Lambert here: A nice companion to the pipeline post immediately below.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

Even China is Buying U.S. LNG

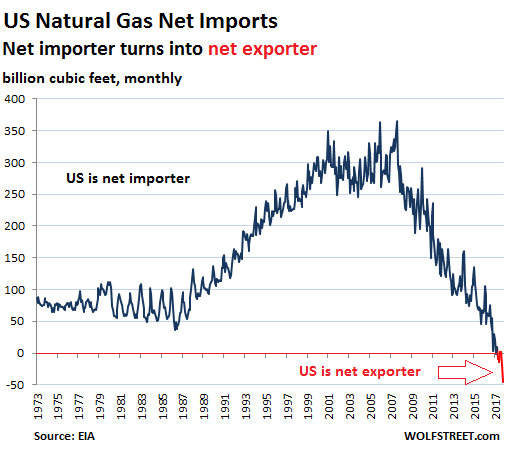

In 2017, the US became a net exporter of natural gas for the first time. It started small in February, when the US exported 1 billion cubic feet more than it imported. By October, the last month for which data from the Energy Department’s EIA is available, net exports surged to 45 billion cubic feet. For the first 10 months of 2017, the US exported 86 billion cubic feet more than it imported. And this is just the beginning.

Exports to Mexico via pipeline have been rising for years as more pipelines have entered service and as Mexican power generators are switching from burning oil that could be sold in the global markets to burning cheap US natural gas. The US imports no natural gas from Mexico.

Imports from and exports to Canada have both declined since 2007, with the US continuing to import more natural gas from Canada than it exports to Canada.

What is new is the surging export of liquefied natural gas (LNG) by sea to other parts of the world.

This chart shows net imports (imports minus exports) of US natural gas. Negative “net imports” (red) mean that the US exports more than it imports:

The first major LNG export terminal in the Lower 48 – Cheniere Energy’s Sabine Pass terminal in Cameron Parish, Louisiana – began commercial deliveries in early 2016 when the liquefaction unit “Train 1” entered service. Trains 2 and 3 followed. The three trains have a capacity of just over 2 billion cubic feet per day (Bcf/d). In October 2017, the company announced that Train 4, with a capacity of 0.7 Bcf/d, was substantially completed and is likely to begin commercial deliveries in March 2018. Train 5 is under construction and is expected to be completed in August 2019. The company is now lining up contracts and financing for Train 6. All six trains combined will have a capacity of 4.2 Bcf/d.

This is just the Sabine Pass export terminal. In addition, there are five other LNG export terminals under construction, according to the Federal Energy Regulatory Commission (FERC), with a combined capacity of 7.5 Bcf/d. This brings total LNG export capacity to over 11 Bcf/d over the next few years and will make the US the third largest LNG exporter globally, behind Australia and Qatar.

In addition, there are several other export terminals that FERC has approved but construction has not yet started. And other projects are in the works but have not yet been approved.

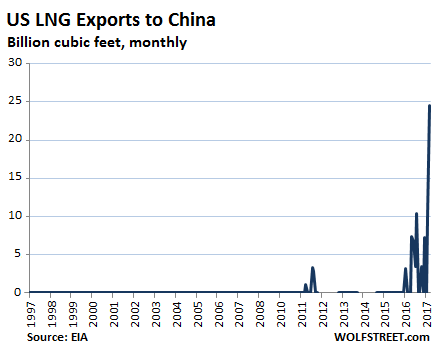

According to the Institute of Energy Research, global LNG demand is currently around 37 Bcf per day. This is expected to grow substantially as China is shifting part of its power generation capacity from coal to natural gas. And US LNG exports to China have surged from nothing two years ago to 25.6 billion cubic feet in October (for the month, not per day):

US natural gas production has been booming since 2009 as fracking in prolific shale plays took off, and the price has collapsed – it currently is below $3 per million British thermal units (mmBtu) at the NYMEX, despite tthe majestic cold wave that is gripping a big part of the country.

Exporting large quantities of LNG is a momentous shift for the US because it connects previously landlocked US production to the rest of the world. Unlike oil, the US natural gas market has largely been isolated from global pricing.

This caused some immense price differences between the US market — where a gas “glut” crushed prices, pushing them from time to time even below $2/mmBtu — and, for example, the Japanese LNG import market, with prices that were in the $16-$17/mmBtu range in 2013 and 2014. Even the average spot price contracted in November 2017, the most recent data made available by the Ministry of Economy, Trade and Industry, was $9/mmBtu. US LNG exporters hope to arbitrage these price differentials.

Meanwhile, US producers are hoping that this overseas demand will mop up the glut in the US and allow them to finally boost prices, including the prices LNG exporters pay. But funding continues pouring into the oil and gas sector to pump up production, and prices have remained low, and drillers continue to bleed.

And there are already global consequences – including in Europe, where large regions, including Germany, increasingly depend on natural gas from Russia as production in Europe is declining. The new competition from the US – though it really hasn’t started in earnest yet since most of US LNG goes to places other than Europe at the moment – is already reverberating through the Europe-Russia natural gas trade. Read… Russia’s grip on European gas markets is tightening

There’s been a remarkable transformation in energy supply in just 20 years or less.

While natural gas has eclipsed coal, on a mild, bright and windy day, here in the U.K. (not that dissimilar from other European countries) wind, solar and a rump of nuclear pushes natural gas into a poor second place http://www.mygridgb.co.uk

Ironically and lamentably, cheap LNG is skewing the economics for installation of more renewable energy. Natural gas could pretty much be sidelined here in the U.K. by wind and some solar, with nuclear picking up essential demand when it’s neither sunny nor windy. But with all that cheap LNG sloshing around, why bother?

But regardless, coal is dead and it ain’t coming back.

can’t speak for the UK as UK is obviously different because of public policy and generally more temperate weather….but in the US, coal is not dead. It’s merely a prince when before it was the king.

Literally right now, 1/3 of the electricity in the mid-Atlantic is from coal, 20% nat. gas, 1/3 nuclear. 3% fuel oil, 3% wind. While New England/NY State benefits from Quebecquois hydro—so they get ~20% from renewables—but still burn a lot of fuel oil when the system is stressed.

http://www.pjm.com/markets-and-operations.aspx

http://www.nyiso.com/public/markets_operations/market_data/graphs/index.jsp

Agreed — Europeans, myself included, completely fail to appreciate and understand how mild and temperate much of the European geography is (outside of the eastern continental mainland, and perhaps Scandinavia) compared with the US. When you guys get a freeze-wave, there’s little comparison to it in Europe, outside of some fairly sparsely populated areas.

That was the point I was trying to make, but I rather missed making it (!) — exporting LNG that could be kept in the ground in the US for when it is needed for a weather-related spike in heating demand externally to satisfy electricity generation (and a small-ish amount of space heating and industrial usage) in Europe which could be met by renewables and some nuclear — all the while retaining coal generation in the US — is simply ridiculous. Especially when you consider the energy inputs needed for natural gas liquefaction. But that’s what happens when you “let the market decide”.

yes absolutely, if the world really cared about being *green*, they’d ban importation of LNG (except maybe Japan and I’m sure a few other discrete cases who no choice).

and sidebar, 1/3 of New England’s electricity is coming from fuel oil right now, 28% nuclear, 24% natural gas, 4% coal, 11% renewables.

https://www.iso-ne.com/isoexpress/

So in the hoopla of getting rid of coal, New England’s merely changed their poison from arsenic to hemlock.

And, like, wow, NYC alone is drawing c. 7-8 GW ! It’ll be fascinating to see what happens on Friday / Saturday when it’s forecast to get really cold… I guess the coal-fired plant is already working flat-out as it is, but I’m going to take a look if I remember to see how it pans out.

Outrageously, I can’t see any federal assistance programmes to seriously contribute to consumer energy efficiency retrofits. From the looks of it (https://energy.gov/eere/femp/energy-incentive-programs-new-york), they’re just not interested in anyone below 100kW. Helping to get rid of the installed base of electric resistance heat would be, um, paying off quite nicely now. If only anyone had the wherewithal to do something about it — and this is one area where pricing mechanisms could be used to, for example, penalise anyone who’s trying to heat a 7,500 sq. ft. McMansion that was cheaply built with electric baseboard heating or strip heat in the air handler in order to pay for someone else on the poverty line heating a 750 sq. ft. apartment and worrying how they’ll pay the electricity bill to upgrade to something more efficient.

yep, it looks like NYC alone does electricity consumption of a small country.. That said, Greater London’s not much different. London total I can find (for 2015, can’t find anything else) works out to about 6.7GW/hour average

I don’t think 7-8 GW is out of the ordinary for an area of 8 million people. I think there is a very rough rule of thumb for colder climates that peak energy use would be around a GW per million people – maybe half or less as a year round average.

In terms of energy use of course a lot depends on the source of space heating, which is the big winter drain. According to this source, in NY its about half from gas, only a small amount from electricity (but I would guess that in the very coldest weather, a lot of people would have supplementary electric heaters on).

Interestingly, the source I link to above says that NY uses 15% above the US average in energy, but much less than the average in electricity consumption. It would seem this is because of the easy availability of natural gas for heating. I’m surprised, I would have thought NY would be much more energy efficient than the rest of the US. Its disappointing really that such a high density city is so obviously wasteful of energy.

The problem — in the US as elsewhere — is that while broad-brush statistics can tell us a lot https://www.eia.gov/todayinenergy/detail.php?id=3690 about typical energy mixes at a regional level, they mask those households which are stuck, due to limited funds, with hard-to-heat residences with expensive fuel sources like electric resistance heat. Maine, for example, has a lot of older and ineffectively insulated housing stock and limited natural gas grid availability — and a cold climate, to boot. But it gets lost in the “northeast region” roundup when national energy policy, such as it is, is decided.

How much coal, gas or oil has to be burned in order to produce a given amount of electricity? If NYC is using less electricity-per-capita than the average city, that could mean that NYC is avoiding the burning of so much coal, gas or oil that NYC is actually using less energy overall in total per capita than the average city. By virtue of not using the coal, gas and oil not burned for the electricity not used relative to other more electro-intensive cities.

I don’t know the answer, but the question seems worth asking.

It is a worthwhile question, and I’ve seen it asked many times, with many different answers. In general, electricity is more ‘efficient’ in using a given amount of oil, coal, gas than directly burning it in a small engine or furnace, mostly because of the greater efficiency of a large power plant. But there are numerous other factors to consider, including of course the energy mix in your local power system, and the methods you are using to convert the electricity to heat or cooling air.

I think most studies indicate that using electric powered ground based heat pumps are the most CO2 efficient way to produce year round space heating and cooling in most situations (although the most efficient of all is the use of very high levels of insulation with direct solar water heating).

OK, If you want to ignore thorium not uranium, google IAEA thorium and read then google wiki thorium lftr technology read that and search some more from info in the wiki report then google”SMU geothermal”

several reports beginning with the first about geothermal in WV , read all of them then google cost of electricity by generation source . if the fossil fuel lovers haven’t changed to data see geothermal electric generation at 2 to 3 cents per KWH, thorium at 2 to 5 cents Hydro at 5 cents not including maintence or major repair of dams, Wind is 35 cents solar 25 cents and that doesn’t include the cost of battery to make W & S a 24-7 solution like all fossil fuel electric gen. and Geothermal & Thoruim !. If there are any engineers out there, then just study the design of each based on USDE design data and guess which will cost least to build and maintain. Never before in history has the world seen the end of a industry as wealthy as the fossil fuel giant! If you think they don’t spend some money keeping game changing electrical generation solutions from killing their cash cow …think again . I’ll bet there are a few trolls reading emails like this and trying to counter the message.

I the world is going to survive this century, we must kill the fossil fuel industry!

Same in Ireland (north and south). Over 50% wind power last night, not bad for a cold stormy winter night (winter evenings are usually electricity peak times in this part of the world).

Wind has actually been a huge problem for gas generators in Ireland, as wind power is mostly produced on stormy winter nights, peak use time, which is when the gas utilities anticipate their highest profits. Although there is a big LNG terminal with full permission in Ireland, there is no sign of it being developed. I don’t think the industry believes low US gas prices will last long enough to justify the investment, and wind is more profitable anyway. Even solar is attracting major investment in Ireland, which comes as something of a shock to a nation of such pale skinned people.

Agree with this in the main but REs aren’t going to be eclipsed by LNG, not in Europe anyway; irrespective of the crash in price of LNG REs have fought an uphill struggle against far more powerful enemies and LNG still does little to meet emissions targets except by comparison with coal.

Poor old Saudi Arabia, though – even if they’d succeeded in pricing the ‘silly money’ out of fracking the supply of LNG combined with massive drops in the costs and increases in the reliability and supply of REs mean time is running out fast..

IMO from a physics-POV—exporting LNG for use as electricity by other countries is just dumb when nuclear is a CO2-free alternative . —given all of the energy losses from fracking, methane flaring, then transportation, then generator inefficiency. (heating/cooking is less dumb as near 100% of the burned energy is applied to work at the destination).

ymmv. as nuclear energy is the third-rail of environmentalism.

on a semi-related note, due to the freeze-wave in the Northeast, many electricity plants are burning fuel oil as natural gas supplies are scare from the heating demand, the lack of new pipelines in the Northeast and utilities pushing headong into nat. gas plants.

Yes, Virginia natural gas is *green* and cheap—until the system is stressed and utilities have to cut back on natural gas and burn fuel oil and coal to meet demand.

“Nuclear is a CO2-free alternative…” Really? How are nuclear plants constructed? Are any trucks involved? Any manufacturing processes? Any generators? How about disposing of the radioactive waste products? Any trucks or trains involved in that? What powers them? How about decomissioning the giant mess at the end of the plant’s life? No heavy vehicles or demolition tech or CO2 involved there?

This “green” argument for nuclear power is every bit as bogus as the argument for electric cars. Sure, they’re green if you ignore the energy and plastics and rare-earth minerals involved in manufacturing the vehicle and the batteries, and the energy and cost of sticking the clunker and its dead batteries in a landfill a few years down the line…

Absolutely correct – the whole game is maintaining Business As Usual. We call ourselves Homo sapiens – and yet we seem totally incapable of forward thinking (OK – there are some notable exceptions .. but in the current scheme of things, pretty miniscule). Sadly – in our current bloated social systems – we have a huge population that is going to get very restive if things start going off the rails – and Governments fear that above all else. So keep cranking the wheels of industry .. As George Mombiot says “No one ever rioted for austerity”.

re: the US exported 1 billion cubic feet more than it imported. By October, the last month for which data from the Energy Department’s EIA is available, net exports surged to 45 billion cubic feet. For the first 10 months of 2017, the US exported 86 billion cubic feet more than it imported.”

US gas imports are seasonal. we will likely import more from Canada this January than we export to meet our own needs, and December and February are likely to be close, given colder weather this year (population weighted heating degree days last winter were 17% below normal)

we burned the most natural gas ever on Monday, breaking a record set in 2014.

what i wrote on gas for the week ending December 23rd:

premiums for LNG in Asia and Europe saw a record spread over the benchmark price for US natural gas as set at the Henry Hub in Louisiana this week…with the price of LNG delivered to Japan, Korea and Malaysia averaging $10.85 per mmBTU early this week, LNG delivered to northeast Asia was $8.11 per mmBTU higher than the US price, while the UK’s natural gas price climbed to as high as $8.83 per mmBTU over the US price…with US natural gas for January delivery hitting a cycle low of $2.598 per mmBTU on Thursday before closing the week at $2.667 per mmBTU, US natural gas suppliers would be in a position to triple what they get from domestic natural gas customers, even after paying for liquefaction and transportation costs, if they could export that gas today…with the weekly Natural Gas Storage Report from the EIA indicating that US natural gas supplies are 5% below their level of the same week of a year ago, our domestic needs are not yet really threatened, but that will certainly be something to watch as the wave of new US LNG export capacity additions starts to come online in the 2nd half of next year..

point is, our natural gas exporters are contracting to sell natural gas at less than the marginal cost of expanding our own domestic production…the number of drilling rigs targeting natural gas formations fell by 2 rigs to 182 rigs for the week ending December 29th, which was still only 50 more gas rigs than the 132 natural gas rigs that were drilling a year earlier, and way down from the recent high of 1,606 natural gas rigs that were deployed on August 29th, 2008…

if natural gas was profitable to produce at current US prices, drilling for it would be expanding, not sitting close to an all time low..

in line with that, here are the historical US natgas production figures monthly up to October: https://www.eia.gov/dnav/ng/hist/n9070us2m.htm

though they set a record in 2015, the growth pace had slowed…then output was down in 2016 and will be down a bit again in 2017, although the recent months are rising YoY…production will be up in 2018, but not because of gas drillling…rising oil production from the Permian in west Texas is producing a lot of natgas as a by-product

The first major LNG export terminal in the Lower 48 … began commercial deliveries in early 2016

Hmmm, is this a case of build it and they will come? Somebody has to sink the capital in to build a fleet of LNG containers which will take a decade to come online. Somebody also has the build the LNG terminals as well as the infrastructure to go along with it. Poland may have one built but think about this – the Ukraine may be happy to pay for American coal which is twice as expensive as what they could buy from the Donbass regions but will Europe be happy to pay double or more for LNG from the US just to spite the Russians?

Consider this as well. That LNG terminal is in Louisiana. Which is in the Gulf. Which has all those annual hurricanes. Which is getting worse through climate change. Would the Europeans want to risk depending on American deliveries under these conditions? I will reword that. Will the Europeans want to risk their economies over this? Last year they shut down the place for a month for repairs. What if Hurricane Harvey had slammed into the place. How will the Europeans be able to trust that a future Trump doesn’t shut down LNG deliveries in winter time to get them to commit to some American policy? Too many variables with no net gain and all loss – on their part.

they started a buildout of the container ship fleet a half dozen years ago..

From what I can tell, in Europe there was a policy of encouraging LNG terminals in order to provide leverage against Russian supply. But there seems to have been a significant slowdown in construction – quite simply, LNG is too expensive relative to Russian and domestic (Norwegian, Dutch, UK, Mediteranean) supplies. It makes much more sense for Europe to broaden out its pipeline network. So I think the only appetite for US LNG comes from the more anti-Russian eastern European countries such as Poland, which hates dependency on Russian gas.

Poland would suffer without revenue from pipelines that transport Russian natural gas to Western Europe. That’s why they adamantly oppose North Stream II.

Not as much as Ukraine, for which it might mean the economic collapse, but still.

A couple of years back I was at a presentation held by a CEO of an energy firm. The firm has interests in nuclear, hydro and wind.

What I found most interesting from the presentation was how they classified the different energy sources:

-variable which was energy source that could easily be quickly started up and shut down. Quickly was defined as in hours as opposed to days and/or weeks. Typically oil or gas and also hydro.

-base which was everything else. That put wind and solar into the base load category as there was and is no control of when or how much power is generated by sun and wind.

So the gist (for me) was: Gas and oil based energy generation should be used to cover when the base load was insufficient. Or shorter: Gas and oil are complementary to wind and solar.

The LNG exports probably makes most sense for cash-flow purposes more than anything else.

Cheap energy is good…maybe

Sustainable energy is better.

The question though, is how the rich and powerful, and/or us engulfed in the banality of consumption, use it. Is it (wind energy or what not) being used for exploitation, destruction, oppression, domination, etc?

If we have so much of it that we can export, how about an export tax on fossil fuel to help lower costs of U.S. residential gas?

they are going to contract more than we produce for export, and within a few years a domestic shortage will develop and residentlal prices will skyrocket…

The more LNG we sell all over the world, the faster we can run out of gas. When all the gas is gone, then we can all freeze together in the dark. So wonderful.

Or maybe we can go all the way back to all coal, all the time. Maybe that’s part of the plan.

you have the scenario exactly right, but it’s not part of anyone’s plan…it’s dozens of self interested actors behaving independently with no grasp of the larger picture that will bring about what you project…

My question is: Is fracking gas production in the USA is sustainable, or this is yet another Wall-street facilitated “subprime” bubble?

Are companies which produce it profitable or they survive by generating a parallel stream of junk bonds and evergreen loans?

Most of them are also shale oil producers and might well depend on revenue from shale oil to produce gas. Shale oil proved to unsustainable at prices below, say $65-$75 per barrel or even higher, excluding few “sweet spots”. Also a lot of liquids the shale well produces are “subprime oil” that refiners shun.

They are not only much lighter but also they have fewer hydrocarbons necessary for producing kerosene and diesel fuel. Mixing it with heavy oil proved to be double edged sword and still inferior to “natural” oil. So right now the USA imports “quality” oil and sells its own” subprime oil” at discount to refineries that are capable of dealing with such a mix. Say, buying a barrel for $60 and selling a barrel of “subprime oil” at $30.

And without revenue from oil and liquids it can well be that natural gas production might be uneconomical.

I wonder what percentage of the total US oil production now is subprime oil.

Modern multistage shale well now cost around $7-10 million. And that’s only beginning as its exploitation also costs money (fuel, maintenance, pumping back highly salivated and often toxic water the well produces, etc). So neither oil nor gas from such wells can be very cheap.

Generally such a well is highly productive only the first couple of years. After that you need to drill more.

Also there is a damage to environment including such dangerous thing as pollution of drinking water in the area,

“In addition, there are several other export terminals that FERC has approved but construction has not yet started. And other projects are in the works but have not yet been approved.”

Don’t I know it. There are two of them we’re trying to fight off here in Oregon, at Coos Bay, mid-coast, and Warrenton, at the mouth of the Columbia (seriously – they want to navigate those floating bombs across the Columbia Bar? That’s the Graveyard of the Pacific.) California was smart enough to outlaw them, so they’re trying to put them in Oregon instead – originally, these were import terminals, so the gas was supposed to go to California!. There’s no gas to speak of in Oregon, so these terminals involve big pipelines across the state, as well.

We’re fighting off coal trains, too, though China’s change of policy might help with that.

Are you all sure ???

As far as I understand it, here in the UK….

Coal , Oil and Nuclear are together used to create our base load…. from a revolving group of power stations.

Our Solar and wind turbines then top up the total output… (Not helped by most wind is in Scotland).

** Calculate the cost of transporting Electricity large distances…. GULP ! )

SO in the UK, Gas is used as the last part of the top up.

(A Coal fire power station cant turn on and off in secounds but a LNG can.,)

After 1000 miles, 8.71% is lost, and delivered power costs at least 19% extra.

After 2000 miles, 17.4% is lost, and delivered power costs at least 42% extra.

After 3000 miles, 26.1% is lost, and delivered power costs at least 71% extra.

After 4000 miles, 34.8% is lost, and delivered power costs at least 107% extra.

That was the situation 20+ years ago. Coal fired plant in the U.K. has been decommissioned as it reached the end of its economic life and now only has a couple of percent contribution. Nuclear does still provide base load coverage but gas fired plant has taken over most of coal’s former base load supply. Gas fired plant satisfies the base load but as it has a quicker reaction time, it can also be used to lop peaks so long as they have a few hours lead time (such as is the case for weather related demand)..

Wind and solar pick up the base load when conditions permit. As the contribution available from these sources is fairly predictable (weather forecast accuracy is now very good for the next 24 hour timeframes) gas fired plant can be kept ready to pick up load when planners know, or are reasonably sure, that wind and solar sources won’t be available.

This has always been the long game. Five years ago I interviewed Chris Guith, who heads policy at the U.S. Chamber of Commerce’s Institute for 21st Century Energy. He spoke of a major goal of US companies to make natural gas more expensive in America, saying beyond enlarging the market, selling more gas abroad also increases the price at home.

Another goal for increasing domestic demand was to bring natural gas into the vehicle marketplace.

Guith also spoke of the largest oil companies making huge investments in natural gas, with thirty or forty year plans.

I don’t know the latest on off-shore methane-hydrate research and feasibility, but Guith noted the U.S. has huge hydrate potentials and was well positioned with off-shore infrastructure and experience.

Here’s hoping for continued advances in solar, wind and ocean currents power. Natural gas has some upsides in emissions when burned, but a number of less apparent downsides, from methane leakage to water quality impacts.