Yves here. Notice how the authors stress how squaring up Brexit accounts is less important than other issues the UK and EU need to sort out. It’s also almost certainly less complex. Yet look at what “less complex” amounts to.

By Zsolt Darvas, a Research Fellow at the Institute of Economics of the Hungarian Academy of Sciences and Associate Professor at the Corvinus University of Budapest,Konstantinos Efstathiou, a Research Assistant at Bruegel, and Inês Goncalves Raposo, a Research Intern at Bruegel. Originally published at Bruegel

Is Brexit a divorce, or is the UK leaving a club? This is the first question to answer as negotatiors discuss the key aspects of the EU-UK financial settlement. The authors present various scenarios, and find that the UK could be expected to pay between €25.4 billion and €65.1 billion. But the final cost can only be calculated after extensive political negotiations.

Negotiations over the Brexit bill, the expected payment by the United Kingdom to settle its financial commitments when it leaves the EU, are likely to be contentious and attract vivid public attention. In fact, this financial settlement is the least important economic issue in the Brexit negotiations, as we argue in our new paper breaking down this Brexit bill. From an economic perspective, future arrangements for trade, financial services and labour mobility between the EU and the UK are much more important.

Nevertheless a conditional agreement at least on the methodology for calculating the Brexit bill could be a prerequisite for more meaningful discussions on the new EU-UK economic relationship. To bring transparency to the debate and to foster a quick agreement on the bill, our paper makes a comprehensive attempt to quantify all the various assets and liabilities that might factor in the financial settlement. Since the paper is rather long, we summarise our key findings in some blog posts. Largely data-based posts look at EU assets and EU liabilities. But in this blogpost we put the two sides together and raise twelve questions which negotiators need to answer in order to calculate the bill.

- Is Brexit more like a “divorce” or “cancelling a club membership”?

When someone joins a club, like a gym, she is not asked to make a lump-sum payment for a share in the assets of the club. So when a member leaves the club, she may not claim any part of the assets, like a share of the changing room or fitness equipment. However, if the member committed to a certain period of membership, the membership fee should be paid up to the end of that period.

The EU is of course much more complicated than a fitness club, but the analogy has merits. The “EU is a club” model would suggest that the UK may not claim a share of the EU’s assets, but would still have to pay for the commitments to which it agreed. In contrast, if Brexit is considered as a divorce, then all assets and liabilities should be split.

- What would be the “committed membership fee” period?

For both the club membership cancellation and divorce approaches, a key question is how we define the period for which the UK has committed to make contributions. This issue is particularly complicated given the special nature of EU budgeting, which includes planned payments and planned commitments, with the bulk of planned commitments made in a particular year deferred for payment in later years. (See our blog on EU liabilities for a more detailed discussion of this).

In 2013, the UK agreed to the EU’s seven year budget plan, the 2014-20 Multiannual Financial Framework (MFF). So perhaps all possible commitments which can be derived from the MFF should be included in the Brexit bill calculation. This is one option, but political discussions may consider other possible agreements. Some options are listed below, ordered from the largest Brexit bill to the lowest Brexit bill:

- Include all planned budgetary commitments related to the 2014-20 MFF up to the end of 2020: these include €580 billion planned payments in 2019-2025.

- Include legal and budgetary commitments made before the Brexit date: these include €398 billion of planned payments in 2019-2023.

- Include planned payments up to 2020.

- Only include actual payments up to the Brexit date.

A futher issue is the fact that, when the UK agreed to the 2014-20 MFF, it did so in the belief that it would remain a member of the EU and benefit from EU membership. Therefore, the degree of the UK’s access to the EU single market after Brexit, and other elements of the new EU-UK relationship, might also be factors to consider when answering the question above.

- How should the UK’s share of EU commitments be calculated?

Of course these commitments and liabilities need to be divided up, and the UK assigned a share. The UK’s historical share of gross EU budget contributions seems to be a good candidate, but the calculation is complicated by the so-called ‘UK rebate’. Since 1985, the UK has been entitled to a financial rebate of about 66% of its net contribution to the EU budget in the previous year. If the calculation considers this rebate (a factor that lowers the UK’s gross contributions to the EU budget), then the UK’s share of commitments is 12% using 2009-15 data. But if the rebate is not considered as a factor that lowers the UK’s gross contributions to the EU budget, then the UK’s share turns out to be 15.7%.

- Should the UK benefit from the rebate after Brexit?

There are two possible rebates after Brexit:

- the usual rebate on the UK’s contribution to the 2018 EU budget, the hypothetical last year of the UK’s EU membership

- a rebate on the UK’s post-Brexit EU budget contributions to the €580 billion in EU spending.

Since in 2018 the UK will still be a full EU member, we cannot see any good reason for the UK not to benefit from a rebate on those payments.

The rebate on post-Brexit UK contributions to the EU budget might perhaps be an issue for discussion. It could be argued that the rebate was an unfair reduction in the UK’s contribution to EU budgets and since unanimity would have been needed to change it, it was politically impossible to change. But once the UK is out of the EU, that rebate should be removed.

However, it could also be argued that the rebate was part of the rules governing the EU budget. Thus, if the UK is asked to contribute to post-Brexit EU budgets according to current rules, the current rules regulating the rebate should apply.

A further twist is that the possible rebate on the EU’s post-Brexit EU budget contributions also depends on the way the UK’s share of EU commitments is calculated. If a rebate-adjusted UK share is used (the 12%), then that calculation already considers the rebates the UK received in the past, so an additional rebate would amount to double-counting. But if the UK’s share is calculated on the basis of past gross contributions without a rebate adjustment (the 15.7%), then a rebate could be justified.

- Should planned EU spending in the UK from 2019-25 be offset?

Of the total €580 billion post-Brexit EU spending plans, €28.9 billion is planned to be spent in the UK. This could be considered as factor offsetting UK payments in the Brexit bill.

- What should happen to this planned spending in the UK?

If spending plans are maintained, according to the current MFF, then the UK would contribute €69.6 billion to post-Brexit spending commitments (if its share is 12%) and then benefit from €28.9 billion of EU spending in 2019-25. If these planned expenditures are netted out, then the UK’s contribution is reduced to €40.7 billion (€69.6 minus €28.9) and all €28.9 billion of post-Brexit EU spending plans in the UK should be dropped. This choice does not alter the net Brexit bill, but it does have important implications about UK participation in EU activities.

- Should planned EU payments to be spent in the UK be separated according to whether the beneficiary is a UK government institution or the UK private sector?

Such a question might be important for the UK government. However, since the UK as a country is leaving the EU, in our calculations we consider the UK as a whole.

- Should the UK contribute to EU pension liabilities?

The EU staff pension system does not have a fund, but staff members accumulate pension rights. Active staff members pay a pension contribution from their salaries to the general EU budget and the general EU budget pays the pensions to retired staff members. Therefore, at any point in time, it is possible to calculate EU staff members’ accumulated pension rights – a future EU liability.

The regulation says that “Member States shall jointly guarantee payment of such benefits”. One possible interpretation is that once the UK leaves the EU, it will no longer be a guarantor and therefore it should not contribute. Another view could be that the UK should contribute to the pensions of British citizens only.

A third interpretation is that the nationality of EU employees does not matter: all EU employees worked for the EU, from which the UK benefitted while it was a member. There is no actual fund behind the pension scheme and thereby the UK paid less for the pensions while it was a member. Therefore, in this interpretation, the UK would be expected to contribute to the pension rights earned by all EU employees up to the Brexit date.

- How should pension liabilities be calculated?

The value of these pension liabilities is not set in stone, but in each year an actuarial estimate is made for its inclusion in the EU’s balance sheet. This estimate greatly depends on the interest rate used for the calculations. Similar actuarial calculations are made for the pension contribution rate paid by EU staff members. However, while the balance sheet calculation considers the actual value of interest rate in December of the particular year (and is therefore very volatile), the staff contribution rate calculation currently uses a 18-year average interest rate (making it less volatile). Given the great sensitivity of the pension liability to the discount rate used, a decision has to be made whether to use the actual interest rate at the time of the Brexit date, or a historical average similarly to the calculation of EU staff contribution rates.

- Should the UK pay its contribution to the post-Brexit spending plans upfront in one go?

One possibility is that the UK pays for all the liabilities and commitments in one big payment close to the Brexit date. On the other hand, various EU’s spending commitments are scheduled to be paid in 2019-25, and the UK might contribute annually when the expenditures are due.

- How should the calculations treat assets and liabilities that have an element of contingency?

For example, Ireland received a financial assistance loan from the EU, which is expected to be repaid by 2042. This loan, and all other EU financial assistance loans are fully matched by EU borrowing. These loans are assets, while EU borrowing is a liability. We presume that Ireland will not default on its loans from the EU, but this will be known with certainty only after Ireland has fully repaid. The expenses from EU contingent liabilities will also only be known several years from now. There are a number of options for taking into account assets and liabilities that have a degree of contingency:

a. The UK pays its full share of these liabilities upfront and is reimbursed by the EU in the future if losses from these liabilities do not materialise.

b. The UK does not pay anything upfront, but pays a share of losses in the future, if a loss on a particular liability materialises.

c. The UK pays the estimated expected loss from these contingent liabilities, without any later clearing.

d. The UK pays the estimated expected loss from these contingent liabilities, but the EU and the UK later settle any deviation between the actual loss and the expected loss.

e. The EU balance sheet includes a €2.0 billion guarantee fund for external actions. This asset, or a part of it, would not be considered in the Brexit bill, but the UK would receive its share from its unused part only in later years. If this fund proves to be insufficient to cover actual losses, the UK will pay a share.

- And what about future pension payments by EU staff?

According to the EU’s staff regulations, one-third of pension costs should be paid by EU staff members. So approximately one-third of pension rights acquired by EU staff up until the Brexit date will be paid by future EU employees – of course, only if the EU will continue to exits and therefore there will be future EU employees. This payment could be considered as an offsetting factor in the Brexit bill. Its consideration can be analogous to the first two options of the previous point:

a. The net UK payment upon Brexit is not reduced by one-third of pension rights, but the UK is gradually reimbursed as EU employees pay their contributions;

b. The net UK payment on Brexit is reduced by one-third of pension rights, but if for any reason the EU dissolves, the UK will contribute to those pension rights which were earned during the UK’s EU membership.

Scenarios

The twelve questions above highlight that the size of the Brexit bill will depend on fundamental political compromises and choices. Depending on the results of these political discussions, very different Brexit bills might arise.

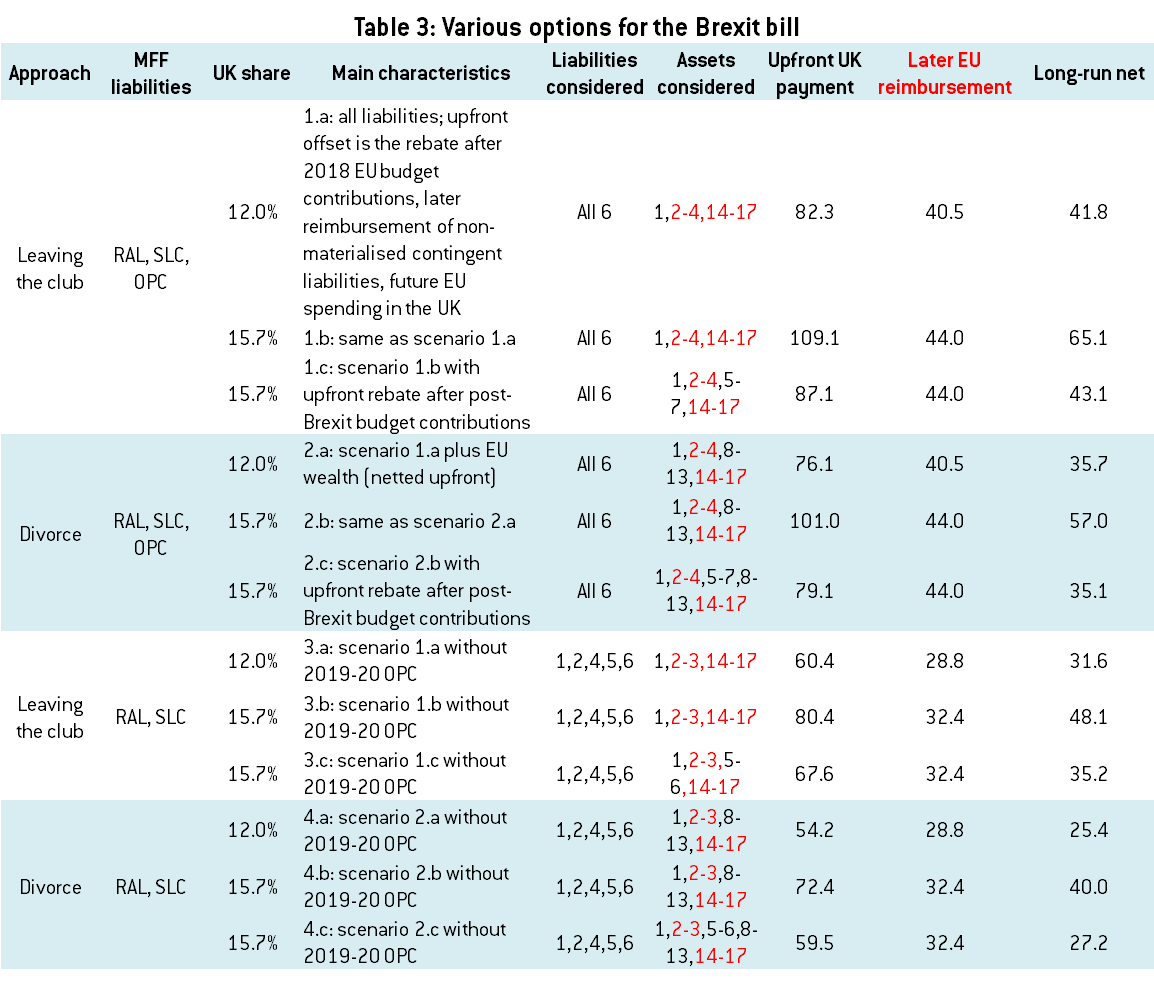

In order to quantify the impact of some of the choices, we now present some scenarios based on various assumptions about (1) ‘leaving the club’ vs ‘divorce’, (2) UK shares of 12 percent (rebate adjusted gross contribution) or 15.7 percent (gross contribution without rebate), (3) different scopes of financial commitments, (4) differences between upfront gross payments and later reimbursements by the EU, (5) netting out or not of EU spending in the UK after Brexit.

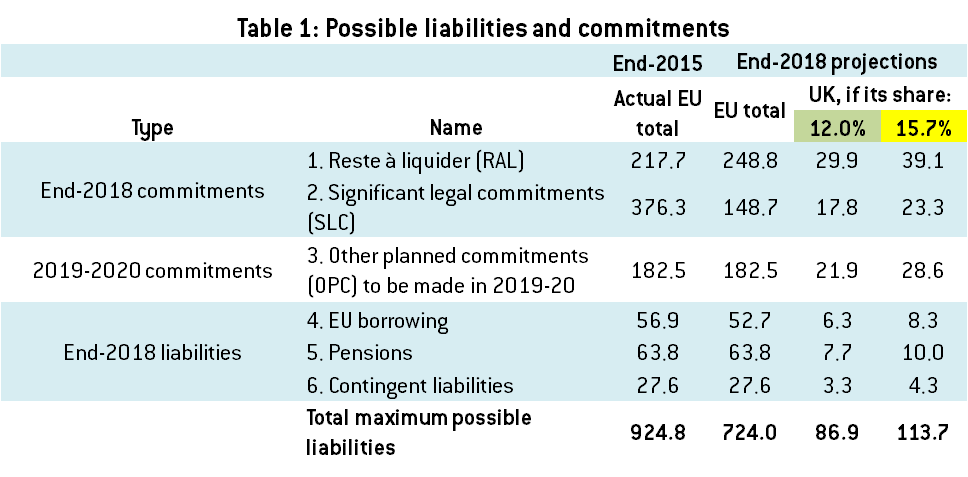

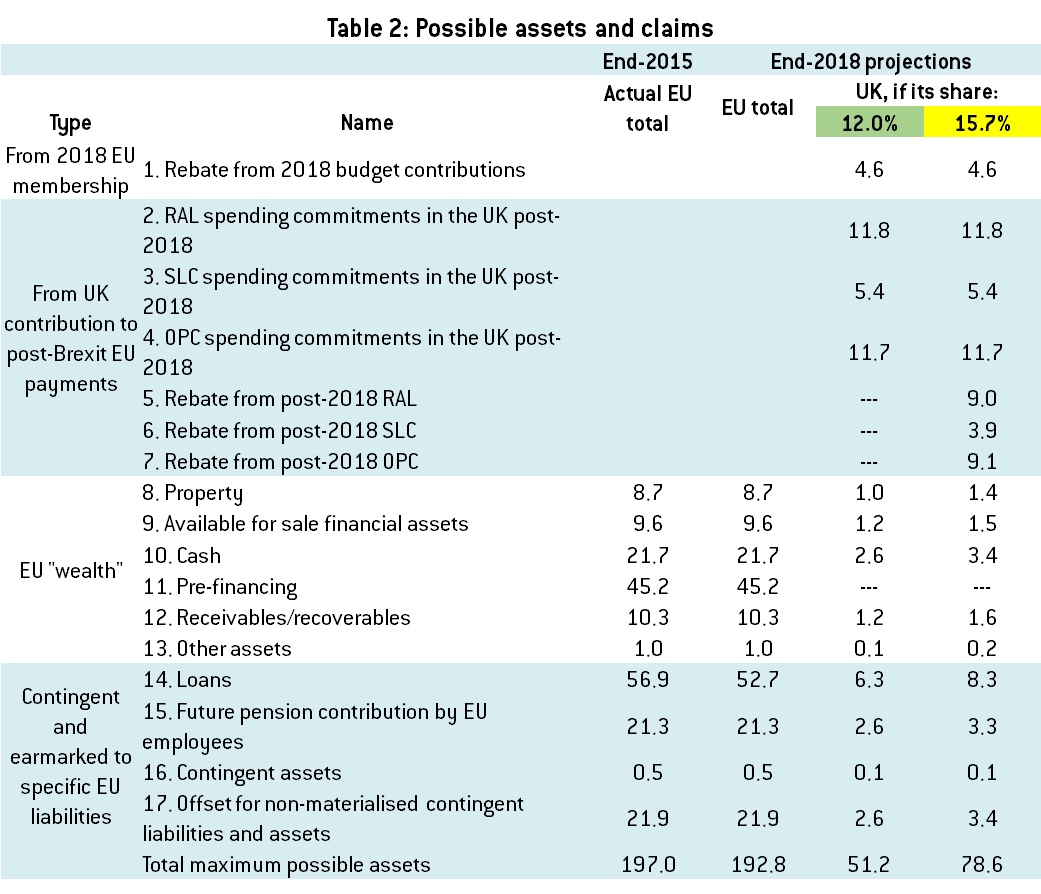

Table 1 summarises EU liabilities and claims at the end of 2018 (the closest year-end date to a probable Brexit date in March 2019) and the UK’s gross contributions to these. Table 2 shows the assets. Table 3 presents some scenarios for the net Brexit bill. Depending on the scenario, the long-run net Brexit bill could range from €25.4 billion to €65.1 billion, possibly with a large upfront UK payment followed by significant EU reimbursements later.

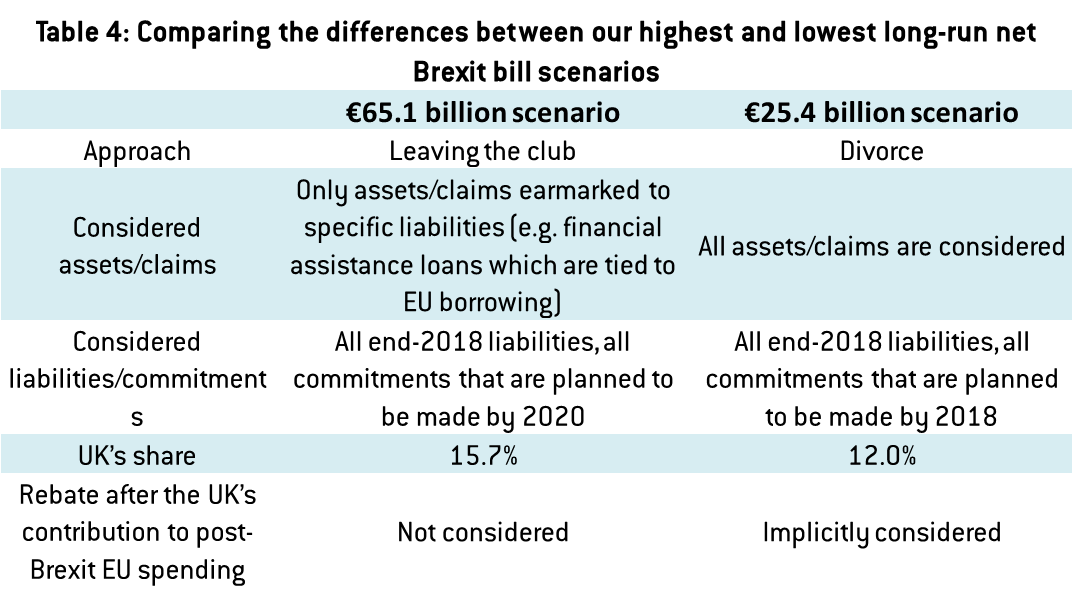

For illustrative purposes, Table 4 compares the differences between our highest and lowest long-run net Brexit bill scenarios.

Of course, these scenarios are not exhaustive, and many other scenarios could be thought of, depending on the answers given to the twelve questions above.

Note: the numbers in columns for liabilities and assets considered refer to the numbers in tables 1 and 2 above. Black numbers indicate that the particular liability or assets is netted-out upfront, while numbers in red indicate assets/claims which will be reimbursed by the EU to the UK in later years. The long-run net amount calculations simply subtract future EU reimbursement from the upfront UK payment, without considering the time-value of money. Depending on choices, the timing of UK payments to the EU, EU reimbursements to the UK, and items to be considered for netting out can be different from the assumptions implied by the table, without impacting the long-run net amount.

While separation terms are their own issue, The Great Repeal Bill of 2017 doesn’t bode well for the escape party.

Beyond nice pix of Treeza and Dave and well wishes from them, it has a mighty 15 pages of significant content,all of which seems to be enabling legislation.

My precis:

We are leaving the EU.

We have no idea how to go about this, so we’d like to give ourselves, in advance, the power to do whatever enters our head.

Devolved entities should stick to their knitting, as there’s nothing in it for them, but we reserve the right to take away any wool or needles as is necessary.

Adding, perhaps superfluously:

The Devolved Entities will be consulted because we wouldn’t want them to feel like marginalised token gestures. But then we’ll ignore everything they say. Unless they agree with the random chirruping and flapping that comes out of Westminster.

And the negotiations will be based around the script for the unproduced Season 7 of Downton Abbey. The British government will play the “upstairs” cast. Boris Johnson will be the first to jump the shark.

My worry here with this at present is that the English newspapers will seek to use this to scupper any prospect of agreement between the UK and the EU 27. There are already some arguing that the UK should not pay the EU anything at all in future. If they can push the UK government into adopting that line, the talks could be over pretty much before they have started.

Would that not risk great damage to the UK?

Yes, but some people do not care about that

And there will be a fast-talking, larger-than-life visitor from across The Pond, with his icily beautiful yet frustrated wife in tow. At the supper table he stands up in his white tux and demands the master bedroom. The men retire for brandy and cigars where they titter over his vulgarity. At midnight he makes a grab for the countess dowager, and is found next morning crammed in a drawer-cum-bed in the servants quarters, with his hands tied around his neck.

I’m not sure what the political dynamics are in the UK. How much are the political elites owned by the financial sector? Meaning they must manage Brexit while doing the least possible harm to that sector. If you had a nationalist running the UK – like Nigel Farage – then I’d suggest simply making a clean break and selling it to the public. That would force the EU to play the heavies, which would be noted by all Britons and would also reinforce the idea that it was smart to get away from such people.

The two year time line is convenient. I imagine that during this period the EU shall collapse. In that sense, time is on the UK’s side.

The financial sector has long had an important hold on the political elites in the UK but the true owners of the system now are unquestionably the newspaper barons. The Brexit vote was a win for them and a defeat for the financial sector. Brexit increases the newspaper barons’ grip on the UK political system which will probably be shared with Trump. UK politicians IMO are largely puppets of these two interest groups, the newspapers and the USG.

I doubt strongly that the EU collapses in the next two years,unless Le Pen wins in France. I think it more likely the UK disintegrates, as Scotland and Northern Ireland could both go.

On a perhaps more moderate note :

http://openeurope.org.uk/today/blog/the-eus-draft-brexit-guidelines-look-anything-but-punitive/?utm_source=Open+Europe&utm_campaign=33eb377984-EMAIL_CAMPAIGN_2017_03_31&utm_medium=email&utm_term=0_c045172cb6-33eb377984-262520905

Yet another argument which sets out a proposition, which if you agree with, is then supported by loads of data.

To the “club membership” analogy. If said club is being subsidised massively by a couple of members, continually opens its doors to those who cannot pay, a club which has not produced a proper set of audited financial accounts, is riddled with lucrative insider deals for the ‘few’, a club which has been designed so suit some members at the great expense of others, I would probably argue that the club has no right to demand an exit payment. If we want to use the ‘divorce’ analogy then I think we could site ‘unreasonable behaviour’.

The ‘exit payment’ focus is a simply ploy to signal other upstart countries that might have their own ideas that leaving is not an option. Generating fear is an ancient tactic. Abusive spouses use it with their partners all the time. Those who are cowed by it fail to realise they can just walk away and begin a new life.

Given that the UK was the principal driver behind the expansion of the EU into Eastern Europe and has agreed every EU treaty change since 1973, it is a bit rich to complain of unreasonable behaviour when the source of the UK’s main complaint (immigration) is the result of its own actions. I think most objective, informed, neutral observers would locate the unreasonable behavour much closer to the UK than to Brussels, given that Brexit is seen as a combination of economic self-harm by the UK and geo-political vandalism.

Well, that’s their neoliberal ideology in action. They’re going to go do it again only at a distance this time by “trading with faster growing India instead of ‘slow growing’ (ie., rights bearing) Europe” as a means of wage arbitrage, which will piss off whole new groups of currently somewhat more protected people in Britain, leaving them at the mercy of growing austerity and accompanying culture of deprecation, and looking to emigrate to an EU (and maybe other places) that’s maybe not so open to them any more.

I don’t see how people see this as nationalistic. It doesn’t look that way to me at all. It looks to me like the neoliberal national elites are looking for a better opportunity, and you know who pays for that.

Or let’s just say, I’ll be very surprised if it turns out any other way.

You may not like it, and I understand that, but the political dream of a united Europe is burning. If you want to blame Brexit go ahead, but the EU is more widely is in trouble. If you also want to think the issue is purely around immigration, be my guest. To claim to be a voice of “neutral observers” betrays your obvious lack of neutrality (who are they?).

I think I would site Greece as an example of vandalism that the EU should be ashamed of.

I’ll not address any of your other points, but regarding the accounts that are not certified by the EU court of auditors that is largely due to irregularities where the members are responsible for spending.