By C.P. Chandrasekhar, Professor of Economics, Jawaharlal Nehru University, New Delhi and Jayati Ghosh, Professor of Economics and Chairperson at the Centre for Economic Studies and Planning, Jawaharlal Nehru University, New Delhi. Originally published at Business Line

Across the developed world the persistence of a phenomenon that was initially seen as a freak occurrence—negative interest rates—is now a cause for concern. One form the tendency takes is for central banks to set their policy rates, which signal their monetary stance, below zero. The process was triggered by the European Central Bank (ECB). Under pressure to forestall deflation in the region, the ECB reduced its deposit rate to (minus) 0.1 per cent in June 2014. Since then, according to the Bank for International Settlements (BIS), till January 2016 four national central banks, from Denmark, Sweden, Switzerland and Japan, have moved the interest ‘paid’ on part of their deposits with them to negative territory.

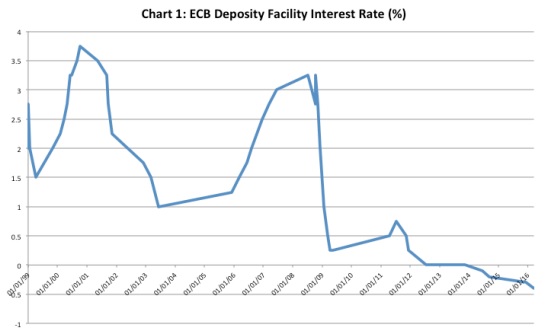

After the Great Recession began in late 2008, there was a widespread trend observed for policy rates to be cut to stall and reverse the economic downturn. This process has now gone so far in some countries, that rates have breached the zero-barrier. The ECB itself has in three steps cut its deposit rate to (minus) 0.2, (minus) 0.3 and (minus) 0.4 in September 2014, December 2015 and March 2016 respectively (Chart 1).

Underlying this trend is a much more pro-active role for monetary policy in countering deflationary trends. Thus, in March 2016 the ECB reduced the interest it pays on deposits (or further lowered the negative rate from -0.3 to -0.4 per cent). In addition, it offered zero interest loans to banks, with the promise that if they use that money to lend 2.5 per cent or more than they were previously doing, then the ECB would pay them the equivalent of 0.4 per cent of what they borrowed from it as interest. In sum, the central bank is promising to pay banks that borrow from it, as long as they increase their lending to households and firms.

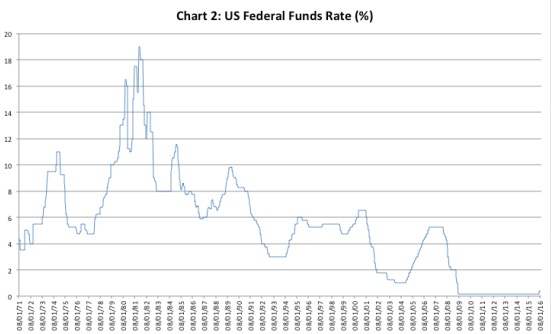

The motivation for negative deposit rates is clearly to pressure or persuade banks to lend rather than hold on to reserves with the central bank. This is not the first time that central banks have opted for such a policy (the Swedish Riks bank had flirted with it in 2009-10). But this time around, the tendency is spreading fast, with more countries contemplating action along these lines. In fact, even Janet Yellen told a Congressional hearing that the US Fed would consider this option if it found it to be necessary. That is not surprising, given the fact that the Fed has relied on the interest rate instrument, which peaked after the oil crisis in the 1970s and has been on the decline since with the fall being sharp with the onset of the 2008 crisis (Chart 2).

This growing popularity of a measure that was very rarely experimented with in the past can be attributed to two sources. First, governments have succumbed to the pressure not to use debt-financed fiscal spending as a means of stimulating recovery. This makes monetary policy measures, such as liquidity infusion and interest rate reduction, the principal instruments to combat recession and spur recovery. Second, the movement of rates to negative territory reflects the desperation that has overcome governments, as they find that deep rate cuts have not had the desired effects of stalling the downturn and ensuring recovery.

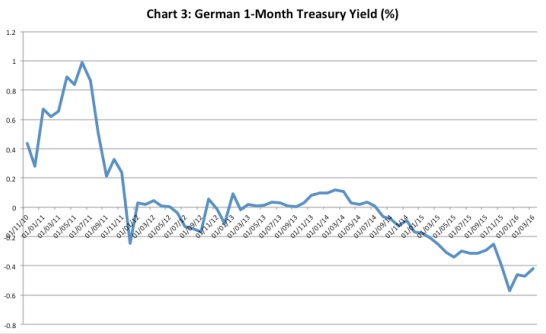

This has affected bond markets as well. Responding to the negative policy rates set by the central banks, investors have been pouring money into safe assets such as domestic and foreign government bonds that offer positive rates, leading to large increases in bond prices. Since bond yields fall as their prices rise, bond yields in countries like Japan and Germany (Chart 3) entered negative territory, with investors paying the government for borrowing from them. According to Bloomberg, the volume of debt with sub-zero yields has crossed $7 trillion, which includes $4.5 trillion of Japanese government debt and $1.1 trillion of German bonds.

Thus negative rates are the consequence of policy makers betting on interest rate cuts to drive growth through multiple channels. To start with, they expect bank lending rates to come down and encourage households and firms to spend and/or invest more, thereby raising demand. Second, investors not wanting to pay governments for holding their money are expected to turn to asset markets like the stock market. That would raise financial asset prices and trigger the oft-cited “wealth effect”. With the value of paper or real assets rising, holders of those assets would be encouraged to spend more today rather than add further to accumulated wealth, spurring demand. Finally, since low and negative interest rates in a country would discourage foreign investors from investing in bonds and financial assets in the country concerned, the currency can depreciate, improving the competitiveness of exports.

The difficulty is that these expectations are not being realised. Households and firms are still burdened with debt, and so are wary about borrowing more, and banks are cautious of increasing their exposure to them even if pushed by the central bank. This could partly explain the thirst for government bonds, which has driven their yields to turn negative as well. On the other hand, with all countries relying on interest rate cuts, the effective depreciation of currencies, while significant vis-à-vis the dollar, is only marginal vis-à-vis one another. That neutralises the competitive benefits from depreciation relative to the dollar, with little chance of an export boom.

Parallel to these developments is concern about the effect that negative rates can have on financial markets. They could trigger a shift to stocks away from bonds and set off a speculative spiral in stock markets. Negative rates are likely to adversely affect bank profits as well. While banks need to pay depositors a reasonable rate to attract their savings into deposits, the low interest environment and pressure to lend require them to cut the rates they charge their borrowers. The result is a squeeze on margins. The effect this could have on financial markets is still uncertain. In short, there are grounds to believe that, while negative rates are the result of the ineffectiveness of interest rate reduction as a means to spur recovery, they can lead to financial instability.

Why then are central banks and governments opting for this unusual stance? In a famous 1943 essay on the “Political Aspects of Full Employment”, the Polish economist Michal Kalecki had argued that if the rate of interest or income tax is reduced in a slump (to counter it) but not increased in the subsequent boom, “the boom will last longer, but it must end in a new slump: one reduction in the rate of interest or income tax does not … eliminate the forces which cause cyclical fluctuations in a capitalist economy. In the new slump it will be necessary to reduce the rate of interest or income tax again and so on. Thus in the not too remote future, the rate of interest would have to be negative and income tax would have to be replaced by an income subsidy.”

In the current context the problem is not that the interest rate that was reduced during the slump was not raised during an ensuing boom. The problem is that large reductions in policy interest rates when they were in positive territory did not counter the slump. But since governments have forsaken completely the option of relying on the fiscal lever to manoeuvre a recovery, they have no choice but to continue reducing interest rates, which have finally entered negative territory. Unfortunately, that too seems unlikely to trigger growth in the foreseeable future. It is only increasing the prospects of another financial bust.

Originally published in the Business Line.

Didn’t the old gold standard tend toward deflation … but had a bottom that couldn’t be passed? The great gold discoveries of the 19th century may have been inflationary, but that was absorbed by the the industrial expansion. Once we went on fiat money backed by something more flexible (oil) isn’t the ultimate bounds and dynamics determined by oil? With the deflation of oil prices in an already deflating economy, that would push financial indicators even lower (except in the dark banking sector). Since industrialization isn’t expanding as fast any increase in relative oil supply, aka inflation of oil dollars, can’t be absorbed, though China has tried hard.

Gold was inflationary for hundreds of years: for example the constant mining of the metal from 1800 to 1900 in the U.S. was equivalent to 5% annual stimulus spending (!).

No fiscal spending was needed: gold miners created a healthy stimulus that propelled the U.S. economy.

Once the U.S. economy outgrew the “gold stimulus” at the end of the century, gold became a rent seeking tool resulting in deflationary debt spirals and destructive depressions.

The final and worst gold standard depression (1929-1932) was followed by the abolishment of the gold standard.

Fiat money isn’t backed by oil. Oil is consumable – silver, gold, bitcoins, etc. are not. What oil and a few other resources are a bottleneck.

Fiat money in the USA is backed by the military.

The only problem with fiat money is that no politicians in one country trust politicians of another country.

They know that no amount of propaganda will convince (global) others of the value of their currency.

They (the politicians of any country) also know that, unlike the captives who are the ‘reputed’ masters (and required to use the currency) of their government of the people, for the people, by the people, these foreigners will look carefully at how much is being printed, and how much the government is spending…these foreigners are the real masters of that (or any) democratic, monetary sovereign government.

Free of a global hegemon, countries trading with each other, (and thus needing to accept different currencies) will want currencies to be anchored to something tangible to avoid any shenanigans.

Luckily, we have a global hegemon.

I seriously HATE this economush. The central banksters and economists see only ONE tool and only ONE way to wield that tool to try and get anything accomplished, ignoring the single best way to fire up the economy. They try to encourage households to BORROW (take on more parasitic debt) to fire up the economy with faux spending using money they do not have; the only real effect to be to enrich bankster CEOs and fund bonuses.

THE single best way to fire up the economy is to spark a fire at the bottom of the rag pile: provide money directly to households/the REAL people who do everything. You get nothing when you simply pass cash to the rich, be they bankster CEOs or Hedge Fund crooks or corporate CEOs. They simply sit on the cash, feather their already heavily over-stuffed and feathered nests and spit on the real people. Give money DIRECTLY to the real people and the economy will fire up organically and, in large part, the way it SHOULD. The people and ONLY the people drive any economy. THEY are the ones who buy shit. THEY are the ones that create actual demand. Demand for yachts or luxury cars is simply too small to drive any economy. You want robustness then you need the actual REAL people to buy things.

First, the smart ones would pay off debts, clearing their slates. Virtually all would go out to buy things they’ve wanted or needed but held off on because their jobs suck ass and don’t pay jack. You never ever start a fire by trying to light the top of a wood pile, you always fire it up from the bottom. If establishment economists weren’t all a bunch of rich, entitled, self-worshipping assholes with lobotomized brains they would loose the myopia and do the deed. Direct disbursement of cash to the people. Make it in the form of Guaranteed Basic Income if you want to title it something. Or call it Citizen’s Dividend. Skip the banks, they are largely fluff and unneeded parasites, give it to the people.

“The money was all appropriated for the top in the hopes that it would trickle down to the needy. Mr. Hoover didn’t know that money trickled up. Give it to the people at the bottom and the people at the top will have it before night, anyhow. But it will at least have passed through the poor fellows hands.”

– Will Rogers

Wise words from a superior economist to ANY offered up as “Nobel Prize” material today.

Will Rogers, really? Then I’d bet he invented the term.

++++++++++++++++++++++++!!!

“Second, investors not wanting to pay governments for holding their money are expected to turn to asset markets like the stock market. That would raise financial asset prices and trigger the oft-cited “wealth effect”.”

Borrowing to juice up prices – I’m glad that never happened with home prices, and worked so well I could see where The FED would want to do it again….

“wealth effect” – the 0.1% already have most of the wealth – apparently they won’t spend until they own every single f*cking thing, including our hearts, lungs, and livers…

All I saw when I read that line was “Bubble blowing AGAIN”. They outright are making it policy to blow asset bubbles as a means of providing literally fake “wealth” to the little people, so they can go DEEPER into debt.

How can they say these things with a straight face OR without being called out on it? They are truly psychopaths.

Its been happening in modern terms for 300 years. The U.S. Fed, banksters & 1%ers use loose credit to lend cheque-book money into the economy to create assets which are then confiscated by them when they decide to call in loans and demand immediate payment. Or they simply raise interest rates which after periods of loose and cheap credit will cause massive personal and small/medium sized business bankruptcies allowing the financiers to obtain the foreclosed assets at pennies on the dollar. Thereby obtaining at rock bottom prices the valuable assets created by the debtors. Debtors by definition are all ‘middle class’ as poor people don’t qualify and wealthy people don’t borrow unless against income streams. So with regularity bankers and wealthy elites use middle class debt to create money and then use exorbitant interest rates and immediate payment demands to extract the assets from the middle class debtors at pennies on the dollar. This radically shrinks the middle class and transfers assets (which may then be rented back to the original owners or others providing ‘rentier’ profit streams for bankers and 1%ers) to financial elites.

Blowing asset bubbles may create ‘fake “wealth”‘ to the borrower but is, after their bankruptcy, creating real wealth for the banksters and 1%ers at pennies on the dollar while financially crushing middle class families..

Our material lifestyles should have shrank 40 years ago. Instead, we maintained it using debt.

Now the US, 5% of the world population, is still consuming more than 40% of the world’s resources and energy… will handing out more money to the people really help or will it just help them cling longer to an ideology that needs to change? Because if that 40% is set to drop no matter what, handing out money to everyone will just fan inflation. From my vanatage point, we have not had inflation BECAUSE the general population has not touched the money…

The global population has gone from 3.5B to more than 7B since our current monetary system was set. It’s hard to believe we can expect more of the same for much longer considering what the previous 3.5B did to the planet. Now we have an extra 3.5B vying fo a better quality of life. Every 40 years or so there is a reset. We are due. It will be interesting to see if the US gets another 40 years of consumerism or if the above mentioned 40% drops drastically.

BTW, personally I think we should distribute money to the people. But not because I think it’s going to solve our problems and bring back the American dream. But because the way our system is built, it needs inflation.

While I understand that a basic income would be putting money in at the bottom, I don’t understand why no one here is talking about doing infrastructure rebuilding projects. This would give millions of jobs to people and improve the productivity of the nations overall. Can someone please enlighten me?

Obama in 2009 said those “shovel ready jobs” for infrastructure projects weren’t as shovel ready as he thought (as he smirked). Might have something to do with it?

Everyone talks about infra… but most infra is not shovel ready. Then who gets to decide what gets built or not? Loads of politicking!

Secondly, who is going to fund it? Pension plans or government? Pension plans are still looking for 6-10% returns while government yields are at 2%…. why would I lend at 2% for 20 years?

Infrastructure work is hard, and long term. No one has any patients for that.

Planning, the most important part, is not given enough funding. Even estimating the cost of a plan can take months.

Then, you get into the DC money game- pretty much every dollar that comes out of DC is already spent in DC. That’s where the “fraud” is. New water project? OK, but you’ve gotta use X brand. Lots of ‘infrastrure work” would also, not have been classified as that a few years ago. In some cases a water treatment plant is simply rolled of a trailer. Zero money to the local community.

The locals are also now getting much more creative in what they fund with their bonding. Stadiums? That’s just the start these days. Shopping centers….

Every dollar that is borrowed for public-private projects like this type is a dollar that is taken away from other, real infrastructure work.

“but new pipes don’t make money! A strip mall does! Give them financing, and a tax break”

That about sums things up.

“No one has any patients for that.” ……..That’s because the ‘patients’ are all dying of abysmal sick-care provided by the ACA………to be of any use on building infrastructure :)

I think if money is injected from the bottom, all the money will go to all the people (not just those who get new infrastructure jobs) directly and immediately.

That way, the money is not split among materials, overhead and (management+labor) costs.

Once the people at the bottom are doing well again (that is, not starving, freezing to death nor dying from lacking affordable access to health care), the people at the bottom can decide what else they want to – more local taxes for local projects, more state taxes for state-wide projects, etc.

And if the federal government says, we need more drones, the people can then says, ‘Well, let us vote on that idea. And we will see if you get that money (you desire) or not.”

I think if money is injected from the bottom, … MyLessThanPrimeBeef

That’s an excellent if not morally required approach but to do it properly requires individual, business, local government, etc. accounts at the central bank otherwise the population is forced* to loan its fiat to depository institutions (aka banks) since only they currently are allowed to have accounts there.

*currently, physical fiat allows those forced loans to be undone.

How can you assume that money “injected from the bottom” would be an efficient and easily regulated system impervious to future perversion? Are we talking about micro-loans? Helicopter drop? Because as long as the tax code is compromised, the middle class will never be able to open businesses with the likelihood of long term success. Especially in an era of the Mega Corporations.

At least spending a large Federal budget on infrastructure would serve to:

a). Make our disgustingly outdated roads, bridges, highways, dams better, more efficient, and longer lasting. The last time most of these had any money put into them (besides routine maintenance) was in the 1950’s -80’s.

b). Stimulate a very large sector(s) of the economy including: mining, construction, lumber, shipping, industrial design, etc.

c). Provide semi-permanent jobs to a large amount of blue collar workers, and permanent jobs in maintenance of new infrastructure

d). Mitigate the involvement of healthcare and military industrial complex, two of the largest players that have already hijacked most of the annual Federal budget.

e). Improve the happiness of the populace; shorter commute times, less vehicle maintenance, etc.

Money can be injected from the bottom in various ways.

One way is via Income Guarantee..

Another is something like Bush’s “A thousand dollar check’ to everyone. It can be a regular feature or employed when needed.

The tax code compromise issue is not particular to money injection from the bottom or from the top. It’s always there and needs to be addressed.

And when the people have surplus money (if not, more injections from the bottom, when needed), there will be money for infrastructure projects and we will see job growth.

Job growth comes after people have gotten money.

It’s OK that way(rather than money trickling down to create jobs in order for workers to have money – and let’s not forget that infrastructure project money is split among materials, overhead and wages), because the objective of getting a job is to have money, anyway. But this way, you get money right away.

+25,000 or what the government should give every American to try to off-set the damage caused by allowing these zombie banks to control policies to their own benefit. Punishing savers and forcing new debt on the masses as their only choice for survival. The bailouts never ended and are accelerating, as a matter of fact, the bailouts were only the first opening salvo of this financial Pandora’s box

Skip the banks, … Praedor

Agreed, but unless you intend that the monetary sovereign use physical cash, that will require that individual citizen accounts be allowed at the central bank – which should be allowed anyway because of a thing called equal protection under the law – otherwise those payments will be directed to the accounts of depository institutions (aka banks) at the central bank as forced loans of new reserves.

Yes, Yes, YES! This was a better read than the article! especially… You never ever start a fire by trying to light the top of a wood pile, you always fire it up from the bottom.

And President Bush came closer to that at the level of small gesture than anyone else lately with his “thousand dollar check” to tax filers.

Oh the humanity! Such irony.

And politically, who will object to a fat direct deposit of new fiat into their newly created account at the central bank?

I like that. How can pro-business conservatives be opposed to dividends? Being a citizen is a lot like being an owner of stock in one’s nation, and stockholders are entitled to dividends.

And…being a “dividend” it gets special protection from taxation (unlike income actually earned by WORKING). The upside is it would drive the 0.1% NUTS that all the “little people” are benefiting from special tax protections that “belong” to the 0.1%. How DARE the little people be treated like WE are! They’re ANIMALS!

Raising minimum wages wouldn’t require much debt-financed fiscal spending and might add some much needed inflation.

Income guarantee is better than rising min wage.

The worker gets the same amount, or more, of additional pay.

The taco restaurant owner gets to keep that money.

It’s a win-win.

IG workers won’t get the respect that they would with a $15/hr min wage job. Subsidies are stigmas. Substantially increasing the minimum wage would reduce the demand for undocumented workers and increase labor force participation. It would also incentivize employers to train & educate workers so they’re worth the pay. A real win-win. The local taco shop would increase prices but would get more business because more people could afford to eat out. Same is true with IG but prices might not increase as much.

No, an income guarantee is just another subsidy to welfare queen corporations like WalMart.

Why wouldn’t minimum wage laws work with a BIG? Because employers will say they are no longer necessary? And the employees might not disagree to any politically significant extant?

Then beyond a BIG we need asset redistribution and that should be no surprise given that the money system is designed (or has evolved) to favor the rich. Then the workers themselves, at least the citizen workers, will benefit from low wages, at least wrt their assets. And being co-owners they would be able to vote for higher wages if they so desired.

I prefer the guarantee as well because it is regardless of employment status. You only get min wage if you have a job. Rather than trying to get everyone into menial jobs at McDonald’s I’d rather they simply get the basic income so they can pick and choose jobs to enhance the income. This would FORCE low-ender business to raise their wages because why work shoveling french fries all day for crap pay if you can make it fine without that job on basic income? You want me to work at that crap job? PAY enough to make it worth my while.

I thought the piece was concise and well-argued.

The reason the ‘conventional’ monetary response doesn’t work anymore is because there is TOO MUCH MONEY in TOO FEW HANDS.

It is grotesque to witness the intellectual contortions our oligarchs and their economic shills will perform to shield their eyes from this truth, which is as simple and bright as the noonday sun.

Exactly. So aggregate demand goes down the drain because the oligarchs don’t spend enough on products/services or invest in productive activities that create real jobs, they just engage in speculation or rental extraction. This leads to a disinflationary or deflationary economy.

I’m curious, what do you mean by aggregate demand? There is a lot of C+I+G+X out there. Are you really talking about the distribution of it?

And what do you mean by a deflationary economy? Have you tried shopping for housing or healthcare when you’re making $30K a year? Are you familiar with the record high levels of student loans and motor vehicle loans?

Negative interest rates are great. Borrow $1 billion, and at -.4 % interest (would that be compounded?) get paid $40 million yearly. Pretty good income for doing nothing except signing some papers.

Could even afford a London flat with an Arab supercar to drive around with, at 5 MPH.

Whaaat? You mean I can’t get that deal? Only banksters can get it? I see.

Don’t forget, the banks(ters) will CHARGE you on that negative interest rate even though they are making money on the top end. Got to pass along the “costs”, donchaknow.

As implied by Praedor, just because the government can “borrow” at negative interest rates, doesn’t mean you can or a private corporation can.

Banksters get that deal. They like to call themselves private enterprise capitalists.

Really, it’s the useless eaters that are making negative rates happen. They have perfected the art of wealth destruction.

Their throne at the policy table needs to be toppled.

If you are a lowly saver, you can first save $1billion, then make $40 million a year “for doing nothing”. But saving a billion is a lotta work. I don’t know how long that’s gonna take. Almost seems like you’d have to do something illegal to get it?

With states cracking down on pain pill abuse, there’s never been a better time to start a heroin dealership.

Key to monetizing this concept on a national scale is franchising. “American Horse” appeals to me (even though the product is imported from our valued ally, Afghanistan).

Partnering with Uber for freelance home delivery completes the killer app. Let’s roll …

I’ll snort to that.

yeah….kinda like trying to sell your vital organs ….on the black market !!

— Balzac, in Le Père Goriot.

If there were any patriots left in the banking class, one of them would refinance all of Greece’s debt with a negative interest rate.

Thanks all for either being very kind and not pointing out my mistake, or not paying any attention at all.

$1 billion at -.4% negative interest is $4 million.

A negative interest rate means that YOU pay the bank that much to keep your money “safe”. It is a cost for depositors not a benefit. That means that almost everyone will take their money out of the bank in cash. This will end the thee centuries old ‘deal’ between governments and banks; whereby banks are granted the right to create deposits and collect interest, in return for providing a safe depository for people’s money (wealth) and paying a modest interest to depositors (these days bank charges for everything would keep the banks rolling in dough from small depositors!). When the people take their money in cash out of the bank because it costs them money to keep it there, the banks no longer provide safe assured security for deposits, which could and should spark an inquiry into allowing banks to create deposits (create money out of thin air and charge interest). They can still make loans but only the national government can create the money and then transfer it to commercial banks when loans are made. This may very well give cause to terminate banks and replace them with local community organizations’ safe facilities. Superwealthy individuals would no longer collect big incomes for simply depositing their money in a bank account. I can hear the cries and the sound of rending of clothes now.echoing out of the billionaires mansions.

Central banking is a follow on operation. When the economy is growing organically for a whole host of reasons, it gooses it a bit with lowish interest rates, then when the momentum builds up they jack up rates and really rake it in, in the name of moderating the economy.

They have everyone looking close at rates to see what will happen when in reality it is the opposite.

The best that CBs can do is exaggerate movements in the economy into boom-bust as we have seen over and over again.

Central banks are not needed and in fact are the problem not the solution.

Bit of an inconvenient truth so I probably will get my comment “moderated”

Central banks are not needed and in fact are the problem not the solution. Jef

Fiat exists in only two forms – physical fiat (eg. coins and paper bills) and account balances at the central bank.

Are you suggesting that only physical fiat should exist? Or is your suggestion that the accounting functions of a central bank still be allowed or moved, for instance, to the US Treasury?

I hope you are well paid by the corporate banking community, if not you simply have no idea what happens in banking. All money is created through loans by moving a bank balance up. When someone takes out say a 100,000 dollar loan for one year at 10%, This is how the bank gets you the money. They open an account for you and simply move the bank balance up $100,000 – they have just created $100k out of thin air! This is exactly how money has been created for 300 years. Banks never lend their own money nor do they lend out depositors money. The first and largely ignored problem with this private corporate money creation is that the interest money isn’t created at the same time as the debt – or ever! All of the debts plus interest which currently exist simply cannot be paid in full – this money does not exist. In the USA the Fed is a private for profit business O/O by the Wall Street Banks. When the Fed pays out something for the Central Government it can simply open an account and raise the balance to whatever necessary, with out taking a penny from their own pockets. The U.S Fed is a corporate scam on the American people whose only hope is for federal politicians to grow a pair end the Fed’s slimy existence of screwing over Americans and go back to Abe Lincoln’s choice – to have the U.S. Treasury create all money, free of debt, necessary and have the federal government spend it debt free into the economy. In fact that’s exactly how the north won the civil war Lincoln built an army on money the Treasury created and gave debt free to Lincoln to send debt free into the economy to build and sustain a far larger army than Davis could by borrowing from French private bankers (Rothchilds) at interest. The “carpet baggers” were representative of the European banks which lent Davis money and were repossessing property to recover their loans, they flocked to the southern states and stripped them bare impoverishing the American southern states and their people in order to satisfy their European creditors. Central Banks (and the U.S. Treasury) have the ability to create and give money interest free to federal and local governments to spend debt free to provide services that citizens need. You harangue against the very and only thing standing between you and endless generational poverty forced on everyone by private for profit banks. You need to check out a website called “public banking” for the complete story.

Trying to get more money into the hands of consumers by making borrowing interest cheaper does nothing for the economy. Especially since the average consumer will not willingly borrow money to cover their costs or finance new purchases.

Throw in wages remaining stagnant while rents are up multiples of inflation over the past ten years and you start to wonder how people are ever going to afford anything ever again when it’s taking more of their discretionary income just to finance their basic needs.

Imagine our economy with the first $40 – 50k of income exempted from taxes and governments as employers of first resort!

Now imagine that income is not taxed at all…wealth is, but I get beyond the argument.

More pushing on a string and perplexity that giving the well off more because those not well off are obviously unworthy since they’re not well off isn’t working for them. Moneta points out that we may be living at a higher than durable standard, but people have been cutting back (not borrowing because they don’t see a bright future) but banksters can’t cut back or allow the population to cut back, so we see them double down on stupid. One thing, though, the rich are a lot richer, they think they’re richer because of merit, and since the beginning of the GFC they have stridently refused to get money to the bottom tiers of the economy, which might imply that their merit is thievery. Sadly I see things like a basic income guarantee as supporting the current trend (benefiting walmart mostly surprise surprise), while infrastructure investment will put more money in the general populations pocket and provide people with real lives. I think also that the “not shovel ready” meme has at least some aspect of the FIRE sector needing to arrange their rent seeking deals as well as use crisis to privatize said infrastructure, while the nebraska backhoe starts up real easy… there is one politician out there, by the way, who has promised more infrastructure investment, and not only in the countries we’ve bombed into the stone age…

Can’t infrastructure investment also increase a nation’s productivity? Don’t you guys have fancy words for stuff like that, like it bends some curve?

Productivity can mean many different things.

A new shorter road could mean it’s easier to ship coal, and thus more ‘productivity.’.

More ‘productivity’ could also mean, instead of 10 man-hours, it takes 5 man-hours to cut down trees.

We might be better off, in that case, to let the would-be logger receive money to do Zen meditation or yoga.

Pray, tell me why anyone would buy government bonds (unless mandated — which again is foolish – since the bonds are worth less than the price paid for it). Better to hold cash as its value increases in deflation.

Can someone tell me why not hold cash instead of buying bonds? stocks are risky…fully dependent on the Fed, ECB, PBoC and BoJ.

When interest was positive there were bonds, stocks….

But with negative interest rates, CASH is king.

How do you hold huge amounts of cash would be the question I am asking myself.

I can hold it for you….

How do you hold huge amounts of cash would be the question I am asking myself.

With fear and trembling?

Actually, as a citizen, you should be allowed an inherently risk-free account at the central bank, same as the banks, and that account should pay no interest nor should you be charged any interest (negative interest). And if the economy needs stimulating or interest rates in fiat are too high then the just solution is new fiat equally distributed to individual citizen accounts at the central bank until conditions improve.

It’s called equal protection under the law and is long overdue wrt banking and money.

Likewise businesses and state and local governments should be allowed accounts at the central bank too and government provided deposit insurance abolished.

Cash is illegal, or will be soon.

I wonder since the abolition of physical fiat would mean that a Nation’s citizens may not use their own country’s fiat AT ALL!

Then it will become obvious that we are enslaved to a government enabled/enforced/subsidized usury cartel of depository institutions with accounts at the central bank.

Are even banksters that stupid?

Do you know a good Medium? Just have to ask your ancestors what they did. Because they did keep their wealth in their own possession. Not much of a problem to solve, when you think about it. The problem is decades of social indoctrination, brainwashing everyone that they must keep their money in banks for it to be safe. I wonder who came up with that idea in the first place?

The why is that cash has costs, too, both in its bank held form and its physical banknote form. Also, debt exposure is primarily a function of diversification. If we reach large negative government yields, people will shift out. Indeed, one could argue that has already happened even before NIRP since central bank balance sheets have expanded so much (for example, the Fed now owns a large amount of both government and private bonds). Those bonds, by definition, represent investors who preferred cash over debt.

As far as the how, well, partly it depends on scale. At an individual level, the vast majority of people don’t even have enough money to hit the FDIC insurance level, so you can just keep money in a checking account. If things get so extreme that retail checking accounts are charging negative rates, then (most people) can withdraw all the money they have in an envelope of $100 FRNs that fits in your purse or backpack. Keep it in something nonobvious and nonflammable. If you think the government would purposefully restrict the supply of banknotes, you might want to panic out of your bank account before your neighbors and coworkers.

For those with a lot of money, the first level of cash protection is products like CDARS that spread FDIC insurance over several banks. The second level of cash protection is withdrawing bank accounts into physical FRNs and keeping those at private vaulting facilities (or one owned personally).

Now you may also be asking a different kind of question, which is what is cash, because for investment allocation questions, cash means “cash and cash equivalents”, which mostly means electronic bank account products, not physical FRNs. If you have a lot of money, and you are dropping the “equivalents” (ie, bank accounts) due to banksters/government tyranny/aliens/whatever, you would likely consider cash to include other items at that point. You would want some foreign currency (if there is any paper money left in the world) and some bullion coins (gold and silver, perhaps platinum and palladium) in your possession and large bars vaulted somewhere (again, like FRNs above, with the specific vaulting preference dependent upon exactly who it is you don’t trust).

You can store a lot of money that way. A single gold bar (400 ounces) costs half a million bucks, give or take – more than the entire net worth of most American households.

Most interesting that Kalecki said this in 1943, based on the struggle ensuing from the Great Depression, no doubt. More commonly known as WW2. If Kalecki and others could see this clearly into the problem of a slump that would not go away, we should have been looking to the root cause of the slump… the fact that capitalism eats everything up faster than it can replace itself. Really efficient capitalists don’t see a problem – they merely recommend we all do what they do. Crazy. And if a slump cannot be cured with easing followed by revival followed by tightening then something is wrong with the entire theory, even if it is Keynes. It is certainly possible that all this was evident in the 20s. Certainly it should have been obvious in the 60s. But the system was in deep denial. It still refuses to change.

The cubs are inflating oil again, measuring their own wealth effect. The apes cannot learn.

ME is crony cap and socialism, China is supplying the money and Germany the technology.

Wall Streets latest and greatest idea is climate money.

The short answer is that Wall Street, for the last thirty years or so, has been skimming prodigiously from the top. The graph above shows how the total economic cost of financial intermediation grew from under 2 percent in 1870 to nearly 6 percent before the stock market collapsed in 1929. It grew slowly throughout the postwar expansion, reaching 5 percent in 1980. Then, beginning during the deregulatory years of the Reagan administration, the money flowing to financial intermediaries skyrocketed, rising to almost 9 percent of GDP in 2010.

This is exceptionally counter-intuitive, as Philippon points out. Over the last forty years, information technology has increased efficiency and lowered costs throughout the economy. Retail and wholesale trade, for instance, have both shrunk by about 20 percent as a share of GDP since 1970, thanks to better technology and improved economies of scale.

The cost of financial intermediation, meanwhile, continues to reach record highs. “According to this measure,” writes Philippon, “the finance industry that sustained the expansion of railroads, steel and chemical industries, and the electricity and automobile revolutions was more efficient than the current finance industry.”

https://tcf.org/content/commentary/graph-how-the-financial-sector-consumed-americas-economic-growth/

Skippy…. drum roll…. and where did it all go – ????? – billionaire Olympus – ??????

” While banks need to pay depositors a reasonable rate to attract their savings into deposits, the low interest environment and pressure to lend require them to cut the rates they charge their borrowers. The result is a squeeze on margins”

Banks requierd TO CUT the rates? Have anyone seen that? I have not seen any order by Governor to banks to lower their lending rates. This is like abominable statement about real world.

Banks do not offer rates bellow 3,5% and only to wealthy and those that borrow small portion of their income.

Monetary policy doesn’t work at ZLB because banks do not follow official rate bellow 1,5% .

If official rate becomes -10% would banks offer their borrowers -1% for loans?

That shows how funy that quoted statement is.

Monetary policy works only if banks follow it in offering loans at close to official rate and lower it as official one is lowered or raise it as it is raised. Only way this policy of negative IR could work is if state owned banks offer official interest rate.

How is that such smart economist can forget how monetary policy works?

Thanks to Praedor for the great comment and discussion sparked by it.

I would add that a far superior way to ‘inject money at the bottom’ is to make it a national priority (one can even argue that this will have a far more beneficial effect on ‘national security’ than the elite-enriching perma-war-on-Terra BS) to resurrect the once-great American middle class which has been gutted by 4 decades of deliberate policy choices by our political/economic elites, with the focus being on re-onshoring some of those tens of millions of well-paying manufacturing and associated jobs shipped overseas during said great hollowing-out of the American economy. You can pay a person simply for breathing (a.k.a. basic income guarantee), but a far better outcome for all involved is to try to ensure there are decently-paying non-shit jobs for all who want them. A populace with the modicum of self-respect that comes from having a reason to want to get up in the morning is highly beneficial to the national social fabric, not to mention the non-Ponzi part of the national economic picture.