The war on cash is escalating. A big driver isn’t central banks who want to be able to inflict negative interest rates on savers, or Treasuries who see cash transactions as hiding revenues from their tax collectors, but the payment networks that want to kill cash (and checks!) as competitors to their oh so terrific (and fee-gouging) credit and debit cards.

However, one bit of good news is there doesn’t appear to be much enthusiasm on the buyer, as in merchant, end.

First, the overview from the Wall Street Journal:

Visa Inc. has a new offer for small merchants: take thousands of dollars from the card giant to upgrade their payment technology. In return, the businesses must stop accepting cash.

The company unveiled the initiative on Wednesday as part of a broader effort to steer Americans away from using old-fashioned paper money. Visa says it is planning to give $10,000 apiece to up to 50 restaurants and food vendors to pay for their technology and marketing costs, as long as the businesses pledge to start what Visa executive Jack Forestell calls a “journey to cashless.”

There are good reasons to think this initiative won’t get far.

Customer resistance. Food vendors, and in particular restaurants, are low margin businesses with fickle customers who have little to no loyalty. Why risk driving business away?

Aside from the fact that some customers prefer cash, a related issue is that using cards and smartphones often seem to be a tax on time. I really hate using chip cards. Mag cards were often faster than cash, since you swiped and could stuff the card back in your wallet while the transaction was being approved. Chip cards, by contrast, require you to keep the card in the machine while it is being approved, so one is very much aware of the wait. And when I’ve seen people using phones (often to buy small stuff like coffee, which really amazes me), I find that they are slower with it that they would probably be with cash, in that they seem to have to fumble with the phone to get the right app readied and then the payment doesn’t always go right through either.

And that’s before you get to the fact that ApplePay and other smartphone payments time stamp exactly when you paid, adding to the information the surveillance state is gathering about you. By contrast, even if you use a credit card at a store, Clive informs us that the card network typically retains only the date of transaction.

Higher merchant charges. I take credit and debit cards through PayPal, and also checks. And even though I am often slow to deposit checks because I find it hard to get to the bank, I’d still rather have checks despite the somewhat greater hassle because I save the 3% cut the card networks take. Visa makes the argument that handling cash has costs too, but they are the ones that have ginned up the numbers, and in my case, they don’t wash. As the Journal points out:

Indeed, many merchants prefer cash because they don’t have to share the revenue with card companies. Credit-card interchange fees, which networks like Visa set and that merchants pay to the banks that issue their cards, are on average around 2% of the transaction amount, according to the National Retail Federation, the largest trade group that represents merchants in the U.S.

“The idea that merchants don’t want to accept cash is a myth,” said Mallory Duncan, senior vice president and general counsel at the National Retail Federation.

Negative impact on employees who get tips. As one of my tax attorney buddies drily remarks, “Some people have this odd idea that cash payments aren’t taxable.” Restaurant workers who have tips as the major source of their income almost assuredly prefer getting them in cash, rather than facing the delay of having their employer receive them through the payment network which creates delay as well as the not-trivial odds that the boss might cheat them either informally or declare that he’s entitled to a processing cut. And that’s before getting to the fact that restaurant pay levels probably pre-suppose a fair bit of tax evasion, so the business owner might risk losing his better employees to competitors who hadn’t gone the no-cash route.

Enforcement. How is Visa going to police establishments that say they aren’t going to take cash? Will Visa have spies? Will Visa have audit rights?

Risk of legal challenge. As a surprisingly large number of Wall Street Journal readers pointed out, cash is a legally sanctioned means of payment. For instance:

Richard Tavis

Merchants who will no longer accept cash won’t get my business, period. Call me a Luddite, but U.S. currency pretty clearly states that “THIS NOTE IS LEGAL TENDER FOR ALL DEBTS, PUBLIC AND PRIVATE”. It seems to me this will go to court eventually. Merchants must accept notes issued by the Fed. Sorry, that’s the way it is.

Richard Tauchar

@Richard Tavis

That’s my take as well.

And, as someone else mentioned, what happens if you refuse to pay with a Visa, or don’t have one, after having completed the meal? Will they take cash then, or is the meal free?So I’d be surprised if Visa had a legal leg to stand on, when trying to make these deals.

The Treasury does support the position that private business can refuse to take cash as payment for goods and services, as opposed to settlement of debts.

However, as writers following David Graeber’s Debt: The First 5000 Years, like to point out, we incur and settle debts all the time. And a bar tab or restaurant bill is a debt. The vendor provides the service<strong> without being paid, then expects you to settle the debt you incurred.

Thus the market segment Visa is targeting for this move (the Wall Street Journal headline says, Visa Takes War on Cash to Restaurants) would seem to be one where Visa is on a particularly weak legal footing. I can easily see someone with a penchant for mixing things up go to a restaurant, either not have a card or bring a card he knows will be declined (just to look like he didn’t intend to stage a stunt) and then video putting down more than enough cash to settle the bill and leave. The merchant will have no legal out. He’s been paid. And at least in any decent-sized city, no way will the cops intervene. They’ll regard this as a private dispute not worth their time. If the restaurant staff try to restrain the exiting customer, they could wind up with a very costly suit on their hands.

Taking cash may be the real point of the merchant. A savvy New York City colleague regularly points out how many New York City businesses, like pizzerias and cheap jewelry stories that never seem busy, or nail salons that have economics that don’t seem to make sense, are probably partly if not mainly in the money laundering business.

Visa has even bigger ambitions:

Visa is trying to turn those numbers more in its favor. In the U.S., it is going after spending categories, such as parking and rent, that have been entrenched in cash and check payments for decades. Abroad, it is partnering with governments to move more payments onto its network, including an agreement that it recently signed with the Polish government to move the country to a cashless system.

For what it’s worth, my landlord (more accurately, his in-house management operation), who has an office building that takes up a full block on Park Avenue in the upper 40s, plus has seven residential buildings, takes only checks for rent. One factor may be that in NYC, if a landlord accepts a rental payment from a party, that party obtains a legal interest in the lease. That in turn means the landlord would lose one of his main axes for controlling who lives in the apartment (or worse, a corporation could pay make a rental payment and in theory let anyone it authorized stay in the apartment). It’s easy to see on a check who is making the payment. On a bank transfer, the landlord may regard it as too much hassle to verify the source of a bank auto-debit to be worth any potential labor-savings on other fronts. I’d be curious to learn from any readers who rent what types of payments their landlord accepts.

In the meantime, those of you who like cash should not just make a point of paying in cash, but also tell the employees and in particularly, anyone who appears to be a manager that they will lose your business if they stop taking cash. Vocal customers may be the best way to head off Visa’s profiteering.

The march to totalitarianism may be incremental, but is still a reality none the less.

Apply anti-trust against Visa/MC … it isn’t too late.

Let’s see. Visa will fund 50 of the 28,000,000 small businesses to which to their $10,000 “upgrade” – spy technology. That is .0000018% of businesses taking Visa. At $10,000 a pop, looks like Visa will be rolling in lots of cash after all 28,000,000 switch over.

I disagree with Madam Yves — those payment networks are owned by the banks, and this strategy has been in the works for over 30 years, and it is indeed so they can, obviously, charge for each and every transaction, as mentioned.

No! Historically the Card Networks were owned by the banks but they were more-or-less forced into divestiture and are now independent traded stocks. Here is Visa’s ownership structure http://www.nasdaq.com/symbol/v/institutional-holdings and MasterCard is little different. A few of the banks have residual minority holdings but they certainly don’t constitute “ownership”.

The Card Networks do charge a fee though as you say. Dodd Frank enacted some very limited capping of interchange fees. The EU went much — much — further.

Negative, sorry, but you are still thinking along corporatemedia spew stuff.

Vanguard and Fidelity are majority shareholders (T. Rowe is majority shareholder owned by Vanguard, Fidelity, State Street, etc.) — and since that 1993 SEC rule change, there is no way to know who the actual investors are through Vanguard and Fidelity, so the owners really aren’t known, but I would seriously wager it is still the banks, which are still owned by the super-rich.

Historically, over the past thirty years, the super-rich have been incrementally making it more and more difficult to understand who the actual owners are.

http://investors.morningstar.com/ownership/shareholders-overview.html?t=V

Fidelity is intimately entwined in the crooked banks. If they are behind Visa & Mastercard, it is hand-in-hand with the crooks.

Fidelity is the crook behind all the unlawful foreclosures with Black Knight. Fidelity is behind all the title companies who have allowed the banks to stop sending in the original notes to escrow to close.

Thank you and correct.

The overall point I am trying to make, though, is that the Big Four investment firms, Vanguard Group, BlackRock, State Street and Fidelity are the majority shareholder owners of the majority of major corporations in at least North America and Europe (and perhaps elsewhere, of that I am uncertain).

Back during the time of the TNEC study and FDR, it was 17 Wall Street firms and banks which were the majority owners, today there are only the Big Four, and thanks to their actions over the past thirty years, we have no real discernible idea of who the actual owners are — who is invested through them.

That isn’t correct. This is a widespread misconstruction thanks to a study done by physicists who didn’t bother understanding what they purported to analyze.

For starters, BlackRock, State Street et al are fund managers. They do not “own” stocks. The funds they manage own the stocks.

Vanguard itself is mutualized so all of the investors in Vanguard funds own Vanguard.

On top of that, Vanguard and Fidelity run brokerage operations. The stocks are in street name. The share owners vote those proxies.

For the funds they manage, most are index funds. Managers are fixated on replicating the index at the lowest possible cost. They have no interest in the proxy rights.

I had lunch recently at a local restaurant and sat at the bar. It was around 11:30 am. The bartender took my food order and said “OK, but I’ll just need your card so I can start a tab.” I said, “I’ll be paying cash.” The bartender said, “Well, I still need your card.” “What for?” “So we can get you in the system and keep track of everyone.” “There’s no one in here!” “It usually gets crowded around 1:00. Card?” “I don’t have one.” Looking annoyed, the bartender turned around and began keying something into the register — possibly “no card”?

All this pressure for a salad and coffee.

Next time, have your coffee and salad elsewhere.

As a long time bartender at a somewhat-nicer establishment that regularly can be on a one-hour wait time, I only take a card to start a tab if you are waiting for your table away from the bar area. It’s a regular occurrence to have 90+ degree temps here in Inland Southern California and grab some beers for the group while you suffer outside for an hour. I can’t keep track of where you go or if you promise to give me cash. And while I’m lucky enough to work at a place where management strives to obey the laws, most in the service industry here don’t. Besides running some funny business on your hours, the most common impropriety with serving staff is that a restaurant owner will force the server/bartender to cover the costs of a guest that ditches their bill. It’s illegal in CA but you’d be shocked to find out how often even upscale establishments engage in that behavior. And dine-and-dashers happen all of the time! Sometimes its even as simple/innocent as “Oh we got paged at the restaurant next door first, let’s go get the table there” and three hours after the rush you see there is still a $30 open tab and management refuses to comp it off without repercussions to your employment, well, you get to eat that $30. When you walk out with $150 on a weekend in tips and that suddenly becomes $120, that’s a big percentage of your income that evaporated for no fault of your own. I believe that is the main reason most establishments will ask for a card – to insure against the a**holes of this world.

Just for the record, I never left the bar, there was no outdoor area, and I ate my salad within sight of the bartender at all times. He was still insisting on my card, and yes, Arizona Slim, that was my last visit.

In Seattle, they have this new LBGTQ (I may have gotten those initials wrong as I really don’t give a fook) law for bathroom usage, so many have the local businesses, where after one purchases an item their men’s room or ladies room may be accessed, shut down one of those two bathrooms, making the other one cross-gender, thusly shrinking local bathroom access by almost 50%.

Ain’t life and businesses grand?????

They could have left them both open and made them both cross-gender. Closing one of the two bathrooms is a display of pure malice and spite. Not even a bussiness decision. Pure malicious spite.

Dude, don’t keep me in suspense. What kind of salad?

Airplane food is often credit card only, how is that legal?

As outlined above, airlines often charge for the service before delivery. There is no debt in the transaction. And the treasury has the position that private businesses can refuse cash.

Because they decline to provide you the drink until after they have your CC. They’re not obliged to do business with you. They’re free to only do business with you in Krugerrands or Bitcoins, but you can’t provide a good or service and THEN refuse to accept a legal payment.

Airlines and others also use cards based on the economics. By eliminating cash they cut out a layer or two of cost, such as some security, training, cash handling, lower (but nonzero) likelihood of robbery, removing steps in daily and monthly closing of books and the like. Some also may get a float or working capital benefit or expense mitigation based on the timing of their payables and receivables. Some businesses push that to extremes like deferring payables to 90 or 120 days, and demanding more discounts or saying So sue us, on the backs of small vendors who can’t protest too much without losing a customer. More crapification ensues.

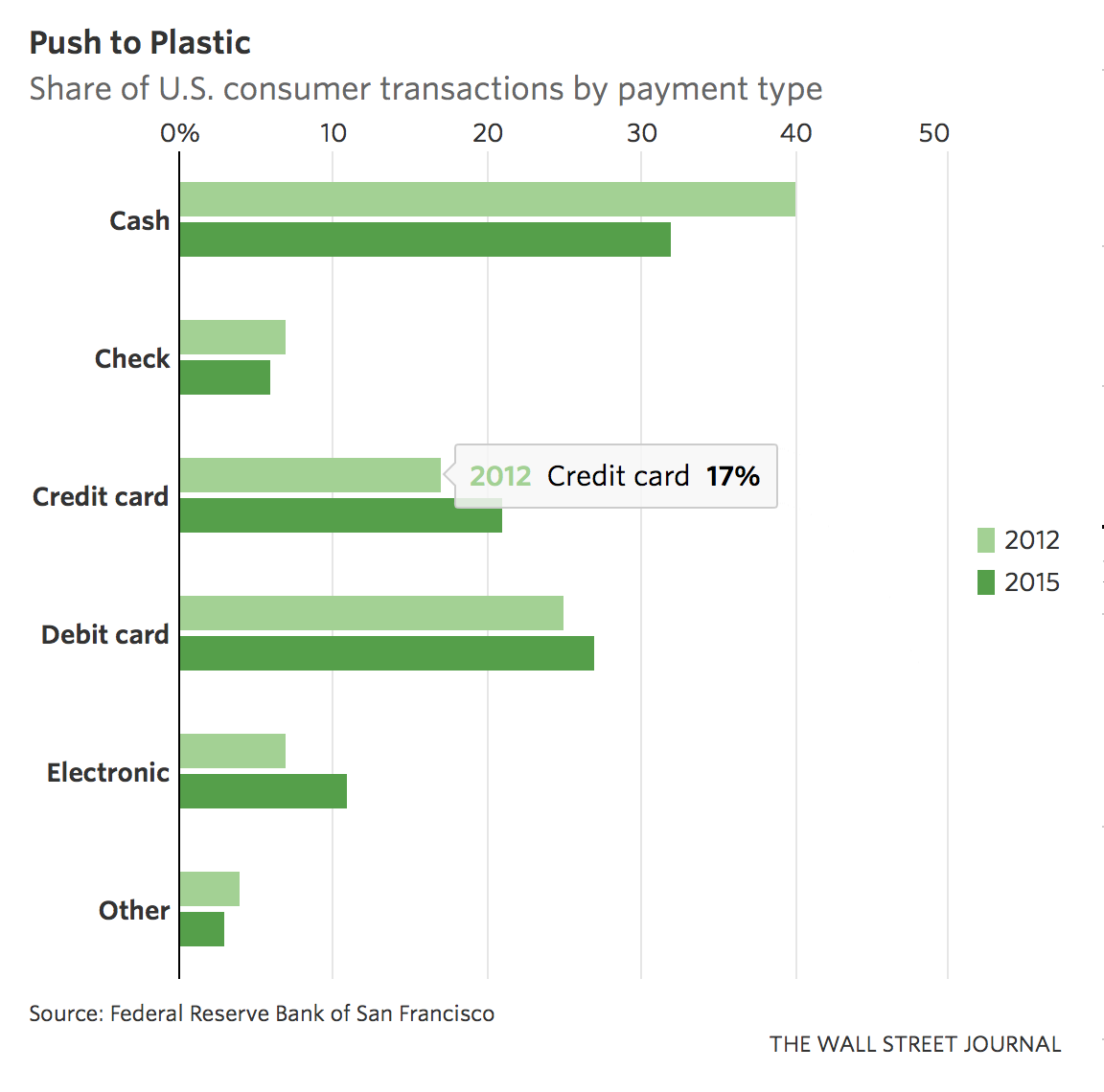

This is is happening anyway just because people and merchants are ceasing using cash voluntarily. The first row in the WSJ graph above tells the tale.

One restaurant chain is already refusing cash altogether.

https://www.fastcompany.com/3061731/sweetgreen-is-going-fully-cashless-in-2017

“We believe the future is hyper-experiential and hyper-convenient,” says Neman. “The middle is going to get squeezed out.”

Eventually, poor or stubborn holdouts won’t be worth the bother. They can just die of starvation.

The only place where Sweetgreen will now accept cash is Massachusetts–where a state law requires it.

What’s really driving this, I think, is the desire to eliminate cashiers. Sweetgreen aren’t too keen on people paying with credit or debit cards in-store, either–they want you to order and prepay using their app.

Mystery shoppers, targeting those businesses which the “big data” gathered by the card processing network indicates as dubious.

E.g. “Before the no-cash action, that kind of shop in that city collected payments 60% by card, 40% by cash; after the no-cash action, the payment volume processed by our network for that specific shop increased only by 25% instead of the expected 67%; send a mystery shopper to investigate, and prepare to insist on compliance with the terms and conditions of our service.”

Then what? Do they sue them for breach of contract or even clawback under some particularly onerous fine print at which point the initial money seems even less desirable?

They may get away with it but I don’t see how it helps them long term

We pay cash for almost everything. Sometimes the supermarket clerks don’t know what to think when I present them a fresh crispy $100 bill in payment when they expect me to swipe a card.

I try to keep them on their toes. Money still works! I intend to do my part to see to it that cash remains viable. I pay cash for as many of my expenditures as I can.

Paying cash is a mental trick for spending control for me. Swiping a card is somehow less…visible…that you are spending money.

But yes, I still pay with a debit card for many things nonetheless.

I do exactly the same thing.

I have a budget to spend on groceries, toiletries, household items, eating out and alcohol each week and I withdraw it in cash on a Thursday. That way I can see at a glance and at any time exactly how much I have left and shop accordingly.

Some weeks on a Wednesday we have fillet steak with a nice glass of something to wash it down and others we have pasta with a quick sauce made from a tin of tomatoes, onion, garlic and olive oil depending on how profligate I’ve been through the week. I definitely find it a lot easier to budget using cash as you simply can’t go over your limit. Once it’s gone, it’s gone.

There is plenty of research to show that if you use cash you spend less, e.g. this blog piece in Psychology Today

When a business stops taking cash for me, they won’t find me coming back and I will go EVERYWHERE online I can find and give them the unwanted publicity they are seeking. I love when they hold the $100 bill up to the light to see if it is real. I laugh and tell them that I just got through printing it.

I also show them where you take that $100 bill and rub it against a white sheet of paper, the green will come off on the white sheet, just like on a 20, 10, 5, 2, or $1 bill. The ink on legit currency never fully dries. That is the best way to really check a bill. I will not accept one in the bank without checking it first. I have actually been given one from a bank branch that didn’t catch it, but didn’t want to give me the real currency back for it. You can say that you want it cashed for a smaller bill and they will inform you now, that bill is illegitimate, so we have to confiscate it, and you are out the hundred bucks. That is what you call passing the buck!

In a cashless society, you have no money. Someone/thing else has it, all the time. You may even go along with this (I don’t), till the next power cut.

I asked another local merchant (fruit market) what percentage of her purchases these days were cash. She said 30% (just like the WSJ!). The Sweetgreen article notes that Massachusetts makes it illegal to refuse cash — sounds like a good place to live.

I see the other end of this, local restaurants that will only take credit cards if the bill is larger than some amount.

I could understand that: dimly lit restaurant, substantial bill, customer throwing wadded up twenties on the little plastic tray. Easy for a waiter or waitress to miscount, and with a larger bill the loss could potentially be larger.

I think that the sentence is ambiguous. I took that to mean that the restaurant would ONLY accept credit cards on large tabs and not for small transactions. PKMKII took it to mean that the restaurant would accept only credit cards and not cash for large transactions.

I usually use double-barrelled payments: Credit card for the bill, cash for the tip

One of the hilarious reasons given for going cashless is Germs! Germs!! GERMS!!!.

Ken “Spreadsheet Class is Hard” Rogoff spends time on this in his book The Curse of Cash,

and for some reason the producers of Marketplace thought it would be a good idea to give

him a platform to continue to spew this nonsense on the show yesterday.

But of course the alternatives to cash (other than using your phone),

like pushing the buttons on a POS chip reader, all involve germ transfer as well.

The absolute worst are those iPad units invading airport restaurants,

where you have to swipe left and right to both order your food and to pay.

At many international airports, you’re one nonstop away from someplace

with a very different microbiome. Bon appetit!

Not to be too snarky but so far as I am concerned the fact that Ken Rogoff is still treated seriously is the final and clinching proof that economics is bull.

Yes “serious economists” have bought into neoliberalism and pushed economic policies that have impoverished many. Yes they continue to push them despite all empirical evidence to the contrary. And yes they failed to predict most if not all of the major economic events of the last 50 years. But we all make mistakes.

But Rogoff cannot do arithmetic, or does not care to try. He either lies about his data or makes a practice of putting his name on work he does not understand (fraud either way) and he is now afraid of touching stuff that other people touch. The fact that he is at the pinnacle of his profession means that his profession has no standards and thus no worth. It is certainly not a science.

Ken Rogoff should have remained a professional chess player. He was quite good at that, in contrast to his lack of prowess in economics. Although I suppose he is well paid for his lack of prowess….

my mom once told me a story (as a little kid!) how one of my ancestors on her side of the family, was counting coins, rubbed his eyes, then soon went blind from an infection.

I’m *still* traumatized by this story! Was it true, and if it was, would antibiotics easily fix this problem?

Silver is a natural anti-biotic.

I’m angry. It won’t be that easy in Poland – by rejecting cash you basically reject like 20% of people working in the black economy plus elderly people who think banks are scary, for some establishments it would basically mean shutting down. I make a point of always using cash and patronizing businesses that don’t take other means of payment, but still, it is scary that they would do it so blatantly.

I know some guys who work as handymen and they only take cash. They have good little businesses. Some of them are Eastern European immigrants and others are retired native-born American tradesmen or guys who lost factory jobs and could never find new formal employment so they take handyman jobs whenever they can get them.

I used to hire a neighbor for yard work. He was a disabled veteran who needed to make extra money and only wanted to be paid in cash. So, that’s how I paid him.

Didn’t Clive comment a while back that there is a possible financial legal loophole (at least in the UK) regarding contactless payment which made retailers nervous? I certainly noted at the time that only one of the main supermarket chains accepted contactless payment…but these days I can’t think of a single chain that doesn’t accept them…

Interestingly my company bank account debit and credit card are not contactless (chip and pin/swipe only) – only my personal ones are.

It was more that for Contactless, these transactions used what is known as “PAN tokenisation” which means that, instead of passing the 16-digit card number in the clear, the card details were translated into a single-use encrypted token which was only decrypted when it was routed back by the Merchant Services Provider to the Card Issuer. So the stores lost a valuable method of tracking customers — when they visited, what they spent, what they spent it on. It didn’t take too much augmented data to allow the stores to, in a majority of cases, reconcile the card PAN to a real customer name and address — it wasn’t guaranteed, but all the store had to do was get the card PAN used in a transaction which captured a name and address such as for a product which had a warranty or where the customer requested a refund etc. and bingo, you’d tied the card to a customer. And probably the easiest way of tying the card to the customer and their address was if you used online grocery delivery. They’ve inescapably got you if you do that because you have to use a card to complete the order and there’s a high degree of probability you’ll use the same card when you visit a physical store.

For those customers like myself who are loyalty card holdouts (the money off they give you is a pale shadow of what the data is actually worth and that’s before you get to the creepy creeping Big Brother aspects) the loss of being able to identify customers via their card PANs was a big headache. So a lot of the supermarkets didn’t play ball with Contactless.

In the end, the Card Networks sweetened the deal by giving the merchants financial incentives based on the number of Contactless transactions they generated. The merchants also worked out that the greater average revenue per transaction for store visits where the customer used Contactless made the loss of data on spend patterns and the ability to generate targeted marketing (e.g. discounts on things you buy regularly or things which they think you’re likely to buy in future given what you already do buy) a price worth paying. The lower mental barrier to spending when Contactless is used genuinely does seems to “switch off” the part of the brain which normally kicks in to generate inhibitions, in-depth considerations about purchasing and the analysis of how much money we’re spending overall. Much better to take more at the checkouts then and there, rather than rely on some vague hope of converting data-driven marketing into real, actual sales.

Plus for the stores, checkout dwell time is a lot less with Contactless. So they save money there as customers spend less time completing the payment. As Yves said above, for CHIP card transactions, the whole thing is a bit of a faff.

So for the stores and the Card Networks, everyone wins when you can cut customers over to Contactless. We, of course, get our cognitive processes messed with.

Ah right thank you for the clarification.

Glad my memory, though imperfect, isn’t entirely out-of-whack!

I use credit for most business transactions. It’s convenient, and depending on where my bank balance is at a given time in the month, doesn’t incur overdraft fees.

https://www.theguardian.com/money/2017/jul/12/cash-contactless-payments-uk-stores-cards-british-retail-consortium

I know Niro who wrote the article on the contactless (how easy it is to rack up debt with it, psychologically speaking)

For Visa I suspect those debts are the point.

I think that the other thing underlying this is the fact that Visa, like most credit companies maintains a two tiered business model. Big franchise businesses like Target, Wal-Mart, Amazon, or (I suspect) SweetGreen linked above do such a high volume business that they pay little to no overhead for credit card access. In many respect Visa pays them by providing a free service because their use of the machines provides Visa with real money.

But smaller places, single restaurants, independents, and the mom-and pops must pay through the nose for credit card readers, often paying a per-transaction fee. For them taking cards is a costly hassle that puts them more at the mercy of Visa than the other way around.

One Deli owner that I frequented commented to me that his transactions were so high that he would literally pay more per day for the machine than he would profit from the transactions on it. This was true he said for most food businesses like his which have narrow margins as it is and cannot really afford anything that cuts into them. That is why the other small restaurants that I know which do take cards still encourage cash at every opportunity. It is better for both the wait staff AND the owner.

In this respect Visa’s commitment of money is not really a donation. All that they are doing is rowing cash back to themselves by (temporarily) cutting their own fees.

I prefer cash for the security aspect. The bank has never contacted me to reissue my cash because somebody has hacked the vendor.

Same here. I am also worried about giving too much power to big institutions like banks and governments in the form of monitoring my purchasing behavior even though I don’t buy anything illegal or even strange.

Another thing that I like about cash is that it forces me to monitor my own spending habits which keeps me from overspending. It is easy to go hog wild with your credit card, especially online. With cash I have to count how much I have in my wallet and this forces me to restrain myself. I almost never impulse buy when I am using cash since I hate seeing my wallet running low or empty. There is something about looking at a wallet with only a few dollars or nothing in it that makes me feel bad.

Few remarks :

a) It seems that healthcare is not the only grossly over-invoicing sector in the US. 3% processing fee ? EU just adopted a directive capping it at 0.3% for credit and 0.2% for debit…

b) Cash is not free, it is actually the most expensive way to make a payment for a given amount. The ECB estimated in 2012 that all cash processing costed 0.49% of GDP in the EU. It is paid somehow by someone.

c) When will one stop this practice of paying service workers through discretionary tips after the job is performed ? This is Dickensian ! I am honestly surprised to find supporters of this in a left leaning blog. I understand though that there is problem of collective action to eradicate it. Not giving tips to someone one knows is only paid through tips is rude and dishonest. Removing the cash payment could be an opportunity to go around that problem of collective action. I would certainly be a patron of a restaurant who advertises its non-use of cash together with honest pay for its waiters/waitresses.

d) I am even more surprised to see the easiness of money laundering through cash in the list of pro-cash arguments. Criminal activities are supposed to be bad, no ?

Personally, when I visit a shop that does not yet use contactless terminals for small payments, I make a point of telling them that they should upgrade soon. One can also loose customers by not using modern way of providing payments.

In my opinion, the real problem with electronic transactions in the US is that it seems to have been delegated to private monopolies that are both technology lagged and very expensive. Countries where it is managed as a public or semi-public infrastructure fare much better.

Your point a is one of the reasons I try to use cash in local businesses. As Yves mentioned above, she pays 3% fees on credit processing as well. If processing fees were capped here in the US as well I might feel more comfortable using credit more often.

Shorter: please track my every purchase!

Your electronic purchase data is not private. Imagine getting the following from your

health insurance extortionist:

“Electronic data proves you are eating a high proportion of your calories as fat, therefore you mandatory health insurance payments are going to increase by 25% as of next month. The charges will be added to your electronic payments.”

Well they may get your business but they would lose mine. I value my privacy.

Re. Tips

I loved working for tips because they were cash. The tips were effectively tax free and equal to the piddling gross wage they paid.

redly may think they are beating the system by working for tips and not declaring the income. No taxes paid sounds like a win win situation. There is a flaw in doing this. You pay later when you reach retirement age. Your SS is determined on your entire working record. If you cheat and don’t pay in you probably will be disappointed come retirement time. If you saved and invested the money and are lucky you might have a small nest egg put aside. The problem is that it doesn’t take long to spend a small new egg. Then you are going have to reduce your life style because your income is reduced. SS payments go on for as long as you live. Unless your unlucky and die young I believe it’s wise to get the most you can from SS by contributing what is required by law. I know several self employed people in jobs where they can hide some of their income and not pay income or SS taxon their earnings. Most of them can not afford to retire and end up working until the die. You either pay now or pay later. When 401K’s first came out they were sold on the idea that your tax rate when you take out the money will be less so you will pay less tax on the money. For me that isn’t true. I have two pensions. One is 70% of my FAS plus a yearly COLA.. The other is SS. Put them together and my income is in the same tax bracket that it was in when I was working. You pay now or later. It’s up to you to decide when.

When you are working minimum wage and paying student loans (even 20+ years ago), what is this “saving” you speak of?

The other huge problem with getting paid in cash and not reporting if you’re a low income person, as most people who get paid in cash are, is that you miss out on the earned income tax credit. (EITC or EIC) Lots of people, including lots of $15 minimum wage activists, don’t understand that the government pays you at tax time. But you have to file. If you have one child, are single, and earn $15,010 annually or less, you get $3,400. With three or more children, $6,318. No children, and it is a maximum of $510. If you’re working 1,600 hrs a year, that would raise your effective pay (in the three child example) from $9.38 to $13.33 an hour, or 42%. I think the $15 minimum wage activists don’t realize that they will likely be losing benefits on a percentage basis at a $15 minimum.

The Frugal Professor has a great exposition of the earned income tax credit in this guest post at Go Curry Cracker.

http://www.gocurrycracker.com/earned-income-tax-credit-guest-post/#more-7581

I get my income from both a minimum wage job with tips, and from self employment which used to be almost exclusively cash, but I have recently had to start accepting cards out of necessity. Fortunately it is still at least half cash.

I try to avoid using cards myself. As others have mentioned, I like keeping track of my “cash flow”, in the literal sense. Any checks and electronic transfers go into my bank account to cover two or three checks a month I write to pay some of my bills. The rest of my bills and most of my routine expenses are paid in cash.

I do report my cash income for the reason mentioned above, in hopes of maximizing my SS income. My current income is low enough that I don’t pay much besides SS and Medicare. Of course, when I retire all of my cash income stops, so if I want to keep spending cash I’ll have to make regular withdrawls. That’s assuming that the banks and/or the federal government continue to allow me to withdraw cash.

b) Neither are electronic payments. It’s just a propaganda technique where money spent on cash payments is counted as costs, but money spent on cashless ones isn’t;

c) That argument is wrong simply because there are lot of countries where cash payments are prevalent, but service staff receives normal salaries and American tipping culture doesn’t exist;

d) Criminal activities are bad, but the traits of cash that make it attractive to criminals also make it the best payment method for regular people.

I go to a bar each day for a couple of beers and some sometimes interesting conservation. You can learn a lot about society by listening to bar conservations. Although this bar doesn’t take credit cards and they serve food, and they do have an ATM machine. I never use it because they charge to use it. I stop by my CU weekly for what cash I think I will need. For everything else I use one of my charge cards depending on what one provides the biggest rewards for where I’m shopping. None of my cards charge a fee for the card. I pay the bill online through a transfer before due so I have never paid any interest or fees. If I don’t have the money to pay the bill when it’s due , I don’t charge it. Each year I get back between $800 and $1000. To me it’s worth using the card. Why would I pay cash when using the charge card pays me money back. In effect it give me a discount on what I buy? I have no problem getting a card. In fact I recently saw an offer from a company that would give you $100 back after you charged $500 in three months. I got my $100 back after the first month and haven’t used the card since. What is interesting is this card came from the same company that I already had a similar card. I’ve done this same thing on three different occasions. A smart consumer can use plastic money to their advantage. The only requirement is that you be prudent in charging and paying off..

I use a credit card (no annual fee) that gives points that I can redeem at no end of shops and other institutions and do the same as you (pay it off in full etc). I have a £50 Amazon gift voucher sitting waiting to be used.

However, I am well aware that the company are using the transactions data to help them build their own online panel for use as a source of respondents for third parties who want to do research (like my company). Retailers with charge cards could also contribute their datasets when a panel company needs a certain type of respondent or have their own specialised customer panel (and only the fairly small numbers of customers who read the fine print and opted out of the secondary use of data are omitted). I’m fairly relaxed about the use of data (since it can so easily be obtained by other means anyway these days) but I can totally understand why lots of people would not be happy in the least.

Be aware that the merchants you are using the rewards cards at are the ones paying for those rewards. The processors charge a higher fee to merchants to accept those cards, part of which is then past on to you as airmiles or cash back or whatever. It may be a good deal for you, as a consumer, but it’s awful for everyone you are making purchases from. So please, just use cash, or at least a regular old debit card, when shopping at a local place. Those rewards cards should be saved for purchases from large corporations only, imho.

+ that comment ↑↑↑↑. no such thing as a free lunch.

For some there is. I don’t feel bad for those that can’t manage their finances and try to make me feel bad about making wise financial decisions. If someone offers me free money , I would be a fool to not take it.People need to be more prudent in how they spend their money and how much they buy with a credit card. Live within your means. I’m not saying that I never borrowed money and paid interest. On occasions there is no other good option. Examples would be big purchases like a house or car. Most people including me wouldn’t have a house or car if they had to pay cash.We all pay in one way or another to rent seekers sometime during our life.

Re “If someone offers me free money, I would be a fool to not take it.”

Just because the costs are not visible to you, does not mean they are not there.

You are surrendering valuable personal data that is being used for a variety of purposes that would most likely horrify you. And then there are the less horrific purposes, such as tailoring advertising to get you to buy things you do not need, or adjustiung the prices your are quoted online to get you to pay whatever certain vendors’s systems calculate as affordable for you.

You are costing your vendors revenue, which is being skimmed by VISA, MC etc.

I am not intrinsically opposed to electronic payments. True efficiency is a good thing. But I am vehemently opposed to a duopoly system with inflated costs and no consumer protection with regard to the electronic data that is being skimmed along with the outrageous payment fees.

I agree with diptherio as a tactic, but ” no such thing as a free lunch” is a meme seeded by uncle Milty that just won’t die, yet he was wrong. Usury, parasitic rent extraction, and profiteering are all about “a free lunch”. Can you see how ‘cashless’ would make it less perceptible than it already is?

Usury, the crop that grows without rain. Modern version is all those payday and subprime lenders braying about how if they didn’t step up, those poor borrowers would have nobody to rely upon. Teach your children to avoid debt. Patronize locally-owned businesses and pay cash whenever practical.

The few local businesses that still exist where I live don’t take a debit card. It’s only cash on the barrel head.

I never ever use my debit card. Credit cards come with some semblance of protection – I don’t want anyone hacking into my bank account.

Whenever the keep cash debate comes up I feel I am a total outlier. I receive all my retirement income directly into my bank account and use a debit card whenever I can, this may mean going a month with the same ten of twelve dollars in my wallet. For just about everything I use my debit card which is free as I have monthly deposits into my account.

Admittedly the banks can and do make money out of a lot of card holders but I can imagine the day when there is a state bank and each individual has all his/her income going through that free account each month.

Privacy? There’s not much privacy right now. You’re on camera everywhere you might pass cash over for payment…

But I have an idea for creating a free enterprise economy which is less likely to allow individuals to acquire obscene amounts of money/capital. I see a requirement for differentiating between “need to support a lifestyle money” and “spare money” It’s spare money “capital” that makes more money that needs to be taxed. How to differentiate? Every month (say at midnight on your birth date) your state account is reduced to zero by the government. All expenditures before the end of your “month” will have either gone for living expenses and anything else you may have invested/saved but 30, 40 or 50% (set by government)of that money will be due whenever that money is redeemed from stocks/saving or whatever and moved on. It would maybe then be spent on an item and the merchant would operate on the same system, spend in within the month on some cost or invest/save it and have the tax liability.

There would still be incentive for people work and improve their lifestyle, there would be no income tax for low income people living month to month. The government could manage the economy by varying the tax rate.

Obviously a system like this could only work by outlawing cash and any other tangible means of exchange.

Sounds like how the implied economy in Star Trek TNG would work.

if you try to reconcile all the various onscreen dialogue Trek writers created over the years.

What could go wrong? Well, one possibility is that if a person irritates someone with power, the person will find that there is mysteriously less money in his state account than in previous months.

All the rewards cards are yet another reverse Robinhood take from the poor and give to the rich. You need a good credit history to get these cards. Holders get a discount that everyone else pays for both in the price of the product and in the swipe fee.

Good point – nothing’s free!

What it would do is force those with bad credit and small-to-nonexistant bank accounts to use cash cards for their transactions. Which come with even more fees and charges than regular credit cards.

Re-post of comment from June 19

Not funny。 on a recent trip state side, I tried to pay for $43.xx of food with a $50 note. The clerk call the office, and the manager sent someone to get my car tag and report me to the police. Apparently they hoped I had enough cash to allow the police to confiscate it, and the police share the proceeds with their informants.

Carry cash and you become a suspect drug dealer… and a major source of income to the modern system of enslaving the poor via bondsmen, probation officers, and the courts replacing whips and chains.

IN NYC the ATMs now regularly hand out $50s so they aren’t suspect here.

Inflation will solve this problem at some point.

Today’s $50 has the purchasing power of the ATM’s $20 bill in the 1980s…

Where I live the local utility company stop taking cash a couple of years ago. Though I’d love to tell them where to go, it’d be a blow to my quality of life to not have electricity. Plus I’m just not interested in wasting my energy in a court battle to make a point the majority of Canadians couldn’t care less about. Sometimes one has no choice but to lose a battle but still keep fighting on other fronts.

I must admit surprise that the local government hasn’t followed suit when it comes to property tax payment. Instead, they not only take cash, they are the only ones who still give pennies in change! How nostalgic it that?

Regarding credit cards, I have one simply for convenience. I only use it when dining or shopping in a “chain” establishment. I would never use it in a local business.

Where I live if you pay your property taxes with a credit card they charge you an 8% fee. Apparently they don’t want to be bothered with credit cards.If you don’t pay your property taxes it isn’t very long and they put he property on the default list and sell it to recoup unpaid taxes.

Here is what I propose: A cash mob day. When we leave the plastic at home and just pay cash.

I really like this idea. And how about a mock bank run day too. Er’body takes the max out in cash at an ATM, or if ya have the time, go right to a teller window and grab a wad of cash. Deposit it right back a few days later. Or not.

I think that would day would make a lot of the less computer focused criminal element very happy.

Here is what I propose: reach out and kick VISA in the teeth. Copy of VISA press release:

Email I just sent to the contact listed at the bottom of the press release (ahadzibe@visa.com):

Stinkin’ bankster parasites …

Snail mail address of Jack Forestell, head of global merchant solutions, who announced the VISA Cashless Challenge:

In their sties with all their backing

They don’t care what goes on around

In their eyes there’s something lacking

What they need’s a damn good whacking

— Beatles, Piggies

News you can use!

can some big tech company w/shareholders (AMZN, GOOGL) who don’t care about valuation start up a new credit card processing franchise? (paypal is kinda getting there_

Visa, Mastercard, Discover, Amex need some big disruption.

Elon Musk would make more money disrupting Visa.

Visa is barking up the wrong tree. They’d be better off building more intuitive, less wonky online payment and transaction systems, where everything is cashless by default, rather than trying to cajole bodegas into the “future.” (Not to mention, once everyone reverse engineers that samsung pay tech, why would they need upgraded payment technology?)

Visa and Master Card take typically 2% of the bill.

Amen typically takes 6%, or did when I was in the business.

As for competition, I has a customer Standard Bank, who became a Master Card issuer, and Barclays was the Visa issuer. I sat in on a phone conversation between executive of the Banks where they were synchronizing the fees to merchants.

The Standard Bank executive turned to me an said with a grin, “that conversation never happened.”

My response was “what conversation?”

The restriction on the use of cash has been so “successful” in India, it’s only fair that we in other parts of the world should share their suffering.

An entire hour long program on the Indian Experiment, funded by USAID, the use of the Euro to make the dollar King Currency again, in digital form of course. Ignore the hokey intro music, this is a serious program about the very subject of attempting to eliminate cash worldwide.

https://kpfa.org/episode/guns-and-butter-april-12-2017/

Other difficulty in America is the rural life of many citizens. Stable internet access isn’t a guarantee in many places.

I live near a lot of Amish people. Cash is king, man.

Even in cities, there are sometimes interruptions in access to the internet. For now and in the near future, a cashless society is pure fantasy.

For a creative outlet, I’m a musician. When I play out:

The gate (cover charge, door money) is cash.

The hat that is passed is cash.

The merch is sold for cash

The cut of bar sales for bringing thirsty fans is cash

The sound person is paid in cash

The music gear (in my case anyway) is usually purchased with cash or trade

Royalties (itunes, streaming, licenses, etc) are paid electronically or by check, which becomes a major pain, as that is taxable and requires a business account at the local credit union. The cost of a business account at the CU, including incorporating each band, isn’t worth it since its a money losing enterprise to begin with (recording/publishing/booking is not cheap!).

The cash that I get for playing and selling merch is amplified because it isn’t taxed, tracked, or cut through bank fees. Eliminate cash and the accounting becomes so complicated and fee-riddled that music no longer is a viable pursuit for artists who still need day jobs (and that’s nearly all artists).

My $0.02

Redleg, I deeply admire performing musicians and sympathize with the challenges of trying to make money at it. It drives me crazy that many people claim to value music, but still expect to get it for free. I’ll gladly pay cash at the merch table to save you the cost, hassle and monopolistic practices of the credit card companies. At the same time, it bugs me when people say that cash income is “tax-free.” Let’s be honest: you choose to evade the taxes.

It’s tax free, given deductions for recording, mastering, art, publishing, travel, gear, maintenance of gear, booking, merchandise, websites, publicists, live sound, etc. So no, I’m not choosing not to pay. I’m choosing not to go through a very complicated process to officially owe zero. We keep track of the pay and the expenses because our spouses want to know where the money goes. If I ever made a profit I will be happy to pay. Hell, if we almost break even in a year our spouses throw a band party. That’s happened once – we sold gear to get there (and regretted selling the gear).

Most musicians I know don’t make enough to cover their expenses unless they play covers several nights a week, but playing covers several times a week inhibits development of original material. It’s a catch 22. The high end musicians (platinum records, Grammys, etc.) do the same thing, except they play as sidemen or producers instead of cover bands.

Now bartering for gear? That is designed to avoid sales taxes. And angry spouses.

Elena Eleniak explained in ‘Under Siege’ that she had one rule: ‘I don’t date musicians’.

Fair points, redleg. Thanks for the reply, and keep making music.

Chase Pay is bribing consumers directly. Here’s the email I just got:

GET $5 OFF THE FIRST TIME YOU ORDER AHEAD

Use the Chase Pay app and get $5 off the first time you order ahead from your favorite restaurants.

Available offers in the app are automatically applied to your eligible orders at checkout. Offer expires 7/31/17.

TRY CHASE PAY TODAY

Has anyone had experience spending time in Sweden lately? We were there for a wedding 4 years ago and cash was OK, but I understand that cash is now very infrequently accepted. How do visitors cope? Are there some government-issued cash cards that one can buy at the border using a credit card? Or what? The actual physical transaction of a foreigner buying something in Sweden is what interests me.

Apparently (if my Polish acquaintances living or collecting welfare in Sweden are to be trusted) this anti-cash fad is overblown by media, the government and banks try to discourage cash use, but it’s still prevalent enough to not be a hassle for cash using foreigners.

Nail salons as money-laundering fronts? Saul Goodman lives!

We had our debit card hacked once, through an ATM machine. Yes, the bank refunded our $700 but what about the poor merchant who was out of pocket that money.

We seldom use a credit card, mostly for online shopping…for that we have a card that has a $500 limit.

We use our debit card…which still still costs the vendor a fee, but not as much as Visa. I no longer use a debit at stores I don’t normally shop in, I use cash then.

I am concerned about the push to a cashless society, I don’t trust that our cards etc. will be safe and I don’t want my information to be gathered.

Every time I read about the “cashless” world to come I am reminded of a Calvin & Hobbes cartoon from a good many years ago.

Calvin asked the Dad where he was going. Dad replied to buy a book, using cash and wrapped it in a brown paper bag.

Exactly the same here, Marieann — “We seldom use a credit card, mostly for online shopping…for that we have a card that has a $500 limit. We use our debit card” — or (mostly) cash.

My wife and I still use an analog landline phone at home; don’t own a cellphone at all (and wouldn’t have one if they were free — I’m looking forward to getting pulled over by some LEO and watching the expression on his face as he tries to suck the data from my cell phone….).

We are 100% debt-free, and haven’t paid a single penny in interest/bank fees of any kind in years. I have been known to drive 30 miles out of my way to avoid paying a toll road charge. I will not do business with anyone that does not accept cash.

It gives me tremendous satisfaction to know that I am starving the bloodsucking parasite banksters. If only more people were willing/able to do the same…. Hit the bastards where it really hurts them, right in their wallets!!!

Glad to know there are others without cellphones. We still use rabbit ears and DTV converter boxes for our CRT televisions.

I always pay cash at retail stores, even though I have a 1% cash back credit card. I have only used my debit card to withdraw cash from credit union network ATM’s.

Parasite banksters is right. They are $2 to $10 feeing people to death.

It is just great to read of others without a cell phones. My husband and I were sure we were the only ones left in the world.

We also use the rabbit ears…..I tried to explain it to someone once, they could not get there head around the fact that I did not pay for TV service.

We are the same with debt-none and we have never paid interest fees either.We have never paid banking fees either.

I try to starve corporate as much as I can by making it myself….or doing without.

Another way to not pay for TV service–have no TV! I recommend it.

Though of course you don’t get the best internet rate without “bundling.”

I actually don’t watch it. We use it for DVD’s and my kitties watch their bird dvd’s.

Though I did turn it on for the Detroit Weather this week, we have had some weird weather in the past couple of weeks.

Our Canadian stations give the Toronto weather forecast, and since we are 10 minutes from Detroit and 4 hours from Toronto guess which one is more accurate.

Yeah, can’t wait to see the bill arrive after a big meal, drinks and dessert and have them tell me they won’t accept my cash that clearly states on the face of it that it’s legal tender for all debts public and private. “You don’t want my money? OK, send me a bill, here’s my address…I will send you a check.”

Now if the restaurant menu has prices in bitcoin or Euros or Pesos, I could see how they get away from it.

Any merchant that does not accept cash should be severely panned and downvoted on Trip Advisor, Yelp and all other media.

“There were cockroaches in the bathrooms! Service was rude, they tried to cheat me” Etc…

If you prefer a just slightly more fact-based critique, try “There were fleas/ticks/leeches/vampire squids all over the card machine which I HAD to use” and so forth.

And, of course, The Handmaid’s Tale very nicely showed how easily an autocratic government could put and end to women having rights to credit cards and then cash. Neolib/conservative could work things the same way.

“And even though I am often slow to deposit checks because I find it hard to get to the bank, I’d still rather have checks despite the somewhat greater hassle because I save the 3% cut the card networks take.”

I will keep that in mind when the next time I give to NC comes around. Thanks for letting me know, I prefer it too!

My mechanic, who I have gone to for years and who has given me rides to my house when I have to leave the car and so knows I live, recently asked me to pay by check rather than take credit and have to pay those fees. I’m fine with that and happy to circumvent the bank. Of course hardly anyone one takes checks anymore.

This is new to me. Merchants will sometimes not accept a credit card for a low value transaction, e.g. <$15. It's possible that VISA is trying to force the merchant to accept a CC for a low value transaction which is not the same as forcing cash only.

” Clive informs us that the card network typically retains only the date of transaction.”

I have to disagree with this, at least for some time value of ‘retain’, as I have challenged transactions with American Express, and they have been able to provide me detailed charge records (for transactions that were swiped at gas pumps) that contained date and time. These transactions were within the billing cycle, so I can’t say whether they retain the time stamp data beyond that period (but storage is cheap, so why wouldn’t they?).

I regularly get food from Sweetgreen, and don’t mind using the card (they swipe my card, even though it has a chip). Am I going to convert to their app? Don’t know. If it were a direct debit from my checking account, I probably would, as I prefer that (even with the risk of transaction error overdrawing my checking account). LevelUp, which I also periodically use, just enters a charge on my AmEx.

Nationalize the network as public infrastructure

In contrast to the US Canada seems to have a more efficient and less costly debit card system (Interac). Using Interac debit means that the store has to spend a whole lot less than credit and it works as if cash.

https://www.interac.ca/en/current-fees.html

Personally I still use credit a lot, but use Tap (non contact very quick processing – faster than cash!)

The treasury doesn’t make, enact, enforce, or offer opinions about laws. They print money, mostly, and do a few other things.

Businesses can’t refuse money – if they could, banks would refuse to accept cash and the economy would collapse within seconds.

I agree, but they are arguing for an interpretation of the law that courts would likely support.

I have a query.

Can cash as legal tender be refused?

I don’t see how it can be legal.

Yes, cash can be refused. According to the Federal Reserve there is no Federal Statute that requires a business to accept cash. I looked into this when a large number of area businesses were refusing to accept large bills.

One interesting side note to think about: If businesses or individuals are not required to accept cash as payment for the settlement of debts, then the only thing cash is good for is paying Federal taxes. I think this fact bolsters the MMT arguments significantly.

“By contrast, even if you use a credit card at a store, Clive informs us that the card network typically retains only the date of transaction.”

Wrong-O Clive. Not only does the credit card company retain that information, but there is also a middle man in every credit card transaction that retains that information, and the merchant retains that information as well. First, when you process a credit card transaction, the transaction does not go right to the merchant and then they pay the company. The merchant has to pay a company that provides transaction security as well as this middle man “translates” the information from the merchants machines into a batch file that the credit card processor’s software understands. Then the processor sends the money to the bank. Please note, this middle man may not be necessary for every credit card transaction, and I have been out of the merchant’s side of this in a couple years; things probably changed.

So to my point about the information not being kept. In my 10 years of experience as the merchant, it was important to retain as much of the transaction information as possible because if you had a chargeback (a protest by the cardholder of suspicion of fraud), the merchant needs as much information as possible to not only protest the transaction, but to also identify the transaction in question. And all 3 parties that I mentioned in the previous paragraph retain all of this for at a minimum of fraud investigation. They retain time (to the second), date, card number, type of card, etc. (I only encountered that much data. I would suspect there was far more.).

Second, to say CC fees are “on average 2%” is baloney. You have to be doing millions in processing on a monthly basis to get near that rate. And even then there are basic flat fees that are charged on processing that will be near impossible to lower. Also, Amex charges 3% to the merchant for the acceptance of their card. The average small business would probably pay about 3.5% of total amount processed in processing fees.

Finally, I am starting to see a “service fee charge” on my receipt when I use my card. Merchants are passing along that 3% processing fee to the customer. So I end up paying 103% for the purchase. Credit card processors are not encouraging this so much as including it in their roll out of services, sort of as a “also if u would like, we have this feature, if you need help activating it, please contact your processing representative”. This ruins the incentives I have to use the card (“2% cash back on all purchases”).