In case you managed to miss it, the Dow was down over 700 points yesterday, which happened to be only the worst loss since February, on the Trump Administration’s formal announcement that it was going to levy 25% tariffs on as much as $60 billion of Chinese imports. In typical Trumpian fashion, since the list of goods to be targeted has yet to be sorted out, the total is expected to be in the $50 to $60 billion range. As Belgian Prime Minister Charles Michel pointed out, Trump hadn’t committed to anything legally, so nothing is final.

And earlier in the week, the Administration made it sound as if companies would have input on which goods would be targeted. From the Journal:

But the tariffs won’t be imposed immediately. Rather, U.S. industry will be given an opportunity to comment on which products should be subject to the duties. As part of the package, the White House will announce possible investment restrictions by Chinese firms in the U.S. and will direct the Treasury Department to outline rules governing investment from China.

Asia stocks also swooned overnight, with the Nikkei taking the worst of it by falling 4.5%. The Hang Seng closed down 3.3%. The reaction in Europe is more muted, with the Dax down 0.8% right now and the FTSE off 0.4%. The reason for the comparative calm may be due to the prospect that the EU will get waivers from the previously-announced aluminum and steel tariffs, plus the fact that China so far has opted for only a mild response. From the Financial Times:

China’s ambassador, Cui Tiankai, called the US accusations of IP theft “totally groundless” and also warned that Beijing would stand up for itself.

“We don’t want a trade war,” he said. “But we are not afraid of it . . . We will certainly fight back and retaliate. If people want to play tough, we will play tough with them and see who will last longer.”

China’s Ministry of Commerce said on Friday it was planning tariffs on 128 US products accounting for roughly $3bn in imports.

Note that China has avenues for retaliation besides tariffs that it might deploy after the US decides what exactly it is doing, such as withholding shipments of strategically important goods and through unofficial channels, encouraging consumer boycotts of US goods.

Too many pundits are reacting as if this move is a threat to global trade. In a rare show of common sense, a Bloomberg newcaster pointed out:

We’re talking about 25% tariffs, we’re only talking about $12.5 billion lets’s say maximum of tariffs at this stage. I mean, if you compare that to even the notional size of the US-China deficit or the billions of dollars of theft that the President’s talking about, it feel pretty small fry.

Now in fact, the maximum could be $15 billion, but the same general point applies.

The upset, of course, is not about the magnitude of this action, but that the US, and more specifically, the fabulously erratic Trump, is seen as threatening to break a system that has worked well for those on the top. However, Trump’s earlier domestic populist threats turned out to be eyewash. He also is also nowhere on his wall.

But given that Trump has not finalized his China salvo, the incentives of his opponents are to exaggerate the significance of this move via big scary headlines like Trump Closes Era of Constructive Economic Engagement With China. Huh? Under Obama, the US and China engaged in tit for tat WTO suits. In the first term of the Obama Administration, the Treasury was under a great deal of pressure to certify China as a currency manipulator, to the degree that China would almost always manage to manufacture a month of an apparent trade deficit with the US right before the certification date. And the TPP was clearly meant to isolate China economically and politically. So how was that not a retreat from “engagement”?

One reason for what looks to be an overreaction is that the “free trade” ideology is so deeply ingrained that any attack on it is treated as heresy. And because Trump has expressed contempt for international institutions like NATO, which are also seen as sacrosanct, any out of paradigm move, even if not a big deal in isolation, is seen as a dangerous precedent.

But another reason for the reaction is more arguably more specific even if not as well acknowledged. Liberalized trade has been a good thing for the US…if you are on top of the food chain.

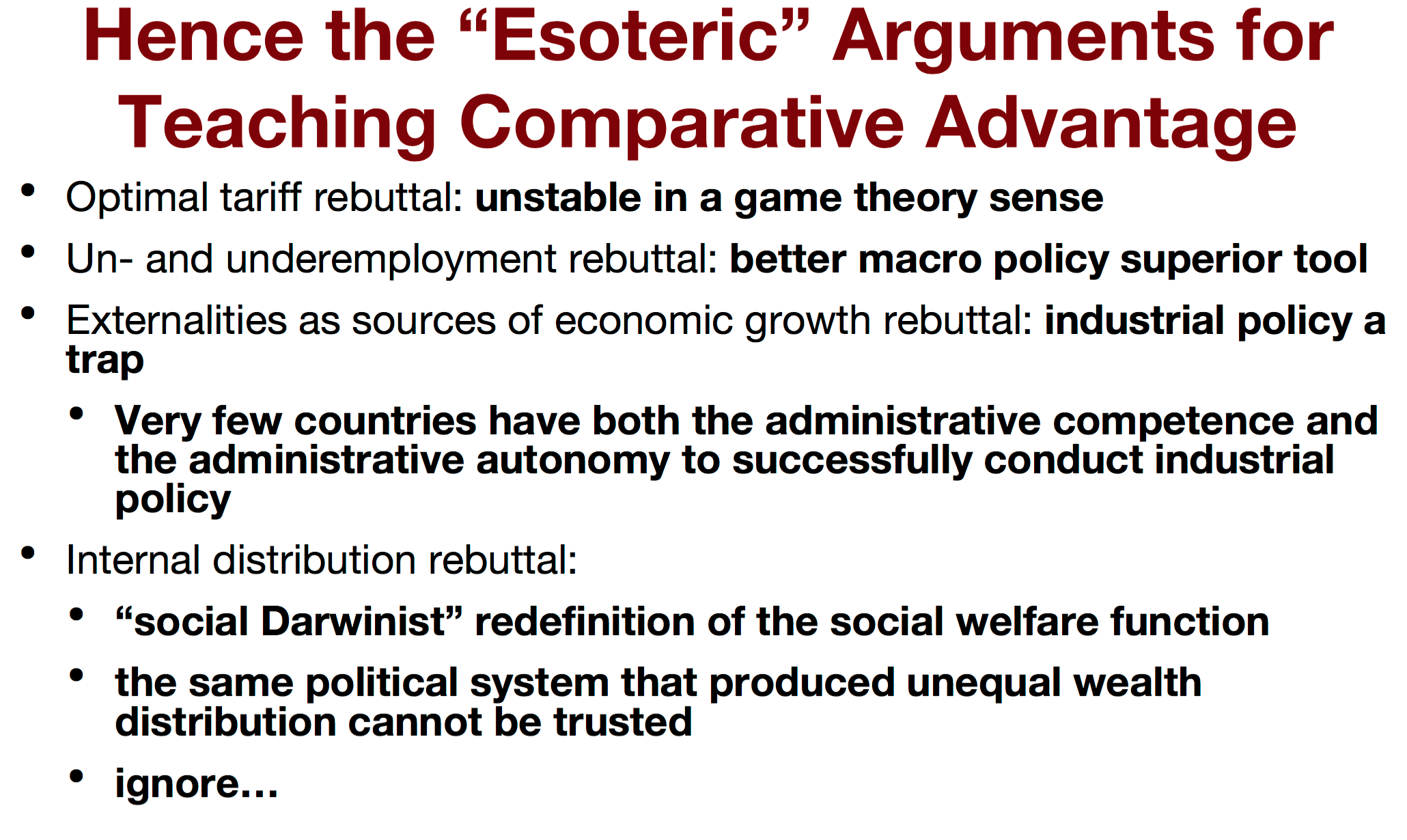

A panel at last fall’s Institute for New Economic Thinking discussed at length how the classic Ricardian story of comparative advantage made for a nice, tidy, but trivial mathematical proof, and that the more sophisticated arguments in favor of more open trade were less definitive. From UC Berkeley professor Brad DeLong’s presentation:

….leaving political/economic doctrines supporting free trade that are truly justified by more arcane and sophisticated arguments. And I must say these complicated and sophisticated arguments are not just more complicated, but also more debatable and dubious than as an ironclad mathematical demonstration that via free trade, Portugal can sell for the labor of 80 of its men, the goods it would take 90 of its men to make, while England can sell the labor of 100 of its men and return product that it would take 110 to make

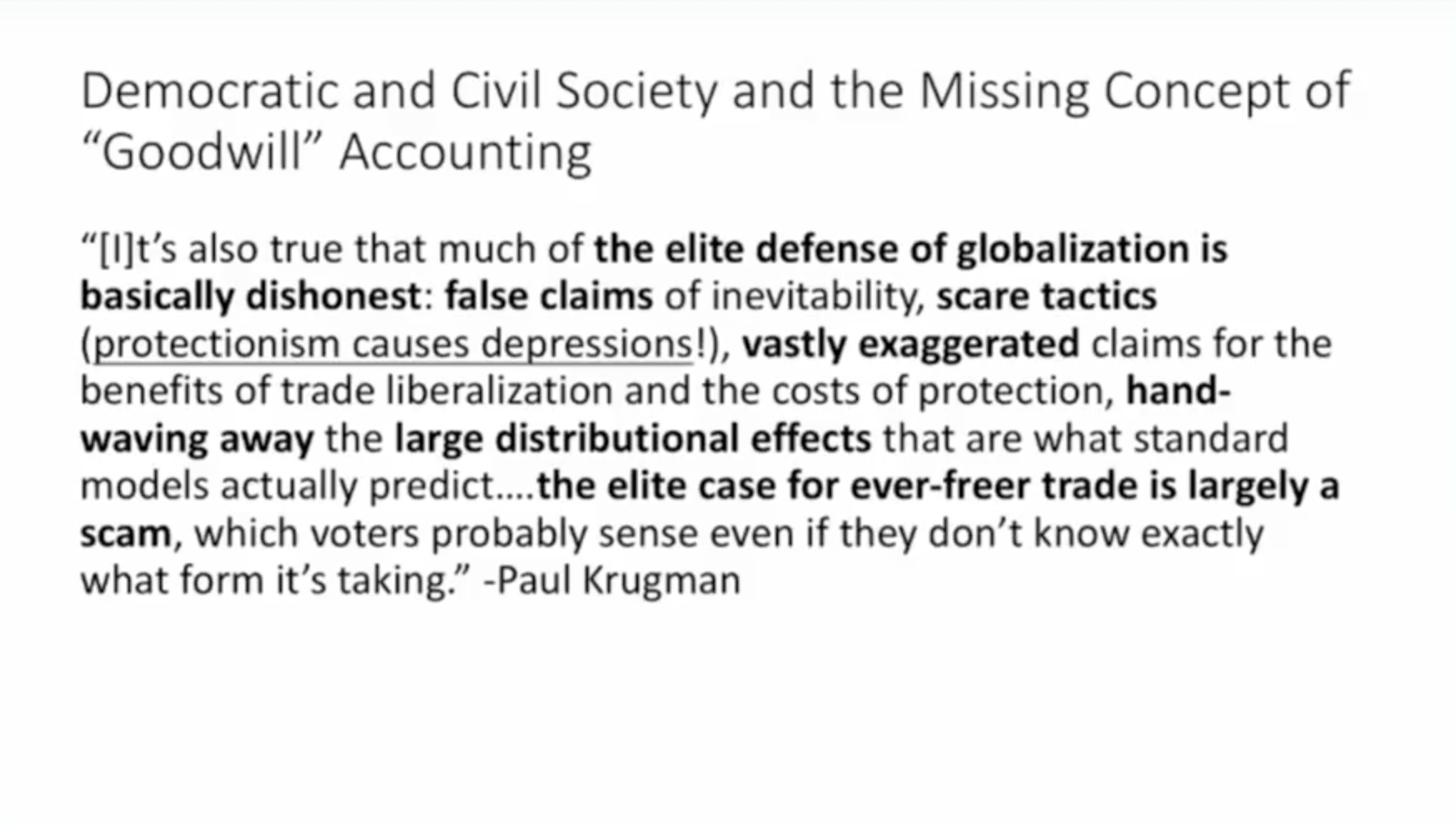

DeLong made clear in his talk that the social Darwinist argument was tantamount to saying that the poor getting poorer and the rich getting richer from trade was a Good Thing. He added:

In that case, we cannot escape the conclusion that comparative advantage is the ideology of a market system that works for the interest of the wealthy. For comparative advantage is the market economy on the international scale, and the market economy is, via the Negishi weights that it assigns to the social welfare function that it actually maximizes, is a collective human device for satisfying the wants of the well off, and the well off are those who control the scarce resources that are useful for producing things for which the rich of the world have a serious jones.

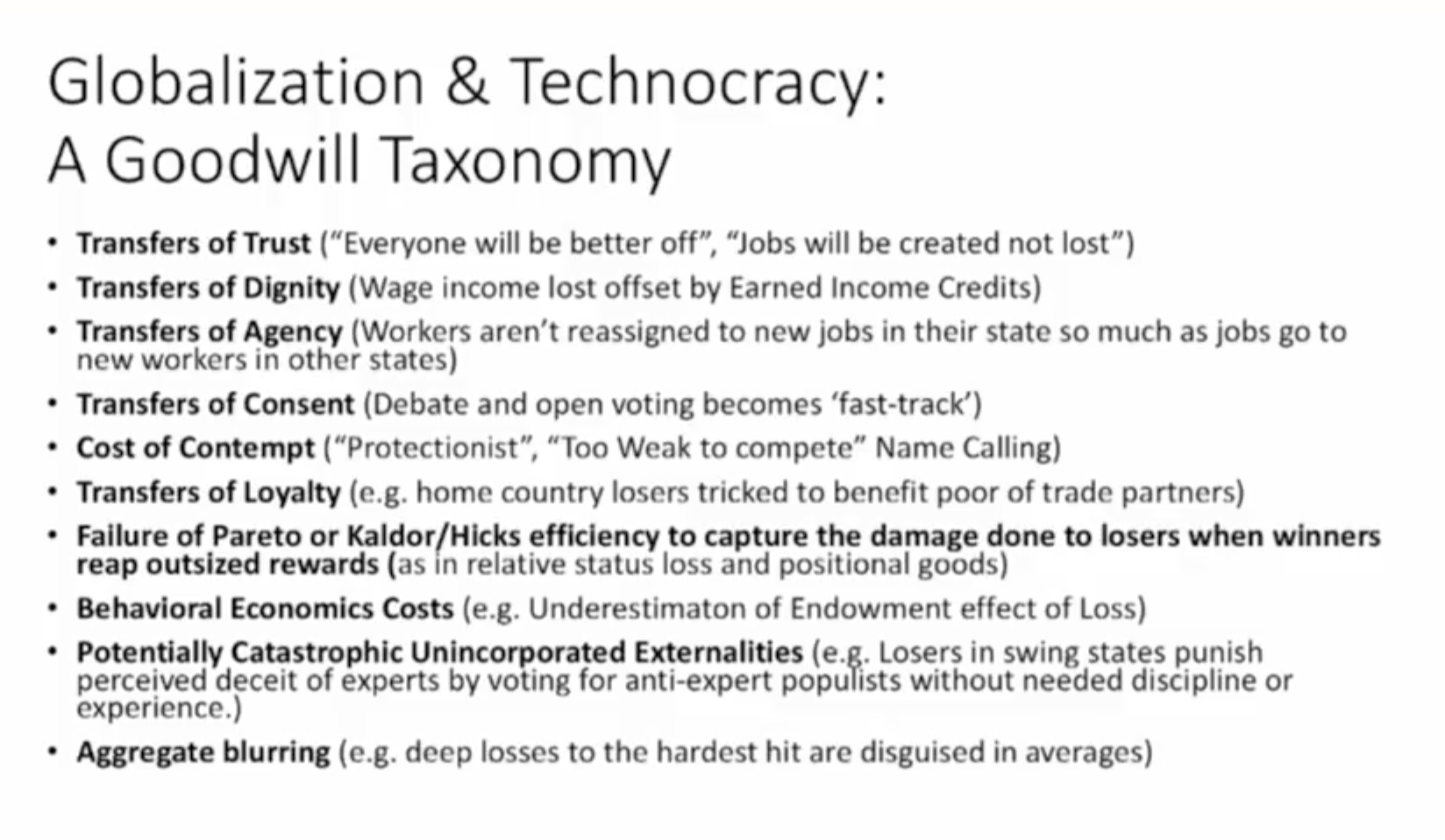

Pia Malaney, Co-Founder and Director of The Center for Innovation, Growth and Society (CIGS) and Senior Economist at the Institute for New Economic Thinking, discussed at length how the typical economist’s calculation of trade benefits ignored many social costs:

Joe Stiglitz pointed out that trade destruction routinely occurs before job creation, even with good macroeconomics. In addition, labor is not mobile, it isn’t costless to move. Workers don’t have access to resources to relocate and also lack information. These are inherent rigidities. “In the face of these market failures, trade libearlizaion can be Pareto inferior. Everybody can be worse off.”

As Pia Malaney said near the close of the panel, to applause:

The other thing I want to point out is I think there’s really this issue of the Star Chamber that economists essentially don’t bring other people into the conversation as it really exists in our minds thank you I think what we saw in this 2016 backlash is that people said you guys know something that you’re not telling us you know we know all these issues with the free trade model and I think at heart we knew that there was a social Darwinist model underlying our policies and that’s just terrifying.

In fact, we’ve seen the social Darwinist face of the Democrats behind the faux caring mask, with their lack of interest in the opioid crisis, their open contempt for the working class, and their insulting “Let them eat training” solutions to the loss of good, stable jobs. A 2016 Wall Street Journal story describes that these programs are typically counterproductive:

Government efforts for laid-off workers haven’t helped much. Washington’s formal program to retrain workers hurt by import competition, called Trade Adjustment Assistance, pays for two years of college tuition and extends unemployment-insurance payouts.

A 2012 evaluation ordered by the Labor Department found that program participants, especially those older than 50, generally made less money four years after starting the program than those who didn’t sign up. The others went back to work more quickly.

We’ll return to this topic, but one point to bear in mind: even though, as we said at the top, the level of official angst over Trump’s trade moves is way out in front of events. However, the fact that trade liberalization has in many ways worked out as might be expected (creating job losses among laborer in high-income countries, as the Samuelson-Stolper theorem predicted), ordinary people were and continue to be sold a large bill of goods. But that does not mean that big changes, particularly going aggressively to more autarkical economies, will necessarily help working people in the near or even medium term. As we’ve discussed elsewhere, in complex systems, you can’t map a simple path for how to get to a desired goal because it is impossible for you to know the terrain well enough to do that. Thus the best path is typically incremental and indirect.

In other words, the best way to tackle trade-created problems is not by trying to redesign the international trade architecture but to improve social structures and find ways to create more jobs at home that address domestic needs.

“Joe Stiglitz pointed out that trade destruction routinely occurs before job creation, even with good macroeconomics. In addition, labor is not mobile, it isn’t costless to move. Workers don’t have access to resources to relocate and also lack information. These are inherent rigidities.”

Yes, hard as it is to believe, those coding camps for coal miners aren’t quite working out as planned.

(The name of the particular coding camp in the story, Mined Minds, is practically perfect. Ka-ching!)

This is one of the many reasons why robust infrastructure redevelopment for the future makes sense. Many of the same skill sets in industries getting abandoned, including coal mining etc., are fairly easily ported over to infrastructure construction and maintenance. So we would be rebuilding for the next generation while giving goods jobs to people who have been getting laid off.

Bridges to nowhere don’t make sense, but there are so many aging water systems, bridges, dams and locks etc. throughout the country that rational reconstruction would allow those local economies to redevelop for the future. It doesn’t make any sense to try to cram all Americans into San Francisco or NYC just so they can have modern high-tech jobs. The future work can be spread through much of the country. young high tech workers could work in West Virginia using infrastructure being built by their fathers, uncles, and aunts.

The immediate injection of decent wages into these communities would do far more to bolster the economy than giving billionaires like the Koch brothers another billion in tax savings.

Instead, we are opting to give the wealthy large tax breaks and letting many areas stagnate with century old infrastructure.

Why not spend it on making completely green infrastructure rather than just fixing up what we have?

Well there really aren’t that many jobs in coding. But coal mines would be shut down in any sane addressing of the climate crisis anyway quite independent of trade.

(Climate crisis)

Don’t look for it, but trust us, it’s a real thing.

Good piece

+1

How reassuring to read a measured and thoughtful article on this subject. Thank you NC

This is why most political systems around the world are tipping towards crisis. Trump in the US, Brexit plus other EU weakening signing, and now China has a president for life. None of these political systems that largely do the bidding for elites only is delivering adequately on Yves last point. Social support and policy of supporting full employment.

I’ve read a lot of the reaction to Trump’s tariffs by China, the EU, academics, economists, etc. but there is a missing piece here. Has anybody checked to see how this is all going down with the people that actually voted Trump into the White House? My feeling is that Trump is always playing to a domestic audience and wants to have a suite of America First achievements in time for the 2020 mid-terms.

You could say that he is ignoring anything outside of American borders and only playing to local politics. Want the billionaires on your side? Give them a massive tax cut – check! Want the media on your side? Attack a Syrian airbase – check! Want Joe Sixpack on your side? Stick it to the Chinese – check! Want Jewish voters & AIPAC on your side? Announce you are moving the US Embassy to Jerusalem – check! Trump is just lining up his electoral ducks is all.

2020 PRESIDENTIAL election.

He doesn’t care about the mid-terms? Maybe not – he isn’t a professional politician.

He has a TRUMP 2020 campaign going already. He may not be a professional politician, but he is also not a “Professional Looser.”

He’s no Clinton. /s

“Trump Closes Era of Constructive Economic Engagement With China”

Yahhhh,… okayyyy…constructive for WHOM???

How elegantly spoken!!!

It’s not clear from the post who “DeLong” is.

Could we get a link to that Institute for New Economic Thinking symposium?

Thank you very much.

Maybe Berkeley economist Brad DeLong?

http://www.delong.typepad.com

I think the INET symposium Yves is referring to is here (“Gains from Trade”): https://www.ineteconomics.org/conference-session/gains-from-trade

held last Oct and part of a (much) larger INET conference called “Reawakening” which also looks interesting:

https://www.ineteconomics.org/events/reawakening/agenda

Yes, and thanks for providing the links and details! My oversight. Have added them to the post too.

Actually, I think the consensus was that it wasn’t very interesting. Just the same old same old for the most part.

My biggest gripe about all this hysteria about trade policy is that in isolation it’s irrelevant. We can have “free” trade and full employment or we can have tariffs and full employment. Our ever increasing so called “free” trade policy position has just been a tool for a policy of diminishing the power of working people. Anyone who thinks that changing the trade policy position is also a change in the policy of how the elite relate to the rest of us has made a leap of faith with no empirical grounding. Even if some jobs come back, you better prepared for other tools of oppression to be pulled out to ensure workers don’t get any hair brained ideas about questioning who’s in charge.

I strongly agree.

I think that the effect of “globalisation” wasn’t directly that of creating more unemployment in rich countries, but rather it pushed rich countries into “reforms” that were basicaly a wind down of the new deal system.

So we get to a situation were in the USA unemployment isn’t really that high, however workers still have small bargaining power, so that both wages and employment conditions worsen.

But winding back “globalisation” won’t by itself rebuild the new deal system (that anyway was still an unequal system, just less unequal than the one we have now): in the period before WW1 for example most or all capitalist countries were openly protectionist, but the labour share of income (an important determinant of inequality and a proxy for labour conditions IMHO) was very low, lower than what is today according to Picketty.

Trade deficits directly export jobs. I know of cases where the factory itself was exported – met a guy whose business it was. And my son worked for a shipyard that “exported” its largest drydock. Then they laid him off, because most of the work went with it.

You’re right about the wind-down of the New Deal/Great Society, but the “trade” policies were part of it.

One tipoff is that to a great extent, the “free trade agreements” aren’t about trade in the usual sense; they’re about finance and “services.” IOW, power.

(this answer is also to Synoia below)

Well, I live in Italy and, while we are currently net exporters, we have higher unemployment than the USA.

The reason is that the same policy that produces unemployment (austerity) also lowers consumption and thus causes net exports (that is, it’s not that exports rose but rather imports that fell).

So, yes, being a net importer is bad for jobs, if you assume that imports can be directly switched to local jobs, but in facts in order to block imports you have to either (A) raise very very high tariffs (since other countries will reciprocate, so you have to block much more imports than what is notionally needed to close the gap) or (B) avoid expansionary measures, that tend to increase imports (what Italy and in general the EU is doing).

(B) is clearly a beggar thy neighbor policy, and will likely increase unemployment also in the local country;

(A) is more problematic than it seems if you are an high added value country, since you are high added value only as long as you can trade your high added value stuff with low added value stuff produced somewhere else.

so in my opinion, I don’t think the USA can really increase employment by reducing import.

The proof is in the pudding: Reagan managed to have a “morning in America” of sorts by inaugurating the trade deficit.

Unemployment, as calculated by our esteemed and totally honest Government, is not the best metric. Labor Participation rate is a better Metric, and shows a much worse picture of Employment.

This. I’m not sure why so many people have decided to forget this recently. Isn’t it why wages aren’t going up?

“Anyone who thinks that changing the trade policy position is also a change in the policy of how the elite relate to the rest of us has made a leap of faith with no empirical grounding. ”

Your expression “leap of faith” made me think of Australia. Here the Federal Gov is pushing for Corp tax cuts (an approx $60 billion claw back for large Co’s). All Australians

( especially independents in the Senate, where the Gov lacks a majority) are being asked to make a – gigantic – leap of faith that such tax cuts (35 years of evidence to the contrary) will inevitably (by economic magic) lead to more jobs AND higher wages. (Sadly, the Gov’s first argument, viz “competitiveness” fell a bit flat). Naturally, the Gov should not interfere with market magic to make pay increases more concrete.

Neoliberalism really IS a religion.

So in layman’s terms, the global political econmony is a machine that transfers wealth from those who create it to those who own capital. This machine is so finely tuned that any change in the rules of operation tends to reduce its efficiency. Thus the owners of capital are heard to squawk loudly.

> the worst loss since February,

Anybody remember off hand why Mr. Market got a sad in February? I don’t. If you were in a relationship with an actual human being that was prone to these sort of hysterics, your counselor would quietly tell you to tie up loose ends and move on.

Fear (Based on reality or not) >> Greed.

‘the level of official angst over Trump’s trade moves is way out in front of events.‘

My angst over Herbert Hoover Trump isn’t official (sad!), but so far it worked for identifying the high water mark of Bubble III in real time. That would be Jan 26th for the Dow and S&P and March 12th for the Nasdaq. Watching a poorly-staged replay of 1930 just makes ol’ Jim snarling bearish.

Most of the kibitzing about alleged ill effects of trade (which would be more properly directed toward financialization and QE) will seem like small beer when the next bear market finishes off public pensions for good.

Since the tax increases needed to bail out public pensions would shove a stricken economy deeper into depression, Puerto Rico’s PROMESA bankruptcy likely will become a national template for slashing the bennies of state workers who thought they were flush for life.

‘in complex systems, you can’t map a simple path for how to get to a desired goal’ — Yves Smith

Read it and weep, president Tweet.

From Reuters:

Actually it takes a very stable genius to accomplish this feat. Trump nailed the exact top on Jan 26th — sheer brilliance! :-)

It’s the fear of an inverted yield curve more than anything else. The Fed Reserve is still trying to forestall that day as long possible as evidenced by their decision and statements on Wed. Still, once you raise rates up to 1.75%, well then you’re within striking range of the 10Y yield. The 10Y could easily dip below that without too much effort – it’s already been below that.

What’s a poor investor to do? Why climb that “wall of worry” of course. Wars and tariffs make fine grist for the newspapers to add to that mill. After all, we’ve already been there before. The Iraq war was a boon for the stock market. Just be sure to be first out when the punch bowl is finally taken away (the Fed inverts the yield curve).

Fully concur on the yield curve threat, which is most likely to materialize in the second half of this year.

On the trade front, unilateral US use of Section 301 almost disappeared as WTO dispute settlement became more effective. Resurrecting Section 301 to whack China on a large scale is radically destabilizing.

This afternoon the pollyanna rationale that “we’re only talking about $12.5 billion let’s say maximum of tariffs at this stage” was rudely blown out of the water as it emerged that tens of billions of Chinese retaliatory tariffs may be in the works in response to the US section 301 sanctions.

Stocks puked like a spring break college student chugging wine coolers. The S&P 500 settled at 2588, a skinny seven points above its Feb 8th correction low of 2581.

If 2581 breaks next week, plenty of

investorsalgos are gonna sell like there’s no tomorrow. In fact the pattern of Jan-Mar 2018 exhibits disturbing parallels with Aug-Oct 1987.On that analogue, today would be analogous to Friday Oct 9, 1987, when the S&P 500 slid to 311.07, just above its Sep 21, 1987 low of 310.54.

The market carried on sinking the following week (Oct 12 to 16), breaking previous support as it fell on four of the five days. Next Monday after that (Oct 19) the bottom dropped out.

Analogues never work perfectly. But a breakdown through the Feb 8th low of 2581 would be a warning that should not be lightly dismissed. Things could turn ugly in a hurry as bots run wild.

Regarding the Trade Adjustment Assistance

“A 2012 evaluation ordered by the Labor Department found that program participants, especially those older than 50, generally made less money four years after starting the program than those who didn’t sign up. The others went back to work more quickly.”

That’s true in my household. The individual who participated, now close to 10 years later is making ~50% of what the person had been previously. That income is now earned in China.

. . . That income is now earned in China.

It’s the division of that income in China that is the problem. The peasants making the goods that are sold here have their wealth creation stolen by those at the top in China, the CCCP Chinese Criminal Communist Party, in collusion with the rest of the world’s elite.

Division of labor creates wealth, division of profits concentrates wealth.

Just as here, although with bigger numbers here.

You are ignoring the Walmart Heirs and the Bezos Shares of the profit.

Distribution is the biggest business segment on the Planet.

For about 15 years I’ve been bugging anyone who would listen about the crap reasoning behind the Ricardian formula advocating free trade between England and Portugal of textiles and wine.

Textile production, I would say, is labor intensive and subject to technological advances and rising demand. Wine production, basically, is low labor with little scope for applying technology or boosting demand. So England comes out way ahead, and Portugal goes down the tubes.

And I know absolutely nothing about economics. That appears to put me well ahead of the few economists who are coming around to conclusions similar to mine.

Ricardo also assumes that capital is immobile, which is clearly not the case today.

Wine production is very labor intensive, and irreducibly so. Believe me, I’ve worked in a vineyard, and my shoulders never quite recovered.

Actual wine production has been capitalized more, but still requires great skill and care.

The real problem with Ricardo is that he “assumed” that capital and labor don’t move freely – clearly not true today. Insult to injury,. economists now use Ricardo to justify free movement for capital, a bizarre example of incompetence compounded by dishonesty.

Damn right working in a vineyard is labour intensive. I have done it myself many times in Europe (http://www.throughthecellardoor.com/german-wine-regions/) and you can’t use a machine on those steep slopes in some areas like Switzerland or the Mosel. It is just one set of stairs after the other, up and down all day long. Watching wine production, it is really a blend of art and science. God forbid that you should turn a vineyard over to a fresh MBA.

The FTSE/Xinhua China 25 Index barely budged. Either the National Team stepped in or this weekend there will be a make up session over dim sum.

While it is amusing to find Kruggles and BDL finally owning up to the disaster that they cheerfully advocated, it is long past time that the horse left the next county and the manufacturing infrastructure of the country is almost totally destroyed.

What is totally offensive is the sneering disregard that they offered anywhere, anytime, to anyone who dared to question the mathematical wonderfulness of their free trade dogma before this death bed conversion.

We working plebes were just too stupid to understand, and should just STFU while our betters discussed matters of magnitude.

I wonder why they changed their tune? Are their tenured sinecures threatened in some way?

And Mr Market is having a sad because someone placed a pebble in the roadway of their path to send the last living wage job out of country…..

‘It is difficult to get a man to understand something, when his salary depends on his not understanding it.’

They’ve been useful cover for capitalist outsourcers for decades. Why did they change their tune now, I wonder?

One reason for what looks to be an overreaction is that the “free trade” ideology is so deeply ingrained that any attack on it is treated as heresy.

Indeed. I was talking to my son about how what I was arguing for was balanced trade. And for him, that didn’t make sense. To his defense he’s a millennial still getting his sea legs, but you can see how the indoctrination is without question. What seemed more natural to him was unbalanced trade, the idea that the only reason to engage in trade is to collect the “surplus”.

If deLong appealed to a capitalist system instead of a market system, it would have aligned perfectly with where my son’s head is at. Because that’s what a capitalistic system is all about, collecting the “surplus”. For all intents and purposes, a market system today is no different than a capitalist system. Only if we were to engage in balanced trade with each other could there conceivably be a difference. And there’s no way to measure that unless we were using different currency systems at the individual level. Makes me wonder if individuals had balanced trade when the tally stick system was being used.

But it’s easier to see between different countries which do use different currencies. Back when we were on the gold interexchange standard, it was the threat of losing ones gold that kept the trade balanced. Because there was no concept back then (not in any significant sense) of using surplus currency from another country to buy their assets outside of their goods and services.

Today there’s all kinds of imbalances in goods and services and it’s balanced out pretty much presumably by foreign direct investment. Previously countries only wanted gold from each other outside of goods and services. Now they’re happy to take possession of bonds (private and public) and stock. And this isn’t even central banks that are doing this (who could care less about the assets that they’re holding). In the case of China, that baton has now presumably been passed to other entities within the country that are picking up the slack (and therefore managing to keep the peg of Yuan to USD pretty much where the central bank of China wants it to be).

So if we’re going to get balanced trade with China (and others) in goods and services, it seems to me that we need to do something about disincentivizing them on them repatriating their surplus currency to the US in the form of purchases of assets (bonds and stocks). Basically give them no option except to repatriate our currency into only one thing: goods and services. That would balance the trade pronto.

And the economists like deLong shouldn’t have to have a cow. Because this wouldn’t do anything to disrupt their sacred comparative advantage models. Still, why do I think there will be much wailing and gnashing of teeth around the idea of balanced trade?

If you really want to get their goat, we should take this further and come up with ways to discourage the capitalist system within the US from hoarding surplus and using it to buy bonds and stocks. That is, let’s have balanced trade between labor and corporations. Or, for that matter, between banks and everybody. But those are topics for another time.

looked at purely in terms of US-China trade, the US economy or the Chinese, the tariffs (on steel and aluminium) that came into effect today, and possible tariffs on range of chinese products, the overall trade cncerns are perhaps exaggerated.

However, all this ignores the effect and uncertainty in global political picture: agreements signed by one US administration (even with legilsative endorsement, as with the WTO agreement) does not bind the next; and it makes a mockery of good faith in international negotiations and agreements with the United States. It is a situation more reminiscent of the interwar years in Europe. This effect is intangible, and makes for instability and disorder in a fragile world order (one that the US largely forged and brought about at end of WWII.

raghavan

It’s worse than you think. The US is already breaking agreements right and left, because, well because there is no one to stop them.

Yet.

Like breaking the agreement with Yeltsin that NATO would not expand. And if Trump breaks open the Iran Nuclear deal, what reason is there for any nation to take the US’ word?

The Russians have a useful word for this, it means “Unable to keep an agreement”

All you have to do is look down the road further than 18 months – something US politicians and financialized corporate executives do not appear to be able to do – to see free trade and globalization are little more than instruments of class warfare. Take the Social Security program for example. It is paid for by taxes on working people in exchange for the promise they will be supported when they retire. But if jobs are off-shored (because foreign competitors enjoy the ‘competitive advantage’ of not having to observe basic environmental health practices or pay what would be considered a living wage) how is that going to happen?

I would describe the trade model as rigged in such a way that nothing ever “fails” no matter what crashes and burns. Economists can do no wrong. A financial meltdown is always somebody else’s fault. Somebody failed to play the game of who could be cheaper, dirtier, and more unregulated than the next guy. Hence trade imbalance and – whoops”, the entire system crashes.