The Financial Times reports that CalPERS lost over $400 million on Lincoln Timber, a failed 2008 purchase of $2.38 billion of timberland in the southern part of the US. CalPERS exited the remainder of this investment in June, for $1.39 billion, a loss of $355 million on the purchase price. Combined with losses on disposals of previous portions of this holding, the total loss was over $500 million. From the Financial Times:

Combined with previous disposals, it appears that total sales of the forestry land netted $1.85bn, leaving Calpers and its partners with a $534m loss before taking into account lumber revenues, inflation, management fees and debt servicing costs.

The article later states that the giant fund paid $52 million in fees. And of course, there were opportunity costs. Again from the pink paper:

According to Calpers documents, its return on the investment was a negative 0.5 per cent over 10 years, underperforming its benchmark, the NCREIF Timberland Index, by 497 basis points over that time.

“Leverage has exacerbated cash flow issues,” said a Calpers external audit last year. “Assets that would otherwise have been allowed to grow and appreciate, have been harvested to manage the debt.”

It also appears that CalPERS, as it is sometimes wont to do, timed its sale badly. The Financial Times points out CalPERS was in haste to exit its holdings:

After starting 2018 with the seventh-largest holdings of forestry land on the continent, the Texas sale all but takes Calpers out of the asset class.

“They made a decision to get out and they wanted to get out fast,” said Brooks Mendell of Forisk Consulting. “They’ve basically accomplished that objective.

A seller that is clearly eager to get out seldom gets the best price, and the comment from Mendell suggests that everyone in the market knew CalPERS wanted out of Lincoln Timber badly.

The deal terms were agreed on May 14, which would typically happen after a the deal had been shopped and the seller and buyer had wrangled over key point.

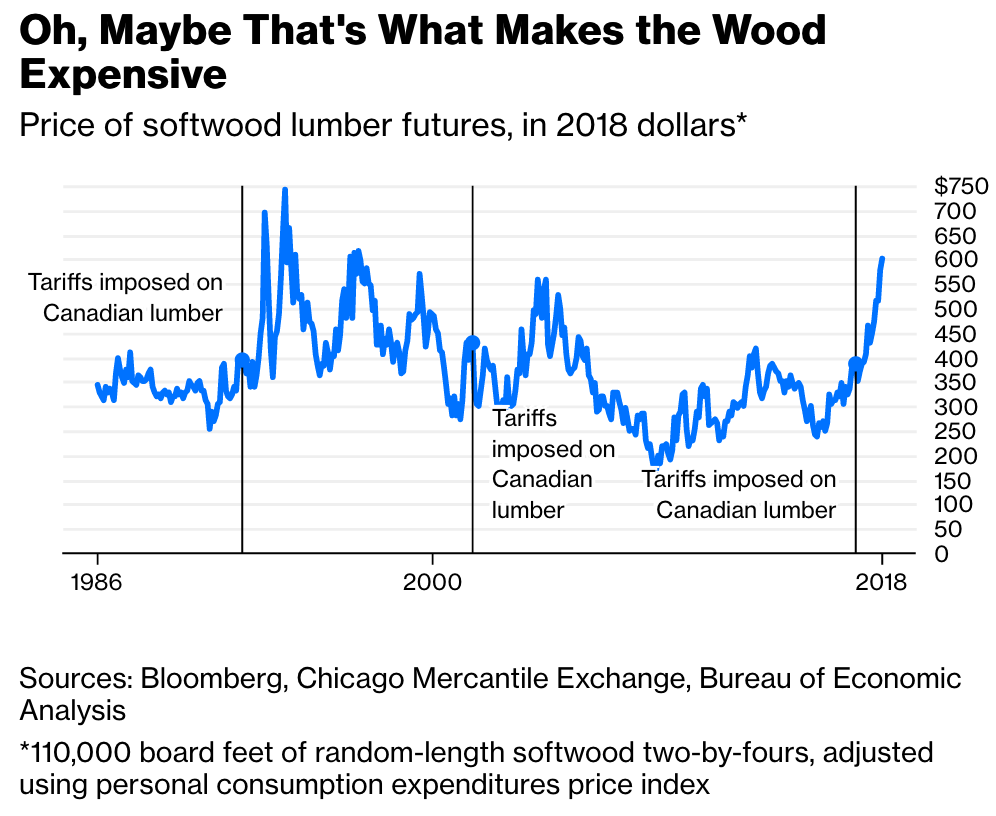

Timber prices have risen this year thanks to Trump’s tariff threat. From Bloomberg on May 10:

Lumber prices are really high right now! The Chicago Mercantile Exchange futures contract for the softwood two-by-fours used in framing houses closed at its highest price ever on Tuesday, in fact.

CalPERS has known this deal was in trouble for a while. If you look at the Real Assets Program review from November 2016, on page 38, it lists Lincoln Timber as having a NAV of 78%. Again from Financial Times:

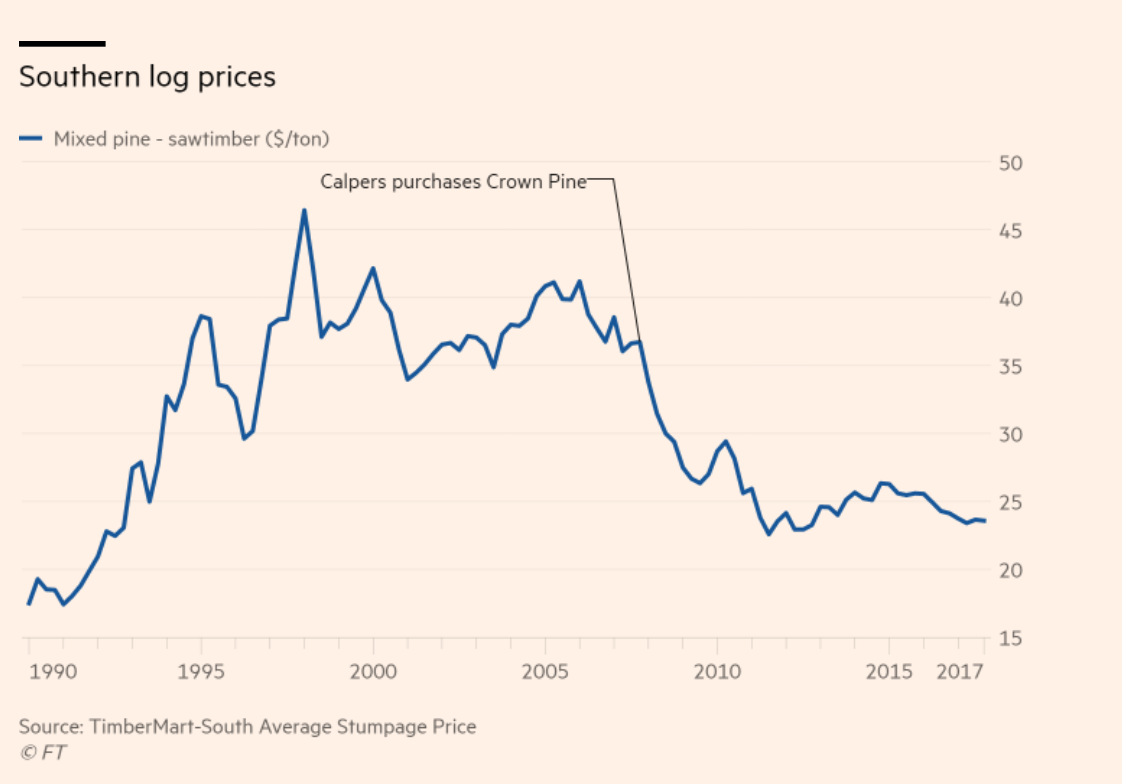

Many pension funds and endowments were lured into woodland in the past decade by the alternative asset class’s high returns and lack of correlation with other markets. But the Calpers consortium wound up buying land in the southern US just in time for a construction slump that has depressed log prices in the region to this day.

“It was just badly structured from day one,” said JJ Jelincic, a former Calpers board member who left the board in January. Another person familiar with the asset said: “Anything that could have gone wrong, did go wrong.”

In the 1990s, CalPERS had been an early entrant into timberland investing, along with Harvard, and had done well with this investment strategy. JJ Jelincic said the Lincoln investment was intended to be the first of a new program, but that a timber portfolio with holdings only in the South, and nothing in the Pacific Northwest, “made no sense”. The article effectively shows that the lumber market is regionalized and Southern lumber took a bath after the crisis:

Note that the fund manager, Campbell Global, had previously been a specialist in timber (as one fund manager described it, “They were an expert in trees”) that de facto subcontracted to big fund managers, then succeeded in moving up the food chain and became an independent asset manager.

CalPERS managed to get out of tobacco at the bottom of that market. Did CalPERS similarly dump this dog at a particularly poor time? Or was the problem mainly a badly-timed purchase compounded by terrible fund manager decisions? We’ll never know for sure, but either way, CalPERS beneficiaries are the losers.

Update 12:15 AM: This story is now the lead story on the Financial Times’ website:

once I did work for a pension fund that got badly burned in dot.com bust #1. Filled with random holdings in venture capital and private equity funds managed by 1B-tier investment banks (not the Silicon Valley firms) .

In 2002 they literally moved all assets into a S&P 500 fund run by Vanguard. Paying benefits from participant contributions. Should’ve worked well for them. Assuming that they stuck with the plan.

Perhaps CalPERS should do the same? well, probably not in year 9 of a bull market.

So I started reading this story and opened up the Financial Times story to get a sense of what happened. A coupla sentences in I could not understand why they were liquidating their timber assets when Trump’s bun fight with Canada has made Canadian timber more expensive while CalPERS timber assets were located in the US. That would have set them up better for future earnings. And then I read the money quote-

“Instead of leaving trees to grow while prices were low, the group harvested them and sold logs at depressed market rates.”

They panicked and went for short term profits. Those trees aren’t there anymore. If they had held their assets, they may have still had a loss but increased timber prices may have ameliorated the losses over time. Maybe they would have been better to stick their money into a nice bank account somewhere where they might have gotten a nice rate of interest.

Having lived in California since 1968 and being married to a state bureaucrat in Sacramento, I

can truthfully opine that the majority of state bureaucrats were born to fail in life’s endeavors.

The CA government is a cesspool of pathology, closely mimicking the federal level.

Yes, I should have been clearer about the investment manager inflicted damage. But why harvest trees early if you also are locked into long term supply contracts? The combined facts don’t make a ton of sense, so I didn’t go after that aspect as hard as I probably should have.

>>>But why harvest trees early if you also are locked into long term supply contracts?<<<

Timberland produces revenue when trees are harvested. There may be additional revenue for leasing hunting rights, but by and large revenue comes only from cutting trees.

Expenses are ongoing.

Thus, if the numbers looked bad yearly, the yearly numbers could have been "improved" (in an MBA cost cutting your way to profits fashion) by cutting immature trees in order to realize smaller amounts of revenue in current years, at the cost of not realizing the expected revenue (larger- since the trees would have been at optimal size and maturity for harvesting) in the years the trees were projected to be harvested.

These trees had been valued by experts prior to CalPERS's purchase; if trees were harvested early, this would have likely negatively impacted both projected future returns and realized total returns, and also the value of the assets at time of sale. (Changing market conditions and forecasts could have driven the early cutting, but Ockham suggests it was probably the poor performance driving the early cutting.)

If there are long term supply contracts which can't be fulfilled in the future by production, there was likely either a settlement of those contracts by Calpers at the time of sale, or if the contracts go with timber land then the value of the asset was negatively affected at disposal.

If Calpers continues to hold the long term supply contract without the trees to fulfill it, then there will be more winning or losing for CalPERS to report in the future.

I understand that cutting trees would enhance short term revenue. But the timber was a long term holding, and a bump in NAV would not help CalPERS much, and I don’t even see how they could book much if any of an increase in NAV if the impact of effectively stripping the tree farm of trees was that they’d default on their supply contracts and owe a penalty.

A quote indicates this was done to “manage the debt” as in make interest payments, but I can’t believe that they manager couldn’t have made an additional borrowing (as the cliche has it, “a rolling loan gathers no loss”) or refied the existing debt on better terms. The world has been awash in money and borrowers have been able to get exceptionally good terms.

The long-term supply would be the problem of the asset (Lincoln Timber) not CalPERS. So that would have been priced into the sale terms.

A simple, dumb, Google search reveals that Forest Investment Associates reported in Fall Quarter newsletter that CalPERS was trying to peddle 1.1 million acres of forest lands in East Texas known as “Caddo” through investment banker Perella Weinberg. In May it was announced that a timber consortium called “CatchMark” had trebled its holdings through the single-transaction acquisition of 1.1 million acres in East Texas.

Let’s see, get the investor into a massive un-diversified investment in a single commodity, and then watch her light her hair on fire when Mr. Market goes up and down on the normal roller-coaster. Oh, so scary! I want to get off! Well, you can get off the coaster, but it’s going to cost you…

“Catch” the “Mark” — get it? I couldn’t make this stuff up if I tried.

It also appears that one of the main the contracts that Campbell Global and CalPERS had to supply sawtimber and pulpwood through 2029 was with Georgia-Pacific. In an incredible coincidence, two former Georgia-Pacific executives, John Rasor and Jerry Barag, are the founders of CatchMark who put together the acquisition and will manage the forest properties acquired in the CalPERS fire-sale.

http://edgar.secdatabase.com/1831/119312518163077/d560212dex992.htm

> I could not understand why they were liquidating their timber assets

Perhaps, just perhaps, they saw the writing on the wall?

Our forests are dying; mortality exceeds net growth

These were not public forests, so are not in that dataset. Not relevant here.

The full quote:

“Leverage has exacerbated cash flow issues,” said a Calpers external audit last year. “Assets that would otherwise have been allowed to grow and appreciate, have been harvested to manage the debt.”

shorter: CalPERS retrenches. (Not a good sign, imo.)

Thanks for your continued reporting on CalPERS, PE, and pensions.

So much for the long-term investment policy alleged by CalPERS. Having a nearly $3B “timber strategy” that failed to diversify into the PNW suggests that this portfolio could have been designed to fail — “anything that could have gone wrong, did go wrong”. And where is this “leverage” that allegedly “exacerbated cash flows?” I thought that CalPERS was a lender?

I have little doubt that someone “connected” will wind-up with CalPERS’s erstwhile shares in Lincoln Timber, and that person or persons will likely make a tidy profit on this “Buy High/Sell Low” fire-sale — on top of the fees and “losses” that have been skimmed off. Not that CalPERS executive management have any sort of history of corruption or anything…

or accountability

$52,000,000 in fees? What justifies numbers like this in these kind of deals?

Signing papers is hard work. Just think of the carpel tunnel insurance premiums the paper pushers must have to fork over.

Timber, like farmland is an extremely long term investment, think 30 to 50 years. You should only harvest when timber prices are high, otherwise let them grow. And evidently, the long term supply contracts forced harvests when prices were near the bottom? Why ? Also, Calpers did not diversify geographically nor by wood types like by adding northern hardwoods. Shouldn’t a large pension fund have better advice and understanding of what they own?

Can we address the shortcomings of the intermediary manager in this case? Campbell Global, like so many TIMOs-Timber Investment Management Organizations- only collect fees if the money is “placed”. This often leads to poor investment decisions based on sloppy due diligence, inflated log price expectations, excessive leverage and other questionable assumptions. Campbell collected $52 million in fees over the term of this investment and suffers no criticism for their role in the debacle? Other TIMOs should be on notice: your days of collecting “no risk” high fees for sloppy work and little value added are numbered.

One might want to know how much lumber was actually sold, at what price, and with which costs.

” a $534m loss before taking into account lumber revenues, inflation, management fees and debt servicing costs.”

What happens after taking into account all these numbers?

Also, your quotes from FT skip over one modest question, namely how FT got its hands on the CalPers documents.

Journalists don’t reveal their sources, particularly when they’ve leaked confidential documents.

o CalPERS Lost in the Woods, Desperately Wants Out

o CalPERS Unable to Maintain Wood Holdings

o Southern Log Strategy Flushed

o Texas Timer Tendered, Trump Tariff Tardy

– Irrational exuberance

– optimistic underwriting

– bad timing

– poorly negotiated fiber supply agreement

– West Coast TIMO…southern timberland asset

Landowners sell trees, not lumber. Harvesting, transportation and milling costs have absorbed any lumber price increases. Tree (timber) values have stagnated and even dropped.

As a forestry consultant in southern U.S., I can see that there are millions of acres of “small log sawtimber” that is being grown to meet these supply agreements. These acres are held by TIMO’s, REIT’s, etc…… with the strategy of maximizing ROI within 25-30 years. There are simply not enough mills across the region to meet this supply, therefore the price is suffering. However, I think there is good news on the horizon. I know of 3 sawmills locally that will begin startup within the next couple of years. Hopefully that is evidence of a trend across the south with this large wood basket.