We’ve written regularly about how private equity firms are widely acknowledged to lie about their portfolio company valuations, inflating them when they are raising new funds, in crappy equity markets, and late in the life of funds, when the most of the remaining holdings are valued at their purchase price but typically sold at a loss.

But their go-go cousins in venture capital tell much bigger whoppers, and with much more visible companies.

A recent paper by Will Gornall of the Sauder School of Business and Ilya A. Strebulaev of Stanford Business School, with the understated title Squaring Venture Capital Valuations with Reality, deflates the myth of the widely-touted tech “unicorn”. I’d always thought VCs were subconsciously telling investors these companies weren’t on the up and up via their campaign to brand high-fliers with valuations over $1 billion as “unicorns” when unicorns don’t exist in reality. But that was no deterrent to carnival barkers would often try to pass off horses and goats with carefully appended forehead ornaments as these storybook beasts. The Silicon Valley money men have indeed emulated them with valuation chicanery.

Gornall and Strebulaev obtained the needed valuation and financial structure information on 116 unicorns out of a universe of 200. So this is a sample big enough to make reasonable inferences, particularly given how dramatic the findings are.1 From the abstract:

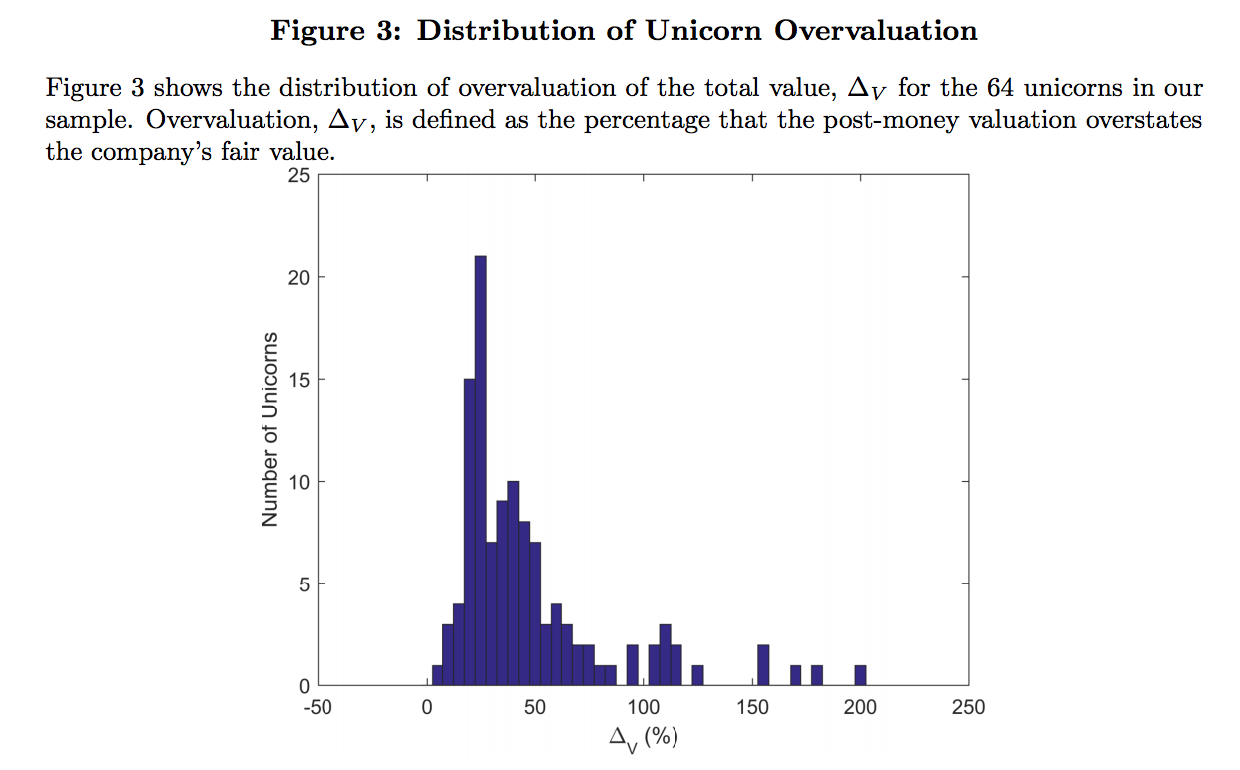

Using data from legal filings, we show that the average highly-valued venture capital-backed company reports a valuation 49% above its fair value, with common shares overvalued by 59%. In our sample of unicorns – companies with reported valuation above $1 billion – almost one half (53 out of 116) lose their unicorn status when their valuation is recalculated and 13 companies are overvalued by more than 100%.

Another deadly finding is peculiarly relegated to the detailed exposition: “All unicorns are overvalued”:

The average (median) post-money value of the unicorns in the sample is $3.5 billion ($1.6 billion), while the corresponding average (median) fair value implied by the model is only $2.7 billion ($1.1 billion). This results in a 48% (36%) overvaluation for the average (median) unicorn. Common shares even more overvalued, with the average (median) overvaluation of 55% (37%).

How can there be such a yawning chasm between venture capitalist hype and proper valuation?

By virtue of the financiers’ love for complexity, plus the fact that these companies have been private for so long, they don’t have “equity” in the way the business press or lay investors think of it, as in common stock and maybe some preferred stock. They have oodles of classes of equity with all kinds of idiosyncratic rights. From the paper:

VC-backed companies typically create a new class of equity every 12 to 24 months when they raise money. The average unicorn in our sample has eight classes, with different classes owned by the founders, employees, VC funds, mutual funds, sovereign wealth funds, and strategic investors…

Deciphering the financial structure of these companies is difficult for two reasons. First, the shares they issue are profoundly different from the debt, common stock, and preferred equity securities that are commonly traded in financial markets. Instead, investors in these companies are given convertible preferred shares that have both downside protection (via seniority) and upside potential (via an option to convert into common shares). Second, shares issued to investors differ substantially not just between companies but between the different financing rounds of a single company, with different share classes generally having different cash flow and control rights.

Determining cash flow rights in downside scenarios is critical to much of corporate finance, and the different classes of shares issued by VC-backed companies generally have dramatically different payoffs in downside scenarios. Specifically, each class has a different guaranteed return, and those returns are ordered into a seniority ranking, with common shares (typically held by founders and employees, either as shares or stock options) being junior to preferred shares and with preferred shares that were issued early frequently junior to preferred shares issued more recently.

The way the VCs mislead the press and the general public is how that they assign a valuation after each round of fund-raising assuming all classes of equity have the same value. As the authors elaborate, using Square’s October 2014 financiang as an example:

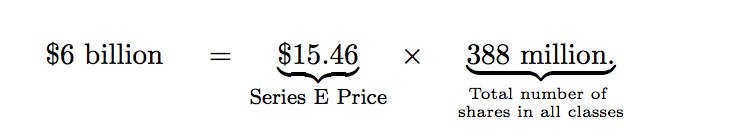

Square was assigned a so-called post-money valuation, the main valuation metric used in the VC industry. This post-money valuation is calculated by multiplying the per share price of the most recent round by the fully-dilluted number of common shares (with convertible preferred shares and both issued and unissued stock options counted based on the number of common shares they convert into). After its Series E round financing, Square had 256 million common shares and 132 million preferred shares, for a total of 388 million shares on a fully-diluted basis. Multiplying total shares by the Series E share price of $15.46 yields a post-money valuation of $6 billion:

Many finance professionals, both inside and outside of the VC industry, think of the post-money valuation as a fair valuation of the company. Both mutual funds and VC funds typically mark up the value of their investments to the price of the most recent funding round. Square’s $6 billion figure was dutifully reported as its fair valuation by the financial media, from The Wall Street Journal to Fortune to Forbes to Bloomberg to the Economist.

The post-money valuation formula in Equation (1) works well for public companies with one class of share, as it yields the market capitalization of the company’s equity. The mistake made by even very sophisticated observers is to assume that this same formula works for VC-backed companies and that a post-money valuation equals the company’s equity value. It does not…

.

And here is the kicker: had this valuation (the last before Square’s IPO, which was way below the $6 billion value shown above) taken into account the claims all the other classes of equity had on cash flows, the authors calculate that the value of the common shares would have been a mere $2.2 billion, meaning the value was inflated by a whopping 171%.

And the paper confirms that just as in private equity, where everyone knows valuations are often sus but no one challenges them because the path of better bonuses and PR lies with playing along, so to VC investors who presumably do know better report these bogus figures to their limited partners:

Conversations with several large LPs indicate that VC funds follow the same practice and mark their holdings up to the most recent round. Even within the VC industry, many people treat post-money valuations as the fair value of the company.

And there are even more cute tricks VCs can and do play. For instance, companies can show rising valuations if they give enough goodies, meaning preferential treatment, to the latest round of funding, when a proper “post money” valuation would show that round lowered the “common shareholder” computation.

Towards the end, the article has a useful section, “Unicorns are Overvalued,” that not only shows their overall conclusions but also shows how often unicorns use terms that inflate valuations like IPO ratchets.

Let’s stop for a second. It isn’t just business reporters, who are typically captured and don’t have enough in the way of finance chops to challenge Silicon Valley Masters of the Universe, even if they think they are on to something. Investors like Fidelity and T.Rowe Price that are investing in some of these companies on behalf of retail mutual funds have been passively accepting these bogus valuation methods. Any fiduciaries, now that this practice has been outed, need to demand proper valuations or they will be violating their fiduciary duty by relying on egregiously incorrect valuations and being unable to make prudent decisions. And on top of that, some heads need to roll.

Note that employees lose, since they also believe the hyped valuations apply to their much less well protected interests in these unicorns.

But this sort of chicanery makes a mockery of the “trust me” posture that is only becoming more widespread in securities investing in the US. Even the notably lax Mary Jo White remarked during her tenure at the SEC:

In the unicorn context, there is a worry that the tail may wag the horn, so to speak, on valuation disclosures. The concern is whether the prestige associated with reaching asky high valuation fast drives companies to try to appear more valuable than they actually are.

Jay Clayton is managing the difficult task of making White look like a vigorous enforcer. He’s so eager to have more IPOs that he has effectively thrown the gate open to fraudsters by going beyond his statutory authority and extending the JOBS Act, which among other terrible ideas, allowed companies to go public without having audited financials, to any company, not just the smaller “growth” businesses who were the original targets for these waivers.

And what is Clayton’s bright idea? To crack down on retail frauds, like bucket shops. Pray tell, how much in dollar terms is actually lost to them? You can bet it’s bupkis compared to the magnitude of valuation fraud identified in this paper alone. And that’s before you get to the fact that maybe getting some compensation years after being ripped off is vastly less satisfactory than never having been ripped off in the first place.

Turning the public and private markets into “heads I win, tails you lose” propositions on such a glaring scale will drive equity investing into disrepute, a status it held from the Depression into at least the 1960s. Even in the early 1980s, buying stocks had a whiff of sulphur about it. But the new class of promoters and regulators don’t seem to mind killing the goose that laid the golden egg as long as they get enough gold in the process.

____

1 One would expect wanna-be unicorns with the dodgiest practices to be the most secretive. In other words, if anything, the sample for this study is likely to have the “better” unicorns in it. The authors state that they tested their subset against their original sample of 146 unicorns (they had certain valuation filters from a bigger original set of 186) and found it to be similar along multiple axes.

Note also that the paper describes in depth the limits on the data it relied upon as well as the complexity of the interaction of various classes of equity under different exit scenarios. For instance:

Beyond the simplest contracts, our model does not have a closed-form solution, especially in light of the complicated capital structures of unicorns. We therefore value securities by simulating numerous exits and evaluating the exact contractual payoffs of each class of shares at that exit.

Ugh.

SSRN-id2955455 (1)

The “unicorn” mirage is starting to lose its shine, that’s for damn certain. Subjecting valuation models to more rigorous scrutiny seems to be a good place to start and imho the greatest change agents in this scenario can be the LPs themselves. My sense though is that they see the abdication of fiduciary responsibilities, perhaps subconsciously, as less risky than missing out on “the next big thing” and this is reflected in the their willingness to swallow whole the snake oil vc industry narratives (of which valuation is but one constituent), so they dare not ask the hard questions and inject a semblance of rigor into demystifying the complex startup financing shenanigans, lest they be locked out of deals for not towing the party line. VCs have no incentive to drive the change as the opacity of these financial structures benefits them, founders typically are the party with the least leverage around the negotiating table (especially true during early financing rounds) so LPs should be the vanguard here, afterall they have the leverage of being the holders of the purse strings…

I wonder, even though I observe from South Africa and US based readers are obviously more plugged in than I am on this, if the down rounds (i.e. start ups raising money on lower valuations than previous rounds) that we are seeing with some startups are indicative of realism starting to creep back into proceedings. So perhaps there is some level of “correction” taking place but as for who/what is driving is (if it is indeed a shift in the modus operandi) I couldn’t be sure…

+1

As the authors point out they had a difficulty in getting the data. And they know that some of the data they have is incorrect.

But hey, the SEC is letting companies go public without audited financials? What fools are buying?

This was extremely informative, thank you (and that picture, almost lost my coffee).

I would think based on a number of factors – the SEC basically condoning valuation fraud, the continued lack of long term planning (extreme short-termism), and the almost desperate thrashing about by capital for returns. That pseudo unicorns will become much more widespread and brash in their fraud up until the point that we dive into another bubble or a giant unicorn blow up (juicero x10) scares capital away for awhile.

Outside of a very gentle chiding I don’t see regulators stepping in. Even if they did want to, what would they be able to do to curtail this? Would this be considered fraud (in the legal sense)?

> valuation fraud

It’s nice to have “move fast and break things,” “it’s better to ask for forgiveness than permission,” as well as “innovation” and “disruption” translated into simpler and more direct language.

…i thought value was what someone would be willing to pay???

Don’t worry, it’s contained.

Expand the 1033 program a bit and there’s no possibility of any serious blowback.

I thought the word “ponzi” would show up by now

The name of one author sounds Russian. We liberals in Silly Con valley cannot accept any fact from Russians.

We demand investigation of the author by special counselor.

Amen!

Observations:

1. IMVHO, people who don’t take the time and effort to actually understand technologies — which usually involves getting your head around some science (!) — are particularly susceptible to getting rolled.

2. If some of these ‘investors’ took the time to read through issues of Scientific American, or their local public library, or even go scout out the US government’s Patents website and other completely free, or next-to-nothing resources, they’d get rolled a lot less often — and recognize unicorns more quickly.

3. I have no idea what the pressure must be to deliver returns that will make ‘X’ revenue to fund retirees, or other socially productive purposes. But if it is driving people to buy into fairy tales, it will not end well.

This post is one more in a long series of public services rendered by NC to rid the world of economic bullshit.

Which makes a wonderful start to my day ;-)

So the SEC is now allowing “companies to go public without having audited financials, to any company, not just the smaller “growth” businesses”?… Wow!!… regarding stock valuations, unicorns and rainbows, it’s starting to seem more than a little bit like 1999… “Back to the Future”?

Btw, I noticed E-Trade is back too, apparently targeting millennials:

http://www.adweek.com/creativity/etrade-stokes-rage-against-the-1-in-remarkable-ads-from-mullenlowe/

Maybe their target market choices are rather limited. As alluded to in the last paragraph of this post, seems many of those in older generations have a rather jaundiced view of Wall Street and participation in the stock market for some reason. Maybe “financialization” of the economy is nearing the end of its useful life?

Gotta say, though, the ads themselves are creative, funny and memorable, especially the yacht episode.