Yves here. This is an important piece that connects many important dots but rejects drawing other important inferences. The author Mark Cliffe seems unwilling to consider that economic policies becomes even more politicized when they fail (or worse, explicitly choose not to) deliver adequate wages and security to most citizens so that top earners can cream even more off the top. In addition, he also accept that high levels of international capital flows are strongly correlated with more frequent and severe financial crises. Thus he argues, as an article of faith, that reducing the amount of global integration would be a Bad Thing. Over the near term, he is likely correct in that any meaningful change in the economic order will result in transition costs. But despite describing the current state of dislocation fairly well, he seems unable to grasp that we are close to the end of the 35 year neoliberal paradigm, which substituted asset price booms and increased consumer access to borrowing for policies that focused on increasing average worker wages. In the topsy-turvy world of the new orthodoxy, worker prosperity was bad because…gasp…it might create inflation! And economists and policymakers have done such a splendid job of fighting the last war long after the inflation threat was vanquished that they are now on the verge of creating deflation, which is far more destructive than inflation, particularly in debt-burened economies.

And this analysis plays into an issue that we’ve raised as far as the fall elections are concerned. The economy is more vulnerable than the overwhelming majority of pundits seem to recognize. Rocky markets or further decay in the economy that the 99% live in will help outsiders at the expense of incumbents. Sanders’ big rise in the polls started in January, when market upheavals reminded voters that Wall Street still poses a risk to the economy and the last time they blew it up, they walked away with cash and prizes rather than orange jumpsuits.

By Mark Cliffe, Chief Economist, ING Group. Originally published at VoxEU

The extended period of low growth following the Global Crisis was denoted the ‘New Normal’ by some. This column argues that the period is still ongoing, and would be more usefully described as the ‘New Abnormal’. Far from being an equilibrium, the low growth was achieved by progressively more aggressive and unprecedented monetary policy actions, in response to a series of financial panics. Furthermore, the aftershocks of the Crisis are still colliding with a series of profound structural changes to and instabilities in the global economy.

The ‘New Normal’ never was, isn’t, and should be replaced by the ‘New Abnormal’. In the wake of the Global Crisis, the idea that the global economy had entered a low-growth equilibrium gained a curious acceptance. In reality, the situation is far from ‘normal’, and the attempt to characterise it as such has been deceptive, disingenuous, and dangerous.

Instead, economists, policymakers, and investors would be better advised to think of the world economy as being in a period of profound disequilibrium, as the aftershocks of the Crisis collide with and complicate a range of structural changes. Ever since the onset of the Crisis in 2007-08, the global economy has been repeatedly flirting with a descent into an even more damaging deflationary depression. Policymakers have averted this only by a combination of luck, judgement, and experimentation.

Belatedly, Mohamed El Erian – who, along with his former colleagues at PIMCO did much to promote the concept of the New Normal after they first floated it back in 2009 – has just abandoned it. He has argued that “it is no longer unusual to suggest that the West could linger in a low-level growth equilibrium […] Yet, […] growing internal tensions and contradictions, together with overreliance on monetary policy, are destabilising that equilibrium” (El Erian 2009).

However, the suggestion that we have been living through a New Normal ‘equilibrium’ for the past seven years is hard to swallow. Normality suggests that the Crisis is behind us, and that we again understand what’s happening and that we can make predictions. It invites little sense of urgency to make radical policy adjustments. Indeed, it tempts us into thinking policy ‘normalisation’ may be around the corner.

Indeed, it is hard to apply the dictionary definition of ‘normal’ to our recent experience – dictionaries typically define it as regular, usual, healthy, natural, orderly, ordinary, rational. There are several reasons why the term ‘abnormal’ might be more easily be applied. Rather than an ‘equilibrium’ we might more usefully think of the economic environment as having been one of latent or incipient instability.

Unprecedented and Unbalanced Economic Policy

The first ingredient of the New Abnormal is the fact that the mediocre growth that has been achieved over the past few years has depended on unprecedented and progressively more aggressive monetary policy initiatives. Meanwhile, fiscal policy, after the emergency easing of 2009-10, has been largely side-lined as a stabilisation tool. High levels of public debt have led most governments to calculate that they have little scope for fresh fiscal stimulus, notwithstanding the sustained fall in the yields on government bonds.

The impetus for further monetary easing has typically been propelled by renewed panic attacks in the financial markets, which have rekindled the fears of a fresh chaotic downturn. The near-death experience of the Eurozone in 2011 following the emergence of the Greek debt crisis, the ‘taper tantrum’ in the emerging markets of 2013, and the China-inspired sell-offs of the past year all forced radical rethinking and easing of policy by the central banks. Zero interest rates, large scale asset purchasing (quantitative easing), and then a shift to negative interest rates, all have taken us into uncharted territory.

This policy experimentation is hardly consistent with the New Normal notion that the global economy has been naturally gravitating towards a low-growth equilibrium. While the US Federal Reserve finally took the first step towards ‘normalising’ policy with an interest rate rise in December, the Bank of Japan and ECB have been busily ‘abnormalising’ with negative rates and more quantitative measures to pump money into their financial systems.

The very fact that these monetary innovations are unprecedented means that their impact is unpredictable. This necessarily increases the scope for policy errors and conflicts. Indeed, the lack of consensus on what needs or can be done is palpable. One sign that all is not well is the recent emergence of a vitriolic debate about helicopter money, whereby central banks create money to distribute to citizens directly or via the government.

Pre-Crisis Economic Relationships Have Broken Down

Policy judgements are also clouded by the fact that pre-Crisis economic relationships have broken down. While the New Normal crowd try to declare the crisis a one-off interruption, it is clear that a range of structural changes are still in progress. We are faced with the rebalancing of China away from investment and export-led growth, sectoral shifts in the labour market, and a range of disruptive new technologies. On top of these, we are still contending with the unfinished business of tightening financial regulation and reshaping the financial system. Each of these structural shifts come with profound social and political consequences.

In this context, how do we identify ‘trend’ economic growth? Where are we in the cycle? Talk of the New Normal shows how far the consensus still suffers from the ‘equilibrium delusion’. This is precisely the kind of thinking that led to the financial crisis in the first place.

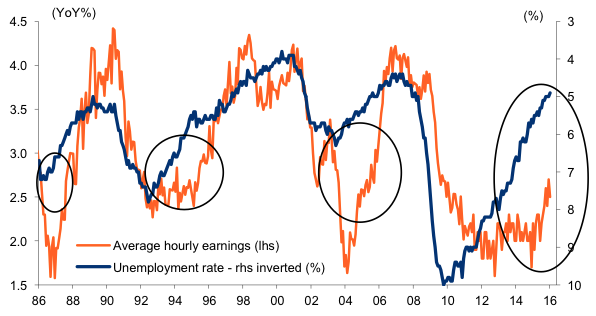

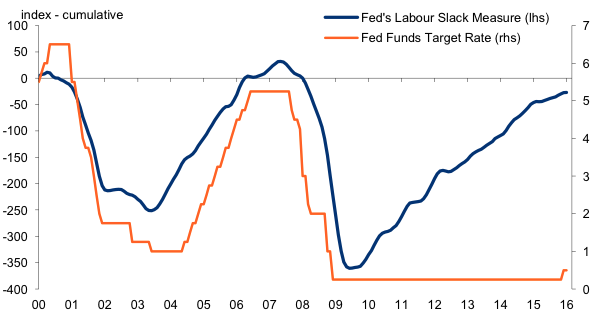

Two examples from the US illustrate the structural problems facing policymakers. Figure 1 shows how falling unemployment failed to lead to the acceleration in wage growth that is typical before the crisis. In a similar vein, this has led the Fed to hold off from raising rates. At the current level labour market ‘slack’, as measured by the Fed’s own favoured index, the Fed funds rate ‘ought’ to be at close to 5% by now.

Figure 1. Despite falling US unemployment, pay is slow to pick up

Source: ING, Macrobond.

Figure 2. The Federal Reserve has been slow to respond to the tighter labour market

Source: ING, Macrobond, Bloomberg.

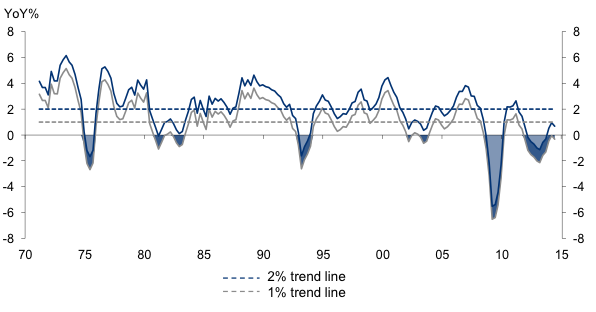

Weak Economic Growth May Make Recessions More Frequent and Prolonged

While the New Abnormal makes it hard to identify the trend, insofar as economic growth is weaker on average, recessions are likely to be more frequent and prolonged. Taking the Eurozone as an example, had its growth trend been lowered from 2% to 1% since 1970, then the number and duration of recessions would have been doubled (see Figure 3). Indeed, this might be something of an underestimate, since the damage from recessions arising from increased unemployment, bankruptcies, defaults, and political tension tends to persist.1

Figure 3. Eurozone real GDP – the impact of 1% lower trend growth

Source: ING, EcoWin.

Policy Divisions are Heightened by Political Tension

Economic weakness and instability are also sources of political tension, both within and between countries. High unemployment and rising inequality have fuelled a backlash against globalisation, free-trade, and big business. At least outside the US, support for progressive taxation and tougher regulation has grown. This may weigh on financial markets and corporate confidence and investment. In this way, there is the danger of a negative feedback loop between economic and political instability.

Were the populist backlash to lead to material shifts in the thrust of policy, then it would have lasting, structural effects. For example, backtracking on trade liberalisation could damage the growth in trade and investment. So distribution, institutions, and politics matter. This is something which is largely overlooked by the neoclassical economic models, with their single representative agents, which are still doggedly employed by many economic forecasters.

Asset prices are more vulnerable to setbacks

Central banks have successfully boosted asset prices, not least because of the heavy purchasing of bonds in their QE programmes. Indeed, this has invalidated the original New Normal prediction of low investment returns. Since their nadir first quarter of 2009, US equities have returned an annualised 16%, corporate bonds 9%, and even government bonds over 4%. However, this leaves asset markets vulnerable if the economic reality fails to measure up to these higher valuations.

Moreover, the regulatory-driven shift of risk away from taxpayers towards markets compounds this risk. The sell-off in bank contingent convertible bonds(CoCos) earlier this year is one example of such fragilities. The essential point is that attempts to increase the resilience of individual banks do not necessarily make the system as a whole more resilient.

Such uncertainty lies at the heart of the New Abnormal. The attempt to sweep this collection of structural instabilities and fragilities under the carpet with talk of a New Normal is a damaging distraction to the urgent task of confronting this reality.

See original post for references

[Mark] Christ’s College, HSBC Chief International Economist, now ING Analyst…a Bankers Banker.

Yves, your range of economic & political realities are no match for the ‘Marks’.

spot on synopsis…further confirmation for your following.

From near the end: “This may weigh on financial markets and corporate confidence and investment.”

Uhh, WHAT investment? Lack of investment in new equipment and new employment is exactly one of the major problems in the “new normal.”

As for corporate confidence: given how corporate executives have driven their industries and economies into the ground, a massive loss of corporate confidence would probably be a very welcome indication that the buffoons are upset they are no longer being allowed to continue their looting, pillaging and wrecking.

You are absolutely correct, Tony. There are many $Billions being used for stock buybacks, and precious little being invested in production (and productivity). This does not bode very well for the future.

Good that you point out the lack of investment going on at the corporate level. The main concern is about stashing cash in every crook and cranny except for R & D. So: Lay off employees (downsize-download to the Pacific Rim) cut benefits, slash wages and reward the vultures at the top. New Normal indeed except some aspects of it (no money for R & D) are hangovers from three decades ago.

In what world? Seriously, what is the evidence-based warrant behind that claim? The prices of (decent) housing, (quality) medical care, educational credentials, (healthy) food, (reliable) transportation, and so forth, have risen dramatically relative to median wages and productivity growth over the past few decades as wealth and power have concentrated into ever fewer hands.

I completely agree wtih you Yves that mainstream intellectuals and pundits refuse to acknowledge (well, at least publicly where their cushy careers might be threatened) how vulnerable the economy is. But the economy is not vulnerable because prices might fall. The economy is vulnerable because the price of a decent standard of living is so absurdly high relative to median wages. We live in a time of tremendous aggregate abundance and yet most people barely have enough to get by from paycheck to paycheck. And those are Americans fortunate enough to have avoided the direct supervision of the criminal justice system which our academic economists essentially ignore.

supposedly 50% of americans can’t put their hands on $400.00 Cash, even 25% would render contagion. in this regard, We The People Are Deflating. and your correct..if economist/’analyst’ had to live these realities, they’d be out of a job!

Wage deflation.

Your point is spot on, but you are missing the definition of deflation by confusing “wages” with “real wages”. Deflation is prices going down regardless of wages. You are completely right that real wages are going down, but “real wages” means wages adjusted for inflation.

The problem with low inflation/deflation is that it leads to a wage spiral. Employers take in less money, and so pay less in wages; workers with lower wages buy less, so employers lower prices… and so on. What you are describing is a more acute part of the equation: I have to work more hours to buy what I need to survive, and you are 100% right that this is the real problem that needs to be addressed.

Also, he is talking about non-discretionary spending. With the prices for consumer goods and such go down, those companies are going to have a hard time fulfilling their liabilities. Then you are in a spiral, where those who do have plenty of discretionary income can buy anything, while the rest are squeezed into abject poverty.

Which had an interesting political effect. Since the poor have no political power in the US, and the wealthy benefit, the State might find deflation desirable.

I don’t really follow the first part of your comment? I’m not missing the definition of deflation. I’m challenging people calling for deflation to summarize the specific evidence behind the claim. This has been one of the fundamental blind spots in our professional class, and it’s particularly noteworthy that even a lot of leftist economic thinking minimizes the extent to which costs have risen in our society.

As to the second paragraph, you are assuming a starting point of fair prices and broad distribution of wealth. We have the opposite. We have a ratio of prices to median wages that is absurdly high and an extremely uneven distribution of wealth. Lowering prices (or similarly, raising wages) would not cause some sort of death spiral. Quite the opposite, it would return us to a healthier system.

Sorry if I was unclear, I’ll try again. We mostly agree, so just to emphasise:

Agreed! It is a huge problem that the major costs people face are health care, housing and student loans, and these are all increasing much faster than wages, but they are not properly reflected in the CPI calculation of the inflation rate.

Agreed! the biggest problem is, like you say, this wealth is all hoarded by a microscopic minority. Inequality is the effect and the plague.

Where I think you are being imprecise is when you say

or similarly

(emphasis mine)

What is the difference between saying prices have gone up vs saying prices have gone up “relative to median wages”? It is the difference between wages and real wages. The first is just prices (useless numbers without context) while the second is the relation between prices and wages. In other words, what the samhill good does a 10% raise do me if prices go up 15%? Or conversely, what do I care that prices have gone down 5% if my wages have gone down 10%? Cliffe is not complaining about deflation compared to wages, as you rightly are– he is just complaining about deflation.

To put this in other terms, what is the problem with low inflation/deflation claimed here by Cliffe and others? As I have repeated several times on this site, inflation or deflation are not problems or goals: they are indicators. Deflation is an indicator of a major problem in an economy: lack of demand. The prices of a lot of goods/services (not including the ones you mentioned like healthcare, housing, credentials…) are going down because workers are not (as you also mentioned) getting paid enough to buy them. This leads to the deflationary spiral I mentioned. The solution is not to say let’s have lower prices or stop price increases– the solution is rather to pay people more than a living wage (wages adjusted for inflation). Increase median net household wealth compared to prices. Prices could go up or down tenfold; it does not matter so long as wages stay ahead of them, which (as you once again correctly pointed out) they clearly haven’t.

https://www.federalreserve.gov/releases/chargeoff/default.htm

Dismal would be Great. where’s a release on the shadow banking ind.?

1870s-1890s Long Depression was like that too.

“Disequilibrium flirting with Deflationary Depression”, and at the same time, major technological shifts.

It’s my go-to reference point in history.

The central banks are obviously up sh creek without a paddle, taking the majority with them, and becoming psychotic. That’s the recipe for war. The immediate problem is ignoring the fixation of CO2 and printing more money for the experts, with artificial scarcity in a positive feedback loop as the result.

One way or another, the Hillary gang is going to get smoked, and a lot of young people are going to see new opportunities. That man came from woman is far more probable, but arguing over the past for a few thousand years doesn’t get you anywhere, and one cannot exist without the other, and neither can survive without children, subjecting themselves to genetic degeneration by shorting the multigenerational negative feedback loop.

The gang leader does not determine outcomes, and there is no short cut to the future. The majority tries to stick a Fred Flintstone wheel into the gear set every time, and nature crushes it and spits it out every time. Learning is a proactive activity, which is why expert systems fail every time, and are so easily replaced by AI.

The transformation of light energy to chemical energy to biological energy is a quantum gear set in a screw, one of God knows how many in the universe, and the unknown isn’t going to tell you what to know anytime soon. “Chance favors the prepared.” The church new the earth wasn’t flat just as the reptiles new there was life beyond the Nile. The speed of light, measured by the blind in a shrinking corner, is only a limit if you accept the assumption.

Faster trains and bigger airports with exponentially increasing security isn’t getting the insecure anywhere. Every failed “economy” in History has been a human slave farm. They all begin with natural resource exploitation, accelerate demographic growth, and crash with deceleration, but somebody still had babies or you wouldn’t be here.

No matter how you look at it, life is a leap of faith. Have your 4 or 5 kids and if the corporate welfare recipients say anything, politely but firmly tell them to go screw themselves, which is what they are going to do anyway. We didn’t work our butts off and put up with all the bullsh just for you to be farmed by moneychangers with debt. And pay your debt forward, not backward, to the next generation. You know what they say about patriotism; life is a two way street, not a blind alley built to ambush the weary. The inflation deflation argument is obviously a smoke screen.

Let’s assume you failed to identify appropriate soil for your seed, your children, you have that $5k, which I just showed you how to turn into lots of paper, in 100s, and are looking for an abutment,

Charleston

Virginia Beach

North Denver Area

Louisville

Ocean Shores WA

Tillamook

Friendship Park CAN

In worst case scenario

Orlando

Reno / Vegas

No next dimension Navy, no new reserve currency, when it is needed and Not before.

I agree

http://www.bls.gov/cpi/cpifact4.htm

“Although medical insurance premiums are an important part of consumers’ medical spending, the direct pricing of health insurance policies is not included in the CPI. As explained below, BLS reassigns most of this spending to the other medical categories (such as Hospitals) that are paid for by insurance. The extreme difficulty distinguishing changes in insurance quality from changes in its price forces the CPI to use this indirect method.”

==============================================

Apparently the inflation figuerer outers can’t figure out that health insurance is costing more, with more deductibles, co-pays, services not covered or in circumstances so limited that it is essentially not covered, and ad infinitum with what used to be covered no longer is.

Yes, TV’s are much cheaper than they used to be. Yes, phones are much cheaper. However, as ever consumer interaction is basically a company grifting you with deceptive and hidden charges that I doubt the BLS is aware of (or wants to find) I look upon the inflation numbers with skepticism. TV’s and phones are a very, very minor part of the financial transaction – what matters is your cable, satellite, and phone service recurring charges, and those have been going up vigorously.

From the BLS on how phone and internet service costs are calculated for inflation:

“Some carriers are unwilling to reveal internal data on revenue for their various plans, despite explicit BLS data confidentiality policies and federal laws designed to protect sensitive data. When the carrier is unable or unwilling to provide revenue information, the data collector asks the carrier for a sample of “dummy” bills that reflect what customers pay for services. If the carrier is unwilling even to provide dummy bills, the data collector seeks the carrier’s permission to select among residential plans the company offers publicly (usually on their website)***.

Once a specific service is selected, its detailed characteristics are recorded so that the same item can be priced over time, and, if the carrier discontinues that item, the most similar replacement for it can be substituted. If the carrier provided sample bills, characteristics from the bills are used to define the specific service to be priced; to preserve confidentiality, personal information, such as customer name, is never used as an item characteristic.”

Whoa! Does that give you confidence in the BLS inflation numbers?

And as always, I note that the averages and aggregates hide the fact that a lot of people’s REAL inflation rate, i.e., 2% inflation and 2% annual decrease in REAL compensation (e.g., more erratic schedule, paying for uniforms, called a “manager” so overtime is less available, and on and on) means the real inflation rate for most people is 4% or higher.

***So…..everybody think their phone, cable, and internet providers clearly and transparently make clear what you are getting and provide a listing of their products**** so that an easy comparison of the products and services can be make???? If you believe that, you probably believe the health insurance providers do the same…

****like the 137 channels ….except, many, many of the channels were the same stations JUST ON DIFFERENT channels… so the net number of novel channels was about 30.

Figure 2 showing the Fed’s labor slack measure [what is it?] approaching boom-time levels is stunning. If that were true, wages should be soaring. But they aren’t.

Two Dartmouth professors published a paper last year, in which labor slack is measured not only by short-term unemployment, but also by incorporating data for underemployment and reduced participation.

At the conclusion, they plug their formulation into a Taylor rule and find that it could suggest a policy rate as low as -1.74 percent (as of early 2015).

http://www.dartmouth.edu/~blnchflr/papers/Blanchflower-Levin%20labor%20slack%2024mar2015.pdf

This is not to advocate for negative rates, but rather to claim that if the Yellenites try to use tightening labor market conditions as an excuse for hiking rates, they are way off base.

Twelve people are recognized as seeing 2008 coming and are on public record beforehand with their warnings.

I am familiar with three of them Michael Hudson, Steve Keen and Peter Schiff.

None of them think anything has been done to sort out the problems that caused 2008.

There have been no efforts to deal with the private debt overhead weighing down the global economy though repayments.

The Central Banks have done all the wrong things by maintain the financial system without clearing any of the bad debt from the system.

Their low interest rates have held off the default tsunami but encouraged even more debt to be taken on, stopping the immediate crisis but making the debt crisis in the future even larger.

The “New Normal” is just a reflection of a refusal to acknowledge the problem.

An interesting coincidence to me: The neoliberal tide rose with Reagan, who came into office when the Fed Funds rate had just been raised to 20% to stamp out inflation. From 1982 on the feds fund rate kept dropping bit by bit. As interest rates fell asset prices rose. Now we’re essentially at 0% and have been for quite a while and will be for a while longer. I wonder if neoliberalism got legs on high interest rates (was seen as the solution), kept going as interest rates kept falling, and is now stalling out as an economic program because no more rate cuts are possible and the real economy is in the ditch. Will prolonged 0% interest rates or slowly rising interest rates finally undo neoliberalism ?

I wonder what’s the relationship between the ways in which neoliberalism would be susceptible to what you’re talking about, and the personal or psychological component that Mirowski talks about in the “Everyday Neoliberalism” section of _Never Let a Serious Crisis Go to Waste_. I think he is suggesting that the system gets reinforced because ordinary people are forced to imbibe it all the time through being obliged to view the world through the lens of the neoliberal theorists in a variety of big, medium & small ways, like the human capital ideas, or like neoliberal theorists’ intentions for how we will approach our credit scores, debt, jobs, etc. Can it even be undone quickly, by means that are central-bankie and not psychological too?

Belated thanks Yves for covering my piece. I believe that our thinking is more aligned than you portray. You suggest that I’m “unwilling to consider that economic policies becomes even more politicized”, even though I argue that “there is the danger of a negative feedback loop between economic and political instability”. The rise of Trump and the growing risk of Brexit are but two signs of that danger growing.

Similarly, you suggest that I “seem unable to grasp that we are close to the end of the 35 year neoliberal paradigm”. I’m not as confident as you are in making such a prediction, but I certainly recognize the possibility when I characterize “the economic environment as […] one of latent or incipient instability”. Nor would I be as confident as you are of the costs of departure from the neo-liberal paradigm being merely ‘transitional’. Your efforts to identify superior policy alternatives are laudable, but it is far from clear that any of the current growing crop of populist politicians are anywhere near finding them.