By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

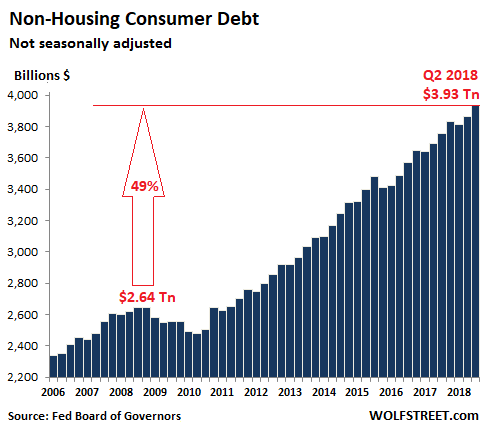

Consumer debt – or euphemistically, consumer “credit” – jumped 4.9% in the third quarter compared to the third quarter last year, or by $182 billion, to almost, but no cigar, $4 trillion, or more precisely $3.93 trillion (not seasonally adjusted), according to the Federal Reservethis afternoon. As befits the stalwart American consumers, it was the highest ever.

Consumer debt includes credit-card debt, auto loans, and student loans, but does not include mortgage-related debt:

The nearly $4 trillion in consumer debt is up 49% from the prior peak at the cusp of the Financial Crisis in Q2 2008 (not adjusted for inflation). Over the same period, nominal GDP (not adjusted for inflation) is up 39% — thus continuing the time-honored trend of debt rising faster than nominal GDP.

But a hot economy is helping out: While over the past 12 months, consumer debt jumped by 4.9%, nominal GDP jumped by 5.5%. A similar phenomenon also occurred in Q2. This is rather rare. The last time nominal GDP outgrew consumer credit, and the only time since the Great Recession, was in the three quarters from Q1 through Q3 2015.

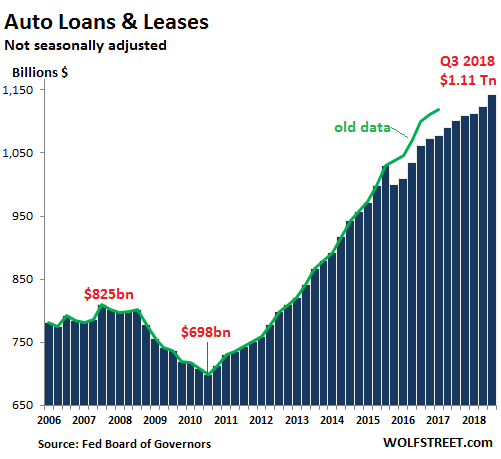

Auto Loans and Leases

Auto loans and leases for new and used vehicles in Q3 jumped by $41 billion from a year ago, or by 3.7%, to a record of $1.11 trillion. These loan balances are impacted mainly by these factors: prices of vehicles, mix of new and used, number of vehicles financed, the average loan-to-value ratio, and duration of loans originated in prior years.

The green line in the chart represents the old data before the adjustment in September 2017. These adjustments to consumer credit occur every five years, based on new Census survey data. Most of the adjustments affected auto-loan balances, reducing them by $38 billion retroactively to 2015. I included the green line to show that it wasn’t a forgotten collapse of the car business in Q3 2015 that did this.

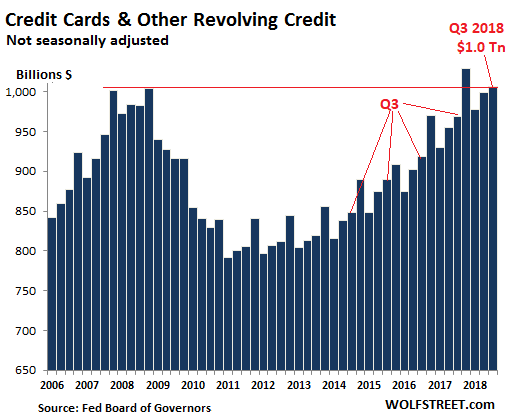

Revolving Credit

It has bedeviled economists and bankers for years that consumers aren’t going hog-wild borrowing on their credit cards. This is a problem for two reasons: Credit cards carry enormous interest rates, and bankers feel deprived if consumers don’t use them. And two, spending cranks up the economy, and if otherwise cash-strapped consumers would charge more on their credit cards to spend money they don’t have, Corporate America could show higher earnings.

So credit card debt and other revolving credit in Q3 rose 3.9% year-over-year to $1.0 trillion (not seasonally adjusted). Given that nominal GDP rose 5.5% over the same period, consumers clearly didn’t do their jobs with their credit cards. Compared to the prior peak a decade ago, credit card debt is about flat (Sheesh, makes economist, shakes head):

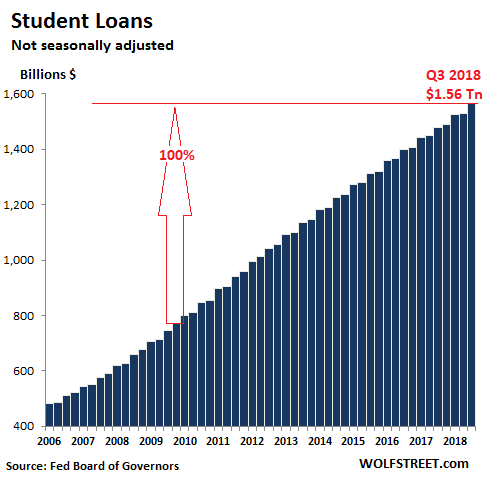

Student loans in Q3 jumped by 5.6% year-over-year, or by $83 billion, to $1.56 trillion (not seasonally adjusted), another sad record:

Looking at the sharp and steady surge of student loan balances, you’d think that student enrollment is booming, as millions more Americans must be enrolling in college to lean what it takes to be successful in this economy. But no.

Turns out, the opposite is the case. Higher-education enrollment peaked in 2010 at 18.1 million and then declined 6.6% to 16.9 million by 2016, according to the latest data available from the National Center for Education Statistics. And yet, even while enrollment declined since 2010, student loan balances nearly doubled, from $800 billion to $1.56 billion.

So the cause of the fiasco isn’t that there are too many Americans getting an education – I wish that were the problem. Instead a mix of factors stick out:

- Colleges are charging too damn much;

- Entire industries, such as consumer electronics and the student housing sector – a thriving subcategory of commercial real estate – are relentlessly sucking on those student loans;

- And occasionally, just a wee bit, the students themselves need to do some navel-gazing; These kids get this borrowed money, and it’s easy money to spend (iPhones, concert tickets, video games, nice housing rather than a dump, clothes…); later, it turns into hard money to pay back, and they’re left wondering how not to buckle under the debt.

And what do these factors of the student loan fiasco have in common? Ha, this is what makes the American economy tick: They all add to debt-fueled GDP!

“It’s time to wait patiently as the air is slowly let out of this bizarre Ponzi balloon created by the venture capital industry,” says a Silicon Valley investor who has been accused of being outspoken before and, after this, will likely be so accused again. Read… Startup Boom a “Dangerous, High-Stakes Ponzi Scheme”: Silicon Valley Investor

An economy based on debt will eventually crash. It’s only a matter of time.

We don’t have an economy based on debt.

Debt expansion accounts for about 15% of front-line spending (the origin of spending). Federal spending accounts for nearly 50% and the balance comes from business investment.

Credit is an add-to. The ability to borrow is dependent on income derived from the other sources, G and I. As long as our debt doesn’t expand faster than our income we are OK (well not OK but not in eminent danger).

The problem with credit expansion is it has a tendency to collapse suddenly when borrowers become over-leveraged. What else can we expect when we try to live on income we haven’t earned yet?

Credit is the trap that the 99% can’t escape from, because we’re taught from birth we have to have and use it to be successful and have a good life.

I have zero credit card debt. I just never have used them. I find these charts shocking and very very scary.

I too have zero credit/debt. There is no circumstance I can see that could move me to borrow money going forward. Then again I’m old – why would anyone want to lend me money for more than a few months?

When I hear people talking about their credit scores and how important it is to them I cringe.

A July Investopedia article concludes that “…while the average person is still making the same amount of money – when accounting for inflation – prices for many of the daily necessities have gone up considerably, which means that each dollar earned does, in fact, buy less than it did 20 years ago.”

People who live beyond their means may deserve an eyeroll, but people trying to live down to their means – especially when they are raising a family – deserve something better (like an economy that works for them too,) The Wolf article makes it plain that our esteemed financial leaders are delighted when people put necessities on their charge cards. Foiling them is an honor and a privilege.

I have a friend who has lost every major purchase he and his wife ever made with credit (house/cars).

It still took a long time to get through to him that taking on debt was never a good decision for someone in his position income-wise. If you can’t afford to buy it today you can’t afford to pay for it tomorrow, unless you have a big inheritance in your future.

If you can afford to make the payments you can afford to save for a cash purchase. But… instant gratification…

“imminent”

I read this on wolfstreet just moments before seeing it posted here. I pulled this quote from the comments section over there because it reinforces a point that’s been made here more times than I can count:

“Also in regards to colleges. I watched a video by Heather MacDonald where she claims that much of the increases in tuition costs are mainly due to administrative positions that have very little to do with educating students but ensuring that all students have the “same outcome”

According to that video UCLA has a “Office of Equity, Diversity and Inclusion” and one of the staff members is making over $300K a year……..let that sink in. Check out the website, sure seems like a lot of make work positions with enormous pay packages.“

University of California is top heavy with admins making $220K and up.

Arizona’s attorney general sued Arizona’s board of regents over tuition costs, stating that the high tuition violates the state constitution requirement that tuition be “as nearly free as possible.” The lawsuit states that tuition has gone up 300 percent over the last 15 years.

The case got tossed from superior court because the judge said the AG lacked the authority to sue the board of regents, but he has filed an appeal.

Just get a group of students to sue?

Students have no money to sue.

Yes! Students behind a climate-change lawsuit just got a green light from the the U S Supreme Court.

Well then, Arizona’s board of regents should sue the Arizona Legislature and Governor to make them cancel their Great Tax Revolt and make them stop boycotting their State Universities and make them start supporting their State Universities again.

And if Arizona’s board of regents can’t do that, or tries it and loses . . . and the Attorney General wins his/her suit against the Regents, then the Regents should just lower the tuition to students back down to whatever the Attorney General wins in his/her suit, and keep paying all the Universities’ costs and vendors and etc. till the Universities have zero money, and then should just let the Universities go into liquidation and extinction.

Let the good people of Arizona pay the True Price for their decision to boycott their State Universities.

Indeed, the money is NOT going toward instruction.

let’s not forget 70 per cent of faculty is now adjunct: precarious piece work with crap pay, no benefits or job security.

Sad!

One of my friends (who has a PhD) was an adjunct instructor at the University of Arizona.

And what was the status of my friend and her fellow adjuncts? Here’s her one-sentence summary:

“You’re lower than whale sh!t.”

Bullsh*t jobs… https://en.wikipedia.org/wiki/Bullshit_Jobs

Higher ed, real estate, health care … all ponzi industries and parasitic on the labor of the nation. Debt fuels them, they fuel GDP and around we go ’till we can’t go around no more.

I’m a college instructor. I used to have a full time contract making 30K a year to teach 5 classes a semester for 3 straight semesters. That is a significant amount of teaching and a laughably amount of money but I took it because, well, it meant I could have one job instead of my normal string of 2-4. My contract (along with 13 others) were not renewed to pay for renovations around the college–meeting rooms, spiffy new welcome center, etc. I’m back to working 2 jobs, paying out of pocket for healthcare (which is actually hilarious and sad because I’m shacking up with and MD) with z e R o job security. By some miracle I secured 3 sections for another semester and then I’ll be moving across the country to start as square one again. I am leaving the academy, after a decade I’ve been worn down. I love teaching, I’d do it forever even at 30K. But adjuncting is a circle of hell I don’t wish on anyone.

I make a point of telling my students how much I make and how little security I have because they have a right to know that the pressures their instructors face, even if a lot of people say it’s ‘unprofessional’ to disclose these problems. I get paid $650 a credit hour, each class is 3 credit hours, I only get 6 paychecks a semester.

I have to tell y’all I’m so excited to move and then end up with some hilarious stressful nonprofit job (I have an MA in sociology, I am talented at research and teaching, can push paper if I must but I’m moving to Maine–the options for my talents are limited) and paying back my beloved’s med school loans while also trying to buy a house and have a kid. At which point we’ll be nearly half a million in the hole, pretending like everything’s manageable and dandy. These are rarefied problems, for sure, and out of all my options I’ve had in my life, these are the best I’ve been presented with.

We’re rooting for you, MC. Maine is a wonderful state, AND they’ve got a new lady governor up there, thank Gawd!

This sounds like a lot of the rising costs at your college are indeed due to temple and pyramid building and/or improvement, and Administrator bloat.

I am 61.5 years old. I make $46,000/ year as a pharmacy technician. It took me years to get there but I am there. I still see young people coming into our hospital as pharmacy technicians . . . full time with benefits, etc. Better treated than adjunct lecturers, young teachers led on with false promises of tenure, etc. And it took me one year of Community College classes to get in.

So unless/until the health care industrial complex collapses, there are still full time jobs for some people existing at the technicianal level, which would offer a better future to young wanted-to-be academicians than a university-industrial complex which is unworthy and undeserving of their ( your) talents and knowledge.

Have you been on college campuses recently. They are like resorts. My undergraduate school looks like high tech Hogwarts with a Starbucks and top notch healthclub. Building new dorms and other buildings like there is no tomorrow. My grad school is doing the same thing. Trying to move from an affordable commuter school to an SEC school with everyone living on campus. The university student center looks like you are inside the starship enterprise. Cost about as much as a starship too. US News warped colleges and democrats helped blow the education bubble to massive proportions making debt slaves of their future voters.

I like a lot about this article, but I don’t like how the graphs’ y-axis doesn’t start at 0. If it did, we could see the proportional increases better. The way they’re constructed, a doubling looks like a tripling or more.

I did a little back of the envelope math on Wolf’s charts to figure out rates of increase (my envelope can exponentiate.) Overall consumer debt has risen about 4.5% per year since 2011. Student loans have risen about 10.5% per year over the same period.

I wanna get one of those envelopes!

I mixed up one of the numbers. 4.5% is for consumer debt less student loans. Overall is about 6%. It turns out my envelope doesn’t copy edit.

That is a lot higher than the rise in wages. Debt to income must be going higher each year.

How much of that growth in student debt is more students in debt? As against . . . how much of that growth in student debt is the buildup of interest-on-existing-debt upon already-indebted students who can’t pay the debt fast enough to keep the interest numbers from increasing?

How much does compounded interest add to the steady increase in student loans?

(Lately, I have been reading Michael Hudson.)

Well, the back of the envelop method for assessing the impact of compound interest is to divide the annual interest rate into “72” and that gives the approximate time it takes for an debt to DOUBLE. So, a 6% (APR) interest rate will DOUBLE a debt in 12 years.

This is why inflation is a debtors friend (provided their wages/income also inflate) and the banks (lenders) hate it.

I have to echo Johnf’s comments. How much of the student loan debt is accumulated interest and fees for late payments?

Plus Michael Hudson is a god that walks the planet.

When one adds increases in consumer debt reported here to the increases in corporate debt from Private Equity leveraged loans for corporate acquisitions, debt-funded corporate stock buybacks, and stock margin debt, it appears that there is a significant imbalance away from debt for productive purposes and toward short-term consumption of discretionary goods and services, speculations, and gaming of the system for private wealth accumulation. I question whether organic, productive GDP growth is largely an illusion. In my view, debt that is undertaken for productive purposes such as corporate capital expenditures, research and development, a house for family formation, an education that would otherwise be unavailable, and similar types of initiatives is broadly beneficial. But in too many instances, that is not what this is about.

Deregulation seems to lead to debt creation in the private sphere. We need new regulations starting with no money in politics, no private equity unless it is used for producing goods and/or services, no shadow banking of any sort (including unregulated derivatives), no bank bonuses based on revenue created except for goods and services, no debt to go to college or university, no debt for healthcare, no hedge funds, no more financialization of the economy. Wonder how long that will take?

There is another really big problem.

Low wages that have not kept up with living costs. If university students graduating had high paying jobs, the debt problems would not be cascading becuase they would have high enough incomes to pay it off. Apart from the a handful of well off graduates going to Wall Street’s, Silicon Valley, and a handful of high paying positions, who else has that kind of money? Underemployed and outright unemployed, yet deeply indebted students are a common sight.

There are other outrages. Apart from administrative senior staff, coaches are also outrageously paid at universities. There are also many universities dedicating a lot of money to elaborate sports stadiums.

Many of the credit card debts are likely due to the fact that people are unable to afford the costs of living and have limited savings because their income is not increasing, certainly not relative to the true costs of living, or outright decreasing. Alarmingly payday loans are growing rapidly in this area.

Same with auto debt. Owning vehicle in many parts of the US and Canada is not a option. Due to the poor mass transit, it is a necessity. In rural areas, it is essential as well.

See also: medical emergencies.

Many underinsured people initially begin paying off medical costs with credit cards and then, seeing the futility, file for bankruptcy.

Everybody, now! #juststoppaying!

Money that can’t be paid, won’t be paid.

Corporations do “strategic defaults” all the time, and can disappear themselves and their “contractual Just Debts” in bankruptcies and reorganizations. To re-emerge, all polished and pure, after that “discharge,” which is a very selective kind of Jubilee that student loan sufferers clearly, Joe Biden made sure of that, and consumer and medical debt crushees practically, are not allowed to get.

Meanwhile, the planet burns, and an iPhone X that we mopes are Bernays’d into belieeeeving we just can’t live without is a thousand bucks, and another $4 trillion disappears into the MIC’s trick box, and trillions hide “offshore,” and Bezos and Zuckerburg and Gates etc. get billions of MMT bucks from the Panopticon to facilitate the repressive state security apparatus.

#juststoppaying.

And I worked my way out of serious debt, but I will not begrudge Jubilee relief to even the most “improvident and fraudulent” mope, because the fraud and looting by the credit-grinding machinery is orders of magnitude bigger and badder. And most of the mopes shouldering these burdens have just done what they were suckered into doing by “the economy.”

Needed: a Gaia-approved checklist of the stuff humans must invest in to be allowed to keep living here, and a guidebook on the stuff all of have to be doing to stop, or at least reduce the mass and speed of, the Death Train that is headed full steam to collide with us.

Ive never paid a dime of my $100,000+ Student Loans.

I stopped filing for taxes years ago because they take my refund (Not much for a single male but usually over a grand).

F being a debt slave. Ill take the Margins TYVM

Re Student Naval Gazing

I spent tens of thousands of my Loan $$$ on Partying- Alcohol, Weed, Blow, XTC, and Crack.

Also i spent 750$ at Express one time…

LSU FTW

Colleges are charging too damn much?

Private Universities or State Universities or Community Colleges or both or all three?

I would like to see some ultra-detailed and granularized studies on what State Universities were costing-overall-per-student beFORE the Great Tax Revolt and nowadays . . . AFter the Great Tax Revolt. Are State Universities’ absolute total costs when divided by the number of students at those Universities more in constant-value-terms per student today than they were before the Great Tax Revolt? If so, how much of those costs are due to pharaonic temple building and Administrator Bloat? That much of those costs would be a genuinely attackable driver of actual cost-rises and would be deserving of attack and beatdown cramdown.

But how much of the “risen costs” are really just measuring the same constant-value cost as before in twice the number of today’s half-the-size dollars? I ask this because most of the costs before the Great Tax Revolt were charged to State Legislatures and/or Federal Assistance, allowing the State Universities to charge a small fraction of the actual cost to students who went to them. But after the Great Tax Revolt, the State Universities could no longer charge their costs to hostile State Governments, and therefor had to charge these costs to the students themselves. That would not be an actual rise in costs, but rather a re-targetting of where those costs get charged and billed to. And that would be to the students themselves. And that problem could only be solved by cancelling the Great Tax Revolt and beginning the Great Tax Restoration and spending all that money on State Universities again.