We’d been skeptical of longer-dated private equity funds as soon as we heard about them. Marketed as emulating the strategy of Warren Buffett, who has about 2/3 of the value of Berkshire Hathaway’s holdings in stakes in private companies, these funds were set to have lives of 20 years (as opposed to 10 for conventional private equity funds1) and planned to hold the individual portfolio companies longer than the “typical” five years.2 The private equity industry push for these types of funds occurred when top general partners were warning that they expected performance to decline in the future. These longer-lived funds looked like an effort to lock up money during a what could have been a last hurrah for the industry.3

But the Warren Buffett branding, and the pretense that these long-hold funds would perform well, now looks like a big ruse. It isn’t just that CalPERS, which is awfully keen to launch a captive version of these fund, has admitted that it won’t perform as well as conventional equity funds, raising big red flags as to why CalPERS is so eager to go this route.

It is that Buffett himself has done better in public stocks than in private equity. So why should CalPERS expect better results from “Warren Buffett style” private equity investing than public stocks when the Sage of Omaha himself does not attain that?

This finding comes from a new study that won the Top Award in the CFA Institute’s 2018 Graham and Dodd Awards of Excellence. The Institute confers awards in various categories and then designates a “best of show”. The paper, Buffett’s Alpha, by Andrea Frazzini, David Kabiller, CFA, and Lasse Heje Pedersen, all principals at quant powerhouse AQR, looks in depth into how Buffett generates his alpha. We’ve embedded the study, as well as a short article explaining it, at the end of this post.

The article finds that to a significant degree, it is because old-fashioned Graham-Dodd investing works. Another factor is that (contrary to Buffett’s own claims), Berkshire Hathaway uses a lot of leverage but still funds very cheaply. Not only does it have an AAA rating, but it effectively borrows at below Treasury rates by using the float of the Berkshire Hathaway reinsurance operation.

Even though Buffett outperforms, it has done so with very high volatility. Recall that Berkshire was a dog during the dot-com era.

Numbered page 42 describes how the authors analyzed Buffett’s public versus private company results in depth. Key parts:

Berkshire Hathaway’s stock return can be decomposed into the performance of the publicly traded companies that it owns, the performance of the privately held companies that it owns, and the leverage it uses. The performance of the publicly traded companies is a measure of Warren Buffett’s stock-selection ability, whereas the performance of the privately held companies may additionally capture his success as a manager…

We could not directly observe the value and performance of Buffett’s private companies, but based on what we do know, we could back them out. First, we could infer the market value of private holdings, PrivatetMV, as the residual because we could observe the value of the total assets, the value of the publicly traded stocks, and the cash….

.

We then computed the return of these private holdings, rtPrivate+1, in a way that is immune to changes in the public stock portfolio and to splits/issuances by using split-adjusted return.

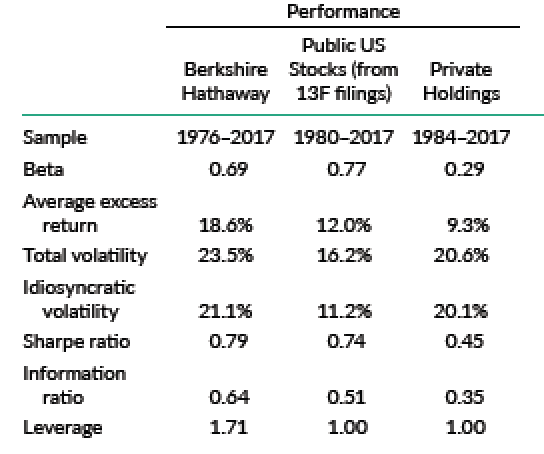

Notice that Buffett’s private equity portfolio is more volatile than stocks, even though the authors attribute the same leverage to the public and private portfolios. Notice also that the Sharpe ratio, a measure of returns relative to risks, is also much higher for Buffett’s public stock holdings than his private ones.

These results come despite Buffett, unlike virtually all private equity fund managers, being willing to sit on the sidelines during frothy markets.

Another reason to be skeptical of CalPERS “Warren Buffett” strategy is that Buffett stressed in his just-released annual shareholders’ letter that he hasn’t done any major deals in recent years and isn’t likely to this year either. From the Wall Street Journal in Warren Buffett Can’t Find Anything Big to Buy:

Warren Buffett is always on the hunt for “elephants,” as he calls large acquisitions. But three years have passed since he bagged a new one.

One reason: The Omaha, Neb., billionaire faces unprecedented competition from private equity and other funds looking to make fast acquisitions, often at higher prices than Mr. Buffett is willing to pay. His last major deal, the $32 billion purchase of aerospace manufacturer Precision Castparts Corp., closed in January 2016…

“With rates low and private equity folks drunk with cash and money all over the place, it’s just naturally going to be harder” for Berkshire to find acquisitions, said Bill Smead, chief executive of Smead Capital Management Inc., which holds Berkshire shares….

In last year’s letter, Mr. Buffett complained about the difficulty of finding attractive deals. “Prices for decent, but far from spectacular, businesses hit an all-time high” in 2017, Mr. Buffett wrote. “Indeed, price seemed almost irrelevant to an army of optimistic purchasers.”

Recall that CalPERS has also depicted the “Warren Buffett” fund as making few but large deals. If Buffett can’t make a go of this, why should CalPERS expect to do better?

While private equity, like second marriages, is an exercise in hope over experience, there is a lot of hopium being smoked at 400 Q Street.

_______

1 The funds allow for extensions beyond 10 years, but with typically with no management fees during the extension period(s).

2 Industry participants often describe the typical portfolio company ownership period as three to five years, but that it dated. The norm post-crisis is now closer to six years.

3 These strategies look more like hedges for the major firms since investors continue to pour money into private equity despite private equity returns failing to meet benchmarks on a widespread basis over the past decade and the warnings that things were likely only to get worse.

00 Buffett's Alpha00 demystifying Buffett's Investment Success

Hmm. I’m not sure I entirely buy this. For example, as you say, Berkshire benefits a lot (and historically might not be able to get off the ground) w/o the float from the reinsurance, which it owns outright.

How’s that taken into account?

Are there any other synergies (cross financing, cross marketing etc.) that Berkshire private portfolio can run where they would not be able to do it with public stocks (like getting hands on the float).

A point on this – I don’t think that things like using float to finance other investments would fly for CalPERS though.

But using those synergies named or unnamed, would also largely be available for Buffet and BH for their private equity segment. And it still is more volatile and less successful than their public investments.

Nor do any such caveats change that a manager with supposedly similar investment parameters, good return over a long investment turn, and a better record than any of Calper’s indicated “partner” choices so far cannot find any companies to invest in.

Both items from this shout to heavens that Calpers is being sold a dog, a lemon, a boondoggle, or even a rube goldberg front of benefit theft.

Oh, I don’t disagree that CalPERS is being sold a lemon (and one going sort of whiteish an squidgy at that). That’s beyond any doubt.

You are right that Buffet could deploy the float in PE or public stocks. But look at it other way.

If Buffet was buying _only_ public stocks, which on paper do better than PE, he would forego the source of cheap funding he has.

But if he can take PE, and use it as a cheap funding to lever more on the public side, the fact that his PE has lower rate of return than his public stock may be irrelevant if it allows him to make more from the public side than if he just put it all into public stock.

Consider following (simplified, not real)

Say Buffet had 100bln to invest. Public stock has 10% return, PE has 7.5%

If he invests all into public stock, he makes 10bln year, 10% return.

Say instead he spends 50bln on PE insurer, and 50bln on public stocks. Your expected return is then 8.75 (10% on 50bln + 7.5% on 50bln). Bad.

But in reality, if he can get a cheap loan from the PE part, say 30bln at a cost of 1%, he can invest that into public markets. So he then gets:

(50+30bln)*10% + 50bln*7.5% – 30bln *1% = 11.45bln

14.5% better return than he would get just going into public stock entirely. So, in reality, his PE investment is generating (indirectly) 12.9% return (6.45bln on 50bln invested), not 7.5% and outperforming the “pure” public one.

But this is very hard to capture in any analysis, and from (briefly) skimming over the paper, I don’t think the paper does capture it.

TLDR; version: PE can be rehypothecated (to simplify) at a higher level than public stock, allowing for higher overall leverage.

But CalPERS could not do this, especially with setting a different entity, as it could not easily lever the PE investment into public stock.

My bad. Thank you for explaining.

And even if it were possible, I don’t see any way that Calpers has the ability to choose the investments that would achieve that. Even sadder I am beginning to think that most of those who can make investment decisions not only don’t have the ability, they don’t even have the desire to maximize the fund’s returns – too much work.

The reinsureance is not a “PE reinsurer”. Please do not make up stuff and confuse readers. It’s a very small team that Ajit Jain created. It was NOT an acquisition. So you have your assumptions wrong. Buffett conceives of it as a source of funding, as the paper. does.

Buffett can borrow on much better terms at the Berkshire level than at the portfolio company level. None of these companies are of would get a blended rate of AAA/less than Treasuries.

That is what you are missing. That is why the authors are correct to attribute the leverage similarly to both types of investment.

I used the term “PE reinsurer” as a shortcut to “full owned and operated (re)insurance group”. Yes, I was sloppy there.

But it’s NOT a small team or a small business. It was a key part of why BH is where it is (and is still a very important part of it).

National Indemnity Company, it’s first insurance acquisition has >400 employees, and its’ float was what enabled Buffet to expand a lot. He said so himself, and said not buying an insurer outright earlier (to get his hands on the float) on was his largest investment mistake ever.

GEICO, which it acquired an equity stake in 1960s and is from 1990s is fully owned by BH has, according to the wikipedia, 38,000 employees. Not a small group. Majority of the float for BH now comes from here these days I believe, yet until this year it was carried on the books for the purchase value + a few bln more (book).

Gen Re, another 1990s acquisitun, has >3k employees. That’s not a small group either.

Berkshire reinsurance business has, to my knowledge, tens of separate US and international entities, for example it acquired a Dutch reinsurer from ING (can’t remember now when).

GEICO may not be AAA rated, but it’s still AA+ (one notch below), as are all the insurance companies in the group. That is, incidentally, higher than BH rating on its own – AA.

The group debt is nowhere near US equivalents, at least not these days. BH group senior unsecured bond in August 2018 priced at approx 110bps over equivalend US 30 year bond.

Importantly though, he also has the access to reinsurance float. The paper talks about this specifically, explicitly saying that it is the major source of his cheap funding, on average 3% below T-bill rates.

That means that for the same funding, holding the insurance group outright generates not just a source of leverage, but at least 3% saving on cost of that leverage.

If he did not have that saving, his returns would be lower, either via lower leverage, or via higher costs of more leverage.

My point is that the insurance float as a cheap source of this funding is key, and he has access to it only because he owns the companies outright (he would not be able to do it if he owned 10% of a public company).

How he deploys that cheap funding is a different story. The results from the authors suggest that he’d be better off deploying it entirely into public companies, and ignore his private holdings ex insurance.

In a way, it’s not dissimilar how the “stellar” traders were able to generate massive returns working for banks. Not because they were stellar in any way, but because their funding was incredibly cheap.

When they moved to hedge funds, pretty much of them got burned really badly.

Coming back to CalPERS – even if they did buy a source of cheap funding, they would not be able to deploy it the same way as either Buffet or banks do cross their portfolio.

So the whole “BH strategy” is really totally irrelevant to them. What is relevant to them from the paper is to build a “Buffet portfolio” of public companies. But they don’t need expensive PE, or even extremely expensive (and worse, external) portfolio managers (god forbid traders), to do that.

Buffett has said in previous shareholder letters that GEICO was a deep value play and (in code) that even though he also got float from it, it wan’t cheap float. The below Treasury funding is almost certainly all from reinsurance.

Buffett entered the reinsurance business with a de novo effort under Ajit Jain. Reinsurance does not take a lot of people, particularly when you write large risks as Buffett does. So having a lot of units does not translate into a lot of people, unlike insurance where you deal with consumers or a range of businesses.

Moreover, absolutely none of your lengthy discussion does squat to refute the point made in the paper, that the parent level leverage should be attributed pro-rata across the public stock versus private portfolio. Any borrowing at the private company level would already be reflected in the disaggregated net return for the PE companies.

I do not want to refute the argument about pro-rata leverage, as IMO it’s irrelevant to what I consider the key point – the cost of funding.

The borrowing at the private company level would be reflected at the private level only if the loans are at fair value intra BH, i.e.any use of float to lever public investments has its fair value returned to the private companies. I see no evidence of that in the paper.

The paper itself states that the returns are due to cheap funding achieved by float.

Do you say that Buffet would be able to use the float (or part of it) if his insurance business was public, and he owned similar stakes to what he tends to have (say 10-20% tops)?

Please read the paper. This is explicitly included in the leverage analysis. They view this as a source of funding, as Buffett does. I’ve sat in Ajit Jain’s office when Buffett would call and discuss specific deals and Buffett clearly saw the point of the reinsurance business as a way to get below Treasury-cost funding. Since he borrows at AAA rates, Buffett should prefer reinsurance all day as a cheaper source of funding….but the reason it is cheaper for Buffett is that his team is super disciplined and write policies only when there is a “hard” market. Buffett is happy to pay salaries and having them do nothing if prevailing terms for reinsurance are unfavorable.

The paper, to what I can see, does not address the fact that the access to this cheap funding exists _only_ because he owns the insurance group outright. He would not have free access to the float if he owned 10% of a publicly owned issuer.

Therefore, the private ownership of the insurers gives him value over and above the market value of the company, if it was sold in an IPO (because the individual shareholders would not be able to realise the value of the float).

I cannot see this value attributed to the private part investment anywhere. The leverage attribution does not do it. Given that they do not anywhere I can see in the paper distinguish between the insurance private investment and other private investment, I can’t see how they can do it.

So the authors acknowledge the key part of it, but do not accrue specific value to the part of his empire that generates it. They put it all up as “private investment”, when IMO it should be “private investment sourcing cheap funding” and “other PI”.

Assuming that the market (BH equity price) realises the value of those insurance companie to BH (it should, Buffet keeps going on it), this actually means even worse things for private equity, because it means that the non-insurance PE in BH brings the whole thing down so badly it overrules even the extremely valuable cheap source of funding.

I don’t buy your argument and neither did the CFA.

It is widely understood that there is value to controlling a company. That is why companies are rationally purchased at a premium to the trading price. So you acting as if this was something the authors missed is wrongheaded.

The value of control is clearly attributed to the private companies given the methodology used. The authors valued the public shares. Everything left is the private company value.

I don’t see any basis for depicting that as incorrect.

I do not say that is incorrect.

In fact, I say that assuming the privately if the privately held business is valued correctly, then the non-insurance business is producing abysmally bad returns, and BH would be way better off just keeping the (private) insurance business and invest rest into public stock.

Again, my argument is that there are two classes of private business BH has. One is clearly valuable, as it allows Buffet to source cheap funding (fundamentally, it actually doesn’t matter whether it’s 5 or 50k poeple. It’s private, wholly owned business that generates cheap funding), which the authors admit is one of the sources of outperformance. The remaining private investments are, by comparison, a bad investment, so bad, that in aggregate they kill even the valuable part.

But again, my final point is that w/o the fully private ownership of the cheap funding business, BH would not be able to achieve the returns he has (even being dragged down by the rest of the private investments), if we assume that cheap funding is an important part of his sucess.

The only counterarguments I can think to that are that he would be able to source cheap funding from publicly owned companies (which I don’t believe he would be able to unless he pretty much owned most of the company anyways) or publicly raised debt (which I don’t believe he can, I showed that as a group his funding is more expensive than the insurance funding).

Constructing the “Buffet strategy” from BH performance ignores the fact that the cheap funding (and thus associated leverage achievable) from the private business would be unavailable to any fund manager.

These results come despite Buffett, unlike virtually all private equity fund managers, being willing to sit on the sidelines during frothy markets.

Buy low, sell high.

it effectively borrows at below Treasury rates by using the float of the Berkshire Hathaway reinsurance operation.

And do it with other peoples money.

As sophisticated as Buffett’s operation is, he sticks to the fundamentals.

Shhhhh! Ixnay on the iveawaygay!

It’s early….

I read that, at first, as “Precision Catpants” and spent a second being awfully confused…where’s my coffee?

Am I reading this right? CalPERS is considering locking up its funds for 20 years in private equity funds? Because it sure sounds like it. Twenty years. So if I had invested money into a 20 year private equity fund back in 1999 I would be only getting it back now. What was happening in 1999? Well, people had not yet been born that are now fighting in Afghanistan. You had the Columbine Tragedy. The World Trade Organization protests in Seattle. The South park film was released. George W. Bush announces he’ll be a candidate for 2000. The Y2K scare. Hmmm.

Man, that was a whole other world. Since then you have had the dot com crash and the world crash of 2007-2008 and now record amounts of world debt accumulated since then. Finance is not the same animal that it was twenty years ago. So, twenty years from now when a 20 year investment comes out, what will 2039 be like? Who can even begin to predict it?

One other thing. The companies that these billions will be invested in. Will they still be there? The average lifespan of a company listed in the S&P 500 index of leading US companies is just 15 years today. That’s not good. The average life span of today’s multinational, Fortune 500-size corporation is 40 to 50 years but if you invested in one when it was 30 years old, will it still be around? Locking your money away for so long really Denver-boots your flexibility. But I’m sure that they know what they are doing (snarc mode disengaged).

20 years is a long time, eh?

So who bought the Austrian 100 year bond?

Also, since then, the stock market dot-com boomed, bust, housing REITS boomed, bust, stock market re-boomed; it’s been a string of bubbles, one following the other. CalPERS doing a 20 year blind deal makes me imagine what would happen if the British South Sea Company offered a 20 year blind investment deal to CalPERS at it’s 1720 height. Bet Marcie would jump on that “deal” quick. /s

Thanks to NC for your continued reporting on CalPERS, PE, and pensions.

adding: Buffet is probably investing with an eye only on profits for his company, imo.

CalPERS might be investing for other reasons, e.g. investing to curry favor with someone, or investing to profit other actors instead of beneficiaries. Considering CalPERS recent track record, it’s impossible for me to not speculate about the reasons. My 2 cents.

Indeed, especially since Marcie Frost seems determined to contract for her high-end expertise at high cost rather than hire it in-house. Even if returns were higher, the higher cost of her proposal would dampen them. Her returns are expected to start low and go down.

As you say, the big question is why.

Buffetology

What four decades of correspondence from the Oracle of Omaha Reveal

Economist March 2nd-8th 2019

He lost over a billion on Kraft-Heinz. Yikes.

The listed net worth of Berkshire Hathaway is somewhere between $530 billions and $618 billions, as of June 2018. So, $1 billion is less than 1% of value, less even than .2% of value, that is, less that 2 tenths of one percent of value. So, not yikes. When looked at in terms of percentages instead of in terms of dollar amounts the picture becomes clearer, imo.

If you had %$100.00 dollars and lost 2 tenths of a penny would you worry?

erm, make that ” If you had $100.00 and you lost two tenths of a dollar, or 20¢, would you worry” or call it ‘yikes”?

Doesn’t Graham and Dodd valuation of stocks depend a lot on having reliable accounting figures? Is corporate accounting really that reliable? After Enron I lost faith in the accounting numbers which I didn’t understand anyway and I’ve been very shy of any stock investments, or any investments for that matter.