By Òscar Jordà, Research Advisor, Federal Reserve Bank of San Francisco, Moritz Schularick, Professor of Economics, University of Bonn, and Alan Taylor, Professor of Economics and Finance, University of California, Davis. Originally published at VoxEU.

The risk that asset price bubbles pose for financial stability is still not clear. Drawing on 140 years of data, this column argues that leverage is the critical determinant of crisis damage. When fuelled by credit booms, asset price bubbles are associated with high financial crisis risk; upon collapse, they coincide with weaker growth and slower recoveries. Highly leveraged housing bubbles are the worst case of all.

Policy Response to Asset Price Bubbles

Before the Global Crisis, the consensus among policymakers and economists alike was to largely ignore asset price bubbles. Justifications for this neglect differed. Some argued that asset price bubbles couldn’t be reliably detected. Others argued that nothing could or should be done about them since any intervention might be worse than the fallout from the bursting of the bubble. An implicit assumption was that central banks could, in any case, clean up the mess. The aftermath of the dotcom bubble lent support for this optimistic view of a central bank’s capabilities. Some even went so far as to decry the notion that asset bubbles exist.

After the Global Crisis, it has become harder for macroeconomists to treat asset price bubbles as rare exceptions that can be excluded from macroeconomic thinking on axiomatic grounds. In policy circles, Alan Greenspan, former Chairman of the Federal Reserve, very publicly stepped away from old beliefs; he admitted the ‘flaw’ in his worldview, and began to entertain the possibility that central banks might need to pay attention to bubbles.1 Yet, we still know little about the appropriate policy response to developing asset price bubbles. While a consensus is developing that ‘leaning against the wind’ with interest rates is not always a good idea, it remains to be seen if the high hopes that are pinned on macroprudential policy will turn out to be justified (Galí 2014, Svensson 2014).

Credit, Asset Prices, and Economic Outcomes: New Evidence

To quantify these trade-offs, more empirical work is clearly needed. What risk do asset price bubbles pose to macroeconomic and financial stability? What does the evidence show? In our new research (Jordà et al. 2015), we study the nexus between credit, asset prices, and economic outcomes in advanced economies since 1870.

We rely on a combination and extension of two new long-run macro-finance datasets. In Jordà et al. (2014) we presented the latest version of our long-run credit and macroeconomic dataset in the form of an annual panel of 17 countries since 1870. To study asset price booms we have added equity price data. The second dataset from the study by Knoll et al. (2014) covers house prices since 1870 on an annual basis for the panel of 17 countries and extends coverage by about 50% compared hitherto available data.

Our main findings support the post-crisis consensus that leveraged bubbles must be taken seriously. Mishkin (2008, 2009) and other policymakers have argued that there are two categories of bubbles: unleveraged ‘irrational exuberance’ bubbles and ‘credit boom bubbles’. In the latter, a positive feedback develops that involves credit growth, asset prices, and increasing leverage. When asset markets switch into reverse gear, the balance sheet overhang creates a painful economic hangover.

- Our study shows that leverage-fuelled asset price bubbles substantially raise the risk of a financial crisis and make recessions considerably more painful.

- Unleveraged bubbles tend to blow over.

Yet, when credit boom bubbles go bust the macroeconomic consequences are severe.

- Credit-fed housing bubbles are the most harmful combination of all.

Living in an age of leverage is not without its costs.

Empirical Identification of Asset Price Bubbles

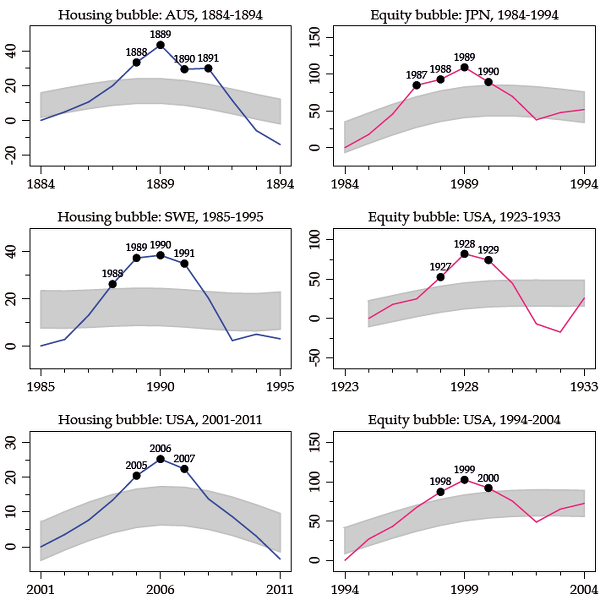

The term ‘bubble’ traditionally refers to a situation in which asset prices increasingly deviate away from their fundamental value. Bubbles often end with a crash in asset prices. Determining the fundamental value is not easy since it is not directly observable. Moreover, there is no universally accepted standard definition of bubble phenomena. Studies such as Borio and Lowe (2002), Bordo and Jeanne (2002), Detken and Smets (2004), and Goodhart and Hofmann (2008) have all used either large deviations of price levels from some reference level and/or large rates (or amplitudes) of increase/decrease as indicative of the rise and fall of bubble episodes. We apply a two-pronged approach. We require a spell of sizeable asset price run-up (defined as a price deviation from log HP trend by 1 standard deviation or more) and a collapse in prices of 15% or more during the spell. Figure 1 displays examples of bubbles identified with this procedure.

Figure 1. Examples of bubble identification

Notes: The figures show, for each 10-year window, the log real asset price (rebased to the start year), a band of ±1 standard deviation (for that country’s detrended log real asset price), and the years for which the Bubble Signal is turned on using our algorithm.

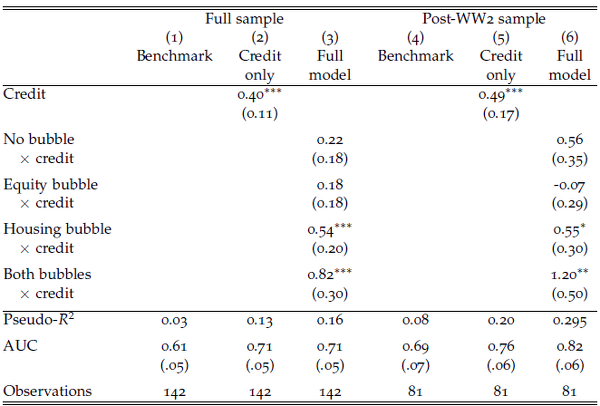

Bubbles, Credit Booms, and Financial crises

It is well known that rapid expansions of credit – credit booms – are associated with a higher likelihood of financial crisis (e.g., Schularick and Taylor 2012, Jordà et al. 2013, Drehmann and Juselius 2014). Here, we investigate how the interaction of asset price bubbles and credit booms affects financial stability. As the logit crisis prediction models in Table 1 show, our new research clarifies the results from our previous research. The association of credit and asset price booms is particularly dangerous relative to expansions of credit alone. Housing bubbles more so than equity bubbles.

Table 1. Predicting financial crisis recessions

Notes: Standard errors in parentheses. * p < 0.10, ** p < 0.05, *** p < 0.01. The dependent variable based on peaks of business cycles identified using Bry and Boschan (1971) algorithm. The dependent variable is one if the recession is associated with a financial crisis within a 2-year window of the peak, 0 otherwise. Bubble episodes are associated with recessions by considering the expansion over which the bubble takes place and using the subsequent peak. See text.

The Economic Costs of Bubbles

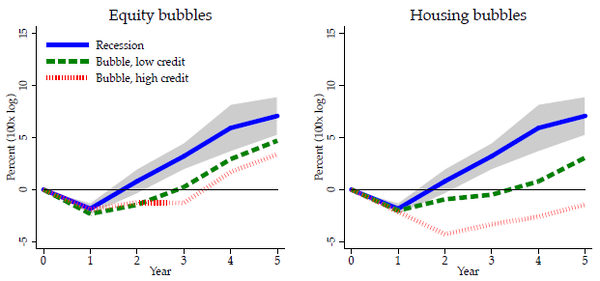

The core theme of our new paper is about the connection between asset price bubbles, credit, and the consequences for the real economy. Can asset price bubbles be safely ignored? Does credit make any difference to how we think about the aftermath of bubbles? Are equity bubbles as dangerous as housing price bubbles? Using historical data, we characterise the typical paths of economies through the business cycle when an asset price bubble is involved and where we stratify by the expansion of credit. We apply local-projection methods (Jordà 2005) to calculate the dynamic responses of economies to leveraged and unleveraged bubbles in equity and housing markets.

The key results are presented in Figure 2 for the full sample (N=140 recessions). The left-hand panel shows the average path of real GDP per capita of economies through recessions and recoveries. In normal recessions, the economy shrinks in year 1 and recovers the previous peak level of output in year 2. The other lines show the average path when there is an equity bubble and below/above average credit growth, and the right-hand panel shows a similar chart using the housing bubble indicator instead. Each panel displays the baseline normal recession path with a 90% confidence region.

The basic lessons are as follows:

- Equity bubbles are damaging.

They are associated with a slightly worse recession and a slower recovery in the full sample. However, we do find that after WWII the damage from equity bubbles does diminish. And even if equity bubbles have a relatively small effect overall, they are clearly associated with more damage when accompanied by above average growth in credit, regardless of the sample studied.

- The right-hand panel shows that bubbles in housing prices are associated with noticeably worse recession and recovery paths.

Moreover, these effects grow much stronger when credit expands above the historical mean during the preceding expansion. On average, after a credit-fuelled house price bubble, advanced economies have taken more than five years to return to their previous peak level of output.

Figure 2. Economic costs of bubbles (full sample with controls)

Conclusions: Bubble Trouble

In this column, we turned to economic history for the first comprehensive assessment of the economic risks of asset price bubbles. We provide evidence about which types of bubbles matter and how their economic costs differ. Our historical analysis shows that not all bubbles are created equal. When credit growth fuels asset price bubbles, the dangers for the financial sector and the real economy are much more substantial. The damage done to the economy by the bursting of credit boom bubbles is significant and long lasting.

In the past decades, central banks typically have taken a hands-off approach to asset price bubbles and credit booms. This way of thinking has been criticised by some institutions, such as the BIS, that took a less rosy view of the self-equilibrating tendencies of financial markets and warned of the potentially grave consequences of leveraged asset price bubbles. The findings presented here can inform ongoing efforts to devise better macro-financial theory and real-world applications at a time when policymakers are still searching for new approaches in the aftermath of the Great Recession.

References

Bordo, M D, and O Jeanne (2002), “Monetary Policy And Asset Prices: Does ‘Benign Neglect’ Make Sense?”, International Finance 5(2): 139–164.

Borio, C, and P Lowe (2002), “Asset prices, financial and monetary stability: exploring the nexus”, BIS Working Paper 114.

Detken, C, and F Smets (2004), “Asset price booms and monetary policy”, in Siebert, H (ed.), Macroeconomic Policies in the World Economy, Berlin: Springer, pp. 189–227.

Drehmann, M, and M Juselius (2014), “Evaluating early warning indicators of banking crises: Satisfying policy requirements”, International Journal of Forecasting 30(3): 759–80.

Galì, J (2014), “Monetary Policy and Rational Asset Price Bubbles”, The American Economic Review 104(3): 721–52.

Goodhart, C, and B Hofmann (2008), “House prices, money, credit, and the macroeconomy”, Oxford Review of Economic Policy 24(1): 180–205.

Jordà, Ò (2005), “Estimation and Inference of Impulse Responses by Local Projections”, The American Economic Review 95(1): 161–82.

Jordà, Ò, M Schularick, and A M Taylor (2013), “When Credit Bites Back”, Journal of Money, Credit and Banking 45(s2): 3–28.

Jordà, Ò, M Schularick, and A M Taylor (2014), “The Great Mortgaging: Housing Finance, Crises, and Business Cycles”, NBER Working Papers 20501.

Jordà, Ò, M Schularick, and A M Taylor (2015), “Leveraged Bubbles”, NBER Working Papers 21486.

Knoll, K, M Schularick, and T Steger (2014), “No Price Like Home: Global House Prices, 1870–2012”, CEPR Working Paper 10166.

Mishkin, F S (2008), “How Should We Respond to Asset Price Bubbles?”, Financial Stability Review, Banque de France, vol. 12 (October), pp. 65–74.

Mishkin, F S (2009), “Not all bubbles present a risk to the economy”, Financial Times, November 9, 2009.

Schularick, M, and A M Taylor (2012), “Credit Booms Gone Bust: Monetary Policy, Leverage Cycles, and Financial Crises, 1870–2008”, The American Economic Review 102(2): 1029–61.

Svensson, L E O (2014), “Inflation Targeting and “Leaning against the Wind”, International Journal of Central Banking 10(2): 103–14.

Footnote

1 See, for example, “An interview with Alan Greenspan,” FT Magazine, 25 October, 2013.

Great idea to keep money creation largely in the hands of deregulated private banks. Given a large share of credit is generated for people who are speculating on prices of a range of asset classes it beggars belief that there is not a serious debate amongst senior economists over alternatives.

‘sizeable asset price run-up (defined as a price deviation from log HP trend by 1 standard deviation or more)’

The undefined acronym ‘HP’ likely refers to a Hodrick-Prescott filter, which separates a time series into a trend component and a cyclical component. It is equivalent to a cubic spline smoother.

Consult craazyman for further details.

…and there are folks who read here, who understand how to take personal advantage, in this environment of what is so simplistically denominated as “volatility,” as if there was some mean to which “things” would tend to recur toward, understand how to take full, smug, condescinding advantage of the docility, stupidity, cupidity, duplicity and idiocy of us ordinary mopes who aren’t wired to even see or feel when we’ve been robbed, mugged, looted and scoffed at. Or be other than meat for the lordlings’ table…

What, might one ask, on behalf of that syntactical twitch “we” presume, conversationally and conventionally, to call “us,” [presumptively All Decent Humanity ™ (sic)?,] what outcomes do “we” actually want, going by what is and what actually happens, and by where “we” appear to be headed, what outcomes do we REALLY, in our genome and our souls, want from “our” political economy? And how do “we” propose to bring them about? A species death wish, however inchoate, is surely up there on the list, going by observation… A convenient, cynical, “moral” justification, also, for the killing and looting and damaging beyond recovery, it might seem: “If we’re killing the planet and us too, why, I’d be a fool not to grab for all the gusto I can get, including yours!”

Greed is still, if not “good,” then very fashionable, and well rewarded, in the only coin “our” f###ed-up limbic systems apparently recognize as legal tender…

those are deep thoughts, but nobody’s perfect!

strange to think how these psychic forces, that manifest through money and bubbles, even way before central banks, before the Fed, back to the S. Sea Bubble, bacck to Tulips, back to Rome itself — where are they and how do they manifest in non-financialized cultures?

The contemporary financialized western world is not the only way mankind has lived and organized itself, it’s not the only place to look for causation and structural analysis, but it’s the only reality economic and monetary analysis seems to contemplate.

Why don’t they see what they’re missing? I think in part it’s because they can’t think for themselves. The only recite what they’ve been told to think. Pretty much.

I mean, if they want to get a pizza and a bottle of red wine, they can think about toppings and whether to get a bottle that costs 8 dollars or 18 dollars. But they can’t think about reality. Not many people can. When you can, yourself, you just think “faaaak what a world”. and you get the 5 dollar Spanish wine and you drink it and you stare at the sky and you think, “Well, there it is.”

Agree with the author, but the subject has already been covered well by Steve Keen, who’s articles have been noticeably absent at NC lately.

I wouldn’t say it was a consensus, since there were a few voices crying in the wilderness, but it is certainly true that everyone who was being listened to had quaffed long and hard at the keg of Neoliberal Kool-Aid.

When institutional investors and wealth managers are throwing money at products that don’t even have the most questionable, thumbnail pro forma showing how any ROI is possible; when single-store boutiques are being talked into issuing publicly traded stock; when investment “Tupperware parties” create inside flipping arrangements and introduce the appraisers who will provide the figures for each sale; when the scam runners are advertising for straw buyers on billboards and radio I think you just may have detected a bubble.

Can’t have the latter without the former. The only purpose of an irrational exuberance bubble is to fuel a credit boom bubble. The Financial Fuehrers want the latter because there are endless layers to make fees from and to hide fraud in. It also makes it harder to see when things are starting to go bad, which gives the players time to walk away from the table and leave the marks holding. So they pump the assets (“assets” being defined, in true Humpty Dumpty fashion, as whatever the owners and derivative factories say they are) and then start leveraging. Consequently, if you see an irrational exuberance bubble, it is probably neither “irrational” nor “exuberant”, at least not in the eyes of the banks running the pump.

Because this is the feedback loop. The asset bubble creates the credit bubble which expands the asset bubble which expands the credit bubble. Until everything pops.

First, the system is now addicted to bubbles, so when one pops, it immediately starts looking for its next fix. Second, with the feedback loop generated by layers of derivatives resembling matryoshka dolls, we’re redlining the system. As I told a friend of mine at the New York Fed over a quarter-century ago when derivatives were starting to take off, “We’ve always recovered from crashes by using the slack that was still in the system before the crash. Now we’re squeezing the slack out. Where does that leave us?” The car in your driveway isn’t very efficient, but it can be economically operated and maintained and will last for years. A Formula One machine is extremely efficient, and after one race, it’s scrap.

Now convince the rest of the economic profession that CB’s are hopeless at trying to stop this and the only way to stop shadow banking creating leverage is to, well, have effective laws and regulations, and prosecute those breaking them… and we may be getting somewhere. Control the market-makers and the liability side of the balance sheet, raising interest rates is just a positive feedback-loop.

Because this paper just states what has been obvious for centuries, but is so convenient to ‘hide’ because the huge wealth extraction mechanism it is (but on the upside, and the downside). And here we are, but hey, we got “free markets” (or not…).

“Now convince the rest of the economics profession that CB’s are hopeless at trying to stop this …”

That’s a tall order when so many practitioners depend on CB’s for their livelihood. Those who work for or consult to CB’s have a pecuniary interest in remaining unconvinced, and macroeconomists don’t seem to be good for much else.

“… have effective laws and regulations, and prosecute those breaking them …”

Some reform of the legal system itself is also in order. The legal system as it operates today is overburdened and also shows signs of breaking down.

This is a political issue. Formation and feeding of recurring massive asset price bubbles has been intentional (albeit unofficial) public policy. Questions regarding both the desirability of this policy and the efficacy of various bubble resolution policies, given that modern asset price bubbles have been fueled with massive amounts of debt, remain largely unasked and unanswered by those who have dominated the public conversation. Creditors’ rights have been dramatically expanded, but some direct and indirect pushback is emerging.

Seems like, planned or not, something like a Jubilee is on the horizon and coming sort of quick.

On the other hand, need to think about how I can do a big short on a total economic collapse. Maybe Paulson has some hints… There’s got to be some way to screw over the rest of the political economy and laugh all the way to the bank… Oh, wait…