Lambert here: As ever, the scandal is what’s legal. Ka-ching.

By Steve Horn, a Madison, WI-based Research Fellow for DeSmogBlog and a freelance investigative journalist. He previously was a reporter and researcher at the Center for Media and Democracy. Originally published at DeSmogBlog.

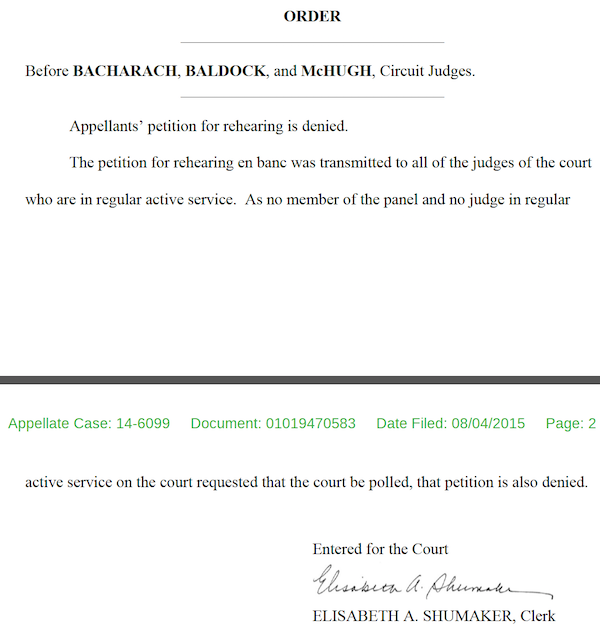

On August 4, the U.S. Appeals Court for the 10th Circuit shot down the Sierra Club’s petition for rehearing motion for the southern leg of TransCanada’s Keystone XL tar sands export pipeline. The decision effectively writes the final chapter of a years-long legal battle in federal courts.

But one of the three judges who made the ruling, Bobby Ray Baldock — a Ronald Reagan nominee — has tens of thousands of dollars invested in royalties for oil companies with a major stake in tar sands production in Alberta. And his fellow Reagan nominee in the Western District of Oklahoma predecessor case, David Russell, also has skin in the oil investments game.

The disclosures raise questions concerning legal objectivity, or potential lack thereof, for the Judges. They also raise questions about whether these Judges — privy to sensitive and often confidential legal details about oil companies involved in lawsuits in a Court located in the heart and soul of oil country — overstepped ethical bounds.

These findings from a DeSmog investigation precede President Barack Obama’s expected imminent decision on the northern, border-crossing leg of Keystone XL.

Investment Breakdown

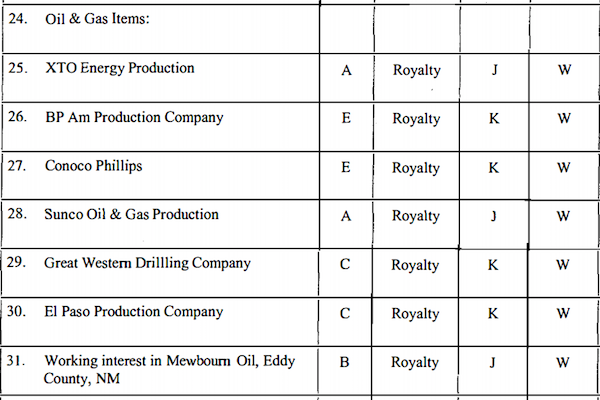

Among the companies listed on Judge Baldock’s financial disclosure located on Judicial Watch’s website for the 2012 reporting year — the year Sierra Club filed its lawsuit — are some with a financial stake in tar sands production. They include ExxonMobil subsidiary XTO Energy, BP, ConocoPhillips, Sunoco and Kinder Morgan subsidiary El Paso Production.

Source: Judicial Watch

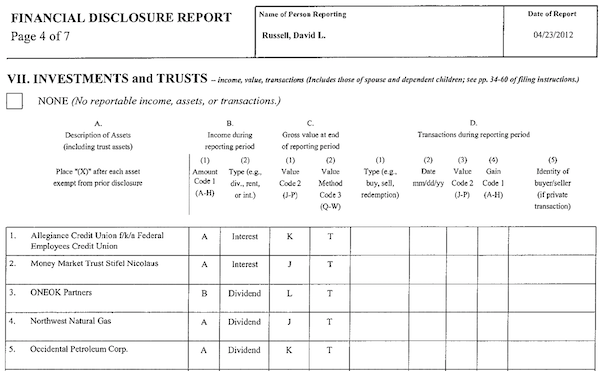

The “j” on the forms means a value of $15,000 or less, while “k” means $15,000-$50,000. Russell’s investment portfolio for the 2011 reporting year also included tar sands-related investments in companies ranging from Continental Resources, Plains All American and ONEOK Partners.

Appeals Court Judge Robert E. Bacharach — a President Obama appointeee in 2012 — also has his 2012 financial disclosure report online courtesy of Judicial Watch, showing he has no investments tied to the Alberta tar sands. Judge Carolyn B. McHugh, a 2013 Obama appointee, has no forms online to date.

A review of Baldock’s forms available on Judicial Watch’s website dating back to 2003 show that starting in 2005, Baldock began investing in all of the same oil companies he has investments in now. Russell had investments in Continental dating back to 2003 and held onto dividends for almost a decade. Neither Baldock nor Russell responded to a request for comment sent by DeSmog about whether they dropped their industry-related investments post-2012.

Financial disclosure reports from 2012 for the three judges who decided the 10th Circuit Court’s portion of the case in October 2013 denying Sierra Club the injunction it requested to get TransCanada to stop builidng Keystone XL South show no oil or gas industry investments.

DeSmog has submitted a request for financial disclosure reports for all seven of the judges who issued rulings for Keystone XL South for both 2013 and 2014.

Tar Sands Ties

Continental Resources at one point signed a deal with TransCanada to carry 35,000 barrels per day of oil obtained via hydraulic fracturing (“fracking”) from North Dakota’s Bakken Shale to market as an appendage of Keystone XL called the Bakken Marketlink.

Harold Hamm, CEO of Continental Resources and energy advisor for 2012 Republican Party presidential nominee Mitt Romney, set up a lobbying group that lobbied for and eventually won the Bakken Marketlink deal called the Domestic Energy Producers Alliance.

Harold Hamm; Photo Credit: Wikimedia Commons

Bakken Marketlink relies on the northern leg of Keystone XL though, which has yet to open shop, and which Hamm now calls “irrelevant.” Not that he cares either, with 90-percent of his company’s oil now moving by rail. Most pertinent to Judge Russell, Continental made a fat wad of cash from Keystone XL South opening up for business.

“Hamm says his lobby group received a written confirmation from TransCanada it would build the southern leg of the pipeline first, a step since approved by the Obama administration while the northern leg awaits permission,” Reuters wrote in a September 2012 investigation. “The southern leg should help drain a glut of crude in the Midwest and help Continental earn more on its oil.”

Indeed, thanks to Keystone XL South (and now Enbridge‘s “Keystone XL Clone“), record amounts of tar sands diluted bitumen (“dilbit”) now flood Gulf coast refineries.

“Between 2010 and mid-2012, pipeline shipments out of the Midwest were relatively flat at about 225,000 b/d until the reversal of the [Enbridge, Enterprise Product Partners jointly-owned] Seaway Pipeline, which now transports crude oil from Cushing, Oklahoma, to the Gulf Coast,” explained Commodity Online.

“Since then, Seaway has been expanded, and other pipelines, such as TransCanada’s [Keystone XL South], were built to carry crude oil out of the Midwest. By May 2015, pipeline shipments from the Midwest reached 1.3 million b/d, the highest since EIA began collecting pipeline shipment data in 1986.”

ONEOK, which bought Koch Industries’ natural gas liquids unit in July 2005, also has a direct connection with TransCanada. The two companies jointly own the Northern Border Pipeline on a 50-50 basis, a line that brings gas extracted from the “Western Canadian Sedimentary Basin to a growing U.S. Midwest market” according to TransCanada’s website.

The tar sands boom in Canada has served as a boon to gas drillers in the Western Canadian Sedimentary Basin, with huge amounts of gas used to extract the tar sands and morph them into dilbit capable of flowing in pipelines.

So although Northern Border flows to midwest markets, it still locks in demand for gas drilling, with much of that gas used to enable huge amounts of dilbit to flow through TransCanada’s Keystone Pipeline System.

Put another way, Judge Russell found a win-win investment and through his legal decision, helped make his investments more valuable assets.

The U.S. Courts seemingly oppose this type of conduct. But as a 2014 investigation published by the Center for Public Intregity explained, it is far from unprecedented, and Judges seldom recuse themselves nor face punishment.

A judge should disqualify himself or herself, explains 28 U.S. Code § 455, when “He knows that he, individually or as a fiduciary, or his spouse or minor child residing in his household, has a financial interest in the subject matter in controversy or in a party to the proceeding, or any other interest that could be substantially affected by the outcome of the proceeding”

“Dire Precedent”

For the case itself, Sierra Club attorney Doug Hayes had argued the case should be reheard because of what it argues is the dangerous precedent it would set if the current ruling stood.

It “affects many other projects nationwide, and would allow the Corps to continue approving massive crude oil pipelines under Nationwide Permit 12 without ever analyzing their impacts, such as the risks and impacts of oil spills,” wrote Hayes, further arguing that the status quo “would permit agencies to avoid NEPA compliance by claiming ignorance of the law.”

Source: U.S. Appeals Court for the 10th Circuit

NEPA, the National Environmental Policy Act, requires that federal agencies allow public comments and public hearings for large-scale energy infrastructure projects as part of their decision-making process. But for Keystone XL South, like Enbridge’s Flanagan South tar sands pipeline and Alberta Clipper (Line 67) project (two pieces of the “Keystone XL Clone”), the Obama Administration allowed these tar sands pipeline companies to dodge the conventional process and get under-the-radar Nationwide 12 Permits instead.

The decision “sets dire precedent,” wrote Hayes, and “involves issues of exceptional importance, as the holding allows other crude oil pipelines to be built with no consideration of oil spills or other impacts as required by NEPA. Prior to this case, the Corps had never before used NWP 12 to approve massive crude oil pipelines in this manner. Now, the Corps is approving other pipelines [he later pointed to Flanagan South] using NWP 12 without any project-specific NEPA analysis.”

Add to this “dire precedent,” then, the fact that at least two of the judges who handled Keystone XL South cases stand to gain financially from the rulings they issued and you have a perfect storm.

Photo Credit: chris kolaczan | Shutterstock

Another Claude Rains moment.

constitutional law expert means expert in ways of ignoring the constitution…but remember…people are now corporations too…it is a legal concept that is the useful counter-position to these corporate takings of the public trust…

if you were to dump a bag of garbage in the dumpster of a corporation or its refuse company, you might have a problem…but when a corporation that burns a product that then trespasses into your lungs…is that not trespass…they could capture the soot…but choose to dump it in a way which leads to it trespassing into your lungs or bloodstream….simple trespass…dilbit is a product destined to eventually trespass into your lungs

It should be obvious by now, that the XL is not going to be built. Normally, if Obama dragged his feet this long on anything, the republican investigative committee impeachment documents would eclipse the penny ante issue at hand. In this case, with no need to worry about “killing a job creating project in the depths of a recession” with double digit unemployment figures at the ready to bash his brains in, XL is just going to have to wait for another, more favorable political cycle. It is too bad that Obama or Clinton in 2015 could not declare publicly that this is just dead. That would save the resources of people such as the Sierra Club for more pressing matters than attacking a pipeline that does not exist and will not get built. Better to close down even more coal fired power plants that are here right now, providing disease and death to hundreds of thousands of people in the US, Mexico and Canada.

Judges seldom recuse themselves nor face punishment. For the case itself, Sierra Club attorney Doug Hayes had argued the case should be reheard because of what it argues is the dangerous precedent it would set if the current ruling stood.