This is Naked Capitalism fundraising week. 1180 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year, and our fifth target, more original reporting.

Yves here. This is an important short paper, in that it provides evidence that contradicts the story our elites would like to tell about inequality: that’s it’s because our modern economy requires more skills, so those at the top can command, and indeed deserve more, and the rest are increasingly servant classes. In other words, the great unwashed public is to believe that the outcomes are meritocratic. Never mind the ample evidence to the contrary, for instance, that the most lavishly paid CEOs are the worst performing.

This article looks at an institutional factor, namely union power, and finds it plays an important role in explaining the rise in inequality in advanced economies. The authors are surprised to find that union weakness is correlated with better pay among top 10% earners. You’ll see they describe why the relationship could be causal. I’d argue that that both outcomes are an effect of the rise in neoliberal ideology, which in particular depicted CEOs as needing to have share-preformance-linked pay, which actually served as a justification for every-widening pay gaps between CEO compensation and that of ordinary workers. On top of that, the rise of pay for the CEO increased C-level pay, and also legitimated higher pay, meaning higher fees, among the professionals that sell services to big corporations.

By Florence Jaumotte, Senior Economist in the Research Department, IMF and Carolina Osorio Buitro, Economist in the Research Department, IMF. Originally published at VoxEU

nequality in advanced economies has risen considerably since the 1980s, largely driven by the increase of top earners’ income shares. This column revisits the drivers of inequality, emphasising the role played by changes in labour market institutions. It argues that the decline in union density has been strongly associated with the rise of top income inequality and discusses the multiple channels through which unionisation matters for income distribution.

Revisiting the Drivers of inequality: The Role of Labour Market Institutions

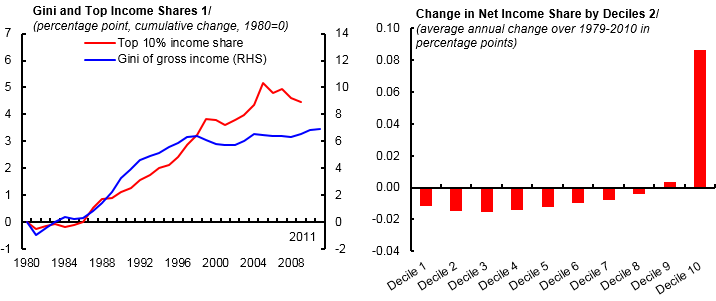

Rising inequality in advanced economies, in particular at the top of the distribution, has become a great focus of attention for economists and policymakers. In most advanced economies, the share of income accruing to the top 10% earners has increased at the expense of all other income groups (Figure 1). While some inequality can increase efficiency by strengthening incentives to work and invest, recent research suggests that high inequality is associated with lower and less sustainable growth in the medium run (Berg and Ostry 2011, Dabla-Norris et al. 2015). Moreover, a rising concentration of income at the top of the distribution can also reduce welfare by allowing top earners to manipulate the economic and political system in their favour (Stiglitz 2012).

Traditional explanations for the rise of inequality in advanced economies have been skill-biased technological change and globalisation, which increase the relative demand for skilled workers. However, these forces foster economic growth, and there is little policymakers are able or willing to do to reverse these trends. Moreover, while high income countries have been similarly affected by technological change and globalisation, inequality in these economies has risen at different speeds and magnitudes.

Figure 1. Evolution of inequality measures in advanced economies

Sources: World Top Incomes Database; SWIID (v.4.0); and Luxembourg Income Study/New York Times Income Distribution Database.

1/ Advanced Economies = USA, GBR, AUT, BEL, DNK, FRA, DEU, ITA, NLD, NOR, SWE, CHE, CAN, JPN, FIN, IRL, PRT, ESP, AUS, and NZL. For the top 10 income share, FIN, GBR, and PRT are excluded due to missing data over part of the 1980-2010 period. Simple average.

2/ Shares of disposable income by decile using Luxembourg Income Study data. Varying years for countries, including AUS, AUT, BEL, CAN, DNK, FIN, FRA, DEU, IRL, ITA, NLD, NOR, ESP, SWE, CHE, GBR, and USA.

As a consequence, the more recent literature focuses on the relation between institutional changes and the rise of inequality, with financial deregulation and the decline in top marginal personal income tax rates often cited as important contributors. Surprisingly, the role played by changes in labour market institutions – such as the widespread decline in the share of workers affiliated with trade unions, so-called ‘union density’ – has not featured prominently in recent inequality debates. Nevertheless, these changes could potentially have profound implications on income distribution.

In a recent paper (Jaumotte and Osorio Buitron 2015), we fill this gap in the literature and examine the relationship between labour market institutions and various income inequality measures (namely, the top 10% income share, the Gini of gross income, and the Gini of net income), focusing on the experience of 20 advanced economies over the 1980-2010 period.1 While we pay particular attention to labour market institutions, our empirical approach controls for other determinants of inequality identified in the literature, such as technology, globalisation, financial liberalisation, top marginal personal income tax rates, and common global trends.

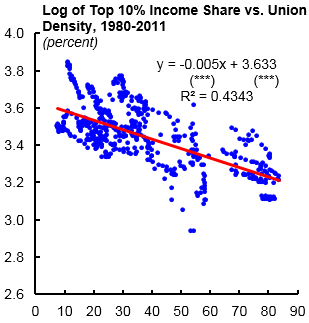

A Surprising Finding: A Strong Negative Link Between Union Density and Top Earners’ Income Shares

The most novel aspect of our paper is the discovery of a strong negative relationship between unionisation and top earners’ income shares (Figure 2).2 Although causality is always difficult to establish, the influence of union density on top income shares appears to be largely causal, as evidenced by our instrumental variable estimates. The set of instruments used for union density captures the fact that, although unionisation tends to decline in periods of high unemployment, the effect is weaker in countries where unemployment benefits are managed by unions (i.e. the Ghent system) or where collective bargaining is more centralised. In addition, the result survives the inclusion of possible omitted variables that could both reduce unionisation and increase inequality. These additional controls include changes in elected government and in social norms on inequality, sectoral employment shifts such as the decline of industry and rise of services sectors, the strong expansion of employment in finance, and rising education levels.

Figure 2. Top 10% income share and union density in advanced economies

Sources: OECD; and World Top Incomes Database.

Note: *** denote significance at the 1 percent level, ** at the 5 percent level, and * at the 10 percent level. Advanced Economies = USA, AUT, CAN, DNK, FIN, FRA, DEU, IRL, ITA, JPN, NLD, NZL, NOR, PRT, ESP, SWE, CHE, and GBR.

The magnitude of the effect is also significant; the decline in union density explains about 40% of the average increase in the top 10% of income share in our sample countries. One important caveat, though, is that the effect could be partly offset when collective bargaining coverage largely exceeds unionisation (e.g. through extension agreements), likely reflecting higher unemployment. While this second finding is somewhat less robust and needs further corroboration, it does suggest that representativeness of unions may be an important element for the latter to reduce inequality.

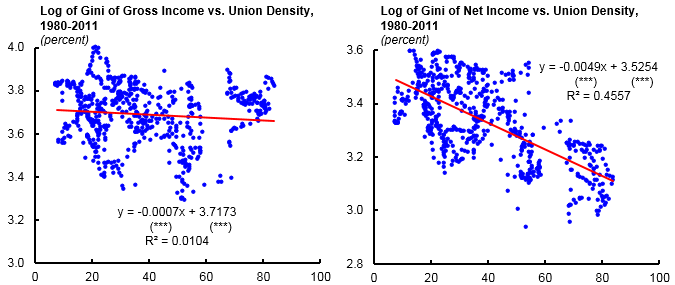

Another main result of our analysis is that the decline in union density has been strongly associated with less income redistribution, likely through unions’ reduced influence on public policy (Figure 3). Historically, unions have played an important role in the introduction of fundamental social and labour rights. Again, this relationship appears largely causal. With regard to other labour market institutions, we find that reductions in the minimum wage relative to the median wage are related to significant increases in overall inequality. But we do not find compelling evidence concerning the effects of unemployment benefits and employment protection laws on income inequality.

Figure 3. Redistribution effect of unions in advanced economies

Sources: OECD; and SWIID (v.4.0).

Note: *** denote significance at the 1 percent level, ** at the 5 percent level, and * at the 10 percent level. Advanced Economies = USA, FRA, DEU, ITA, NLD, NOR, SWE, CHE, CAN, JPN, IRL, PRT, ESP, AUS, AUT, BEL, DNK, FIN, NZL,and GBR.

Channels: A Balance of Power Story

Our finding of a strong negative relationship between union density and top earners’ income share challenges preconceptions about the channels through which union density affects the distribution of incomes. Indeed, the widely held view is that changes in labour market institutions affect low- and middle-wage workers but are unlikely to have a direct impact on top income earners. Our finding highlights the interconnectedness between what happens to the middle class and top income shares. If de-unionisation weakens earnings of middle- and low-income workers, the income share of corporate managers and shareholders necessarily increases.

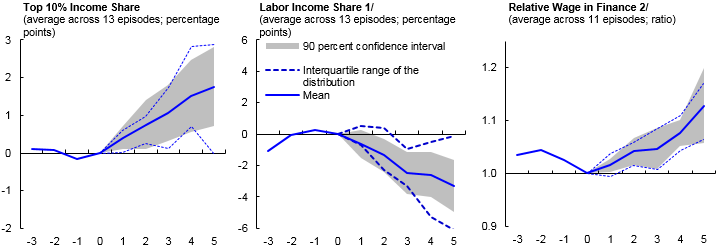

There are several channels through which weaker unions could lead to higher top income shares. In the workplace, the weakening of unions reduces the bargaining power of average wage earners relative to capital owners and top executives. Channels include the positive effect of weaker unions on the share of capital income – which tends to be more concentrated than labour income – and the fact that lower union density may reduce workers’ influence on corporate decisions, including those related to top executive compensation (Figure 4). Outside the workplace, there could be a political economy channel by which a weakening of unions reduces workers’ political voice and strengthens other already dominant groups, enabling them to better control the economic and political system in their favour (Acemoglu and Robinson 2013).

Figure 4. Episodes of strong declines in union density: Effects on inequality

Sources: World Top Incomes Database; EU Klems; OECD; and author’s calculations.

1/ Labor income share is share of labor compensation in value added, adjusted for the labor income of the self-employed.

2/ Relative wage in finance is the ratio of labor compensation per hour worked in finance to the labor compensation per hour worked in the rest of the economy.

Conclusion

If our findings are interpreted as causal, higher unionisation and minimum wages can help reduce inequality. However, this is not necessarily a blanket recommendation for higher unionisation and minimum wages. Other dimensions are clearly relevant. The experience with unions has been positive in some countries, but less so in others. For instance, if unions primarily represent the interests of only some workers, they can lead to high structural unemployment for some other groups (e.g. the young). Similarly, in some instances, minimum wages can be too high and lead to high unemployment among unskilled workers and competitiveness losses. Deciding whether or not to reform labour market institutions has to be done on a country-by-country basis, taking into account how well the institutions are functioning and possible trade-offs with other policy objectives (competitiveness, growth, and employment). Finally, addressing rising inequality will likely require a multi-pronged approach including tax reform and policies to curb excesses associated with the deregulation of the financial sector.

Authors’ note: The views expressed herein are those of the authors and should not be attributed to the IMF, its Executive Board, or its management.

Please see original post for references

“The views expressed herein are those of the authors and should not be attributed to the IMF, its Executive Board, or its management.”

::

“Threatened by climate change, Florida reportedly bans term ‘climate change'”

Interesting as usual, but there is another way to look at this.

Unions do not make labor more valuable. Unions are like agents for top athletes, they are necessary but they can’t get high salaries for athletes whose skills are not in demand. Similarly when the labor market is tight, even average workers can command high salaries, and of course this tends to flatten the income curves. If you own a business and it is essential that you have both a computer programmer and a truck driver, and both classes of labor are in very short supply, then both classes of labor will have a lot of negotiating power and the pay differential will be narrowed (though not eliminated) and profits will also be squeezed.

However, a single business negotiating against 1000 independent agents has an imbalance of negotiating power, and a union simply makes sure that individual workers are not played off against each other and that workers get what they are truly worth.

However, in a flooded labor market, where there are 1000 desperate people competing for each job, wages will be low, and unions simply cannot fight the law of supply and demand (a guild can, but that’s another kind of thing entirely). In this case unions only add costs to the workers but increasingly cannot negotiate better wages and benefits, so they naturally fade away. I believe that Samuel Gompers understood this.

In other words, supply and demand. However, since about 1970 the invocation of supply and demand as regards the labor market has been increasingly banned from polite discussion – because of course the rich want to manipulate this most important factor in wages and profits without interference – so we are left casting around for increasingly baroque explanations of low wages and high profits when the answer is obvious…

There is one direct link that the paper doesn’t seem to point out: many CEO’s and top managers have bonuses explicitly linked to cost/profit outcomes, so top managers able to achieve labor cost savings (much easier to do by evading or avoiding unions) will reap some of that savings personally.

It was my impression that the links between non- and deunionization and income inequality had already been fairly well established. More fundamentally, the less power a person, group, class, or category has, the less they will get in a liberal-capitalist economy.

What is mysterious is that most of those who would most benefit from strong unionization are so unenthusiastic about them.

Labor has few means to fight back. Strikes are too often illegal for workers. Labor is too often vilified – Jimmy Carter and Ronald Reagan both fired striking federal workers. It’s short sighted.

The owner, the employees, and the buying public are all one and the same, and unless an industry can so manage itself as to keep wages high and prices low it destroys itself, for otherwise it limits the number of its customers. One’s own employees ought to be one’s own best customers. Henry Ford

One’s own employees ought to be one’s own best customers.

True if the company makes products. Not true if large financial instrument are bought and sold, or enhanced with derivatives and then all instruments traded.

There is a feedback loop at work here. Not one I personally admire. The solution is to remove Government, Public or Fiat Money, as the backing for the financial industry. However, expecting such a radical change is policy requires flying pigs, or some extreme catastrophic event.

I predict an extreme catastrophic event. What, when and it’s magnitude, and our state after the event are all not predictable.

sorry but the only places unions seem to be interested in is govt employees or govt cronies.

the union employees that i have had the experience of dealing with are mostly rude and bullies.

there’s nothing wrong with the idea in abstract, but in america any power is quickly converted into rent extraction. As unions are in the same game they have lost sympathy. unions want to ding everyone else except themselves, (eg MTA unions), obviously people see through the game.

The bigger problem i see is what the youth is going to do. My kid out of high school – super bright – got into college but could not get a single summer job. nada. only friends and family could help out with some odd jobs. not even McD. only people interested were the network marketing frauds who wanted him to monetize friends and family by selling some overpriced junk to them.

For people starting out i see a very very bad situation out there. And dont even start about college debt, with professors making 350k. The amount of greed and deception out there is getting sad.

Um….you do realize that union members make up a very small percentage today of the workforce? Only 11.1% of workers today are Union. Median wage is $970 week.

http://www.bls.gov/news.release/union2.nr0.htm

I am really tired of the denigration of workers and the idea that they don’t deserve good wages in the United States today.

all u’m saying is that the “model” does not work anymore. The unions just play for themselves like other players. which is why they are concetrated in the public and crony sector which can transfer its bills to your tax account. all these are predators and they are constantly on the prowl for the weakest kill out there.

i have a small business ie, the one that can only afford to pay minimum wage. I can see the writing on the wall. I deal with many, many people daily. I can see the change in american society.

anyway my main concern here was not the worker – he is screwed because the customer cannot pay for higher wages – a direct consequence of “courageous bernanke” who just printed money and bailed out friends in high places.

i am asking about the kids… who are represented by no one and are the easiest targets for the predatory system that we have. Once predators run out of easy prey, then they have to turn on each other and life wont be so easy anymore.

so yeah dream on about the unions. I lived long enough in the union paradise of NYC, which basically survives on a majority of illegals and just arrived.

There is panic in the air and it shows in the actions of the PTB.

Does anyone remember those ads you to see if airline magazines about negotiating seminars? Directed at the business traveller? One of the bits of copy I remember was “you don’t get what you deserve you get what you negotiate.” In other words, if you take away negotiating power, the person you take it away from gets screwed. One woukd think the business traveler class would have no difficulty understanding this simple relationship.