“I love the smell of deflation in the morning” doesn’t have quite the right ring to it. But that’s the sort of carnage we are seeing. From the Wall Street Journal:

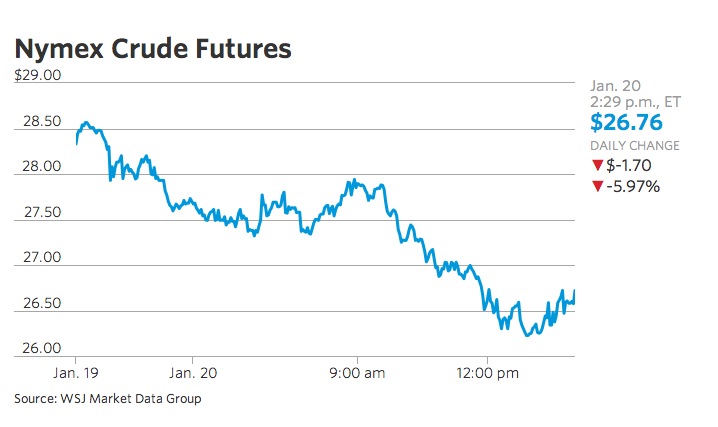

The selloff in oil prices accelerated Wednesday, intensifying a slide in global financial markets as investors worried that oil’s relentless downdraft signaled global economic gloom.

The front-month U.S. oil contract settled down 6.7%, posting the biggest one-day loss since September. Oil prices have dropped more than 25% this year.

Much of the 19-month oil-market selloff has been driven by concerns about ample supplies. What’s increasingly weighing on investors is the fear that demand growth is wilting, particularly in China, which could reflect deeper economic woes….

Oil investors fear that demand in China, which consumes about 12% of world’s crude, may falter as the country shifts to a less energy-intensive economic model. On Tuesday, the Chinese authorities announced the country’s gross domestic product rose 6.9% in 2015, its slowest pace in 25 years.

ESAI Energy LLC said Wednesday that the pace of demand growth in China from 2015 to 2030 will be 60% slower than the pace of demand growth from 2000 to 2015.

Brent was not hit as hard. Again from the Journal:

Brent, the global benchmark, fell 82 cents, or 2.9%, to $27.94 a barrel on ICE Futures Europe, also on track for the lowest settlement since 2003.

Crude sank the most in more than four months, dragging down shares of oil and gas producers to the lowest in almost seven years.

Futures fell as much as 8 percent to the lowest since May 2003. Royal Dutch Shell Plc, the first global major oil company to report fourth-quarter earnings, said Wednesday it expects profit to drop at least 42 percent. Markets could “drown in oversupply,” sending prices even lower as oil demand growth slows and Iran boosts exports, the International Energy Agency said Tuesday.

“At this point things are ugly and there’s no reason to buy into this market,” said Stephen Schork, president of the Schork Group Inc. in Villanova, Pennsylvania.

And the Bloomberg update on stock and currency markets:

Turmoil returned to financial markets as oil plunged past $27 a barrel, the Dow Jones Industrial Average sank as much as 565 points and global equities approached a bear market that is fueling a rush into haven assets.

The Dow and Standard & Poor’s 500 Index slid to lows last seen in early 2014, though selling eased in afternoon trading as the 30-stock gauge cut its decline to under 400 points. MSCI Inc.’s gauge of global equities fell to 19.8 percent below its May record and emerging shares plunged 3.2 percent. Russia’s ruble and Mexico’s peso fell to records, while bets mounted on an end to Hong Kong’s dollar peg. A measure of default risk for junk-rated U.S. companies surged to the highest in three years. Yields on 10-year Treasuries dropped below 2 percent and the yen jumped to a one-year high.

The global equity rout accelerated on Wednesday, sending the FTSE All-World index into bear market territory as oil prices slid to new lows and investors fled for the safety of high-rated government bonds.

Fear rippled through global markets, taking the UK, French and Japanese stocks to more than 20 per cent below their 2015 highs — the common definition of a bear market — and compounding equities’ worst start to a year on record.

The US S&P 500, the Dow Jones Industrial Average and the Nasdaq briefly fell more than 3 per cent to more than 10 per cent below their prior peaks, meaning they entered a market “correction”, but rallied in early afternoon trading, with the S&P 500 down 1.95 per cent.

Equities have been dragged down by rising concerns over China, global economic growth prospects, sliding commodity prices and questions over whether central banks remain willing to act as a backstop.

Investors rushed for safer government debt on Wednesday, crimping the yields of 10-year US Treasuries, UK Gilts, German Bunds and Japanese bonds to just 1.96 per cent, 1.62 per cent, 0.48 per cent and 0.21 per cent respectively. The price of gold also rose sharply.

The remark about central banks is important. Under QE and ZIRP, and conditioned by over 20 years of the Greenspan/Bernanke/Yellen put, investors had assumed the Fed would always watch their back. But Fed officials have stays mum as the markets have careened downward. Whatever mojo the famed Plunge Protection Team had no longer seems to be working now. And even though economists have been trying to legitimate the idea of negative interest rates, the Fed is already unpopular in America. If citizens had to pay interest, as opposed to fees, to keep money in the bank, the public backlash would virtually guarantee that the ultimate result would be a reduction of the central bank’s power.

When can we start talking about the ECB’s experiment with negative interest rates being an abject failure? As far as I can see, it’s mostly a tool for beggar-thy-neighbor currency devaluation without having the central bank go through the burdensome task of buying up overseas assets to push down the currency.

Looks like the Plunge Protection Team kicked @2:00 pm EST.

They read this piece and got Real Mad

Its interesting that the financial papers continue to focus on the price of oil as the alleged reason for the market chaos. This, despite the lack of any real evidence of a significant drop in oil demand (the price drop is very obviously largely supply driven). As the article from Wall Street On Parade given in the links strongly suggests, the real reason would seem a fear of major bank contagion (why else are bank stocks being hammered so badly?).

I wonder is it that the financial press are just too worried to openly talk about bank contagion, or is it that they genuinely don’t know?

Low oil prices should be a huge benefit to many industries, from airlines to farmers to automakers.

Only if you believe in supply side economics.

Wages have not risen. Demand is flat.

They know. The Dallas Fed has denied it already

Everybody asking “why are oil and stocks going down” but few are asking “what were they doing so high in the first place?”

Nobody seems to conclude that free money for 7 years (or 25, depending on how you count it) may have had something to do with it.

Few concluding that with 70% of stock volumes due to corporate buybacks (again with free money) and the rest just robots picking each other’s pockets…um maybe it’s not accurate to call it a stock “market” any more? With hyper-activist central banks the new guy in town for stock ownership, a guy who can “never” get a margin call?

I agree with Dalio, QE 4 is on its way, followed by 5,6,7, helicopter drops, then when that stops working, confiscation bail-ins from bank accounts. And war.

I wish I was confident that we’d get to QE5 before the war, but I’m not. I’d rather have neither but that doesn’t seem likely.

You have answered my question below, thank you.

U.S. petroleum consumption was actually lower in 2014 than it was in 1997 and 25% lower than earlier projections predicted. A large part of this reduction in gas use has been attributed to fewer vehicle miles traveled. Though oil markets have seen massive price cuts, the lack of demand continued through 2015.

http://www.zerohedge.com/news/2016-01-20/us-center-global-economic-meltdown

I would be very interested on any comments about Warren Mosler’s theory of why oil prices dropped and are continuing to drop.

As I understand it, Mosler says that Saudi Arabia, as the swing producer, can cause a price increase/decrease by offering to sell at a premium/discount to various benchmarks, like WTI or Brent.

While I have not been able to understand exactly how this would work, I respect Mosler and his analytic ability.

If he is correct, then the Saudi’s, who are currently offering to sell at a discounted price relative to WTI, can reverse course and charge a premium over the same benchmarks when they feel that they have caused enough damage to the American producers of shale oil.

Any thoughts?

WanderingMind,

Interesting. I don’t know anything about Warren Mosler but Saudi Aramco increases and decreases discounts and premiums to various markets monthly. Memory fades, but I think the last time I noticed this kind of move a premium was applied to shipments to Asia for the following month (that’s East Asia; are the people who are so free with ‘Asia’ aware that Israelis are Asians? As are Saudis and Pakistanis and Kazakhs and…) and a discount to crude being sent to the US.

That isn’t to say that the Saudis couldn’t cause ructions if they made BIG discounts or premiums, but in view of the difficulties they’ve brought on themselves currently by shooting themselves and all other producers in the foot, I’d hope they’d be more careful next time. I fear that it all depends on Deputy Crown Prince Muhammad bin Salman, the Power Behind the Throne at the moment.

There is no real argument about this – the Saudi’s have been quite clear that are deliberately over producing in order to gain more market share – this isn’t just about driving the price down, its also making aggressive deals to the relatively small number of purchasers who have alternative suppliers (because of refinery limitations oil isn’t quite as fungible a commodity as people tend to assume) in order to lock in new customers. The second aim for the Saudi’s is to reassert their political role as the world swing producer – the one producer which can set an oil price, just by saying ‘this is the price’. This king making role in OPEC is central to the power of the House of Saud.

It was always assumed that the Saudi’s would withdraw this pressure as soon as they have achieved their tactical aims, which are (in unknown order), to punish investors for putting money into unconventional oil, to hurt the Iranians, and make Putin angry. They’ve only really succeeded with the first, although they probably aren’t hurting enough yet for the Saudi’s taste.

The problem for the Saudi’s – and they almost certainly did not anticipate this – it will prove far harder for them to push the price up than they expected. There is such an enormous glut now that even if they cut back production by 10 or 20% or more, it will not have a significant effect for many months at least. There is simply too much oil floating around, and too many struggling operators are waiting for any sort of price rise to open up their plugged wells quickly to get cash flow. Quite likely, many purchasers will simply prefer to run down stocks rather than accept higher prices from the Saudi’s (or anyone else). So while the Saudi’s may succeed in retailing their dominant market share when this is all over, they may well have done so at a huge and unintended cost – they will find they can push the price down, but they can’t push it back up again.

I think Mosler’s theory is that it is not supply vs. demand, but the price premium/discount which causes the price swings. The way he puts it is that oil is an essential commodity – i.e. you either buy what you need or the lights go out – and the Saudi’s can cause market moves by premia/discounts to the benchmarks because of their swing producer status, regardless of the amount of oil otherwise available.

I confess not to understand the exact dynamic he is talking about, but think it is an interesting take which fits in more with the oligopolistic nature of the oil market (and many other markets) better than the standard supply-demand analysis. which I believe is more applicable to a market where there is close to perfect competition.

The Saudi’s have one thing to fear: The Peasants are Revolting.

With continued low prices, continued for longer than anticipated I’d believe, and couple with China’s unanticipated decrease in demand, the Saudi’s tempt their people to revolt.

Your are correct about Refineries. They are “optimized” to a supply of crude oil, and it is expensive, and they incur downtime, to move to a different (different oilfield typically) supply of crude oil.

Refineries which produce low sulphur diesel can accept gas oil from any other refinery.

“There is no real argument about this – the Saudi’s have been quite clear that are deliberately over producing in order to gain more market share”

They are not. Their exports are essentially flat year over year.

2013 – 7.54 million barrels a day

2014 – 7.11

2015 — 7.4 (estimate)

Would it be more accurate to say then, that the Saudis are opting to not cut production in order to increase their market share? It would seem to me as well that if I have a plentiful supply of an item, that I need the money, and I am not losing money by continuing to produce the same amount, then I would rather get a smaller amount of income than none at all.

If you are talking about US shale players then at the current price level (below $30) most of them have a negative cash flow and can be bankrupt in year or less, unless Wall Street extend financing or oil price recover to $60 or above level.

Only few stronger players will survive. Shale production was essentially conversion of junks bonds into oil even in better times. This is a VERY expensive oil. Now it is difficult to sell bonds and they no longer can drill enough wells even in “sweet spots” to stem the decline of production so this is just a matter or time when they go down.

Each well is around $6-$8 million and at this price level it is impossible to get those money back in probably 80-90% of cases. North Dakota is probably already not attractive for any company to drill at this price level.

The Saudis can impose a ceiling on the price of oil by opening their taps, but they cannot turn off enough oil to put a floor under the price.

So let’s all welcome Iran back to the “free” market in oil after their forty-year exile therefrom, shall we? Perhaps its price is falling as that long-lasting but essentially political distortion of the market for this particular commodity unwinds and the more fundamental supply-demand equation comes to solely rule this market once again.

Or is that too simple an explanation?

Gee, I wonder what else may have had its natural price equilibrium distorted as a knock-on effect of the distortion in the natural price of oil by all those long years of political wrangling.

Anything that uses oil as a major input, I guess.

Let us all hail the age of permacheap oil. So much to burn. So much to skydump.

Yves had this up several weeks ago looking at this issue:

http://www.nakedcapitalism.com/2016/01/2016-oil-limits-and-the-end-of-the-debt-supercycle.html

wanderingmind, the saudis only control what they’re selling, and by extension what they’re selling influences others…as i pointed out this week, the electronic oil priced and sold at NYMEX everyday exceeds US production by a hundredfold; that’s where prices are set…

read the paragraph after the chart:

http://focusonfracking.blogspot.com/2016/01/new-low-oil-prices-and-how-theyre-set.html

Ok. So, if the Saudi’s quote a price of “WTI – 5%” to some of the people they supply, then what impact does that have, if any, on the futures prices that you are referring to?

FYI, here is what Mosler is referring to.

correcting that link: http://moslereconomics.com/2016/01/06/saudi-pricing-mtg-purchase-apps-adp-trade-factory-orders-ism-non-manufacturing/

btw, my response to your question above is in moderation, should appear shortly….

up until a month ago, WTI was strictly a domestic price, so if the Saudis were quoting a discount from that, it would affect the comparable global prices, such as Brent and Bonny light, that would be selling to the same markets as the Saudis…

WTI prices used to move with the Brent price until fracking and i believe it will again, but as you can see it this chart, it hasn’t much over the last 5 years: https://rjsigmund.files.wordpress.com/2015/12/december162015discountorpremiumbrentvswti.jpg

It depends on how fast and how far the BRIC economies and Europe contract. It’s hard to know these days what real demand is for oil. Europe and China seem to be hording the stuff, not using it. American banks and PE/Hedge Fund investors seem to have been given the wink and the nod that no matter how much red ink is spilled by the US oil and gas sector, they will be backstopped by Uncle Sam. The whole idea of “markets” in the textbook sense doesn’t really apply to the financial or fossil fuel industries any more. They are all intertwined with governments and central banks to such an extent that price discovery is impossible. The question is not what these things are worth, but how long they can be managed and finessed until utter chaos erupts.

…and gas is still around 3 a gallon in San Diego.

I filled up an hour or two ago at my local Costco here in Minnesota for $1.579/ gallon. As I write the cheapest gas in the area is about $1.50.

http://www.twincitiesgasprices.com/

My daughter got gas today in Mobile, AL, for 1.52/gal. I got mid-grade a couple of days ago for 1.60.

Cosco & Grocery Stores have recently been ramp’n up their H2O additive…friend of mine owns a family run garage and showed me a print out of 2 months work. 60% were car engines shutting down. if your not ‘cool headed’ with the neutral gear, while gliding at 70mph down an interstate…well good nite & good luck.

my friend said the only station with any real grade (around here, GA) is QuickTrip…

Same here in PNW.

Here in Mexico gasoline is 13.16 pesos/liter, which at an exchange rate of 18.1 works out to $2.75/gallon. Energy prices are essentially anchored to the dollar, so as the peso depreciates gasoline gets expensive in pesos but stays cheap in dollars. Difficult for those who are paid in the local currency and good for anyone who earns dollars. And the weak peso is definitely starting to bite here.

Oil is a commodity, and we have seen this type of price behavior in the past. That falling oil prices in and of themselves pose a systemic threat is a deflection red herring IMO. Not to say that the derivatives overhang, poor risk underwriting and management, and lack of regulatory limits and control issues won’t magnify the sector problems.

Appreciated the final paragraph regarding QE and ZIRP; and the Greenspan and Bernanke Puts. Always the MSM’s focus is on how many trillions have been “lost” and the percentage the market indexes have fallen from their highs in the current drop. Never discussion in the MSM of how much was added to market capitalization on the way up, why, how it was done, who lost and who gained as a result of the underlying policies, who is responsible, ways out of the mess, and whether these central bankers are people who will constructively contribute to resolving the maladjustments that have arisen as a result of the earlier policy failures?

I consider the observation by Ellen Brown that there has been a crack in the citadel to be a positive development:

http://ellenbrown.com/2016/01/16/the-citadel-is-breached-congress-taps-the-fed-for-infrastructure-funding/

there might be some confusion for those who are reading oil price quotes from other sites…as the WSJ says, the front-month U.S. oil contract settled down 6.7% to $26.55 a barrel, but trading in that February contract (CLG16) expired today, and all the quotes for the price of oil you’ll see henceforth are for the March contract (CLH16), which closed today at $28.35…

The timing of this couldn’t be better for Trump and Sanders. Anything that helps peels away the cheap veneer covering this phony, financial-ized economy keeps the Bush and Kasich campaigns in the toilet, and puts a stiff headwind in Hillary’s face.

Should this downturn get worse I expect an “Empire strikes back” moment later in the spring, perhaps QE4 gets launched sooner than we think (though the optics of that for a Fed that claimed “victory” in hiking just a month ago are horrible.)

Or we could go the 2007-08 route of propping up housing, only this time it’s bankrupt shale drillers and energy tycoons who get the bailouts.

Pardon my ignorance — what’s behind all this oil and stock swooning? Is it just China? Is it partly the old rate hike? I’d think it was bad fundamentals, but there’ve been bad fundamentals for years… are the fundamentals in China somehow more relevant than the fundamentals in the U.S.?

just rec’d this in email: http://english.cri.cn/12394/2016/01/21/3381s913989.htm

Xi’s text to iran.

“(this guy does not fuck around)”

” We will establish a comprehensive strategic partnership and increase exchanges between political parties, legislatures and at the sub-national levels. We will deepen our cooperation under multilateral frameworks such as the Shanghai Cooperation Organization, the Conference on Interaction and Confidence-Building Measures in Asia (CICA) and the UN, to steadily increase political mutual trust and substantiate our strategic relationship.”

they’re going long…