CalPERS has abandoned the part of its private equity “new business model” that it tried to implement, a “fund of funds” scheme that we has criticized as likely to hurt returns and corrupt-looking how it was being implemented.

However, CalPERS has changed the spin but not the substance of what it is trying to do with its deliberately misrepresented part of its of its “new business model,” and has even gone from trying to depict it as “innovative” to presenting it as completely old hat, which it isn’t. Having gotten key parts of the story wrong before, the main outlets that cover CalPERS continue to muff their coverage.

CalPERS’ Original Plan

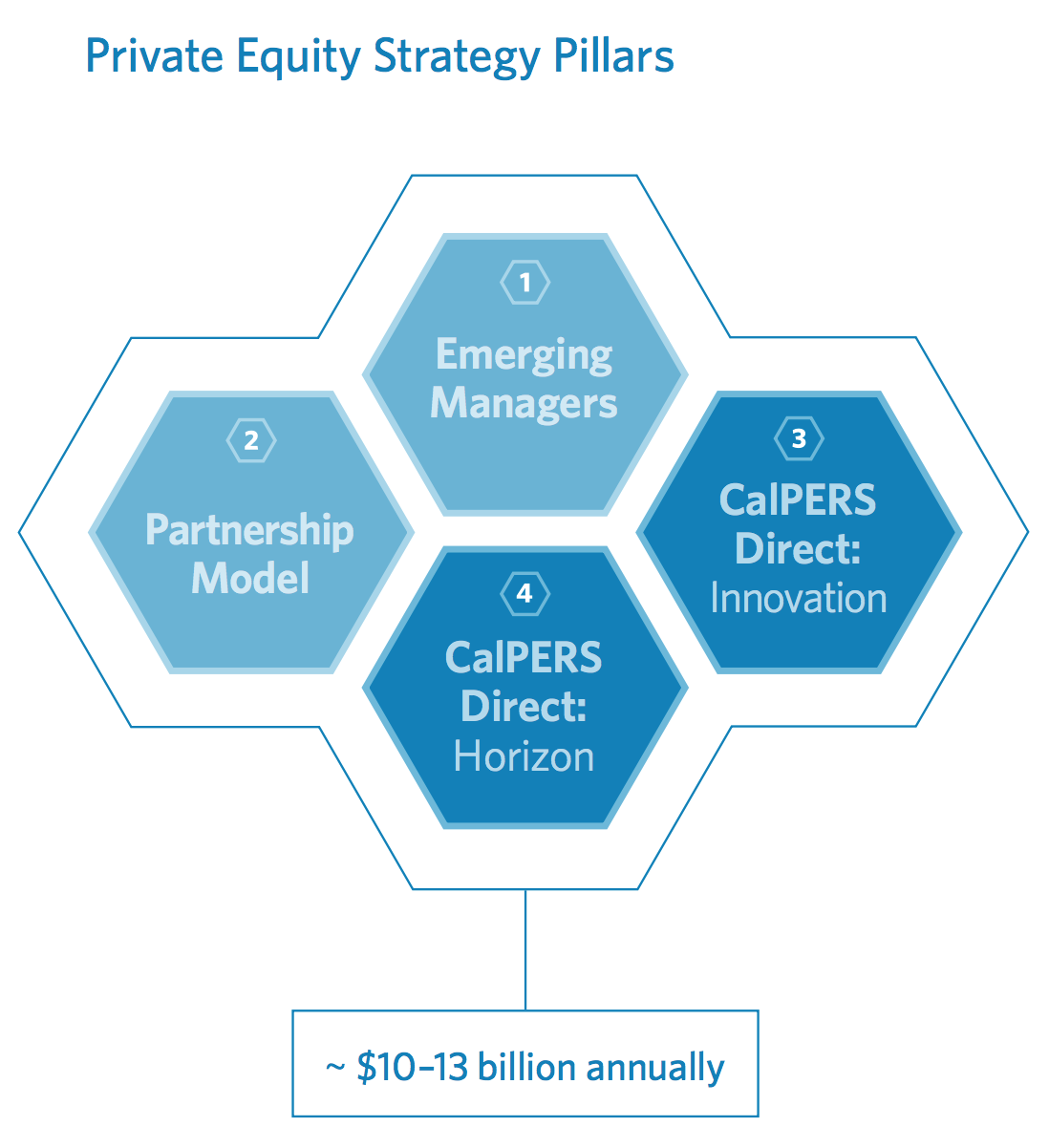

CalPERS’ “four pillars” had been:

Expanding its existing “emerging managers” program

Continuing to invest in private equity funds, but outsourcing most and over time potentially all to “fund fo fund” managers, introducing another layer of fees and costs

Doing “late stage venture capital” through one general partner that CalPERS would create

Doing “core economy investing” though a second general partner that CalPERS would create

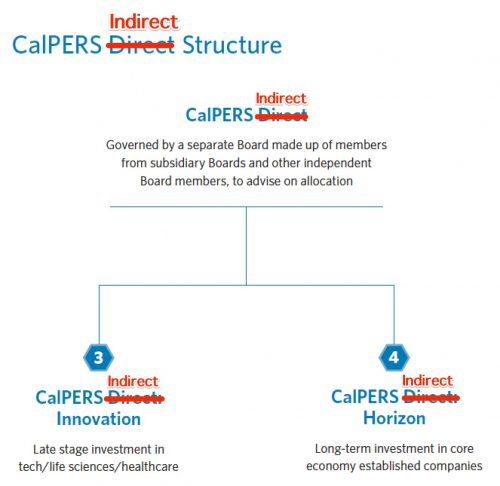

The last two CalPERS had misleadlingly called “CalPERS Direct” even though this was never direct investing. Direct investing means cutting out the middleman and doing the investing in house with your own staff. Even the CalPERS-friendly expert Dr. Ashby Monk, brought in to give the board a pep talk, felt compelled to point out that what CalPERS was doing was not direct investing. And as Dan Primack said shortly after CalPERS announced its new scheme, in CalPERS sets questionable private equity course:

There are only three things in life you can count on: Death, taxes and CalPERS doing strange stuff with private equity….

The comp is supposed to be Canada’s big public pensions, which have spent the past decade building direct PE investing platforms and deemphasizing indirect investments with outside managers. But those Canadian systems generally maintain oversight rather than creating independent boards. Or, put more simply: CalPERS is creating an indirect model for direct investing, which seems to largely defeat the point.

CalPERS also presented two other changes it planned to make. One was that the two new entities it would create would be evergreen and would hold investments for a long time and that it would expand its current emerging manager program, which are managed by Grosvenor in two fund of funds.

CalPERS invited six fund managers, Blackrock, Goldman, AlpInvest (a subsidiary of Carlyle), Hamilton Lane, and Neuberger Berman to submit proposals over the last Christmas/New Year holiday. We explained why this program was likely to hurt returns as well as how the solicitation process was deeply flawed. One of the objections in the second post: “CalPERS threw it entirely on the outside firms to tell CalPERS what it ought to have. Would you ever allow a used car salesman to pick your car for you?”

CalPERS Retreats and Changes Its Messaging

We had pointed out that CalPERS looked to be having trouble with its funds of funds scheme, since the original schedule had the finalists presenting to the CalPERS board in March or April, and those dates came and went with no beauty show.

CalPERS staffer John Cole admitted in the Investment Committee meeting this week that CalPERS was no longer pursuing the fund of fund manager solicitation.

But CalPERS has also changed its messaging about its plan to create two general partners, with all the extra risk and cost of a startup, as well as being poorly diversified by putting so much money in the hands of two managers. CalPERS made a great deal of noise in May about CalPERS Direct, which we and Primack debunked as being anything but that. As we pointed out in May:

Per the chart below, you can see that we are not exaggerating when we call Eliopoulos’ sales patter a Big Lie. Repeating the word “direct” does not make it so. any more than when Trump doubles down on things that are obviously false, like his inauguration getting record turnout.

Eliopoulos apparently wants to relegate CalPERS not only to being a mere limited partner, as in a passive investor, in its two additional investment rackets, but to interpose two layers of boards between them and CalPERS.2 One can only conclude he wants to make damned sure CalPERS has no idea what is going on with the money it commits to these vehicles, and that they are even more of a black box than private equity is already. It appears that avoiding even the weak disclosure called for by California law is of paramount importance.

Yet all of the supposedly savvy business press that covers CalPERS took up the false claim that this program would be direct investing, including Joshua Franklin at Reuters, Christine Idzelis at Institutional Investor, Randy Diamond for Chief Investment Officer, and Mark Anderson of the Sacramento Business Journal. As one private equity professional said, “The press is easily confused and CalPERS makes a point of confusing them.”

In its Investment Committee meeting this week, departing Chief Investment Officer Ted Eliopoulos conceded that CalPERS would simply be entering into a typical general partner/limited partner type arrangement, specifically a “separately managed account” where the limited partner has his own fund that the general partner manages, as opposed to being one of many limited partners in a so-called “co-mingled fund”. But that new spin is misleading too. CalPERS, for reasons that have yet to be adequately or coherently explained, is setting up two brand spanking new partnerships to make these investments, and intends to select the key staff that it will stake. Now that CalPERS has ‘fessed up that these are just really big separately managed accounts, why not farm out the money to someone with a track record, rather than gamble on a newly created firm, particularly since research shows they underperform?

It was remarkable to see how reporters garbled the latest developments. For instance, from Arlene Jacobs at Pensions & Investment, by apparently not bothering to read the solicitation materials for the scuppered funds of funds plan, does not comprehend that they were never intended to be for the emerging manager program, which has always been a fund of fund, and CalPERS has not given any indication that it intends to change that. See how she conflates them:

CalPERS staff also are changing their thinking on the emerging manager private equity portfolio. Earlier this year, CalPERS had conducted a search for a manager to run the fund-of-funds type portfolio. Bidders in the request for information were AlpInvest Partners, Hamilton Lane, HarbourVest Partners, Neuberger Berman, BlackRock (BLK) and Goldman Sachs Asset Management. Under the revised proposal, CalPERS officials no longer will be outsourcing the emerging manager portfolio, Mr. Cole said. The emerging manager portfolio is expected to grow to less than $500 million over a decade.

“We have come to the realization after a lot of analysis and discussion that the structure is unlikely to meaningfully strengthen our organization,” Mr. Cole said on Tuesday.

And if you doubt my reading, the very next paragraph makes her error clear:

“So as we complete our search, which will be in early 2019, for a permanent head of our private equity team, we will re-evaluate our options under pillar two (the emerging manager portfolio).”

No, as you can see from the first chart above. pillar one is emerging managers. Pillar two, which is what the new fund of fund manager program was to address, is “partnership model,” as in investing with new funds offered by existing fund managers.

By contrast, Randy Diamond at Chief Investment Officer got this part of the story right:

The California Public Employees’ Retirement System (CalPERS) has ended its consideration of a plan that would have seen a strategic partner play a key role in running its existing $27 billion plus private equity program.

BlackRock, Goldman Sachs Asset Management, Neuberger Berman, AlpInvest Partners, Hamilton Lane, and HarbourVest Partners had all submitted plans to CalPERS early this year detailing the role they would play in managing the largest private equity portfolio in the US.

John Cole, a CalPERS senior investment officer, told the investment committee at its meeting on November 13 that the plan is now off the table.

“A year ago, we thought maybe it would be best to find the large partner in a discretionary role to help us identify good funds and to expand our relationships to include more co-investing and access to secondary transactions,” he said…

Cole did not go into detail and CalPERS never specified whether the chosen firm would have run all or part of the private equity program, which is mostly invested in co-mingled funds with general partners.

It was also good to see Diamond include this troubling part of the history of the failed idea:

CalPERS had been in exclusive talks with the world’s largest asset manager, BlackRock, before announcing that it was seeking proposals from a wider set of managers to be a strategic partner in the administration of the private equity program.

It was therefore distressing to see Diamond continue to parrot CalPERS’ false “direct investing” label, particularly since CalPERS is trying to reposition that and Diamond’s own words in the second paragraph below contradict the “direct investment” claim:

CalPERS is also pursuing an expansion of its private equity program, pending board approval, creating its own $20 billion direct investment program that would invest in later-stage companies in the venture cycle and take buy and hold stakes in established companies.

The expansion would be managed by a separate organization, funded by CalPERS, that would have the power to make investments without the approval of the CalPERS board.

Dietrich Knauth at PE Hub was the closest to getting it right in its first sentence:

California Public Employees’ Retirement System clarified goals for a revamp of its private equity investing, saying its proposed “direct” investment vehicles will work exactly like a “tried and true” separately managed account.

As we said, the new scheme is not like a “tried and true” separately managed account. CalPERS is bizarrely trying to divert attention from the fact that it is trying to enrich set up two new general partner. If CalPERS were merely committing money to two super large separately managed accounts, it wouldn’t take months of closed session meetings and Silicon Valley fixer Larry Sonsini drafting governance documents to do that.

Having said that, calling it a separately managed account is a less inaccurate description than “direct investing”.

But the headline, CalPERS plays down ambitious plan to become direct PE investor, perpetuates the confusion by creating the impression that CalPERS has changed its plans in a significant way for its last two pillars, as opposed to changing its messaging.

But the reversal of the fund of funds scheme, which as Diamond insinuated, looked intended from the very offset to hand the business to BlackRock, should send alarm bells ringing. CalPERS spent well over a year on what was a very simple to execute idea, only to figure out it made no sense. Why should we believe that the more radical and difficult elements of this scheme make any more sense?

Got a general question here about those private equity entities that CalPERS wants to create. Is there any difference between these entities that CalPERS wants to set up and the “Special Purpose Vehicles” that Enron was notorious for that had names like Jedi and Raptor? I was just reading a book that described them as types of off-balance-sheet vehicles and that were legal entities that were supposedly separate from their parent organization.

Enron’s ones held particular assets and borrowed in their own name with the sponsor holding some equity and receiving fees from managing its own affairs. If they went belly up, the parent organization was supposed to be free and clear but as often as not, the parent organizations spent resources to bail out their wayward children. God knows what sorts of exposures such units could build up in its portfolio which made me wonder about the ones that CalPERS is thinking about.

It is just in reading this passage, it sounded a lot like what CalPERS wants to set up. Oh, an additional question. Why is Ted Eliopoulos still pushing this? He is supposed to be out the door this Friday. Or is this how like Obama spent the last months of his Presidency pushing for the Trans-Pacific Partnership as if his future fortunes depended on it?

Funny you should mention Enron and Jedi….

Had never even considered the fact that CalPERS and Enron were both together in California. Birds of a feather…

Enron was based in Texas. They did, however, rape California by gaming the deregulated electricity market.

From the 2002 NYT article link above:

Moreover, Calpers’s own governance has been unsteady in recent years, as political infighting and squabbles among board members have muted its voice in the corporate governance arena. Some senior board members are now debating whether Calpers should return to the outspoken tactics that built its reputation in the 1980’s and early 1990’s.

That was in 2002. We know what Enron thought of California’s ‘Grandma Millie’. It’s on tape recordings; includes the phrase ” ‘f-‘ Grandma Millie” (laughter)…” Has CalPERS’ staff and board adopted Enron’s attitude toward all the public employees for whom it holds retirement accounts?

Thanks for NC’s continued reporting on CalPERS, PE, and pensions.

Enron also zapped Oregonians through their PGE 401k shenanigans. Imagine ‘luring’ employees into a stock, to the exclusion of alternatives, so nudging them to put one’s eggs into one basket.

When I read about CalPERS and their funds of funds, I am reminded of those CDO-squared vehicles and similar diversification (read, fee-generating and risk-shedding) instruments of destruction from a short decade ago.

The California Constitution, Article XVI section 17(a), makes it clear that:

The CalPERS staff are acting like drunks at a roulette table. They seem to have no concept of how any of their hare-brained “innovations” are going to boost returns over what they’re already doing, and their failure to articulate how they’re doing more than piling chips on “Red” should be a Red Flag to any Board member with a functioning brain cell.

They are also ignoring the obvious risks of gifting funds to untested managers — and worse, of handing over billions of dollars under a governance structure being designed by a ridiculously conflicted 77-year old holdover from the ‘90’s Tech train-wreck. Sonsini lately appears to have been spending more time as Managing Director of WS Investments’ nine-figure portfolio than practicing law. One of Sonsini’s sons is the General Partner heading the Enterprise Group at the $18 Billion PE firm New Enterprise Associates; another son is CEO and CIO of the $6.8 Billion Sobrato Organization property developers. Is this objective advice or another Bernie Madoff?

I have always thought it would be appropriate for retirement funds to be part of a state-wide ecosystem of economic needs. Like a closed system for offering very low interest loans to students and businesses and for mortgages. If pension funds were strictly managed like good banks it could work. Instead we have a free-market free-for-all run by scam artists that the SEC ignores. This fund-of-funds idea wasn’t rejected, it was just further obfuscated with general partners. Remember now, general partners are the guys taking all the risk and so demand big returns. Which in itself is against fiduciary rules in every way. But in the case of CalPERS it really looks more like faux general partners who are only interested in setting up a system of circular funds to shuffle money from one to another as needed to stay afloat. Please note this is a complex ponzi scheme. There is no there there. And it most certainly blatantly violates the SEC’s 15% rule in no time flat because reinvesting, in-house, that 15% quickly becomes 100%. This is almost the definition of ponzi.

These structures appear to be proposed to shelter Calpers’ management and Governance from the potential storm when the amount of under-funding of the pension plan becomes fully revealed.

Under funding based on unrealistic expectations of rates of return, a direct result of the Fed’s control of rates, and thus return from Bonds.

I don’t believe the people proposing these mechanisms are stupid. I do believe they are acting scared.

The Of course, hiding the under-funding issue is driving all of this “innovation” theater. The under-funding was created by the multi-year “contribution holiday” that employers were given during the Tech Bubble of 20 years ago, now compounded by opportunity costs and the meddling of federal tax cuts, rate cuts, and military adventurism.

I hope that the irony isn’t lost that Larry Sonsini was one of those most responsible for spinning much of the smoke-and-mirrors New Economic Paradigm fantasy that dug the hole that CalPERS now finds itself in…