By Nat Dyer, a freelance writer based in London. He has an MSc in International and European Politics from Edinburgh University. He was previously a campaigner with Global Witness, an anti-corruption group. He tweets at @natjdyer. Originally published at Economic Questions

This is the story of Susan Strange and Hyman Minsky, two renegade economists who spent a lifetime warning of a global financial crisis. When it hit in 2008, a decade after their deaths, only one rocketed to stardom.

When Lehman Brothers went belly up and the world’s financial markets froze in the great crash of 2008, the profession of economics was thrown into crisis along with the economy. Mainstream, neo-classical economists had largely left finance and debt out of their models. They had assumed that Western financial systems were too sophisticated to fail. It was a catastrophic mistake. The rare economists who had studied financial instability suddenly became gurus. None more so than Hyman Minsky.

Minsky died in 1996 a relatively obscure post-Keynesian academic. He was only mentioned once by The Economist in his lifetime. After 2008, his writings were pored over by economists and included in the standard economics textbooks. Although not a household name, Minsky is today an economic rockstar named checked by the Chair of the Federal Reserve and Governors of the Bank of England. One economist summed it up when he said, “We’re all Minskites now”. The global financial crisis itself is often called a “Minsky moment”. But not all radical economic thinkers were lifted by the same tide.

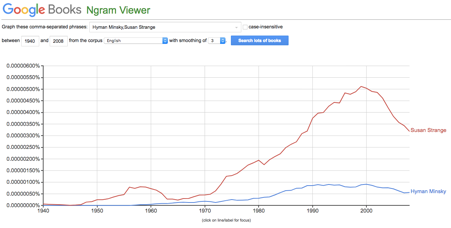

Susan Strange was more well-known than Minsky in her lifetime (see Google ngram graph below). One of the founders of the field of international political economy, she taught for decades at the London School of Economics. Alongside her academic work, she raised six children and wrote books for the general public warning of the growing systemic risks in financial markets. When she died in 1998 The Times, The Guardian and The Independent all published an obituary for this “world-leading thinker”.

The two renegade economic thinkers, although working in different disciplines, had much in common. They both gleefully swam against the tide their entire careers by studying financial instability. They were both outspoken outsiders who preferred to teach economics with words rather than equations and were skeptical of the elegant economic models of the day. They were big thinkers haunted by the shadow of the 1930s Great Depression. They both died a decade before being vindicated by the 2008 financial crisis. And, they read each other’s work.

The New York Times called Susan Strange’s 1986 Casino Capitalism “a polemic in the best sense of the word.” Calling attention to financial innovation and the boom in derivatives, the book argued that, “The Western financial system is rapidly coming to resemble nothing as much as a vast casino.” Minsky, in his review, said that the title was an “apt label” for Western economies. Strange provided a much-needed antidote, he said, to economists “comfortable wearing the blinders of neoclassical theory” by showing that markets cannot work without political authority. He probably liked the part where Strange praised his ideas too.

Casino Capitalism hailed Minsky’s ‘Financial Instability Hypothesis’ way before it was fashionable. Strange singled out Minsky as one of a “rare few who have spent a lifetime trying to teach students about the working of the financial and banking system” and whose ideas might allow us to anticipate and moderate a future financial crisis. Minsky’s concept of ‘money manager capitalism’ has been compared to ‘casino capitalism’.

But, put Susan Strange’s name into Google News today or ask participants at meetings on economics about her and you don’t get much back. They will sometimes recognise her name but not much more. Outside a small group, she’s a historical footnote, better remembered for helping to create a new field than the force or originality of her ideas. It is as if two people tipped the police off about a criminal on the run but only one of them got the reward money.

So, why did Strange’s reputation sink after the global financial crisis when Minsky’s soared?

Professor Anastasia Nesvetailova of City, University of London, one of the few academics who has studied both thinkers, believes it is due, in part, to their academic departments. “Minsky may have been a critical economist but he was still an economist,” she told me. Strange studied economics, but then worked as a financial journalist before helping to create the field of international political economy, now considered – against Strange’s wishes – a sub-discipline of international relations. Economics is simply a more prestigious field in politics, the media and on university campuses, Nesvetailova said, and Minsky benefited from that. “Unfortunately, [Strange] remains that kind of dot in between different places.”

As we live through a political backlash to the 2008 crisis and the IMF warns another one might be on the way, Strange’s broader global political perspective is a bonus. In States and Markets, she sets outs a model for global structural power which brings in finance, production, security and knowledge. Her writings predicted the network of international currency swaps set up by the Federal Reserve after the global financial crisis, according to the only book written about Strange since 2008. Her work foreshadowed the global financial crime wave. And, she argued repeatedly that volatile financial markets and a growing gap between rich and poor would lead to volatile politics and resurgent nationalism, which is embarrassingly relevant today. The financial crisis may have been a ‘Minsky moment’ but we live in Strange times.

This global political economic view explains why Strange criticised Minsky and other post-Keynesians for thinking in “single economy terms”. Most of their models look at the workings of one economy, usually the United States, not how economies are woven together across the world. This allows Strange to consider “contagion”: how financial crises can flow across borders. It’s a more real-world vision of what happens with global finance and national regulation. Her greatest strength, however, also reduced her appeal in some quarters as it means Strange’s work is less easy to model and express in mathematics.

Minsky found fault in Strange too. She should have more squarely based her analysis on Keynes, he said and showed the trade-off between speculation and investment. Tellingly, his critique is at its weakest when engaging with global politics. Strange unfairly blamed the United States for the global financial mess, Minsky wrote, even though it was no longer the premier world power. Minsky was only repeating the conventional view when he wrote that in 1987 but it was bad timing: two years later the Berlin Wall fell ushering in unprecedented US dominance.

In her last, unfinished paper in 1998 Strange was still banging the drum for Minsky’s “nearly-forgotten elaboration of [John Maynard] Keynes’ analysis”. Now it’s her rich and insightful work that is nearly forgotten outside international relations courses. A jewel trodden into the mud. Just as Minsky is read to understand how “economic stability breeds instability”, let’s also read Strange to appreciate her core message that while financial markets are good servants, they are bad masters

Google Ngram showing the frequency of references to Susan Strange (red) and Hyman Minsky (blue) from 1940 to 2008

Strange was more referenced in her lifetime than Hyman Minsky. Google Ngram’s search only goes up to 2008. After 2008, we would likely see a hockey stick spike for Minsky and Strange continuing to fall.

Except bourgeois “nationalism” is a globalist fraud. All the 2008 bailout did was kick the debt can to the Chicaps who went on a debt rush themselves that globally gave liquidity to post-crisis “western” debt markets. That is over now. Chicap debt is now in its contraction leading toward debt contraction resuming in the west.

These “nationalist” elections are nearing overturning as recession pressure builds from the debt contraction.

A real nationalist can’t exist without socialism. Period.

i suppose a real nation can’t exist without socialism to some extent, if that is what you mean.

Something got messed up with the formatting in the byline. The “strong” tag is visible.

Fixed, as well as the entire page being in italic.

Minsky is now considered a pioneer of MMT.

Since Minsky and Strange operated in diferent disciplines I would be good to see how Strange is considered within their discipline compared, for instance with members in these lists. A first glance at those makes me think that one has to be very conservative or pro-stablishment to be “popular” in international politics.

Of the 24 different people named on the combined lists you linked, Wikipedia identifies 15 as “American.” (One of those is Asian-American.) Another 7 are identified as American but born abroad (6 in Europe, 1 in Asia). One is of unspecified nationality, mostly educated in the USA but partly in Australia. One is identified as German. Therefore 23 out of the 24 are in all probability culturally “American.” Only 2 out of the 24 are women. There is, I would say, strong prima facie evidence of bias in assembling these lists. Specialists who work or worked outside the USA had a very low chance of being nominated (1 in 24); women had a chance almost as low (1 in 12). It is as if people who work in major centers of international affairs (Brussels, The Hague) or finance (Switzerland) had no chance. People who work in many major countries (Russia, France, Canada) had no chance. People of Asian descent had only a small chance; people who work in Asia (China, Japan, Israel, Iran), or anywhere south of the equator, had no real chance. People who work, or were even born in, any small country apparently had no chance either. People who write (and hence, think) primarily in any language other than English (even major ones like Spanish, Arabic, Portuguese) had little or no chance of making these lists. People of color had little chance. For these reasons, the views of most of the world are unlikely to be represented by the work of the people whose names did appear on these lists. On the other hand, American views are grossly over-represented. Perhaps in lists like these we see what hegemony actually looks like.

I think more precisely neoliberal. Noticed how anything or anyone that didn’t agree fully with it in positions of influence either got purged or weren’t hired? Keynesianism becomes leftist; Democratic Socialism is what the lonely crackpot professor is babbling about, socialism is nonsense, and communism is unmentionable. The idea that dare not speak its name.

I have noticed that it is the far more crippled field than political science as well.

Unfortunately, neither Minsky or Susan Strange “got the reward money”. Both died over a decade before their ideas were validated. But it is useful to see how their ideas in many ways complement one another although they had some academic disagreements. Thank you for Dyer’s post, as I was previously unaware of Susan Strange’s work.

As an aside, I do wonder if Brooksley Born had read Susan Strange’s “Casino Capitalism” when as a federal regulator she objected to their use by the banks and was summarily and harshly repudiated by Summers, Greenspan and Rubin.

I also wonder what Susan Strange and Hyman Minsky would think about the continued exclusive policy reliance on monetary policy and financial markets, the determined opposition to deficit fiscal spending solutions by governments like that of Germany; the implementation of and dogged adherence to negative interest rates by the ECB, Bank of Japan and other central banks in the face of the evidence; and what they would have to say in response to those economists who propose their use in the U.S.?

And what they would both say about bank deregulation that enables global speculation, state-subsidies of key players, and monetary and political support of financial markets that now serve primarily to benefit speculators and those who personally profit from disinvestment through share buybacks, leveraged buyouts, and other mechanisms?

So US Treasury Secretary Mnuchin has been involved in the bilateral trade negotiations with China. Why?… Seems to me this exemplifies the body of work by Susan Strange. To paraphrase the old Chinese proverb, we live in Strange times indeed.

Thanks to Yves as always and to Chauncey for his excellent comment, for which, if you don’t mind, I would like clarification. I can’t tell what the antecedent noun was for the word “their” in line 3, paragraph 2. It’s crucial to my understanding of what you’re getting at. Thank you.

Thanks for your comment, Andrew. Perhaps the subsection titled “Born and the OTC derivatives market” in the link “Brooksley Born” on Wikipedia.org will help clarify:

There was also a documentary about her and what had occurred on PBS “Frontline” in the wake of the financial collapse in 2008 that aired in October 2009 titled “The Warning”. A text summary of that documentary, which was 56 minutes in length, is at this link:

https://www.businessinsider.com/the-warning-brooksley-borns-battle-with-alan-greenspan-robert-rubin-and-larry-summers-2009-10

A salient extract from the article:

“I walk into Brooksley’s office one day; the blood has drained from her face,” says Michael Greenberger, a former top official at the CFTC who worked closely with Born. “She’s hanging up the telephone; she says to me: ‘That was [former Assistant Treasury Secretary] Larry Summers. He says, “You’re going to cause the worst financial crisis since the end of World War II.”… [He says he has] 13 bankers in his office who informed him of this. Stop, right away. No more.'”

Greenspan, Rubin and Summers ultimately prevailed on Congress to stop Born and limit future regulation of derivatives.”

It is noteworthy that Brooksley Born )together with Sheila Bair) received a Profiles in Courage award in 2009 in recognition of the political courage she demonstrated in warning about conditions that contributed to the global financial crisis. But I am also struck by her observations about the continuing nature of the risk.

Minsky understood instability, so I’m puzzled that he criticized Susan Strange for blaming the USA for the growing global economic instability. I think she was prescient. And I also think we got caught in our own trap. Instead of real political solutions to economic realities, we just shoved money, arms, TV sets, cars, and big fat non-performing loans at other countries. It was bribery. Our preferred method of fighting the dreaded commies. But it had no political reality – and she is right to criticize us. We managed to prime our own pump and maintain the fiction that the free market was the most efficient form of economics, even though it was completely inscrutable – by design. Then the USSR collapsed, and then we were overtaken by our own events. All that money needed to turn a profit. And it was impossible because it was never based on productive investments. (Minsk certainly would have understood that part.) And the world was looking pretty tapped out. As the Russians said in 2008, it was always a ponzi scheme. All we could do in 2008 was… nothing really. Finance had no political power in the end. And of course there is the problem of oil and impossible expectations of growth now. So as they say, this is the new reality. And to my thinking all of the repairs are by necessity going to be green which almost precludes further profiteering because there’s no way to exploit green without making money itself just a token of exchange. (Which I think it should be anyway.) Green is the ultimate referee. The ultimate value. But I can get overly critical in my disappointment.

Bit of irony here. IMF has played a big part in financial instability crises for various countries, albeit delayed-action.

That’s because it has been transformed into weapon to be against economically heretical countries instead of a tool used for economic stability.

It’s also a weapon used to keep smaller developing nations in line/in debt.

Susan Strange seems to have been a catalyst for a lot of what was at the time subversive economic thought. I would predict that as time goes along a lot of the economic ‘stars’ such as Milton Friedman will be revealed for the frauds that they were and that anybody who has won a (made up) Nobel Prize in Economics would also be suspect. History, when properly written, has a way of revealing who the real heroes were as well as who the villains were. As long as Susan Strange’s name is not forgotten, her stature will rise as the present economic system becomes unglued. You wonder what would have happened if Strange and Minsky had gotten together to write a book on economics and thrashed out their disagreements between each other. As Ignacio has pointed out, one has to be very conservative or pro-establishment to be “popular” in international fields but going by that list he pointed out and which Alfred analyzed, if you based yourself in the US and subscribed to neoliberal fantasies, that gave you the inside track to popularity. It was only the 2007-8 crash that gave voice to alternate economists such as Minsky and I suspect Strange too over time.

Brooksley Born and Susan Strange will both be born again eventually in the public consciousness. Their prescient writings will be studied and reviewed by future scholars at some point, where erstwhile graduate students pursue reviews of the literature. The notion of what constitutes that literature will continue to expand in the internet age, as murder and reality will out.

Looked at Henry Giroux, Zombie Politics and Culture in the Age of Casino Capitalism 2010 but neither Minsky or Strange are in the index.

I don’t suppose this could have anything to do with the fact that Minsky was a man, and Strange was a woman.

Nah, that thinking is too conventional.

Being a woman is a reason, but all of? Maybe because she was pushing for political economy instead of the more acceptable separate, watered down, economics and political science fields that is just as good a cause.

Proponents of unpopular opinions tend to be dropped down the memory hole. Being a woman adds to the impetus.

I am surprised by the lack of comments on this post . Many issues that NC covers such as Brexit, USA politics, Finance (US and Global), can be seen in global light by reading Susan Strange’s books. IMO opinion very little exists in isolation. An example is the 2008 financial crisis which was not just USA but Global. In a recent comment Yves mention how fragility of global supply chains

From my observations, many but not all of the world’s population are arguably the most well read, most educated, and most advanced humans in history. Focusing on the USA the above statement applies even more.

And yet why are societies ills not better? It’s 2019 and the USA is still dealing with issues such as social justice, severe poverty and homelessness, racism, women’s rights, and a extremely high costs of living for housing, transportation, healthcare, and college to name just a few.

IMO it comes down to Power and Wealth. The global influence of the transnational corporations, multinational corporations, the Finance sector, etc has grown exponentially in the last 40+ years aided by the digital/internet era. And the international political economy is Susan Strange’s turf.

A few of the people on Ignacio’s list have explored the influence of power in the world economy. In history there have been others as well with a more USA focus such as C. Wright Mills The Power Elite and William Domhoff’s Who Rules America..

Another author who has written about the global economy especially as it relates to ethics and power is Raul Prebisch.

Most of Susan Strange’s books are moderate in length but well worth it. I especially enjoyed States and Markets.

You are right. Much of the misery is economically beneficial, or at the least economically expensive, to those in power. There are many people who see problems and have ideas for solutions and who are in the entire political, economic, social, and ideological spectrum; the solutions, whatever their merits, all involve reducing the wealth, power, and even social standing of those prospering right now. Those prospering will use the power wealth gives them to prevent any true reforms. Even something as acceptable as true equality and protection under the rule of law is a threat to be stopped.