I find it hard to get excited about stock market risks unless defaults on the borrowings can damage the banking/payments system, as they did in the Great Crash. This is one reason the China perma-bears have a point: even though the Chinese government has managed to do enough in the way of rescues and warnings to keep its large shadow banking system from going “boom,” the Chinese stock markets permit much higher level of borrowings than those in the West, which could make them the detonator for knock-on defaults.

The US dot-com bubble featured a high level of margin borrowing, but because the US adopted rules so that margin accounts that get underwater are closed and liquidated pronto, limiting damage to the broker-dealer, a stock market panic in the US should not have the potential to produce a credit crisis.

But if stock market bubble has been big enough, a stock market meltdown can hit the real economy, as we saw in the early 2000s recession. Recall that Greenspan, who saw the stock market as part of the Fed’s mission, dropped interest rates and kept them low for a then unprecedented nine quarters, breaking the central bank’s historical pattern of reducing rates only briefly.

Greenspan, as did the Bank of Japan in the late 1980s, believed that the robust stock market prices produced a wealth effect and stimulated consumer spending. It isn’t hard to see that even if this were true, it’s a very inefficient way to try to spur growth, since the affluent don’t have anything approach the marginal propensity to spend of poor and middle class households. Subsequent research has confirmed that the wealth effect of higher equity prices is modest; home prices have a stronger wealth effect.

A second reason for seeing stock prices as potentially significant right now be is that the rally since Trump won the election is important to many of his voters. I have yet to see any polls probe this issue in particular, but in some focus groups, when Trump supporters are asked why they are back him, some give rise in their portfolios as the first reason for approving of him. They see him as having directly improved their net worth.1

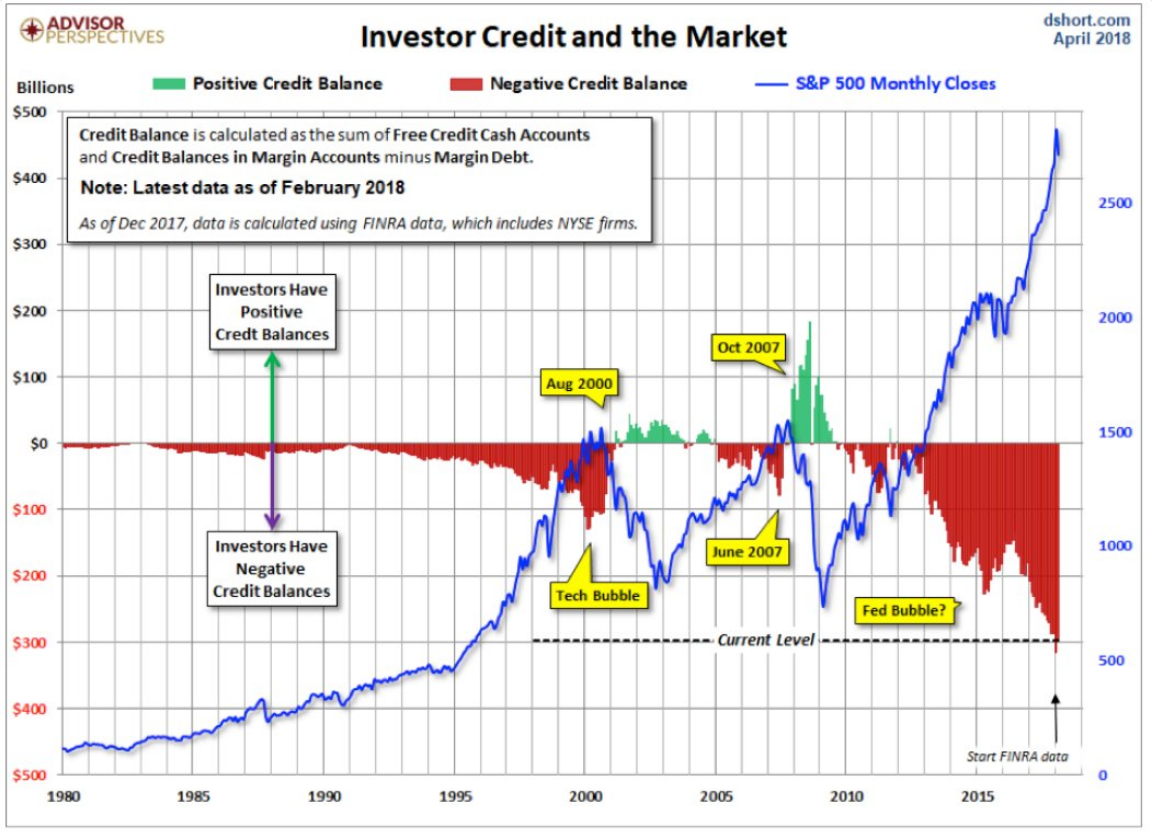

With that long-winded introduction, this chart, from Brad Lamensdorf, a portfolio manager at Ranger Alternative Management, via Business Insider, in many ways speaks for itself:

One implication is obvious: highly levered equity markets are subject to more violent downdrafts as margin calls lead to forced sales.

But Lamensdorf makes a second point: the 1% (and I would assume not the 0.1%) are borrowing against stocks: “Among those with the most at stake are the top one percenters, who’ve borrowed to buy stocks and used their portfolios as collateral for other lines of credit…”

The propensity to borrow is a big difference between the affluent classes of yore and their modern-day counterparts. A colleague, after making a nine-figure fortune in real estate, went on to establish what became one of two largest lenders against art. The idea that a rich person would have personal property in hock would have been unthinkable in say, the 1960s. The widespread financialization of the economy has completely destigmatized the use of credit….as long as you don’t get into the crosshairs of debt collectors….as did Annie Liebowitz, who had pledged her entire photography portfolio plus several houses as collateral for a loan from Art Capital. She allegedly refused to sell her back catalogue as promised to retire the borrowings. Art Capital sued, threatening to put her into bankruptcy and seize the pledged assets. A new lender came in, paying off Art Capital, in return for becoming Liebowitz’s sole creditor (as in presumably getting the rights to the collateral) and as I read Liebowitz’s comment to the Guardian, for an interest in her new work.2

That’s a long-winded way of saying that a lot of people at the top are more fragile financially than they appear. And the tendency for the well off to leverage themselves appears if anything to have become more acute since the crisis, when you’d think that a meltdown of that magnitude would instill some lasting caution. But I guess I am just an old fogey.

_________

1 Don’t discount the fact that this may be a twofer among Trump fans: it’s a politically uncontroversial justification for supporting him plus it allows the speaker to identify themselves as successful by having a big enough portfolio for the market upswing to have made a difference to the speaker’s finances. But cognitive research also says people have a funny way of coming to believe in positions they take publicly. So saying that the Trump rally justifies one’s support of Trump will make it truer to the speaker than it might otherwise have been.

2 This can’t have been open-ended..for instance, there could have been a set amount she was expected to pay from upcoming work and a formula as to how interest on that would be computed and how payments would be credited.

Uh oh. Serious question. What happens when it all goes…poof?

Depends who is holding the loan (which may, or may not, be the originator). You can get a feel for the major players in this market by doing a few searches on “high net worth wealth management loans” or similar. While there is still a degree of offloading collateralised loan obligations (“CLOs”) from the originator’s balance sheet, this has much reduced since the GFC. And if CLOs go seriously bad, they historically tended to get taken back by the originator anyway.

That will dredge up a lot of information on this interesting sideshow in big finance. Here, for example, is private bank Coutts offer. Which is, please try not to laugh, actually a brand of state-owned failed bank RBS. As you can see, it’s all very la-di-dah and desperately trying to be a million miles away from payday lenders or those “Ca$h 4 Gold” shops I see walking down the High Street. But it is essentially the same business model with plusher offices and better looking salespeople.

That was fascinating. Essentially payday loans for celebrities. Thank you.

“…we do not have a limit on the number of properties you can mortgage.”

What could go wrong?

Typo: “Greensapn”

Although he is a sap, sooooo…..

The physical stuff of the economy – factories, people, houses and the rest remain. The only real question becomes, who ends up owning what, and can they enforce that claim.

Paging Hyman Minsky. You have a courtesy call.

Unless I’m missing something, that chart is… wow…. really worrying. I had no idea leverage was so high relative to 2007.

Looks like weapons-grade plutonium, poised for fission. Yikes.

Seen many scary charts from Charles Hugh Smith, Hussman, Nolan and others tracking precarious debt, but this one is bloody, as in arterial-spray bloody. It’s Nolan’s “grandaddy of all bubbles” (beyond a mother-of-all-bubbles) that can’t be saved by continuing fiat transfusions.

It’s sorta like the bus in the movie Speed, rigged to explode if Sandra lets the speedo drop below 60. But the analogy breaks down because in this movie, all passengers have deadman switches in the seat cushion. Keanu can’t save CalPERS and IBM . . . nor the collateral masses.

I think the psuedo-Fed knows this but is trapped. Yellen and Vice-chair Fisher, former Pres of Israel’s CB, chose about the right time to inflict themselves on their unfortunate families.

Regarding that credit chart – my take on the GFC was that the bust was in collateralized mortgage paper, which will not show up in a chart of margin debt at brokerages. The big leverage wasn’t in buying stocks that time, which is not the usual setup for a financial bust. I consider the 2007 margin debt an outlier because of the mortgage fraud schemes that brought down the house that time.

Knowing now that the big money is leveraging more than before, which I see as lacking the prudence of prior generation wealth, makes the current bull market interesting to say the least.

‘that chart is… wow…. really worrying‘

It does show, though, that margin debt is a coincident rather than a leading indicator. As long as stocks are rising, the red sea of equity-collateralized debt carries on getting deeper, and good times prevail.

When stocks tick down — even 5 or 10 percent — brokers start liquidating their overleveraged clients, creating a reinforcing effect of “automatic destabilizing” selling driven not by sentiment but by margin mechanics.

The Fed’s Regulation T allows a customer with $10,000 cash to buy $20,000 worth of stock, with $10,000 of it borrowed from the broker. Should the original $20,000 portfolio fall to $14,285 or lower, leaving equity of ($4,285/14,285) = 30 percent, the customer will get a margin call demanding same-day transfer of $2,858 to bring account equity back up to 50 percent, else the position gets liquidated before the close.

This is fine for the occasional individual whose speculative stock picks go south. But when the entire system gets a margin call, liquidation becomes a question of … to whom?

For now, the Federal Reserve’s steady dumping of bonds is being absorbed. But when the system goes into liquidation mode, the bond dumping not only must stop, but actually reverse into QE IV … a/k/a “central bank capitulation” — coming soon to a market near you.

Insightful comment, Jim. Thanks, especially regarding margin debt liquidation and your concluding paragraph. However, I do question whether ‘liquidity management’ isn’t already being done through other mechanisms. This is clearly not your father’s stock market of industrial capitalism with its regulatory enforcement, Glass-Steagall Act, and prosecutions of Wall Street and CEO criminal behavior. That market with its stock valuations based on fundamentals was in the rearview mirror many years ago. Although perception is reality, this is financial capitalism, the antithesis of “free markets”, fueled by and perpetuated with:

• Virtually unlimited low-cost ‘money’ courtesy of the Fed and Treasury with intensive intraday markets management. Thinking of going short after looking at this chart of margin debt, a little over 2 percent of total current US stock market capitalization?… Well, there is a possibility that “‘They’ have more ‘money’ than you do” and “Prices are set on the margin.” … In fact, for all practical purposes I suggest they have infinite money and were MMTers before MMT became cool, at least in so far as keeping stock market prices and MIC profits elevated, and lowering corporate tax rates. Also read recently that they have labeled the stock market an integral component of national security without explaining exactly why that is so.

• Corporate Stock Buybacks (cumulatively totaling in the trillions of dollars, funded in large part with debt that is increasing leverage risk at many corporations.

• Foreign Capital from the deep pockets of ‘global wealth’; including ‘money’ from foreign central banks in Switzerland, etc.; ‘sovereign wealth funds’ with funds of unknown origin; and ‘private investors’ in the EU, China, Japan, East Asia, PetroStates and elsewhere.

• Capital of short sellers from occasional squeezes, just to keep the playing field tilted unless and until ‘the right people’ have their shorts, futures and options set up.

• And underwritten by monthly 401(k) and IRA purchases of ordinary Americans who have been financially ‘encouraged’ to use the stock market as a vehicle to “save for their retirement”. Btw, this constituency also votes.

What, me worry? The entire system is too big to fail. Can you imagine the upheaval this time if housing prices, pension funds, stocks and bonds all hit an air pocket simultaneously? Got your Venezuela visa, comrade?

A decade after Obama first kneeled to wall st, people are still seething. The pseudo-Fed’s PPT will of course do whatever it takes, legal or not, via their dealer proxies or by just buying stocks outright, to keep this sucker from going down. It’s just astonishing that they would knowingly blow a multiple-size debt bubble after the last one gummed up their face and hair. Remember Paulson or Geithner’s martial law threat to Congress? They probably have FEMA camps well stocked.

There will always be a buyer for all those that must sell. The question is only at what price the transaction occurs.

> . . . .as long as you don’t get into the crosshairs of debt collectors….as did Annie Liebowitz, who had pledged her entire photography portfolio plus several houses as collateral for a loan from Art Capital.

Did Annie need an operation, and that’s what she borrowed the vast sums for?

Yeah, what is the backstory there? I mean, come on. She’s an excellent photographer. One of the best of those who are currently living.

How in the heck did she get into so much financial trouble?

We’ll find out next year.

Real Estate is beginning to correct and there are plenty of other problems…

Is that why I just got a business card from a CRE guy I’ve never heard of? Is there a bridge for sale somewhere?

The snark meter maybe pinged when Krugman wrote the market was going to crash as his immediate reaction to the president election results, then on Wed, Thurs and Fri the S&P was down (~1% a day or something–I can’t fetch the data instantly but the memory is vivid) then starting Monday or Tuesday it just started going up up up and away to the moon Alice. A lot of Trumpies got a lot of pecks in on poor Krugman on those days.

What I want to know is whether Bezos will be doing the construction shovel party for Amazon HQ2 before or after the next meltdown. If it hasn’t happened yet, he will be experiencing a smiley-egogasm and there’s your photo op for all that went wrong on this cycle. Also: Uber or Tesla, which one blows up first? (Timing is the problem. In Alchemy of Finance Soros says he lost a small fortune shorting the millennium tech bubble too soon.)

My money’s on Tesla. Because, unlike Uber, it actually makes something. And there have been production problems with that something.

Agree about Tesla in part. SpaceX has a future but the car business is a major money drain. Most of Tesla’s bad publicity is in the car segment (production problems, power steering, bad auto reviews, union problems) https://www.wired.com/story/tesla-model-s-steering-bolt-recall/

Not to forget the self driving problems, an unnecessary distraction.

Potential Noob question here: Doesn’t this also demonstrate that those same 1%’ers go Credit positive after S&P corrections? Why would this time be different?

Either way that’s obviously worrying for everyone else who struggles to stay afloat amid the financial wave machine.

I don’t understand what defines an investor nor how the positive or negative credit for investors is aggregated. If an investor is anyone who has money invested in the stock market and the only accounts aggregated are margin accounts with brokers — does that mean the positive credit amounts after the stock market downturns represent the winners’ winnings from the cycle? What caused the gap in positive credit roughly 3rd Qtr. 2009? There also appears to be a very small bump in negative credit at that point.

The slope of the tech bubble run-up appears similar to the slope of the present run-up of the S&P. But the there was relatively much less borrowed credit in play than in the present run-up. There also appears to be a disturbing symmetry between the negative credit and the S&P average following 2013.

The downward movements of the S&P on either side of 2016 are interesting. The first downward blip started around the time of the Presidential primaries and the second started around the time Trump was elected. Around 2013 is when big increases in negative credit started, aggregate increases at a much greater rate than in any previous run-up of the stock market approaching an ongoing rate of increase similar to the increases approaching the rate only seen as the previous peaks of the S&P were approaching their high points.

I’m a suspicious person but even so there’s something creepy about this stock market picture beyond what looks like the setup for unusually large downturn. Like you I am troubled by those green peaks following the 2007 crash. The red-blue symmetry in our present run-up, especially right around the Presidential election cycle suggests to my suspicious mind that somebody — not me — got the high sign. The guys holding the green after the 2007 crash might be some of the same guys holding the green after the next crash bottoms. Are they just smarter than the average bear or better informed?

How does equity buying by central banks (like the Swiss, maybe others who DON’T have to report it) factor into this skyrocketing since 2015?

https://qz.com/1140322/check-out-the-swiss-central-banks-insane-90-billion-investment-portfolio/

Maybe it doesn’t, but certainly correlated to the initial 2015 lull and then lurch upwards.

Nothing new. I believe HNWIs in Hong Kong were using “accelerator” products as far back as the Asian crisis. Accelerates on the way up and it’s the same way on the way down.

So is this truly just margin debt, and If so held by who? Are high frequency firms part of this, pension funds, or maybe foreign holders? I can’t imagine it’s the regular retail mom and pop inventor who pushed this up. Who holds the margin gets the call, and I can’t imagine how a high frequency firm would deal with such a thing.