By Steve Roth. Cross posted from Angry Bear

Increasingly, businesses don’t generate profits. They generate capital gains. It’s fiendishly clever.

Image you’re Jeff Bezos, circa 1998. You’re building a company (Amazon) that stands to make you and your compatriots vastly rich.

But looking forward, you see a problem: if your company makes profits, it will have to pay taxes on them. (At least nominally, in theory, 35%!) Then you and your investors will have to pay taxes on them again when they’re distributed to you as dividends. (Though yes, at a far lower 20% rate than what high earners pay on earned income.) Add those two up over many years, and you’re talking tens, hundreds of billions of dollars in taxes.

You’re a very smart guy. How are you going to avoid that?

Simple: don’t show any profits (or, hence, distribute them as dividends). Consistently set prices so you constantly break even. This has at least three effects:

1. You undercut all your competitors’ prices, driving them out of business. Nobody who’s trying to make a profit can possibly compete.

2. You control more and more market share.

3. You build a bigger and bigger business.

Number 3 is how you monetize this, personally. The value of the company (its share price/market cap) rises steadily. Obviously, a business with $136 billion in revenues (2016) is going to be worth more than one with $10 or $50 billion in revenues — even if it never shows a “profit.” You take your profits in capital gains.

Because stock-market investors are always going to be thinking: “They could always turn the dial from market share to profits. Just raise prices a skootch, and reap the harvest. In spades.”

But: they never do. It’s like a perpetual-motion machine, or holding yourself up by your own bootstraps. All that rising valuation is eternally based on the fact that they could raise prices and deliver profit (and yes: they could). In the meantime the business both generates and has massive value. It employs 270,ooo people, delivers zillions in employee compensation, pays zillions more to suppliers, receives hundreds of billions in revenues, and dominates whole segments of multiple industries. Are there really no “profits”? Nobody’s being irrational here.

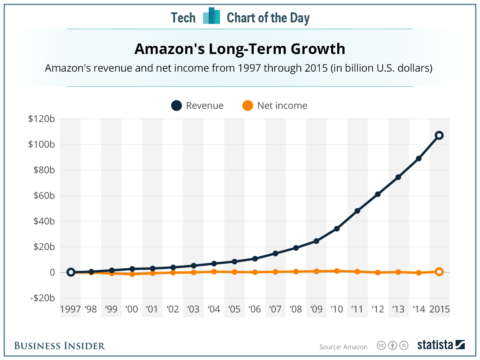

Here are the results of your long-term plan:

Half a trillion dollars in revenues.

Essentially zero profits. Ever.

Dollars delivered onto investors’ balance sheets? Somewhere north of 300 billion.

And instead of being double-taxed on profits for all that time, investors’ income is taxed once, at the low 20% capital gains rate. And that, only when those gains are “realized” through sale of the stock. In the meantime it’s all tax-deferred — yet another huge effective-tax-rate win for shareholders. The longer they hold, the bigger the win. If they pass the stock on to their heirs, those gains are never taxed at all.

And just to mention in passing, none of that shareholder income ever appears as household income in the national accounts. It might as well not exist.

You gotta be impressed. That Jeff Bezos is a very smart guy.

Disingenious article.

Everything in it is correct and Amazon should be simply split up due to many reasons

However criticizing the decades old tax avoidance by avoiding dividends and “only” being a growth stock is nothing that Amazon invented or abuses particularly more than other tech companies.

Microsoft did it long before the current crop of companies and started paying dividends when they couldn’t avoid it anymore, Amazon, Facebook, Google do it, to name the most prominent ones

The underlying reason why it is done is not really the fault of the companies but the tax system. Labor is taxed by the personal tax rate, company profit is taxed by the company tax rate (another problem, oh well), but capital gains is not taxed by personal tax rate or company tax rate but capital gains. That needs to be fixed, not Amazon singled out.

All the increase in value of the stock market in the whole S&P 500 is undertaxed like the article describes, and I haven’t counted, but my guess it’s way more than some paltry 300 billions. It’s a unfair tax subsidy for public companies compared to other companies.

Agree on the labour vs capital tax – which is an injustice of the system (courtesy to both Reps and Dems), even more perverse now given that capital is nowadays extremely cheap compared to labour (which means that the labour, if anyone, should get a favourable tax treatment).

There’s another thing that the article misses. Or rather, how the article could be rewritten. How a great philanthropist brought a lot of thing extremely cheaply to the masses, disdaining profit for his own company to make his product(s) the most available ever.

Look at Amazon’s stakeholders – shareholders, employees, suppliers and customers. Customers, which is my and large the largest group, is clearly happy – otherwise Amazon would not grow the way it did/does. Shareholders are (right now) happy even despite no dividends. The first unhappy group is low-level employees, who are exploited mercilessly. But now assume that they could be replaced with robots, so there would not be any low-level employees in Amazon. That leaves only suppliers – who, especially the small ones, are not happy with Amazon either. That said, there’s a question whether they are still not better off with Amazon than w/o it – and I don’t really have an answer for it.

You could say that Amazon’s competitors are also not very happy – well, they are not, but there’s no business whose goal is to make its competitors happy.

The main problem I see with Amazon is that it just took the social drive to optimize (strong in Anglo-Saxon world, but particularly in the US), and took it to the extreme. But it optimizes only one, admittedly a very visible thing – the price paid by the masses. But in doing so, it destroys the ecosystem – and now I don’t mean the business ecosystem, but rather the creative ecosystem. Because as an author, you’re now much worse off than you were before, and shortly you may have only two options – sign crappy contracts up front (which means you work for free if you are not successful, and if you do happen to be a success, a lot of it will go to someone else), or self-publish, which almost guarantees you’ll fail.

Amazon, to me is NOT a cause, it is a symptom of a society that is breaking. But, TBH, Amazon’s breaking of the society is nothing compared to how FB and Google do it. Because those two control what you see in general (Google) or what you see in your social circles (FB). And that’s way way worse than Amazon.

Amazon destroys the real ecosystem (the planet) by encouraging mindless consumption of material goods – that is their only goal and how we ended up with something as family blog‘ed up as the “Amazon Dash Button”.

As I’ve said here before, no one is fulfilled by Amazon “Fulfillment Centers”.

This is another thing you cannot single out Amazon for.

Capitalism is always constant, massive, overblown, destroying and above all else growing consumption.

Walmart or Amazon, there is no difference. Just that in its relentless drive to the bottom, survival of the fittest, today Amazon is fitter than Walmart.

Walmart killed the mom+pop stores, Amazon kills Walmart. What goes around comes around.

Don’t hate the icon,hate the system that produces these icons.

I like to hate both…. You’re excusing the Bez for not having a moral compass, even given his apparent intelligence, meaning he should know better.

But this isn’t true capitalism. It’s corporate welfare at its finest.

And moral compass… amen to that, another thing that no longer exists in this country.

Just to be clear, Amazon doesn’t actually optimize for the lowest price for the masses. And that is for a very simple reason: about half of their revenue comes from 3rd party sellers, on which they make 15%-30% commission. So don’t fool yourself that you’re getting the best price from Amazon. You’re not. But you’re getting enough other things at a good market price to make it worthwhile – like super fast shipping for example.

What they do optimize for is revenue growth and total domination – which is much worse.

So very true. If one actually takes the time to “shop around” even through those old fashioned brick and mortar stores, they will see they aren’t always getting such a great deal. Amazon relies on people being lazy, and on “subscriptions”. NO thanks.

I agree with the first commenter that the article is not convincing.

The whole edifice depends on investors paying more and more for Amazon stock. This is not something Bezos or Amazon can control and the edifice might just crumble if investors one day demand actual profits and not just potential of profits.

Many influential investors like David Einhorn are short the stock for that reason.

The investors in a position to pressure Bezos, et al, are in the same boat of preferring capital gains to profits and income.

But, sure, maybe someday the situation will change. Amazon won’t be able to find ways to keep self-investing that investors believe raises the value of the company.

“if investors one day demand actual profits”

18+ years and counting

So what happens when Amazon outgrows its fish tank, metaphorically speaking? Eventually they’ll attempt to grow their market share into a sector that either doesn’t pan out or has a superior competitor, or demand in their existing markets dwindles (how long before millennials kill Amazon?). At that point, if Amazon needs to contract to shed losses, won’t the market cap/value plummet as Amazon’s strength turns into a weakness?

The loss of future growth prospects will have the greatest impact on the stock. Much more so than profitability. Crapitalisim demands growth more than anything else. Even with a profit, if growth seems capped at 5%, then the stock can tank 90% or more.

walmart should move from nyse to nasdaq. then it is in the qqq. then walmart has to be bought by all that passive QQQ money. ….until people start selling QQQ

The bit that doesn’t make sense is this:

“1. You undercut all your competitors’ prices, driving them out of business. Nobody who’s trying to make a profit can possibly compete.”

Because in the sense that matters to your prices you did “profit”. You just took all of that “profit” and invested it back into the company to expand *other* lines of business and increase the value of the company.

Undercutting competitors to drive them out of business is a time-honored strategy. Commodore Vanderbilt, one of the 19th Century Robber Barons, did that in the ferry business. His ferry market efforts led to capital accumulation that allowed development and expansion of his railroad business.

And it only works if there is some sort of collusion involved. You need financing to operate at a loss long enough to kill your competitors.

‘Free market’ my ass.

Yes, of course, and certainly undercutting competitors is a strategy Amazon uses, but this proposed mechanism for making that possible doesn’t make sense.

The real tax strategy by which Amazon undercut competitors was the sales tax dodge it had in place until last year. That did allow it to undercut competitors with a tax dodge for many years.

The other very clever maneuver was the way it used historical supplier payment customs to get the book publishers to finance its early growth.

Used to work for a retail company about 6-7 years ago with multiple websites and online storefronts. Several Amazon stores.

Any product that would sell well at a certain price point for more than 24 hours on an Amazon storefront would have an Available From Amazon link up by 8AM at 0.10 – 1.50 less, depending on the overall price point of the item. Free shipping *of course*.

Every single time. The boss was tearing his hair out. Didn’t realize that when Amazon is your “business partner”, you ain’t really the boss. He did a lot of free market research for them though.

Vanderbilt and the 19th century guys got nothing on ‘ol Bezos.

Interesting. Poaching is the business model, along with gratuitous abuse of the warehouse employees, getting a free ride on property taxes for a decade or so after getting tens of millions in subsidies to put their satanic mill in the area.

You should hear the caterwauling from the Detroit media about not making the list. Detroit dodged a bullet and these idiots don’t even realize it.

Whichever city get’s it, will be cursed. Housing costs will go up and tax revenue will disappear into Amazon’s maw, to make Jeffie even richer. I figure it will be at total loss for whichever city get’s it, when it blows up in their faces.

Really, what can you expect from politicians, most of whom are lawyers and enjoy being the center of attention and spending money that isn’t theirs.

Looking at the “long term growth” graph in the post reminds me of cancer.

At what point does the Sherman Anti-Trust Act apply? For anyone? I know they’re always late to the party (IBM, Microsoft) but they do enable a rotation to take place (Microsoft enabled by the IBM sanctions for example) rather than the Death Star growing to infinity. And are we really happy with billionaire rentiers (Bezos, Jamie Dimon et al) extracting so much individual personal wealth? 25% of the children in the country below the poverty line, 90% of people going sideways or backwards, Third World infrastructure, and these guys deserve another zero?

I’m with you! Amazon is just one of several new forms of monopoly. Whatever happened to our anti-trust laws? Do we need to bring Teddy Roosevelt back?

Would settle for either kind of Roosevelt at this point, but I’m with you

Exactly, but people in this country seem more concerned with “food stamp cheats” over corporate welfare …. maybe it’s easier to pounce on the little guy.

The FTC generously uses our tax dollars to not do anything about anti-trust but helps all the big corporations. Just like the rest of the agencies since Prez Carter.

One risk Amazon runs in their computer-cloud business is that Microsoft and Intel decide that they will monetize their best O/S + chips on the cloud/subscription model while selling inferior hardware and software to competing companies. Reminds me of the old days when mainframe computing was marketed on a timeshare basis… suppose for instance that only Intel’s newest in-house computers were really safe against the Meltdown bug!

I’m going to echo the sentiment that this article doesn’t convince me.

A case could be made that:

1. Capital gains should be taxed at rates much higher than labour (I”d strongly support that – the only time investors actually “invest” in a company is during an IPO and if they issue new stocks)

2. Amazon has used its monopoly power to bully suppliers, use discriminatory pricing against the general public, and other unethical business practices. Anti-trust is long overdue.

3. Amazon has treated its workers extremely poorly, as has been documented in the media.

However, the way this article is not written in that way – it implies that this is “invisible”. It’s not invisible – it should be that capital gains are taxed much higher than labour outside of IPOs and issuing of new stock. That would put an end to this.

Tax rates in a just society (in 2018 USD):

Labor under $30K: 0

Capital Gains: much higher than now

Wealth above $10M: 0.5% annually

Wealth above $100M: 1.5% annually

Wealth above $1B: 2.5% annually, entrance into lottery for year end deathmatch (10 enter, 1 leaves, then we throw that 1 into a tank of sharks. Aired on the afternoon of Christmas so even the poorest among us receive at least one gift that day)

High Frequency Traders: 5% per trade

Food, Housing, Health, Care, Employment, Education for all who want them.

I have other ideas too.