A devastating article by Ben Carlson shows that endowments have underperformed similar-risk stock-bond portfolios using Vanguard funds.

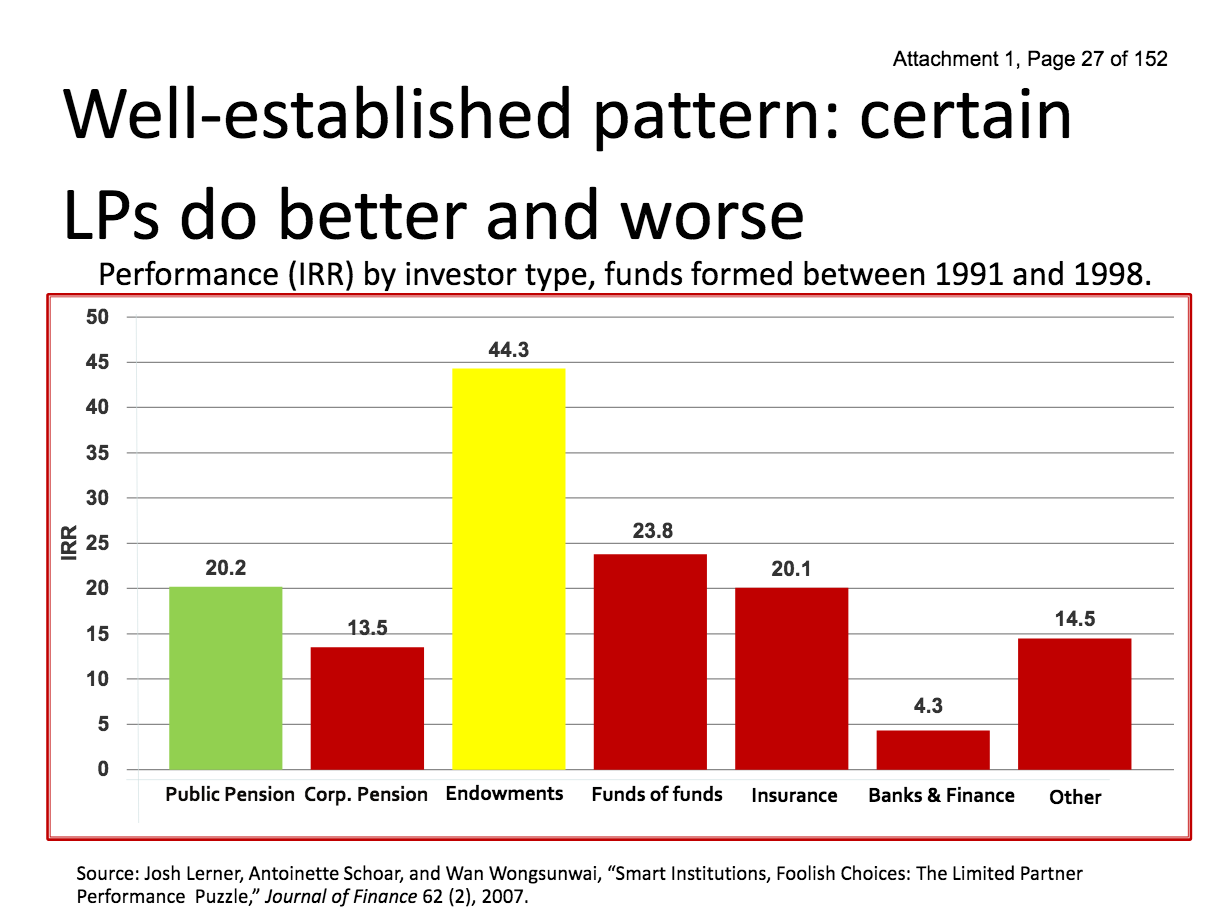

This finding is damming because endowments, particularly college and university endowments, have long been held up as the ne plus ultra of professional investment. In particular, endowments, most famously Yale University, were held out as being particularly adept at investing in high risk, high fee alternative investments like private equity and hedge funds. Harvard Business School professor Josh Lerner presented this slide at a 2015 workshop at CalPERS on private equity:

As a result, part of Lerner’s talk was on how CalPERS could aspire to operate more like these endowments when it grew up.

But now these supposed stars have feet of clay. They have been caught out with underwhelming results.

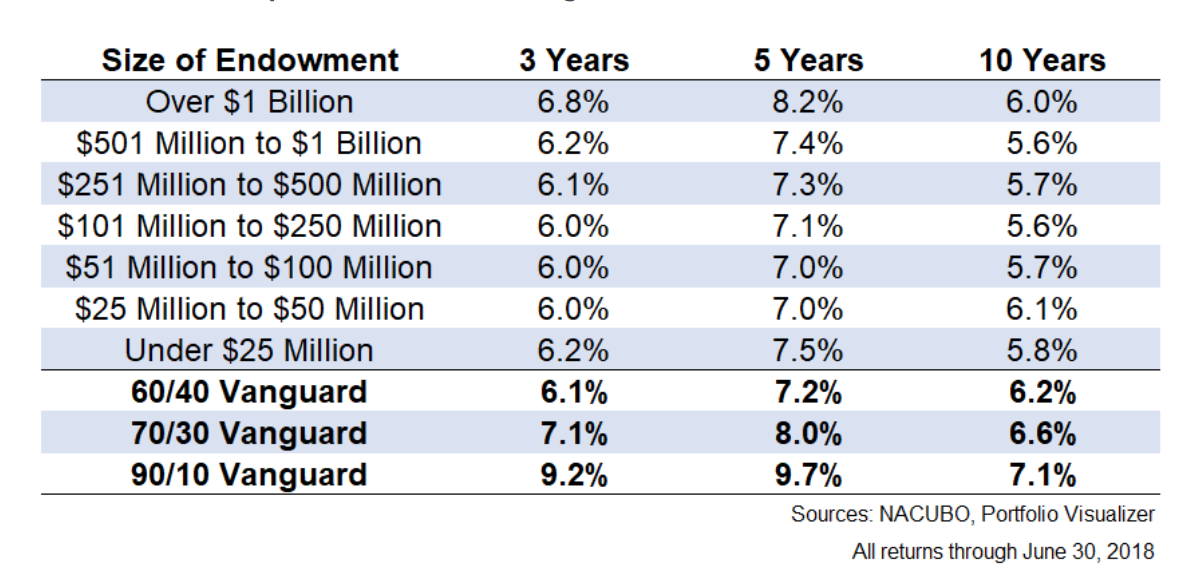

Carlson highlights the latest issue of the NACUBO-TIAA Study of Endowments, which covers over 800 higher education endowments collectively managing over $600 billion. Carlson stresses that this survey serves as a benchmark well beyond the education endowment world because these institutions are seen as “best of breed”.

Carlson show how their results stacked up against various stock/bond mixes from Vanguard:

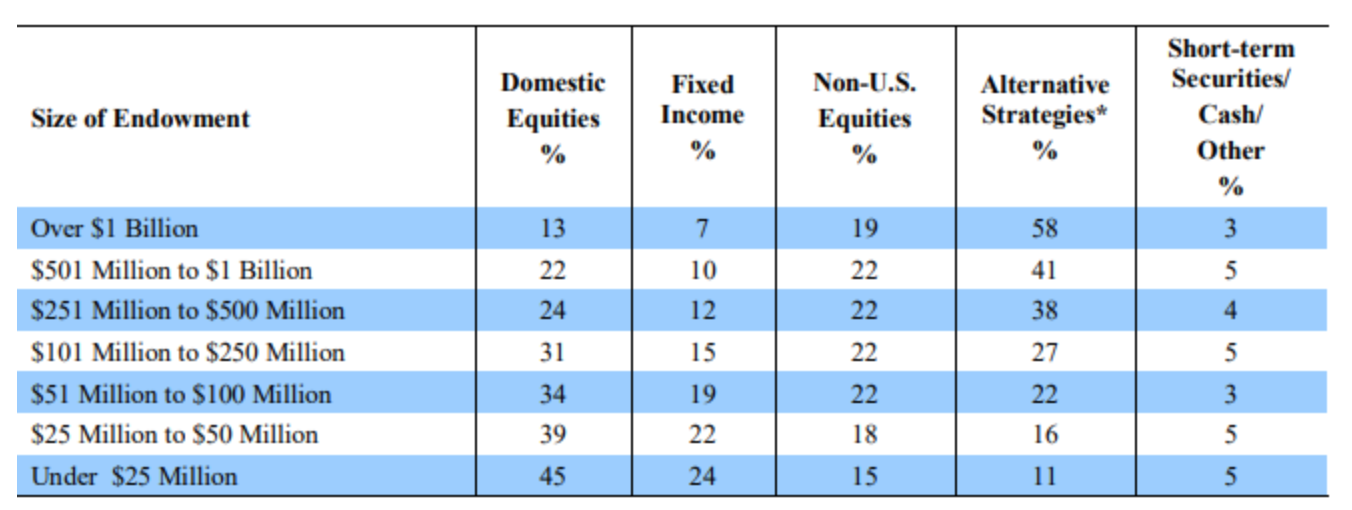

This comparison is more damning than you might appreciate at a first look because the endowments are taking far more risk than the prototypical 60/40 stock/bond mix suggested for retail investors:

To help make a comparison, Carlson treated the endowments’ bond + cash allocation as tantamount to the bond portion in a simple stock/bond mix. No group approaches 60/40. The smallest cohort is 29% bonds + cash, and the over $1 billion funds have only 11% bonds + cash, making them most comparable to a Vanguard 90/10 mix.

And please don’t try the argument that hedge funds are lower risk that stocks. For starters, the SEC filings of fund managers that are public and offer hedge funds like KKR and Blackstone say otherwise. Second, since 2007, experts have admitted that hedge funds do not offer “alpha,” meaning manager outperformance. No alpha means no justification for paying those fat fees. Nor have hedge funds done much to mitigate risk; since 2012, their performance has correlated with equities.

Carlson makes a different argument, that the hidden leverage and lack of liquidity makes the risk even higher that it appears:

Alternatives are illiquid. Investors rarely know what the underlying holdings are. Private equity and venture capital are illiquid, levered equity positions. Hedge funds also utilize leverage. In my mind, that makes these positions far riskier than a diversified low-cost stock market index fund. Even if the volatility looks lower in these funds from their reported numbers, it’s masked by the inherent illiquidity.

- It’s hard to believe how close the return numbers are between the large funds and the small funds. In the past, the funds with the most money tended to outperform their smaller brethren…..the best performing group over the past 10 years was the $25 to $50 million endowments, not the ones managing more than $1 billion.

- The fact that the long-term return numbers for these funds are all so similar is striking when you consider how different their asset allocations are (not to mention the differences in managers or funds in those asset classes). The biggest endowments have dozens of staff members who specialize in specific asset classes or strategies. Some of these people are paid millions of dollars a year. They travel all around the globe meeting with money managers and performing due diligence on investment opportunities. They have enormous committees and boards filled with highly connected and educated people. And yet the little college endowments — with far fewer people, in far simpler investment strategies, using much smaller budgets and making much less money than the giant endowments — did just as well….

- My guesstimate is 60-70% of these funds really have no clue how their private investments are performing because these funds are so difficult to track and they won’t know how this experiment will turn out for many, many years. I think the majority of them will be sorry.

- The illiquidity premium was assumed to be a foregone conclusion by any institutional investors. It’s time to reassess this idea.

The “illiquidity premium” is the idea that investors get more return for investing in illiquid investments. In fact, some finance pros have taken a strong form of this argument, claiming that the only opportunity to get a performance premium was via assuming illiquidity risk.

But the fallacy is that this gets the classic risk-return tradeoff backwards. Investors should demand higher expected returns when they take on more risk. Taking on more risk, like illiquidity risk, does not produce higher returns. Otherwise, everyone who invested in a restaurant would do well.

In fact, investors are playing with their benchmarks to hide the fact that too much money is chasing illiquid investments, to the degree that they aren’t producing enough return to justify the additional risk. Recall that we’ve criticized CalPERS for lowering its private risk premium. The CalPERS benchmark, consistent with what virtually all private equity investors used, was a stock index plus 300 basis points (3%) for the illiquidity and leverage risks of private equity.1

One additional point: the smallest endowments doing almost as well the bigger boys even though they are taking on vastly less risk. They have nearly three times as much in bonds and cash and have on average less than 1/5 as much allocated to levered, illiquid, high fee alternative investments. This points to a bubble in alternative investments, that investors are throwing so much cash at these strategies that they’ve so bid up prices as to lower returns. And valuations have gotten more strained in the last two years. This will not end well.

_____

1 Note you can still play games via the index selection. It should come as no surprise that most investors used the S&P 500 index, which historically had been flattering because bigger companies tended to grow more slowly that much smaller private equity portfolio companies. But as the S&P 500 has done particularly well in recent years, investors switched to other indexes to make relative results look better.

So endowments and hedge funds etc are make work programs for credentialed elites. Nice work if you can get it.

Yes, that is a key point I neglected to make, so thanks for the observation! Once big investors have staffed up to put money in these complicated investments, the employees on those teams have the obvious incentives to depict what they are doing as successful, so their boards also wind up buying in by virtue of having authorized the strategy and the hiring.

And there is another reason for the tonier schools to invest in PE and hedge funds….to not piss off potential donors. Being alternative asset apostates does not endear one to the 0.1%.

I wonder what percentage of the schools’ mega-donations come from hedge fund, PE, VC and other fund managers?

The Global Financial Crisis and the Iraq War debacle (and all other fiascos of the last 20 years…) have taught us that the most important thing for elites is not to avoid being wrong, it is to never disagree with other elites. They are insulated from the effects of their own mistakes.

I may have missed an NC link to this elsewhere, but Ben also has a good article about the problems with the Omaha Public Schools’ (OPS) pension fund, and how their shift into alternative investments (private equity, et.al.) made a mess of the fund.

https://awealthofcommonsense.com/2019/02/how-to-wreck-a-pension-plan-in-3-easy-steps/

Donations for Colleges, Public Penions pay for play to super pacs since Citizens United – all driving Private Equity. PE violates many state fiduciary laws but no one wants to enforce it. I will as Kentucky State Auditor see christobe.com

One additional question I have about endowments is always what costs are borne by the endowment and what are borne by the university (thus lowering the returns)? My understanding is that at many institutions, even if the salaries and budgets are paid by the endowment, many of the other costs, such as building and back-office are not charged to the endowment, like other departments. Although these are often smaller costs, they add up and should be included when determining the overall returns for the endowment.

The last ten years have been great for stocks, so the higher the stock fraction, the better.

Not many ten-year periods are recession free… whenever the next recession hits the ones with more bonds and cash will do better.

A 20-year period would include two recessions… I assume even vanguard would be sub 6%. Granted P.E. did better back when there was less competition.

Worth noting Buffett advices his heirs to put it all in vanguard…

You would pick up the very tail end of the real glory years of PE in a 20 year comparison, which was 1995 to 1999. That is about to roll off.

I compare portfolios to the Vanguard LifeStrategy series of defined risk funds. The Growth fund is 80 percent equities in a blend of domestic and foreign all the way down to the Income fund that is about 25%-30% equities. They provide a stable diversified portfolio with an expense ratio of less than 0.2% and a minimum buy-in of $3,000. The Vanguard Target Date funds start with an equity percentage a bit higher than the LS Growth fund and eventually end up at the Income fund.

Isn’t this just a matter of choosing your sample period? IE your 90/10 mix would have returned approximately -32% in 2008, far worse than all but the most poorly managed of endowments, and it would skew your numbers clearly in endowments’ favor.

Beating equities during a 10 year period where stocks averaged nearly 10% (also the longest bull market in history) is neigh on impossible and not a particularly useful comparison. The simplifying assumption that “alternatives are just equities” is clearly wrong and misleading.

First, I don’t see where you get your claim that a 32% loss in 2008 would be some sort of wild outlier for large endowments, which was the cohort that was taking 90/10 level risks. Harvard and Yale both lost nearly 30% in 2008 before you get to the “smoothing,” as in lying, about valuations (see below), so I don’t know where you get your claim about 32% being some sort of unheard of result:

https://www.nytimes.com/2009/09/11/business/11harvard.html

Second, as I am sure you know, investors generally chased return in the post crisis ZIRP era, so it is vey likely that as of 2008, the level of risk in endowments generally, and in the large ones in particular, was markedly lower than in 2018. So you’d need to benchmark against a lower-risk Vanguard fund mix.

Third, you see those Harvard/Yale results despite bogus private equity valuations. Private equity funds are widely recognized to under-report losses in down equity markets. There was a big for stocks on September 30, 2008. Think there was one for any portfolio company? There was criticism at the time that the valuations didn’t reflect reality, since PE holdings should have performed worse that stocks yet were valued as doing markedly better. Relying on cooked numbers is not a sound basis for investing.

Moreover, tons of very high profile quant funds also failed in 2007 and 2008, and averages from that period are similarly unrealistically high due to survivorship bias.

In today’s edition of paywall lotto I got through the Wall Street Journal paywall and read my favorite story on the unreliable art of forecasting stock market winners. This story is fantastic if you have never read it.

The Long Climb and Steep Descent of Legg Mason’s Top Stock Picker By Jason Zweig November 18, 2011

Bill Miller was lauded by all as a genius for a long time and now he isn’t. Perhaps the link will work for you. :)

University endowments also choose these investments because endowment oversight boards are frequently filled with hedge fund, private equity, and other ‘alternative strategy’ investment professionals.

Members of the Board of Trustees of Princeton University which supervises investment of this University’s endowment include:

Kathryn A. Hall ( Chair of the Board of Trustees ) Founder, CEO, and CIO of Hall Capital Partners ( Fund of Funds to Hedge Funds & Private Equity )

Philip U. Hammarskjold – Co-Chief Executive Officer, Hellman & Friedman ( Private Equity )

Yan Huo – Managing Partner & Chief Investment Officer, Capula Investment Management ( Hedge Fund )

Paul A. Maeder – Founding Partner, Highland Capital Partners ( Venture Capital )

Thomas S. Roberts – Founder and CEO, Equality Asset Management ( Private Equity )

C. James Yeh – Senior Managing Director, Citadel Investment Group ( Alternative Asset Manager )

Members of the Board of Directors of the Harvard Management Company which manages Harvard University’s endowment include:

Joshua S. Friedman – Co-Founder, Co-Chairman, and Co-Chief Executive Officer, Canyon Partners ( Hedge Fund )

Robert Jain – Co-Chief Investment Officer, Millennium Management ( Hedge Fund )

Thomas L. Kempner Jr. – Co-Founder and Co-Executive Managing Member, Davidson Kempner Capital Management ( Hedge Fund )

Brian C. Rogers – Chairman of the Board and Chief Investment Officer, T. Rowe Price Group

Members of the Yale Corporation Investment Committee which is responsible for oversight of this University’s endowment include:

Francis Biondi – Co-founder, King Street Capital Management ( Hedge Fund )

Anne Glover – Co-founder, Amadeus Capital Partners ( Venture Capital )

Ann Miura-Ko – Founding Partner, Floodgate ( Venture Capital )

Ben Inker – Partner, Grantham, Mayo, Van Otterloo & Co.

Charles Goodyear IV – President, Goodyear Investment Company

Thank you Jim, I find these lists useful. Ann Miura-Ko and Floodgate turn up here:

https://web.archive.org/web/20120501235802/http://www.taskrabbit.com/team

This is old informaton but is part of an ongoing churn. Substitute the name of a new startup either in the present day or in the next tech boom, if there is one. So now you have a “way in” that I wasn’t aware of, potentially. The universities sometimes apply pressure to divest from fossil fuel or coal. So under what circumstances could Yale, Harvard or Princeton be pressured to divest from precarity?

I am a little off-topic by talking about what portfolio companies do in the world, and not just their returns. A lot of the time, the two are related if you’re the Bezzle or a control fraud, but I don’t think you would necessarily have unprofitability on your side if you want to say “precarity is socially harmful”. It’s helpful if it doesn’t have a good return at the same time, but it might very well have a great return.

The presence of VC on these lists intrigues me because the attention is usually more on the types of firms that use more debt while VC is supposedly “on the side of the angels” because they only use equity. So as a matter of fact, I am confused by Carlson’s sentence “Private equity and venture capital are illiquid, levered equity positions.” After 2008, there was a Congressional hearing about the alternative investments, and the rationale that the Senators were making was that the public had a right to know what the firms were doing because we had just seen that leverage is dangerous. There was a representative from a VC lobby on the panel who said “you don’t want to be talking to me, I think you want those guys at the other end of the table. They use leverage and we don’t. We aren’t dangerous, therefore you have no ‘danger’ rationale for butting in on our private business activity.” What does it mean to have a levered equity position?

Indeed. The “Efficient Market Hypothesis” states that all information has already been taken into account, and that it is impossible to consistently beat the stock market, so it’s better to just invest in index funds and skip the overhead of active management.

But there’s a catch. The “Efficient Market Hypothesis” requires that much of the market is made up of active traders! If we all use index funds, there is no market and it all falls apart.

Unless the market is unlinked to an underlying value. Then you can’t beat the market because there is nothing other than the market, no external reality for you to get information about which dominates the market. It’s just gambling.

Aka if you are fully financialized, you’re just tracking a random number generator.