Yves here. Even though Ilargi is duly alarmed about Harvard Ken Rogoff continuing to pump for negative interest rates, the op-ed flow suggests this idea is losing favor among Serious Economists. It appears that at least the Fed recognizes that the experiment with super low interest rates hasn’t worked out as they thought it would. The undue eagerness of the Fed to “normalize,” as in raise rates even though the state of the economy isn’t anywhere near zippy enough to justify tightening, shows that the central bank wants headroom to be able to lower interest rates in a crisis. The Fed may also have noticed that negative interest rates haven’t induced consumers to spend, but instead appear to be interpreted by both businesses and individuals as deflationary expectations. In deflation, you want to hold cash and cash equivalents and defer spending since most things will be cheaper later. How economists could have persuaded themselves that negative interest rates would spur spending is beyond me.

The Fed may also have come to recognize that interest rate manipulation has asymmetrical effects: that it can choke off real economy activity but is lousy at stimulating it (the cliche is “pushing on a string”).

And since the folks at the Fed don’t generally get out in the heartlands, they may not have recognized that preppers (who are not all extreme right wingers, but there are big overlaps between the two groups) love cash and gold and are paranoid about the Fed. They have guns. Trying to deprive them of their cash would not be a hazard-free exercise.

By Raúl Ilargi Meijer, editor of Automatic Earth. Originally published at Automatic Earth

Harvard professor and chess grandmaster Kenneth Rogoff has said some pretty out there stuff before, in his role as self-appointed crusader against cash, but apparently he’s not done yet. In fact, he might just be getting started. This time around he sounds like a crossover between George Orwell and Franz Kafka, with a serving of ‘theater of the absurd’ on top. Rogoff wants to give central banks total control over your lives. They must decide what you do with your money. First and foremost, they must make it impossible for you to save your money from their disastrous policies, so they are free to create more mayhem.

Prepare For Negative Interest Rates In The Next Recession Says Top Economist

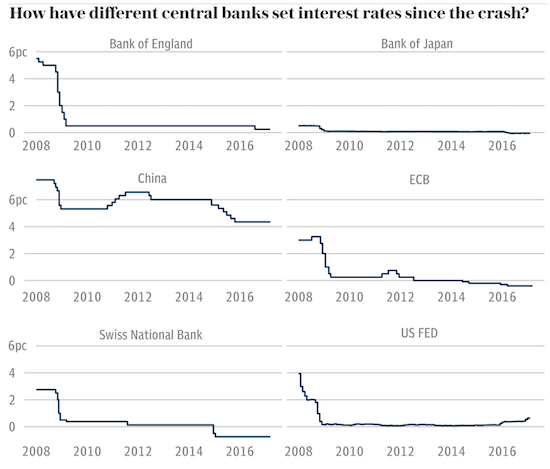

Negative interest rates will be needed in the next major recession or financial crisis, and central banks should do more to prepare the ground for such policies, according to leading economist Kenneth Rogoff. Quantitative easing is not as effective a tonic as cutting rates to below zero, he believes. Central banks around the world turned to money creation in the credit crunch to stimulate the economy when interest rates were already at rock bottom.

Central banks create recessions and crises. Not people, and not economies. Central banks. The next recession, which is inevitable, that’s the one thing Rogoff has right, will come when the bubbles in housing, stocks, bonds, etc., created by central banks’ QE, ZIRP, NIRP, start to pop. And there’s nothing worse than giving central banks even more tools for creating crises. We should take away the tools they have now, not hand them more sledgehammers.

In a new paper published in the Journal of Economic Perspectives the professor of economics at Harvard University argues that central banks should start preparing now to find ways to cut rates to below zero so they are not caught out when the next recession strikes. Traditionally economists have assumed that cutting rates into negative territory would risk pushing savers to take their money out of banks and stuff the cash – metaphorically or possibly literally – under their mattress. As electronic transfers become the standard way of paying for purchases, Mr Rogoff believes this is a diminishing risk.

Risk? What risk? The risk of people doing what their money what they choose to do, doing what they think is best? Of people trying to save their savings from being burned by central bank policies? What kind of mind comes up with this nonsense? Who is Ken Rogoff to think that he knows better what you should do with the money you worked for than you yourself do? You’d be a fool not to protect you hard-earned earnings from negative interest rates. Rogoff therefore seems intent on creating nations full of fools.

“It makes sense not to wait until the next financial crisis to develop plans and, in any event, it is time for economists to stop pretending that implementing effective negative rates is as difficult today as it seemed in Keynes time”, he said. The growth of electronic payment systems and the increasing marginalisation of cash in legal transactions creates a much smoother path to negative rate policy today than even two decades ago. Countries can scrap larger denomination notes to reduce the likelihood of cash being held in substantial quantities, he suggests. This is also a potentially practical idea because cash tends now to be used largely for only small transactions. Law enforcement officials may also back the idea to cut down on money laundering and tax evasion.

What makes sense is to not create crises. What does not make sense is negative interest rates. Ultra low interest rates have already destroyed trillions in savings and pensions, and now Rogoff effectively says central banks should take this a step further, and target whatever it is you have left. This is insane megalomania. It’s communism in its worst possible form. Oh, and it’s outright theft. Of a form that’s far more insidious and harmful than money laundering.

The key consequence from an economic point of view is that forcing savers to keep cash in an electronic format would make it easier to levy a negative interest rate. “With today’s ultra-low policy interest rates – inching up in the United States and still slightly negative in the eurozone and Japan – it is sobering to ask what major central banks will do should another major prolonged global recession come any time soon,” he said, noting that the Fed cut rates by an average of 5.5 percentage points in the nine recessions since the mid-1950s, something which is impossible at the current low rate of interest, unless negative rates become an option. That would be substantially better than trying to use QE or forward guidance as central bankers have attempted in recent years.

Forcing savers to keep cash in an electronic format would make it easier to steal it. Central banks could dictate that you lose 5% of your money every year. Or at least, that’s what they think. They want you to spend your money, and they got just the way to force you to do that. Or so they think. Well, go ask Abe and Kuroda how that’s worked out in Japan lately. What actually happens is that when you start stealing people’s money, savings etc., they become afraid of losing the rest too, so they start looking for ways to save their savings, not spend them.

In that sense, Rogoff’s suggestions amount to terror, to terrorizing people into doing things that go against their very survival instincts. What gets people to spend money is if they don’t feel terror, when they see their money and savings grow by a few percent per year. That is the exact opposite of what Rogoff wants to do. When people ‘sit’ on their savings, they do so for good reasons. What do you think has happened to Japan?

“Alternative monetary policy instruments such as forward guidance and quantitative easing offer some theoretical promise for addressing the zero bound,” he said, in the paper which is titled ‘Dealing with Monetary Paralysis at the Zero Bound’. “But these policies have now been deployed for some years – in the case of Japan, for more than two decades – and at least so far, they have not convincingly shown an ability to decisively overcome the problems posed by the zero bound.”

No wait, Rogoff is right second time: indeed “they have not convincingly shown an ability to decisively overcome the problems”. Because they’re terribly wrong. Theoretical promise? That’s all? But that means you’re just experimenting with people’s lives and wellbeing. Who gave you that right?

It’s high time, even if it’s very late in the game, to take political power away from central banks- and thereby from the banks that own them. There is nothing worse for our societies than letting these people decide what you can and cannot do with our money. Because as long as they have that power, they will seek to expand it. To prop up their member banks at your expense. And there is only one possible end result: you’ll be left with nothing. They want it all.

Until we take that power away from them, please don’t talk to me about democracy. Talk to me about Orwell and Kafka instead.

Too bad, in the resulting economic collapse, universities and colleges will go out of business, eliminating employment for such fine thinkers as Professor Rogoff.

Hear, hear ! Where economics is concerned Rogoff has got pretty much everything else wrong in the past why upset his record this time. He should stick to chess.

You can be sure he’s got his tangibles – the virtual economy is for suckers.

In all senses of the word.

God forbid the Deplorables might turn globalist themselves and start investing in real gold-backed, industrial economies like China or Russia.

‘Let them eat fake’ is this neoliberal Marionette’s ‘solution’….

I doubt very much that Harvard will go out of business.

The other day, while watching the national news about scammers and skimmers and the theft of credit and debit card information at gas pumps, the announcer, right at the very end had a useful tip for Boobus Americanus on how to avoid getting scammed.

“Use cash”.

Of course Rogoff rides in a limo, never pumps his own gas so is unaffected by the dangers peasants endure every day.

At this point, every electronic transaction is at risk, no database is 100% secure, and who knows whether the hacks are coming from the NSA, CIA, the Rooskies or some thirteen year old genius sitting in a dark basement. The only medium of exchange that is not hackable is cash.

For a chess grandmaster, Rogoff has not thought through the implications of passing laws to make the use of cash illegal. Thinking the peasants will be easy marks and cheerful victims to central bank experiments means he does not understand human nature at all. I can Imagine torch bearers surrounding the Eccles building in year three of their forced “cashless experiment” and any politician at the time running on a promise to behead central banksters will be elected in a landslide.

I suspect that Rogoff’s economic thinking is pretty much in line with his chess thinking. In each, he is working with known pieces, known moves, and known rules, and click-clacking logically through those to reach The Solution. If the real world doesn’t match up, I don’t know that he has to feel responsible.

Q.v.

Voltaire’s Bastards — John Ralston Saul

The Master and his Emissary — Iain McGilchrist

Given that Rogoff has previously advocated for crushing austerity I find it unlikely that he cares much about what happens to other people. Either that or he really is so far abstract in his views of the world that real consequences do not trouble him.

Either way, given that he published a “working paper” based upon absolutely false data, ran around the world selling policy on it, and then faced exactly zero professional consequences for the fraud he probably has little reason to check himself now.

Wow, I didn’t know Ilargi was an Austrian. Not that I agree with most CB’s policies, but this sounds pretty Rothbardian.

Yes, I should have said in the intro that his tone is overwrought even though he’s right about the super low interest rates being a bust.

He doesn’t go there in this post, but he does not understand (or has refused to consider) MMT. So he treats government debt as bad irrespective of whether it is private debt, government debt of a currency user (like a US state or Italy) or a sovereign currency issuer, where the issue is real resource constraints (as in you can create too much inflation).

But despite those shortcomings, I agree with him on the war on cash and the insanity of negative interest rates. They are a reckless experiment and there is no reason to think they will achieve what the proponents believe they will. And the evidence from Japan and saver reactions to super low rates suggest strongly they will backfire. The Fed actually convinced itself that when they cut interest rates, retirees and other savers would spend more of their capital to preserve their consumption levels, as opposed to cut spending/save even more because they were freaked out about the fall in their incomes.

The Fed is “pushing on a string” because they have never equivocally stated in public that the money they issue goes nowhere near those would spend it, and so “pull on the sting.”

“The Banks only lend money to those who don’t need it.”

Note “need.”

Yves with respect to your header comment:

I agree with you that the FED’s thinking on negative rates is nonsensical. But does it even make sense to consider businesses and individuals in the same category here or to expect that either group cares about deflation?

Businesses generally focus on investments that stimulate future cash flows or sustain existing ones. In that respect most businesses (outside of finance) are more apt to watch consumer spending and future markets when making investments and are unlikely to give the FED much thought.

Individuals on the other hand cannot spend what they don’t have. And when you are already underwater what good is a little more debt? Cheap or not that would only put you further behind.

I believe the reason that orthodox economists expected negative rates to spur the economy is that they live entirely in the world of high finance which happens to be the only place where “deflationary pressures” are sufficient reasons to spend money. And they live in the world of models that conveniently ignore things like poverty, and political policy. Real people and non-finance businesses concern themselves with other things beyond the FED’s white smoke.

Where is the logic in “ZIRP hasn’t had the effects that we predicted (boosting the economy and higher CPI) so we obviously need NEGATIVE interest rates.”? Economists have gotten SO used to explaining away the imperfections in their models that they are ignoring the fact it isn’t that their model is “imperfect” it has stopped working AT ALL.

When did their model ever work? They are always surprised by “unexpected outcomes.”

Somebody should check Rogoff’s spreadsheets for him.

It’s seems easier to play the situation as a long-odds bet and only pay the moron 80,000 $ (was it?) for his professional credibility.

I would think that neg. interest rates would encourage asset bubbles – particularly in real estate. This could create the situation where it would be impossible to return to “normal” (i.e. positive positive rates) without popping the bubble.

Doesn’t sound well thought out to me. Of course I’m not a highly credentialed economist, so what do I know…

These highly credential economists, whose pay check depends upon telling power what it wants to hear, all clam to be able to predict the future.

We have names for such people: Witch Doctors, Charlatans, Con-Artists, Fraudsters, etc.

or

Spot the difference?

Enough of the crap that the Fed didn’t buy must be out of the system (or sold to pension funds) in order to raise interest rates.

Maybe it will slow down the better-than-free money flow and the uneconomic Ubers of the world can go under like the Enrons they are.

Probably wishful thinking.

The alternative to eliminating cash for negative interest rates is the capital levy, a real estate tax on money. There might be an evasion problem.

On the bright side, if Rogoff gets his way some people might decide to spend their money on some tar, feathers and a rail on which to ride Rogoff right out of his ivory tower.

One can hope, but the reality is that academics rarely have to face the consequences of their ideas… it will be the politicians who take the heat.

Beyond raising class economic and wealth concentration issues and denial of due process questions under the Constitution, I am having difficulty understanding the basic policy rationale behind the destruction of money through negative real interest rates while the Fed has created trillions of dollars under its “Quantitative Easing” programs.

Seems to me that in addition to bidding up US Treasury bond prices, a primary policy effect of the Fed’s Zero Interest Rate Policy (ZIRP) has been to channel newly created money through the primary dealers to bid up stock and bond prices. Termed “the Wealth Effect”, this policy has led to a decline in the velocity of money, as the money rests quietly in bubble-priced financial assets. If the Fed’s policy goal is to destroy money, why not allow bond and stock prices to drop rather than fueling further maladjustments by eliminating price discovery in the financial markets through an ever-present underlying bid by the money-creating entity? Alternatively, why not tax passive wealth beyond a circumscribed level?

Leaves one wondering why deficit federal fiscal spending on programs that benefit the people of this country rather than on policies that disproportionately benefit only a small segment of the population at the expense of the majority are being so carefully avoided.

Everything you just suggested would not directly benefit the monied elites, but would instead help everybody else. Since those elites usually spend lots of bribes, aka donations, on the political class, and we cannot, those suggestions are ignored, or called job killers, or labeled communism.

Also, the wealthier you are, the more likely your income depends on those “bubble-priced financial assets.”

The Fed has not created more dollars with QE. That’s a basic misperception.

QE is an asset swap. Please read the details here:

https://www.cnbc.com/id/100760150

Bernanke did say repeatedly that it was about lowering long term interest rates and tightening mortgage spreads. Basically, the intent was to spur another housing cycle, which had traditionally been the engine of growth in the US. The Fed seemed utterly clueless that with young people having no jobs or at best not very good or stable jobs, they weren’t going to run out and buy housing just because mortgages were cheap. There was some modest stimulus that resulted from all the refis lowering household fixed costs.

Thank you for this thoughtful and thought-provoking link and the T-accounts analysis. Will need to reflect on it some as I was looking at the Fed’s balance sheet in isolation. First blush, don’t know that the Geithner Treasury’s balance sheet remained static, but am mindful of the possibility of my own “cognitive dissonance”.

Isn’t the problem also the banks are not giving out loans, but pushing credit cards instead?

From my very basic understanding, the Fed is making more funds available to the banks to lend out, but the banks aren’t playing along? Even if the “T-Bills” are swapped for “Reserves”, the bank still has to want to loan it out.

Years ago one of my managers recommended that I get an emergency loan, which would have been doable, but now I get the impression that rather than make a loan that was at that time something like 6-8%, today they want you to used a credit card at 20% plus. I vaguely remember that getting the 6% loan would have been more likely back then than getting a 11-12% credit card.

So instead of paying the bank back at 8% I would have to pay them back at 20%, or more. That’s great for the banks but the money skimmed off by that extra interest goes to them and not towards my paying off the loan or doing something productive with it. Like getting my car fixed.

BTW, thank you for the link.

Please forgive my delayed response. I needed to think about this a bit. The author of the linked article stated that a bank’s reserves at the central bank should NOT be considered “money”. I disagree with his view. The reserves serve as both a storehouse of value and medium of exchange, the very definition of “money”.

The Fed has exchanged increased reserves at the Fed for financial assets on the banks’ books. IOW the Fed has essentially created new money in the form of reserves to exchange for financial assets. The financial assets are being sold by the banks and purchased by the Fed in exchange for immediate access to funds through the conceptual equivalent of a demand deposit account subject to prescribed reserve requirements.

There already are negative interest rates, when you subtract the fees banks routinely charge depositors from the paltry interest they’re offering. I’m surprised no alternative banking system has arisen — to what extent is this a function of a regulatory regime that establishes an entry barrier but offers no real depositor protection?

The big reason I am not a real communist, as opposed to just a socialist, is the belief that governmental control, or at least an extremely strong influence, of the economy would centralize power in too few hands. If you have any good understanding of history you would realize at least the possibilities. Yet, we have those in power effectively privatizing gains, and socializing losses, and then trying to concentrate economic power into every fewer companies, and give the government, which is supposed to have its power and regulations stripped away, an even greater ability to gain information on, and control, the general population. It is a good way too, to destroy the free in free markets. I thought this was an argument used by economic conservatives against communism.

Also, what about the large portion of the American population that do not have banking access and rely almost totally on cash, gift cards, or money orders? This is not just thoughtless, it is absolutely foolish and dangerous. Especially as it looks like we might be in a situation much like the 1960s to the mid 1970s in less than four years. There will likely be much unrest, violence, and reasons for the government to overreact.

See Jerri-Lynn’s stories on India’s move to restrict cash…

The Powers That Be know no qualms.

I think I read them already, but thank you. I could do with re-reading them as I still don’t understand the why of the how of what they did.

Even in the United States a large chunk of the legal economy is cash based. If the President suddenly said that next month all the hundreds and twenties will not be legal tender, and oh yeah there are not enough new replacement bills being replaced and you can only exchange $20 a day of new for old. It would be a mess.

Talk about stupid.

Many of the stories I have read say that the common people have been very pleased by the “demonetization” in India. I find that hard to believe, since it was the poorer people who were primarily harmed by removal from the system of the equivalents of $5 and $10 bills. Are they really pleased to be forced to establish bank accounts on which they must pay fees to clear their financial transactions? Would the Indian newspapers (they seem to have less “consolidation” of communications than we do) tell us if the people were displeased?

I sent the following message to the good professor back in January. No reply of course…

Dear Professor Rogoff,

I have a fundamental question that goes to the crux of current policy debates regarding limiting cash transactions in order to achieve negative interest rates. Per Paul Krugman, “…in a liquidity trap saving may be a personal virtue, but it’s a social vice. And in an economy facing secular stagnation, this isn’t just a temporary state of affairs, it’s the norm. Assuring people that they can get a positive rate of return on safe assets means promising them something the market doesn’t want to deliver – it’s like farm price supports, except for rentiers.”

I wonder if the prescription of those in the “negative interest rates are good” camp may rest on a false premise (or two)–quite apart from uncertainty about the true equilibrium interest rate:

The first premise is that there has been excess saving in the US. How can this be so when median household net worth (at a median HoH age of 52) is only $80,000, with most of this tied up in home equity? That’s barely enough to cover 2 years of retirement spending, and lifespans are increasing. The BU’s Center for retirement research projects large retirement funding gaps for households, even under the unrealistic assumption that Social Security, as well as public and private sector pensions, will somehow be fully funded. Our national savings rate, which used to average ~10% during the 1950s to 1970s, dropped steadily after 1980 to near-zero in the middle of the last decade. It has only recently rebounded to 5%. But most retirement planning analyses tell you that a saving rate of 10% or more is necessary to fund a secure retirement, assuming realistic market returns and safe portfolio withdrawal rates. I can tell you from professional experience that a large majority of Americans are financially unprepared for retirement which, for a large number of whom, is rapidly approaching.

The second premise is that negative interest rates are likely to spur consumption. Given households’ increasing age and poor asset position, might not the income effect of negative interest rates (which are nothing more than an asset tax) outweigh the intertemporal consumption effect? Those with more wealth (i.e., from whom there is excess savings) are those most likely to be influenced by the income effect of negative interest rates.

One might oppose cash on other grounds (I do not) but I question the effectiveness of negative interest rate policy in addressing the secular stagnation issue. I believe the latter is driven by demographics and excess debt (a result of too-low interest rates in the past), which cannot be remedied by further extremes in interest rate policy. On the contrary, negative interest rates sounds like a policy designed by Captain Bligh: i.e., the beatings will continue until morale improves!

If you could take a few moments to reply, kindly explain what I am missing. I have all the right degrees, so hopefully I was trained properly.

Rogoff and his ilk are insane if they think people will let bankers tell them how to spend their money, where to keep it and in what format. The article does a good job rubbishing Rogoff and co.’s deluded rhetoric However, this…

…is just silly. And untrue. Americans have an extremely difficult time grasping the concepts of communism, Marxism, socialism, fascism (and far-right/left). You don’t have to like Obama to know he is not in any way a Marxist. Despising the Democrat Party and laughing at people who think it is socialist is a sound, reality-based policy.

One can disagree with Trump’s policies and call out people who mindlessly label him a fascist. One can criticize SJW anti-free speech crusaders and their intersectional IDPol doctrine without erroneously referring to them as “cultural Marxists”. And one can demolish a central banker’s delusion without taking leave of reality and calling it “communist”.

In the same vein, Bernie “Sheep Doogy Dog” Sanders is not “far-left” and random Republicans are not “far-right”.

NHS/Canadian-style healthcare is not a slippery road to fascist dictatorship.

Words have agreed upon meanings that are listed in dictionaries. If coherent communication has a future we need to stop making up definitions and passing them off as “truth”. The current trend of pretending every aspect of language (and human behavior) is “subjective” renders language meaningless and makes meaningful, coherent communication very difficult.

(Pretending public or corporate policy by algorithm is “objective” because mathematics is equally foolish.)

A society that has few shared values left and can’t even agree on what unambiguous concepts mean is not sustainable. This is yet another “unintended consequence” of neoliberalism and the dissolution of the nation state.

A chaotic “society” defined by a neoliberal free-for-all of “citizen entrepreneurs” frantically marketing themselves and making up sh*t as they go along with no consideration of a reality that exists outside, and independent of, their inner subjective world is, almost literally, insane.

The conflation of words like leftist, liberalism, socialism, and communism was/is part of a deliberate effort to equate them with the the worse, most evil and dysfunctional part of Stalin’s dictatorship. If everything on the “left” is the same as Stalinism then it’s all bad. Further, what is on the left keeps expanding especially as the American politics is pushed right from the 1940s to now. Unions, workers rights, workplace safety, equality, social security, food stamps, unemployment, capping political contributions, any government funding of healthcare/insurance, taxes and on and on. There is also the intertwining of such ideas as free markets and capitalism which are two different things.

This process has not weakened the political and social left it has squeezed out conservatives who don’t completely agree with the American checklist for being conservative. Both political parties have spent great effort into molding their checklist for being a good little member of either party, with neither checklist having any real connection to a liberal or conservative ideology except it seems of either maintaining the status quo ( which might mean the Democrats) or expanding the wealth, and political power of the wealthy elites most of whom are maybe to the right of an American style Francisco Franco.

You.. Temporarily Sane…

You, Sir or Madam, have won the coveted Threads Award today!

Congrats on being the Inaugural Winner!!!

B.bu.but – As we all know Dictionaries are compiled and written by Privileged People, if one relies on dictionaries and common ideas then one is abdicating the Definition Power to Privileged People who by having the definition power asserts that privilege to define what our particular tribe may think and express. Because Freedom :)

Identity Politics is *all* about Tribal Identity, being as “unique” as practically possible and virtue signaling to demonstrate uniqueness, in the loudest and most vulgar, crass, totally cannot be missed, manner.

I think the whole IdPol idea came to prominence from “our” leadership watching the Trotskists, Marxists, Dialectical Marxists, Communists, Socialists, Socialist Workers and God only Knows what else on the left, quite literally sometimes, tear each other to shreds over minute things like the specific RAL-code (colour) of the rope that shall be used to hang the rich with come The Revolution.

… And from watching Nigerian businessmen doing OK in places like Mogadishu in the 80’s, “they” probably decided that an organised society is a business risk and not having a society as such is quite manageable because private security can be procured and residential areas fenced off.

Margaret Thatcher even declared “There is no such thing as society”, on TV.

You’re right. Politicians have used divide and conquer, but Good Grief, Leftwing organizations never mind revolutionary/reformist ones seem obsessed with finding new reasons for dividing themselves.

The business and political elites use this to great advantage. In fact, it’s sometimes SOP for authoritarian governments to discouraged the proles getting together even a bowling league. They might organize politically and actually start causing problems.

With all due respect, this American always thought Margaret Thatcher sounded like an ass. Although her achievement in becoming Prime Minister when we idiot Americans were debating whether Geraldine Ferraro could be Vice President because vagina has my respect.

Thatcher was a very, very good politician. With only a couple of slight flaws of course, one being that just about all of her policies were atrocities and that she cleansed the Conservative Party of any existing or emergent talent in order to eliminate any future challenges to her leadership.

Which is one of the reasons Brexit happens and once getting it, no one can remember what it was actually about, but now … we have principles and stuff …. and it all it becomes a royal mess.

” Ultra low interest rates have already destroyed trillions in savings and pensions, and now Rogoff effectively says central banks should take this a step further, and target whatever it is you have left. This is insane megalomania. It’s communism in its worst possible form. Oh, and it’s outright theft. ”

Actually its capitalism, in its current form. And yes, its theft.

So the answer to the recession is to get the 99% to spend more money and save less?

“Sophisticated Investors” will find ways to mitigate the effects of negative interest rates.

Then when the next bubble pops and wealth consolidates to the top even moreso we’ll be looked down upon for not being “savvy” with our money.

You need to bone up on what happens during deflation. Those “sophisticated investors” lose out because every financial asset is someone else’s financial liability, and those liabilities go bad at an even higher rate under deflation than in “normal” times.

Yep, 1929 was a great leveler. That, plus the recession and change in tax policies that followed, produced an enormous shift in the distribution of income and wealth…for a time.

The introduction to this post has, perhaps inadvertently, provided an answer to a question posed in long-ago posts on the gun control issue; namely: what rights do the ” to-defend-our-rights” gun owners ever really intend to defend with all their guns?

And here is the answer which has, perhaps inadvertently, been provided to that very question.

“And since the folks at the Fed don’t generally get out in the heartlands, they may not have recognized that preppers (who are not all extreme right wingers, but there are big overlaps between the two groups) love cash and gold and are paranoid about the Fed. They have guns. Trying to deprive them of their cash would not be a hazard-free exercise.”

The guns are for killing anyone who tries to enforce laws against owning and/or using cash. They may well get used for killing anyone who formally and officially tries to pass or even introduce legislation outlawing people from owning and/or using cash. If the movement to outlaw cash gets loud and organized and threatening enough to raise in the minds of many cash-owners the specter of having their cash outlawed, the guns might well be used to kill the leaders and effective “soldiers” of the movement to get cash outlawed.

Is that a good thing? Is that a bad thing? It is certainly a real thing.

And I would again note with interest the fact that it is Naked Capitalism itself which has finally provided a very plausible and real-world answer to the question of “what are all the guns for?”