The Story of the Butterfly That Got Adopted by A Red Ant Smithsonian

Life lessons from villains, crooks and gangsters BBC

Professional services: Accounting for change FT. “[S]ome fear audit quality is at risk amid potential conflicts of interest.”

GDP Numbers Reveal Underlying Momentum, Possible Headwinds for U.S. Economy WSJ

Port of New York and New Jersey Saw Record Container Traffic in July WSJ

One of the Most Popular Doom Scenarios for the U.S. Economy Is Fizzling Out Joe Weisenthal, Bloomberg

The Upside of a Downturn in Silicon Valley NYT

Is the unthinkable becoming routine? Bank for International Settlements (June 2015). When you’ve lost the Bank for International Settlements…

Mr. Market

Welcome to a wild world of robot investing Gillian Tett, FT. Finally, somebody mentions algos and HST!

Stocks Crashed the Last Two Times This Happened Wolf Street

Oil markets catch breath after biggest gains in six years Reuters

China?

Friday Thoughts on Crazy Nonsense Baldings World. Things to watch…

China’s Stock Market Tumble and the Outlook for the Global Economy New Economic Perspectives

PBoC uses complex tool to tame yuan China Spectator

China’s Meltdown Goes Deeper Than the Stock Market The Nation (Re Silc)

China’s workers abandon the city as Beijing faces an economic storm Guardian. Who’s gonna move into all those fancy apartment blocks?

China’s Hunt for Growth in the Countryside Bloomberg

China Falters, and the Global Economy Is Forced to Adapt New York Times. “The leadership, concerned with maintaining social stability, has been quick to act.” Sounds like the Chinese Communists are more scared of their people than the Demopublicans are of us.

There is only one way to China-proof Australia Macrobusiness

Heard of China’s Fake Rolexes? Now There’s a Fake Goldman Sachs Bloomberg. More like meta-fakery, isn’t it?

Asia extends global stocks rally as upbeat U.S. GDP soothes sentiment Reuters

The unfortunate case of Malaysia’s prime minister Asian Correspondent

10 excuses for being absent from Bersih – Edward Beruang Malaysian. Big demo against President Najib, the guy with the mysterious $700 million in his personal bank account. Note that a Najib government would have had to sign TPP.

Grexit?

Greece debt crisis: Interim PM Thanou is first woman leader BBC

Tsipras Risks a Fragmented Parliament in Greek Election Gamble Bloomberg

Tsipras gambles on outright poll victory FT

SYRIZA bubble ready to pop Ekathimerini

European Commission signs three-year ESM stability support programme for Greece Hellenic Shipping News

European bailout fund chief upbeat on Greece Deutsche Welle

Update Coeure: EZ Needs Reforms to Affirm Euro Is Irreversible Market News. If you have to say it..

America’s Dangerous Bargain With Turkey NYT

Ukraine and Top Creditors Agree to Restructure $18 Billion in Foreign Debt NYT (William)

“If the agreement goes into effect, it would write off 20 percent of the country’s foreign debt and go far to help Ukraine avoid a drawn-out, Greek-style negotiation with large bondholders… bondholders including the giant California-based Franklin Templeton fund – Ukraine’s largest lender – would accept an immediate loss on the principal.”

William: “Those in a position to open up new markets for the atlantic ruling class get special treatment…”

2016

America Is So in Play Peggy Noonan, Wall Street Journal. I’m with Nooners on this one. Clinton isn’t. Bush isn’t. Sanders is. Trump is.

#BlackLivesMatter disrupts Clinton rally to demand she cut ties with prison industrial complex Fusion. Hit ’em where it hurts: Disrupt the ka-ching.

No, Bernie Sanders still isn’t going to run as an independent WaPo

Insurers Win Big Health-Rate Increases Wall Street Journal

Gun violence in America, in 17 maps and charts Vox

The Case Against Cash Bail The New Yorker

Police State

Officers remove activists’ tent after clash at Denver courthouse Denver Post. “[Civil rights attorney David Lane’s] motion accused Denver police of confiscating 1,000 jury-nullification pamphlets that the federal judge had approved in his injunction. Police also took a shade tent, a table, four chairs, buckets, a cooler, signs and other items, the motion said.”

Ex-Cop Who Killed Six People Now Teaches Other Officers When to Use Their Guns Gawker. Well, he’s the expert!

Katrina Anniversary

New Orleans After Katrina: Inequality Soars as Poor Continue to Be Left Behind in City’s “Recovery” Democracy Now

Democrat Donna Brazile says Bush got Katrina right NOLA

After Katrina, FBI prioritized cellphone surveillance Boing Boing

Class Warfare

Tipping, power, and the gig economy mathbabe

What Amazon Didn’t Understand About Overwork The Nation

In landmark case, labor board will let more workers bargain with their employer’s employer WaPo

Civil unrest is already happening in America and it could get a lot worse in 2016 Business Insider

George A. Akerlof – Phishing for Phools Chronicle of Higher Education

Tech nerds are smart. But they can’t seem to get their heads around politics. Vox

Who Hacked Ashley Madison? Krebs on Security

Estimating the reproducibility of psychological science Science (Allan).

Retrotopia: Dawn Train from Pittsburgh The Archdruid

Exclusive: Read Julian Assange’s Introduction to The Wikileaks Files Gizmodo

The day macroeconomics changed Mainly Macro. “[I]f I cannot understand something, it is best to assume it does not exist. [Not.]”

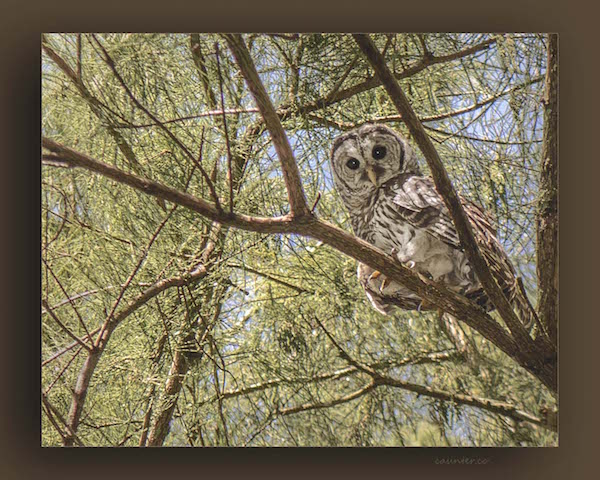

Antidote du jour (via Jason Gordon):

Jason writes:

I was at the UCF campus in Orlando, Florida a couple of days ago and I saw this owl sitting far up in the tree, looking down on the students walking under it. Of course I’m the only one weird enough to walk around campus looking straight up, so no one else saw it.

Intake of saturated and trans unsaturated fatty acids and risk of all cause mortality, cardiovascular disease, and type 2 diabetes: systematic review and meta-analysis of observational studies

re: Malaysia demonstration…be sure to boot up your hard line connection.

India found a way to shut down the mobile internet (to 63 million people) during protests…I wonder if it will catch on elsewhere in Asia

http://thenextweb.com/in/2015/08/26/india-just-turned-off-mobile-internet-for-67-million-citizens-amid-protests-in-ahmedabad/

Class Warfare Down Under: The Abbott regime’s neoliberal war on workers continues:

It used to be that the way to get labelled an economic Benedict Arnold (or whatever the Oz equivalent is) was to export jobs. Now it seems that opposing the importation of low cost scabs will get you accused of economic treason. By a Minister, no less.

New Orleans After Katrina: Inequality Soars as Poor Continue to Be Left Behind in City’s “Recovery” Democracy Now

Bill Quigley, the interviewee, appears to have his heart in the right place but he is simply wrong when he says New Orleans is safe. New Orleans is plagued with violent street crime in all neighborhoods at all times of the day, including the French Quarter, the Marigny and Uptown, all areas that were reasonably secure before Katrina. Most of these violent crimes are committed by teenagers and this is no doubt a result of the economic and social displacement from the storm. As your article earlier this week noted, the New Orleans black middle class never recovered from Katrina and the black middle class was the glue that held New Orleans culture together. In the new New Orleans — a dystopian, neoliberal, libertarian paradise — social and cultural bonds are valuable only if they can be monetized as an iPhone app or marketed to tourists in TV commercials. This is the future. Laissez les bons temps rouler!

See “Who Runs the Streets of New Orleans?” http://www.nytimes.com/2015/08/02/magazine/who-runs-the-streets-of-new-orleans.html

If this was linked on NC, I missed it. Excellent article, if nightmarish.

Yes, I had seen that article. Privatized police promoted by our neoliberal ideologue president and the Democratic mayor of new Orleans to go with the privatized schools that expel poor students so they can become juvenile criminals for the privatized police to combat. As Lambert might say: Ka-ching! Ka-ching!

Let’s how they can privatize police in Sicily.

And the winning bid is…

Coming soon: Privatization of tax-collection to old-school tax farmers.

Maybe it’s worse now, I don’t know, but I lived in New Orleans for 27 years prior to Katrina and imho parts of Uptown and Marigny were considered dangerous with a number of well-publicized murders in both Marigny and the Quarter. I lived in Marigny and when it got dark outside most people I knew generally didn’t walk around alone if it could be helped.

Everything else you said is spot on.

You know better than I do but it sure seems worse to me. There were always violent crimes even in the safer neighborhoods since, as you know, New Orleans neighborhoods bleed into one another (pardon the bad pun). But now there are rapes, murders and ESPECIALLY armed robberies all over town — including the Quarter — and at all times of the day. I have been visiting New Orleans since the late 80s and I have friends who live in the Quarter and the Seventh Ward. I’ve never seen it as bad as it is now. Even the gutter punks in the Marigny and the Quarter are getting violent. I always felt safe in the Quarter and almost always in the busier Marigny and Uptown streets, at least at “normal” hours and in a (relatively) sober state. Maybe I have just been lucky. But these days I warn people who are visiting New Orleans to be careful, especially towards the extra-sketchy Canal Street end of the Quarter, and I never did that in the past. I think New Orleans tourism is one really bad incident away from a big problem.

Lambert, thanks for the link to the BIS report. While its concern with financial booms and busts is admirable, in my opinion its claim that interest rates are too low, and its apparent “Return to Normalcy” 1920s-like praise on fiscal austerity is not.

I realize you don’t care for low interest rates. I disagree with you, but rather than bury the lede by quoting the article at length, here’s the killer rebuttal, a graph comparing long term interest rates with real GDP during the New Deal years and 1940s:

https://research.stlouisfed.org/fred2/graph/?g=1Iei

Long term interest rates were about 2% for 20 years (and the Fed funds rate was about 1%), during which the US saw its greatest GDP growth of the entire 20th century, and the middle and working classes prospered to boot.

So there is nothing wrong with ultra-low interest rates. Fiscal policy made all the difference. Then, there was the New Deal, the super-focus on industrial production during WW2, and the harnessing of it on the returning GIs afterward. Now, after a brief stimulus, we have had austerity.

In the 1930s and 1940s, we had an effective SEC and Fed, and Glass-Steagall. In the 2000s, Galss-Steagall was repealed, and while the Fed, as the banking regulator, still had all of the tools necessary to shut down excessive speculation, under Alan Greenspan it refused to use them.

The BIS argues in favor of “normalizing,” i.e., raising, interest rates. But what is always left unanswered in these arguments is the lack of proof that the risks of lowering vs. raising interest rates are asymmetric. If raising rates causes just as much pain now, as failure to raise them would cause later, why on earth should we consciously bring on the pain?

Finally, the BIS argues (discreetly and obliquely) for cutting back the safety net. Here’s what they say:

“Domestic policy regimes have been too narrowly concerned with stabilising short-term output and inflation and have lost sight of slower-moving but more costly financial booms and busts….

“Addressing these deficiencies requires … rely[ing] less on demand management policies and more on structural ones, so as to abandon the debt-fuelled growth model that has acted as a political and social substitute for productivity-enhancing reforms…. Monetary policy has been overburdened for far too long. It must be part of the answer but cannot be the whole answer….

“This means, first and foremost, facilitating private sector balance sheet repair, supporting reforms that boost long-term productivity growth and a greater but judicious emphasis on investment at the expense of current transfers. The quality of public spending matters more than its quantity.”

—

“Current transfers” is code for “unemployment insurance, Social Security, and Medicare.” “Reforms that boost productivity growth” is code for cutting back on corporate regulation and taxes.”

So while I agree with the BIS that ultra-low interest rates (without financial regulation), encourage financial booms and busts, I disagree that it is the low interest rates, rather than the lack of financial regulation, that is to blame. While I agree with them that there has been too much reliance on monetary policy, and not enough on fiscal policy, needless to say I also disagree with their proposed solution.

But really, I encourage you to think seriously about that graph I linked to at the top of this comment, and consider whether your dislike of low interest rates (which, by the way, has also allowed millions of homeowners to refinance their mortgages at very low rates and free up both further savings and consumption) might be misplaced.

Take a closer look at your own link, specifically, the years immediately following period you cited. GDP continues to grow at quite a nice clip despite interest rates rising all the way through the ’70s. It makes no argument for or against low interest rates.

There’s perhaps a couple of things you aren’t considering: 1) this chart appears to use nominal GDP, so it ignores that effects of inflation. If interest rates are 2% and nominal GDP is 8%, that looks great! But it’s not so great if inflation is running at 9% (for example). I’m sure the FRED database can generate a chart using real GDP as opposed to nominal, which is likely to tell a different – and more useful – story. The other factor, 2) much of the developed world’s industrial capacity was decimated during WWI. The period you’ve picked includes the decades immediately after the war, where the US had a near global monopoly on industrial production, and had tremendous population “growth” from servicemen and women returning from overseas plus the baby boom. All that pent-up demand was finally unleashed, and you get the GDP growth as a result.

great comment, MLS.

IMO, the rich play too many “money games” when the rates are this low, and the “financialization” of the U.S. economy in this environment can only continue to hurt the lower- and middle-classes while the rich skim the cream off the top. It goes against everything I learned in school, but I still argue rates should rise. In additiona, I’d recommend the upper tax bracket should move to 40% and capital gains taxes should increase along with taxes on dividends. TAKE THAT America! :)

I’m with you on letting rates rise, if for no other reason than to re-calibrate expectations that the Fed is here to save us from every market swoon. Investor perceptions that risk has been removed from stocks is just sowing the seeds for an enormous blowup at some point in the future, like pulling a rubber band until it snaps. Healthy markets have some volatility with 8-10% corrections on a periodic basis and yes, even the occasional recession. Letting that happen is the best thing for our economic soul. Your point about the damage low rates do to the middle and lower class is extremely important also. Low rates have enriched the rich and left those of meager means behind. That needs to be corrected.

Disagree with you on taxes, but I’m not getting into that today! :-)

Fred doesn’t have inflation data before the 1950s, or I would have used that. With the exception of 1948, inflation was very low throughout this period.

My point wasn’t that low interest rates always = good, but rather they do not inevitably lead to booms and busts or policies harmful to the middle or working class. The data shows that decisively..

I tried to edit the above response, but it didn’t take.

Anyway, the GDP measure in my graph is real, inflation adjusted GDP, so your first criticism is incorrect.

The “Tech Nerds can’t get their heads around politics” article is a very good read. The author has captured very effectively the attitude of many of the people I interact with as an engineer in a research function.

This is part of the reason why I think Aaron Swartz was such an impressive person, in that he was motivated to fight in the trenches rather than looking for a moonshot. The same is true of Yves.

Yes! Aaron was incredibly patient with all the BS necessary to stall CISPA up on Capitol Hill– he was a very rare combination of compassion, intellect and pragmatism– who our country could sure use right now. The fact that this inverted totalitarian regime hounded him to death, instead of honoring him for his valiant efforts, shows how the ruling kleptocracy is rotten to the core. :(

RG’s summary of the Guardian China Sky Is Falling article:

China is crashing! Evidence:

— 2 scrap metal recyclers are heading back to their villages.

–The RMB is being devaluated (horrors!).

— Domestic inflation rises (apocalypse!)

–Imports are down (this is necessarily bad?)

–Foreign analysts are bearish (quelle suprise!)

And of course this leads us to the de riguer guff on the Chinese political system being in danger of imminent collapse.

Of note is that all of this reinforces the dirt-poor economic misconceptions prevalent amongst the general public that stock market = economy, higher currency exchange is always better, and that inflation is the ultimate evil. Standard crappy reporting.

Also, millionaires, or richer, are leaving or have already left.

With his anti-corruption drive, Xi and his supporters are encountering resistance from others inside the party. And the handling of the explosions at Tianjin will test his leadership.

While stock market ≠ economy, confidence can be shaken, as well faith in the party’s omnipotence.

Utter bollocks.

The idea that most Chinese believe the Party is omnipotent is naive at best and crassly racist at worst. And invoking the Confidence Fairy is always the first resort of the oligarchy whenever a fraction of their plunder is threatened or whenever they smell the possibility for plundering even more.

I just spoke to a friend in Beijing today about the “crisis” he says: “No one here cares”.

Why is that racist?

Many people believe in their own governments’ omnipotence (and their own central bankers’), not just the Chinese.

And how does your friend in Beijing know ‘no one here cares?’

China is awesome!

Here are pics of the growth China.

https://www.google.com/search?q=china+smog&rlz=1T4GUEA_enUS646US646&tbm=isch&tbo=u&source=univ&sa=X&ved=0CCEQsARqFQoTCImTs8X8y8cCFcqagAod0BMAiw&biw=1431&bih=786

Please see the same pics for the stalled growth China.

Wow. Those pictures are impressive, and not in a good way. This is what India can look forward to.

I think India holds the record for raw sewage floating down major rivers, but they have room for improvement in industrial waste creation.

I don’t know David Cameron did go on vacation in Cornwall.

http://www.dailymail.co.uk/news/article-3214067/Sam-David-Cameron-dodging-raw-SEWAGE-went-surfing-annual-Cornish-holiday.html

How can anyone beat this record?

Wow, just like London in the 1950’s.

Antidote du jour:

Everyone likes owls. Despite being weird looking. I read yesterday their eyes are fixed in their heads which explains why they rotate their necks all the time…

Retrotopia piece by JMG was awesome! Usually he is a little (read a lot!) heavy on the weird and woo side but his utopian take on ‘lakeland’ hits the spot in these depressing days of worldwide decline and decay . Great read. Thanks for the catch.

The link to the Archdruid article is incorrect (it has a trailing “d”). It should be

http://thearchdruidreport.blogspot.com/2015/08/retrotopia-dawn-train-from-pittsburgh.html

Not ” … pittsburgh.htmld”

Yesterday, Yves linked to a great piece in Jacobin titled, “Our Forgotten Labor Revolution” which focused largely on the organizing efforts of the Knights of Labor in the aftermath of the “Civil” War. For anyone interested in the topic, a relatively new book by Dr. Jessica Gordon Nembhard goes in-depth into the history of “African-American Collective Economic Thought and Practice” (that’s the book’s subtitle).

Here’s an interview she did a while back that those who enjoyed the Jacobin article will find of interest:

Black Co-ops Were A Method of Economic Survival

There’s a link in the editor’s note to the PSU page where you can purchase the book, for reading or adding to your tsundoku collection.

Thanks for the link!

re: Ex Cop Who KIilled Six People Now Teaches….

The ex-cop, James Peters was hired by VirTra, a virtual reality law enforcement/Military training company A reporter experiences the simulator—it appears that for the cop “shoot first ask questions later” is the best choice:

—It was one of the most intense and draining experiences I’ve ever had as a reporter. I cannot describe it as fun; it was too hair-raising for that and made my heart pound and my hands shake. I was put through six scenarios and was “shot” in all but one because of my poor decisions or failure to take control of a situation before it escalated into violence.—-

http://www.dailyrecord.com/story/news/local/2015/05/24/daily-record-reporter-tries-police-simulator-gets-shot-lot/27786657/

“For the cop,” being the operative words… James Peters, the cop in question, was retired on “disability,” six months after shooting a man holding a baby in the back. Said he “thought” the cell phone in the man’s pocket was a gun. Someone had called and said they had been threatened with a gun. In my home town, people have been killed by police mistakenly after nosey neighbors called to report someone with a gun, which the dead person turned out not to have.

Those shooting scenarios simply prime the response of the shooter, they are rarely began or followed up with any carefully reasoned assessment of either the scenario or the responsibility of pointing a firearm at another.

Most of our police are very poorly trained individuals who should not be armed with deadly weapons. The English model, with only the supervising officers armed, not the regular patrol officers , seems to result in much less mayhem and unnecessary shooting.

Shooting is never the “best” choice. It is the last choice.

Violence is the first refuge of the incompetent.

From the Daily Record story:

“The instructor, from a computer, manipulates the sequence of the situation by escalating or de-escalating tensions based upon how well the trainee is handling a situation.”

So the trainee is acting out the opinions of the instructor. And it is opinion, with no provable mechanism for human interactions. An instructor who thinks deescalating a situation is showing weakness will push the gunfight button for anything other than barking orders and making threats. That’s widely considered keeping control of the situation.

Using virtual reality to reinforce the folklore of ‘keep ’em down’ policing. For the video game generation, a lot more effective than war stories around the break room.

`Glitch’ is the new `the dog ate my homework’:

BNY Mellon Glitch Disrupted Pricing on Nearly 5 Percent of US Funds

IIRC, they were continuing to have this problem at Wednesday’s market close.

Well, if I’d read the article I wouldn’t have made the comment. Sorry for the redundancy.

Does this give anyone other than my a chill triggered by the memory the BNP Paribas anoouncement on Aug 9 (?) 2007 that it was suspending withdrawals from 3 of its internal hedge funds due to their “inability to value” the securities in the funds.

AFAIA this was the first “public” (I saw it on the BBC web site’s ‘front page’) indication of the credit collapse at the beginning of the GFC. So-called liquidity vanishing faster than a pink unicorn at the first hint of trouble.

Tinfoil hat warning BUT ETFs = this generation’s CDO ? Where an ETF’s sponsor = corrupt credit rating agency’s AAA rating.

I agree. ETFs have been sold to the public as being equivalent to mutual funds, but day-tradeable. What percentage of retail customers understand how complicated ETFs are and how many moving parts have to work in order for there to be a market for them?

You got an extra “d” at the end of the Archdruid’s article address. Here’s the correct link:

http://thearchdruidreport.blogspot.com/2015/08/retrotopia-dawn-train-from-pittsburgh.html

Re: accounting for change

There are two factors working against each other when trying to report financial information, reliability and relevancy.

The historical cost of an asset is very reliable, but may not be relevant at all. Same with the current cost of a liability that will be paid 20 years in the future.

The accounting profession has moved more and more to reporting ‘relevant’ info as opposed to reliable.

There are many variables at play when trying to determine what that reliable number is to be, which is ‘a feature, not a bug’.

A joke in the accounting profession goes like this:

A kid asks his parent who is a cpa what 2+2 is. The accountant gets up , closes the door and says ‘well what do you want it to be’.

That being said, the one good thing about the profession is that we are personally responsible for everything we.sign.

The day macroecnomics changed: Commandments 7, 10, and 11 seem to particularly apply here.

“Meditation upon our limitations leads to inquiry into how markets work, and meta-reflection on our place in larger orders, something that neoliberals warn is beyond our ken.”

http://www.the-utopian.org/post/53360513384/the-thirteen-commandments-of-neoliberalism

Just a quick comment on “CEOs call for wage increases”. I’ve been having email exchanges with Peter Geogescu about his Op-ed in the NYT. I was surprised he answered my email directly and that he was interested in what I had to say. I made some very direct cogent points regarding his responses but those points were ignored in further dialog. I would say the bottom line for him is that he just sticks to what he knows, what has worked for him in the past and anything beyond that is not really open for consideration. And that, more than anything else is the problem from what I can see.

Kansas City Fed has posted the J-Hole schedule:

https://www.kansascityfed.org/publications/research/escp/symposiums/escp-2015

Tomorrow the big cheeses (governors of the BOE, ECB, Reserve Bank of India and Stanley Fischer of the US Fed) arrive for symposia on “Reinflation Challenges,” “Inflation Dynamics During and After the Zero Lower Bound” [hint: ungood!], and “Global Inflation Dynamics,” featuring the aforementioned éminences grises.

J-Yel herself is missing, laid up with an inflamed hangnail.

It ain’t Bonnaroo, but it ain’t bad.

What time do the Foo Fighters go on?

sssshhhhhhsh….foo’s are off the docket. the lords of helll will be hog tied for the viewing of: American Ruling Class, Nickel & Dimed

Nickeled and Dimed

Nickeled and Dimed

There’s No Free Lunch

or overtime

We Just Get

Nickeled and Dimed

They’re gonna pay me seven bucks an hour

to clean out everybody’s shower

Wipe the counter

Make the beds an’

(an’) Stack the shirts

And sell the bread

Or work the register

Pour Coffee

an’ take orders for delivery

do the floors (and)

And greet the guests (and)

And wear the nametag on my chest

Nickeled and Dimed

Oh Nickel and Dimed

There’s no free lunch or overtime

We just get nickeled and dimed

Now three shifts at $2.25 plus tips ‘ll be $150

And then two days at $80 makes $160

That’s $310 a week

I got $650 in rent

and then $110 in gas and utilities

Two for food and groceries leaves

$25 a week for me

Nickeled and Dimed

Oh Nickel and Dimed

There’s no free lunch and no free time

We just get nickel and dimed

Now it don’t always seem fair to me

But I’ll get through it if I try

I don’t call this prosperity ’cause

we’re just barely getting by

Until my daughter breaks a bone

or what if my old buick dies

or Verizon disconnects the phone

And they mess up my whole credit line

Nickel and Dimed

Oh, Nickeled and Dimed

There’s no free lunch or overtime

We just get nickel and dimed

Nickel and Dimed

Nickeled and Dimed

There’s no free lunch and no free time

There’s no ladder I’m gonna climb

I’d rather lead a life of crime

than just get nickel and dimed

Wealth Inequality

CEOs call for corporate tax breaks and implore workers/citizenry/consumers to “Give Trickle Down a chance!”

News at 10

Disney announces plans to make the movie, lays off 50% of workforce and requests an increase to the H1-B cap.

William Dudley says Fed can help with negative interest rates too.

The Peterson Foundation releases a study showing that if social security were both eliminated and privatized, the workers immediate cash flow would increase, and long term investment returns would be far greater, making everyone rich.

CEOs unanimously agreed to table any discussion of food stamps, Obama Care and fiscal deficits until after the 2016 elections.

Crude oil touched $45.04 today, as the Saudis step up their assault on Yemen.

It was bad, real bad, when Saddam Hussein drove crude up to $40.00 in 1990 with his invasion of Kuwait. Claudia Rosett, idiot stenographer of the WSJ, wrote that crude was headed for $60.00 and the US economy would collapse. All wrong.

But starting wars that drive up crude’s price is okay when our ‘friends’ do it. Now it helps the US economy, you see. Let’s roll!

Ha! I didn’t need to, but I just gassed up yesterday night. Tank was 1/2 full. Perfect timing!

Gas around here has been exactly $2.37 at every station in town – same as when oil was $60, however many months ago that was.

“If you have to say it…”

I’m not familiar with this one. Could someone please complete this (aphorism?) for me?

Yes, I’m a troglodyte.

Another way to say actions are louder than words.

If you have to say it, it probably isn’t true

Fed babble goes over the top

http://finance.yahoo.com/news/feds-kocherlakota-2015-rate-rise-130703848.html#

Kocherlakota calls for more QE!!!

He also is basically saying the Fed should be using the VIX as the measure for meeting the Fed’s “dual mandate”. Which of course implicitly validates that the dual mandate has anything to do with anything. Other than bubble blowing. But at least if you watch the VIX, you’ll know if the bubble is popping, I guess. So the Fed can control Peak Bubble this way.

This is abstraction that would make a C++ programmer proud!

If only I could get my servo systems to work that well.

These people are certifiable lunatics.

From the Yahoo article:

So we have our first transsexual District Reserve Bank president, working under Mr Yellen.

She should come out in style at J-Hole, in furs and high heels, as Queen VIXen.

Makes you wonder what’s up with Ms. George at the KC Fed, too.

Bruce Jenner is still the cutest one IMO. Tho Ms. George is a bit of an improvement over Boy George.

Vice Chair Stanley Fischer, live from J-Hole:

Probably this is a coded way of posing the perennial rhetorical question: ‘Women — what do they actually want?’ Fortune is a woman …

Fischer is a “hawk” which is something completely different again. A bird? Dunno what that means in a Fed context anymore either.

Funny how everyone knew huge leverage had everything to do with that spat of volatility we had back in 2008-2009.

If I were designing the Fed Servo System I would use leverage as the inner loop proportional gain term. Interest rates would be the derivative gain term for providing some inherent stability. Then if I could define what “inflation” is, what it is good for, and if my inflation sensors are working, I’d use that as a long term error correction integral gain term. Like if inflation was running above target, you carry forward that positive error before fretting about a low reading.

Then I would tell Congress not to believe in my Servo System one iota.

‘Fisch or cut bait,’ snarked a young staffer. I wish …

I’m gonna answer the quandary since you menfolk seem so perplexed and flummoxed- We want men not to act like idiots.

There now you can go back to the masses and share and start working on some other problems masters of the universe.

When women finally take over, they’ll behave like idiots too. It seems to come with the territory.

Comes with the power. I wouldn’t call Margaret Thatcher and Golda Meir idiots, but I would call them as power and war-hungry as any man.

those are the only kinds of people who want to “take over”,

I’ve noticed that.

It’s strange how some people think women aren’t as idiotic as men. That’s weird to me, why somebody would think like that.

That’s an amazing delusion that collides with any clear perception of reality. I think that’s the real issue, reality perception. Not many people have clear reality perception. Sometimes it’s hilarious. But sometimes it’s traumatic, what it leads to for both women and men in an undistinguished mass of suffering, pain and misery.

Why is it like that? That’s a deep thought. Either a man or a woman can answer it, but they have to see things clearly before they can..

Would “idiots” often translate to: “acting they way they want, rather than what we want”? IOW, acting like women instead of men?

I’m always reminded of the classic couples battle where the woman says to the man, “It doesn’t matter who’s wrong, just apologize.” If it doesn’t matter, why doesn’t the woman apologize?

Large crowds gather for AIPAC’s high-noon duel with Obama next month:

These are fraught moments for the Sheldon Adelson Republican Party(TM), which blindly supports a foreign leader in absolute lockstep.

CEOs have decided that the 99% deserve higher wages, but it shouldn’t come out of their pockets?

Over the last 40 years, the 1% have paid off our politicians to lower taxes on corporations and the rich to the point where government can’t afford up-keep on infrastructure or pay back the funds they’ve borrowed from Social Security.

This has left more and more of the tax burden to the 99% to pay for the cost of everything.

Now the 1% has finally figured out that the impoverished 99% have virtually no discretionary income with which to buy the products and services they offer, so they’ve come up with a nifty solution;

If the government will give the 1% more tax-breaks, they’ll give some of that money to their employees in the form of pay-hikes, they’ll then be able to spend more and all will be well again.

A clear demonstration of the sort of magical thinking that passes for genius among the oligarchs.

I’ll bet these same guys regularly invest in perpetual-motion schemes?

Just as the Fin world has “Goldman Envy” I think we have here an early sighting of “Walmart Envy (TM)” whereby every CEO starts whining “Why can’t I get my workers paid in Food Stamps ?”.

great owl pic, you’re right many people don’t look up..

“Big demo against President Najib, the guy with the mysterious $700 million in his personal bank account. Note that a Najib government would have had to sign TPP.”

Why do you keep repeating the false statement about $700 million? This article shows the actual flows of money.

http://www.sarawakreport.org/2015/08/pms-anonymous-donation-was-transferred-back-to-singapore-major-exclusive/

$620 million flowed in on 23 March followed by $61 million on 25 march, followed by $650 million back to the originator account 30 August. The net amount into the PoM account is thus only $31 million, not $700 million. The personal account was closed on 30 August. The intrepid investigators make no statement as to where the $31 million went. Did it go to another PoM acount or did it too go back to the opriginator?

http://i0.sarawakreport.org/0/e/9/8/a/0e98a145adaa3f66a54fc9dd6b2329d7cc48ecfb.jpg

The Bersih outfit is yet another US funded regime change group. Its leader is up to his nek with the NED. Look for color coordination and presence os the Otpor clenched fist symbol. The current Pom’s biggest crime is not being sufficiently obeisant to the US regime. The corruption thing is typical pablum for the masses. The US is now hosting Kolomoisky who seems to have acquired $1.8 billion via dubious means from Ukraine and that seems to present no problems for the USG.

http://landdestroyer.blogspot.co.uk/2015/03/malaysia-more-to-anwar-ibrahim-than.html

Malaysia is in the way for TPP and is strategically located with respect to trade routes to China.

You’re right. I should have said “$700 million that flowed into and out of his personal bank account, from whom and whence we do not know.” Sorry for the shorthand.

Evidence on the color revolution stuff from a credible source, please, not Cartalucci or whatever his real name is. As he and you should both know, colored shirts do not a color revolution make. And I am very well aware that in Southeast Asia — much as here — there is a notable dearth of “good guys” with clean hands.

You write:”Malaysia is in the way for TPP and is strategically located with respect to trade routes to China.” Yes, NC readers are very well aware of that, since we’ve been pointing it out for months. Thanks for your support.

“Evidence on the color revolution stuff from a credible source, please, not Cartalucci or whatever his real name is.”

A Malaysian soure for NED funding of Bersih (probably included in an earlier post on the same subject but inluded again for your convenience).

http://mymassa.blogspot.co.uk/2015/08/bersih-under-change-by-ned.html

“As he and you should both know, colored shirts do not a color revolution make.”

Not on their own, but they are part of a US play list: NED funding (check), colored logo (check), Otpor symbol (check), Soros involvement (check), etc, etc.

Just to make it clear: I do not condone corruption by anyone. I do oppose misleading statements, people being ‘economical with the actualite’. I do oppose selective use of corruption as a weapon by the US against non-compliant leaders.

Najib may be corrupt or he may not. What happened to the £31 million? Did it stay with him or did it go back to the originator of the $650 million? Is it possible that the whole thing was a sting? If I was in his position and I was looking for a bribe, the last thing I would do is ask for the money to be sent to an account in my name in my own country. I would have it pass through multiple Carribean accounts to an anonymous account in a suitably financially secure location. If Najib is indeed corrupt, he needs to get better advisors (/sarcasm in case it is not obvious).

Yves and NC readers,

Spotted a good Dave Dayen piece…

http://finance.yahoo.com/news/government-rolling-over-big-banks-100000774.html

http://www.silentvector.org/2015/08/electronic-education-part-i-elegance-of.html

HSBC to process 275,000 delayed payments overnight

System failure leaves many workers without their salaries ahead of bank holiday weekend, but bank promises to refund any costs incurred

http://tinyurl.com/qjl5ujp

Admittedly, Silicon Valley law-breaking and general disdain for the law and government have moved far beyond Napster at this point, but this approving quote from the BBC article “Life lessons from villains,..” still makes me want to throw up:

“And, some entrepreneurs aren’t even afraid to operate in legal grey areas in their effort to disrupt the marketplace. The co-founders of music streaming service Napster, for example, knowingly broke music copyright rules with their first online file sharing service, but their technology paved the way for legal innovation as regulators caught up.”

Operating in “legal grey areas”? No, there was law – copyright and other – and Napster broke it. Napster technology paved the way for “legal innovation as regulators caught up”? No, many persons colluded with Napster in downloading stolen music, and almost all got away with it and still are getting away with it, although Napster per se eventually collapsed under the weight of many lawsuits.

I know my family, which includes a singer-songwriter and has been partially dependent on album and CD sales, is poorer for the successful thefts. “Innovation” and “disruption” sometimes equal theft, and successful theft should not be held up as a “life lesson.”

You’re willfully ignoring 15 years in research, development and cost pressure in audio hardware and software; the ability for artists to turn their music into 5-10MB files and access listeners without the permission of the major labels; the ubiquity of access to music; and the ability for nearly anyone with an Internet connection and a music store nearby to produce as much music as they might like regardless of commercial viability. Why?

I was more than happy to pay $60 for a DAW license recently because the authors weren’t bean-counting jerks, and $50 for a development environment that makes me so much more productive in my day job. I downloaded a ripped copy of our host’s ECONNED and put the money in her tip jar because f[amily blog] Amazon. They Might Be Giants is doing quite well giving away tons of their music every week and several smaller musicians that actually engage with their fans are not hurting for money.

I kinda want to steal a copy of your family member’s discography just because of your self-important, almost factless screed — and I hate folk music!

There is definitely a life lesson to be found in that; in fact, two: your reputation and your attitude affect your bargaining power; and never work on spec.

The most tragic thing about napster was it’s proliferation of low fidelity over-compressed file formats (mp3) which are the real threat in the recording industry. http://spectrum.ieee.org/computing/software/the-future-of-music/0

Most young people really have no clue what high fidelity even means let alone what passes for music. Sound quality and talent in many cases are inversely proportional to the technology brought to bear in the industry.

Lou Reed is correct, “it’s like the technology is taking us backwards. It’s making it easier to make things worse.” I proposed a theory, or lets call it a corollary to Moores law ~15 years ago as Rap music was coming on the scene w/ inexpensive digital CD proliferation. Quality/Fidelity (of Media in this case, could be spelling or punctuation w/ the advent of spell/grammar check etc.. pick your poison..) is an inverse log proportionality to the technology available to create/disseminate it.

So the dynamics w/ MP3 music file proliferation I think is a horse race between the cost of storage media going approaching zero (assume near zero the only advantage of an MP3 is irrelevant) and “the publics” progressive ignorance of the implication/inherent merit of full format “audio fidelity”. Perhaps an unintended consequence of the proliferation of MP3 that may influence this Function is that the population who chronically download and listen to them will all go deaf and the rest of us can then erase/destroy all the MP3 music files as a remedial mop-up operation.

https://www.youtube.com/watch?v=lAz1aObRkjM

Deep Listening: Why Audio Quality Matters