to default, but needs to see the books to make sure.

If this is the endgame, then it probably makes no sense for V to tap into potential sources of money now, which would deplete resources needed for the transition period.

The talk about a referendum and German reparations all look very desperate. We may be closer to Grexit than anyone knows.

It looks like the ECB is worried that Greece is close to default, but needs to see the books to make sure.

I read it exactly this way, but with the opposite conclusion. Namely, that the ECB et al are not willing to force a default. They will release funding if they are convinced a default is imminent.

The reading seems very specific:

Klaus Regling, head of Europe’s financial rescue fund, said the money was originally paid in by Greek banks before the country’s bail-out in 2010, and creditors “had no legal claims” on it.

http://www.telegraph.co.uk/finance/economics/11461476/Greece-awarded-financial-breathing-space-with-550m-lifeline.html

I don’t think you can draw any conclusions from it.

Be careful interpreting news about Greece in the papers. I just read about an hour ago a major news source that claimed Greece responded to Germany’s NO regarding reparations by threatening confiscation of German property in Greece.

First, the chronology of these claims is off. The justice minister that addressed confiscation occurred first. But the context around his utterance was left out. He was actually referring to court cases that the people of Distomo won against Germany going back 17 years now, court cases from European courts. Greece has refused to enforce judgments in favor of those individuals out of deference to Germany. This is a long running saga. The justice minister essentially said he is now inclined to sign the papers (and presumably the judgments would be enforced). So, this is not a case of the Greek gov’t confiscating property per se, it’s a bit different.

Second, Greece has always maintained it has never received proper reparations from Germany. This is a belief across the political spectrum. While the concept of reparations is questionable (I can’t see how it gets the Greece anywhere except to highly the moral/ethical stakes here) there is also a loan from Greece to Germany which has not been repaid. Germany only repaid a quarter of it prior to 1960. Some estimates put that loan at around 50 billion now. So, in order to see the actual Greek position, you would have to differentiate a loan from reparations. Regardless, this isn’t a new thing.

Third, Varoufakis was also quoted to have said to Germans Greek will never repay their loans. This info was presented as a new thing he said this weekend. In actuality, the Varofaukis quote is very dated, and it was made a long time ago.

Thanks, Dan. Appreciate your timeline summary. Was viewing these as oblique actions running in both directions in response to an impasse in debt negotiations, although that may also be true.

This today from the BBC: http://www.bbc.com/news/world-europe-31831694

This issue serves to deflect attention away from others with responsibility in the matter, including members of the Troika, and large privately owned banks and their bond holders; and casts it into a familiar historical narrative.

Just posting these if you are interested Dan or anyone else. Not sure how accurate they are.

http://www.greece.org/blogs/wwii/?page_id=166

http://truth-out.org/news/item/27261-germany-s-unpaid-debt-to-greece-albrecht-ritschl-on-germany-s-war-debts-and-reparations

From the post: “These are expenditure items that are not easy to avoid or reduce in the case of liquidity shortage, at least not without having a significant social and economic impact.” Yah, “significant social and economic impact…”

Got to love the bloodless prose of economic/fiscal/financial analysis. May I offer a sentence to that pretty small set of people who butter their bread with the “fat” squeezed out of the ordinary people that build the wealth that seems to be the real basis of so many various economies? “F__k you and your f__king charts and formulas and papers.”

Even the smart people will not agree even on what “money” is, they seem to hold to disparate views that surprisingly seem to relate to how they personally can benefit from grabbing more of it than anyone else, so they can try to figure out how to drive their exotic cars and get more sex, drugs and haute cuisine. And if “more for me” means all you ordinary people, over whom “I” and my peers have managed, by stealth and cleverness and concentration and coordination of effort, to have taken power, will starve in unemployed and disenfranchised misery, all bits of wealth and dignity and security stripped away, and without even the little protections that serfs and slaves had in the past, and be driven to suicide as the final desperate alternative to living in cardboard box (eventually subject to rent too, if “I” can wangle it), well what is it “we” get to say? Oh yeah, “Zu schlecht!,” and “Tant pis pour ça!”

Maybe “you all” can run away some place, but maybe you remember that on other occasions, your precursors drove things to the point that the rest of us churned ourselves into a readiness for action, and our battle cry was “Burn It All Down!” Where, eventually, are “you all” going to hide? Where is your virgin Argentina?

One thing which is not clear to me is why they would tap things like Social Security funds, as opposed to telling the IMF they need an extension.

Being in the position of possibly defaulting to the IMF is much better strategically in terms of their negotiations with the Troika than being in the position of defaulting on domestically sensitive obligations.

No it isn’t. Greece is not defaulting on the IMF. It’s their most senior creditor. From Ambrose Evans-Pritchard last week:

The Greeks must pay the IMF €1.5bn in a series of deadlines this month, starting with €300m as soon as Friday. No developed country has ever defaulted to the IMF in the history of the Bretton Woods financial system. Such a move would shatter confidence and reduce Greece to a financial pariah in motley company with Zimbabwe…

Yanis Varoufakis, the finance minister, sought to silence such talk over the weekend, telling Associated Press that a default to the IMF was out of the question, even if a halt in payments to the EU institutions remains a serious threat. “We are not going to be the first country not to meet our obligations to the IMF. We shall squeeze blood out of stone if we need to do this on our own, and we shall do it,” he said.

The IMF deadlines are not rock hard. The Fund usually allows some grace period. There is a procedure for arrears if a country genuinely wishes to pay. “The clock starts ticking. It is another matter if they start saying they won’t pay for six months,” said one expert.

http://www.telegraph.co.uk/finance/economics/11445627/Greece-eyes-last-central-bank-funds-to-avert-IMF-default.html

Note that AEP is much closer to Greek sources than Brussels sources and is more sympathetic to the Greek position than many other journalists.

Yeah, I read and understood the AEP piece on that score when it came out. But what remains unclear (and is probably the source of the preceding comment), is WHY the IMF is senior. Is this simply a question of who loaned to Greece first, fine print in the various loan agreements, because the IMF’s hands are cleaner (would be a pretty poor reflection the others), or something else?

Debtor-in-possession lenders in the US, who come in during bankruptcy, are senior too.

I’m sure it’s a condition of their lending that they be made senior, that the other lenders have to accept the subordination for the IMF to do the rescue. Remember that the IMF comes in only if a country has defaulted or is about to default, so the IMF can dictate terms.

Yves, yes I think AEP’s analysis has been about the best out there, and I agree that it looks like their plan is to pay off the IMF. That’s why I’m confused.

If they think they can pay everyone and eventually make the social security funds whole, then this makes sense, but it looks like a dangerous game to me, because if they’re wrong, and suddenly they can’t make those funds whole the Troika will have them over a barrel. They’ll be at risk of losing popular support by not being able to make pension payments, and they’ll be accused of having “stolen” the money etc etc.

Given a choice between that and telling the IMF they’ll need a delay, I’d much rather ask for a delay. “Shatter confidence and make Greece a pariah” is all a bit abstract. It sounds awfully close to “you’ll upset the poor markets”. I’m not saying this is a great choice, but it seems better than the alternative. Telling them they’ll get paid as soon as they get the next disbursement doesn’t seem so bad.

We are no longer in the Bretton Woods financial system. And Evans-Pritchard has neglected to mention what Germany owes Greece from the second world war. If he wishes to invoke historical precedents, this is one of them.

No developed country has ever defaulted to the IMF in the history of the Bretton Woods financial system.

Evans-Pritchard & Varoufakis are not correct, or are at least very misleading & mpr’s general point is valid:

Argentina Defaults on $3 Billion I.M.F. Debt.

As Mark Weisbrot explains:

More Pain, No Gain for Greece: Is the Euro Worth the Costs of Pro‐Cyclical Fiscal Policy and Internal Devaluation? p.17-18

If I am reading the two bar graphs and related tables correctly, it appears to me that the government of Greece is running a small primary budget surplus; i.e., government revenues are slightly exceeding anticipated outflows, but the numbers are marginally insufficient to meet scheduled debt payments and accrued interest. Scheduled amounts due on Greek sovereign debt beyond 2015 were not presented.

The more I see, the more I believe development of supplementary money (such as Robert Parenteau discussed here yesterday) and/or debt default, would be to the advantage of the people of Greece, rather than continuing to suffer hardships and deprivation to pay the looters for the transfer of private debts onto the backs of the Greek people who are watching as their social services, education and healthcare are relentlessly cut; employment opportunities simply don’t exist; small businesses are forced to fold; public assets continue to be drained away through sales under various “privatization” schemes; and suicide rates rise.

Meanwhile, AP reported yesterday that Draghi’s ECB will be buying Corporate bonds as part of the European Central Bank’s new 1.1 trillion “quantitative easing” program at a 60 billion euros per month pace. Funny, that. And with “Money” out of thin air no less. Wonder specifically who those corporations are, and if they include large bank holding companies? If so, why them and not the banks of Greece?

You have to tip your hat to the looters for the brilliance and sheer audacity of their schemes, including transferring sovereign debts to make them subject to London law, and for their retaining control of the ECB, central banks, and supranational creditor agencies. Living their dream, they are.

The court at The Hague as a solution?… I think not. It receives much of its funding from the government of Germany.

Greece was running a small primary surplus now. It probably isn’t any more. It’s not just the withholding of tax payments. The economy has gotten worse since Syriza took office between the deposit run and general uncertainty. And this isn’t based on MSM reports, which can skew anti-Greece. I’m hearing this from readers with friends and contacts in Greece.

So, what is/are the remedies that might not lose generations in the Southern Tier and all that? Not that the rulers of the Germans and French and English have ever shown a lot of concern about “lost generations” and wars of attrition, even when the “lost” were their own stupid bovine citizens. “Can’t make knackwurst without cranking the meat grinder,” right? And this sure looks like, from the Greek perspective, preemptive war, with lots of casualties and tons of infrastructure damage.

What has always hurt Greece since the crisis began is frozen credit. This is what has shuttered profitable exporters. And since Syriza has taken over, the ECB has clamped down on Greece’s banks. That more than anything would hurt the economy.

Strange, real social concerns subordinate to economic doctrine.

Or not.

Isn’t obvious that the IMF and the other creditors will have to extend payment dates if they wish to avoid defaults? If default now is what they want, there would be no reason to send in auditors to examine Greek books. Default would put world markets topsy turvey, and this kind of instability is not welcome.

http://www.bbc.com/news/world-europe-31837660

I read somewhere that 50% of the working public in Greece works for the state. I do not know if this figure is true. What has been reported in German media, however, since many YEARS, is that civil servants who swindled themselves into their positions by falsifying their resumes, civil servants who have been convicted of wrong-dong including murder, still get their salaries, even after many years. Yesterday it was reported that the Troika forced the previous government to stop payments to these people and to lay them off, and the Troika gave the go-ahead to the Greek government to instead hire 15 thousand professional replacements for them who are QUALIFIED. However, the current government re-instated, or want to re-instate the bad apples. This was reported yesterday.

There seems to be a lot of sympathy for the Greeks on this blog. However, since at least the start of the crisis, i.e. since years, there were reports how thousands of dead people still collect government pensions. How Athens is full of swimming pools for which no taxes have been paid. There were stories of whole villages full of “blind people”, all of them collecting welfare. There have been millions of German tourists in Greece, who have first hand insights into how things work there, but more importantly, German small businesses who are/have been involved with trade. Some owner of a transportation company commented how they learned the hard way, when they deliver goods to Greece, to unload them ONLY in exchange for hard cash, after they had gotten several fake cheques in the past.

Many Germans say that Greece is a state unfit for the 21 century — and they say this on the background of their own experiences. Just as the German press invalidates / is mum about the noose that the EC/Germany has put around Greece’s neck, the other side of the coin are people who sympathize with Greece while disregarding how they just will not learn.

Germans are very familiar with rich states paying for poor ones, this kind of transfer is happening within Germany, i.e. Bavaria footing the bill for poorer states including Berlin. The fact that Greece will not be able to repay its debt is totally clear to many regular citizens. The German media parrot the official line. However, Greece is also a mess of its own doing. I have not read one single thing about measures that the current government has actually initiated to remedy the current situation, apart from the playing games with the Troika – apart from yesterday’s report that they want to rehire the previously laid off government workers, the ones who have no clean vest. And I don’t believe there are any capital controls in place, still not.

@GNS Many of the points you make are perfectly reasonable. I don’t have enough information to confirm or rebut details, but lets accept that Greece is a society with a large amount of corruption with an inefficient tax system.

The main issue is that even if all the above is true, once you’ve gotten to the point where Greek GDP has shrunk 25%, people can’t get medicine, and suicides are significantly up, all the points above become moot. Its like continuing to beat a cancer patient because its their own fault for smoking. Its simply morally indefensible. Since Greece is meant to be part of the EU “family” its like continuing to beat a member of your family with cancer.

And please don’t say you’re administering chemotherapy. The Troika plan for Greece predicted the economy would be growing by now. So while, we’re on the subject of “personal responsibility”, what about the IMF and ECB taking some responsibility for implementing a program which had disastrous consequences ? (As many people predicted).

Unfortunately it doesn’t surprise me that its Germany thats driving this outcome. Germans are very fond of “rules” – I lived in Germany for three years and can confirm this is not just a stereotype. Indeed this is the argument your finance minister gave recently. I don’t want to say this is always a bad trait, but the problem with this is that people who were a little more flexible in their thinking might recognize that was is being done in Greece is simply immoral and unsustainable whatever the rules, and make some adjustments. With the Germans the rules are their own justification.

People who were a little more flexible in their thinking might recognize that the pre-existing problems in Greece were made significantly worse by the flawed structure of the Euro. As a technical matter, Germany’s position that everyone should be virtuous “like the Germans” and run a trade surplus is incoherent – it isn’t possible for everyone to be in trade surplus. If Germany were not in the Euro it would have a stronger currency and fewer exports. In that sense it is benefitting from the arrangement.

So you have people (I include the IMF and ECB), who have a flawed financial model of how the world works, and whose policy prescriptions have (unsurprisingly) caused a humanitarian disaster, insisting on more of the same. For anyone who has any sense of decency, and isn’t just chanting “rules must be followed” like some kind of zombie, its pretty clear who to side with.

I’d say about at least a third of the German population is in favor of debt forgiveness. Another quarter of the regular population would be in favor if it was presented in other ways than those of “morality”. OTOH, that Greece media circus fans the flames of a right-wing Anti-Euro-faction to the right of the CDU – they use a language that I hoped I’d never hear again ever. Schaeuble’s / Merkels policies are not questioned by the media. ARD TV shows the humanitarian problems in Greece, but the media are intellectually lazy when it comes to question Schaeuble / Merkel policies. How could Draghi whose former firm played a main role in cooking the books so Greece could enter the Euro become ECB pope. And the people who looked the other way in the EU – probably tucked away in some cushy Brussels jobs. What about US geopolitics. It’s a very colorful mosaic indeed what’s going on. Including the Greek government saying (a few days ago) it would funnel more refugees through to northern Europe. By being blind on one eye as to how Greece behaves, and to only harp on the national flaw of the anal German mentality does not solve this impasse.

Being blind in both eyes does not “solve the impasse” either. Is this an impasse, anyway? or it the analogy to the paterfamilias beating the cancer sufferer hold a little closer? The guy with the club can stop the beating and help the person facing the ravages of cancer to heal. The person with cancer, denied medicines and food, has no equivalent way of reducing the pain.

Looking more broadly, of course, where’s the remedy that leads to no more beating and no more smoking? Given that we humans apparently can control neither our appetites for foolish behaviors that make us sick, nor our addictions to vicious behaviors that ought to sicken us?

I thought I have made it clear that I am in favor of debt forgiveness and giving this tiny country a new start, as are A LOT OF other people here.

But go ahead, blame me for being heartless, as the one who swings the club and being the bad guy in the rest of your metaphors, and accuse me of being blind on both eyes, when it is exactly that which I am trying to avoid.

This is from 4 years ago.

http://www.vanityfair.com/news/2010/10/greeks-bearing-bonds-201010

And who but a German, Friedrich von Hayek, and his follower Otmar Issing, a principal architect of the Euro, would want to impose “a rule” that a public good, a sovereign state’s ability to create its own money debt and interest free should be “denationalized” as far as possible in favor of a closed system where only private banks and the rich could provide money at a price to a European society!

http://www.ecb.europa.eu/press/key/date/1999/html/sp990527.en.html

….”who but a German”. There you have it. I tried to explain that despite sharing a passport, not everyone thinks alike here, not everyone is blind to even the issue you raise, and certainly not everyone agrees with the policies of the EU. Sorry to read such a coarse prejudice.

GNS, I agree with you about that “who but a German” remark.