Yves here. Varoufakis is extremely articulate and charismatic, and had the correct economic analysis for the mess Greece was in in 2015, as well as an economically sound solution in the form of his and Jamie Galbraith’s A Modest Proposal. However, one of its centerpieces was some fudges to get around prohibitions against Eurozone-level fiscal spending.

Given that economic problems are now becoming political ones, Eurocrats may be more willing to consider fudges that before. But I don’t see them as anywhere near giving up their fervor about fiscal discipline. Until the Eurozone is willing to run meaningful and sustained deficits to lower unemployment rates, the stagnation and lack of opportunity, particularly in southern countries, the populists will gain more seats.

By Yanis Varoufakis, the former finance minister of Greece, Professor of Economics at the University of Athens, Visiting Professor at the Lyndon B. Johnson Graduate School of Public Affairs, University of Texas, Austin and co-founder of DiEM25. Originally published at openDemocracy

“I wanted a Germany that was hegemonic and efficient, not authoritarian and caught up in a European Ponzi scheme. That was in 2013.” Excerpt from the Munich Seminar.

This CESifo group Munich seminartook place on June 11, 2018 in Ludwig-Maximilian University, in Munich. The euro crisis has highlighted the urgent need for reform in the Eurozone. However, approaches to a solution can be divided into two camps. The disagreement, primarily between France and Germany, is reflected very clearly in their different attitudes towards fiscal union. While the French strongly support a fiscal union, which necessarily implies fiscal transfers by Germany and other donor countries, Germany absolutely rejects a fiscal union and favours a post-crisis write-off of bad loans instead. In his speech Yanis Varoufakis argues that both visions are flawed and potentially dangerous, going on to differentiate between the solution to the Eurozone’s structural problems and the zeal and ambitions of its political class.

In these trying times for Europe, our common home, opportunities like tonight’s to discuss honestly and frankly Europe’s crisis are priceless.

When the title of my talk was announced, many of my critics were puzzled. Having portrayed me as a Greek politician who, back in 2015, came to Germany cap-in-hand demanding more money, they had difficulty explaining why I would be standing in front of you to argue that Germany neither can nor should pay more to save the eurozone.

The puzzle of course disappears after a close look at what I was saying since 2010. Let me give you an example. On July 24, 2013 I published an article in Handelsblatt entitled ‘Europe needs a hegemonic Germany’. In that article I had, again, surprised many by arguing in favour of a strong Germany as the best way of leading Europe out of its difficulties. My criticism of the German government, and its attitudes towards the eurozone more broadly and Greece more specifically, was not that Berlin was not paying enough but that, in a sense, it was paying too much – except that it was wasting the German people’s money in perpetuating what I termed a gigantic exercise in fraudulent bankruptcy concealment.

I added that Europe needs a robust Germany, an energised Germany, to lead the way, to use its money wisely – in other words to be genuinely hegemonic, as opposed to spending too many resources on concealing impossible bankruptcies. Indeed, back then, in 2013, I had warned that continuing to insist on hiding serial bankruptcies would cost all of us more and more and would require increasing degrees of authoritarianism to perpetuate and reproduce the policies of denial.

In short, I wanted a Germany that was hegemonic and efficient, not authoritarian and caught up in a European Ponzi scheme. That was in 2013. Two years later, in March 2015, I wrote an article, while Greece’s finance minister, referring to the first and second bailout loans, of 2010 and 2012. Allow me to quote from it:

“The fact is that Greece had no right to borrow from German – or any other European – taxpayers at a time when its public debt was unsustainable. Before Greece took on any loans, it should have initiated debt restructuring and undergone a partial default on debt owed to its private-sector creditors.

But this “radical” argument was largely ignored at the time. Similarly, European citizens should have demanded that their governments refuse even to consider transferring private losses to them. But they failed to do so, and the transfer was effected soon after. The result was the largest taxpayer-backed loan in history, provided on the condition that Greece pursue such strict austerity that its citizens have lost one-quarter of their incomes, making it impossible to repay private or public debts.

The ensueing – and ongoing – humanitarian crisis has been tragic… Animosity among Europeans is at an all-time high, with Greeks and Germans, in particular, having descended to the point of moral grandstanding, mutual finger-pointing, and open antagonism. This toxic blame game benefits only Europe’s enemies.”

A personal note here, if you permit it: For me, nothing hurt more than my unfair portrayal as an anti-Europeanist Greek politician demanding more money from Germany, or arguing that Germany must pay more for Greece and for Europe. In fact the reason I resigned the ministry is simple: I was refusing to sign the third bailout, to take more of your money, because I was convinced that, when you are bankrupt you have no right to borrow more. What should we have done? Declare bankruptcy, suffer the pain together with the lenders that should not have lent to the previous governments, reform the country and move on. What happened instead?

Italy and Greece

A few weeks after my resignation, Mrs Merkel, Mr Tsipras and others agreed on another 85 billion euros loan to the Greek state. On that day I rose in Greece’s Parliament to denounce this as another extend-and-pretend loan – another mountain of money given to the bankrupt Greek state in order to pretend for a few more years that it is repaying its debts – and granted under conditions that guarantee that the Greek economy and our society would continue to shrink, that the debt would notbe repaid, and that Europe would move on to repeat the same mistakes in Italy – a country whose public debts and banking losses are just too large for Germany and other countries to sustain via Greek-like bailout loans.

That is what I said in the summer of 2015. Today, I painfully observe the realisation of those fears. Italy has fallen to the forces of xenophobia and Europhobia that welcome the European Union’s breakup. How did that happen? It happened because the failed policies first tried on Greece were also implemented in Italy.

Just like Greece, Italy had been ruled for decades by a corrupt oligarchy enriching itself from EU transfers and relying on a kind of ‘establishment-populism’that traded on the impossible promise that everyone would become better off as long everyone pretended to adhere to the EU, Maastricht & Fiscal Compact rules – rules that could not be adhered to even if the government wanted to.

When this promise was proven false, and the doom loop of bankrupt state and zombie banks caused per capita income to shrink and prospects for most Italians to wither, the electorate voted for a new government representing two opposing anti-establishment populisms(that of the xenophobic Lega and of the Five Star movement). The crucial difference, ladies and gentlemen, between this Italian government and the Greek one I served in is that wewere committed Europeanists – we did notwant to leave the euro even though we had, realistically, to consider a Grexit – especially when constantly threatened with it by the creditors. The main movers behind the new Italian government, however dream of being threatened with Italexit, a fact that guarantees a clash of gigantic enormity with Berlin, Brussels and Frankfurt.

A Badly Designed Monetary Union

These developments, ladies and gentlemen, are not the result of bad choices, of human frailty. They are the result of a badly designed monetary union. Germany is simply not rich enough to support this faulty architecture. The EU cannot, backed by Germany, extend and pretend Italy’s 2.6 trillion debt, as well as the losses of their zombie banks. At the very same time, Italy will continue to stagnate within this faulty architecture until some political event will cause its uncontrolled, very costly breakdown. It is the fate of an unsustainable system not to be sustained. The longer it is sustained by political stealth and authoritarianism, the more catastrophic its collapse will be, when it comes.

What should we do?

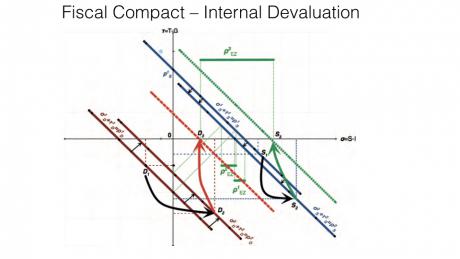

So, what should we do? What should Germany do? Some argue that we need the German treasury, and the treasuries of other surplus countries, to support the treasuries of the deficit countries. This is both infeasible and undesirable. Infeasible because the fiscal surpluses of the Germanies are dwarfed by the banking losses and debts of the Greeces and the Italies. Then there are those who propose the liquidationist approach – let public debt default if it must. While I sympathise with the logic, and I wish we had followed that approach with Greece’s public debt, liquidationism is inconsistent with the euro architecture: following such government bond automatic restructuring, our weak banks that rely on these bonds for collateral and repo operations will go under, demanding of the weakened states to refinance them – which defeats the purpose of liquidating part of their debt.

Back to square one then: What should we do? I shall be arguing that:

- The current rules cannot be applied, even if we were all desperate to apply them

- Those who seek a fiscal union with the German federal government footing the bill of other governments are wrong: the German government cannot afford to finance the eurozone’s necessary reforms and, indeed, it should not have to

- Those who propose the liquidationist route – e.g. that the ESM extends loans to states at the price of restructuring of their debt – are also wrong, because they do not take into consideration the doom loop binding together the insolvency of our states with the insolvency of our banks (e.g. Italy’s)

- Proposing a new Treaty as a solution to the eurozone’s immediate problems only deepens the sense of pessimism in the heart of those who, correctly, estimate that the current political climate makes New Treaties impossible

- In this eventuality, there are two courses of action that we must consider: One is the controlled dismantling of the current eurozone. The other is a simulationof a federation using existing institutions and new policies based on a re-interpretation of the letter of the charters and treaties.

So, let me begin by explaining why the current rules cannot work within our asymmetrical monetary union (MU). Sure, the Maastricht rules and the ECB charter could have worked fine in a symmetrical MU, as long as governments wanted/were forced to stick to the rules: a symmetrical MU is one in which countries differ on productivity and endowments but every market in every country comprises exclusively pricetaking firms, customers and workers (in other words, no one has the capacity to influence prices). In such a symmetrical, perfectively competitive union trade surpluses and deficits, as well as different productivity growth paths, are auto-corrected through a process of devaluation in the country whose productivity growth lags behind and of internal revaluation in the ‘stronger’ country. Whether this devaluation is external or internal makes no difference. Whether we have the euro or separate currencies does not matter, except perhaps that under the euro we would have enjoyed lower transaction costs.

However, things are very different in an asymmetrical MU. In a positively asymmetrical MU like our eurozone, financial markets are bound to destabilise our economy and cause a crisis that makes impossible the implementation of our rules.

What exactly is an asymmetrical MU? It is a monetary union between:

1. National economies that comprise large oligopolistic manufacturing sectors, replete with economies of scale (as well as of economies of networks and of scope), with production units operating at excess capacity (that reflects their market power and their capacity to deter competitors), and concentrating much economic activity on the production of capital goods; and

- 2. National economies where the capital goods sector is atrophic, where production is much less capital intensive, and where economic rents are not due to economies of scale but due to corrupt practices and socio-political impediments to competition (e.g. restrictive practices, crony relations between authorities and particular business interests).

When one nation, or region, is more industrialised than another; when it produces most of the high value added tradable goods while the other concentrates on low yield, low value-added non-tradables; the asymmetry is entrenched. Think not just Greece in relation to Germany. Think also East Germany in relation to West Germany, Missouri in relation to neighbouring Texas, North England in relation to the Greater London area – all cases of trade imbalances with impressive staying power.

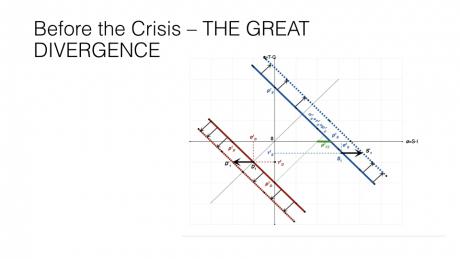

A freely moving exchange rate, as that between Japan and Brazil, helps keep the imbalances in check, at the expense of volatility. But when we fix the exchange rate or, even more ambitiously, introduce a common currency, something else happens: banks begin to magnify the surpluses and the deficits.

They inflate the imbalances and make them more dangerous. Automatically. Without asking voters or Parliaments. Without even the government of the land taking notice. It is what I refer to as toxic debt and surplus recycling. By the banks.

It is easy to see how this happens: A German trade surplus over Greece generates a transfer of euros from Greece to Germany. By definition! This is precisely what was happening during the good ol’ times – before the crisis. Euros earned by German companies in Greece, and elsewhere in the Periphery, amassed in the Frankfurt banks. This money increased Germany’s money supply lowering the price of money. And what is the price of money? The interest rate! This is why interest rates in Germany were so low relative to other Eurozone member-states. Suddenly, the Northern banks had a reason to lend their reserves back to the Greeks, to the Irish, to the Spanish – to nations where the interest rate was considerably higher as capital is always scarcer in a monetary union’s deficit regions.

And so it was that a tsunami of debt flowed from Frankfurt, from the Netherlands, from Paris – to Athens, to Dublin, to Madrid, unconcerned by the prospect of a drachma or lira devaluation, as we all share the euro, and lured by the fantasy of riskless risk; a fantasy that had been sown in Wall Street where financialisation reared its ugly head.

Crucially, the private capital inflows from a country like Germany to a country like Greece, alter the structure of B’s economy. A large, inefficient service sector develops in the Greece’s while periphery’s manufacturing wanes under the inexorable pressure of the surplus countries exports. While manufacturing wages collapse in absolute and per worker terms, the portion of the wage bill that comes from this parasitic, import-and-debt financed sector rises. And so does the corrupt oligarchy in the Periphery, house prices and a false sense of wealth. To sum this up in a vulgar but accurate manner, this is similar to buying a car from a dealer who also provides you with a loan so that you can afford the car. Vendor-finance, is the term used. Only in Europe we practised it at a macroeconomic level.

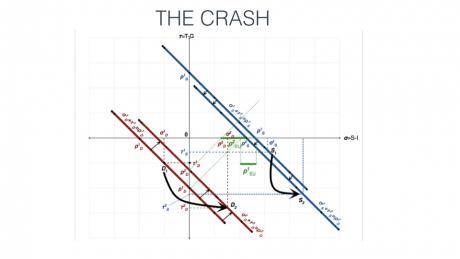

Irresponsible Borrowers and Irresponsible Lenders

I think you can see the problem? To maintain a nation’s trade surpluses within a monetary union the banking system must pile up increasing debts upon the deficit nations. Yes, the Greek state was an irresponsible borrower. But, ladies and gentlemen, for every irresponsible borrower there corresponds an irresponsible lender. Take Ireland or Spain. Their governments, unlike Greek ones, were notirresponsible. But then the Irish and the Spanish private sectors ended up taking up the extra debt that their government did not. Total debt in the Periphery was the reflection of the surpluses of the Northern, surplus nations.

This is why there is no profit to be had from thinking about debt or surplus in moral terms. And this is why my message to my German friends is simple: before the crash, we Greeks invested our loans and transfers unwisely. But you invested your savings, your surpluses, unwisely.

Let’s take a dispassionate look at Germany’s current account: it is large, persistent, and extraordinary in international and historical comparison for a large country that is not focused on exporting raw materials. This means that your savings are increasingly entrusted to the hands of foreigners who do not have the capacity to look after them. Germany’s net international investment position is over 50% of GDP, after discounting past investments that have lost about 15% of GDP worth in the crisis. Moreover, the German surpluses are mostly due to the non-financial corporate sector, followed by government, with only a modest contribution by households and financial corporations having actually turned to a net borrowing position. So, it is not the demographics that drive the CA surplus in this country. It is the euro’s architecture.

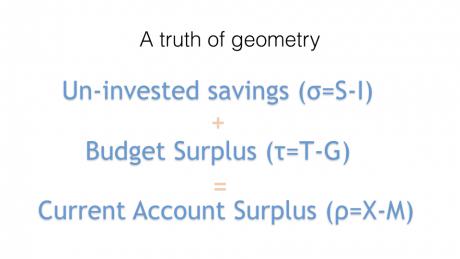

When σ>0 everywhere, and we push τ to zero, we are forced to a large trade surplus – which pushes the euro up and strengthens… Trump.

Will σ not equilibrate in the periphery if wages and prices fall? Will internal devaluation – austerity not do the trick? No, because private and public debts and losses do not devalue – and investment is deterred by this loop of doom, by this recycling of state and private bankruptcies. Even in countries like Spain and Ireland, the growth we have been celebrating recently is due to another unsustainable rise of private debt.

And this is where the rules become impossible and the EU’s attempt to pretend that they still hold ridiculous.

An example of Europe’s Ponzi schemes by which to pretend that the rules were adhered to:

For the full lecture including the last 20 minutes, not on the wrong question, “How can we pretend that the rules still hold?’, but “the right question” which is, ‘ What must we do to stop this crisis from destroying us?’ – see the video above. In argument 5, Varoufakis outlines two stark options, the controlled dismantling of the current Eurozone or a simulationof a federation. ( Video 58 minutes in all).

For the subsequent Q & A ( 23 minutes), see here:

German domestic politics, like in the US, requires the easy route of tyrannical exploitation of one part of the world by another, in this case exploitation of S Europe by N Europe. That gets German or American politicians elected, but it is unsustainable. Eventually the tyrannized fight back. The rise of Japan, China etc present the same problem. Without exploitation, relying on only the domestic economy leads to stagnant growth.

I fear the future of this man to be that of being forgotten to history, sidelined into irrelevance. His constructive and creative perspective is something I just don’t come across at all and would love seeing being put to the test hopefully outside the messier stages of a crisis. He apparently remains active and ambitious but after years I don’t see that his efforts are gaining any traction at all.

Any other readers that could perhaps dispel my hopelessness for Varoufakis? That see some future ahead that’s not completely degenerative?

First, the Eurozone has to crash and burn. That process is now well underway, primarily in Italy. When Spain joins in, the end begins. Both are too big to torture as they did to Greece.

Unfortunately, as has been established here, leaving the Eurozone makes leaving the EU look easy. So it won’t be pretty – unless, as seems unlikely, it’s a joint decision.

Our current world financial system of badly made loans and unqualified borrowers was explained on Married with Children decades ago when Steve makes a bank loan to Al for his Dr. Shoe help line. Steve makes the questionable loan to Al to win a bonus vacation trip. Dr. Shoe fails, Al loses all the money, the loan fails, Steve gets in trouble and tries to blame Al. Marcy (Steven wife and bank manager) then tells Steve – if you give a monkey a gun and the monkey shoots someone you don’t go blaming the monkey! To make the episode even more brilliant Marcy then makes a loan to Al to save Steve’s job which Al loses again costing Steve his job and getting Marcy demoted.

Brilliant explanation! Of course only old enough Americans will get it.

Saving the European Monetary Union from itself: a folly on par with trying to save the US Democratic Party from its own venality and corruption. Lots of luck, Yanni & friends. This joke is so old I think it must have been passed down as an heirloom in Henny Youngman’s family.

How can that happen? Germany and Holland have surpluses. Whatever the “fudge” the Germans and Dutch will believe they have to “fund” the lazy southerners.

It’s just another version of the Impossible Trinity.

Synoia:- “It’s just another version of the Impossible Trinity”

Perhaps, but isn’t it rather the impossible singularity:- ie monetary union without political union? Without political union (with or without MU) it is impossible to gain the support of any one region for transfers from it to any other. As Varoufakis (along with many others) points out, political union was the prerequisite and – without it – MU was doomed from the start to fail.

And has failed, even though it lingers painfully on.

Is this correct? Got the order wrong?

Got

1 Monetary Union

2 Political union

Should have

1 Political Union, and yes it would take a long time.

2 Monetary Union

@Synoia

Exactly!

Help me. The Eurozone is a monetary sovereign. The Eurozone can deficit spend at the Eurozone level all day. It’s a political decision not to which unfortunately is hard wired into some of the governing agreements. The Eurozone fudged other provisions during the crisis, and the ECB separately and regularly violated its own rules to keep funding sick banking systems. Varoufakis has proposed additional routes for making the optics of breaking the rules look better. It’s either that or the Eurozone becomes ungovernable as authoritarian governments flout the rules, as Poland is doing now. “Ungovernable” is too mild a word but you hopefully get the idea.

True, however, the Political decision was a result of the Germans not wishing to subsidize the “lazy southerners.”

Let’s perhaps discuss “German Flexibility” over what they consider their money? Rigid comes to mind.

Politically I cannot see a German Leader sending the German’s “hard earned money” to rescue the Italians or Spanish. The argument that the Germans only earned the surplus because the Euro exchange rate was below what would have been the equivalent Dmark rate is too ethereal for a good solid German debate.

Dat is Deutshe, Ja?

@ Yves

“Hard wired” is very apt, I think But we could all debate for ever how it came to be decided to adopt the particular configuration of hard-wiring that was chosen in the lead-up to Maastricht:- there was nothing inevitable about it, and it flew (knowingly in some quarters (eg Delors)) in the face of all the weightiest, best-researched, technical advice that had previously been sought and offered, warning that disaster would be the result if they were to be so ill-advised as to adopt the very course which they in fact chose.

The simplest explanation seems to me the best – ie that it was yet another manifestation of the triumphant success by then of the neoliberal “project for world domination”, formulated at Mont Pèlerin from 1947 onwards. But it could have been just sheer blind stupidity and self-deception, of course.

“The Eurozone fudged other provisions during the crisis, and the ECB separately and regularly violated its own rules to keep funding sick banking systems. Varoufakis has proposed additional routes for making the optics of breaking the rules look better”.

All very true, and so any sensible person might think (I take you to be implying) it would be a no-brainer to act on the basis of Varoufakis’s logic. The flaw in that lies, though, in *who* gets to decide *which* rules get bent, to *whose* benefit:- that’s a highly-selective process, a game played with loaded dice. The cardinal “principle” is:- NO (PERMANENT AND NON-RETURNABLE) FINANCIAL TRANSFERS. Whereas Varoufakis’s aim is (as I understand it) to counteract the inherent inequity built-into the very fabric of the present (what he terms “asymmetrical”) nature of the EMU.

To do that would inescapably entail acceptance by the capital-intensive northern nations of financial transfers *in some form* to the southern nations – not directly but by their consenting to allow such a process to happen by relaxing their existing control over it; they would have to assent to the proposition that it would not be they but some “federal-level” mechanism operated by EU agency which would oversee and drive that process. So as I see it it is NOT in fact (no matter how much it is dressed-up to be) mere fudging of the rules but implies a fundamental shift in the locus of power in order for it to be able to happen, accompanied by implicit abandonment by the northern nations of their entrenched opposition to irreversible financial transfers.

So, back to square one…

I am not saying and have never said this is a no-brainer. Do not straw man me.

I am articulating the underlying logic of Varoufakis’ position. That does not mean I agree with it.

Recall that I was a big critic of Varoufakis in 2015 because as much as he had the correct economic analysis, he failed utterly to understand the negotiating dynamics and who had the upper hand. It was clear Greece was not going to get cut any breaks by the Troika as of late February. A lot of readers, particularly Europeans who somehow found our site, were furious at us saying the equivalent of the plucky Greeks taking on the Trokia was like kids with BB guns taking on a Panzer tank. Describing the fact that Europe would have its way with Greece was seen as advocating for the nasty Germans, as opposed to forecasting outcomes. Most commentators also defaulted to the typical Anglo assumption, “Of course there will be a deal,” when there was no bargaining overlap between the two sides’ positions and neither side was going to relent other than under duress.

“I am not saying and have never said this is a no-brainer. Do not straw man me”.

That wasn’t my intention, and I’m sorry if it seemed as if it was. It wasn’t your position I was critiquing but Varoufakis’s.

For what it’s worth, I don’t doubt that the basis for your own 2015 critique was entirely valid. But this lecture was delivered in June 2018, and I was trying to respond constructively to your opening invitation:- “Help me”, flowing from (your paraphrase of) the lecture’s central theme.

What really need to happen is that Germans start spending and importing more. The problem is that Germany and others are running austerity programs and engaging in wage restraint whilst also running large surpluses. In macroeconomic terms it is madness – as the article says, they just end up with piles of unspent cash whilst deliberately going without, then having to lend this cash out to people who end up going bankrupt..

What makes sense for a household does not make sense for a large economy. Germany needs to raise it’s standard of living.

I continue to think that he is the best, if not also the most honest, economist in Europe. Maybe the world.

It is hard not to hold some level of respect. His books are all worth a read too. I found ‘And the weak suffer what they must’ particularly informative on post WW2 political economy.

Let’s face it, the EU system in its current form is fundamentally flawed.

The EU leadership wants austerity and they have no plans to address the massive trade deficit that many nations sustain with Germany. Compounding this problem, the system seems to be suppressing the wages of citizens in many nations. The EU is becoming like a colonial relationship between Germany and the peripheral nations. The thing is, the average German nor the average citizen elsewhere has not benefited m, as in a colony the benefits go mostly to the rich.

Furthermore, each nation is not sovereign and the ECB seems to only care about lowering inflation over all else. This is effectively a recipe for class warfare.

The EU is going to either have to reform or break up in some way.

“In this eventuality, there are two courses of action that we must consider: One is the controlled dismantling of the current eurozone. The other is a simulation of a federation using existing institutions…”

So just how likely is option 2? And how wise? Wouldn’t that be one fudge piled on another? He’s still hoping to save the initial botch.

5 years getting in, 5 years getting out. Longer than most governments last. They should start now, but they won’t. It’s almost enough to make me grateful for our own mess.

The U.S. constitution is one huge series of fudges on a document that was already failing within 20 years of ratification and it’s manged to survive by fudging it into complete fiction. This also explains why Americans hold it as holy writ – when something becomes nonsense keeping the principle as a legal fiction requires a religious position.

Thus yes possible.

@Ape

Brilliant!

But – fortunately or not – the idealistic and revolutionary ardour that accompanied the drafting of the US constitution – and also to a certain extent the original vision of what came to be the EU – is now conspicuously lacking where the latter is concerned. It has turned very sour indeed – for a whole lot of reasons but it was primarily, I suggest, the ethos of neoliberalism – perhaps one should say in this context ordoliberalism (the German variant) – which was the culprit.

In support I would cite Bill Mitchell’s article “Wolfgang Schäuble is gone but his disastrous legacy will continue” (Google it) as definitive. But I’d admit to being biased.

hahahahahahahahahahahahahaha

Applause

Isn’t that the very essence of Politics? Politics is an algorithm for solving multivariant problems with feedback so every solution changes not only the original problem but also the global fitness landscape.

For this kind of problem, there simply is no global or stable optimums to be found, so some degree of mess, fudge, can-kicking and whatnot is alway needed to somehow keep everything going reasonably well.

We should be happy and grateful for the mess.

Those regimes going for perfection and purity did not do very well – Very broadly, In European history two basic approaches was tried: Attempting to simplify society down to what could be handled by someone taking advice from burning bushes or voices inside of their heads or dictating everything and murdering all dissenters who were deemed to be injecting disorder into the perfect purity.

“They” will find a way to fudge the rules and Germany will be on board with it because in the end Germany still needs bad borrowers to buy their products now a lot more than they need responsible citizens who will not buy anything for 15-20 years because they are still saving up for it.

Simple solution,

Germany leaves the EMU and brings back the DM

The rest of the EMU agree joint debt issuance

The ECB starts acting like the BOJ

Monetary issues sorted.

Then the political and structural issues can be dealt with without the sword of Damocles hanging over.

Thank you for this post. It was amazing. YV is so coherently all-inclusive and logical I was almost in tears (really). Yes indeed, let us bring together the great and the good. YV has always flown above my sky – but this time I really heard him rumbling. And to my thinking he has performed a wonderful alchemy of combining MMT with a unified European Union in a very grounded monetary foundation. And he is also true to his deep socialist commitment, internationally as well as nationally. Wow.

Italy:

It is not impossible to rule Italians but it would be useless – Benito Mussolini

In hindsight, I believed two items when it was announced the ECB would be located in Germany.

1. The British would not join the Euro.

2. Having strong German Influence over the ECB would cause difficulty.

There is great divergence in values, especially financial values, between the EU non-sovereign states.

I think it was Galbraith the Younger who revealed the fatuousness of an international trade in money – for that he deserves a public holiday named after him. Well, at least he gets my respect.

Varoufakis is facing off the central banking system. To bring down the predatory system he should endorse Richard Werner’s prescription for community banks – something the ECB is eliminating in Germany and Austria to remove the last competition to their control.

https://www.youtube.com/watch?v=MechH0ebs_c

Reformers need to abjure competition amongst themselves, spare each other and unite to defat the powerful forces ranged against humanity.

Varoufakis’ big problem is that he wants to save EU, were has it should frankly crash and burn. It is the only way to wake up the “left” that continue to pretend that EU is a peace and stability project.

And as long as said “left” keep believing that, they will go along with anything the right decides to implement. Even if it is is completely at odds with what the left used to stand for.

I agree with digi owl. The EU was pitched on the same airy-fairy notion as American neoliberalism. The entire fraud is nested in a contradistinction of conformity to Thatcherite individualism and multicultural convergence via exchange students and worldwide travels.

Austerity exemplifies the fraud: It creates debt under the guise of reducing it. Reducing deficits and hence debt requires growth to expand revenue bases that prevent budget shortfalls. Such growth requires sales, which is the antithesis of austerity and the antigrowth policies of neoliberalism. Greece was a scapegoat of a IMF loan made by Strauss-Khan to ensconce French and German debt.

Whereas xenophobia is a dirty part of the species, only clinical denial could overlook the egregious connection between retrograde nationalism and the scarcity of resources resulting from the antigrowth dogma of neoliberalism. Greece was victim of the same takeover scam that was popularized by corporate raiders until Bill Black imprisoned these suite thugs. Our survival might depend on recalling that Hitler scaffolded his platform on an anti-austerity agenda.

At the global level, the grand pitch was neoliberalism ending war via colonizing nations into interdependent trading satellites to install world governance: flower-power imperialism. Inverted austerity, inverted tariffs, and inverted nationalization for privatizing the public sectors into shareholder governance.

The only bone I would pick with divi owl, is that YV doesn’t speak for the Left. At the recent Left Forum, there were no fans of banker-occupied politics that betoken the Eurozone or America or any nation under neoliberal capture. Bernie’s infrastructure has more brainpower than the Reagan Revolution. Thanks to MMT and others who know the debt is largely odious and unpayable. Monopoly banking doesn’t care about conjured money being repaid; it swapped industrial production for keystroking liquidity production to steal tangible assets.

The neoliberal duopoly is pursing class warfare via transnational capital pulverizing the populations of the nation-state world. As Warren Buffet noted, his side has not only won every battle, it’s been a total rout.

All this theoretical “what if,” is great, what happens when it collapses, which is what about 3-4 months away?

That’s when the revolution begins. Milton Friedman was a hideously flawed economist, but he was correct when defending disaster capitalists who never let a good crisis go to waste. He said in a time of chaos those with the best ideas laying on the shelf will be empowered. The Left is filthy with good ideas that obviate the implementation of IMF loan sharks ”rescuing” us via neo-feudalism.