By Beatrice Scheubel, Economist, Directorate General International and European Relations, ECB, Livio Stracca, Deputy Director General International and European Relations, ECB, and Cédric Tille, Professor of Economics, Graduate Institute, Geneva and CEPR Research Fellow. Originally published at VoxEU.

More than ten years on from the start of the Global Crisis, policymakers are discussing the effectiveness of the global financial safety net – the combination of reserves, central bank swap lines, regional financial arrangements, and the IMF. This column evaluates the effectiveness of the use of IMF support and foreign reserves in globally driven crises. It finds that actual use of IMF support helps during currency crises – the type of crisis for which the support was originally designed. Use of reserves is of limited effectiveness and only during sudden stops.

More than ten years since the start of the Global Crisis, policymakers are still discussing whether the international financial architecture has evolved for the better. Only recently, in October 2018, an Eminent Persons Group (EPG) of accomplished experts in international governance delivered a report to the G20 on how to reform global financial governance (EPG 2018). One key concern, frequently mentioned in the debates of the G20 during the last years, is that as the international financial architecture has become more multipolar, it has also become ‘patchier’ (Denbee et al. 2016, EPG 2018).

In the view of many policymakers, this development – for example, the accumulation of reserves for use in times of stress (Aizenman and Lee 2008, Aizenman and Sun 2012) or the advent of new players, such as regional financial arrangements (RFAs) – is worrisome, because not all countries may be equally covered by the multipolar elements of global crisis insurance. This makes the global financial safety net – as the combination of reserves, central bank swap lines, regional financial arrangements, and the IMF is known – less effective, or so the argument goes.

However, assessing whether this is really the case is not straightforward. For one, it is difficult to measure whether a macroeconomic outcome after a crisis has been caused by the use of the global financial safety net or has materialised despite its use. For another, the elements of the global financial safety net have been designed for different purposes and their effectiveness therefore needs to be measured against their stated purpose. They may be used as substitutes or as complements.

In a recent paper (Scheubel et al. 2019), we address these two difficulties by combining two novel approaches. First, we identify sudden stops and currency crises that are global in nature in order to rule out reverse causality when assessing macroeconomic outcomes after the use of the global financial safety net. Second, we assess the use of IMF support and own foreign reserves jointly, drawing on the global financial safety net database of Scheubel and Stracca (2019). We evaluate whether these elements of the global financial safety net are effective in mitigating crises and whether they are particularly effective when used as complements. We also distinguish the actual use of the global financial safety net from its availability, which could act as a deterrent.

Our results indicate that the issue with the global financial safety net is not about its being patchy, but about using the appropriate tool for different types of crises. In particular, we find that actual use of IMF support helps during currency crises—the type of crises for which IMF support had been originally designed. Use of reserves is of limited effectiveness and only during sudden stops. We do not find evidence for a deterrence effect of either higher potential access to the IMF or high holdings of reserves.

Identifying the Theoretical Effect of the Global Financial Safety Net on Growth

The message from theory is more ambiguous than one could have expected. We develop a simple model of a small open economy faced with a constraint limiting its international borrowing to smooth consumption and finance imported inputs. We show that global financial safety net access (which loosens the constraint) and use (which provides the country with additional resources) have an unclear impact on output, in particular depending on whether they are temporary or persistent. This is because the horizon over which the global financial safety net tools apply impacts the path of borrowing for smoothing reasons, which is mirrored in the ability to borrow to finance imported inputs. The absence of a clear-cut conclusion from theory makes it even more compelling to carry out an empirical analysis, although this is also fraught with difficulties.

Identifying Globally Driven Times of Stress

Simply considering how growth and inflation evolved after sudden stops is not adequate. Investors are indeed likely to pull back from a country which is about to experience a weak growth spell for reasons that have nothing to do with capital flows as such. To get around this issue of reverse causality, we first identify capital flow episodes that are globally driven. Gyrations in the global financial cycle have been identified as a major driver of capital flows to emerging economies (Ghosh et al. 2014, Forbes and Warnock 2012, Rey 2016) and these have featured prominently in the policy debate and in the discussions of the G20 Eminent Persons Group.

Using a database of annual information on 32 countries from 1990 to 2014, we identify years of capital flow reversals in emerging market economies. Specifically, we follow the approach of Forbes and Warnock (2012) and Laeven and Valencia (2012) to define sudden stops and currency crises respectively.

Second, we construct our own measure of the global financial cycle by taking the principal component of a range of financial quantity and price indicators, following the approach of Eickmeier et al. (2013). We then run a number of logit regressions for sudden stops, currency crises, and other capital flow episodes on standard controls and our global financial cycle measure. If the marginal impact of the global financial cycle is significant in a country-year with an episode, we then label this episode as ‘global’. Our procedure identifies about half the sudden stops and currency crises as global, and we focus on these in the remainder of the analysis.

Impact of Safety Net Measures on Growth

Using a local projection approach over the year when an episode happens and subsequent years, we find that stops and crises indeed have an adverse effect on growth. To assess whether elements of the global financial safety net help cushion this impact, we add measures of potential access and of use to our specification. The measure of potential access shows whether the mere presence of potential global financial safety net support may instil confidence and reduce the depth of the recession, and the measure of used resources shows whether the actual drawing on global financial safety net resources during a crisis helps. We measure potential access to the IMF’s resources by the IMF quota, and potential access to reserves as reserves scaled by GDP. We measure use as, respectively, the amount of disbursed IMF loans and the deviation of reserves from historical trends (adjusted for exchange rate valuation effects).

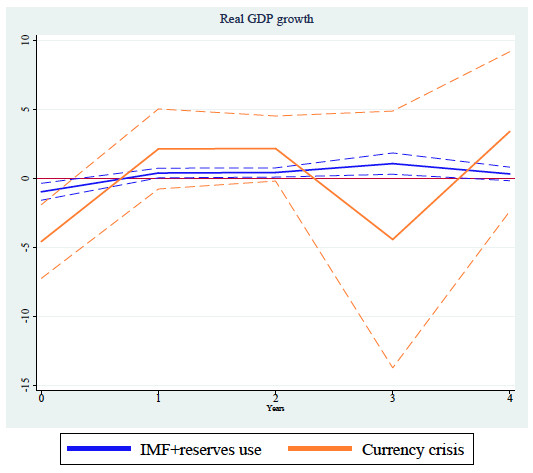

We look at potential access and use of IMF and reserves separately, as well as jointly. Moreover, we instrument global financial safety net use as it is potentially endogenous to growth (a larger contraction of output in a global crisis may push countries towards using the safety net more). We show an example of the pattern of GDP during and after a sudden stop with and without GFSN use in Figure 1 (based on ordinary least squares estimates).

Figure 1 Effect on real GDP growth of IMF and reserve use during a currency crisis

Notes: The figure highlights the effect of a currency crisis (orange) and confidence bands as well as the effect of IMF and reserve use during a currency crisis (blue). It shows that GFSN use can attenuate large movements in growth due to a currency crisis.

The following key results emerge from our analyses:

- Potential IMF access supports growth during a sudden stop, but this result is not robust when using instrumental variables. There is no effect of potential IMF access during a currency crisis.

- We find no effect of reserves access on growth in any of the specifications.

- Reserves use reduces growth during a currency crisis, but the result is not robust when using instrumental variables.

- IMF use has a negative effect on growth only during the first year of a currency crisis, but supports growth thereafter. This ‘pain first, gain later’ pattern could reflect the fact that global financial safety net tools are not immediately deployed, or that the conditionality associated with them could initially weigh on growth. This result adds an important dimension to the literature on the effect of IMF programmes on growth, as the literature typically finds negative effects, while we show that such a negative effect is reversed during the years following a currency crisis.

- IMF use is more effective after currency crises than after sudden stops. This points to the IMF being more effective for the kind of crisis for which it has originally been designed at Bretton Woods, namely, to deal with balance of payments crises and to prevent dis-orderly exchange rate movements.

- When considering IMF and reserves use jointly, we find confirmed that mainly IMF support influences the growth outcome, and mainly for currency crises. This is confirmed also somewhat when using instrumental variables.

Conclusions

We find that while the global financial safety net can, in principle, help a country absorb globally driven shocks, the effectiveness of the elements depends on which type of crisis they are used for. First, the mere availability of global financial safety net access is not sufficient to cushion capital flow episodes and a country actually has to use the safety net. Second, the effectiveness is clearer for currency crises than for sudden stops, in particular for IMF support. In addition, the benefits come with a delay. Finally, IMF support appears to have a stronger cushioning effect than foreign exchange reserves, although this does not exclude the possibility that reserves could still be important in episodes that are driven by local or regional conditions. IMF support comes with strings attached and the IMF has ‘deep pockets’, at least from a perspective of a small economy.

Overall, our results indicate that policymakers should be less concerned about the global financial safety net being ‘patchy’ and, rather, encourage more targeted use of safety net resources. For example, this could be achieved through better coordination of the different layers that ensures the use of each layer when it is most efficient, for example, by sequencing them or by combining resources.

Authors’ note: The views expressed belong to the authors and are not necessarily shared by the institutions to which they are affiliated.

Well, time for me to do research on who, when, why, and where this terminology -“global fianancial safety net” – popped up from.

Most excellent observation and question, Summer.

It may be the IMF, as they theoretically provide the backstop – at least they had acronymed it by 2016. https://www.imf.org/external/np/pp/eng/2016/031016.pdf

I assume this is like Social Security and Unemployment Insurance for the 0.1%.

global financial safety net….

I believe “safety” is either spurious or we need a definition of who is being saved.

For example in Argentina, which is going through yest another crisis, it appears only the rich in that country benefit from a Neo-liberal trade regime. The wealthy move their money out, precipitating a crisis, and when the Argentine currency tanks, buy and even bigger share of the spoils.

A regime of encouraging local manufacture, import substitution, and protecting it with tariffs is best.

This describes an economy postulated by a clutch of mainstream economists wallowing around in the echo chamber of the EU – a neoliberal aberration designed by financial technocrats where sovereign capacity has been effectively nullified. It bears no relationship to the real world, so no one should be surprised that the views are not those of the institutions who employ these economists. These guys are off the reservation!

A financialised view of the global economy might make sense to the propeller heads on the trading floor, but the reality is that any sovereign Government can easily protect their domestic economy by using capital controls, currency issuance capacity and trade regulation. Think Iceland and how the IMF decried their attempts to reverse the negative impacts of the EU nonsense, to now discover that the Government effectively utilised their tools to squash the parasites who were destroying their monetary capacity. Note that the IMF no longer comments on the Iceland matter and has conveniently forgotten about their dire predictions which never came to pass. Similar to the rubbish they wrote about Japanese bonds where doom has been predicted for decades and yet never happens. Don’t let’s even mention Brexit. They are clueless.

An economics fresher would understand that the macroeconomy is not dependent on the financial markets which are more like a speculative casino and don’t underpin the world economies at all. Financial commentators conflate the financial markets with the real economy, continuing to insist that the global economy depends on financial markets, where in fact, the reverse is the case. A tiny percentage of international financial markets provide the capacity to facilitate international trade, but the vast majority is hot currency bounced around the globe clipping on the way through, without providing any economic benefit whatsoever.

No wonder the EU is in a mess.

Thank you. I can’t decide which is worst: their utter cluelessness; their utter amnesia; or their completely arrogant hubris. Take a look at the swap lines the NY Fed opened in 2009: by far to Eurozone banks. Yet they continue with the complete fiction of “national banking” silos. Lil Timmy Geithner (NY Fed head at the time) knew what game was afoot. They asked Bernanke repeatedly to list the recipients of the trillions in Fed largesse during the crisis: of course he demurred. The list included the Harley Davidson Corporation fer chrissakes. The books of the Fed? Unaudited. Unreported and unregulated shadow markets abound: especially for Eurodollars. Two out of three U.S. Dollars are in circulation outside the U.S.. Jeffrey Snider at Alhambra Partners writes very convincingly on this. Then there’s China: what exactly does “credit” mean there anyway? Unknown. And please don’t mention the 1 *trillion* mismatch between Italian and German debt (LTRO) that maintains the fiction of the euro.

At least in corporate world scammers and grifters and fraudsters like these would (might) end up in jail. Instead we get a holy priesthood we’re all supposed to take seriously and bow before. Marching in lockstep, crushing country after country while insisting their Earth is the center of the universe.

Global safety net, hmm.

To paraphrase Stalin: “How much does the global financial system weigh?”

It is true that Neoliberalism has become a religion like Catholicism in someways; this might explain why money, or more accurately wealth, is treated as morality and ethics are in religion.

The more I read on modern economics and its beginnings in the 19th century not only am I more angry, I am more confused about how the mental dissonance has not killed it; maybe the movie They Live is not fiction?

To regulate the system you need to understand the system, but hardly anyone does

The UK eliminated corset controls on banking in 1979 and the banks invaded the mortgage market and this is where the problem starts.

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.53.09.png

Whoever put those corset controls in place knew what they were doing; no one since 1979 has had a clue and the economy has been running on debt.

We have been pulling future prosperity into today to inflate the value of the nation’s housing stock and the present has looked good at the expense of the future, when that debt gets paid back.

What did Glass-Steagall actually do?

Glass-Steagall separated the money creation side of banking from the investment side of banking. It also stopped the money creation side of banking from trading in securities.

Without Glass-Steagall the bankers could create money to buy securities they produced themselves in a ponzi scheme.

This is what they did in 1929 and 2008.

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.52.41.png

1929 and 2008 look so similar because they are.

The central bankers put the record straight in 2014.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

Richard Werner points out, the Basel rules are based on the assumption that banks are financial intermediaries, but they are not.

https://www.youtube.com/watch?v=EC0G7pY4wRE&t=3s

This is RT, but this is the most concise explanation available on YouTube.

Professor Werner, DPhil (Oxon) has been Professor of International Banking at the University of Southampton for a decade.

To regulate the system you need to understand the system, but hardly anyone does, not even the BIS.