Lambert here: But it doesn’t matter. People love their health insurance companies! (And do note the role, entirely accidental I am sure, played by body shops outside staffing firms.)

By Rachel Bluth, Kaiser Health News reporter. Originally published at Kaiser Health News.

About 1 in 6 Americans were surprised by a medical bill after treatment in a hospital in 2017 despite having insurance, according to a study published Thursday.

On average, 16% of inpatient stays and 18% of emergency visits left a patient with at least one out-of-network charge. Most of those came from doctors offering treatment at the hospital, even when the patients chose an in-network hospital, according to researchers from the Kaiser Family Foundation. Its study was based on large employer insurance claims. (Kaiser Health News is an editorially independent program of the foundation.)

The research also found that when a patient is admitted to the hospital from the emergency room, there’s a higher likelihood of an out-of-network charge. As many as 26% of admissions from the emergency room resulted in a surprise medical bill.

“Millions of emergency visits and hospital stays left people with large employer coverage at risk of a surprise bill in 2017,” the authors wrote.

The researchers got their data by analyzing large-employer claims from IBM’s MarketScan Research Databases, which include claims for almost 19 million individuals.

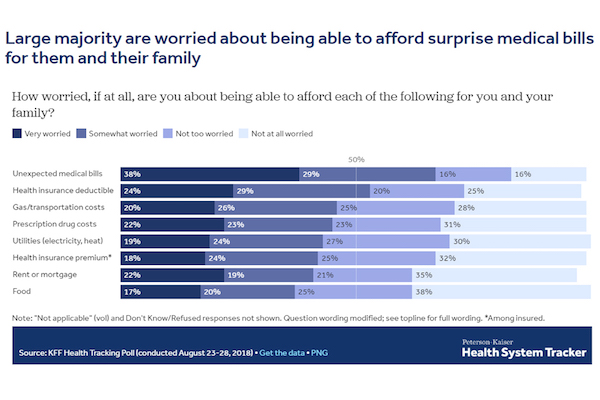

Surprise medical bills are top of mind for American patients, with 38% reporting they were “very worried” about unexpected medical bills.

Surprise bills don’t just come from the emergency room. Often, patients will pick an in-network facility and see a provider who works there but isn’t employed by the hospital. These doctors, from outside staffing firms, can charge out-of-network prices.

“It’s kind of a built-in problem,” said Karen Pollitz, a senior fellow at the Kaiser Family Foundation and an author of the study. She said most private health insurance plans are built on networks, where patients get the highest value for choosing a doctor in the network. But patients often don’t know whether they are being treated by an out-of-network doctor while in a hospital.

“By definition, there are these circumstances where they cannot choose their provider, whether it’s an emergency or it’s [a doctor] who gets brought in and they don’t even meet them face-to-face.”

The issue is ripe for a federal solution. Some states have surprise-bill protections in place, but those laws don’t apply to most large-employer plans because the federal government regulates them.

“New York and California have very high rates of surprise bills even though they have some of the strongest state statutes,” Pollitz said. “These data show why federal legislation would matter.”

Consumers in Texas, New York, Florida, New Jersey and Kansas were the most likely to see a surprise bill, while people in Minnesota, South Dakota, Nebraska, Maine and Mississippi saw fewer, according to the study.

Legislative solutions are being discussed in the White House and Congress. The leaders of the Senate Health, Education, Labor and Pensions Committee introduced a package Wednesday that included a provision to address it. The legislation from HELP sets a benchmark for what out-of-network physicians will be paid, which would be an amount comparable to what the plan is paying other doctors for that service.

That bill is set for a committee markup next week.

Other remedies are also being offered by different groups of lawmakers.

Kaiser Health News (KHN) is a national health policy news service. It is an editorially independent program of the Henry J. Kaiser Family Foundation which is not affiliated with Kaiser Permanente.

Seriously, who are these people who love their health insurance?

At this point, I am pretty sure with few exceptions the people who love their insurance are top management and or the companies that negotiate these profiteering contracts with those same insurance companies. Only the bubble beltway hasn’t gotten the message. Witness all those people at the Fox Town Hall with Sanders that shocked the moderators when they asked the gotcha question about their employer health insurance.

I like paying 750/month for myself (single) as opposed to $50k for the operation that I just had. Problem is, I only make $16/hr, you do the math…

Very few of them really exist. The claim that millions of people love private health insurance is based on carefully crafted push polling questions framed by the health insurers. They ask “if you knew you would lose your current coverage, how would you feel about M4A,” or “if you knew people with employer-sponsored health insurance would lose their current coverage….” And, of course, 66 million people separated from their jobs in 2018, so tens of millions “lose” coverage every year due to layoff, retirement, changing employers, business failures, etc.

Those polls never directly juxtapose “losing” coverage with “gaining better coverage,” which people would under the current M4A proposals. Kaiser Family Foundation has integrated the industry’s push questions into their “knowledge” surveys about M4A. Last go round they asked them twice — whether people knew that everyone with employers sponsored coverage would “lose” it, then same about everyone on the exchanges.

“lose coverage” is much more powerful language than “not pay deductibles and copays,” and they never ask “would you be ok with losing your current coverage if you got much better coverage that can never be taken away.”

There’s nothing intrinsically wrong with message testing, but it’s all in one direction. When you see some of the following questions along with the industry stuff, you’ll know it’s a poll really looking to see which messages move people in ether direction:

Do you know that you would be able to go to any doctor or hospital you want under M4A?

Do you know that your employer won’t be able to change or drop your coverage?

Do you know that your employer won’t be able to tell you which doctor to go to?

How would you feel if you could switch jobs without worrying about health care?

Which do you prefer: a system where your employer lets you choose which insurance company will tell you which doctors and hospitals you can’t go to, or a plan where you can see whatever doctor you choose whenever you need care, with no out of pocket costs.

There are good arguments on costs, too. But tbh, they’re hard to articulate until Jayapal and Sanders develop a mechanism to ensure that for workers and employers who are currently spending above average amounts on premiums, any excess current premium spending above the tax cost of M4A will be captured and put to compensation and not profits.

““It’s kind of a built-in problem,” said Karen Pollitz, a senior fellow at the Kaiser Family Foundation and an author of the study. She said most private health insurance plans are built on networks, where patients get the highest value for choosing a doctor in the network. But patients often don’t know whether they are being treated by an out-of-network doctor while in a hospital.”

again…no menu, no price tags, no team shirts….

it ain’t a “market”.

(“”rational actors with perfect information”…lol)

we’ve got around 10k in debt for the first month or so of our long emergency with cancer…the period before medicaid kicked in.

some of it will get paid.

most of it will likely not(something about blood…and turnips…)

interestingly…and apparently largely unknown…is that one can get a “debt consolidation loan” for credit card, mortgage, and other “consumer” debt….but not for medical debt.

you must, instead, deal with fifty bill collectors…representing many medical outfits you may have never heard of—-imaging, labs, that guy in a white coat who walked by and looked in the door—

one of the articles of faith with the neoliberal order, is that since transactions are inherently Good, it makes sense to maximise them.

so instead of the floor doctor being employed by the hospital, itself…she is employed by an LLC with an anodyne, hard to remember, name.

“It’s kind of a built-in problem,”

a global economy of pickpockets.

yay.

Sounds awful. The last thing you need is extra stress at a time like that. Deepest sympathies. Here’s hoping it works out for you all.

A good description. After the last hospital visit I had w/o an option to choose my hospital or doctors, I got a bill for one of the doctors. How can you say you want only doctors who take Medicare?

I learned that I can’t go to the hospital of my choice and it is a city decision to limit me to the two closest. I suspect the reason is that most of the rest of the time the ambulance medics would decide. I have now been to three and neither of the two closest are acceptable quality. I have talked to a number of medics now and they all say that is just the way it is.

If anyone likes their insurance now, they don’t yet need it and that goes for Medicare.

Ambulance bill for roadside pick-up and 10-mile ride to Kaiser Hospital ER $2100

2-hour stay at ER, EKG test and two pills $5000

Thanks Medicare. We paid nothing.

The problem here is not the health insurer. It is corruption in the provision of medical services by the in network hospital that permits out of network doctor staffing agencies and doctors to perform expected medical services on its premises.

I live in the Capital district area of NY. I discovered recently that almost all the hospitals here have entered into contracts with emergency care staffing corporations for the provision of medical care. In addition, Urgent care facilities staffed by only Physician’s Assistants are proliferating here. This area is apparently regarded as a good target for medical profiteers.

In a rational society, you know one where the recognizes the captive or powerless entity and provides them the protection they are denied, the hospital/medical group etc would be responsible to make sure all parities working there are in network. And by law all additional out of network charges would be theirs.

Of course in a truly enlightened and rational society we would have single payer and the government would use all its power making sure that society at all levels were healthy and well cared for when they weren’t. And massive profits would be on things that were truly discretionary like private jets and yachts not on emergency care.

In 2015 I came down with sepsis after a prostate biopsy (which turned out positive for cancer). Was admitted to John Muir hospital in Walnut Creek via the ER (I was a Muir system patient at the time). Subsequently got a bill advising that the Emergency Dept at Muir was “out of your Network” (an “independent contractor”). Eye roll.

‘Nuther thing I already knew, but most people don’t: an ER encounter is an “outpatient visit” for billing purposes. For Medicare benes, that makes it a “Part-B” claim subject to different (i.e. higher) deductibles and co-pays.

Ah. Now that’s news I can use. As I mentioned below, I spoke to a claims adjuster yesterday concerning my bus accident. One of the questions she asked was about my eligibility for Medicare. So, the question wasn’t just informational in nature. Real money is involved.

Thanks for the enlightenment.

My late daughter was a Kaiser-Permanente member. She was admitted to a KP hospital several times during her recent Stage IV pancreatic cancer ordeal (she died 15 months ago). Each time, she had to go through the ER for admission. Even Kaiser, who owns their own hospitals, subs out their ERs to “independent contractors,” which, of course, raised Danielle’s co-pays and “co-insurance.” The only route to admission was an 8-12 hr “triage” stint in the ER.

There’s hardly any such thing as a through-the-front-door “elective admission” any more.

That’s the definition of fraud, right there.

When I was on a jury hearing a “pill mill” case from Biloxi Mississippi, we were told that one definition of a “pill mill” was when the ‘patient’ was required to go through, and pay for, a full doctors appointment for what was essentially a renewal of a pre-existing prescription. The mandatory “triage” endurance each time a “regular” patient was admitted for an already diagnosed condition fits this definition. Perhaps a resort to the RICO provision would be salutary.

Sorry about your daughter. I hope she ‘passed’ peacefully.

Thanks. Danielle died peacefully (6 weeks into home hospice care), but her illness was anything but.

Talk about “surprise bills,” the night at the ER she decided to go into hospice care rather than do another futile admit, they insisted she come home via ambulance (subbed out to the city fire & rescue dept) — all 1.9 miles to our house. After she died, I kept getting bills for her, one of which was about $2,500 for the ambulance ride (“Seriously?”). Needless to say, that did not get paid. Wish in one hand, [bleep] in the other, see which one fills up faster. She died way beyond broke, there was no “estate” to be probated or attached. Not that a host of claimants didn’t repeatedly try. They all came to know Bad Bobby, who, while not a lawyer, was way ready for all of them (It wasn’t my first rodeo, and I didn’t want anyone BS’ing my grandson into assuming any bogus liabilities).

Too true. One has to learn to be heartless and abrasive when dealing with any billing office or service. It’s a shame, but that particular beastie is outside the norms of civilized society.

Good to know, many of my friends are getting Medicare Part B insurance solicitations from Kaiser. Will inform them to look elsewhere. My condolences to you Sir.

Everyone needs to use things like Yelp and other rating services to make such things known to the curious public.

“but most people don’t: an ER encounter is an “outpatient visit” for billing purposes. For Medicare benes, that makes it a “Part-B” claim subject to different (i.e. higher) deductibles and co-pays.”

I don’t get it. You want ER services to fall under Part B (“out patient”), because it has a relatively small deductible. And once it’s satisfied, you’re clear for the year.

Part A, for hospital admissions, has a much larger deductible, and it’s applied per admission, not per year.

Well, legally, because you’re not yet admitted “to the floor,” it’s necessarily an outpatient encounter. People just don’t know that generally. You’re right about the “deductible.” The co-insurance is quite another matter (apropos of both A and B). Which is why one needs a “Medi-Gap” supp. Humana Medi-gap lost their butts on me last year. In June after Danielle died I had hernia surgery, followed by open heart aortic valve replacement (“SAVR px”) in late August. My OoP for the year was nil. Thank you Humana.

In a bit of irony, I’m now Kaiser, “Medicare Advantage.” My OoP caps for the year at $6,700. Though, I don’t expect anything major, got all my heavy lifting done in 2015 and last year.

I am going through training to become a SHIBA, a volunteer Senior Health Insurance Benefits Advisor. As a retired physician, I advocate for Improved Medicare for All. This is one of the many reasons why. Indeed, if you are not officially “admitted” to the hospital, but just in for “observation” status for two days, you will be billed at Part B rates.

Here’s an article explaining all this: https://www.forbes.com/sites/howardgleckman/2019/01/02/understanding-medicare-observation-status/#1523b9947876

If you don’t have a supplemental Medigap plan, you can be overwhelmed by the cumulative out-of-pocket B charges, which could far exceed the $1,364 deductible for each Part A benefit period–which ends when you have been discharged from the hospital (and/or approved skilled nursing facility) for 60 days in a row.

Buying Medigap plans to sufficiently cover these costs can be cost prohibitive for many seniors. Furthermore, they may be unaware that this is essential coverage. If a Medigap plan is not purchased within the year a senior qualifies at age 65, there is no guarantee you can even purchase a plan as your pre-existing conditions will be considered.

Medicare Advantage plans are different than “traditional” plans when it comes to your overall benefits and expected out-of-pocket costs. But all of them are very Rumsfeldian. Unknown unknown expenses to add to your health care anxieties.

They prey on the weak and helpless, especially the ones that go for emergency care. This is another example of hospitals not really caring for the well being of the sick. Once they capture a victim, their aim is to suck him dry.

The insurance companies are to blame too because they allow the out of network charges to occur. The insured doesn’t know what service or provider is “in network”. He makes a good faith attempt to go to “in network” hospitals but then the gougers take over.

The ‘attending physician’ I saw during my ER sojourn after last month’s bus accident was a “Body Shop Droid.” The bill I received, which was the one I described earlier, the semi-threatening one, was from an “Emergency Room Physicians Management Company LLC.” I have nothing to compare it to, but it came to just over $700 dollars US, for two or three ‘look see’s’ at my battered carcass.

The ambulance “service,” a properly neo-liberalized separate commercial entity, (anyone remember when ambulances were a part of the hospital apparat?,) billed me just over $1000 dollars US. I finally reached a claims adjuster for the bus companies insurance company yesterday. One of the questions she asked me, after I had established that I had been ‘ambulanced’ to the hospital was, how many people were transported in that one ambulance? When I quipped about ‘double dipping’ on the part of the ambulance “services,” she laughed and said, “If you only knew.”

I have still not heard from the hospital itself.

In Elisabeth Rosenthal’s excellent book “An

American Sickness” she recommends adding the following statement to any consent form you sign in the hospital “Consent is limited to in-network services only and excludes out-of-network services”. My wife and I carry copies of this in our wallets just in case. Haven’t had occasion to try this yet and see their reaction.

“An American Sickness,” yes, an important read.

Yes, a well written expose.

Stanford University Hospital has good lawyers.

Their Financial Responsibility Form includes a clause to void any alterations to its terms and conditions.

Yes, I thought that might be worthwhile. If they don’t have consent, they can be sued for “treating” you. However, if say the emergency room docs are out-of-network, this may mean you don’t see a doctor at all.

“I read 1,182 emergency room bills this year. Here’s what I learned.”

https://www.vox.com/health-care/2018/12/18/18134825/emergency-room-bills-health-care-costs-america

The corollary of “Someone has to pay!” is “Someone gets it for free.”

What happens locally at San Franciscan General Hospital:

Undocumented person or homeless guy;

1.Get ride to hospital in ambulance.

2. Get free translator, if needed

3. Claim no I.D.

4. Get treatment.

5. Pick up free meds at pharmacy.

6. “No hope of recovery”= “Free”

American citizen with insurance

1. Walk in hospital.

2. Spend half an hour proving I have insurance.

3. Get treatment.

4. Get bill for hundreds of thousands because they “are out of network.”

https://www.vox.com/policy-and-politics/2019/1/7/18137967/er-bills-zuckerberg-san-francisco-general-hospital

A state bill is in the works to ban this. However, taxpayers will still provide free care for indigents and now, per a new state law, not only illegals in emergency rooms, but all illegals, until age 26, get full medical inpatient insurance coverage, paid by taxpayers.

https://www.nationalreview.com/news/california-to-provide-full-health-benefits-to-illegal-immigrants-under-age-26/

If you have to link to the National Review to support your opinion, maybe you should rethink your opinion.

E pur si muove!

https://www.sacbee.com/news/politics-government/capitol-alert/article231310348.html

Facts

https://thehill.com/homenews/state-watch/446075-california-lawmakers-vote-to-offer-health-insurance-to-undocumented

Are

https://www.sfchronicle.com/politics/article/California-will-give-health-coverage-to-13964206.php

Facts

Sweet mic drop, thanks.

From your The Hill link:

> California’s Medicaid program would extend its coverage to adults who would otherwise be eligible to receive benefits under the program but were unable to do so because of their immigration status under the existing law

These are benefits CITIZENS ALREADY RECEIVE.

Sickness and disease doesn’t stop based on nationality. Sick people will spread their sickness to you. Everyone needs care. Society is better off if everyone is healthy.

Why does this even need to be said? People are so filled with short-sighted cruelty. A sign of desperate times.

Thank you, FS.

Unfortunately, facts won’t overcome deeply ingrained prejudices. The “illegals get special benefits that citizens don’t” is one of the most absurd hate-memes that just won’t die. It’s especially absurd when you consider the reality that the undocumented are collectively subsidizing American entitlement programs like Social Security that they won’t access.

It’s like whack-a-mole. People disprove one instance of it, and then some conservative rag like the National Review pops up a new version, and people who deeply want to believe it, believe it.

The deeper question is: why do people deeply want to believe it? I don’t think it’s economic desperation, because if it were, one would expect this hate to be stronger among the young, whose life hopes have been progressively devastated for decades. And yet hate burns hottest among older Americans, and hotter still among white older Americans, including the very affluent.

You assume an ever expanding pot of money.

There are budget and infrastructure constraints. The more people getting benefits, the less money per person and the longer the waiting time.

Citizens with limited services resent paying taxes for non-citizens. Maybe you don’t, also, feel free to write as many checks as you want.

There is also the issue of fairness to Legal immigrants who have followed the rules.

e.g.

‘The more people getting benefits, the less money per person and the longer the waiting time.’

“Some of the hundreds of people in dire need of care wait in a parking lot for 12 hours in below-freezing temperatures for a chance to be seen in Knoxville in February. Tickets were handed out first come, first served. ”

https://www.washingtonpost.com/national/the-clinic-of-last-resort/2019/06/22/2833c8a0-92cc-11e9-aadb-74e6b2b46f6a_story.html

As a KP employee and member who lost my wife from brain cancer a couple years ago, I sympathize with your loss. I’ve never heard of this happening at KP. What kind of plan did your daughter have? Either her summary plan description or certificate of insurance should stipulate all out of pocket expenses for ER. There should only be one copay. Cost share may change if she had a deductible HMO or HDHP.

I’m with Kaiser in CA.

I just send their member services this, based on the wording by Mark above.

“Kaiser Emergency Room Consent is limited to in-network services only and excludes out-of-network services.”

I will post responses from Kaiser.

Being first gen Italian I applied for Italian citizenship back before Eurolandia was consummated just in case the rules were changed. Main reason was worries over my on and off health insurance, so just to be safe. Sure enough found myself in my fifties w/o insurance, which is a seriously unwise situation, and hesitently moved to Italy. It’s been rough to say the least, the country is deep in the dumps, but the health system is WONDERFUL. Yeh, everyone moans and complains about a long list of valid problems with health care here, but they have no idea the alternative. I tell everyone here to mark my words and protect what they got from the devious, erosive neo-liberal threat.

Preaching to the choir on NC but just in case anyone has doubts the positives; no financial stress to compound health stress, no corporate bureaucracy, state system is quite well streamlined, no copays if you’re unemployed or poor, outweighs ALL the negatives.

I think the title is a little inaccurate, it’s not 1-in-6 patients, it’s 1-in-6 visits (or stays). Two visits in a year bring an individual’s odds to 1-in-3, etc.

Also, note “at least,” aggregation removes detail.

From the study:

And out-of-network charges can occur for simple services like a blood test, this recently happened to a friend. She visited a service office listed by her insurer, but the office had contracted with an out-of-network analysis lab, resulting in a non-covered $1100+ charge. Which is a bit amazing in itself, during a recent checkup (my first in 12 years) which was covered by a Medicaid plan, I inquired about the costs for my various tests, to understand affordability; how much would this or that cost if I walked in without any coverage plan? My comprehensive blood test would have cost $183, my echo-cardiogram $118. What about the hormone-level test my friend got? Under $500. All these prices are for cash up front of course, avoiding the 25%+ in interest and finance fees that a payment plan would incur.

Tangentially, I just saw an anti-Medicare for All ad on TV in my market yesterday (the DC metro area), the first such I have seen. The focus of the ad was that M4A would result in long wait times for procedures; 4 weeks for a cancer consultation, 8 weeks for a kidney replacement consultation, and so on. The ad was so patently misleading it was kind of astonishing: people already wait many many weeks for medical consultations under our gloriously inefficient “excellent” healthcare system–a fact I’m sure most Americans are familiar with. I know of people with cancer diagnoses who have had to wait months to get an appointment with a specialist. So, I’m surprised that’s the tack that the lobbyists would take in their “M4A will ruin everything” scary ad. That was the whole focus of the ad: wait times. Seemed like a weak tea argument to me.

In the DC metro area?

The healthcare industry spends four times as much on lobbying as the MIC.

That ad is part of the lobbying blitz, imo.

I saw a similar ad last night on a Kansas City channel. It was lies from top to bottom. Beginning with, Americans love their health insurance. Lies, all lies!

Sounds like it aimed at retirees on MC, trying to scare them into calling their congressperson to say “nooo”.

The lobby against Medicare for All is still using the old ‘death panels’ scare tactic, too.

There are plenty of comfortable old people who believe these arguments, including my parents on a platinum-dipped retirement health care plan. My mother gets specialist care at the Mayo Clinic and says health care in this country is fine, and the only thing young people have to worry about is how many TVs and cell phones to buy. And yeah, my parents live and vote in FL. It boils down to “I got mine, screw you Jack” with a side of comfortable ignorance, and yeah they bristle if you try to point it out.

What amazes me is that often the “Jacks” they’re saying “screw you” to are their own children and grandchildren.

We had a flying visit from my sisters and their husbands, plus Mom last weekend. This subject came up. Both sets of people are 10%ers. Both chimed in with “horror” stories when the subject came up. One mentioned that, when he had to go in to the hospital for a procedure, when someone came in to insert the anesthesia drip, he questioned if that attending person was “in network.” “Are you telling us how to run our hospital?” was the reply. My brother-in-law, who is not a shrinking violet, replied, “Since you’re telling me how to spend my money, yes, I am telling you that.” “They were not amused,” was his wry comment on the hospital’s reaction to an obstreperous patient.

One brother-in-law, when the subject of retiring came up, mentioned thinking about retiring to Spain, where his parents are from, and cited medical provision as a major consideration.

Both groups mentioned scheduling several “major” medical procedures during one year so as to take advantage of doubling up on one year’s co-pays and deductibles.