The odds now favor the tentative deal struck over the weekend to “rescue” Greece, which many have correctly depicted as a brutal economic colonization of Greece by its lenders, coming unraveled. It’s hard to see how Greece could muddle through, given that a sketchy plan attribute to German Finance Minister Wolfgang Schuble over the weekend, that of a five-year temporary Grexit, was so obviously a napkin doodle rather than a plan as to be a negotiating chip and a taunt rather than a serious idea. But the lack of any alternative to the punitive plan that is starting to go pear shaped means that Greece would stumble into a Grexit utterly unprepared, with its banks unable to open at any foreseeable time in the future. That’s a game plan for utter catastrophe. If you think the unplanned Lehman bankruptcy was an unmitigated disaster, a Grexit would make that look like a walk in the park.*

Why does the deal now look to be in such dire shape? Unlike the earlier extended Greece v. everyone else impasse that went on for months, the underlying problem was that the two sides had no bargaining overlap between their positions and were conducting the negotiations in a media fishbowl. That made it impossible to find areas of mutual interest (having the new government improve Greece’s broken tax system, which only taxes the incomes of about 30% of the public, cracking down on oligarchs) and figuring out ways to come up with optical solutions on the issues where they were odds so each side could declare a victory.

The impediments now are what are informally called “too many moving parts”. It’s also one of the reasons that many people make bad calls about the likelihood of something succeeding, like a new venture.

If you ask someone who is starting a business and you ask them, “What are the odds this will work out?” you’ll almost certainly get answers well over 50%. Otherwise, why would they bother? But even if they tell you that it’s a slam dunk and they give you some very persuasive patter as to why the probability of winning is 90%, if you pick apart what has to happen, you can usually quickly ascertain why they’ve made a big overestimation.

That “90% odds of success” typically means that the entrepreneur believes that the odds of all the things that need to happen are around 90%. Let’s eliminate ones that are completely under their control and assume that the things that have any element of risk, like “We get our prototype into manufacturing in no more than nine months” and “We get no less than $50,000 of orders in the first six months” and “No more than 15% of the amount of our orders pay more than 60 days late” really are 90%. What happens if our venturer has to have seven things like that happen?

His probability is 90% x 90% x 90% x 90% x 90% x 90% x 90% = 47.8%

When we look at the Greek situation there are far too many things that have to occur for the deal to go through, and the odds for favorable outcomes for just about each one looks to be markedly below 90%. I’m not about to play bookie, but it’s looking uncomfortably likely that the tentative Greece pact will come unglued. And one big factor favoring that outcome: the critical actor, Germany (and specifically, Finance Minister Wolfgang Schauble, whose support as we have stressed is a necessary but not sufficient condition for having a deal be consummated) isn’t highly motivated to salvage the preliminary agreement if it goes off the rails. Schauble has long thought a Grexit was the best solution for Greece; Timothy Geithner’s memoir says Schauble was advocating it in 2012.

Understand the structure of what is happening. It’s essentially a three-part process: Greece passes mandated sets of bills on July 15 and July 22. Some key European parliaments approve must approve the weekend agreement. Separately, the European Commission, unable to find money to keep Greece afloat, as in not defaulting on the ECB on July 20. The only way it can find is to activate a dormant facility, the European Financial Stability Mechanism. In theory that should mean Greece gets its bridge financing, but as we’ll see soon that is not a given.

The bridge financing is essential because if Greece were to default on the ECB, the central bank could not lend to Greek banks under the ELA. That would be a death sentence to the Greek banking system. The big reason that Greece has been willing to prostrate itself is that it is desperate to get ELA funding back, hopefully Thursday after it passes part of its required legislation Wednesday,. It can then get its banks open again, ideally in some form this week before the damage to importers and the tourist industry becomes irreparable.

Let’s look at the things that need to happen for Greece to get its funding:

The Greek Parliament needs to pass legislation consistent with four of six creditor demands today. Even though Tsipras in theory has the votes, a revolt is underway on the streets, with strikes and protests planned. More important, Tsipras and his allies may be blocked procedurally. From the New York Times:

But with many other parties willing to vote for the package, his most pressing problem was more likely the speaker of Parliament, Zoi Konstantopoulou, also a member of Mr. Tsipras’s Syriza party, who objected to Mr. Tsipras’s attempts to pass narrower proposals last Friday.

Some analysts said that Ms. Konstantopoulou, a stickler for rules, could prevent him from using the fast-track procedures that would be necessary to get the job done in time to satisfy European leaders. Portions of the plan must be passed by Wednesday, and more a week from Wednesday.

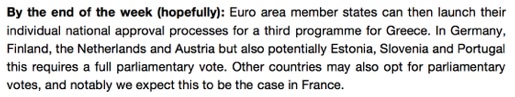

Some parliaments, most important, Germany’s, need to approve the bailout for the deal to move forward. Remember that the baroque Eurozone rules require unanimous decisions. That means after the hoped-for Greek parliamentary approval, the other 18 nations of the Eurozone must all formally give their approval In many, this requires parliamentary approval. And this needs to happen by Monday to avert a default with the ECB. Fabrio Goria posted a timetable from SocGen. A key section:

Finland, Portugal, Spain, and the Netherlands have been more hard line than Germany. Finland has proven hard to contain in the past. Even before the events of today, it would probably be a smidge optimistic to put them in the “90% odds of approval” camp.

And now we have the huge complicating factor of the IMF threatening not to be involved if there is no haircut to the face amount of Greece’s debt. The memorandum that was hammered out on the weekend explicitly bars that. As we discussed at more length in our post last night, none of the Eurozone countries wants to give Greece debt relief that way because it would hit their national budgets as soon as the cuts were made. Under Eurozone rules, that mean they’d need to raise taxes to cover the shortfall. Even if they whacked away at Greece’s big fat debt heap over a series of years, it would still be painful unpopular domestically and deeply contractionary. It would amount to transferring a big chunk of Greece’s austerity to everyone else. That may seem more equitable, but for elected officials, it’s tantamount to turkeys voting for Thanksgiving.

By contrast, if Greece fails to pay any of its debts, the losses don’t start to hit national budgets till 2020 and they are spread out over decades (save possibly losses on Target2 and ELA exposures, but the Bundesbank might relent and let the ECB monetize those shortfalls). It’s not hard to see where the course of political least resistance lies.

The Eurozone members, again most of all Germany, regard IMF involvement as mandatory. They don’t have the expertise and staff to run the creditor gaol that they want to make of Greece, plus they want to keep their hands as clean as possible.

In addition, the well-deserved firestorm over the proposed Greece pact has likely reached the attention of the German press. That’s almost certain to strengthen the hand of nay-sayers: “Why should we bother with Greece when we’ll get so much heat, not just now but as the process continues? Better to let them go and have them take their lumps.” That will help Schauble and any other Grexit fans. And Merkel, who seems to be more aligned with Schauble than she was a month ago (do not lose sight of the face that Schauble has more clout with the German parliament on this issue that Merkel does) would regard the prospect of IMF non-participation with alarm.

Getting bridge funds via the EFSM released by Monday to make the €3.5 billion payment due to the ECB.** The Financial Times reports that the UK’s David Cameron is rounding up a group to block the funding:

Under the EU’s Byzantine voting rules, Mr Osborne must now rally a weighted majority of fellow EU members to block the proposal. Although he has the support of some other non-euro countries — both Denmark and Sweden registered their objections at yesterday’s EU finance ministers’ meeting — it is unclear whether Downing Street will have sufficient allies to block the plan.

The EU-wide fund, known as the European Financial Stability Mechanism, was set up at the outset of the eurozone crisis with €60bn in lending capacity. When the eurozone moved to set up a new, permanent rescue fund for the currency union’s 19 members, Mr Cameron won agreement at an EU summit that the EFSM would never be used again for eurozone rescues. But EU lawyers have argued that the 2012 deal was a political agreement, not a legal one, allowing them to re-tap the fund.

And mind you, that’s what has to happen just to get the bridge deal in place to prevent the ECB default and keep the rescue on track. There are plenty of other negotiations and approvals that have to happen after that, such as the next round of Greek legislation needs to be passed on July 22. And we didn’t mention another complicating factor: if a majority of the ruling coalition’s members vote against Tsipras’ legislation, it will force snap elections. How can the bailout process move forward in the interim? As Syriza Left Platform member Stathis Kouvelakis explains in Jacobin:

The reasoning is that Greek constitutional practice is the following: on every bill the government has to show that it has a majority coming from its own ranks, from the party itself or from the coalition…

Although it is not legally binding, it is the case that, in Greek constitutional history, when a government loses control of its majority, the famous dedilomeni as it is called (“declared majority”), it has to go for new elections. This is why immediately the discussion of new elections started. The new elections have already been announced — now it’s just a question of when they are going to happen.

The article explains at some length that not all members of the Left Platform voted against the proposals that the government sent to the Eurogroup on July 11 in order to prevent this trigger from being activated (I’m not clear how exactly that was achieved, but I infer “present” votes and abstentions played a role). But the votes Wednesday are seen as of even more historical importance, and all dissenters are expected to vote “no”.

So it is very much touch and go as to whether a default with the ECB can be averted, and any of the approval failures or a default itself are likely to be event horizons. And it’s hard to see how any sort of rescue process could be revived were that to happen.

Similarly, with the IMF and Eurozone nations now at loggerheads on the issue of a debt writedown as an almost certain condition of the perceived-to-be-essential IMF participation, we have a separate big reason for the deal to fail, even if it somehow manages to move through next Monday based on sheer inertia.

As terrible as this punitive “rescue” seems, the reason that Tsipras and a large number of MPs are pushing it ahead is that the human cost of a Grexit is even worse. If this deal is like having your arm cut off, a Grexit would be tantamount to having both legs amputated. The accelerating collapse of the economy as the bank holiday continues is a mere taste of what would be in store. As we’ve reminded readers, for starters, Greece is not self sufficient in food. Shortages are expected to bite by the end of them month if the banks don’t get back to something like a normal footing so importers can pay foreign suppliers. Drugs are also running out despite pharma companies being pressured to keep shipping insulin even though they are not being paid.

What is at risk is not merely more economic distress but Greece turning into a failed state. And Europe may soon have the discomfort and the guilt of seeing how quickly they made that come to pass.

___

* Note that we do not expect shades-of-Lehman market reactions, at least in the near term. The crisis of 2007 and 2008 had four acute phases, with the final being triggered by the Lehman collapse. We’d expect the economic and political blowback in the Eurozone to have a similar decay path. As Hemingway described how he went bankrupt: “Two ways. Gradually, then suddenly.”

** The EFSM funding would total more than €3.5 billion, but it’s the ECB payment default that would have serious consequences, and that is the €3.5 billion billion part of the total. From the Financial Times:

The European Commission has submitted a formal proposal to use an EU-wide rescue fund to rush aid to Greece to ensure Athens does not default on €7bn it owes on Monday, a proposal that will require Britain to rally allies if it wants to block it.

According to an EU official, the commission submitted the plan to use the European Financial Stability Mechanism late on Tuesday after deciding that it was the best option to avoid Greece defaulting on a €3.5bn bond Athens owes the European Central Bank and €3.6bn it owes the International Monetary Fund…

Valdis Dombrovskis, the European Commission vice-president in charge of eurozone issues, told reporters on Wednesday that Brussels had narrowed the bridge financing options for Greece down to bilateral loans from eurozone capitals or the EFSM, but that it had become clear there was “no prospect for bilateral help”.

Instead, the EU will rely on the EFSM for the entire €7bn loan Greece needs to pay debts that fall due on Monday. Mr Dombrovskis said EU authorities were working on ways to guarantee non-euro members will not lose money if Athens defaults on the EFSM loan….Even the formal attempt by Brussels to use this fund is a big political setback. Mr Cameron has trumpeted securing a “black and white” promise in 2011 that the fund would be mothballed so British taxpayers would not be part of eurozone bailouts.

The EU-wide EFSM was set up at the onset of the eurozone crisis with €60bn in lending capacity. When the eurozone moved to set up a new, permanent rescue fund for the currency union’s 19 members, Mr Cameron won agreement at an EU summit that the EFSM would never be used again for eurozone rescues.

But EU lawyers have argued that the 2012 deal was a political agreement, not a legal one, allowing them to try to tap the fund again.

At some point soon, it’s going to become important to figure out what part of Greece’s debt could be legitimately categorized as odious debt.

Has anyone documented exactly how much of Greece’s debt was incurred to pay off existing debt. I realize it’s not that easy, but to some extent it’s question of where the documentation can be found that describes what debt was incurred and who was paid off over several years of refinancing.

The situation in Greece amounts to a multi-year spree of financial pillage and assessing the blame is a matter of following the money.

Given that documentation, it would seem likely that even without specific allegations, a new deal will suddenly appear out of nowhere – in this best of all possible worlds.

That’s a non-starter. A committee in Greece looked into that issue and the Greek government is not pursuing its findings. It’s not an accepted legal theory for sovereign and international debts. It’s not recognized in the US. It’s only a valid legal theory in jurisdictions that recognize it, and that appears to be not all that many. Argentina would have had vastly better grounds for arguing it than Greece has (many of its debts pre its 2002 default were incurred by a military junta that syphoned off a lot of the proceeds for its top members) and it didn’t bother since it knew it would go nowhere.

tinoco claims arbitration

1923 us supreme court chief justice arbitrates great britain v costa rica

but I dont believe in writing off any of the greek debt…sounds cruel, but just as the world blames the poor bakery worker from 1931 who sat by in 1935 and did not ” die” in an attempt to overthrow the nazi coup and dictatorship…most greeks sat back with an ” it’s not my concern” attitude about pasok(papandreou clan) and new democracy(karamanlis and mitsotakis crew)…

i got mine and the hell with you is how this mess evolved

the german poodle barking named schaeuble is just some clown taking advantage of everyone else in europe not willing to break a nail or get a bloody nose and are doing a tex antoine…

germany is one percent of the global population and less than 5 percent of global gdp…schaeuble has less than 25% of the population in germany willing to allow him to carry them over the cliff into wile e coyote land

who cares about the bild…

people might comment about the new york post or daily news…but they are both losing tens of millions of dollars every year…

There’s a simple solution to the moral hazard you describe: if creditors are made responsible for who they lend to they will be more careful and not lend to kleptocrats, murderers and thieves. The concept of cancellation of odious debt will force lenders to display some discipline. I know its a foreign concept these days when lenders throw money around like its created out of thin air, but its the only solution that makes any sense.

you reacted without researching…it is usa law that odious debt can not be collected…

tinoco was a dictator and those who asked the people to pay for the dictator lost…

greeks elected and reelected and reelected the same kleptocratz…that is not technically odious debt…that was the point that my post did not get across…it is usa law…but the “election and reelection” of kleptokratz does not lead to odious debt arguments…that db or dresden or hypo were funding bribe money for seimens for 25 years or where the funds can be shown went directly to pasok and new democracy cronies might open up a door to odious debt…but arguments that the music did stop and there not enough chairs…that is not odious debt…it is “stupidity” and selective amnesia

on the other hand i also know that reparations for world war one and world war two did not magically disappear just because hermann abt signed a deal with france and great britain

i am an advocate for full payment of not just the nazi theft of central bank assets…but full reparations as well…

Not exactly exhaustive research, but a couple of bits of context:

“Greece: Corruption and the Crisis,” http://blog.transparency.org/2012/06/06/greece-corruption-and-the-crisis/ [2012 document]

and

“So Many BrIbes, a Greek Official Can’t Recall Them All,” http://www.nytimes.com/2014/02/08/world/europe/so-many-bribes-a-greek-official-cant-recall-all.html?hpw= .

Our own “Defense Department” runs on bribes and fraud and magically disappearing wealth, to the point that it’s impossible to audit. The German industry and its “sales force” and lobbyists (same thing?) are patently corrupt, along with so much else in the “business world” and its magic lamp called “politics.” Somewhere there needs to be a sense of bedrock decency laid down, along with the limits to “honest graft,” and what it takes to keep the species alive, and what rights and reasonable expectations the ordinary people, the ones that make the Real Wealth our Rulers’ yachts float atop, can insist on. Or not, in which case the other thing is inevitable.

Blame all the people of Chicago for Daley and Emanuel? Seems the notion of collective punishment still has some vitality when it comes to odiousness, if only because we individuals see what is crushing others and could so easily be dumped on us (more than the “system” currently is doing, that is…)

Some slack is tolerable, inevitable. Too much and the machine flies apart.

What outcomes do “we” want from our political economy, hmmm? And who are “we” to ask, and to even demand? Yesterday was Bastille Day — nobody mobbed on the current versions of Versailles, either… Though the closing sentence of this link, “Bastille Day: The Women’s March on Versailles,” http://www.thegrindstone.com/2011/07/14/mentors/bastille-day-the-womens-march-on-versailles/, ought to tell “us” something: “But since we have Christine Lagarde heading the show over at the IMF, it’s clear that French women, and all women, have come a long way.”

alex morfesis – “It’s quite clear that from 2010 forward, with the first bailout, there was never any ability to clear the books and return to a reasonably-stable situation economically in this country through taking on those loans.

It’s also quite clear that all the way back to Greece’s entry into the Euro there was active complicity and involvement in outright fraudulent accounting undertaken by and with many international banks — and then the banks that “bought” that debt agitated in the first bailout for transfer of the paper to the central bank and thus onto the backs of the EU’s citizens, a second fraudulent act since there was no way for it to be paid off in full and thus that transfer was the fruit of a poison tree.

The people involved in this need to be indicted and the banks involved in this must have their charters revoked and be shuttered irrevocably with their officers and directors spending the rest of their life worrying about dropping soap in the shower.”

https://market-ticker.org/akcs-www?post=230353

Greece entered the Euro because Goldman Sachs helped cook the books so they smelled better. All of the higher-ups would have known this, but I’ll bet the people didn’t. Then when things started to stink and the banks were in trouble for having lent to Greece (the BANKS made bad debts that they didn’t want to accept), the banks got rid of their debt by throwing it onto the taxpayers. Nice if you can get it!

Odious debt? Smells like it to me.

We’ve said repeatedly that the “odious debt” argument is a non-starter. Democratically elected Greek governments agreed to take these loans. The Greeks do not have clean hands. They Greek banks would have been toast had there been no bailouts, which means distress of the sort you are seeing now and huge depositor losses. The comparatively small Greek banking system had more exposure to Greek government debt than the German banks did (59 billion euros versus 40 billion euros). While it is true that the other banks benefitted more in aggregate, one can argue that the Greek banks benefited more proportionally. And some of the French and German banks that were spared were systemically important banks, which means everyone in an advanced economy, including you and me, benefitted too.

Why aren’t the people who were overseeing these banks in jail? Why are they being paid any money at all? They’re useless.

I appreciate what you said. I just find it so frustrating that people are suffering while the “systemically important banks” are protected over and over again.

Instead of replying to one another, shouldn’t we be out on the streets/on the phone protesting, getting very angry at our politicians, forcing them to change some rules to bring these bankers in line?

I do wonder how any of us can support an international financial system that refuses to recognize debts incurred by corrupt kleptocracies should be expunged. The system as it exists provides all the wrong incentives to creditors: they can freely lend to any government anywhere regardless of whether that funding will be siphoned into personal accounts of the kleptocrats, knowing that those debts will have to be honored by those trying to repair a nation’s finances after removing the corrupt government and will sit like an albatross around the necks of innocent people. Without a concept like odious debt finance exists in a moral vacuum and exists purely as a way for unscrupulous creditors (in such a system is there any other kind?) to ensnare nations in debt peonage, to work in collusion with kleptocrats and generally destroy national sovereignty. Without a strong ethical grounding international finance has devolved into war by other means. At some point, and it may be soon, such a system will collapse under its own weight existing as pure corruption and nothing else. When the only reason to pay a debt is because you will face destruction otherwise, the system itself will soon lose all legitimacy.

“The system as it exists provides all the wrong incentives to creditors”

The $IMFS ( dollar based International financial system) is, in its essence, an all spur and no brake (on credit/debt creation) mechanism. That is the legacy of a system where gold, by virtue of it being derivatized, can no longer provide what was once an essential function. Chronic imbalances just build up in the present monetary arrangement.

The other function that gold can’t provide by virtue of being derivatized is that no one can save (purchasing power) in the present system,. We aren’t merely all Keynesians now, we are all speculators forced to commit our surplus to the greatest financial churn the world has ever seen. And, like a cancer of the body, the financial realm is now taking down the entire global economy. You see, in this system, everyone is a “creditor” whether they like it or not. Everyone is, by hook and by crook (literally and figuratively) compelled to save in debt. That is what must be remedied, and there’s only one way to do it.

Huh? We had massive bubbles under the gold standard. Look at the railroad speculation of the 18th century. of the stock market bubble, which was debt fueled, and the crash. Frank Partnoy in his book The Match King even describes how it even had CDO like-structures.

We now have nothing but bubbles, Yves. The nature of the $IMFS, where there is no means to clear imbalances, and all passive savings feedback into the system, is a monster beyond anything that has been experienced in prior times. FWIW, I’m not advocating a return to any iteration of previous gold standards, but my view is that free floating currencies, which, themselves float freely against a free floating physical gold market, namely one that exists in the absence of paper derivatives (which were designed to artificially expand the supply of a non commodity so as to extend the $’s timeline) is, by far, the least disruptive solution to the present system’s ills.

Bimetallism and Fiat both share one common flaw, human tool user problem, yet many only focus on the object, in an emotive manner, Gold in an exceptionally romanticized nature.

Tho what we have come to know is the “environment” dictates, as such, one would think that is where the examination should occur, so that question should start where[?], the object or the minds that create that environment.

Skippy… At this juncture it seems the dominate ideology, spun from mental abstractions, has more agency than inanimate objects, but yeah, lets focus on a pile of dirt or an exchange of information.

“international finance has devolved into war by other means”

Michael Hudson is arguing that Greece’s debt is illegal:

The term odious debt is a legal term. It was invented earlier in the century, almost 100 years ago, for debts that are basically wrong, or ones that are taken on by a non-democratic government in the name of the people, but paid to themselves and their backers. Then they try to shift this debt onto a country’s taxpayers. Under international law such debts don’t have to be paid.

That’s what happened in Greece… What Greece has to do, in effect, is reinvent the wheel. It has to say, “Look, there has to say some body of law as an alternative to anarchy.” Because under anarchy, the central bankers can come in and grab whatever they want, or try to bankrupt Greece and drive it out of the Eurozone, and create a disaster.

There should be a principle that if a country is a sovereign country, it has the right to say “Here] are the terms on which we can repay the debt.” That’s part of international law since 1648. That was the year when the 30 Years’ War ended and the definition of a state came into being. A state is defined as having the ability to issue its own money, levy its own taxes, and set its own laws, as well as the ability to go to war.

Greece has that right…

He has a proposal for addressing such debts and has been “talking to politicians mainly on the left to outline the principles of an international organization that we insist be created.”

(From Real News interview; transcript on his site.)

*Sign*

It is not illegal if no court with jurisdiction accepts the legal theory you need to use to make your case.

And Hudson is similarly incorrect about his notion of what a state is. Nations enter into treaties that require them to go into war under certain circumstances, usually if an ally is attacked. We would not have had WWI if Hudson was correct. Part of the calculus of all the participants was who would be obligated to enter when things got rolling. Similarly, EU/Eurozone members have ceded certain aspects of national sovereignity to EU/Eurozone level institutions by treaty.

Hudson is out of his depth when talking about the law.

The structure of the guarantee is a stunning detail. The whole thing falls apart if debt restructuring (which everyone agrees can be accomplished through extend/ pretend mechanisms over time) occurs through excercise of the guarantee because losses would have to be recognized immediately!

The simple solution would be to rework the terms of the guarantee such that any loss recognition could be delayed by layering a swap on it that would push recognition into the future. Have they learned nothing from Goldman?

Greece will default. Maybe not now if they can pass some deal they have cobleld together for the short term. But eventually they will default because they will never be able to pay off their debts. And the damage it will do to their long term economy trying to pay off her debts means that anger and rage will just increase among the population. Eventually a govt (probably far right) will come to power with the mandate to default.

Greece’s economy should not be linked to the German ecconomy. They need a different exchange rate. This is the fundemental flaw with the Euro. Greece needs to get out of the Euro and restart her ecconomy.

To use Yves medical analogy I would say a default now would be like a heart attack. Potentialy fatal, but can be recovered from. The alternative is the Austerity and staying in the Euro which is a form of terminal cancer. That will just kill the patient over time. Neither options are pretty and both can lead to death. But one has a chance of recovery over time. The other doesn’t.

The stipulations of the new agreement are revealing in that their implementation will make Greece even less able to perform a Grexit in, say one or two years, even it it carefully plans in its most practical details:

a) Pension and wage reforms will impoverish the population further, depressing internal demand, and sending even more SME to bankruptcy.

b) The complete privatization with the proceeds marked for paying down debt and reimbursing banks will not just deprive the State from existing infrastructure, but also from the funds required to invest in infrastructure.

c) The VAT increase will cancel whatever cost advantages had been achieved through internal devaluation and jeopardize the competitiveness of Greece in the few sectors it still had (such as tourism or ship maintenance).

d) Further depression and the justified disgust with the lack of respect for democracy will entice even more people to emigrate (of course, the younger and better educated will leave first), just as in the Baltic countries.

In other words: Greece has been bled white so far, now its economy will be thoroughly eviscerated. After such an operation, a Grexit will become simply impossible — the country, reduced to a third-world comprador society with some remaining tourism for wealthier foreigners (perhaps with sex services) will have nothing it can build upon to live independently.

I am certain this is a feature — ensuring TINA is at the heart of the neo-liberal EU project.

As terrible as it sounds, it was much preferable for Greece to perform a Grexit in 2010 than in 2012, much preferable in 2012 than in 2015, and it looks as if it would be preferable to perform a catastrophic Grexit now than a truly cataclysmic one, say, in 2016 or 2017.

The whole euro is a never-ending horror story.

Um, they have already defaulted. They defaulted on an IMF payment on June 30.

The issue is not the default. What is catastrophic is a Grexit. That will become inevitable if Greece does not get funding from the ECB for its banks soon.

But is it an official default?

Because that would trigger derivative positions for global banks and hedge funds. You are right they didn’t pay on June 30th, and most people would call that a default. But I don’t think they are counting it as such.

Anyway, Greece will eventually default and will Grexit. It’s only a matter of when. If they don’t they will have decades of slow ruin.

I’ve addressed this issue with you repeatedly and you keep bringing it up. It’s been at least three and perhaps as many as six times. This is a now an abuse and you are going into moderation. Comments like this (bad faith argumentation, in this case continuing to bring up issues that I have responded to, aka “broken record”) are why I am closing comments on posts. My experience on this post says I’m going to have to close comments more rather than less often.

There is just about nothing in the way of a sovereign CDS market so any impact would be small. Moreover, the pricing would already reflect how distressed Greece is and that the odds of a Grexit are high. The protection seller has to post collateral to reflect the current value of the swap, so anyone of the very few people dumb enough to write a Greek CDS has already shown losses and ponied up collateral to reflect that.

If it goes like this, I am sure the Germans will extract something to pay off the debt.

When I first saw Mr. Scheuble’s 50 bln fund idea, I immediately recognized this as a serious document, not something that was hoped to be rejected. This was actually how the imperial powers conducted business in the late 19th century. Once they deem the debtor cannot pay and lack the governance sufficient enough to extract funds, they install their own tax administration for the sole purpose of squeezing funds out of the debtor, sometimes with the help of armed guards and from the citizens directly (as the debtor state usually pledge tax receipts as collateral, the imperialists considered sending armed man to directly collect taxes normal). So, this is exactly the same scenario here.

That is why I think (catastrophic it might be) Greece must exit the EMU, perhaps also the EU. Otherwise Germans will indeed find ways to extract 320+ billions and a lot of interest on top of they will never let the Greeks breathe.

It’s a condemnation of the Global Economy that in this age of material excessiveness a country cannot be self sufficient in the most basic essentials. It would not surprise me if Greece is one of many nations in this position. Perhaps I’m being naive but isn’t the #1 priority of governments to ensure the basics for survival? Why even have nation states if our governments can’t be bothered to meet this requirement?

I’m sorry for what the Greeks are going through but how long has Cassandra been warning them of the insanity of their situation? Maybe this is the century where we have no Cassandras? For a country to not be self sufficient in food, it really is gambling on normalcy bias.

Globalisation working as intended.

But isn’t that one of the first things the IMF do when they go into a country? They tell them to stop growing their own food, and grow something they can export even if it’s just Hemp.

“Don’t worry” theysay you can buy all your food from US owned highly protected and hugely subsidised big Agriculture. Making a country unable to feed itself means they are ripe for being rapped further down the line.

Do the Greek creditors really want their money back or do they want all the assets? Gas and oil rights might be worth trillions. The Greek political class have sold their country out from their people for a few pennies.

I agree with this so fundamentally I can’t properly express it.

Their #1 priority is to ensure the survival of the government. Constituent survival is a

happylucky coincidence.BTW, there are many second and third world countries that are forced to be self sufficient because they haven’t had access to the easy money that Greece has had for the past 15+ years. As Yves said last night,

Yeah, that’s why there are IMF riots (right at this moment, I’d guess, but can’t seem to find out) in a EU country.

David – perhaps Greece has “gotten breaks” because they should never have been admitted into the club in the first place, and only entered through some magical accounting tricks? Isn’t that closer to the truth?

Why even have nation states if our governments can’t be bothered to meet this requirement?

Why indeed. The powers-that-be couldn’t agree more. They are taking care of this unholy blemish on their profit sheets (national sovereignty) as quickly as they possibly can with the help of the TTP, the TTiP and the TiSA.

Nation states will be a thing of the past before you know it. Problem solved.

The nation-state is a thing of the past, to be/having been* replaced by the “market state” (in Phillip Bobbit’s Shield of Achilles, which I should really get back to work on).

* It’s a historical process happening to us right now.

I wasn’t aware that we had markets either.

I didn’t say “free markets.” That’s utopian.

LS wrote,

I didn’t say “free markets”

Now you have, but I didn’t even imply the term free market. In the meantime, as I sense you’ll agree, a market that isn’t entirely free may still be a genuine market. However, because our present financial arrangement has untold amounts of intervention and manipulation, and is also rife with fraud, and a host of other practices inimical to the once quaint notion of “price discovery”, my original unqualified comment stands, we have no markets.

Right, correction: Nation states are and any remaining vestiges of them will be a thing of the past before you know it. Problem solved.

The timing for when Greek public assets would be formally moved outside of Greek control –r committed to be moved in a binding way–is also crucial.

In addition to the immediate emergencies of providing food, medicine, water and energy, keeping onto the remaining state assets is of critical importance. It would make no sense to me to sign away these assets, in order to seal a deal that everyone agrees cannot possibly succeed.

Does Schauble have a conflict of interest by sitting on (or heading) the board of the bank that will supposedly take control of the Greek assets, per the pending agreement? Has the German media picked up on this? If so, does anyone in Germany care?

The Luxembourg-based “entity” that

iswas originally supposed to take control of Greek assets is “like” an entity of which Schauble is chair, but not that entity. Of course, everything has turned out to be worse than we imagined, so it’s entirely possibly the corruption will be out in the open, no fig leaf at all. But we’ll see.Adding… Having refreshed my memory, the fig leaf is that the entity will be based in Athens. I don’t know who will chair it. If any reader has better information, please pipe up!

I heard that the proposed Athens entity was a branch of the Luxembourg-based entity.

I believe this was mentioned on one of the numerous interviews on The Real News Network. Take it with a grain of salt until something more definitive surfaces. If I come across a link I’ll post it.

“Does Schauble have a conflict of interest by sitting on (or heading) the board of the bank that will supposedly take control of the Greek assets, per the pending agreement? Has the German media picked up on this? If so, does anyone in Germany care?”

Yes, been commented on at the time, but now the structure is different.

However, the bank KfW is a big government owned Bank, and the Finance Minister of Germany is on the Board, automatically.

No, no, no, no, no. Real News Network, interview with Dimitri Lascaris:

It isn’t KfW and we don’t know who the board is yet. The loss of national sovereignty issue is bad enough, and there’s no reason to confuse matters with incorrect information. If somebody has a newer link, please post.

in Athens, so exposed to the IMF riots. Should be interesting.

It’s really amazing how convoluted this has become. Basically, Greece leaving EMU is simultaneously increasingly likely and increasingly horrible. Mainstream politicians in Greece (and “leftist” intellectuals outside of Greece) have been burying their heads in the sand instead of dealing with this reality. Politicians in Germany are Evil Neoliberal Austerians. Yet instead of occupying Greece, they are willing to let Greece go – the exact position of the radical leftists in Greece. It’s the less evil non-Germans sympathetic to Greek causes that want to trap Greece inside the euro.

Something just doesn’t add up. Which is often how reality actually works in practice. We are where we were five (or ten) years ago, except Greece has squandered the time bought in the interim. The debts just can’t be paid. Stupid math.

The leftists in Syriza who are advocating a Grexit are largely Marxist academics. Please tell me how much you would trust either an academic or an economist to run a war, which is the level of effort involved here. They have not made the slightest investigation of the practical issues involved in a Grexit. They are merely grasping at it out of a desire to have an alternative.

100x +++

Ha yeah, I don’t want Marxist academics running things. I continue to appreciate your following of events on this.

My trust level in economists as a general profession is somewhere just north of zero. I’m also much more centrist, and I support European integration conceptually. The failure of Syriza to have been seriously planning for governance over the past few years is indicative of the systemic management failure we have been witnessing everywhere. That’s not a judgment on any one person, although there certainly are some more egregious outliers. It’s just an observation on how we have scaled authoritarianism faster than we have scaled legitimate, socially stable authority.

I think I’ve observed this before, but this process has pained me for some time precisely because the only real solution I see is for Greece to renounce its debts, and the likely consequence of that is for Greece to not be welcome in the eurozone. I want a United States of Europe, but I don’t think Europeans want that (with a generous side of the helping American neoliberal invisible hand, of course). I don’t see how else this show ends. The situation is extremely crappy, and few in positions of power even seem willing to acknowledge that reality, let alone demonstrate competent exploration of practical solutions. We’re in the confidence fairy stage at this point. Everything has to happen secretly because even talking about options destroys everything, as if transparency and democracy are somehow the problem rather than the solution.

The Anglo-Americans want to blame the Germans. The Germans want to blame the Greeks. The Greek government cannot put forward either a vision of Europe they want to participate in or a vision of how they want to reclaim national sovereignty. And this whole fiasco ends up reinforcing nationalistic ways of thinking quite apart from left/right divisions.

Well if you believe Varoufakis they did make the slightest investigation and in the wake of the no vote he wanted to begin the process of planning and preparing in earnest. Instead Tsipras chose to give up and let the creditors determine the solution, which wasn’t a choice he could actually make because the creditors don’t have a real solution either. So crucial time has been wasted, the situation has deteriorated beyond even further, and the country is totally unprepared for the most likely scenario going forward. It probably will fall to the military to pick up the pieces.

Yes.

NC and others commenting have said repeatedly that they didn’t have a plan, but V said that he had a plan of what to do in case the banks shut down, but , essentially, Tsipras chickened out.

He told Aussie radio that they could only have a small group looking at the problem cuz if they had the numbers needed the secret would eventually emerge and all hell would have broken loose.

Though hard to see how that hell could be worse than the one they are in now …

That is what he said about this particular inaction.

From the today’s link:

Perhaps there were reasons too.

First, Varoufakis has lied repeatedly and blatantly, and he is highly motivated to burnish his record.

Second, there was a discussion that was leaked via Ambrose Evans-Prtichard a couple of weeks ago regarding this “plan”. It was so sketchy as to be a napkin doodle. To treat it as anything more than a rough and initial set of idea is misleading. Moreover, Varoufakis effectively admits he looked into this only late in the game which is way too late.

The much higher functioning Paulson Treasury similarly had a plan for dealing with a crisis. They never consulted it or acted in accordance with it when the criss actually hit.

Third, there is no evidence that Varoufakis consulted with anyone who had expertise in banking or payment systems. As indicated with the napkin-doodle comment above. that means what little time was spent on it was probably garbage in, garbage out. The leaks are consistent with it being high level and not well informed.

“Third, there is no evidence that Varoufakis consulted with anyone who had expertise in banking or payment systems.”

Well, he is in good company. More than one Nobel laureate, for example.

Hahaha!

That’s a great summary. Nobody actually has offered solutions to the multi-year run on Greek banks. Not the IMF. Not the ECB. Not the Americans. Not the British. Not the Germans. Not the French. Not the Italians. Not Syriza. Not Varoufakis or Tsipras individually. We’re at the level of absurdity where Schauble is basically trolling the TAN idea.

Now we’ve reached the point in the slow motion train wreck of things being so severe that capital controls are in place. So in the continuing absence of solutions, it seems like all that’s left is to decide what form of indirect taxation to impose: depositor bail-ins (Cyprus template) or drachma reintroduction (Grexit). Cyprus was way less complicated, and they didn’t finish removing the last of the capital controls until this spring.

Frankly, I’m suspicious of Varoufakis. His, “I’d rather loose an arm [than have a “yes” vote on the referendum]”, struck me as lame, a tip off if you will. When he got the ostensibly desired “no” vote, I suspect he was not too unhappy at being removed (if that is what happened). He seems relieved to be out of the hot seat and back on the sidelines where he can point to Tsipras and Co. from the more academic position of calling the mistakes (and re-casting things more to his liking) rather than being in the middle of them.

His statement (paraphrased) that, “I didn’t want to plan for a Grexit (or was it conversion to Drachma?) because of the self fulfilling tendencies of such plans”, strikes me as a good example of recasting events to suit one’s image especially in so far as it’s very difficult to challenge.

Yep, that sounds like a good read to me, too.

If you go back to one of Varoufakis’ earlier articles (where he describes himself as a ‘reluctant Marxist’) he states that the reason he is reluctant is that there is no one on the left who is competent to run the economy.

I would be, can I apply for a job somewhere?

Was he looking for people. there must be enough left wing ex bankers who could help out!

Wow, that is s good nugget. Thanks!

Define “competent.” Or, ideally, ask him to.

Especially in Europe, government is really administered by the bureaucracy, the “permanent government.” Politicians are there to give orders and hope they’re followed.

I think he makes some interesting points. What does society want to replace the downward spiral of extreme capitalism with?

What does a functioning socialist system look like?

How can somebody that is successful avoid the trap of entitlement?

How radical of a change can a society be expected to adapt to?

I think one of the things to overcome is an over reliance on taxation. I think this is often used manipulatively while not recognizing where money actually comes from. We get lost in a self imposed limited gold standard way of thinking.

—————–

“Yet with Europe’s elites deep in denial and disarray, the left must admit that we are just not ready to plug the chasm that a collapse of European capitalism would open up with a functioning socialist system. Our task should then be twofold. First, to put forward an analysis of the current state of play that non-Marxist, well meaning Europeans who have been lured by the sirens of neoliberalism, find insightful. Second, to follow this sound analysis up with proposals for stabilising Europe – for ending the downward spiral that, in the end, reinforces only the bigots.

Let me now conclude with two confessions. First, while I am happy to defend as genuinely radical the pursuit of a modest agenda for stabilising a system that I criticise, I shall not pretend to be enthusiastic about it. This may be what we must do, under the present circumstances, but I am sad that I shall probably not be around to see a more radical agenda being adopted.

My final confession is of a highly personal nature: I know that I run the risk of, surreptitiously, lessening the sadness from ditching any hope of replacing capitalism in my lifetime by indulging a feeling of having become agreeable to the circles of polite society. The sense of self-satisfaction from being feted by the high and mighty did begin, on occasion, to creep up on me. And what a non-radical, ugly, corruptive and corrosive sense it was.

My personal nadir came at an airport. Some moneyed outfit had invited me to give a keynote speech on the European crisis and had forked out the ludicrous sum necessary to buy me a first-class ticket. On my way back home, tired and with several flights under my belt, I was making my way past the long queue of economy passengers, to get to my gate. Suddenly I noticed, with horror, how easy it was for my mind to be infected with the sense that I was entitled to bypass the hoi polloi.

I realised how readily I could forget that which my leftwing mind had always known: that nothing succeeds in reproducing itself better than a false sense of entitlement. Forging alliances with reactionary forces, as I think we should do to stabilise Europe today, brings us up against the risk of becoming co-opted, of shedding our radicalism through the warm glow of having “arrived” in the corridors of power.

Radical confessions, like the one I have attempted here, are perhaps the only programmatic antidote to ideological slippage that threatens to turn us into cogs of the machine. If we are to forge alliances with our political adversaries we must avoid becoming like the socialists who failed to change the world but succeeded in improving their private circumstances. The trick is to avoid the revolutionary maximalism that, in the end, helps the neoliberals bypass all opposition to their self-defeating policies and to retain in our sights capitalism’s inherent failures while trying to save it, for strategic purposes, from itself.”

I think he makes some interesting points. What does society want to replace the downward spiral of extreme capitalism with?

What does a functioning socialist system look like?

How can somebody that is successful avoid the trap of entitlement?

How radical of a change can a society be expected to adapt to?

I think one of the things to overcome is an over reliance on taxation. I think this is often used manipulatively while not recognizing where money actually comes from. We get lost in a self imposed limited gold standard way of thinking.

—————–

“Yet with Europe’s elites deep in denial and disarray, the left must admit that we are just not ready to plug the chasm that a collapse of European capitalism would open up with a functioning socialist system.

I realised how readily I could forget that which my leftwing mind had always known: that nothing succeeds in reproducing itself better than a false sense of entitlement. Forging alliances with reactionary forces, as I think we should do to stabilise Europe today, brings us up against the risk of becoming co-opted, of shedding our radicalism through the warm glow of having “arrived” in the corridors of power.

The trick is to avoid the revolutionary maximalism that, in the end, helps the neoliberals bypass all opposition to their self-defeating policies and to retain in our sights capitalism’s inherent failures while trying to save it, for strategic purposes, from itself.”

Yeah, I think the point about taxation is spot on. That’s one of the central philosophical disputes. Do we reclaim progressive taxation, or de-emphasize the very concept of taxation itself? Not all of us agree with the MMT advocacy of the latter approach.

But I think that last bit quoted is a little too self-serving for my tastes. Varoufakis is an affluent world traveler, spending a considerable amount of time in Anglo-American countries and institutions. He’s one of the comfortable co-opted. He couldn’t even be bothered to take a stand on the vote in parliament Friday. He had to go to his vacation home instead.

Academics can’t run a war? Surely you jest. Why, it’s the find world of Academia that, at least here in the US, has brought about “trigger warnings” and “safe rooms” as protection for students when someone might dare utter an opinion (or even a fact) that isn’t in line with the students’ views.

If Academics are capable of protecting students from “micro-aggressions” this way, I have no doubt that they can likewise protect a nation from military aggression.

Simple shaming and name-calling of any military aggressors should suffice.

One of the really strange details is Geithner’s little meeting with Schaeuble on the island of Sylt. Sylt is a very isolated place. Not easy to get to. But good for maintaining secrecy. It’s odd that Schaeuble of all people would want to meet there when he could easily roll himself into a nice hotel in Berlin instead. And even odder is that he invited Geithner (of all people) there to tell him he wanted to push Greece out of the EU. Something tells me there is far more to this story than Geithner is admitting. Geithner probably refused any monetary assistance. He simply claims to have been shocked. But you have to wonder if maybe Geithner was the one who suggested the EU dump Greece, and Schaeuble thought it could work as a last resort. I can only imagine Schaeuble was desperate about Deutsche Bank and German bundfoolery to deign to talk with Timmy at all. Since at least 2012 Varoufakis has been making a case in favor of Greece remaining in the EU. He has certainly known that long that Schaeuble wanted Greece out, why else make such excellent arguments? And in that sense, so far Greece is winning simply by staying in the EU. Now France and Italy are on their side. And the IMF also (probably channeling us since we want to keep up the appearance that we are letting the EU take care of its own problems). Finally some allies. If Greece can just keep it together.

Yes indeed, this has rape and pillage written all over it, more “foaming the runway”…this meeting reeks to me.

I agree there’s a lot more interesting stuff to the story than what Geithner has talked about publicly (and that lack of transparency across the western world is one of our major problems). The context at that point was a bank run as well. Almost 2/3 of the total deposit outflows from Greek banks happened during that time frame (2010-2012). The interesting question to me is winning allies to do what? The ECB either funds Greek deposit outflows through ELA or it doesn’t. Not much middle ground there. When France and Italy (Draghi is Italian, after all, and Lagarde nominally runs the IMF) put money on the line in a way that doesn’t undermine Greek sovereignty, that will be interesting.

FYI, Sylt is a legit resort destination. So in and of itself there is nothing particularly questionable that the Germans would host an important delegation/conference/free vacation for visiting dignitaries there. After all, we’re talking the US official who evaded taxes on his time at the IMF. Sylt is probably exactly the kind of place he’s used to being treated. It’s like when your employer pays you tax free compensation through frequent flier miles, just scaled up to the technocratic elite.

Food for thought,,,, IMHO the deal will wreck itself….sooner or later

Against confirmation bias:

FT (from FT Alphaville further reading) Gideon Rachman: Germany’s conditional surrender… not sure the link works)

http://www.ft.com/intl/cms/s/30e6bc60-2957-11e5-acfb-cbd2e1c81cca,Authorised=false.html?_i_location=http%3A%2F%2Fwww.ft.com%2Fcms%2Fs%2F0%2F30e6bc60-2957-11e5-acfb-cbd2e1c81

The bridge financing is a mess: the EFSM can not be legally be used, and according to ZH UK and others are to be bought off with “guarantees” taking the form of SMP Greek loans. And there is not enough in the pot for the entire financing needs…

http://www.zerohedge.com/news/2015-07-15/uk-furious-proposed-%E2%82%AC7-billion-greek-ponzi-perpetuating-bridge-loan

Legally, the ESM cannot be used for the bailout, as a prerequisite is “debt sustainability” …… (read the contract)

And last but not least – what is going on with the Greek banks – everybody thought they would have run out of dispensible cash by now, but…… did the ECB provide more cash and ELA or other “bridge financing”? It is so quiet, nothing to be heard….

Good to see that the comments are open again, Thank you.

If I am reading all this correctly, then the IMF take Greek debt is a huge problem for the leaders of the creditor nations. Requiring ‘debt relief’ I assume means taking a haircut and the tax payers of the creditor nations will have to pony up.

Assuming as many do that Washington is ultimately in the drivers seat at the IMF, then it seems to follow that the US wants to save Greece at the expense of the EU taxpayers. Obviously the interest in ‘saving Greece’ is not humanitarian – strictly strategic. They don’t give a damn how destitute the Greek people are; just don’t let Greece leave the NATO orbit.

A number of EU countries have already taken an economic hit in order to comply with Washington’s strategic desire to isolate Russia. And now they could potentially be asked to take another if the IMF sticks to its guns.

Can anyone see the EU defying the US on this?

The EU and Germany in particular have also been kind of elbowed aside in Ukraine. The Kiev government is currently preparing a fire sale of publicly owned concerns and is openly courting American and Canadian investors.

As a reminder…

http://m.huffpost.com/us/entry/7588594

” the tax payers of the creditor nations will have to pony up.”

That’s what happens when you design your system to negate MMT.

(My reading of various descriptions of the Euro setup. Can anyone who actually understands MMT correct me?)

“What is at risk is not merely more economic distress but Greece turning into a failed state”

It would not be hyperbolic to claim Greece is presently a failed state by conventional standards

Are the Americans going to support Grexit, or are they going to call the poodles and tell them to get the deal done?

I’ve started to wonder if Merkel and German behavior is being shaped by simmering issues with sanctions against German business…eh. ..Russia and the NSA. The IMF refused to cut earlier deals where Greece would cut defense spending. I wonder if Germany is trying to make the U.S. pay or risk losing a NATO ally through a “grexit” when there isn’t an iron curtain and a massive F-35 scandal.

Of course, Merkel might have done a headcount and seen that there isn’t enough cash parliaments in Europe are willing to part with to sustain Greece, and she might be dealing with her reality.

The American role in all this is very murky. I’m sure Washington is involved at some level (where aren’t they?) especially as this is a NATO member. Certainly Washington and Beijing have enough Euros available to them to bail out the Greeks, but neither seems interested. The amounts are, compared to the funds used to backstop European bank counterparties in 2008-9, quite modest. Obviously the Americans and Germans don’t see the collapse of Greece as system-threatening. But I guess if they can allow Libya, on Europe’s doorstep, to completely collapse into anarchy and warlordism they are not too concerned about the likely fate of Greece.

Much of U.S. policy is dependent on the White House. The other actors are too small and have too few resources to do more than run terrorist ops and perhaps forcing DC into an embarrassing situation (Nuland or France possibly supporting an uprising leading to a relatively calm ousting of Gaddafi without the aid of U.S. super soldiers and wunderweapons. ).

How active and bright are the people empowered to act on behalf of the President. What do they know and what are their goals? Domestic concerns are an issue too. Obama burned bridges with sequestration. Going to Congress an asking for money for Greece to pay German banks won’t sit well regardless of 2008/9 comparisons. The Hillary fever among Congressional Democrats always struck me as an understanding that Obama was a huge mistake.

Libya disappeared because Obama only cares if he can be affected. Discussing problems in Libya undermines the decision to ice Gaddafi, hand out weapons, and the premise of “democratic, smart wars.”

I expect Greece to be ignored until it starts to look like a potential embarrassment for Obama.

“I expect Greece to be ignored until it starts to look like a potential embarrassment for Obama.”

Perhaps. It would be incredibly short sighted as such – though that would certainly be familiar behavior… I suspect there is a certain amount of, “Merkel and Co., do what ever your sordid little hearts desire to torture Greece and wave it around wiggling to flash freeze the other periphery countries in terror. Just back US up when it comes to Russia in general and Ukraine in particular.

This tacit and utterly ruthless agreement on road kill has been suggested here various times, but I don’t remember anyone seriously challenging it.

The renewal of Russian sanctions has intrigued me. The sanctions have hurt European business, and politically Putin ms the winner.

I wonder if Germany’s double down is meant to pull the U.S. into Greece.

This is soooo maddeningly ridiculous. The EU clowns refuse to officially go for haircuts but they’re going to get a damned haircut no matter what anyway! They think by NOT acknowledging reality (that Greece will NEVER pay back the debts) will magically prevent them from raising their own taxes to cover the shortfalls that ARE going to happen anyway. Ree-dick-you-luss.

One way or another (officially or unofficially) the EU country creditors are going to get a big haircut. End of story. Pretending otherwise makes them all unfit to “rule”.

The EU countries might eventually have to take a haircut, but that’s a problem for a different set of clowns after this set of clowns are comfortably six feet under or ensconced in some well-paying/low-responsibility position.

Article on “Open Assembly”, a local self-help citizen group formed in the ship-building town Perama:

http://america.aljazeera.com/articles/2015/7/14/greece-shipping-town-girds-for-bailout-battle.html

Open Assembly is helping local people on the ground (food, shelter, etc.); it actively positions itself politically against Golden Dawn, which is also handing out food. Open Assembly seems to be grass roots.

Small-scale local community self-help groups and informal networks will be increasingly critical, as State and European-level financial & other institutions are increasingly impotent to provide the most essential needs. They will find unique ways to move forward, one hopes.

I approve your sentiment about ‘small scale local community self-help groups’, but pardon me for being sceptical of the one featured at america.aljazeera.com. I am reminded (and I am sure others are as well) that Plato’s Politeia (The Republic) begins at the Pireaus, where Socrates has gone to witness a festival celebrating the arrival of a new god/religion from abroad. This is a little too pat for me to embrace it.

It seems to me that the IMF is not on the side of the Greeks, nor is it on the side of the EU. It is on the side of NATO. To keep Nato where it is, the perceived crisis will be handled as was that of Ukraine. But Greece is different – the usurpers cannot play the neoNazi game here. They must approach Greece differently, ‘supporting’ the anti-neoNazis – groups such as the one featured above, relying on Greek sense of history. It never stopped being the Shock Doctrine for them.

Tsipras had already leaned toward the US in comments, and I noticed the Guardian saying ‘Well, the good thing is this keeps Greece out of Russian tentacles’ or something of that nature. The Greeks will have to be very wary; fortunately that is in their nature also.

I’ve no idea of the bona fides of “Open Assembly”, and no way to assess them. Anything in the media has to be treated with scepticism.

Small, local organizations / groups like the one portrayed by the article are going to provide what lifelines there are. Who knows, maybe even Golden Dawn will be good at this–it would benefit them politically, so they’ll probably try.

In the Irish Times there was recently also an article about Perama, but it didn’t say anything about any community organizations of any kind:

http://www.irishtimes.com/news/world/europe/once-mighty-shipyards-fall-silent-as-the-greek-crisis-wipes-out-a-way-of-life-1.2278161

Greek National Socialist and Golden Dawn leader Ilias Kasidairas literally tearing the documents apart.

https://vine.co/v/erhJ913H0TY

The unsustainable won’t be sustained. The consequences will be tragic and horrific, but societies that make bad decisions often meet tragic and horrific ends. The Polynesians, the Romans, the People’s Temple–all of them at some point collectively decided to believe and do stupid things for their various ignorant reasons, and they paid for it. That is the unchangeable rule of life.

And choosing to rely on a rapacious financial system and foreign suppliers to meet the most basic living needs in an era of dwindling energy resources and a collapsing ecology is a–really–bone-headed decision. Greece is getting the brunt of it first because they are small and weak. But the same is in store for the rest of us who are also living unsustainably. If not the creditors, then the ecology will demand it.

Clearly the IMF has just exploded a land-mine in the middle of the process, and rendered the possibility of Grexit at close to 100% if not 100%, by insisting that the EU has to make a choice:

They know perfectly well that a 30 year grace period amounts to writing off the debt in practical terms, and not just the existing debt, but all future assistance!

Alternatively:

So, alternatively, the EU funds a Greek deficit with annual funds transfers, which the IMF knows is a non-starter, or the creditors take an upfront haircut, which would immediately impact tax-payers.

After blowing their land mine, the IMF smugly concludes that “the choice between the various options is for Greece and its European partners to decide.”

This amounts to a demand by the IMF for a haircut, since that’s the only conceivable option. The EU is not going to give Greece a 30 year grace period, and they cannot even think of funding annual transfers to fund the Greek budget.

Unless someone can force the IMF to walk back this demand, Grexit now is forced. But the IMF is coming under increasing pressure from its members not to extend any more Greek deals that make zero economic sense, and will never result in the fund getting its money back, just so the EU can avoid telling the truth to its taxpayers.

The easy part was punishing the Greeks. The hard part is deciding between the creditors who will take the blame for the losses.

But Yves, you should play bookie! You could make a fortune on this issue alone.

I’m not sure if this link has been listed here but if it hasn’t I highly recommend reading it.

http://www.newstatesman.com/world-affairs/2015/07/yanis-varoufakis-full-transcript-our-battle-save-greece

Yves, your math is unambiguous. and August is coming.

Forget about a bailout for Greece. What’s needed is a bailout for the Eurozone. In other words, Europe must bail itself out. For all practical purposes, Europe has borrowed so and so many billions of Euros from itself so it can pay itself for the billions it borrowed earlier. Greece is merely a token in this transaction, the hapless puppet that provides the illusion of legitimacy.

I’ve predicted that Greece will get its bailout and I still stand by that. But it would be a lot simpler and a lot easier for Europe to forestall the dreaded default by paying the debt itself, without involving Greece. It would look perfectly absurd, but by now the underlying absurdity is evident in any case, and to everyone.

Regardless of how it’s done, the money MUST be repaid, if only for technical reasons, because upon technical default (which has not yet happened, the IMF nonpayment notwithstanding) all Hell will break loose. The powers that be cannot let that happen. (If they could, then they wouldn’t be wasting their time with all these meetings, negotiations, deadlines and whatnot, but simply cut Greece off at the knees and get on with business as usual.)

The IMF paper has made things a lot more difficult for sure, but regardless, the money must be found and so the money will be found. There will be no default, no Grexit, just months and years of endless pain for the innocent victims of Greece, along with so many other working class “folks.”

Oops. To make myself completely clear I should have said “for the innocent Greek victims” instead of “innocent victims of Greece,” which is ambiguous.

So they’ve accidentally (?) made the ECB the dictator of Europe, because they’re the only ones that can just create money – but as I understand the system, they aren’t allowed to.

Unless, of course, they absolutely have to, in which case rules, schmules. The rules made the mess.

“Mere anarchy is loosed upon the world.” – WB Yeats, “the Second Coming.”

What is really disturbing in this analysis (and it’s a bravura analysis) is that there is no room for the usual fudging that keeps the EU running. Unless the ECB opens the spigots, it’s showtime.

“the underlying problem was that the two sides had no bargaining overlap between their positions and were conducting the negotiations in a media fishbowl. That made it impossible to find areas of mutual interest (having the new government improve Greece’s broken tax system, which only taxes the incomes of about 30% of the public, cracking down on oligarchs) and figuring out ways to come up with optical solutions on the issues where they were odds so each side could declare a victory. ”

IIRC that was what Varoufakis was attempting to do early on, when he declared that he was “70%” in agreement with the Troika proposal, but he was constantly rebuffed by demands for a “comprehensive” agreement apriori before any agreement could be reached. IOW the Troika inflexibly didn’t negotiate at all, since finding common ground on which to start negotiations is a part of all negotiations, and leads on to confidence-building measures. Wasting all the time arguing over the shape of the table isn’t negotiating.

He never followed up on that 70% remark. For starters, there was never a detailed proposal for how they’d improve tax collections. Dijsselbloem REPEATEDLY said the the creditors could do a partial bailout (a release of some of the 7.2 billion euros in funds) for a partial reform list. Varoufakis never took him up on it.

In the New Statesman interview, YV said they Eurogroup kept changing the focus from one topic to another (one week one topic, EUgroup doesn’t accept what Greece proposes but doesn’t offer a counterproposal, then immediately demands a new topic for the next week–IOW, no negotiation).

YV points out that there are no minutes or other records of what transpired, and (I think from the same interview) that this is an unelected body with no accountability, and says Germany completely dominated it.

That said, even if one accepts any of these arguments, it still doesn’t excuse the lack of experienced EU negotiators, and the lack of advisers in the government who understand how to execute (and not only teach or debate or inspire). There must be leftists who have practical managerial or government or operational experience with large-scale entities, even if not in Greece. (The Spanish coop giant Mondragon comes to mind. Others who have experience incorporating different paradigms might include Ricardo Semler of Semco Brazil, or David E. Martin of M-CAM.)

The Syriza party needed to demonstrate it could get things done, and other weaknesses might have been forgiven or been easier to deal with if they had shown greater competence in governing.

Easy to criticize from the sidelines. Maybe the next phase will introduce new people & approaches to deal with the weaknesses exposed so far.

I wonder if this is a rearguard action by the U.S taken via the IMF. U.S. Could not get debt reduction in the latest agreement, so it is using its leverage by threatening IMF to withdraw from participation. United States knows this agreement solves nothing; it is another exercise in can kicking which will give Greece additional time to prepare to leave the currency union. Once Greece leaves, it is more likely to end up turning to Russia and China.

No, I think this is the IMF protecting itself as an institution. It’s already gotten so much heat over Greece that it has damaged its legitimacy. And with the US having only 1/6 of the board seats v. Europe having 1/3, the idea that the US calls the shots is exaggerated. That may have been true 15 years ago but is no longer.

As we outline in the post, the IMF sticking to its guns this time (versus in the 2012 bailout, when it also insisted that the Eurozone countries take haircuts, and accepted a commitment that they’d do it later which they never honored) greatly increases the odds of a Grexit. The US most assuredly does not want a Grexit. Therefore it is separately difficult to see the US as being behind this move.

I know we have been over this a few times already, but under the new circumstances couldn’t the Greeks declare a new national currency called the Greek Euro? The physical notes are the ones denoted with a Y and nothing needs to be changed in the national payments systems etc. They even have the printing press for the EUR10 notes and they can quickly knock up some 20s, 50s, 500s etc. which are different from the existing Euro versions. That would rebuff any accusations of forgery.

The fact that they can do this might well explain why preparations for the Drachma have not advanced very far.

Another solution : the Greek Central Bank coud just start lending the banks on its own, without consent of the ECB. It can also print cash : Greece has a facility that can print ten euro banknotes.

Of course, this would blow the whole EMU,but at least, it would be up to the Germans to introduce a new currency.

The Germans have recently proposed that Greece issue IOUs for domestic use during a transitional period.

http://uk.reuters.com/article/2015/07/14/uk-eurozone-greece-schaeuble-ious-idUKKCN0PO0C820150714

Since early this year my gut guestimate was that a Grexit was well over 50% likely and if it happened nearly 100% due to emergency or unplanned exit. Given it hasn’t quite happened and we’re so close (and that light in the tunnel isn’t the other end – its the train!) I am baffle Greece doesn’t use the one card it now has to at least make the transition as manageable as possible. As I understand it an outright default, I’ll never pay, situation puts the rest of the Euro members on the look for their Euro liabilities (which is tax increase equivalent for most other Euro citizens). They should be negotiating a relatively smooth and quick exit plus some transitional support in exchange for future commitments on at least some, if not all, of their debts.

There are two wars in Europe; the one in Greece with Euros and the one in Ukraine with bullets. Washington DC is involved in both. Applying the economic screws to a geopolitical ally, Greece, is proof that finance rules all. Both wars document that the wellbeing of people is of absolutely of no concern. My sense is that the technocrats know the fragility of the system and will do anything to avoid the declaration of default on the debt and prevent a efficacious exit from the Euro. The oligarchs demand that every last penny of the debt be paid back with interest. They are addicted to the rush of pillaging wealth. The suffering of the people adds a glow to their power.