By Nick Cunningham, a freelance writer on oil and gas, renewable energy, climate change, energy policy and geopolitics. Follow him on Twitter @nickcunningham1. Originally published at OilPrice

Geopolitics has taken over the oil market, driving oil prices up to three-year highs. The inventory surplus has vanished, and more outages could push oil prices up even higher. Yet, there are some signs that demand is starting to take a hit as oil closes in on $80 per barrel.

In the IEA’s May Oil Market Report, the agency said that OPEC might be needed to step in and fill the supply gap if a significant portion of Iran oil goes offline. Saudi Arabia suggested shortly after the U.S. announced its withdrawal from the Iran nuclear deal that OPEC would act to mitigate any supply shortfall should it occur.

But while geopolitical fears helped push Brent up to $79 per barrel in recent days, the underlying fundamentals are also mostly bullish.

Venezuela’s production is plummeting, and output is 550,000 bpd below its agreed upon target as part of the OPEC deal. Conservative estimates suggest that the country could lose several hundred thousand barrels per day over the course of 2018, but there are several massive threats to PDVSA’s operations that could make that forecast look optimistic.

ConocoPhillips continues aggressive action to obtain control of PDVSA’s assets after an international arbitration court awarded it $2 billion in awards. Related: The Most Underappreciated Story In The Oil Market

There is a great deal of confusion about what Conoco’s actions mean for Venezuela’s oil production, but the asset seizures could be pivotal. Reuters reports that the American oil major is now trying to seize two cargoes of crude and fuel near a terminal in Aruba run by Citgo, a subsidiary of PDVSA. The cargoes are holding 500,000 barrels of oil and 300,000 bpd of jet fuel, gasoline and diesel.

On top of that, Venezuela is set to hold a presidential election on May 20, an event that could be met with more painful U.S. sanctions. Conoco’s actions, combined with a crackdown by the U.S. Treasury, could send Venezuela’s oil production deeper into a death spiral.

The big question is if supply will be lost in Iran, which, coupled with the supply losses in Venezuela, could severely tighten the oil market. “The potential double supply shortfall represented by Iran and Venezuela could present a major challenge for producers to fend off sharp price rises and fill the gap, not just in terms of the number of barrels but also in terms of oil quality,” the IEA wrote in its report.

OECD crude inventories fell in March by 27 million barrels, putting total stocks at a three-year low and, crucially, 1 million barrels below the five-year average. That data point is worth emphasizing: OPEC has claimed for more than a year that it was trying to erase the inventory surplus, and at least according to IEA data, that mission has now been accomplished.

Still, the group may not be ready to take their foot off of the accelerator. They meet in a few weeks in Vienna to figure out their next steps. But with inventories now back at average levels, there is some upward pressure on oil prices, particularly with more outages looming in 2018.

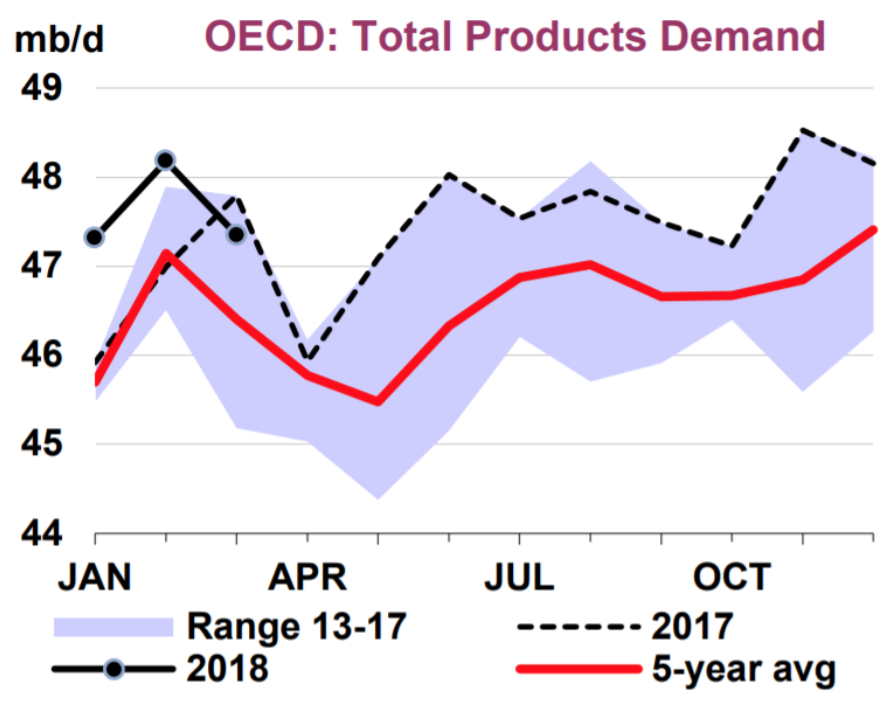

However, the cure for higher oil prices tends to be higher oil prices. The IEA lowered its demand forecast for 2018 by 40,000 bpd – not a massive revision, but notable because it offers some signs that demand will slow as prices rise. Some other reports back up this notion. There are reportedly spot cargoes for oil from West Africa, Russia and Kazakhstan that are going unsold, forcing steep discounts. “While recent data continue to point to very strong demand in 1Q18 and the start of 2Q18, we expect a slowdown in growth in 2H18.” Up until now, demand growth looked strong, but “the recent jump in oil prices will take its toll.”

“On balance, the report is tending more to the negative side. Demand for oil has been revised downwards for the second half of the year from April,” PVM Oil Associates strategist Tamas Varga told Reuters.

The IEA noted that the global economy is still “doing well,” and that “underlying demand growth remains strong around the world.” That suggests demand won’t suddenly fall off of a cliff. “Still, the fact is that crude oil prices have risen by nearly 75% since June 2017,” the agency cautioned. “It would be extraordinary if such a large jump did not affect demand growth, especially as end-user subsidies have been reduced or cut in several emerging economies in recent years.”

What is there in me saying that this is a self-created problem? The article talks about problems coming out of Venezeaul and Iran but both of these countries are under sustained attack by the US. I am sure that the Saudis and the Gulf States all promised to make up the shortfalls in oil supply but personally I think that they are full of it. The article also talks about the price of oil inching towards $80 a barrel but what happens if it shoots past $160 a barrel (http://www.macrotrends.net/1369/crude-oil-price-history-chart) like it did back in 2008? What then?

This is not a matter of geopolitics trumping the oil market but a matter of neocons trumping the oil market and neocons were always notorious for trying to create their own reality. All I can say is that I am glad that high oil prices will not have an effect on the US economy nor the US midterms later on this year. Articles are already coming out saying that it is going to be the most expensive US driving season in years but that shouldn’t be a problem now, should it? (snark mode disengaged)

Yes it’s almost as if Trump foreign policy was designed to drive up oil prices. Whether voters will make this connection and indeed respond at the ballot box remains to be seen. After all Dem foreign policy was mostly the same with hostility to Venezuela and Iran and a tendency to view high gas prices as a kind of carbon tax, albeit one that goes into the pockets of KSM and US frackers.

yep boilerplate republican…i’d say the money in us fracking goes to debt service to wall st, the frackers are just hoping for one more round of financing.

Nowadays I think about all oil market news in terms of climate change. Price spikes encourage speculative investment in extracting oil from high-cost fields like tar sands and shale, which might otherwise be left underground. Even if the price later falls, the infrastructure built during the boom will make it economical to transfer much of this carbon from the earth’s crust to its atmosphere. The price hikes resulted because some Venezuelan and Iranian production is being taken off line for now, but that oil costs relatively little to produce, and will be extracted eventually.

Although it may be desirable that Venezuelan and Iranian crude may be left underground for the time being, it will come out eventually.

Gotta aim for that sweet spot of cheap enough to discourage public transit and renewable energy, but expensive enough to generate sustainable profits.

i thought of another thing this morning and that is that high oil prices are bad for environmentalists and other anti-oil activists. it’s so much easier to defeat a pipeline or a fracking proposal when the price of oil is low and the prospect of high costs can spook the greedy oil corps to walk away than when it is high.

as a corollary, activists should use low oil prices to push through anti oil bills as aggressively as possible, pre-emptively, if you will.

That’s an intriguing theory . . . and one I would not have thought of. If prices ever get super-low, environmentalists and such might well try to achieve various anti-pipeline victories and other supply-restriction efforts. And see how far they get.

I remain supportive of the theory that the way to encourage the conservation of something is to discourage the use of something. And the way to discourage the use of something is by raising the price. I personally hope the price of oil goes so punitively high that “all the new pipelines in the world” can’t bring the price back down fast enough to matter. It is only in such an environment of torturously punitive prices that all the civilizations in the world will be tortured into dropping oil from their energy portfolios by grinding their whole ways of life around to stop needing oil for energy anymore.

Five Hundred Dollars a barrel should do the trick. Anything less won’t be painful enough to force a permanent change.