Yves here. One of the ironies of the fact that central banks appear to be throwing in the towel on negative interest rate policies (NIRP) is that their elite economist allies appear not to have gotten the memo. A noisy contingent is pushing to eliminate cash, and one of the big justifications is to allow central banks to engage in NIRP more effectively.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

Markets are suspecting that central banks are in the process of exiting this fabulous multi-year party quietly, and that on the way out they won’t refill the booze and dope, leaving the besotted revelers to their own devices. That thought isn’t sitting very well with these revelers.

In markets where central banks have pushed government bond prices into the stratosphere and yields, even 10-year yields, below zero, there has been a sea change.

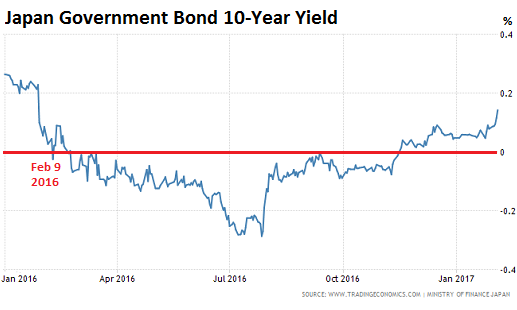

The 10-year yield of the Japanese Government Bond (JGB) jumped 2.5 basis points to 0.115% on Thursday, the highest since January 2016, after an auction for ¥2.4 trillion of 10-year JGBs flopped, as investors were losing interest in this paper at this yield, and as the Bank of Japan, rather than gobbling up every JGB in sight to help the auction along, sat on its hands and let it happen.

And on Friday morning, the 10-year yield jumped another 3 basis points to 0.145%!

In September last year, the BOJ started the now apparently troubled experiment of trying to control not just short-term interest rates but also the entire yield curve. It targeted a 10-year yield of about 0% (it was negative at the time). Analysts believed that this would mean a range between -0.1% and +0.1%, and that if the yield rose to +0.1%, the BOJ would throw its weight around and buy.

But the fact that the BOJ allowed the yield to go above that imaginary line signaled to the markets that it no longer has the intention of capping the yield at +0.1%, that in fact the BOJ has stepped back.

This happened even as BOJ Governor Haruhiko Kuroda, on Thursday, once again was trying to jawbone the markets with a verbal commitment to his yield-curve targeting strategy and his mega-QQE of ¥80 trillion ($710 billion) a year in asset purchases.

The 10-year yield had fallen below zero for the first time on February 9, 2016, as the BOJ began dabbling with its own negative interest rate policy (NIRP), because its zero-interest-rate policy and its mega-QQE bond and stock buying binge somehow wasn’t enough, and because everyone in Europe was doing it. But that’s like so ancient history now (via Trading Economics; red marks in the charts below are mine):

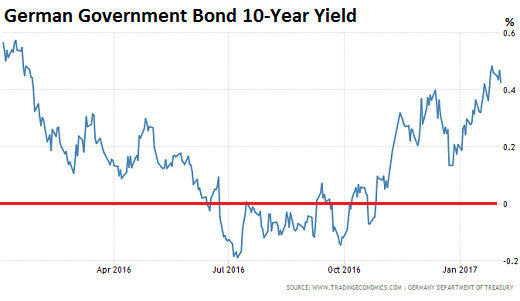

Germany, the second largest NIRP fiefdom, is subject to the ECB’s crazed NIRP absurdity and asset-buying binge that includes government bonds, corporate bonds, covered bonds, asset backed securities, and what not.

But there too, bonds have fallen in price despite the ECB’s purchases, with the 10-year yield emerging from negative la-la land just before the US election and soaring after it. There are now rumors that the ECB will announce sometime later in 2017 the untimely and slow death of QE (via Trading Economics):

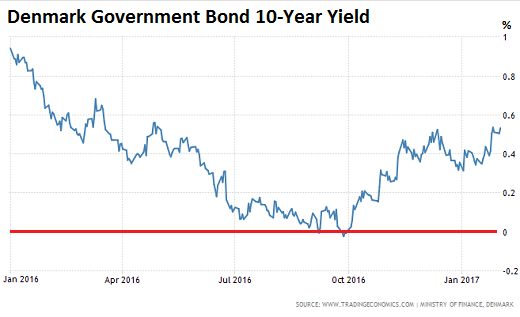

Denmark, whose households are the second biggest debt slaves in the world, still has its own currency and therefore its own monetary policy, and therefore its own NIRP. But the 10-year yield only briefly dipped below 0% and has since rumbled higher (via Trading Economics):

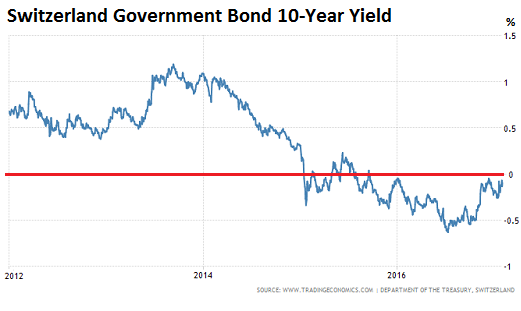

And that leaves Switzerland, whose households are the Number 1 debt slaves in the world, as the lone straggler in the 10-year negative yield absurdity, but it too is about to exit.

Its 10-year yield plunged below 0% in January 2015, the first sovereign debt in that maturity to do so, when the Swiss National Bank scuttled its currency cap against the euro, and at the same time cut its benchmark interest rate from -0.25% to -0.75%. It was a day of chaos that those who got tangled up in it will likely never forget. A lot of wealth was transferred, by dint of a central bank decision.

The charts above covered one year because that was the time frame of negative 10-year yields in those countries. But in Switzerland, the story started two years ago hence the five-year chart. On Wednesday, the 10-year yield rose to -0.10%, and on Thursday, it rose further to -0.024%, getting perilously close to 0%, before easing back to -0.04% (via Trading Economics):

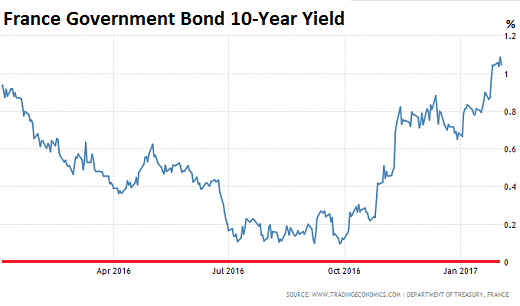

In France, the 10-year yield never quite made it into the negative. The French government would like nothing more than to maximize its profits from its debts, which the negative-yield absurdity allows it to do. But it only got within a hair of it in September 2016 when the 10-year yield reached an all-time low of +0.10%. Close, but no cigar.

France, I believe, was the country whose 10-year yield got the closest to participating in the NIRP absurdity without actually making it. Alas, since then, bond prices have tumbled as the 10-year yield has soared over a full percentage point to 1.05% (via Trading Economics):

These 10-year yields are still very, very low at a time when the annual inflation in the Eurozone has shot up to 1.8% and is threatening to tear higher. Financial repression at its finest continues.

In the US, 10-year Treasury prices have also fallen and the 10-year yield has surged by over a full percentage point since last summer. Unlike the central banks in Japan and Europe, the Fed is on a path of raising rates and is also thinking out loud about unwinding its big-fat balance sheet by shedding some of its Treasuries or mortgage backed securities or both.

So it would make sense for US yields to rise. But why are yields in the bailiwicks of the other central banks so jumpy? Because markets smell a rat – as central banks, despite ceaseless jabbering, appear to be sitting on their hands after years of iron-fisted market domination.

But markets have gotten so used to central-bank booze and dope that they “cannot believe” it will ever really end. Read… “Watch Out for the Shock”

Update: The Japanese Central Bank just stepped in. Moving on.

Any bond experts out there that can help this rube out?

The 10-year yield of the Japanese Government Bond (JGB) jumped 2.5 basis points to 0.115% on Thursday, the highest since January 2016, after an auction for ¥2.4 trillion of 10-year JGBs flopped, as investors were losing interest in this paper at this yield, and as the Bank of Japan, rather than gobbling up every JGB in sight to help the auction along, sat on its hands and let it happen.

And on Friday morning, the 10-year yield jumped another 3 basis points to 0.145%!

For argument’s sake, a bond of 1,000,000 yen at an interest rate of .115% earns 1,150 yen annually and at .145% earns 1,450 yen, an increase of 300 yen.

To earn 1,150 yen at an interest rate of .145% requires 793,103 yen. Did that original 1,000,000 yen bond lose over one fifth of it’s “value” on that 3 basis point move?

Anyone, please correct me if I am wrong?

Your calculation is for a perpetual bond, one that pays interest forever but has no payoff at maturity. The calculation is quite different for a bond that terminates interest payments and repays principal after ten years.

@cnchal – Yes, that bond probably did lose about 20% of its value. The 3 basis point increase is a 26% increase in the rate from .115% to .145% (.030/.115=.2608=26.08%), so the decrease in the value of the bond will be of similar magnitude.

Huh, imagine that, bond buyers want to actually make money on them. Crazy idea!

Thanks for this post. Enlightening to this casual, intermittent market observer. So it seems that after over thirty years of gradual interest rate suppression and appreciation of bond prices that culminated in negative nominal and real interest rates, tighter money is on the table; although real interest rates will presumably continue to be managed below the rate of CPI inflation absent systemic political change.

Timely article by Sergey Pekarski in the February issue of the International Journal of Central Banking that supports this policy shift. One important implication he noted: …”an increase in the present value of future budget deficits does not necessarily have inflationary consequences.”

annual inflation in the Eurozone has shot up to 1.8% and is threatening to tear higher.

Yikes, TAKE AWAY THAT PUNCH BOWL! No doubt wage-push inflation. Or not.

Apparently you can get paid to borrow money.

http://www.npr.org/2015/04/14/399641297/when-rates-turn-negative-banks-pay-customers-to-borrow

Hopefully the “war on cash” will quietly end too.

This is madness and rent seeking.

– War on cash

– High bank fees

– Negative interest rates

That is a transfer of wealth from people to the banks. It won’t be your community credit union that sees the profits, but the large mega banks.

How can you have capitalism if you have destroyed the value of capital? That in essence is what they have done. Zero interest rates, and endless money printing = reduction in purchasing power of the masses, and huge increase in asset prices for the elites. Good luck trying to find the money to buy a house or an education or a health care program. Never mind, those helpful people at the Fed have the answer. Endless debt.

If the Democratic Party wanted to do something major to help the majority, it would become hostile to the Fed. Perhaps Nanci Pelosi (I love capitalism) could question why Goldman Sachs and J P Morgan get 0% or .25% interest rates while students get 3 to 6% on their loans.

Global central banks are now buying up the world stock markets with cheap money. They are taking them private. Anything to avoid the poor elites losing their shirts when interest rates start to rise and markets fall. So who will be left owning all this giant pile of rubbish just as they whole thing collapses into the ground? Well, you and and me, and our children with a giant pile of debt.

Bravo. I’d modify your opening statement tho:

How can you have capitalism if you have destroyed the very concept of “money”?

I give you 100, two years later you give me back 98. That’s not money. Money does not contain the concept of a guaranteed unavoidable capital loss (unless you’re talking about seignorage, which we’re not). That’s a tax system.

Of course the geniuses like Rogoff want to repeal cash, because it’s money. You might call this other “tax collection certificates” or something.

In a debt-based money system the banks can only print the principal they can’t print the interest. So you must have constant “growth” to stay ahead of the machine, or you must insure that debt service (interest) is so low as to be laughable (and destroy banks, insurers, and savers in the process).

Don’t get me started on central banks printing money to buy stocks. I have just one question for the geniuses who think that is a good idea: how would you ever know what a stock is worth?

It’s more a war on growth than cash. imo for the last century we lived on inflation and it paid for all the growth and prosperity, or “prosperity” since we have left an insurmountable environmental deficit now that we’ve decided to stop growth – so paying to fix it can only be centrally planned. In order to stop growth we must stop the thing that feeds it: inflation. Higher interest rates are the driver of higher everything. So in order to control growth and inflation they have to contain higher interest rates. They can’t let interest rates run amok in a suicidal world that only understands a paradigm of debt service by perpetual economic expansion The whole thing is on the brink of imploding already. This makes sense to me but what doesn’t make sense is how effective NIRP will be going forward if we succeed in turning cash into digits – it will facilitate central planning and prevent bank runs – but logic fails me when I look for beneficial changes to our current absurd economics.

A financial collapse is inevitable, but their ability to put it off has grown. The system should have gone down in 2008 but they avoided the bullet. Next time who knows? The’re $20 trillion in debt now. In the late 1980s It was a mere $850 billion in debt.

Problem now is who is going to buy any new debt? China and Saudi is dumping US debt. At the moment the central banks are taking up the role as buyer of last resort. I saw a graph the other day which sowed US debt since Nixon took the U.S. off the gold standard in 1971. Unbelievable how it has sky rocketed.

A finacial collapse maybe the only way you will get political change now. Particularly on the democratic side. If the elites want to get rid of Trump they may crash the system quite soon.

Even if they get rid of Trump, the anger that spawned him will still be there.

It’s only a matter of time before someone else wins. The elite are facing a legitimacy crisis, only they are too arrogant to see it.

Thank you Sally for an honest bias-free post from the heart. I wish there were more people like you speaking out.

Sure the debt has expanded in nominal terms from $850B in the late 1980s to $20T today, but dollar has also lost an enormous amount of its purchasing power over that same time period. The Fed can put as many dollars into circulation as it wants to to pay down that debt, with a corresponding loss in the dollar’s purchasing power.

In a normal world, problems would have started to materalize when purchasers of US treasuries lose faith in the future dollar’s purchasing power and demand higher interest rates as compensation for the risk. But, with central banks around the world buying up their own sovereign debt and keeping interest rates artificially low – with few short term consequences – the policies of extend and pretend can continue as long as necessary. Eventually it will prove diasterous, but like climate change, I wouldn’t hold my breath waiting for calamity anytime soon.

Everyone misses the most important aspect of banning cash, viz. that it is almost impossible for the commercial banks to engage in any type of activity with the non-bank public without causing an alteration in the money stock. Whereas the volume of currency needs no formal or specific regulation since it is impossible for the public to acquire more of an given type of currency without giving up other types of currency, or else demand or time deposits.

The basic process by which currency is put into and taken out of circulation is through the banking system. This distinguishes a managed currency system (since the quantity issued is dictated by the impersonal needs of trade and not determined in any way by the government’s needs for revenue), from a fiat currency system and makes our currency self-regulatory.

Since banning cash exacerbates the impounding and ensconcing of voluntary savings within the confines of the payment’s system, it is a contractionary and deflationary public policy. Such a ban will reduce R-gDp and reduce overall incomes.

The latest money flow #s put R-gDp c. 4% in the 1st qtr. 2017:

7/1/2016 ,,,,, 0.109

08/1/2016,,,,, 0.111

09/1/2016,,,,, 0.112

10/1/2016,,,,, 0.039

11/1/2016,,,,, 0.105

12/1/2016,,,,, 0.109

01/1/2017,,,,, 0.126

02/1/2017,,,,, 0.134

03/1/2017,,,,, 0.139

There’s been an acceleration in money velocity. So bonds are a bust.