By Clemens Jobst, Lead Economist at the Oesterreichische Nationalbank and Helmut Stix, Research Economist, Oesterreichische Nationalbank. Originally published at VoxEU

Many societies in the developed world have been shifting away from cash towards electronic alternatives. Despite this, there has been a remarkable increase in currency holdings over the past decade. This column looks at the evolution of cash holdings over time to shed light on this apparent contradiction. While circulating currency over GDP has been declining since WWII, there have been sizable increases in recent decades which are only partially explained by low interest rates.

If we were to believe technology cheerleaders, cash is about to disappear. It has already almost done so in Sweden (Skingsley 2017) and thanks to both new hardware (mobile phones and near-field communication) and software (internet, instant payment systems), it will disappear everywhere else soon.

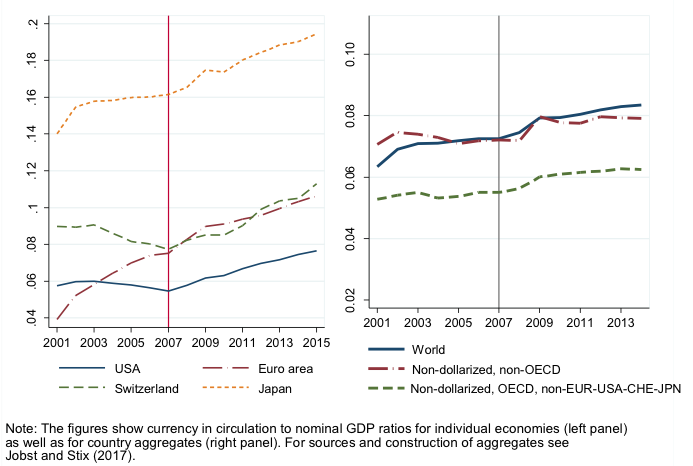

Appealing as it might be, however, this story does not match with the empirical evidence. Goodhart and Ashworth (2014) noted a “remarkable” increase in the ratio of currency to GDP in the UK from 13.3% in 2007 to 16.1% in 2014. In the US and the Eurozone, people not only hold sizeable amounts of physical cash – in 2016 per capita holdings were around $4,200 and €3,400, respectively – but, even more puzzling, cash holdings relative to nominal GDP have increased in recent years (Figure 1, left panel).

Figure 1 Currency in circulation over nominal GDP (%)

Attempts to explain this apparent paradox typically consider currency-specific factors. US dollars, euros, and Swiss francs are commonly used and hoarded abroad (Bartzsch et al. 2013, Judson 2017, Assenmacher et al. 2017), so increasing circulation might reflect foreign demand. In the case of sterling, which is not an international currency, Goodhart and Ashworth (2014, 2017) attribute the increasing use of cash after 2007 to a thriving shadow economy.

The Increase in Cash Demand is a Widespread Phenomenon

As we show in a recent paper, the increase in cash demand is not restricted to a handful of currencies but is a broader phenomenon (Jobst and Stix 2017). We collected data on currency circulation for a sample of economies covering 96% of world GDP from 2001 until 2014. Three stylised facts stand out:

- Aggregate currency circulation at the world-level has increased significantly, from 6.5% of nominal GDP in 2001 to close to 8.5% in 2014 (Figure 1, right panel).

- Sub-aggregates reveal that circulation increased for both international and non-international currencies as well as OECD (i.e. richer) and non-OECD (i.e. less rich) economies (Figure 1).1

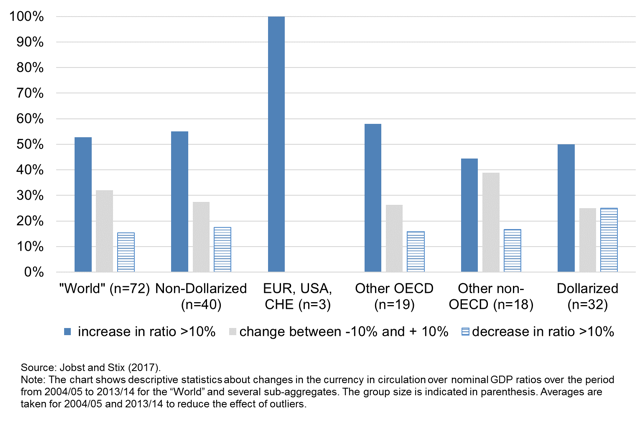

- Finally, also within sub-aggregates the increase in circulation is broad-based and not limited to a handful of larger economies (Figure 2). While the ratio declined by more than 10% in 11 economies, for the sample of 72 economies, the median change between 2004 and 2014 was +13%.

Figure 2 Changes in currency in circulation over nominal GDP ratios, 2004 to 2014

Both the magnitude of cash circulation and its increase over the past decade raise crucial questions for central banks and policymakers. What explains the puzzling size of cash circulation? Can the increase over time be explained by conventional economic forces (e.g. lower interest rates), or are there alternative explanations? What does the apparent demand for cash imply for considerations to phase out or to restrict the use of cash?

How Big is Big? The Recent Increase in Cash Demand is Large in a Long-Run Perspective

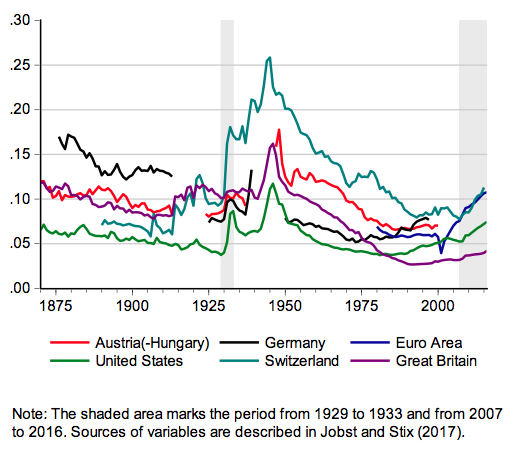

To put the recent development in cash demand into perspective, we looked at the evolution of cash circulation over the past 150 years for a sample of five countries for which such data are available, plus the Eurozone.2 The following main observations stand out:

- While over the long-term cash demand declined between 1890 and 1990, as expected, the decline is not uniform. In particular, the high point in currency in circulation was reached not in the 19th century but during WWII.

- Consequently, the common focus on post-WWII data that shows a continuous decline in cash usage from very high levels, usually associated with innovations in payment technology, give a ‘biased’ picture of the longer-term trend covering the past century.

- Since the 1980s/90s the declining trend has come to a halt or even reverted in all economies considered.3

- Large shocks seem to have persistent effects on the level of circulation as is evidenced by data for the financial crises of the 1930s (shaded in grey in Figure 3) and WWII.

- In the long-run perspective, the recent increases are sizeable.

Figure 3 A longer term view on currency in circulation over nominal GDP (%)

Low Interest Rates Can Only Explain Part of the Recent Increases in Currency Demand

Several arguments could rationalise the recent increase in cash demand: low interest rates, an increase in shadow economic and/or criminal activities, and low confidence in banks or increased uncertainty that bolster the role of cash as a safe (haven) asset.

To analyse the relative importance of these factors, we estimated a panel money demand model for the period from 2001 to 2014. We focus on domestic demand factors and therefore disregard all currencies which are internationally demanded. Estimated income and interest rate elasticities – the two standard determinants in money demand functions – are within plausible ranges. But we also include year fixed effects, which measure any average change (across economies) that cannot be explained by these conventional economic forces. These year fixed effects are close to zero before 2007, but positive and increasing thereafter. Low interest rates after 2007/08 can thus account for some part of the increase in cash demand; however, there seems to be a shift in cash demand after 2007 that remains unexplained.

What Can Explain the Shift in Currency Demand after 2007?

Accounting for criminal activities (e.g. drug trafficking) in the panel models is almost impossible due to missing data. Taking into account shadow economic activities is difficult, but at least proxy variables exist. Goodhart and Ashworth (2017) conduct individual country regressions for the US and the UK and report a positive effect of (proxy variables for) shadow economic activities. We employ an estimate of shadow economic activities from Schneider (e.g. Schneider 2015) which is available for all economies in our sample and which does not employ currency circulation as an input for its calculation. Our results suggest that changes in shadow economic activity between 2001 and 2014 had no effect, on average across economies, on changes in currency circulation.4 Clearly, it would be preferable to have alternative measures of shadow economic activities to reach more conclusive results.

The Global Crisis is another potential driver, lowering trust in banks or increasing uncertainty. As measures for trust are not available for a broad range of economies, we instead split the sample into groups of economies. We find that, on average, in economies without a systemic banking crisis in the recent past (Laeven and Valencia 2012), demand for cash did not increase. This result contrasts with an increase in currency demand in economies that experienced a systemic banking crisis in 2007/08.5 While these findings seem to make sense, the phenomenon is more complex. In fact, an unexplained increase in the currency-to-GDP ratio is also found in economies without a systemic banking crisis in 2008, but which had experienced such a crisis before – which applies mainly to higher GDP economies.

Keeping in mind that these findings are only indicative as unobserved variables might be correlated with this grouping, we conjecture that reports of banking problems in some countries might have affected sentiment everywhere. This could have led to a situation in which bank deposits and cash were no longer seen as perfect substitutes (which does not necessarily entail a sudden or strong shift in deposit to currency ratios as would be typical for banking crises). Or, in the words of Friedman and Schwartz (1963: 673): “The more uncertain the future, the greater the value of [the] flexibility [of cash] and hence the greater the demand for money is likely to be”.

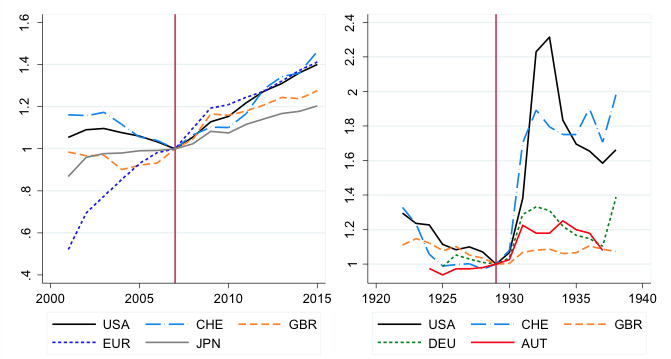

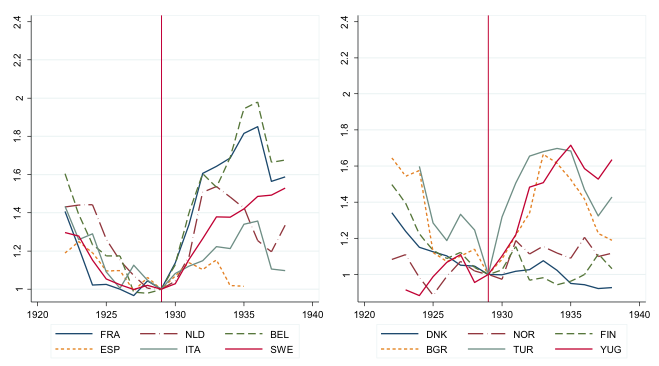

In order to explain the observed pattern in cash demand, however, the argument requires a rather persistent increase in uncertainty going well beyond the short-term shock in 2007/08, for which evidence is also difficult to come by. News-based indices (Baker et al. 2016) indicate that economic policy uncertainty increased substantially in 2008 and remained at elevated levels, at least in Europe. In this respect, it is interesting to look back in history once more. Figure 4 shows the evolution of currency in circulation over nominal GDP for a range of countries during the 1920s and 1930s, a period characterised by banking crises and significant economic uncertainty.[vi] To be sure, in some of the most affected countries like the US, the currency ratio increased in the 1930s much more than after 2008. What is striking, however, is the persistence of the increases well after the banking crises had been overcome or deposit insurance was instituted, as in the US in 1933.

Figure 4 Increase in currency circulation around financial crises, 2008 versus 1930s

Note: The figure shows the temporal evolution of the CiC over nom. GDP ratio for the Great Recession (upper left panel) and the Great Depression (remaining panels). The ratios are indexed to one in 2007 and 1927. For sources, see Jobst and Stix (2017).

We Need a Better Understanding of Non-Transaction Cash Demand

Cash use for transactions most likely will decline. But cash balances for transactions comprise only a modest share of overall cash demand (a rough estimate of 15% might be a good guess across richer economies). Instead, changes in currency in circulation are dominated by motives like hoarding. While transaction demand is reasonably well researched – for example, through the use of payment diary surveys (e.g. Bagnall et al. 2016) – still too little is known about non-transaction demand in general, and recent increases in particular. Overall, there is a need for better data and more research to improve our understanding of people’s use of cash.

See original post for references

A few additional possibilities:

– As speculators and rent-seekers hijack banking, they do what all privatizers of public functions do: ration and hoard to raise the cost. The non-wealthy are being turned from customers into profit centers that must be churned (ala Wells Fargoing). Fees are de-banking us. It would be interesting to check the cash figures from nations with postal banks.

– In a similar vein, cash starts to tick back up when banking deregulation starts (1970ish). The article mentions banking stability but doesn’t point out the good fit with the desupervision trend.

– The poor have no Panamanian accounts. Their tax evasion must be low-tech and on-shore. Does cash track hikes in payroll taxes?

– A predatory court system has the power to issue debt/money in the form of obligations like liens. Cash affords a simple way to evade that dragnet.

– Dissemination of ATMs making cash easy to find at any time?

A possible risk in relation to the predatory court system is however the threat of civil forfeiture. Often the simple act of holding a non-minor amount of physical cash is regarded as evidence of a crime sufficient to justify seizure.

Civil asset forfeiture absolutely infuriates me. This is illegal unconstitutional theft; yet it keeps happening over and over, all over the United States. You’re correct that people need to be cautious.

One of the few good things about Eric Holder’s tenure as Attorney General was that he made some moves away from this odious practice. And now that Jefferson Beauregard Sessions, III, is the Attorney General, Holder’s reforms have been reversed:

https://www.cbsnews.com/news/sessions-signals-more-police-property-seizures-coming-from-justice-department/

This is a pure manifestation of kleptocracy — just like a Third World dictatorship.

Except Oregon, because of an initiative years ago, which requires a conviction for asset seizure. It was very popular, with conservatives as well as progressives; property rights, you know.

The First World isn’t limited to Sweden. People are not of one mind regarding the new technology. Keeping money in a bank has to be encouraged … but it could be arbitrarily mandated. Having every chewing gum purchase be auditable by the tax man … doesn’t sound very smart at all … even if you have a smart phone.

Why would you put your money/valuables behind several feet of steel and concrete, in a vault *that you don’t have the key to*?

Any money you have in a bank is yours until it’s deemed otherwise. And you have no control over who makes that decision, when, or why.

Hard pass.

You do realize that legally, when you deposit money into a bank, that you no longer own it? You have a lien on it in the form of a card or passbook but you may find that the bank’s creditors may have a claim on deposits in that bank (including yours) ahead of you.

Forgot to mention as well. A coupla years ago at the G20 in Brisbane, it was agreed to change the banking laws so that if the banks want to seize bank deposits to bail themselves out of a crisis, they could. That means your money and it has already been used in Cyprus.

And derivatives, numbering in the Trillions of dollars, are ahead of depositors too, thanks to Dodd Frank.

Avoid banks that play in the derivatives market. Mine does not. I asked.

http://www.zerohedge.com/news/2014-12-12/presenting-303-trillion-derivatives-us-taxpayers-are-now-hook

Wade Riddick

November 29, 2017 at 5:33 am

I think you bring up some very, very good points.

Just as an example of the heads the banks win, tails you lose, I get a notice from the illustriously run city of Fresno about automatic payment of the water bill. So, this costs me 2.7% by credit card (not the usual credit card fee built into any credit card transaction, but an ADDITIONAL fee for the processing of the credit card by the vendor the city has hired) and if done by electronic check it is 0.95%.

The kicker is that the vendor makes no warranty and takes no responsibility if it screws up and somehow doesn’t manage to pay the bill on time. Why in the h*ll should I not just stick with snail mail?

And when you look at the fees and penalties associated with so much “paperless” stuff, it just doesn’t add up….er, uh, for the consumer. Oh, it adds up for the banks…

Fresno Dan,

Is your City of Fresno merely offering you the choice of adopting the Electronic Payments System if you want to do that? Or is your City of Fresno telling you that Electronic Payment is the only system they will accept, and that you will either adopt their Electronic Payment System or they will cut off your water?

Which is it? What is the City of Fresno telling you? Voluntary or Mandatory?

drumlin woodchuckles

November 29, 2017 at 12:46 pm

“Why in the h*ll should I not just stick with snail mail?”

by the same token, I think its pretty clear why people stick with cash

I will guess, based on a vague feeling, that City of Fresno is offering you the choice rather than overtly imposing it on you. It is better to at least be offered the choice. I suspect Fresno would among other things like the convenience of getting electronic payments instead of having to physically process physical checks.

I still pay all my bills by landmail. One big reason I do this is that every single stamp bought and used helps slow down the extermination conspiracy against the U S Postal Service just a little bit.

…very well collected thoughts WR, but as for keeping cash, I’m not buying it…$100,000 for example, we feel much more safe invested in property…

sometimes managing real property can be a time consuming chore. Good for a part of the investment portfolio, but need to be reasonable.

And owning property for investment will become a lot more expensive if the tax bill passes. The House Bill would have you pay FICA taxes (15.3%) on the income, the Senate Bill would tax all rental income at 25%. Most small landlords pay at considerably lower rates now. This thing is a tax increase on the little guy.

Negative Interest Rates.

Without any proof whatsoever, I am beginning to suspect that perhaps a lot of people are hoarding sums of cash at home or within easy reach as people’s confidence has been severely shaken in the past decade or so. This may explain in part the anomaly in the data seen here. What could not be ignored over the past decade is solid proof that in an emergency, the government will absolutely throw most of the people under the nearest bus in order to protect a few select institutions – even when it was these same institutions that caused the emergency. For some people, being used to foam the runway to further protect these institutions did not exactly help people’s confidence about what would happen in a further emergency. But why the retreat to cash?

I think that a prime attribute of cash is that it is “fail-safe”. It needs no external externalities to work. You can drive a truck over it, pick it up and it will still work. You can throw it into the water and it will still work. You can bury it, fold it, twist it and yet it still works. Now here is where the externalities come into play. To have digital cash that works, you need computers and server farms, you need internet connectivity and secure connections, you need a technological infrastructure as well as a banking infrastructure and especially high levels of trust – or at least insurance!

However, if net connections go down, you’re out of luck. If your area or whole state loses power, you’re out of luck. If the government declares a bank holiday, you’re out of luck. If there is a hack done of your card or even the whole network, you’re out of luck. As you can see, there are multiple points of failure that are part and parcel of the system and there are other as well that I have not listed. Perhaps enough people have noticed this and decided to go into physical cash as a reserve which has led to the increase of cash. People are using it but from reserves at home and not reserves kept in banks.

As to how this has played out in the past using Australia as an example (pop. 25,000,000), in the 10 weeks after Lehman crashed and burned, Aussie households pulled out 5.5 billion dollars out of the banks as trust was being eroded. In 2008 the Australian Reserve Bank had to order another $4.6bn in $100s and another $6bn in $50s to be printed as its strategic bank holdings were being run down. Also, It came out later that one official was going on TV saying how solid the financial system was but afterwards getting on his mobile to his wife and getting her to go the local ATM and pull out the cash limit as fast as she could. I just think that enough people were paying attention and that there are now household reserves of currency being built up that explains the size of cash circulation as they are using these home reserves instead of banks.

The Rev Kev

November 29, 2017 at 7:03 am

excellent point Rev! How many debit cards were working in the first few days after the hurricane IN Houston?

And for those who counter that in the immediate environs of an emergency location, who is so crass as to demand cash, I respond: how many service stations gave away gas for all those outboard motors?

I agree. I think it has a lot do with uncertainty and mistrust of the government. For instance, here in the US many of the libertarian and survivalist sites make a big deal about having at least 2-3 months of cash on hand.

Digital or physical cash, both can run into the problem of currency devaluation. I recall the Argentinian crisis – there was a TV factory operating, and the workers just kept on producing TVs after the management had fled, and trading them at the local market for food etc. You end up going right back to a barter economy.

Holding cash in Argentina since the turn of the century has been a fools errand when compared to all that glitters…

A troy ounce was worth 300 pesos in 2000, and the very same one is now worth close to 25,000 pesos today~

The other day all the credit card readers were not working at a market we patronize.

“It’s a software problem”

Lots of people had to walk away from their prepared food purchases and groceries because they didn’t have enough cash on them to eat. They will undoubtedly remember those with cash who got called up to the still working registers while they stood around with the saliva jetting into their mouths, their lunch hour ticking down and their ATM cards sitting useless in their pockets.

The bigger question is what if the registers did not work? The card readers would have been useless. I have seen that too.

As the dumbfounded Millenials they hired stood around helpless behind the counter, the adults they employ got out a roll of blank register tape and wrote down the amounts of cash they took in and made change for larger bills.

I helped out by adding up the price of the food items and a possible sales tax and left the exact amount, including coins on the counter and walked out.

“Everybody rides free” is what we heard when the row of fancy new electronic ticket dispensing machines that accept credit cards, ATM cards and regional transit cards stop working at the entrance to a ferryboat.

Well, if they did not work because of electric grid failure, then rooftop solar and a battery bank is an optimal solution. I used to live in an area with regular power outages; the local food store had backup generators.

The point is that a number of natural disasters and blackouts have emphasized how much non cash payments depend on the power and telecom sectors being up. Recall that in PR for a good while if you did not have cash you could not buy stuff after Maria. Or as the final episode of the first season of Mr Robot showed other things can bring the entire electronic payment system down. So the situation reinforces the need for a disaster fund in cash at home. In general after a major blackout it might take 3 days to get the electronic systems back up, but at least at smaller retailers you might be able to buy stuff with currency.

This is just a modern repetition of what our grandparents learned in the us in 1933 when the banks were closed for a couple of weeks and cash was all there was to transact business. My grandmother always kept some cash in a stash at home for example (born in 1891)

Now for governments this is a good thing as it is essentially free money for the federal reserve as currency costs very little and the federal reserve gets the difference between the face value and the cost of production.

Cash will never go away. Too many of us already resent being ruled by our inferiors to the extent we already are.

Want my cash and gold? Come and get it, if you can dodge all the lead.

Moolah labe ;p

After Hurricane Sandy, in Jersey City, power was down four days. Phone networks were down. ATMs didn’t work. People with portable electric generators became very popular with the lost souls wandering the streets looking for juice to charge their “devices.” A local pizza place (with gas ovens) did a thriving business. Cash dwindled as people bought food and candles. Things were getting a little scary by Day Four, as in, would the social net of shared civility start to fray? After this happened everything went back to normal and no one increased their personal cash reserves. /sarcasm

A few years back I went to BofA for a cashier’s check. There were 10 people in line in front of me. EVERY one of them were cashing checks and walking out with cash. The lowest number (I could hear and see them counting) was $800 and change, and one guy took out $7000 to buy a car or something, but the average was easily $1200 or so. The underground economy is larger than the elites are willing to admit.

One place that very seldom gets robbed despite taking in cash all day long mostly for postal orders, is the post office.

Some have quite a bit of security measures, but most have very little compared to banks…

…hopefully prospective bad guise aren’t reading this

That automatic federal sentencing law for robbing a mailman or a post office is worth noting in a cost benefit analysis of “who to hit”.

I was in a bank that got robbed about 25 years ago, and couldn’t believe how johnny on the spot law enforcement was after the fact, wow.

Be it a bank robbery or hopefully not a post office robbery, the criminals doing the act aren’t too brilliant usually.

The foursome that robbed a B of A branch I was in, got $800 for the effort and were caught a mile down the road on the 60 freeway.

This really isn’t that hard to figure out. Rising economic insecurity is driving more people to be under and unbanked; some by choice but many by the dynamics of the system. And these people do have savings or hoarding as the author calls it.

“To be sure, in some of the most affected countries like the US, the currency ratio increased in the 1930s much more than after 2008. What is striking, however, is the persistence of the increases well after the banking crises had been overcome or deposit insurance was instituted, as in the US in 1933.”

Hello!!! By the time the depression bottomed out millions were homeless, out of work, their credit was destroyed, and they were migrating to anywhere that was employing people. It was easier and safer to live on a cash only basis. Fast forward to 2008 and you have the same dynamics just on a smaller scale because the depth of the crisis was not 1933 sized. I also don’t find it surprising that the bottom of the currency circulation decline occurs around 1980 when the government gave up on full employment and began reversing economic security for most workers.

I couldn’t agree with the Rev more. In regards to cash forfeiture does anyone have a solution to this:

My son wants buy a relatively inexpensive vintage car. The seller only accepts cash. How can you travel over state lines safely to make that transaction without the possibility that a small town traffic stop takes your cash?

Keep the withdrawal slip from the bank bundled with the cash? Make a copy for your pocket?

Tell your son to check his brake lights, wear a collared shirt, drive carefully and if he, or you, I suspect, are really paranoid, to buy a quart of Walmart cayenne pepper to “clean his carpets”— that’ll defeat omniscient cash sniffing dog.

“…2016 per capita holdings were around $4,200…”

There is the statistic which showed that a huge percentage of the US population couldn’t raise $400 in an emergency. It’s more like some businesses and a lucky minority of individuals have enough wealth to hoard several thousand dollars or more… then there is the drug trade, which no doubt accounts for hundreds of millions in hoarded cash.

There’s no way you could expect many participants in a $10k bank run, as most aren’t fiscally fit.

Perhaps keep some decoy cash for Officer Bandit to find and steal and go away happy with? And keep other cash too well hidden for happy Officer Bandit to exert himself looking for?

(Now . . . I would NEVER alternatively suggest that you spend several years ahead of time exposing yourself to very tiny doses of ricin or abrin or some other poisonous protein, such that over those several years your body can generate antibodies to a small but real dose of ricin or abrin or snake venom or whatever other poison protein you care to use. Then , once you are immunized to a small but real dose of your self-enforcing-justice poison of choice, lacing the “decoy money” with some ricin or abrin or whatever, for Officer Bandit to expose himself to when he steals your money. Because such an action would be very very illegal, and I would never suggest doing a very very illegal thing. Not here. Not anywhere. )

I used to read stories of hidden cash hoards, as survivors of the Depression died off. My grandparents were enormously impacted by financial loss in the thirties. They had a grocery business and extended a ton of credit to customers who never paid them back. My grandmother was a widow for ten years before dying in the mid seventies. Going through her house and belongings my parents found a paper shopping bag hidden in the back of a closet with what would be in today’s money well over a hundred thousand dollars. Keep in mind this was some thirty five years after the Depression was said to have ended in 1942…

I’ve seen what happens to cash hidden in a wall for 80 years looks like, and it was so brittle that with just a little finger pressure, the pre-1928 banknotes-about 40% larger than now, would crumble in your hand. To be able to redeem old currency, you need one full set of serial numbers with a few of the other serial number-if memory serves, and out of $80,000, only $15,000 was redeemable, was what I was told.

I don’t doubt that for a minute but these were not Depression era banknotes. My grandmother lost all her trust in banks and simply refused to deal with them for the rest of her life, apart from cashing her pension cheques. Of course operating outside of the banking system was a lot easier before credit cards and computers.

A harrowing diary entry from December 18, 1931:

“It seems that if a bank once closes it’s doors, it remains closed forever. For awhile a fuss is made, efforts to reopen, etc., but nothing happens. That is the situation now in Youngstown with the City, Dollar & 1st National still closed. In Chicago this year 59 banks were closed and only 2 reopened. In Toledo out of 4 large banks-only 1 reopened. The stockholders now are getting double-liability notices.”

For those paying attention, Puerto Rico is a grand wake up call for the virtues of a cashless society. No power, no money, no food.

And it isn’t just Puerto Rico that has served as an example, to those paying attention. Cyprus was a wake-up call that deposit insurance isn’t much. Subsequent news out of Europe, US and Canada has weakened deposit insurance as well. I will add more down-thread.

Greece, particularly, was instructive for the ten days that the Troika shut down the the banks there.

I don’t trust this article. I don’t understand why the author is dividing cash-in-circulation by nominal GDP. To know whether cash use and/or hoarding is increasing or not, wouldn’t you want to compare it to noncash equivalents instead of to GDP?

I mean, shouldn’t the total volume of cash dollars (or Euros or whatever) that is “out there” be compared to the total volume of bank account and investment account balances? Not to the amount of stuff that is produced in a given year, which GDP doesn’t even accurately measure, since there is no guarantee that every dollar of GDP actually produces anything of value, but even if it was a perfect measure how would it be comparable to total volume of cash?

Maybe the author of this article wasn’t smart enough to think of that, in all well-intended innocence.

And in that same vein, it might be good to know how many purchases in the overground sunlit economy are made in cash as against how many purchases in the overground sunlit economy are made in cashless methods. If the percentages of cash versus non-cash payments were changing, then the question could be asked as to why those percentages are changing, if they are.

You’re right.

Why isn’t cash measured against the overall money supply instead of GDP?

As an additional thought, this effect might pertain to the increase in volume of international capital flows (though not necessarily “trade” per se).

In a word, no.

Cash is assumed to facilitate transactions, as in people or businesses holding cash in a till. GDP is a decent comparison since it is activity in the transactional economy. The criticisms with GDP revolve around it not capturing the value of non-transactional activity.

So excess cash (and remember we are talking currency, not $ in checking accounts) is seen as unnatural. Having cash sit around is running the risk of robbery or having it burn up in a fire. That is why people generally keep most of their extra financial holdings in a bank or in investments.

Credit is good for when you have plenty in reserve.

Cash is good when every penny counts, you are immediately aware of your expenditure.

Too many fall in the second group.

When I was a lad and had accumulated around $432 in my savings account, the thing that always was appealing was the idea that I was earning about 5% on it, with the promise that through patience, I could double my money in a reasonable amount of time, even if it looked like forever, which is the prospect now.

How long would it take to double your money with compound interest @ 1%?

Kinda makes having the banks holding your money for you, superfluous, aside from it being ‘safe’.

How long? 72 Years.

Every person ought to remember the rule of 72. No, it doesn’t have to do with Nixon.

Google and watch the video:

“Albert Bartlett, exponential growth, energy on finite planet”

for the application of this to money and as a bonus, resources too.

http://www.albartlett.org/presentations/arithmetic_population_energy.html

The Nippon I visited in the 1980’s was almost in entirety, a cash and carry country, and credit cards were few and far between…

What’s it like now?

According to the graphs in the article, and to anecdotal evidence from friends who have been there, Japan is still a cash-based society. Low crime rates and NIRP probably help keep cash strong.

This was a great thread. Clearly the authors need to think more about why people would want cash. The section on the Great Recession / Financial Crisis was a tentative start, but the authors completely overlooked many events since 2008 that would tend to drive people to cash. Many commenters nailed good points: people living hand to mouth don’t use banks much; natural disasters expose the weaknesses in digital-credit systems; wealthy people and businesses hoarding cash out of suspicion of the banking system.

I want to add a couple more items. Since 2008 there has been a steady erosion of depositors’ rights. The evisceration of the Cypriot banking system was a big wake-up call, as has been the long-running financial tragedy in Greece. The ongoing trickle of news articles about deposit insurance restrictions (or “bail-in provisions”) in Europe, USA and Canada (among others) shows that in the next crisis, depositors can expect to receive harsh haircuts.

In addition, banks have done nothing to earn the trust of their customers over the past decade. In principle, banks are adequately regulated and thus depositors are supposed to sleep soundly, but another steady stream of news articles has shown that banks have continually flouted regulations, the law and even sound long-term business practices in favor of short-term bonus-maximizing schemes. Wells Fargo is the current poster child but everyone knows the cockroaches are everywhere. Given the number of cockroaches in evidence, one has to assume some level of fraud and bezzle as well. So now no one with any brains can have complete trust that “their” money is safe in the bank.

Finally, I think a lot of people have woken up to the fact that Big Brother watches everything, and in a world where privacy rights are no longer properly respected, people may choose to carry and use cash simply to avoid having their every habit aggregated by Google/FaceBook/Visa/whoever, when that information is as often as not used to exploit people. The demand for cash can in this way be linked to the demand for cryptocurrency.

The desire for financial privacy is rational and flows from the natural rights to liberty and the pursuit of happiness, so I take exception to the insinuation that the cash economy is a “shadow economy” and somehow criminal in nature. In my experience the biggest criminals are the ones in the banks. What they do might be technically legal in some cases, and none may have gone to jail for their crimes, but the financialized destruction of trillions of dollars in middle class wealth from 2005-2015 is certainly the greatest injustice since World War 2.

Another reason for using cash, and therefor having to have cash, is sympathy and support for the small merchant and the independent merchant. Every credit card transaction charges some kind of credit card fee. That fee is money the merchant does not get. Small merchants on small margins may actually feel that is a painful lack of gain for their work.

I believe that our legacy hippy co-op has to pay 2% of the price charged to the credit card company every time a purchase is paid for with a credit card. I once suggested to a cashier ( who said she would pass it up the line) that if the co-op offered a 1% discount off the stated price for every payment in cash, that dividing up that avoided-2% between the buyer and the co-op would let the co-op make !% more money than it would otherwise have made on that purchase. And it would let the customer pay 1% less than the customer would otherwise have had to pay on that purchase.

Maybe I will leave a note about that in their suggestion box.

One of the stories that came out of the recent fires in Santa Rosa CA was of an elderly man who had an unspecified amount of cash (but it sounded like $20-40K) which was his life savings burn along with his mobile home.

Cash at home is kind of like cash at the casino — you don’t gamble more than you can afford to lose.

The recent articles here on the fiasco with cash in India confirmed to me that routinely using cash is a practice I’ll continue. Credit cards get used when appropriate (at the gas station, online purchases, large purchases) but they also get paid off every month, but I’m not planning on going somewhere with nothing but a debit card in my pocket.

We’d be a lot happier about our money in the bank if it paid some measurable amount of interest. I can remember that 30-40 years ago my grandparents would pull the interest off their $18-20K CD each year and use it as a significant supplement to their Social Security income. I think if we were making .5% interest these past years it would be a significant improvement as I think we’ve been closer to .05%. But I’ll admit that after seeing real saved money disappear in “financial investments” we are extremely risk averse and we’re basically parking the money and we could probably find a higher return somewhere else if were willing to tolerate more risk. On the other hand, we’ve got “quant suff” for our modest lifestyle so we’re more concerned with not losing what we’ve got rather than adding to it.

The recent 26-week T-Bills are providing ~1.5% Yield. Better than many 1 year bank CD’s. (Safer,too.)

My worry is the effect going cashless would have on the poor and needy. Like–day laborers, particularly the undocumented, naturally would rather be paid in cash.

The homeless/beggars–how are people supposed to give them money (let’s not deal with whether that’s good or not)?

Charity boxes for spare change at stores…or ringing a bell outside for people to drop coins or a buck into a pot.

Savings–people on the public dole are punished if they actually manage to save money for something to improve their lives. Saving it in cash lets the bank account not get over the limit where benefits would be lost. Working the system maybe, but the system sucks and is self-perpetuating.

Street performers–instead of a hat are they going to have to bring along a scanner so we can give them a bit of money that way? And to all of the above–I imagine it’s psychologically easier to reach in a pocket for a few quarters than it is to get your money card out. And it’s quicker.

Whether it’s good or bad for the overall economy, or most people, I don’t really care about. Seems it would have serious negative effect on those who are struggling.

When Ocwen began trying to foreclose on me 5 years ago despite me never having missed a payment (or even late) I promptly printed my online banking records to prove it. Within 3 days BofA, admittedly at Ocwen’s request, deleted all of my online transactions with Ocwen ( and just Ocwen). When I asked why they basically said they own the system and therefore own” those records. Needless to say I now keep less than 1000 bucks in the bank at any one time. FYI every banker I know hoards cash.