Yves here. I don’t want readers to think we’ve gone all soft, but it is worth pointing out that investor cash holdings are at an unusually high level and that in recent history has been a good indicator of market bottoms.

However, there are reasons to wonder whether the past will be a predictor of the future.

First, more and more trading is algo-driven. That creates the potential for both downdrafts and rallies to move faster, and more important, further than they would have in the past. In other words, the market structure is not the same as in 2008.

Second, the 2008 crisis came after three previous crisis phases, each of which the authorities beat back, albeit with more effort each time. And in the September-October debacle, the credit markets had seized up, the payment system was at risk, and the authorities were in all-hands-on-deck mode to prevent firms from collapsing and do what they could to calm badly-rattled nerves. This time, probably because the credit and payment systems are not the focus of the upheaval, The Powers That Be have largely sat pat. The lack of intervention (and political obstacles in the US to dropping rates through zero, not that we would advocate that course of action) means the markets may move on a different path.

Third, in deflation, what you want to hold is cash and cash equivalents and high quality bonds. Period. So if the central banks continue to fail to arrest the fall of inflation into deflation territory, fund managers are unintentionally winding up where they ought to be. The wee problem, of course, is that these institutional investors are presumably being paid to do something else, like invest in stocks or bonds of a certain flavor, so one has to wonder when holding unduly high cash balances, which may prove to be a winner from their client’s perspective, gets them punished for style drift (as in not adhering to the investment strategy you said you’d follow).

And if we really are going into deflation, there is another possible development in the wings: the end customers will figure out that they should hold only cash, cash equivalents, and high quality bonds, and will flee funds that do anything else, leading to a considerable thinning of the investment management sector. On the one hand, we’ve long said the financial services industry is hypertrophied and needs to shrink, and more and more economists, and even the IMF, have endorsed the idea that the financial services industry of the size of America’s is a drag on growth. But transitioning to a better-balanced has transition costs, and finding a next act for once-highly-paid and narrowly-skilled professionals may prove to be one.

By Chris Becker. Originally published at MacroBusiness

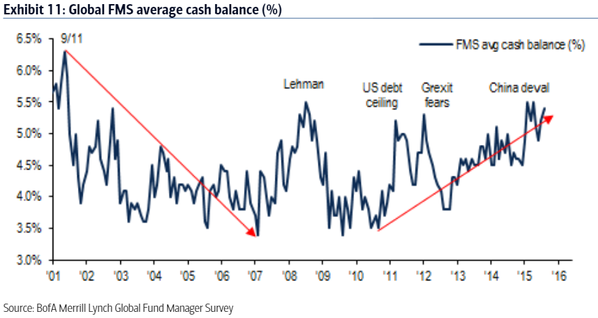

Is the bottom in? One of the greatest contrarian indicators during bear markets is when the “professionals” move to cash, and the latest Global Fund Managers Survey has current cash levels at their highest since the 2008 top:

Early days yet but the ASX200 was up nearly 2% on the open as Yen weakened and Aussie dollar is trying to get back up to 70 cents as we await the next Yuan fix and Chinese markets to open

Alternative view: Fund manager holdings are high because they expect withdrawal of funds.

I always used to hate watching my fund melt down because the fund charter said to be fully invested in stocks of some sort. After going thru the school of hard knocks a couple of times, you learn the right way to do it. It’s up to you to pull your money out.

not just expect, but seeing already. Equity mutual funds saw ~$72bn of outflows while taxable bond funds saw ~$45bn of assets leave in 4Q2015. Some of these assets went to like-minded ETFs which by their nature do not hold cash but offer greater flexibility with intraday trading, but on a net basis (combining the activity of mutual funds and ETFs by asset class) assets moved from stocks and bonds into the safety of money market.

Yes, this makes sense! Lots of funds went boom in the crisis, and this time around, fund managers may want much bigger cash buffers.

It’s worth keeping in mind new requirements around money market funds. If you’re a big fund manager, by the fall, unless you’ve got only treasury securities, you’ve got to start floating your NAV. There’s a possibility of big structural movement of money being driven by these new requirements.

There’s also a requirement to have exit fees and lockups in place to cover heavy redemptions, so in order to avoid this, it’s better to have more cash on hand because investors may get more skittish knowing that their fund manager could rapidly slam the door shut on them.

Typo: “highest [cash levels] since 2008 top” Should be “bottom”.

In other words, the “Pros” are as wrong as the Public.

“Top” in terms of cash levels (per the chart) but I see how not having gotten to the chart yet that this is inapt.

I’m with craazyboy!